The Bottom Line: Is NinjaTrader Worth It in 2026?

If you are serious about trading in futures and want a low-cost platform paired with professional automation tools, then NinjaTrader absolutely delivers in 2026.

You’ll pay as little as $0.09 per micro contract, and the strategy development capabilities rival anything on Wall Street.

But there’s a catch.

This NinjaTrader review wouldn’t be complete without mentioning that beginners often find the platform overwhelming. If you’re new to trading or prefer stocks over futures, combining broker TradeStation with charting platform TradingView offers more opportunities across more markets with a much gentler learning curve.

What is NinjaTrader?

Since 2003, NinjaTrader has dominated one specific vertical of the trading world: futures. Unlike platforms that spread themselves too thin across multiple markets, this company made a calculated bet to build the most sophisticated futures trading ecosystem possible.

Today, NinjaTrader serves dual roles. First, it’s a powerful trading platform that connects to multiple brokers. Second, it operates as a licensed futures commission merchant (FCM), meaning you can trade directly through its brokerage services.

What makes this NinjaTrader platform review interesting is how the company targets serious traders. This isn’t another app promising to make trading “easy” or “fun.” Instead, NinjaTrader built tools for people who treat trading like a business.

You can use NinjaTrader’s platform with other brokers, such as Interactive Brokers (NASDAQ: IBKR). Or you can trade directly through the NinjaTrader brokerage. This flexibility appeals to professional traders who want the best tools regardless of where they hold their accounts.

NinjaTrader Accessibility

For years, NinjaTrader meant one thing: a Windows desktop-only solution. Mac users were out of luck unless they were willing to experiment with virtualization software.

That’s changed significantly. The company now offers a full-featured mobile app for iOS and Android that goes beyond basic account monitoring.

You can place trades directly from charts, access real-time data, and manage complex futures positions from your phone. The interface uses intuitive swipe gestures and feels responsive.

Still, Mac users face limitations. NinjaTrader remains Windows-native, so you’ll need Parallels, Boot Camp, or similar solutions to run it on macOS.

The full power of strategy development and backtesting still requires the desktop platform. Mobile trading works well for managing existing positions, but you won’t be able to code automated strategies on your iPhone.

NinjaTrader’s Key Offerings

The NinjaTrader brokerage and platform services break down into four main areas, each targeting different aspects of professional trading workflows.

1. Trading Platform

This is where NinjaTrader built its reputation.

Advanced Charting & Technical Analysis

You get over 100 built-in indicators right out of the box. But the real magic happens with customization.

Want to modify an existing indicator? Easy. Need to build something completely new? The tools are there.

The charts feel alive as you are not just looking at price action, but interacting with it. Users can place trades, set alerts, manage orders, all directly from the chart as it requires no switching between windows or hunting through menus.

