Addepar is not publicly traded.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like Addepar who want to sell their shares.

Sign up with Hiive here and get access to Addepar before its IPO.

Interested in how to buy Addepar stock? You’re in the right place.

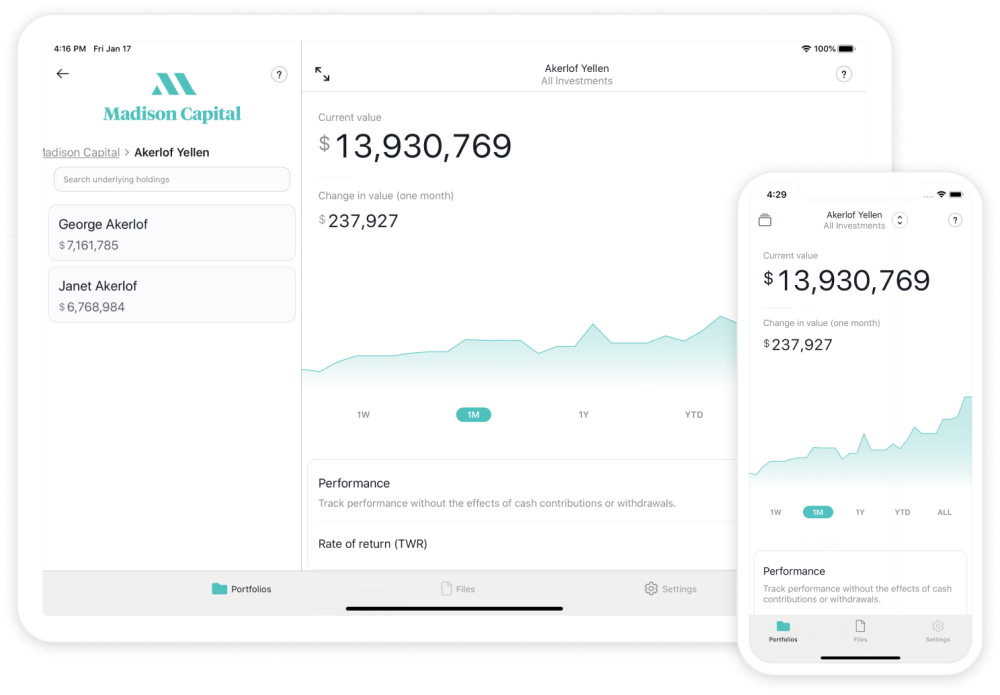

Addepar is a premier wealth management platform that stands at the forefront of the industry by seamlessly integrating performance reporting, data aggregation, and advanced analytics for investors and financial advisors.

Established in 2009, Addepar has experienced remarkable and rapid growth, evolving from a promising startup into a powerhouse supporting over $6 trillion in assets on its platform and collaborating with over 1,000 firms as of December 2023.

And the company isn’t slowing down either, investing over $100 million in research and development annually.

This substantial investment appears to underscore Addepar’s dedication to enhancing its platform, ensuring it remains at the cutting edge of technological advancements.

Simply put: in our opinion, Addepar is a dynamic entity reshaping the landscape of wealth management.

Let’s delve deeper into what makes Addepar stand out.

Can You Buy Addepar Stock? Is Addepar Publicly Traded?

No, Addepar is not publicly traded.

As a private company, Addepar’s shares are not available on public stock exchanges. This means that retail investors cannot purchase Addepar stock through conventional brokerage accounts.

However, accredited investors can gain exposure to Addepar in other ways. Let’s dig in.

