Bottom Line: Which Wealth Management Firms Stand Out?

Empower and Range stand out as two of the best all-around options for wealth management firms in 2026.

- Empower offers some of the most powerful free financial tools on the market, while also providing professional wealth management for investors with $100,000 or more.

- Range, on the other hand, is ideal for high-income households that want direct access to a team of CFPs without paying traditional percentage-based fees. Both services combine modern technology with personalized financial planning, making them excellent choices depending on your goals and account size.

We’ll dig into both of these services (plus several of the other best private wealth management firms) to help you find the best wealth management firm for your financial goals.

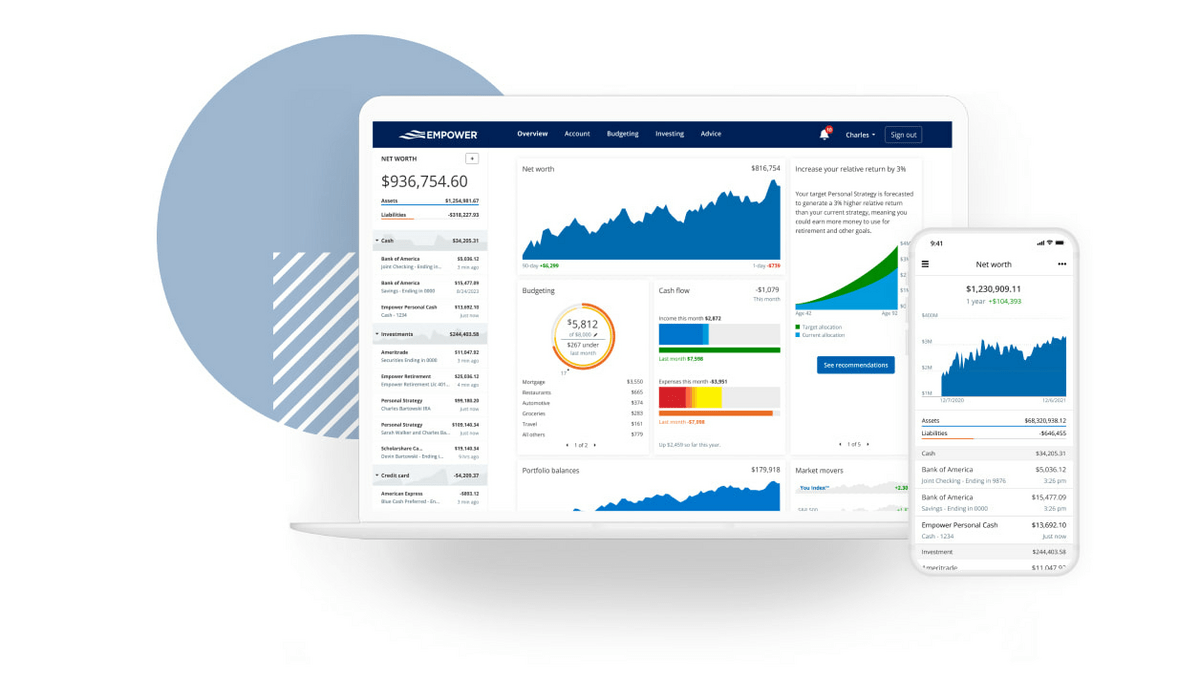

1. Empower – Best Free Tools

- Fees: 0.49% to 0.89% of total assets

- Minimum: $100,000

Empower is an established wealth management first that offers comprehensive financial planning services to clients that have investments of $100,000 or more. Financial services include:

- Tax optimization

- Disciplined rebalancing

- Dynamic portfolio allocation

- Education & college planning

Empower has 3 tiers of financial planning services, aimed at clients with different investment balances:

Investment Services: Empower Investment Services offers clients with $100,000 or more in investable assets access to a team of financial advisors to help build a financial plan. This includes creating an asset allocation strategy, designing an investment plan for retirement, planning for other financial goals, and even college planning for your kids.

Wealth Management: Empower Wealth Management is for clients with $250,000 of investable assets or more. The service is similar to what is offered by the Investment Services, but you will have a dedicated financial advisor to work with directly. It also includes a customized portfolio and tax loss harvesting.

