The only thing I miss about being a financial data analyst for Fortune 500 clients is the data.

I had access to every major data platform, website, and feed available: Refinitiv, Thomson Reuters, Capital IQ, YCharts, and, best of all, Bloomberg.

A Bloomberg Terminal is the gold standard for real-time news, research, analysis, data, and economic reports on local and global scales. It’s ridiculously powerful.

And at an annual fee of $24,240 per user, it’s ridiculously expensive.

When I quit my job and set off as a consultant I missed the power, but there was no way I was forking over $2,000 per month for my own Bloomberg Terminal.

Plus, for what I’d be using it for (my own portfolio), it was overkill anyways.

So I went to Google and searched: “alternatives to Bloomberg Terminal”.

And I got some pretty terrible results…

Platform | Best for | Cost |

|---|---|---|

Analyst Reports & Fundamental Analysis | $19.50/month (billed annually) | |

Investment Reports | $239 / year (Get $25 off with this link) | |

Real-time newsfeed | $27/month (billed annually) | |

Advanced Financial Data & Analytics | Various tiers; Basic is $15/month | |

Portfolio Quality Tracking | $89/year | |

World Bank | Free Economic Data | Free |

Yahoo Finance | Free Financial Statements | Free |

Bloomberg Terminal Alternatives

Here’s the problem:

The Bloomberg Terminal was created for financial professionals who work on or with Wall Street. It’s enterprise software, for people with enterprise budgets.

Hence the $2,020 per month price tag.

And all of the Bloomberg Terminal competitors I found were the same:

- Bloomberg Terminal – $24,240 per user per year

- Refinitiv Eikon – $22,000 per user per year

- FactSet – $12,000 per user per year

- S&P Capital IQ – $30,000 per organization per year

- YCharts – $6,000 per user per year

While you can find a lot of free features in our YCharts review, these paid subscriptions aren’t viable for most of us.

What I needed (and what you need too) is Bloomberg Terminal alternatives for individual investors.

You know, cheaper (or free) stuff.

Before I get to my list of Bloomberg Terminal alternatives for retail investors, I want to quickly cover what features I was looking to replace.

Bloomberg Terminal Features

Bloomberg Terminals deliver real-time news, research, analytics, data, and economic reports (among thousands of other functions) on U.S. and global stocks, bonds, commercial paper, repos, derivatives, syndication loans….you get the point.

I knew I wasn’t going to replace all of the features and data, so I really only wanted to replace my most used resources:

- Analyst reports and ratings

- Consensus earnings estimates

- Fundamental analysis

- Real-time news

- Historical charts and data

- Investment and economic reports

With this list, my search for cheaper alternatives to Bloomberg Terminal began.

The 7 Best Alternatives to Bloomberg Terminal for Individual Investors:

You can pick your favorite option from this list and just use it on its own but, if you want to completely replicate a Bloomberg Terminal, you will need to pair some of these softwares together (which is what I do).

1. WallStreetZen: The Best Bloomberg Alternative for Analyst Reports & Fundamental Analysis

Pricing:

-

- Basic: $0

- Premium: $19.50/month (billed annually)

Exclusive offer:

WallStreetZen is a stock research platform that covers NYSE- and Nasdaq-listed equities.