How to Buy Addepar Stock as an Accredited Investor

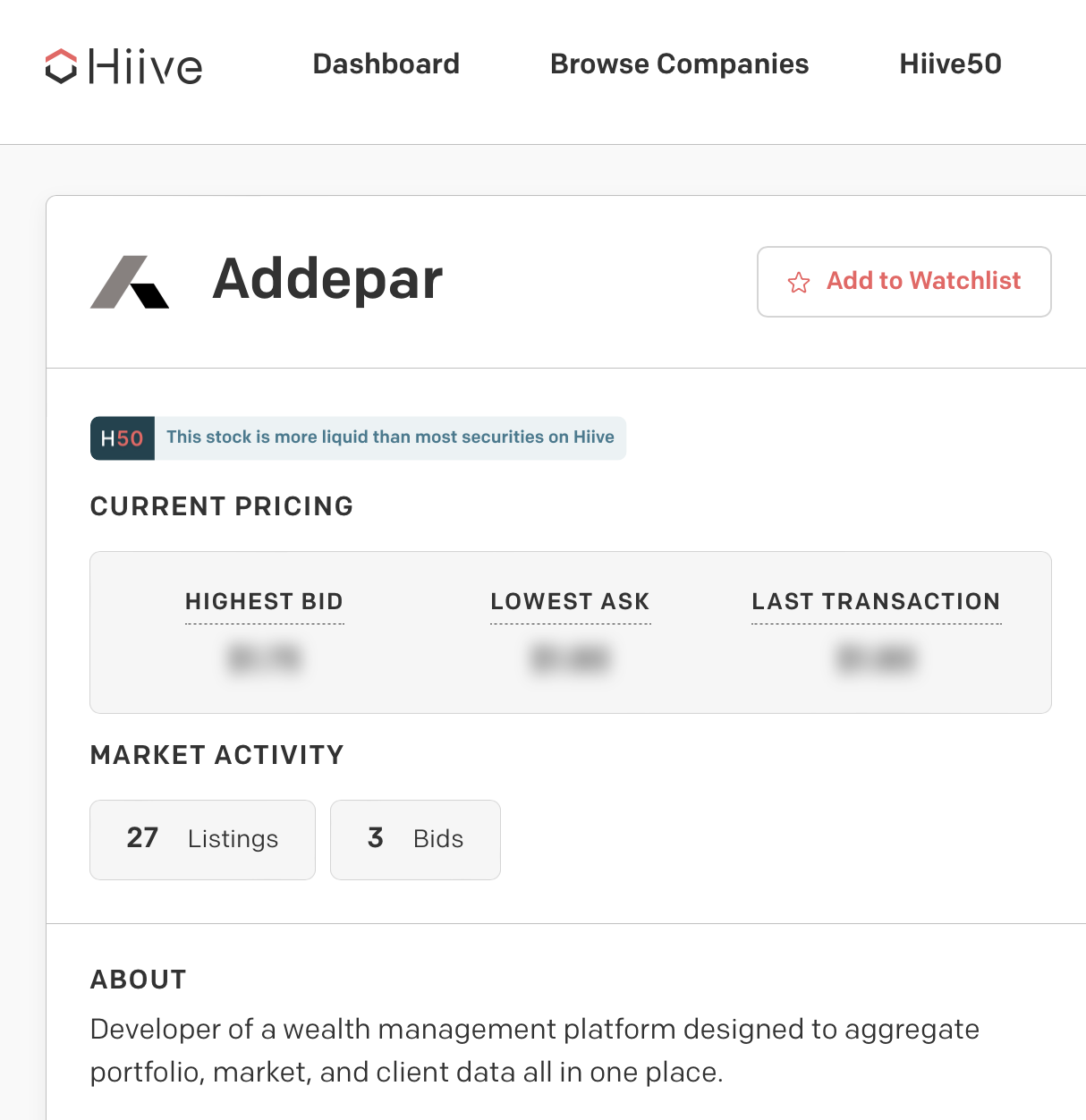

Addepar is not publicly traded. But if you’re an accredited investor and want to know how to buy Addepar stock privately, consider Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors.

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

Steps to Invest via Hiive:

- Sign Up with Hiive: Create an account on Hiive’s platform to gain access to its marketplace.