Private Client: Empower Private Client is for clients with $1 million in investable assets or more, and comes with a dedicated advisor, access to private equity investments, private banking services ($5 million or more), and tax & estate planning.

In addition to wealth management services, Empower has a free investing analysis and budgeting tools that are available to anyone:

You can sign up, connect your investment accounts, and analyze your retirement, spending, and even the fees charged in your accounts.

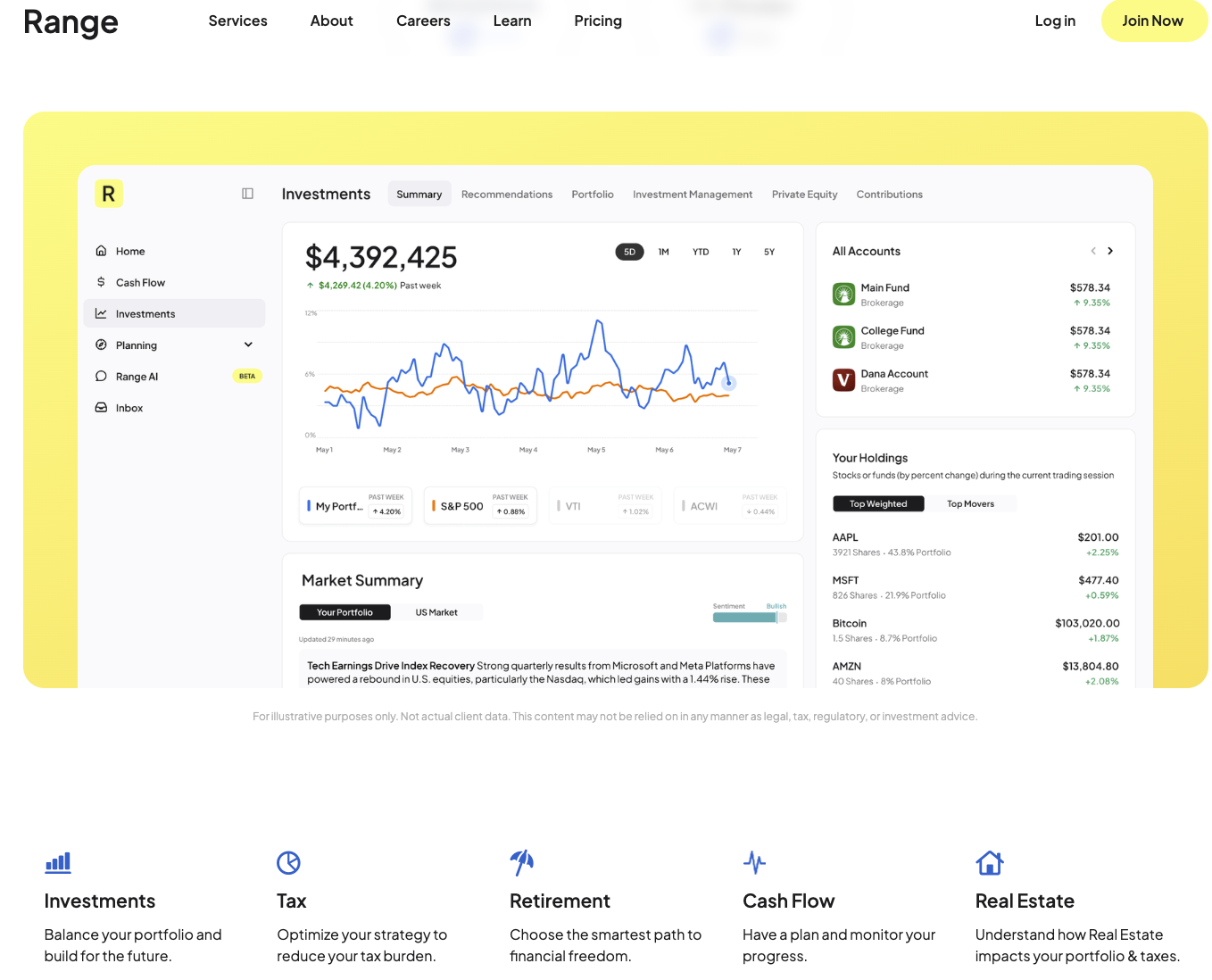

2. Range – Best For High-Income Households

- Fees: $2,950 to $9,950 per year

- Minimum: None

Range is a hybrid wealth management service that combines the advantages of tech-driven financial management with real-life CFPs that can give you direct financial advice. Range is aimed at high-income households that have more complex financial situations.