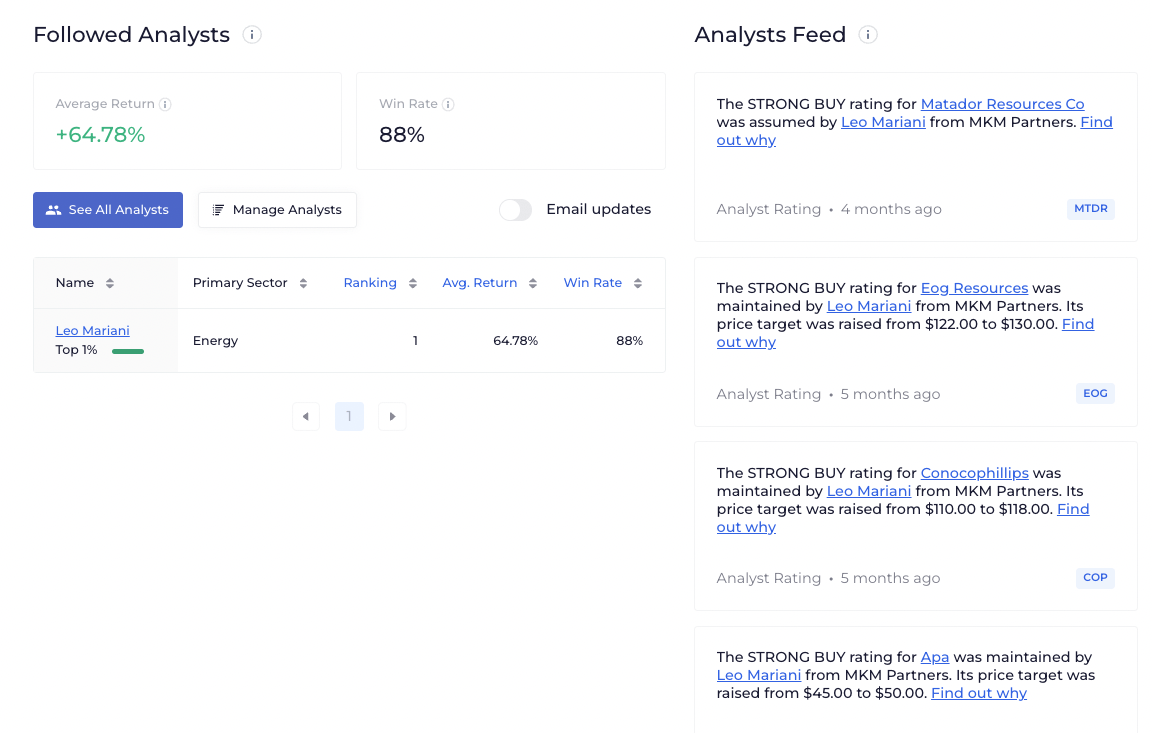

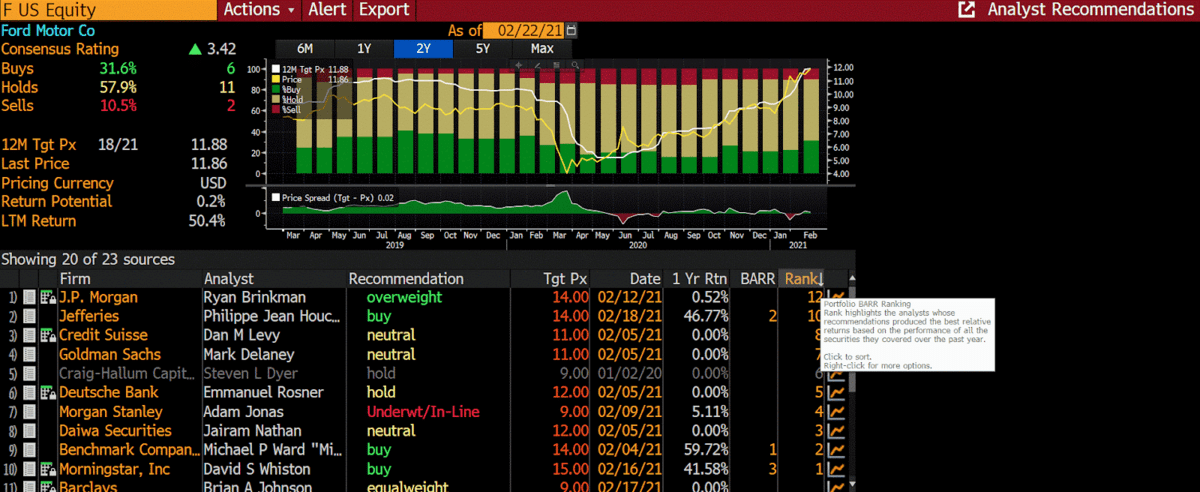

One of my favorite features on the Bloomberg Terminal is Analyst Recommendations:

After looking up any stock, you can view a list of the Wall Street analysts issuing ratings on that stock and view their rating – but that’s not the cool part.

You can also view the total return of each analyst’s ratings in the past year and how they rank compared to other analysts.

Why is this important?

Because most analyst reports aren’t worth the paper they’re printed on.

Let me explain.

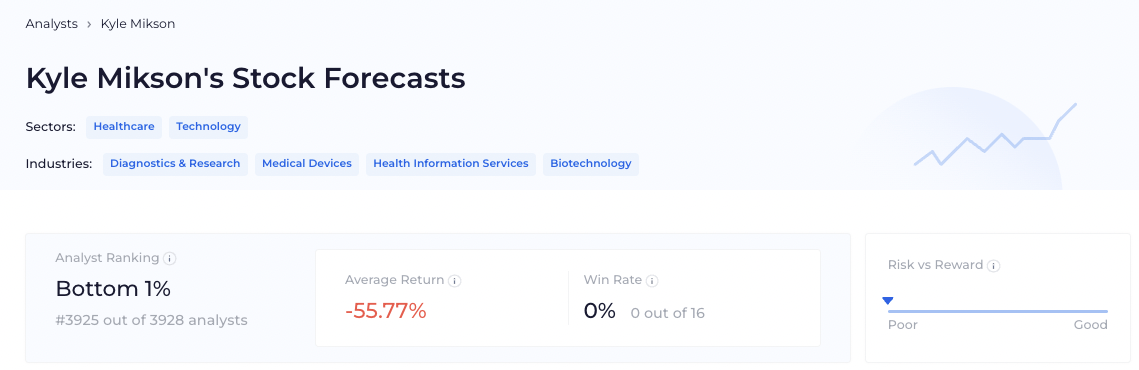

If you see that some analyst named Kyle Mikson marks a stock you own as a “Strong Sell”, should you sell it? Before you answer that, what if I told you Kyle Mikson has been right 0 out of his last 16 ratings, with an average return of -55.77%?

I don’t know about you, but I’m not going to listen to a thing Mikson says.

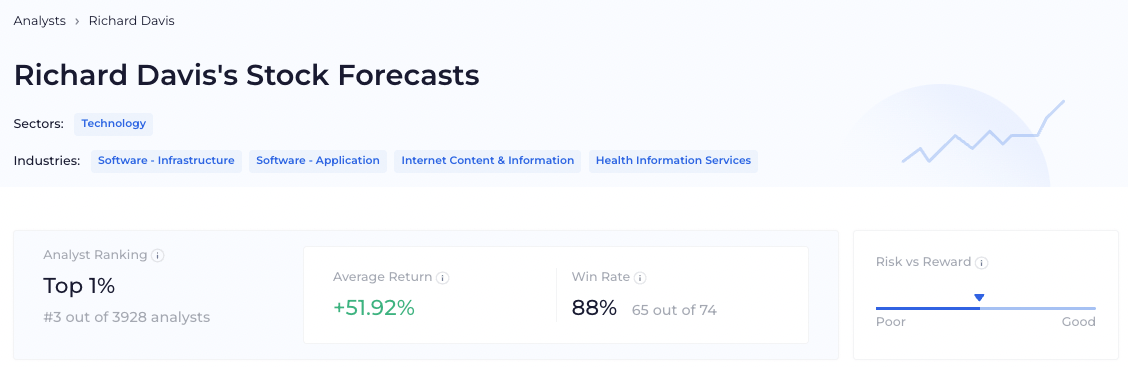

On the other hand, if Richard Davis issues a “Strong Buy” on a stock, it’s probably worth looking into:

Hence the importance of tracking analysts’ performance data.