- Explore Listings: Browse the available listings to find Addepar shares or other exciting investment opportunities.

- Add to Watchlist: Add Addepar to your watchlist to get notified about new listings and trades.

- Negotiate and Purchase: Engage in negotiations with sellers to agree on the terms and purchase the shares.

- Monitor Investments: Track your portfolio and any updates regarding the companies you’ve invested in.

How to Buy Addepar Stock as a Retail Investor

For retail investors, purchasing Addepar stock directly is not an option since the company is privately held. However, retail investors can stay informed about potential opportunities and explore similar investment avenues.

Let’s take a look:

Who Owns Addepar?

Addepar was founded in 2009 by Joe Lonsdale and Jason Mirra. Since that time, the company has undergone six rounds of financing, raising half a billion dollars from notable investors, including:

- D1 Capital Partners

- WestCap Group

- 8VC

- Signatures Capital,

- Valor Equity Partners

Does Warren Buffett Own Addepar?

No, Warren Buffett does not own Addepar. However, his investment firm, Berkshire Hathaway, often invests in high-potential companies, making it a point of comparison for investors.

While Buffett has not invested in Addepar, other notable investors, such as Valor Equity Partners and 8VC, have shown confidence in the company.

Alternatives to Addepar for Retail Investors

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

Retail investors looking for exposure to similar investments should consider publicly traded alternatives to Addepar.

Clearwater Analytics (NYSE: CWAN)

Clearwater offers a SaaS-based investment accounting and analytics solution that aggregates, reconciles, and reports on more than $7.3 trillion in assets each and every day.

Their platform supports various asset classes and currencies, providing accurate, comprehensive, and customizable reports for investment accounting, performance, compliance, and risk reporting.

