Final Verdict: Is MarketBeat Worth It?

MarketBeat’s FREE tier is an excellent all-in-one platform for all things finance.

However, I hesitate to recommend paying $399/year for the Premium version, as there are more affordable options that may suit specific needs:

- Advanced investors might find themselves wanting for truly in-depth insights and could see more value in platforms like Stock Rover.

- Beginners could be overwhelmed by information and could find that WallStreetZen’s Premium offering provides far more actionable signals.

- If you want more narrative analysis, Seeking Alpha might provide more value.

Keep reading for a detailed MarketBeat review that digs deeper into its features so you can decide if it’s right for you.

What is MarketBeat?

Although officially launched in 2011 as the Analyst Ratings Network, MarketBeat can trace its roots to 2006 and the Dakota State University dorm of its founder, Matthew Paulson.

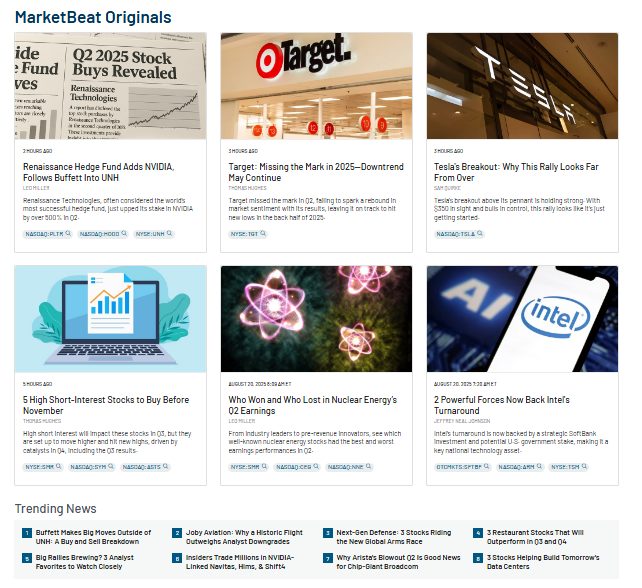

The platform, whose original iteration was a blog called “American Consumer News,” is now best-known for being an extensive stock research platform, with a robust offering of real-time data, analyst ratings, finance news, and a daily newsletter for investors.

MarketBeat also offers a degree of both personalization and more direct utility as it also serves as a portfolio management platform.