Range handles financial planning a bit differently than a traditional wealth management firm. Instead of transferring your assets over to Range, you simply connect all your financial accounts to the platform, and a team of CFPs (plus AI algorithms) analyze your finances to create a customized financial plan.

Range offers a wide range of services, including investment management, tax planning, estate planning, and equity compensation planning, provided by a team of CFPs who are fiduciaries.

Of note, the tax planning service alone can help you navigate complex tax scenarios with expert guidance and lower your tax burden while investing more.

Range doesn’t have an asset minimum to start working with the platform, but does emphasize that they are focused on high-income households (usually about $300k+ income).

Range also doesn’t charge an assets under management fee (AUM), but charges a flat annual fee for its services that range from $2,950 to $9,950 per year. For more details, check out our detailed Range Wealth Management review.)

3. Fisher Investments – Best For Ultra-High-Net-Worth Individuals

- Fees: 1.00% to 1.50% (tiered)

- Minimum: $1,000,000 (or on a case-by-case basis for smaller accounts)

Fisher Investments is a high-touch, actively managed wealth management firm that caters to ultra-high-net-worth individuals with substantial assets.

What sets Fisher apart is its focus on rigorous proprietary research, global macro positioning, and customizing portfolios according to client goals and market conditions. Fisher operates on a pure “fee-only” model (no commissions) and uses a tiered AUM fee schedule.

The tiered fee structure offers lower fees for higher net-worth clients. While the fees aren’t publicly posted on the website, here’s roughly how the tiered fee structure breaks down:

- 1.50% for accounts under $500,000

- 1.25% for accounts $500,001 to $1 million

- 1.125% for accounts $1,000,0001 to $4 million

- 1.00% for accounts above $5 million

Because of these higher fees, Fisher tends to be more attractive to ultra-high-net-worth clients who expect the white-glove service and bespoke financial planning to outweigh the overall cost. But investors with lower account balances might find the fee too high compared to other financial planning services.

4. JPMorgan – Best For Integrated Banking + Wealth Services

- Fees: 0.60% for balances $25,000 – $249,999, 0.50% for $250,000+

- Minimum: $25,000

J.P. Morgan Personal Advisors (part of J.P. Morgan’s wealth management arm) is a hybrid advisor platform aimed at Chase and J.P. Morgan banking clients. J.P. Morgan Personal Advisors offers professional portfolio management, tax loss harvesting, and financial planning as a digital service (similar to a robo-advisor), plus the ability to meet with advisors in person at Chase branches or on a video call.

Here are some things that make J.P. Morgan Personal Advisors stand out:

- Relatively low AUM fees compared to many full-service firms (0.60% to 0.50% AUM)

- In-person advisor access via branches for those who prefer face-to-face meetings

- Full financial planning, robust tax strategies, ESG portfolio options, and access to institutional research

- Easy integration with Chase bank accounts (required for management)

J.P. Morgan Personal Advisors offers the best of digital investing with automated portfolios and tax strategies, with the personal touch of human advisors to bounce questions off of.

You do need a Chase or J.P. Morgan bank account to sign up for the service, and you don’t get access to a dedicated advisor (team only) until your portfolio reaches $250,000.

5. Zoe Financial – Best For Finding A CFP Advisor

- Fees: Varies by advisor

- Minimum: None

Zoe Financial is a matching service that connects you with independent, fiduciary CFPs (certified financial planners) that best fit your financial goals and situation. Zoe has a stringent vetting process to help you select (or be matched with) a planner whose pricing model, specialization, and style match what you’re looking for.