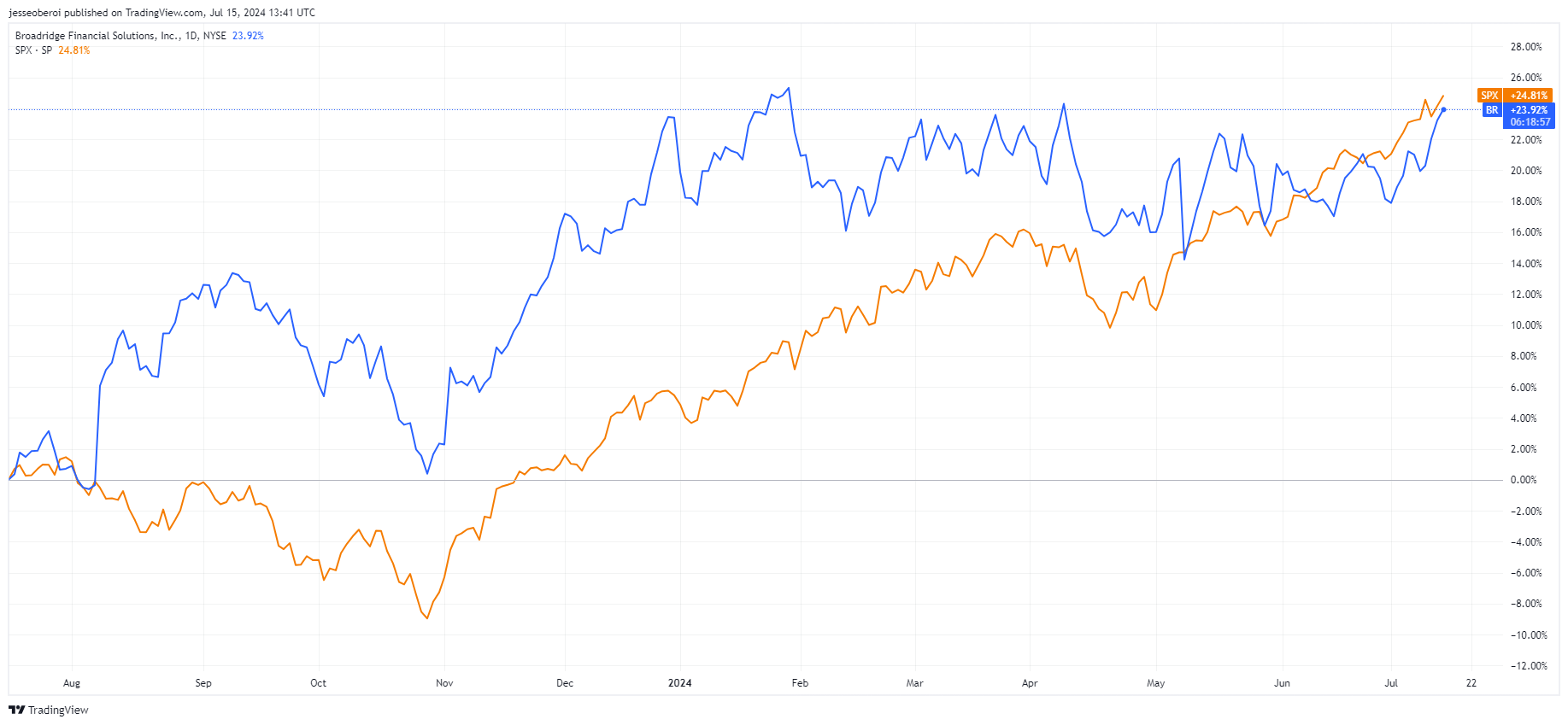

Broadridge Financial Solutions (NYSE: BR)

Broadridge offers comprehensive data aggregation and financial reporting services for wealth management firms. Their platform reconciles, normalizes, and aggregates data to provide actionable insights and improve decision-making across the enterprise.