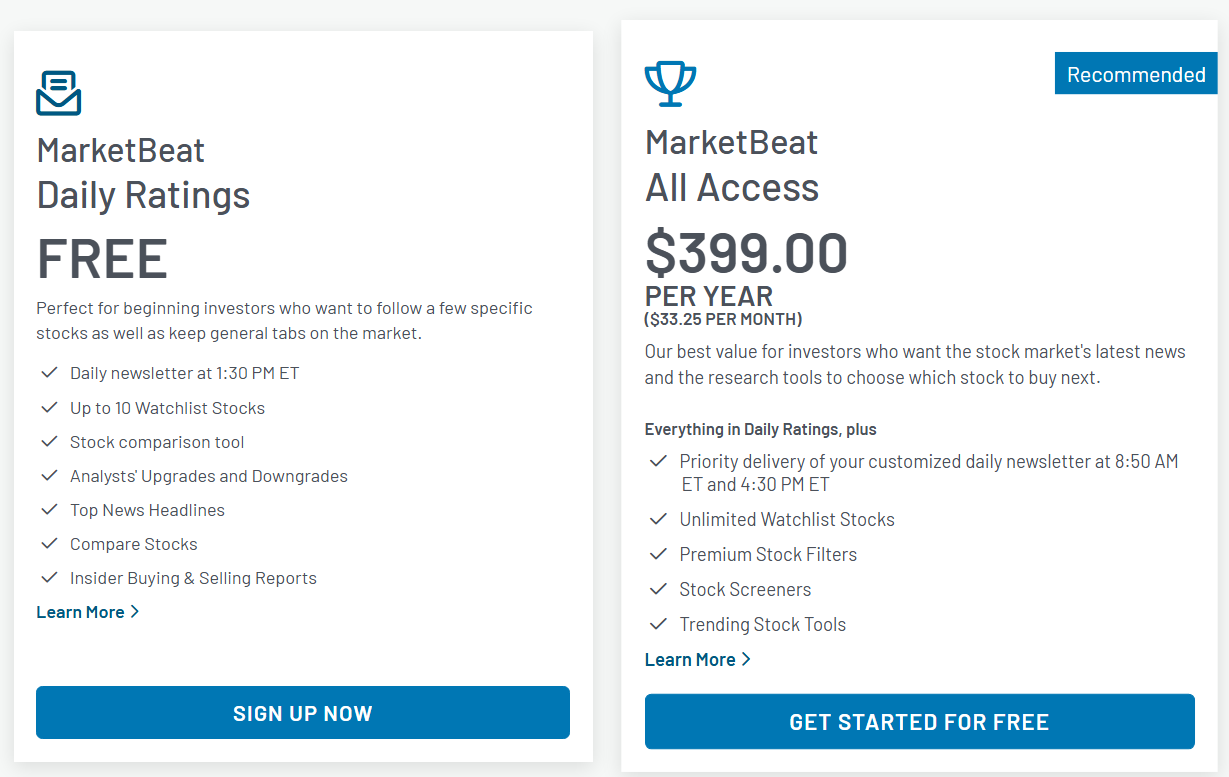

As with many investing websites, MarketBeat boasts a free and a premium tier, the latter giving you access to more features.

There used to be a middle tier for $19.99 per month, but it was recently condensed into MarketBeat All Access, which is available for $399 per year.

Related Reading: 11 Best Stock Research Websites & Tools

What Are MarketBeat’s Key Features?

MarketBeat offers extensive tools for monitoring price action, corporate developments, institutional activities, and analyst attitudes.

Free Tools

There are plenty of great free tools on MarketBeat.

Along with the steady supply of top daily market headlines, the free version offers stock-monitoring tools such as the MarketBeat analyst ratings revision feed, a way to compare and contrast different shares, key financial, fundamental, and technical indicators, and an insider trades tracker.

Marketbeat’s analyst ratings are arguably one of its most popular tools.

MarketBeat’s analyst ratings tracker is a standout feature as it provides more comprehensive information for free than competitors like TipRanks, and is easier to parse than MarketScreener’s feed.

Related Reading: TipRanks Review 2025: Is It Worth Paying For?

You can also test out the website’s portfolio management tool without paying, with the main drawback being you’re limited to following 10 stocks. The same limitation applies to the related email and SMS notifications, as well as the more holdings-specific news feed.

Lastly, the website offers three newsletters for free: Daily Ratings, Daily Canada, and CryptoBeat.

The tradeoff is that paid users have both a temporal and a quantitative advantage as they receive two daily newsletters, with the first arriving shortly ahead of the morning bell.

Did you know we have a free newsletter? WallStreetZen Ideas offers recent Strong Buy upgrades, hot or not stocks in the market, and you get a no-cost list of 5 stocks to watch every week. Subscribe now.

Premium Tools

The premium “All Access” tier of MarketBeat is a seemingly straightforward upgrade from the free “DailyRatings.”

- Unlike the singular mid-day newsletter, paying customers receive two daily editions: one forty minutes before the market’s open at 08:50 AM EST and the other right at the closing bell at 04:30 PM EST.

- The website’s news offering also gets beefed up as the premium version bolsters the regular top news headlines with additional exclusive articles, a real-time feed, and a weekly market preview.

- All aspects of the portfolio management tool are upgraded to provide tracking and coverage of an unlimited number of stocks in as many portfolios as the user desires.

- “All Access” equity coverage also gets expanded substantially with information such as dividend announcements, earnings calls, and insider and institutional trading.

