There are plenty of great brokers out there. But how can you tell if they’re any good for trading options?

eOption’s name says it all — this brokerage is specifically geared toward options trading and has some of the best prices and trading software around.

Intrigued? In this comprehensive eOption review, I’ll guide you through everything you need to know before deciding if this options-focused platform is for you. We’ll talk about everything from the basics like assets covered and the trading platform itself to the resources it comes with and nitty-gritty stuff like eOption fees. Let’s do it:

eOption Review in 2025 (Our Take)

The Bottom Line: If you’re an options trader, eOption is a fantastic platform.

It has super cheap options trading, free stock and ETF trading, and a plethora of handy features for options research including automated trading.

if you’re an options trader looking for advanced features — or even if you’re a less-experienced user looking for unique trading features and educational content — this might be the platform for you.

However, investors who are looking for other trading instruments or long-term investment assets might be unsatisfied with the platform’s limited offerings and pricing.

eOption Overview

eOption is a low-cost brokerage, focused on providing high-volume options traders with low fees and powerful research tools.

Besides options, the brokerage offers free stock and ETFs trading. Bonds and mutual funds are on the menu too, but not at a very competitive price.

However, active traders interested in crypto, futures, CFDs, or fractional shares won’t find them here.

Only U.S. clients get the benefit of low-cost trades with no account minimum. Non-U.S. investors need at least a $25,000 account balance to start trading.

Who Is eOption Best For?

Most eOption reviews will tell you the same thing — the platform is really best for two specific groups…

- Options Traders: eOption is a great choice for options traders who are looking for a robust options trading platform that allows for the quick execution of numerous options trading strategies.

The platform offers over 40 different options strategy types, with a low-cost fee structure that allows you to trade options for $0.10 per contract, including a base rate of $1.99 per trade.

- Active Traders: eOption is a good choice for active stock traders looking for a long list of equities they can trade for free.

The brokerage also offers margin trading with affordable rates that let you trade for APR of 7.75% (for accounts under $25,000) and 4.57% (for accounts above $25,000) for any funds borrowed on the margin.

eOption Features:

Assets Covered

eOption offers a range of tradable assets best suited for options traders and stock investors:

- Options: Low-cost platform for trading options on stocks, ETFs, and indices.

- Stocks: eOption offers stock from NYSE, NASDAQ, and AMEX, as well as some OTC markets