WallStreetZen enables individual investors to have the same analyst insights as the professionals working at hedge funds and investment banks get with their $25,000 Bloomberg Terminals.

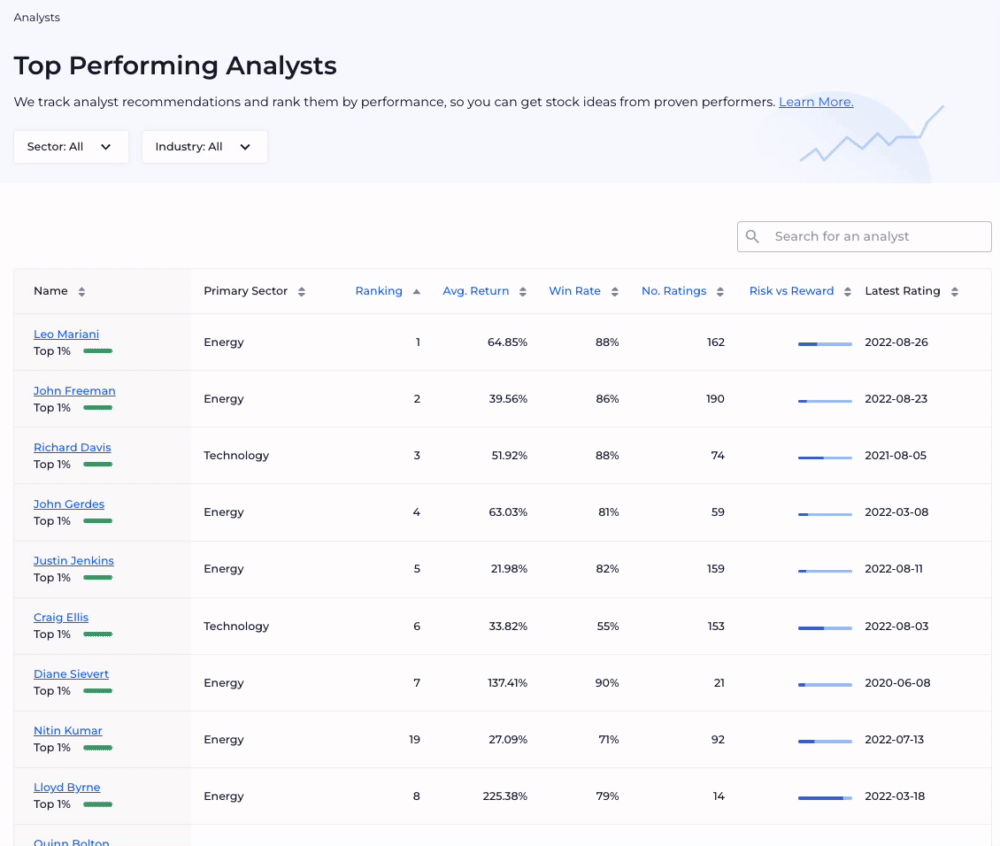

It tracks, analyzes, and ranks more than 4,000 analysts based on their win rate, consistency, and average returns so you can uncover winning stock recommendations made by the best-performing analysts on Wall Street. The feature is called Top Analysts:

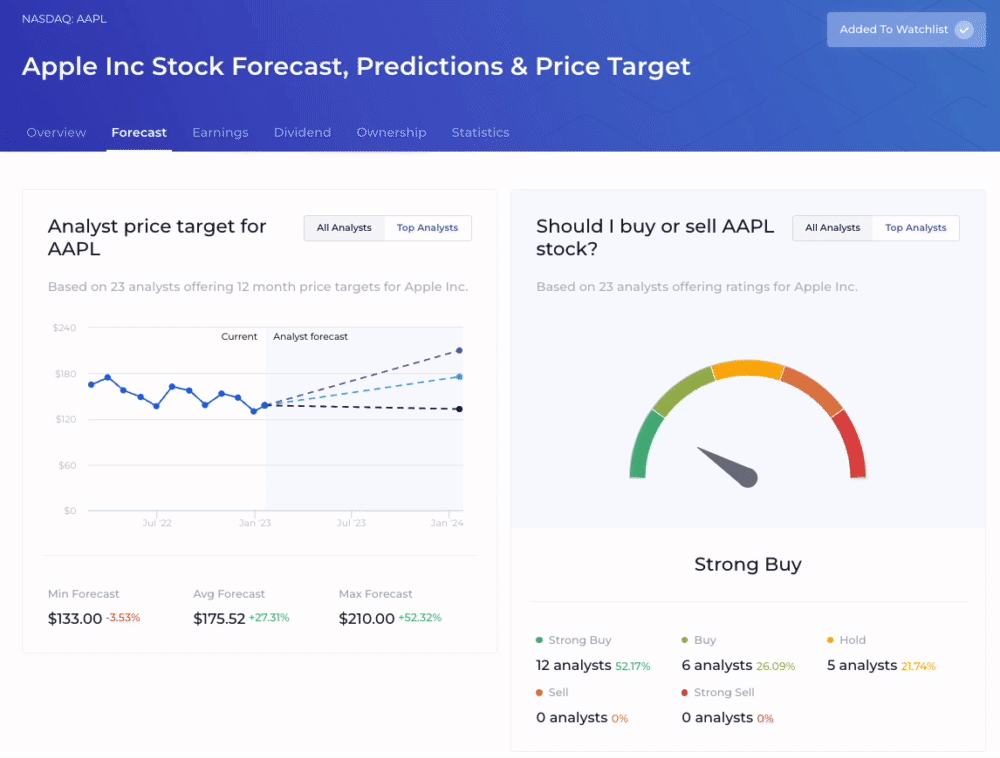

In addition to the repository of analysts, WallStreetZen shows consensus ratings and price targets on each individual stock, color, and financial forecasts:

If you especially like a certain analyst’s reports and stock recommendations, you can follow the analyst and receive email updates every time they issue a new Buy/Sell/Hold rating:

And Top Analysts is just one feature on WallStreetZen!