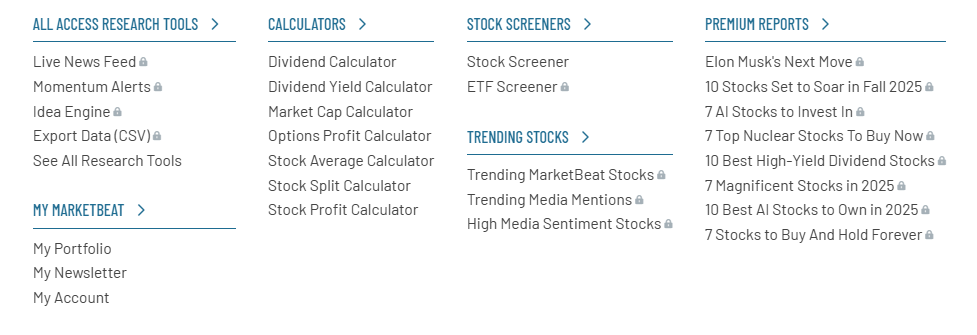

- Paying customers receive access to a wide variety of stock, exchange-traded fund (ETF), ratings, dividends, and other screeners, as well as more advanced, “premium” filters to better find the data they need.

Related Reading: 10 Best Investment Newsletters

Along with the deluge of information, All Access offers a generous set of actionable information.

For example, premium users benefit from an aggregate showing which equity is trending around the web, which stocks have the most momentum, and can tinker with the “Idea Engine ”— an AI tool described as using “artificial intelligence, algorithmic factors, technical indicators to identify stocks that are poised for near-term growth.”

Free AI tool to help you find stocks

WallStreetZen’s Zen Rating AI factor merges several elements — earnings, cash flow, price movement, and industry trends — into a single, actionable insight.

It employs machine learning using a Neural Network trained on 20+ years of fundamental and technical data. It can detect patterns beyond human capability, offering a deeper view of not only past performance but potential for future price movements.

Go ahead — enter any ticker below and see its AI grade.

All Access is competitively priced with a MarketBeat subscription cost coming in at $39.99 per month or $399 per year, if you commit to an annual subscription.

MarketBeat Subscription Tiers

Feature | What you get with Daily Ratings (Free Tier) | What you get with All Access ($39.99/month or $399/year) |

|---|---|---|

Daily Financial News | Daily Newsletter, Top Headlines | Two Daily Newsletters, Top Headlines, Premium Articles, Weekly Market Preview, Real-Time News Feed |

Market Data | MarketBeat Analyst Ratings | Analyst Ratings, Dividend Announcements, Earnings Calls and Results, Insider Trading, Institutional Trading |

Portfolio Monitoring | Monitoring tool, Personalized News, and Email and SMS Alerts for up to 10 stocks | Monitoring tool, Personalized News, and Email and SMS Alerts for unlimited stocks, and the ability to link to your brokerage account. |

Stock Screeners | None | Stock, ETF, Ratings, Dividend, Earnings, and Insider Trades screeners, as well as premium equity filters. |

Web-Based Research Tools | Stock Comparisons | Stock Comparisons, Idea Engine, Momentum Alerts, and Excel/CSV Data Export |

Trending Stock Tools | None | View stocks trending on MarketBeat, Reddit, and Media Sentiment, and receive access to the Media Sentiment Analysis |

Company Profile Pages | Full access to information such as Analyst Recommendations, key metrics, dividend history, news, charts, and others | Full access to information such as Analyst Recommendations, key metrics, dividend history, news, charts, and others |

Extra Features | Ranking by insider activity within the last 90 days. | Ranking by insider activity within the last 90 days, Brokerage and Analyst performance ranking, Top Analyst Picks, Monthly Premium reports, and more |

Strengths of MarketBeat

Comprehensive Data

MarketBeat offers a vast array of tools and metrics that you can use both to select winning stocks to add to your portfolio, as well as to track and predict the future movements of equities you already own.

User-Friendly Interface

The platform’s webpage and mobile app are well-known and even better regarded for their layout, as indicated in many a MarketBeat review. For years, the platform’s users have been especially appreciative of the ease of use and, with the premium version, a high degree of customizability.

MarketBeat Complaints

Not all users are upbeat about the platform in their MarketBeat reviews. One of the platform’s biggest sins, according to online feedback, is its marketing strategy.

