Turo is not publicly traded, but accredited investors can still buy its stock.

Hiive is a marketplace where accredited investors can buy shares of private companies before they go public.

Sign up with Hiive and get access to Turo before its IPO.

You’ve heard of peer-to-peer lending. How about peer-to-peer car lending?

Yup, it’s a thing — and Turo is the undisputed leader of the niche. The company’s killing it — it was last valued at $1 billion.

Wondering how to buy Turo stock?

Even though Turo has filed to issue an IPO, the company is not yet public. But that doesn’t necessarily mean you have to sit on your hands until it IPOs.

In this article, I’ll share:

- How accredited investors can invest in Turo

- How retail investors can gain indirect exposure to Turo

- How to buy the Turo IPO once it goes public.

Let’s go…

Turo: The Basics

Turo isn’t your typical car rental company. For one, it doesn’t own and maintain a fleet of cars. Rather, it provides a platform for car owners to rent out their cars. (Sound a bit like AirBnb? That’s the idea.)

The idea? The rental rates are lower, which makes consumers happy. The people who rent out their cars make money. They’re happy. The company has less overhead. Everyone’s happy.

Here are a few more key details to know about Turo:

- What is now Turo was founded in 2010 as RelayRides by a trio of Harvard Business School classmates.

- The company was taken over by entrepreneur Andre Haddad, who expanded the company to San Francisco and then nationwide and eventually rebranded the company as Turo. (Haddad, by the way, is said to rent out his own cars on the platform.)

- Over the years, the company has partnered with some big names, including General Motors (NYSE: GM) and their OnStar division, Delta Airlines (NYSE: DAL), and more.

- As of 2021, there were over 350K vehicles listed on Turo.

- The company was last valued at $1 billion.

- In 2022, the company generated over $746 million in revenue — a big jump from 2021, when it reported revenue of $469 million.

OK, so you can see why the company is worth watching. Now you want to know how to buy Turo stock. Here’s the scoop…

Can You Buy Turo Stock? Is Turo Publicly Traded?

Turo plans on going public — in fact, it has filed to go public on the New York Stock Exchange. The Turo stock symbol will be NYSE: TURO.

But the IPO has not happened yet, so you can’t buy Turo stock yet. Unless, that is, you’re an accredited investor…

How to Buy Turo as an Accredited Investor

Turo is not publicly traded. But accredited investors can invest in private companies including Turo through Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors.

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

Sign up with Hiive, check out Turo, add it to your watchlist, and get notified about any new listings and trades.

On Hiive, each listing is made by a different seller who sets their asking price and the amount of volume offered. These sellers might be employees, venture capital firms, or angel investors.

As a buyer, you can create a watchlist of companies to watch and get notified about price changes or new listings. Once you find an offer you’re interested in, you can accept the asking price as listed, place a bid, or negotiate directly with the sellers.

How to Buy Turo as a Retail Investor

As noted earlier, while Turo plans to issue an initial public offering (IPO), it simply hasn’t happened yet.

So, as a retail investor, you could wait for the IPO…

Or you could consider other strategies. But first, you need to know a few details…

Who Owns Turo?

Turo was originally founded as RelayRides in 2010 by Shelby Clark, with the help of her Harvard Business School classmates Nabeel Al-Kady and Tara Reeves.

It was subsequently taken over by Andre Haddad, who still acts as the company CEO.

Over the years, notable investors have included Canaan Partners, August Capital, Shasta Ventures, Google Ventures, and InterActiveCorp.

Does Google Own Turo?

Nope. Google (NASDAQ: GOOGL) does not own Turo. However, Google Ventures (Google’s venture capital arm) is an investor.

Fun fact: Google is connected to another company in the auto space — Waymo, a self-driving car company. (Want to know more? Check out our article about how to buy Waymo stock.)

Want to buy shares of Google for indirect exposure to Turo? You need a broker. Don’t have one? We recommend eToro.

It’s one of the world’s most popular investing platforms, with over 28.5 million users.

Plus, eToro is currently offering a $10 bonus* for U.S. residents.

$10 bonus for a deposit of $100 or more. Only available to U.S. residents. New accounts only. Additional terms and conditions apply.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

How to Invest in Turo Stock as a Retail Investor

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

Investors

Google (NASDAQ: GOOGL) — As noted earlier, Google Ventures (the venture capital arm of Google) is an investor in Turo. True, exposure to Turo will be very indirect indeed through such a huge company.

Competitors and Car Rental Companies

Turo isn’t public yet, but some of its competitors are, like:

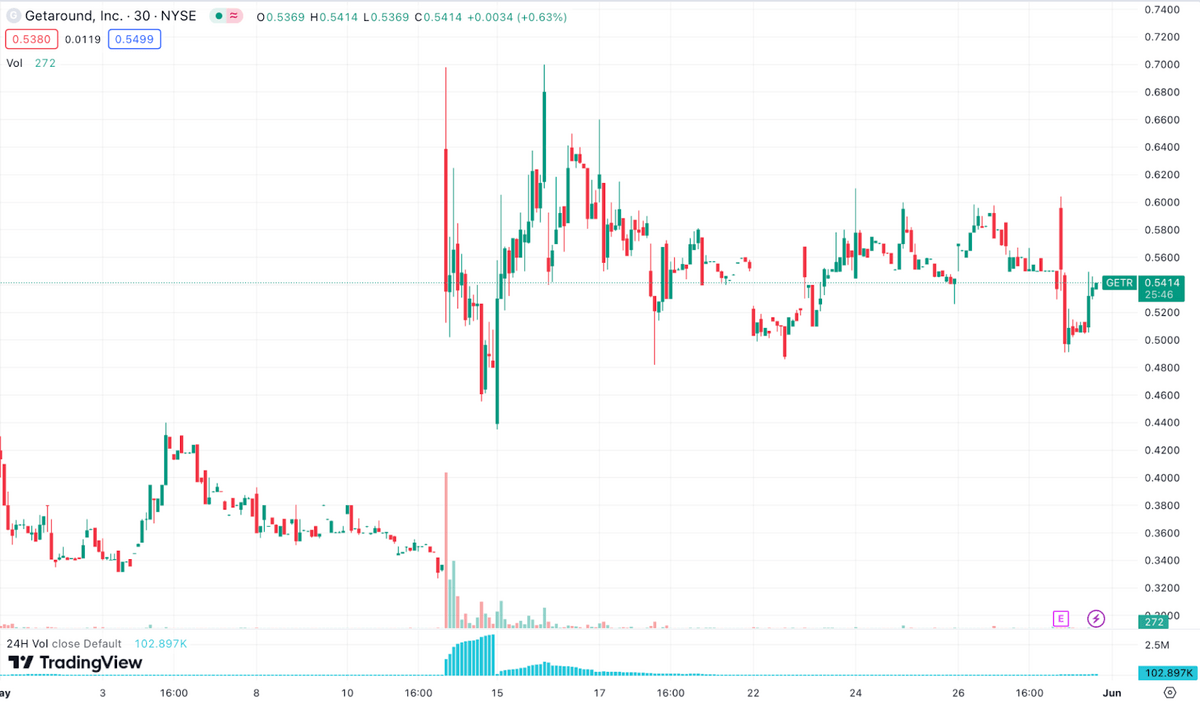

- Getaround Inc. (NYSE: GETR) — 1-month chart below

- Hyrecar (OTCMKTS: HYREQ)

Additionally, as a car lending service, many people compare Turo to car rental companies. While they’re not exactly the same, it’s possible that uptrends in overall car rentals could benefit both Turo and companies such as…

- Avis Budget Group (NASDAQ: CAR) — This company is also the owner of ZipCar, which also resides in the “car-sharing” niche, though the vehicles are owned by the company.

Partnerships

As noted earlier, Turo has partnered up with companies in the past, including General Motors (NYSE: GM) and their OnStar division and Delta Airlines (NYSE: DAL). If and when they announce new partnerships, it may be worth keeping an eye on the partnering party.

How to Buy the Turo IPO

Here are the steps on how to buy Turo stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Turo

- Select how many shares you want to buy

- Place your order

- Monitor your trade

Turo Stock Price Chart

Since Turo is not yet public, there’s no Turo stock price chart to refer to. However, there are other ways to assess how the company is doing.

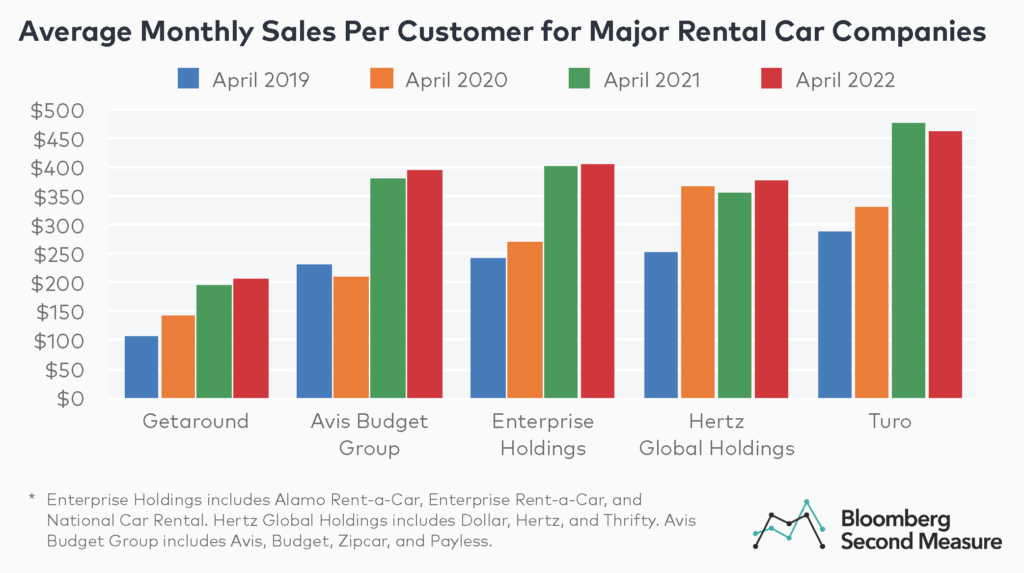

For instance, the below chart demonstrates what a major player Turo has become in the car-rental sector — it’s giving long-established companies like Hertz (NASDAQ: HTZ) and Enterprise a run for their money.

One thing’s for sure: plenty of investors are eagerly awaiting Turo’s IPO.

If you’re an accredited investor and you don’t want to wait for the IPO, check out Turo on Hiive.

If you’re a retail investor, keep your eyes out for the IPO — and in the meantime, consider some of the other avenues discussed in this article.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How to buy Turo stock?

At writing, Turo is not yet publicly-traded so there is no way to buy Turo stock. However, accredited investors may invest in the company through platforms like Hiive.

How much is Turo stock?

While Turo has filed to go public on the New York Stock Exchange, it has not yet issued its initial public offering (IPO). Since Turo stock is not yet listed on the stock exchange, there is no Turo stock price yet.

What is Turo stock symbol?

When Turo goes public, it will trade under the ticker symbol NYSE: TURO. However, at writing the company has not gone public yet, so the Turo stock symbol is not yet active.

Who owns Turo stock?

Turo was originally founded as RelayRides in 2010 Harvard Business School classmates. The current CEO is Andre Haddad, and notable investors include Google and InterActiveCorp (IAC).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.