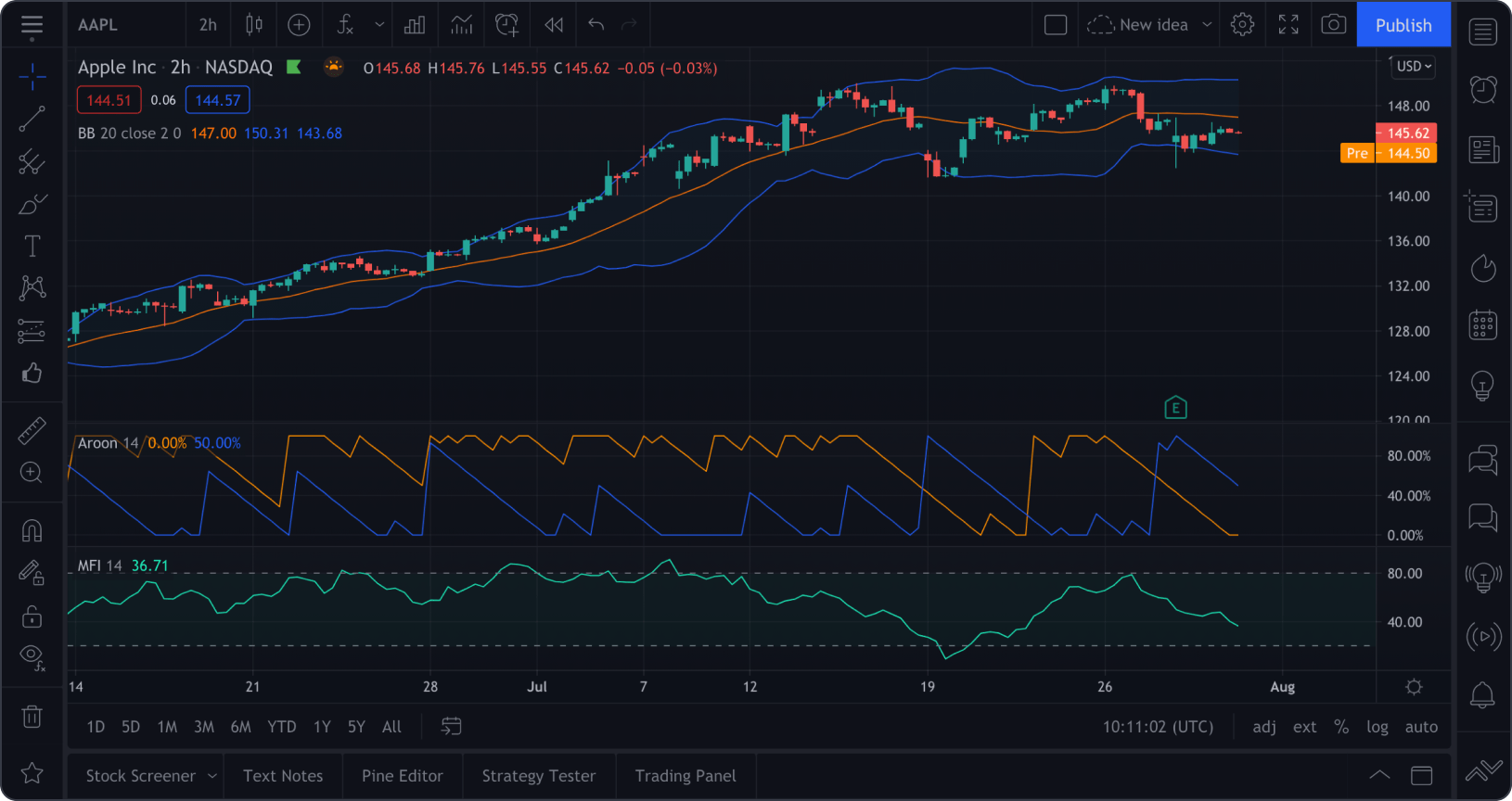

A cheaper alternative for excellent charts…

TradingView is the best app for stock charts – full stop. It was built first and foremost as a charting platform, which shines through in both its power and its wide range of charting applications.

TradingView has the tools to show its information in a variety of ways. You’ll have customization options like 14 chart types, 90+ drawing tools, and 100+ pre-built indicators.

Even the free tier of membership is great — but the (still-affordable) paid subscriptions are even better. Try it free for 30 days and see for yourself — click the link below.

Strategy Development & Automation

Here’s where things get serious. NinjaScript, their proprietary programming language based on C#, lets you build automated trading systems from scratch.

I’ve seen traders develop complex machine learning algorithms as well as simple moving average crossovers.

So, build your strategy, backtest it against years of historical data, and then deploy it live. The whole workflow feels seamless once you get the hang of it.

Backtesting & Simulation

Before you risk real money, you need proof that your strategy works. NinjaTrader’s backtesting engine processes tick-level data with institutional-grade accuracy.

You’ll receive detailed performance reports that show Sharpe ratios, maximum drawdowns, and profit factors, all the metrics traders care about.