Indeed, MarketBeat’s hunger for signups even led to its being tangentially linked to the McGorty junk news websites network, uncovered by BuzzFeed.

Limited Analysis Depth

Beyond being pushy, MarketBeat has something of a reputation for being wide as the ocean and deep as a puddle. Many advanced users tend to complain that the depth provided by the platform is insufficient.

Others have noted that a significant portion of information and data provided by the website can be found elsewhere, frequently for free.

Still, MarketBeat’s major selling point is not truly diminished by such criticism. After all, it is, first and foremost, a massive aggregate of stock market information that makes research significantly more convenient.

In that regard, the issues of depth are likely to affect only a small minority of users.

Related Reading: 10 Best Stock Research Websites & Tools

Some of MarketBeat’s data can, however, be out of synch with other sources. The reasons are often arcane, given that some users complain that the platform’s customer support can be dismissive.

User Experience Issues

Two words: Aggressive marketing.

The situation is especially egregious in the All Access tier, as one of its selling points is a lack of advertisements.

MarketBeat technically stays true to the promise. But according to many user reviews, it supplants ads with a deluge of unwanted text messages and emails, while also disrupting workflows with pop-ups, including within the portfolio management tool.

This overabundance of signals is among the most common MarketBeat review complaints.

Customer Issues With Unsubscribing

The issue with unwanted messages and pop-ups is also exacerbated by the fact that many users have had difficulties in unsubscribing and cancelling their newsletter subscriptions, which are set to renew automatically by default.

Get Started With MarketBeat Like a Pro

Sign-Up

MarketBeat offers a simple way to sign up with either an email and a password, or using either your Google or Facebook account.

Despite giving users a free trial for its premium product, it nonetheless requires you to fill in bank card or PayPal information before gaining access, which is, admittedly, customary even if annoying.

Workflow

While there are no one-size-fits-all workflows, a good rule of thumb is always to gradually develop your watchlist, get acquainted with the types of data and information the platform provides, and progressively increase the scope of market-tracking.

An additional good rule of thumb is to cross-reference all of the important data with other, independent sources such as WallStreetZen or Seeking Alpha, especially with multiple users reporting occasional mismatches between MarketBeat and other platforms.

Tips

A major pitfall of any platform that offers the volume of data akin to MarketBeat is good old-fashioned overload. A straightforward way of avoiding this, especially when just starting on the platform, is to focus on stocks with a grade above 4.5 on MarketRank.

Indeed, one of MarketBeat’s top features for assessing equity at a glance is its 1.5 million stock-strong proprietary tool that assigns an average grade based on numerous relevant company metrics.

Additionally, and especially with the platform’s reputation for flooding users with text messages and emails, it is important to keep a finger on the unsubscribe button at all times lest the sheer volume ensure useful information is lost.

MarketBeat Alternatives

It’s always worth considering alternatives. Numerous other options offer a variety of advantages, such as being more streamlined, abundant with more hard-to-come-by information, or being plainly more affordable.

1. WallStreetZen vs. MarketBeat

- Who it’s for: Investors seeking professional signals and premium tools in a streamlined format.

- Cost: Basic plan available for free; $1 for a 2-week trial; Premium plan available for $19.50 per month if billed annually. See plans

- Why we chose it: Clear and actionable signals paired with professional insights and an abundance of quality educational resources.

WallStreetZen is focused on providing its users with a clean and readable interface. But you still get streamlined, easily digestible information that is easily and immediately actionable.