- ETFs

- Mutual funds

- Fixed income products

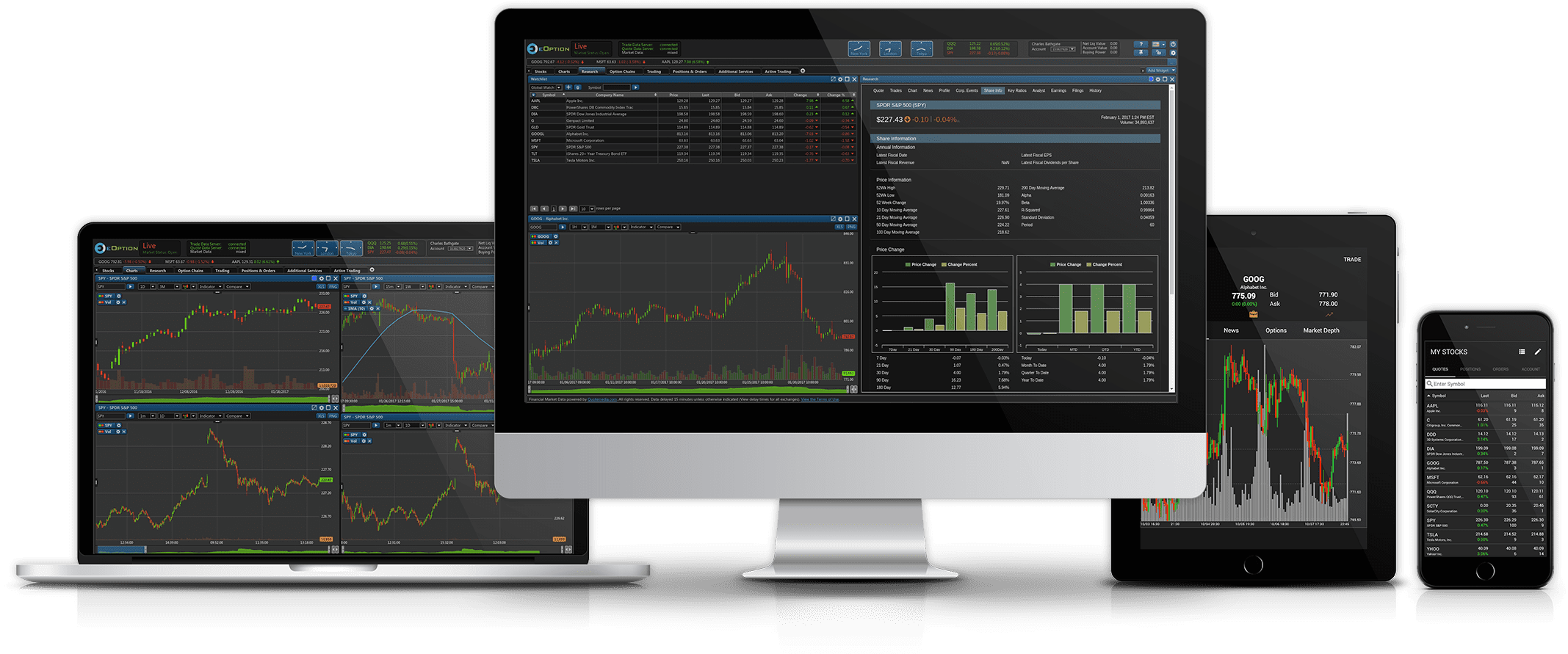

Trading Platforms

Here’s a brief description of eOption’s trading platforms:

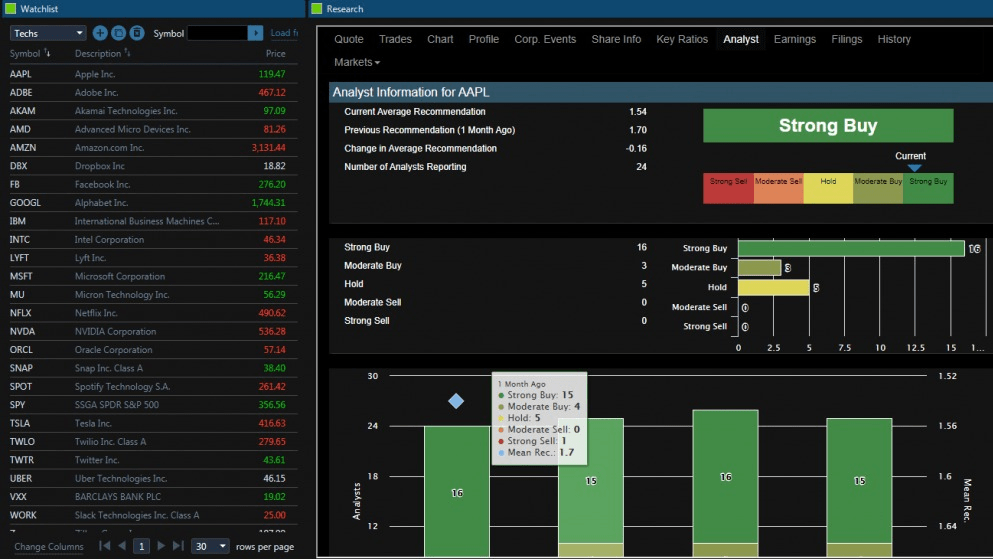

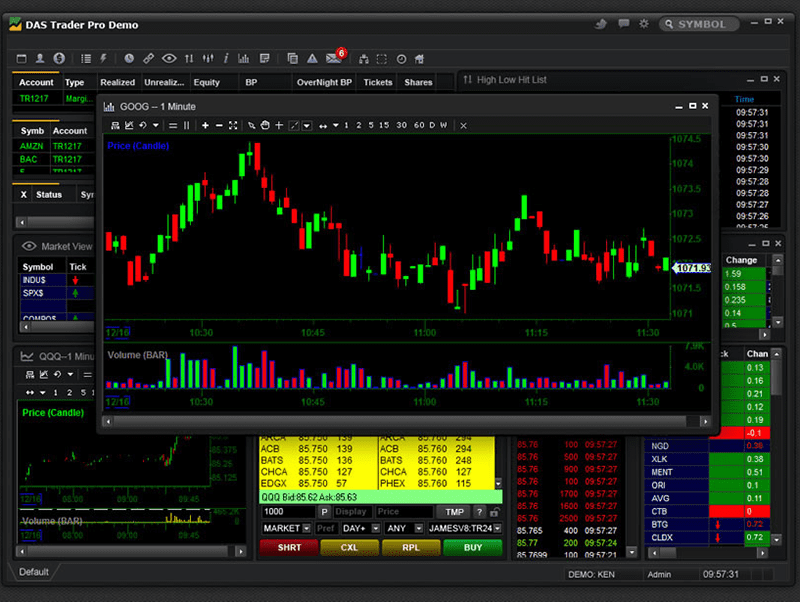

1. eOption Trader Platform: eOption Trader is the brokerage’s main trading platform: a desktop, web-based trading platform designed for active traders that comes with advanced trading tools and charting capabilities.

It allows you to easily trade stocks, options, and futures and is best equipped for direct access trading. The platform allows users to create stock watchlists, track stocks’ performance, compare them, and access market news.

However, the platform doesn’t help you with in-depth fundamental analysis research except for basic stuff like income statements and analyst reports.

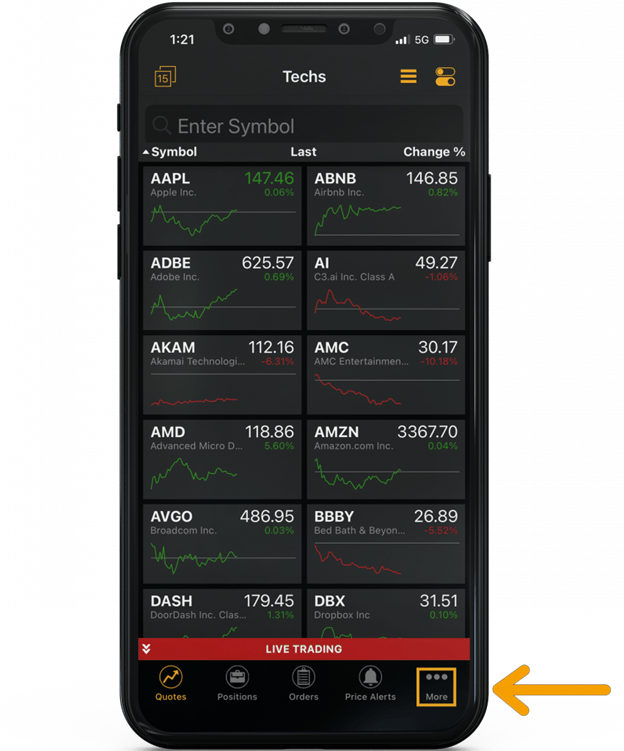

2. eOption Mobile App: The mobile app comes with a layout similar to the desktop app, but it is optimized for trading on the go. The app has the same features and tools as the desktop versions, but in a tighter package:

The app updates in real-time, which helps traders track price changes on a second-to-second basis. Also, the app allows traders to execute multi-leg options trades.