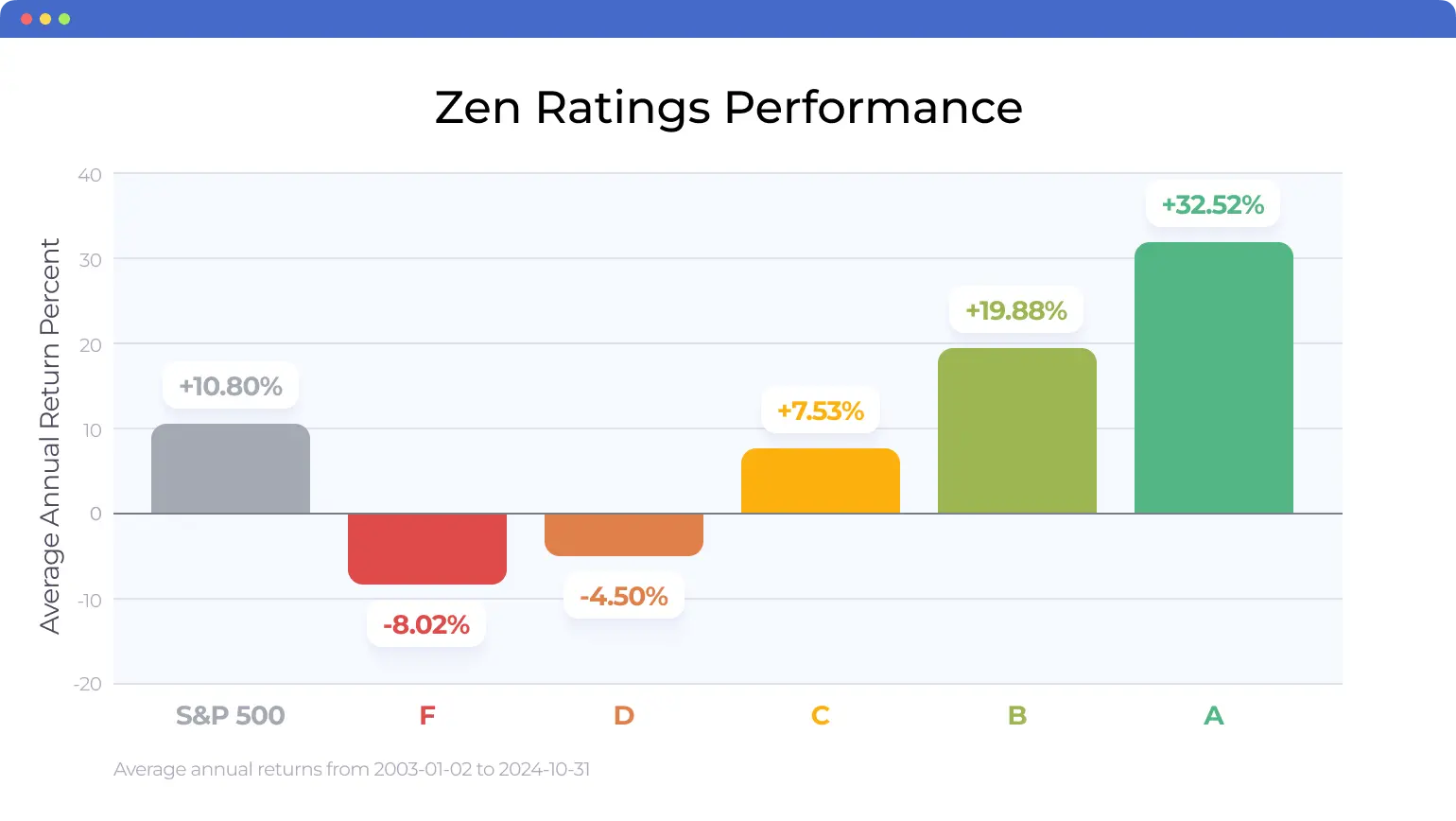

Our other top feature? Zen Ratings, our proprietary grading system for stocks that is supported by proven performance data.

Our Zen Ratings model analyzes 115 different factors that have been historically proven to drive stable growth for stocks, ranging from growth to value to momentum to exclusive AI algorithms. It distills these factors into an easy-to-understand letter grade. A-rated (Strong Buy) stocks identified using this system have produced an average annual return of +32.52% since 2003.

Other user favorites include Watchlists, Stock Ideas, and the Stock Screener. Long-term, fundamental investors benefit the most from these features, but there are a number of active traders using Premium features in their daily workflows.

WallStreetZen is one of the best alternatives to Bloomberg Terminal for individuals, if not the best.

You can explore WallStreetZen for free, but I highly recommend using the button below to get a 14-day trial of Premium to unlock the full power of the platform:

Exclusive offer:

2. Seeking Alpha: The Best Bloomberg Alternative for Investment Reports

Pricing:

- Premium: $239/year – get a 7-day free trial (new customers only) and $25 off using this link

Exclusive offer:

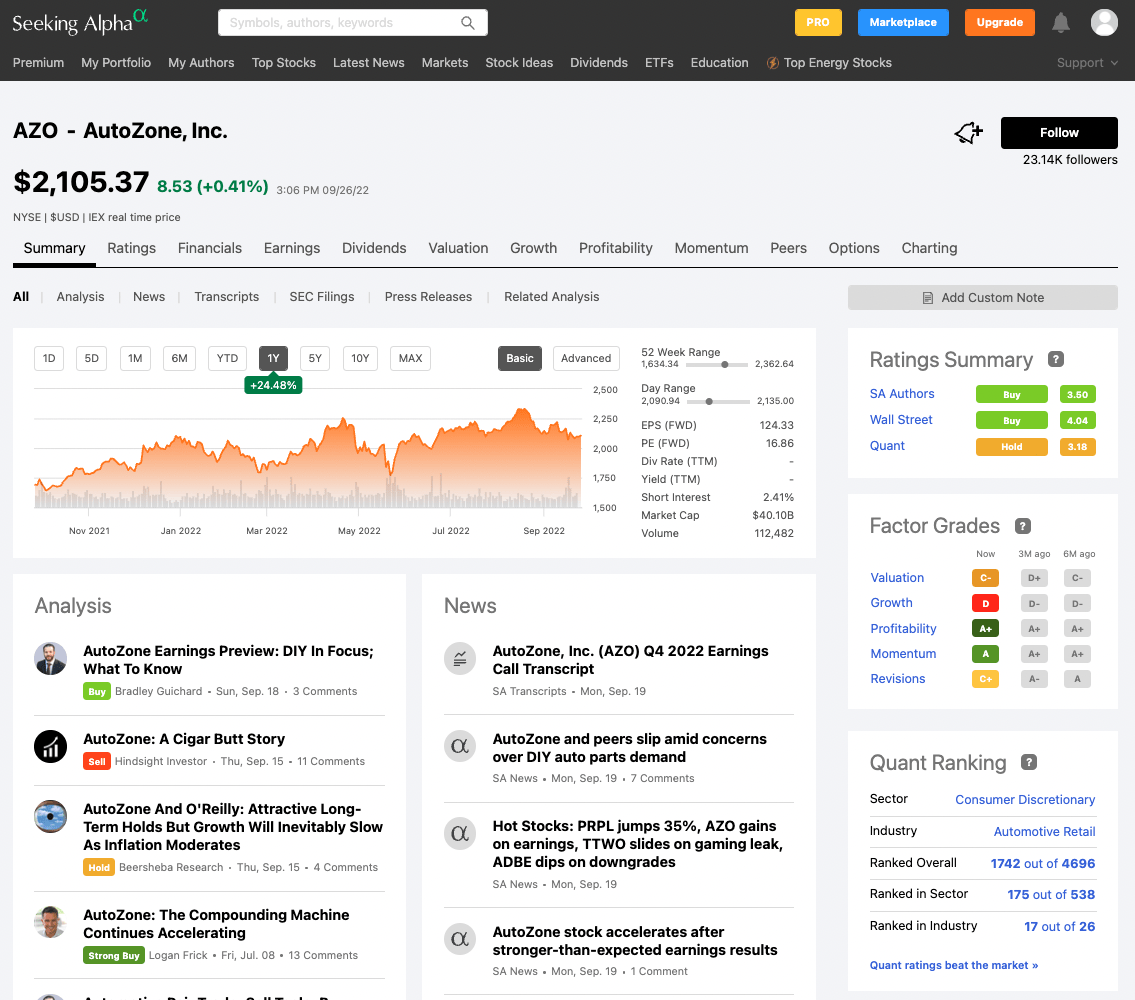

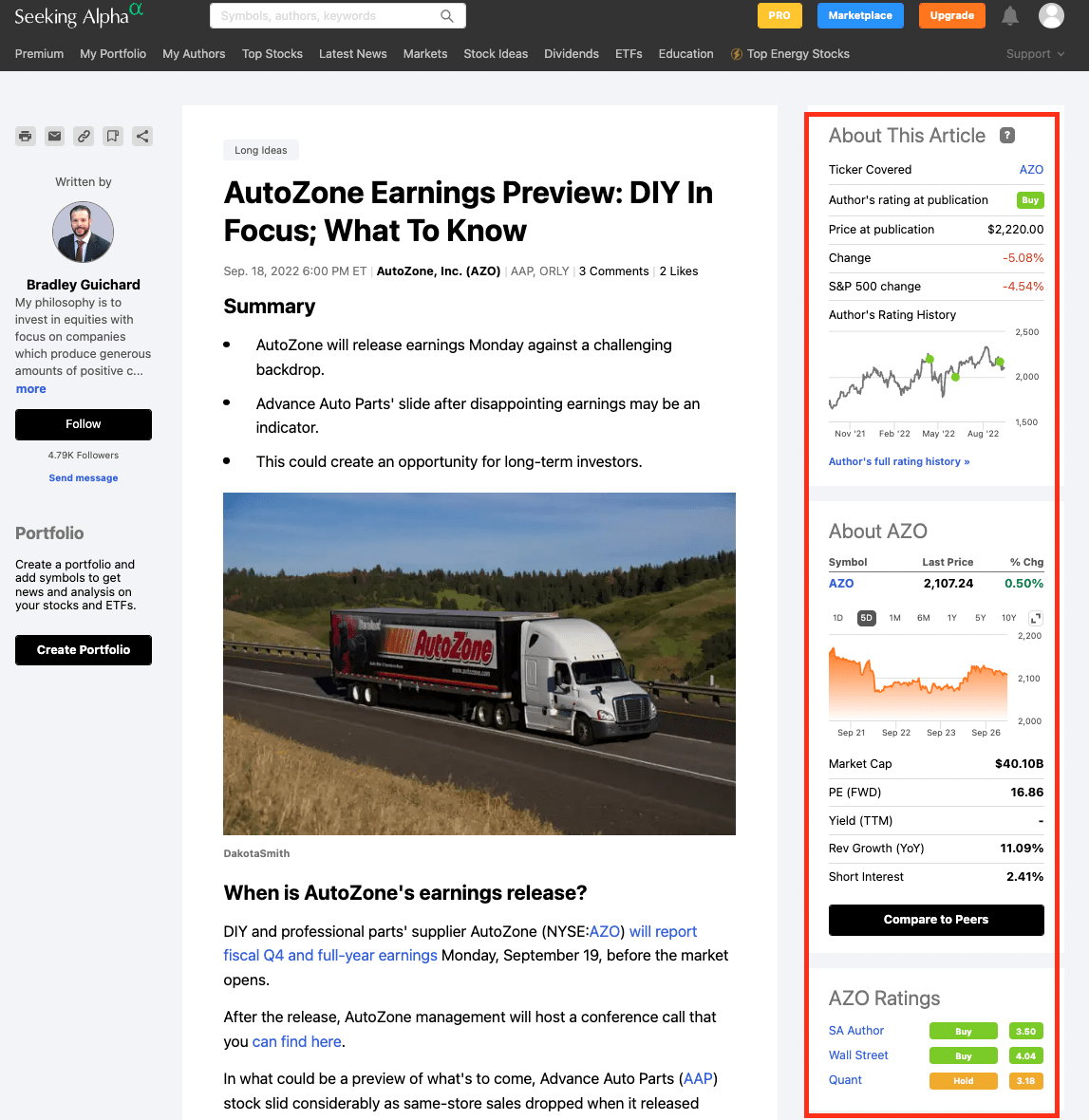

Seeking Alpha is my favorite place for stock research reports.

Seeking Alpha is powered by its contributors – more than 7,000 professional and amateur investors are responsible for producing over 10,000 articles per month. Each article contains unique insights and analysis into individual investment opportunities, the vast majority of which are stock research reports.

The experience and detailed analysis of Seeking Alpha’s contributors is unmatched. After signing up for Premium, you will have instant access to thousands of diverse opinions and endless investment research.

In addition to Seeking Alpha’s qualitative reports, it has a number of quantitative features to help you with your own fundamental and technical analysis, and tools to help you analyze your investment portfolios. Its proprietary rating systems, newsfeeds, and stock screener should not be overlooked.