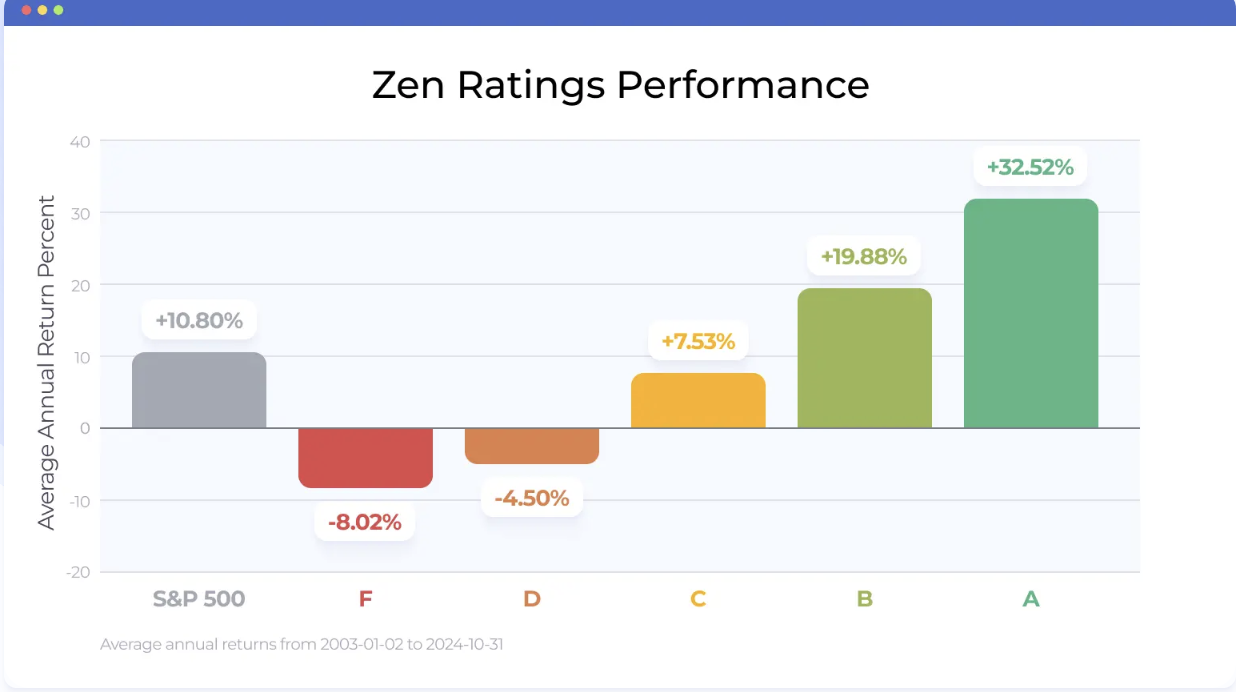

This is best seen in features like Zen Ratings, which, similar to MarketRank, uses a wide variety of important data points to identify equities with the most growth potential. With Zen Ratings, each stock is measured on 115 factors proven to drive stock growth, and expressed as a letter grade. Stocks rated “A” using this system have historically generated 32.52% annual returns.

See the entire list of A-rated stocks with WallStreetZen Premium

The website’s other services, such as Zen Investor and Zen Strategies, work to cut through the noise and help avoid information overload that we are all too susceptible to in the 21st century by a mix of expert stock picks and investing tactics that have been extensively backtested to match traders’ means and goals.

2. Stock Rover vs. MarketBeat

- Who it’s for: Investors who prefer to read the market through charts.

- Cost: Essentials ($7.99/month), Premium ($17.99/month), Premium Plus ($27.99/month)

- Why we chose it: High level of chart customizability.

At face value, Stock Rover appears quite similar to MarketBeat. It’s a comprehensive, data-rich market research platform. Still, there are multiple clear differences.

To begin with, Stock Rover is somewhat more affordable as even its priciest premium tier will set users back by $27.99 each month. It’s just a few dollars, but over time, it can add up to significant savings.

Stock Rover is is also more geared toward visual learners and thinkers, with robust and highly customizable charting software at its core.

Nonetheless, it is not a straight upgrade over MarketBeat, as it has a steep learning curve and is designed primarily for desktop use, which may overwhelm many users.

3. Seeking Alpha vs. MarketBeat

- Who it’s for: Investors who prefer narrative analyses.

- Cost: Seeking Alpha Premium costs $239/year when billed annually, but you can try it for Free for 7 days with this link

- Why we chose it: Unparalleled volume of new and interesting analyses every month.