The trade simulator deserves a special mention as you can practice in live market conditions without financial risk. Its perfect for testing new strategies or to get comfortable with the platform.

Suggested Reading: The Best Stock Market Simulators

Actionable trade alerts based on backtested strategies

If you like the idea of backtested strategies but want someone else to identify opportunities for you, consider Stock Market Guides.

Stock Market Guides leverages cutting-edge technology to deliver superior stock picks, to the tune of 79.4% average annual returns.

This highly-regarded service (check out our review here) provides stock and options picks by backtesting hundreds of thousands of trades using historical data.

Market Replay

This feature justifies the platform for many traders. You can download historical market data and replay it tick by tick as if it were happening live. Users can fast-forward through slow periods, rewind to catch something you missed, or pause to analyze critical moments.

Order Execution Tools

NinjaTrader delivers with multiple order entry interfaces designed for different trading styles. The SuperDOM (Depth of Market) works great for scalping while the Advanced Trade Management (ATM) system handles complex orders with predefined risk parameters.

2. Brokerage Services

The NinjaTrader brokerage operates as a licensed futures commission merchant with some of the industry’s most competitive rates.

Futures Trading

This is the platform’s cash cow. Traders can access equity indexes, energies, metals, agricultural commodities which is everything that trades on major futures exchanges. The margins are incredibly low, starting at just $50 for micro contracts. That makes futures accessible even for smaller accounts.

Commission rates start at $0.09 per micro contract for licensed users. When you’re trading actively, those savings add up fast.

Forex Trading

Major and minor currency pairs get the same treatment as futures. All the advanced tools, automation capabilities, and competitive pricing are also available in the forex markets.

Equities & Options

Here’s where the NinjaTrader brokerage shows its limitations. They don’t offer direct stock or options trading. However, the platform integrates seamlessly with other brokers. Connect to Interactive Brokers or other supported brokers, and you can still use NinjaTrader’s tools for analysis while executing trades elsewhere.

Low Margins & Pricing

The pricing structure is designed to target active traders. The more you trade, the more you save. Combined with reduced margin requirements, it can dramatically cut trading costs compared to traditional brokers.

What if you want more than futures trading?

If you’re interested in trading futures but want a platform with more robust features for day traders too, consider TradeStation.

For futures trading, the platform offers competitive $1.50 commission rates, lower margin rates for intraday trading, and excellent charting features.

Beyond futures, TradeStation offers access to a variety of asset classes, including stocks, ETFs, cryptocurrencies, options, and options on futures. With an intuitive interface, solid backtesting and data availability, it’s a great pick if you’re interested in futures in addition to other trading strategies. Check it out now.

3. Market Visualization Tools

NinjaTrader Pulse

Think of the tool as your market command center. Monitor multiple instruments simultaneously, track custom watchlists, and get real-time news feeds.

Free Trading Charts

Even without a brokerage account, you can access powerful charting tools for free. Most indicators and drawing tools are available for free, making it a smart way to test drive the platform you commit.

Order Flow Tools

For traders who analyze market microstructure, these tools reveal the hidden dynamics behind price movements. See volume and order direction at different price levels or spot supply and demand imbalances that don’t show up on traditional charts.

4. Ecosystem & Marketplace

Third-Party Add-Ons

The NinjaTrader Ecosystem marketplace hosts a plethora of custom indicators, strategies, and analytical tools.

Need something specific? Chances are that someone has already built it extending the platform’s capabilities far beyond what any single company could develop.

Community Support

The community aspect surprises many new users. Active forums, user groups, and developer networks create a collaborative environment.

Education & Training

The educational resources are extensive, including daily webinars, video tutorials, and comprehensive documentation.

Who is NinjaTrader Best For?

NinjaTrader built its platform for specific types of traders. It excels in certain areas while falling short in others.

- Experienced Futures Traders: If futures are your primary focus and you want professional tools with competitive pricing, NinjaTrader delivers what you need.