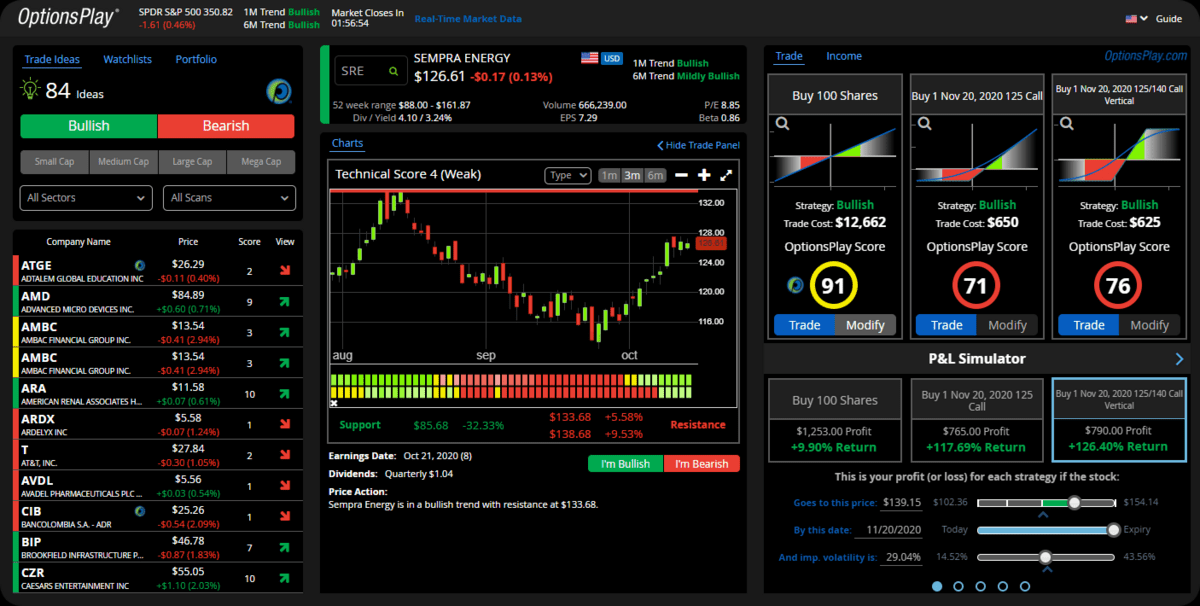

3. OptionsPlay: OptionsPlay is a third-party trading platform provided at no extra cost to existing eOption users. The platform offers a range of features, including the ability to scan for potential trades, build options strategies, and analyze risk.

The platform provides daily trading ideas with numerous filters (by market cap, sector, market sentiment, etc.) that give you a comprehensive overview of valuable trading hints and strategies.

One of the key benefits of OptionsPlay is its intuitive interface, which makes it easy for both beginners and veterans alike. The platform also has a wealth of educational resources, including webinars, tutorials, and market analyses.

Charting

eOption offers advanced and highly customizable charting tools, designed for easier trend spotting and comprehensive market performance overview.

The platform allows users to customize charts in the following ways:

- By type: Traders can visualize market data with line, area, OHLC, candlestick, or hollow candle charts.

- By time period

- By activity period

Users can access numerous customizable technical indicators, and also compare two symbols within the same chart.

Plus, you can visualize and analyze multiple data sets on charts by overlaying events such as earnings, splits, and dividends.

Screeners

eOption provides a range of screeners that enable investors to filter stocks:

- Basic Stock Screener: Filters stocks based on basic criteria such as market capitalization, price-to-earnings ratio, and dividend yield.

- Advanced Stock Screener: Provides filtering options such as technical indicators, options volume, and short interest.

- Mutual Fund Screener: Filters mutual funds based on criteria like fund type, expense ratio, and performance.

- ETF Screener: Filters exchange-traded funds (ETFs) based on criteria like asset class, fund type, and expense ratio.

- Bond Screener: Filtera bonds based on criteria such as credit rating, maturity date, and yield to maturity.