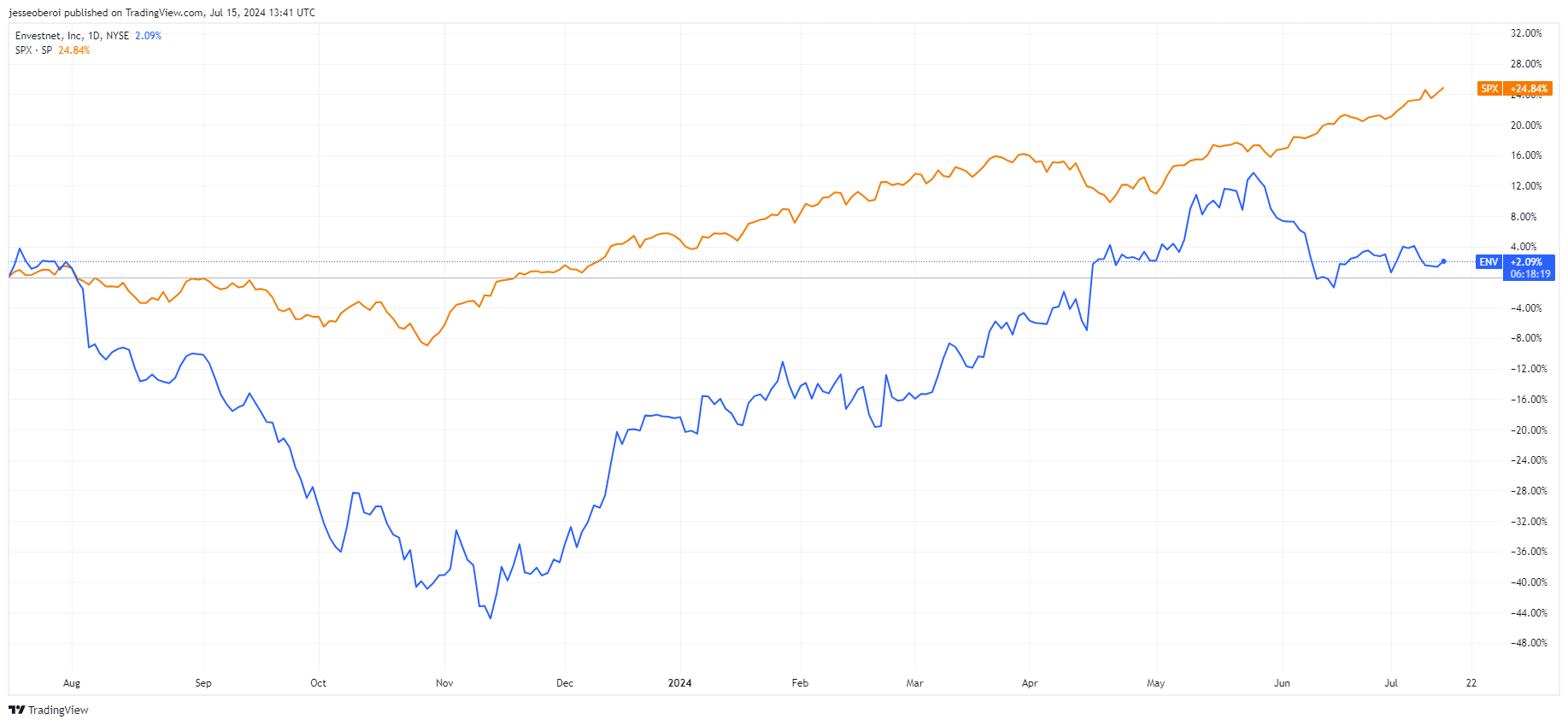

Envestnet (NYSE: ENV)

Envestnet provides a platform that connects and enriches data sets, offering financial advisors actionable insights and dynamic experiences. Their solutions include data aggregation, analytics, and personalized client reporting.