- Algorithmic Traders: The strategy development capabilities rank among the industry’s best. Build, test, and deploy automated systems with institutional-grade tools.

- Active Day Traders: Fast execution, advanced order management, and real-time data make this platform ideal for traders who need split-second decision-making.

- Cost-Conscious Traders: With some of the lowest commission rates in the industry, active participants can reduce their trading costs.

However, beginners often struggle with the complexity. If you primarily trade stocks or options, the focus on futures may not align with your needs. Casual traders who make just a few trades per month probably won’t benefit from the advanced features.

NinjaTrader Reviews: What Are Real Users Saying About NinjaTrader?

I analyzed reviews across multiple platforms to gain a comprehensive understanding.

The Praise:

Experienced users consistently highlight the platform’s power and competitive pricing. Trustpilot reviews praise the advanced charting, automation tools, and responsive customer support. Many appreciate the low commission structure and extensive customization options.

One professional trader on Reddit mentioned, “The backtesting capabilities alone justify the cost. I can test strategies against years of data before risking a penny.”

The Complaints:

Some users struggle with the platform’s complexity, especially during initial setup. Reddit discussions reveal mixed experiences with customer service as some praise the technical support while others report delays in account setup and withdrawal processing.

Mac users frequently complain about the Windows-only requirement. As one user put it: “Great platform, but why no Mac support in 2025?”

The Reality Check: Most negative feedback comes from traders who underestimated the learning curve or had expectations that didn’t match the platform’s professional focus. Success with NinjaTrader often correlates with experience level and commitment to learning the system.

💡 Start with the free version to get familiar with the interface and features before upgrading to a paid license or opening a brokerage account.