Education

Unsurprisingly, eOption’s educational program revolves around options trading

However, most of the educational articles and videos require some basic investing knowledge, so intermediate and advanced investors may find more value in these resources than beginners.

The platform’s educational offering includes:

- Webinars: eOption holds live webinars conducted by experts that cover a wide range of topics such as options trading strategies, technical analysis, and market trends.

- Tutorials: Tutorials cover topics like options trading, technical analysis, and risk management. These tutorials are available in video format on the eOption Youtube channel, with up to 60 videos that cover a broad range of common investing topics. Solid for beginners, but not too alluring for intermediate traders.

- Articles: You can access these articles in the “Resources” section of the website; there are articles for all traders from beginners to advanced.

- Daily Market Updates: eOption offers regular market analysis and commentary, covering a wide range of financial instruments. The brokerage provides daily market updates with information on the most volatile stocks, important economic statistics, and daily trading recommendations by experts.

- Paper trading account: Like most brokers, eOptions has a paper trading account where you can trade using fake virtual money. All the broker’s platforms have this practice account which is crucial for beginners, as well as other traders who want to try out new strategies.

Automated Trading

eOption offers an Auto Trading feature that automatically executes trades using newsletter alerts researched by clients.

Investors have more than 50 available newsletters that can be linked with the eOption trading platform for automatic trade executions. Clients also have the option to set maximums per trade.

The Automated trading option comes with higher fees than regular trading for equities and options. The brokerage charges a commission rate of $2.00 for equities; for options trading, investors are charged the fee of $3.99 per execution + $0.10 per contract.

eOption Fees and Commissions

Here is a breakdown of eOption fees and commissions:

Options | $0.10 per contract + $1.99 per trade |

Stocks/ETFs | $0.00 |

Foreign stocks | $39 |

Mutual funds | $5 |

Bonds | $5 for the first 25 bonds/ $3.00 for additional bonds |

Auto Trade | $2 for equities/ $3.99 + $0.10 per contract for options |

Broker-assisted trades | $15 on top of other fees |

Pros and Cons of eOption

Pros | Cons |

|---|---|

Low options trading fees | Limited fundamental analysis tools |

Easy to use mobile app | Limited set of tradable assets |

Unique automated trading method | Lack of educational resources for beginners |

Free stock and ETFs trading |

Final Word: eOption Review

If you’re interested in passive investing or buy-and-hold strategies, eOption is probably not the right fit.

But if you’re an active options trader, eOption could be just what you’re looking for: an options-centric brokerage that’s loaded with features designed specifically for options traders.

It’s a great brokerage for traders interested in high-frequency options trading at an affordable price and who want access to options trading tools and resources.

However, the platform isn’t the most intuitive for beginners — it’s best for options traders who have some existing knowledge and experience.

FAQs:

What is the Minimum Deposit for eOption?

The minimum deposit for eOption is $500 for a cash account and $2,000 for a margin account. Minimums may vary outside of the U.S.

Who Owns eOption?

eOption is a privately-held brokerage firm that was founded in 2007. The company's website lists the CEO as Joseph Ricketts, who is also the founder and former CEO of TD Ameritrade. However, it's important to note that eOption is not owned by TD Ameritrade or any other financial institution.

What is the Most Trusted Trading Platform?

A trustworthy broker must have 3 characteristics: a long track record, few if any concerning incidents in the past, and it should be regulated by top U.S. financial authorities like the SEC and FINRA. A few notable brokers like this are Fidelity, Interactive Brokers, and TD Ameritrade.

How Good is Option Trading?

Option trading offers investors flexibility and control over their positions while allowing them to potentially generate higher returns with less capital than traditional stock trading. However, selling options can be particularly risky since options-sellers are obligated to buy or sell the underlying asset in high volume come expiration date.

What is the eOption Promotion Code?

At writing, there are no eOption promotions running. As such, there is no active eOption promotion code.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.