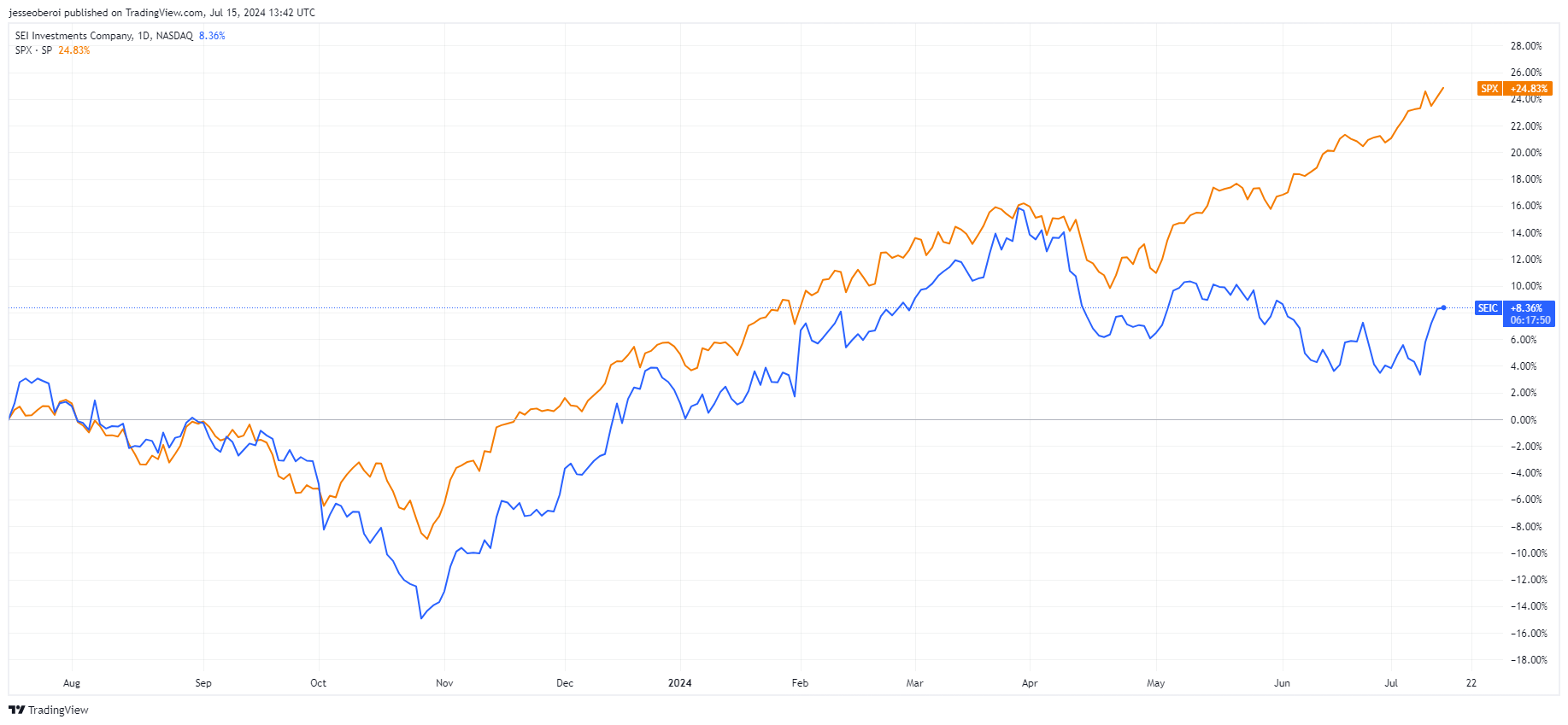

SEI Investments (NASDAQ: SEIC)

SEI provides the Archway Platform, which is designed for financial data aggregation and reconciliation across various investment types. This platform supports both public and private investments and offers sophisticated accounting and reporting technology for wealth management.

How to Buy the Addepar IPO (How to Invest in Addepar Stock)

Here are the steps on how to invest in Addepar stock if and when it becomes available. In other words, if it IPO’s, here’s how to invest in Addepar stock:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Addepar