But the heart of Seeking Alpha is its investment research created by its 3rd party contributors. Similar to the Top Analysts feature on WallStreetZen, Seeking Alpha has Article Sidebars and Author Ratings to help you quickly judge the quality of the report and the author who wrote it.

Besides WallStreetZen, Seeking Alpha is the only other premium service I use.

Exclusive offer:

3. Benzinga Pro: The Best Bloomberg Alternative for a Real-Time Newsfeed

Pricing:

- Free

- Basic: $27/month (when billed annually)

- Essential: $117/month (when billed annually)

- Options Mentorship: $281/month (when billed annually)

Exclusive offer:

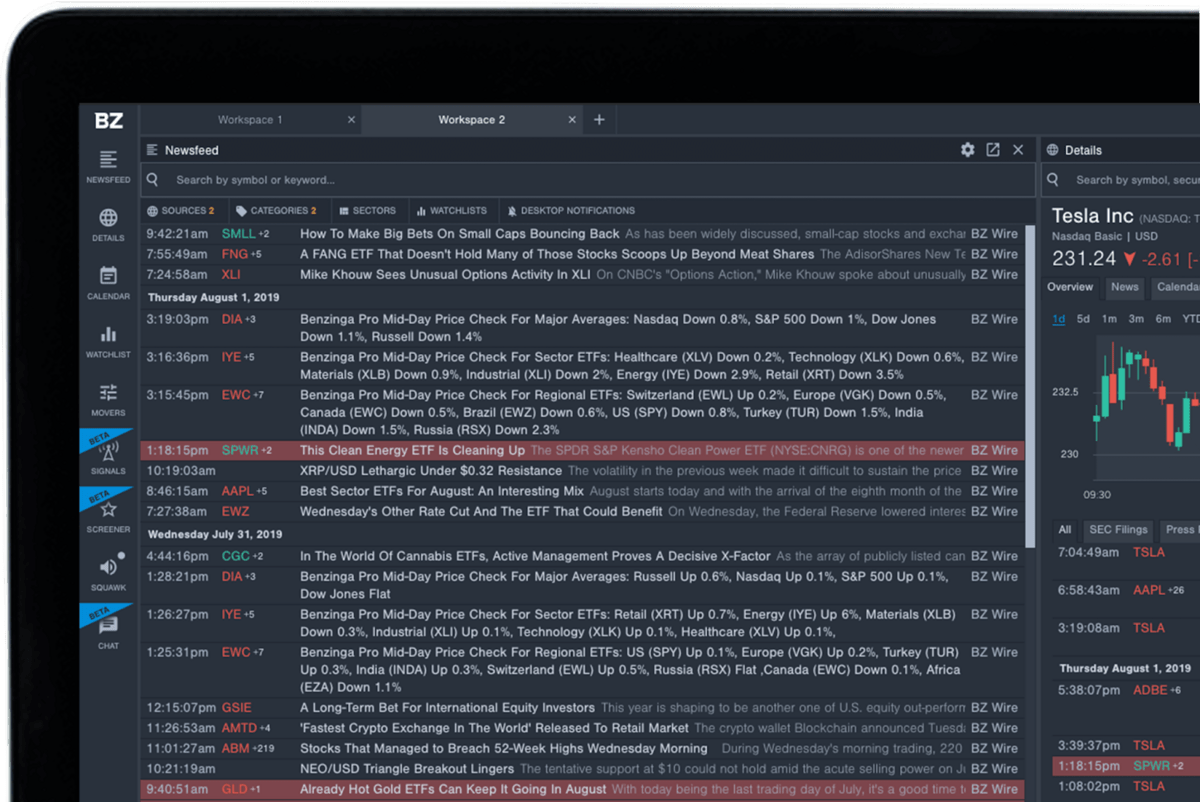

Another huge feature I miss about having access to a Bloomberg Terminal is the real-time newsfeed. Benzinga Pro is the best service in this category and always seems to be the first to break major headlines.