Seeking Alpha is one of the most comprehensive sources of information and analysis on the stock market on the internet. The website offers a mix of content generated by its vast and active user base and written by financial experts.

These insights can be appealing to certain users over MarketBeat as they take a more narrative approach in covering stocks. This can make the information more easily digestible. However, the opposite could be the case for those who prefer more to-the-point coverage.

Seeking Alpha also provides extensive stock ratings as an aggregate of algorithmic analysis, Seeking Alpha itself, and the wider Wall Street attitudes, concurrently leveraging hard data like valuation, analyst revisions, growth, and profitability.

4. Motley Fool Epic vs. MarketBeat

- Who it’s for: Long-term investors.

- Cost: Stock Advisor starts at $74.50/year for a two-year commitment, Epic at $299 in the first 12 months and $499 after.

- Why we chose it: High-quality analysis and signals, and a strong stock recommendation track record.

Motley Fool has been a mainstay for investors for decades for a good reason. It boasts one of the most comprehensive sets of research tools available with its Motley Fool Epic, while retaining a somewhat affordable price at $299 in the first year, and $499 in subsequent years. Motley Fool Epic includes a subscription to Motley Fool’s top scorecards: Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor. Check out the below chart detailing Stock Advisor’s track record:

Users who can go without the exclusive podcast and some of the highest-end tools provided by the platform can also find much to love by sticking with a less-expensive (and less tricked-out) subscription to Motley Fool Stock Advisor—priced at $74.50 per year with a two-year commitment.

This subscription tier also provides expert analyses and stock picks, and occasionally issues bonus pieces and educational content.

Who Should Use MarketBeat?

MarketBeat May Be For You If…

MarketBeat is best-suited for active traders who thrive in information-rich environments and don’t easily get overwhelmed by data.

MarketBeat is also an excellent pick for intermediate investors who can benefit from the extensive services offered by the website, but who do not need the exceptionally in-depth information typically found elsewhere.

MarketBeat is NOT For You If…

- You prefer simplicity. WallStreetZen’s easy-to-read Zen Ratings system, curated picks through its Zen Investor service, and curated portfolios through its Zen Strategies service, take the onus off of you to do the heavy lifting.

- You want detailed stock reports. Stock Rover is likely a better pick for you if you want to dig deep into particular tickers.

- You want narrative-driven analysis. If you do, you’re likely better off with a platform like Seeking Alpha.

Final Word:

Despite its faults, MarketBeat has a lot going for it. I have been personally using the website regularly for years, as its nature as an information aggregate is simply too convenient to ignore.

Admittedly, MarketBeat has also always been an intermediate stop, a place I visit to cast as wide a net as I can and get a general feel for the market before going to other sources such as Seeking Alpha and WallStreetZen for confirmation and a deeper dive.

Still, this does not mean that every user will merely use the platform as an intermediate stop, as it has a lot to offer in its own right. Simultaneously, it can equally easily be a poor fit for certain investors and traders.

As always, MarketBeat’s actual use will depend on the individual, and thankfully, the 30-day free trial is always available before reaching the final decision.

FAQs:

How Much Does MarketBeat Premium Cost?

MarketBeat’s premium “All Access” offering will cost paying users $39.99 per month, or a slightly lower $399 per year ($33.25 per month) if they opt for an annual commitment. That is on the higher end of the spectrum — for example, WallStreetZen costs only $234 per year.

Is MarketBeat Good for Beginner Investors?

MarketBeat's free tier can be a great place for beginner investors as it offers a broad view of the market in a single place. However, beginners may find a cheaper and more accessible service like WallStreetZen more user-friendly and intuitive as they start their investing journey.

Does MarketBeat Cover Cryptocurrencies?

Yes, MarketBeat provides coverage of cryptocurrencies through its free CryptoBeat newsletter and digital assets-tracking toolkit.

How Do I Cancel a MarketBeat Subscription?

MarketBeat has dedicated and easy-to-access website pages for unsubscribing from both the premium and free versions of its platform. While the process tends to be straightforward, difficulties when attempting to unsubscribe are among the most common MarketBeat review complaints.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.