Here’s a few features of using Zoe Financial:

- No required asset minimum

- Freedom to negotiate fee structure with your advisor

- Access to advisors with different specialities (tax, estate, equity compensation, business owners)

- A tech-forward platform that simplifies onboarding, communication, and tracking

Using Zoe Financial doesn’t require paying a fee up front, but you’ll be matched with a CFP that has their own fee structure. If you want a trusted platform to find an advisor that perfectly fits your investment goals, Zoe is worth a look.

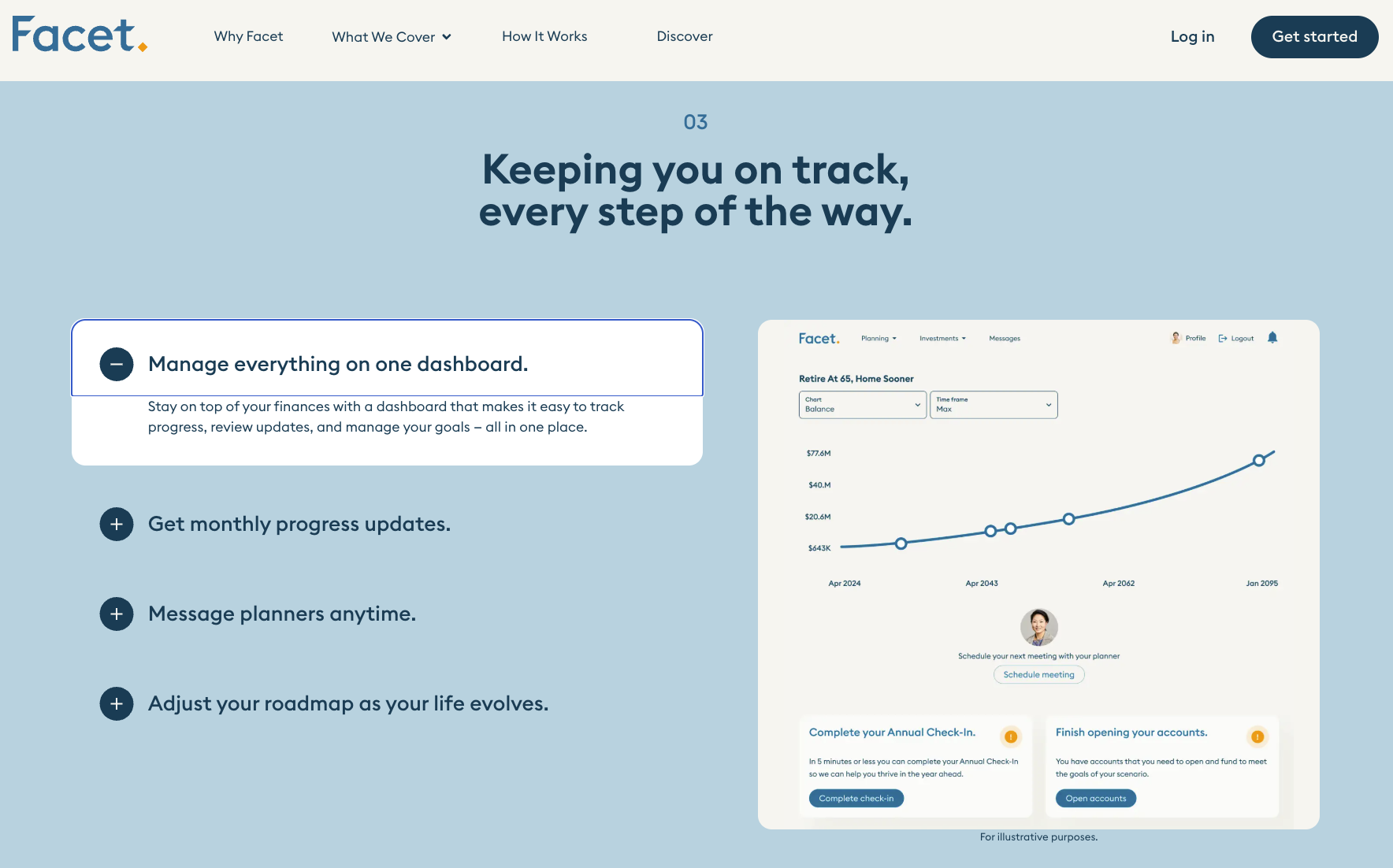

6. Facet – Best For Flat-Fee Planning

- Fees: $2,100 to $7,600 per year (flat fee)