In addition to breaking news, Benzinga Pro offers earnings releases, conference calls and key points, charting, analyst ratings, rumors, the biggest winners and losers, and many more actionable alerts.

Its charts are powered by TradingView, my #1 recommended charting tool (see my TradingView review), its watchlists are Excel compatible, and you can easily screen U.S. stocks by market capitalization, price, sector, and more.

Benzinga Pro also has some financial statements and SEC filings available.

All of those extra services are really just window dressing – Benzinga Pro’s direct feed of exclusive news compiled by an aggregation of online news sources is what you’re signing up for.

Exclusive offer:

4. Koyfin: The Best Bloomberg Alternative for Advanced Financial Data & Analytics

Pricing:

- Free

- Basic: $15/month

- Plus: $35/month

- Pro: $70/month

Exclusive offer:

Koyfin was specifically created by its founders (former Wall Street analysts) who were frustrated by the cost of Bloomberg which made Terminals inaccessible for individual investors. Stemming from that frustration, Koyfin’s mission is to provide analytics to research stocks and market trends to all investors.

Custom dashboards for stock analysis, portfolio analysis tools, charting and exporting, advanced and historical graphing, a sophisticated stock screener, analyst price targets and ratings data – it’s all here.

Not to mention, it’s a heck of a lot more user-friendly than a Bloomberg Terminal.

Koyfin makes it easy to uncover new investment ideas and research current positions with data, analytics, and market news all in one place. It’s one of the best alternatives to Bloomberg Terminal for individuals.

Exclusive offer:

5. Ziggma: The Best Bloomberg Alternative for Portfolio Quality Tracking

Pricing:

- Basic: $0

- Premium: $89/year

Exclusive offer:

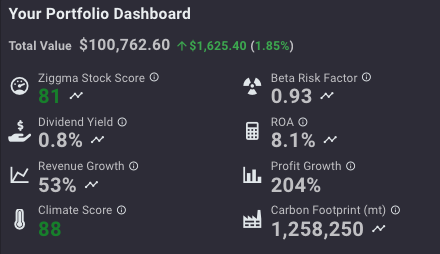

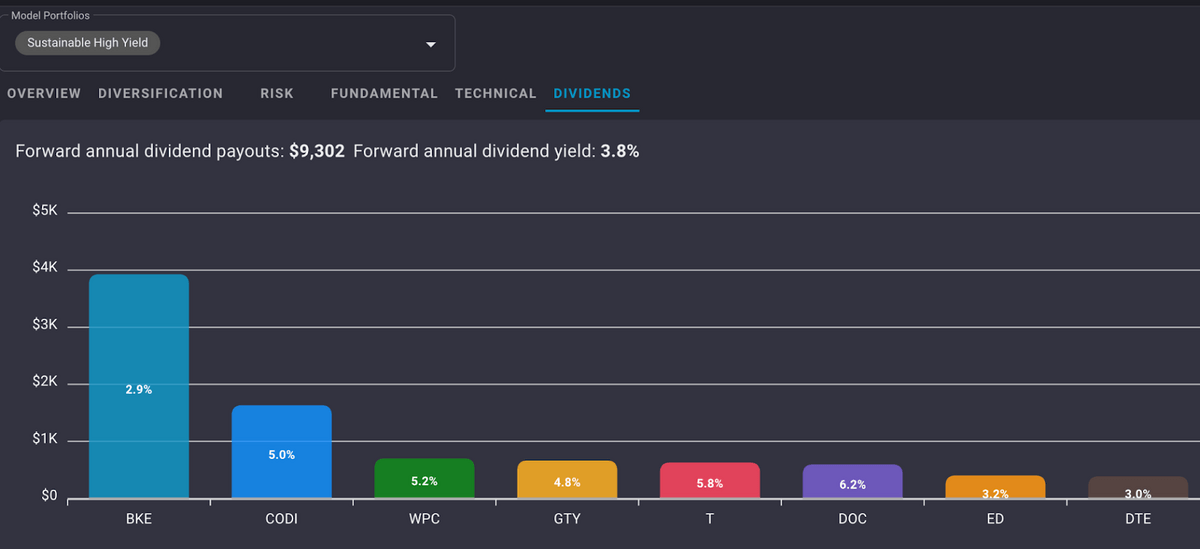

Ziggma’s portfolio dashboard makes portfolio tracking easy. By incorporating portfolio quality, you can see your portfolio risk, yield, and even your stocks’ average Climate Score.

You can connect an unlimited number of accounts for free, and Ziggma will provide you with an Aggregate view of all portfolios at once. And if you find it cumbersome to track your portfolio split to make sure you stay diversified, Ziggma’s Smart Alerts will monitor your stocks based on customizable limits you set on data points such as stock prices, P/E ratios, and dividend yield.

Ziggma also computes your projected dividend income for the next 12 months, making it easy to stay on top of your portfolio’s revenue:

Beyond its portfolio tracking, Ziggma has a solid offering of investment research. While it’s not as robust as Seeking Alpha’s repository, many Ziggma users find it to be the perfect amount of information.

Exclusive offer:

6. World Bank: The Best Bloomberg Alternative for Free Economic Data

Pricing:

- Free

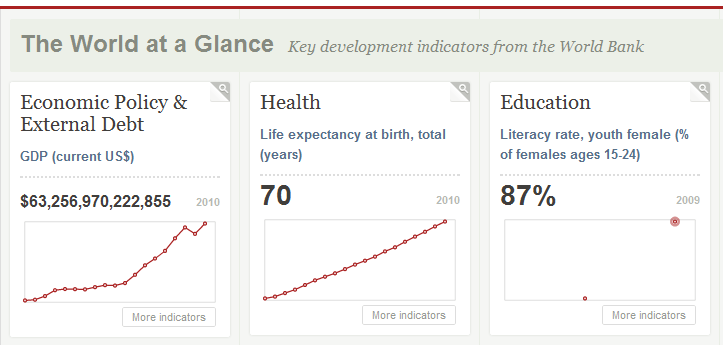

The World Bank is my favorite place for objective economic data and analysis.