NinjaTrader Pricing

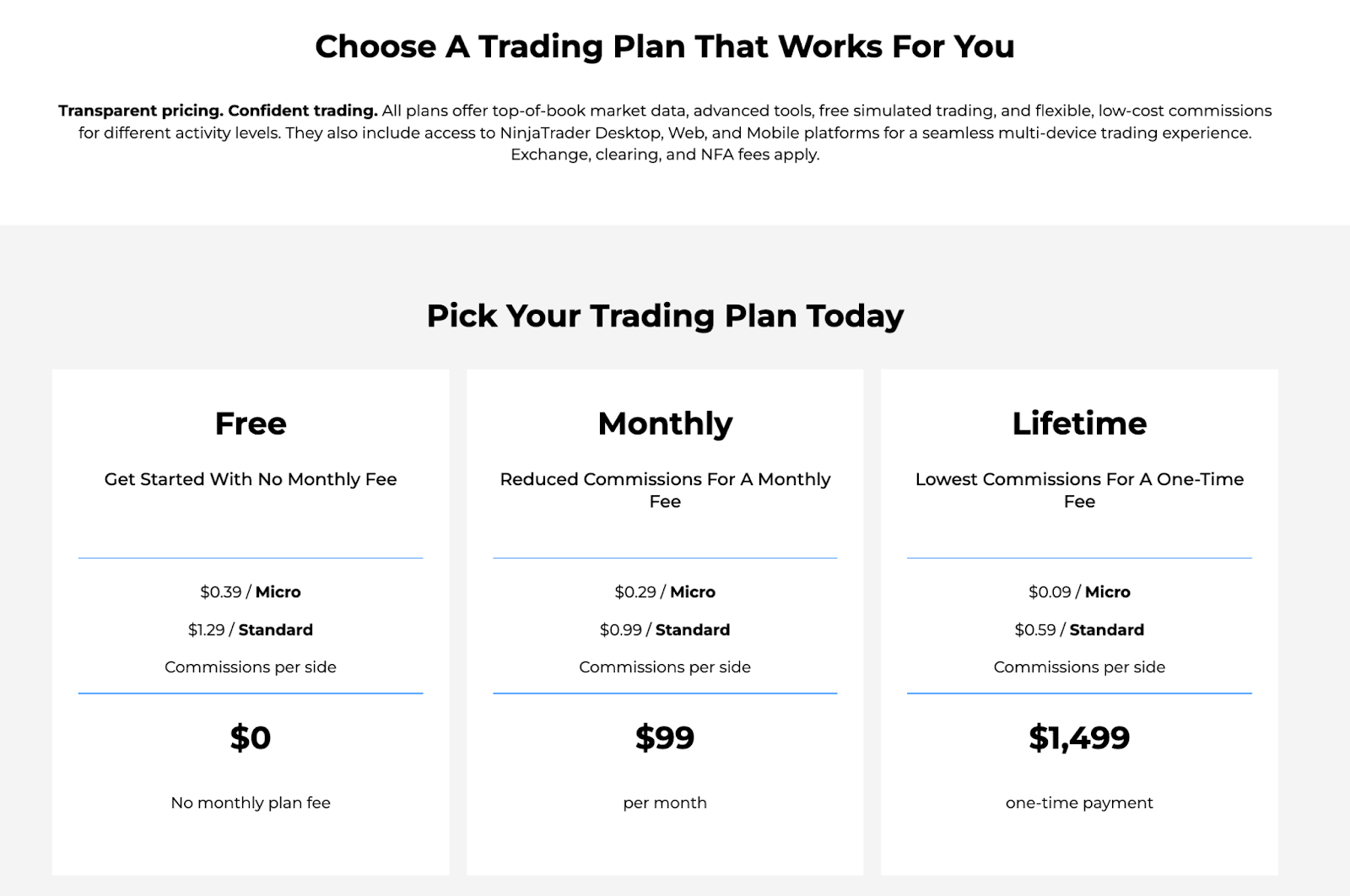

The pricing structure accommodates different trading styles and volumes:

Platform Licensing:

- Free Version: Complete access to charting, analysis, and simulation

- Monthly License: $99/month with reduced commission rates

- Lifetime License: $1,499 for permanent access with the lowest commissions

Trading Commissions:

- Free Version Users: $1.29 per standard contract, $0.39 per micro contract

- Licensed Users: As low as $0.09 per micro contract plus $0.15 clearing fee

Additional Costs:

- Market Data: $12/month for a complete exchange bundle or $4/month per exchange

- Account Minimum: No minimum deposit required

- Margins: Starting at $50 for micro contracts

For active traders, the licensing fees often pay for themselves quickly through commission savings. Trade just a few contracts daily, and the reduced rates easily offset the monthly license cost.

How to Open an Account on NinjaTrader

To open a NinjaTrader account, you can sign up for free with your name and email address. You will need to create an online account, and then download the desktop software for trading.

To sign up, you will follow these steps:

- Submit and verify your email address

- Create a username/password

- Select an asset to trade (Futures, Options, Forex)

- Choose an account (third-party broker to connect to)

- Choose a plan (Free, Lease, or Lifetime)

- Complete identity verification (name, address, financial and personal info)

- Wait

Due to compliance requirements, account approval may take a few days.

Once approved, you will need to deposit a minimum of $400 to begin trading, or you can use the free simulator.

NinjaTrader Vs. TradingView Vs TradeStation Vs thinkorswim

Choosing the right platform depends on your specific needs and requirements. Here’s how these popular options stack up:

Core Focus

- NinjaTrader: Laser-focused on futures and forex with advanced automation

- TradingView: Web-based charting and social trading across all asset classes

- TradeStation: Multi-asset platform covering stocks, options, futures, and crypto

- thinkorswim: Comprehensive platform from Charles Schwab (NYSE: SCHW) with strong education

Platform + Charting

- NinjaTrader: Desktop powerhouse with 100+ indicators and unlimited customization

- TradingView: Web-based accessibility from any device with extensive social features