- Select how many shares you want to buy

- Place your order

- Monitor your trade

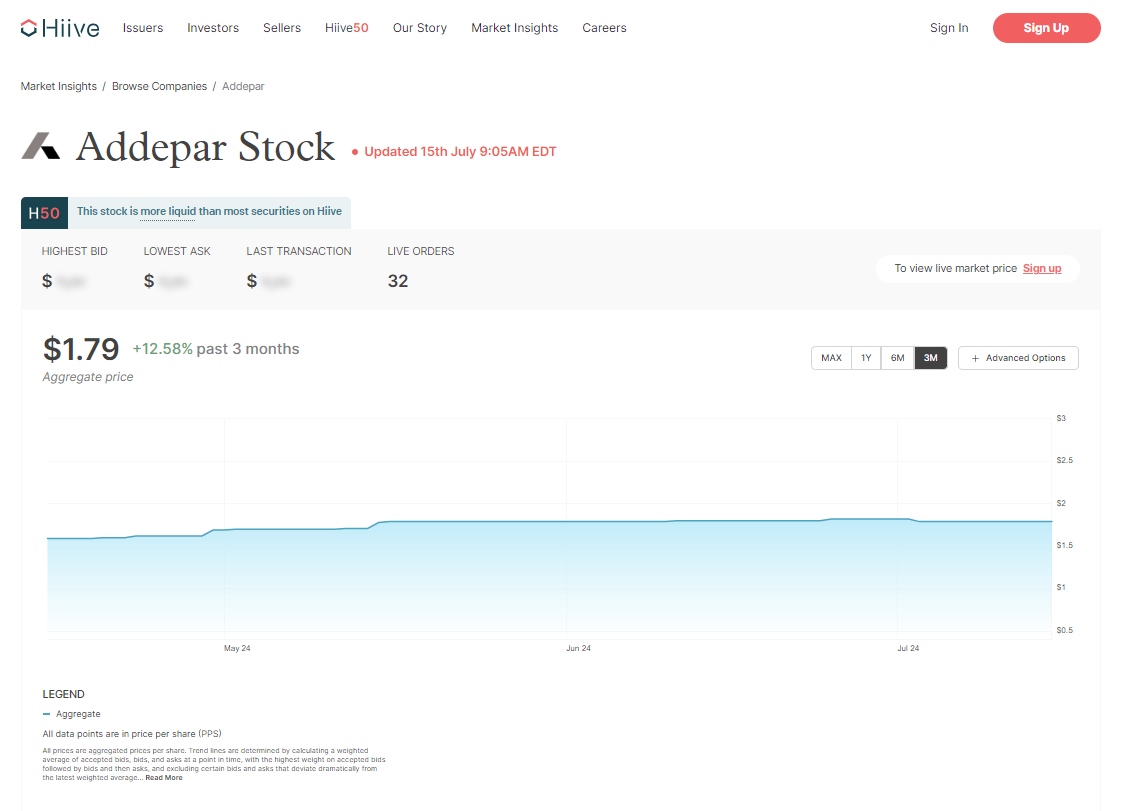

Addepar Stock Price Chart

Here is the current aggregate price for Addepar on Hiive*:

Generated based on Hiive’s proprietary algorithm and does not reflect any current offers or an indication of future performance.

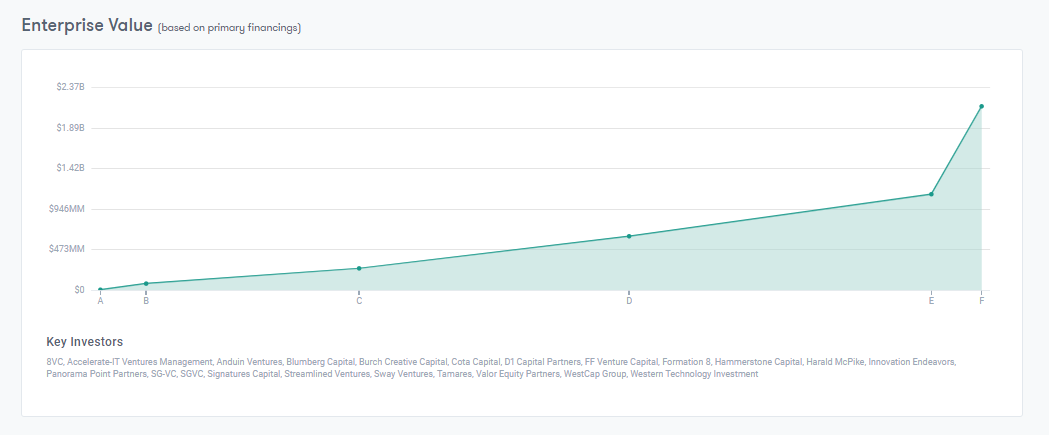

While no Addepar stock price chart exists on your brokerage account, you can assess the company’s enterprise value (EV) growth, a metric commonly used to measure a company’s total value.

In 2011, the company was valued at $7.37 million.

As of 2021, the company’s EV was a whopping $2.2 billion.

Conclusion

Addepar has firmly established itself as a powerhouse in the wealth management industry.

Despite its private status, which limits direct investment opportunities for retail investors, Addepar may be a compelling prospect for accredited investors through platforms like Hiive. If you’re not an accredited investor, consider some of the other approaches discussed in this article.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How can I buy Addepar stock?

You can't buy Addepar stock as it is not publicly traded. Accredited investors can invest through private marketplaces like Hiive.

How much is Addepar stock?

Addepar stock is not publicly available, so there is no public stock price.

What is the Addepar stock symbol?

There is no Addepar stock symbol as the company is not publicly traded.

Who owns Addepar stock?

Addepar is owned by its private investors, including venture capital firms such as Valor Equity Partners and 8VC.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.