The World Bank is home to more than 20,000 datasets, covering things like economic growth statistics, inflation rates, interest rates, FX rates, income statistics, employment statistics, population statistics, education statistics, tax rates, and more for hundreds of countries, each continent, and at a global level.

The best part: It’s totally free.

7. Yahoo Finance: The Best Bloomberg Alternative for Free Financial Statements

Pricing:

- Free

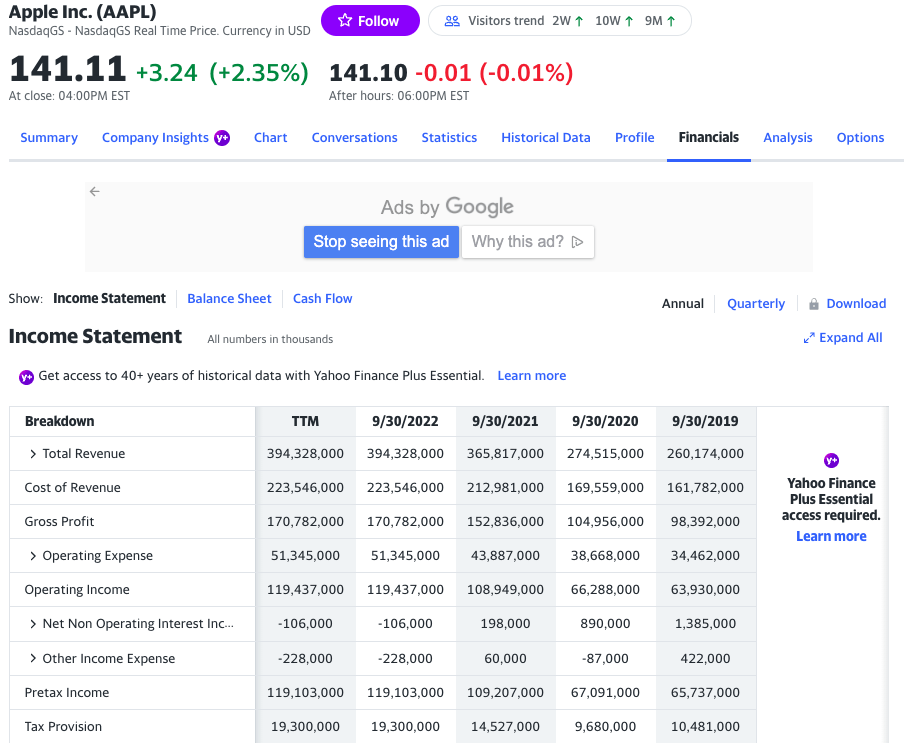

Another quick place I check fairly regularly is Yahoo Finance. It’s a great spot for simple, free quote data.

Overall, the information provided is fairly basic, but they have data for every stock I’ve ever searched and always have 3 years worth of financial statements. For a finance and accounting nerd like myself, I like digging through these statements searching for trends other investors may have missed.

It’s fast, simple, complete, and free.

Final Word: The Best Alternatives to Bloomberg Terminal

There’s my list of the 7 best alternatives to Bloomberg Terminal for retail investors.

As mentioned earlier, if you’re truly looking to replace a Bloomberg Terminal, you’ll want to combine a few of these platforms.

Personally, I use WallStreetZen, Seeking Alpha, The World Bank, and Yahoo Finance in concert. I find this to be the perfect combination for my workflow.

I suggest you start trials with a handful of the above platforms and decide which, if any, are the right tools for you. Some of the Bloomberg alternatives listed above are vastly better suited for certain tasks than others, something you will only discover for yourself after testing.

The good news: Every recommendation listed above is much cheaper than a Bloomberg Terminal and significantly easier to use.

FAQs:

Does Bloomberg Terminal have competitors?

Yes and no - Bloomberg Terminals dominate the professional investing industry. For enterprise solutions, a few competitors are YCharts, Refinitiv Eikon, S&P Capital IQ, and FactSet, but a Bloomberg Terminal is in a league of its own.

For individual investors, WallStreetZen, Seeking Alpha, Benzinga Pro, Koyfin, and Ziggma are good alternatives. For free solutions, The World Bank and Yahoo Finance should be on your radar.

What is Bloomberg Terminal equivalent?

There is no real Bloomberg Terminal equivalent, it’s in a league of its own.

If you’re looking for an enterprise equivalent, YCharts, Refinitiv Eikon, S&P Capital IQ, and FactSet are worth looking into. If you’re an individual investor, check out WallStreetZen, Seeking Alpha, Benzinga Pro, Koyfin, and Ziggma.

What is the cheapest way to get Bloomberg?

A Bloomberg Terminal costs $24,240 per user per year - there is no cheaper way to get it.

If you’re an individual investor looking for a Bloomberg alternative, check out WallStreetZen, Seeking Alpha, Benzinga Pro, Koyfin, and Ziggma.

Who are Bloomberg's major competitors?

Bloomberg doesn’t have a legitimate competitor. Other enterprise solutions include Refinitiv Eikon, YCharts, FactSet, and S&P Capital IQ, but they do not compare to the power and sophistication of a Bloomberg Terminal.

Why does everyone use Bloomberg Terminal?

A Bloomberg Terminal is the most complete, fast, and powerful solution available for enterprise clients. Its data, analytics, real-time newsfeed, investment research, reports, and economic updates are categorically better than every other competitor, and they’re all located in one place.

How much should I pay for a Bloomberg Terminal?

A Bloomberg Terminal costs $24,240 per user per year.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.