- TradeStation: Desktop and web options with advanced analysis tools

- thinkorswim: User-friendly desktop platform with comprehensive features

Automation + Strategy Development

- NinjaTrader: Industry leader with NinjaScript programming and robust backtesting

- TradingView: Pine Script for custom indicators, but limited automation

- TradeStation: EasyLanguage programming with solid backtesting capabilities

- thinkorswim: thinkScript for custom studies with basic automation

Brokerage + Market Access

- NinjaTrader: Futures and forex specialist with ultra-competitive pricing

- TradingView: A Charting platform connecting to various third-party brokers

- TradeStation: Full-service brokerage with multi-asset access

- thinkorswim: Complete brokerage services with commission-free stock trades

Pricing

- NinjaTrader: Free basic use, $99/month or $1,499 lifetime; ultra-low futures commissions

- TradingView: Free basic plan, $14.95-$59.95/month for advanced features (get 30 days free with this link)

- TradeStation: Free platform with competitive commission structure

- thinkorswim: Free with Schwab account, commission-free stock trades

Community + Ecosystem

- NinjaTrader: Strong developer community with extensive third-party marketplace

- TradingView: Massive social trading community with active idea sharing

- TradeStation: Smaller but dedicated community focused on active trading

- thinkorswim: Large user base with extensive educational resources

Who It’s Best For

- NinjaTrader: Serious futures traders wanting advanced automation and low costs

- TradingView: Traders of all levels seeking excellent charting and social features

- TradeStation: Active multi-asset traders want comprehensive tools

- thinkorswim: Beginners to intermediate traders seeking a user-friendly, comprehensive platform

Final Word:

Each platform serves different needs. NinjaTrader dominates futures trading with unmatched automation and cost efficiency. For broad market analysis and social trading, TradingView excels — particularly in tandem with a high-quality broker like TradeStation — and may better serve traders who want comprehensive, multi-asset access.

The choice depends on your primary markets, experience level, and whether you prioritize automation or simplicity.

FAQs:

Is NinjaTrader worth buying?

NinjaTrader is worth buying if you're a serious futures trader who values advanced automation and low costs. The platform license pays for itself through reduced commissions, especially for active traders. However, casual traders or those focused on stocks might find the free version sufficient for their needs.

Is NinjaTrader really free?

Yes, NinjaTrader offers a free version with full charting capabilities, market analysis tools, and trade simulation. The free version has higher commission rates and lacks some advanced features, but it provides legitimate access to professional-grade trading tools without cost.

How much does it cost to use NinjaTrader?

NinjaTrader offers basic charting and simulation at no cost. The full platform costs $99/month or $1,499 for lifetime access. Additional expenses include market data feeds ($12-$41/month) and trading commissions (as low as $0.09 per micro contract for licensed users).

Is NinjaTrader better than thinkorswim?

thinkorswim suits beginners and traders who want stocks, options, and educational resources, all with a user-friendly interface. NinjaTrader serves experienced futures traders who prioritize advanced automation and lower trading costs. Your choice should align with your experience level and primary trading markets.

Is NinjaTrader legal in the USA?

Yes, NinjaTrader operates legally in the USA as a registered futures commission merchant (FCM) and a member of the National Futures Association (NFA). The company has maintained proper regulatory compliance since 2003, operating from Chicago under established financial regulations.

Which is better, NinjaTrader or TradingView?

The answer depends on your trading focus. NinjaTrader excels for serious futures traders wanting advanced automation and direct market access with low costs.

TradingView is better suited for traders seeking excellent charting capabilities across multiple asset classes, social features, and web-based accessibility. Many professional traders use both platforms for different purposes.

Can I withdraw funds from NinjaTrader? How?

Yes, you can withdraw funds from your NinjaTrader brokerage account. Standard processing takes 1-2 business days for domestic wires. Some users have reported occasional delays beyond stated timeframes, so plan accordingly and avoid relying on immediate access to withdrawn funds for time-sensitive needs.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.