- Minimum: None

Facet is a comprehensive financial planning and investment management platform that charges a flat subscription fee annually. As opposed to AUM-based fees that increase along with your portfolio — your plan, advice, and portfolio management are all bundled in a single flat fee.

Here’s why Facet stands out:

- Investment management is included (no extra fee based on your total balance)

- No minimum investment required, making it accessible to investors at lower asset levels

- Personalized financial planning covering all major areas: retirement, cash flow, debt, company equity plans, tax strategy, etc.

- A dedicated CFP (depending on plan), virtual sessions, and messaging support

- Access to private investments (depending on plan)

While Facet doesn’t have a minimum, the fee might be high if you’re just getting started with investing. But for higher-net-worth clients and those getting closer to retirement, the comprehensive service can make a substantial difference in your retirement and other financial goals.

What is the Difference Between a Financial Advisor and Wealth Manager?

While the terms “Financial Advisor” and “Wealth Manager” are often used interchangeably, there are some notable differences in the services offered, the type of clients both service, and the access offered.

Feature | Financial Advisor | Wealth Manager |

Best for | Individuals or families of moderate to high net worth | High-net-worth and ultra-high-net-worth clients |

Services offered | Financial planning (retirement, budgeting, investments) | In-depth financial planning, tax strategy, estate, trust, alternative investments, etc. |

Fee structure | Flat fee, hourly, or smaller AUM rates | Usually larger AUM fees, potential performance fees, tiered pricing |

Advisor relationship | Narrower focus, often limited to investments and planning | Deep, multi-generational, integrated services (think: family office) |

Advisor access | Limited access to advisor or planner, only a few official meetings per year | More bespoke, often a dedicated relationship team or private-client experience |

Bottom Line: All wealth managers are financial advisors, but not all financial advisors qualify as “wealth managers.” If your financial picture includes individual stock holdings, trusts, private equity, estate planning, or generational wealth transfer, you’ll probably benefit from a wealth manager over a more basic financial advisor.

Final Word:

Wealth management can help you do more than just invest for retirement — it can help you hit short- and long-term financial goals, avoid overpaying taxes, plan your estate, and leave a legacy for future generations.

Finding the right wealth manager depends on your goals, income, asset balances, and the fee structure. It’s a good idea to connect with a few advisors to find one that works best for you.

FAQs:

What are the best private wealth management firms?

The best private wealth management firms online right now are Empower and Range. Empower offers some of the most powerful free financial tools on the market, while also providing professional wealth management for investors with $100,000 or more.

Range, on the other hand, is ideal for high-income households that want direct access to a team of CFPs without paying traditional percentage-based fees.

What is the Difference Between a Financial Advisor and Wealth Manager?

A financial advisor typically serves individuals or families of moderate to high net worth, offering guidance on budgeting, retirement, and investment planning for a flat or hourly fee.

A wealth manager, on the other hand, caters to high-net-worth and ultra-high-net-worth clients with a more holistic approach—covering tax strategy, estate planning, trusts, and alternative investments—often through higher or tiered AUM fees.

The relationship is also deeper and more personalized, with dedicated teams and ongoing, family-level service rather than occasional meetings.

Do I need a wealth manager?

Wealth management can help you do more than just invest for retirement — it can help you hit short- and long-term financial goals, avoid overpaying taxes, plan your estate, and leave a legacy for future generations.

What is the best wealth management firm for ultra high net worth?

Fisher Investments is a high-touch, actively managed wealth management firm that caters to ultra-high-net-worth individuals with substantial assets.

What sets Fisher apart is its focus on rigorous proprietary research, global macro positioning, and customizing portfolios according to client goals and market conditions.

Fisher operates on a pure “fee-only” model (no commissions) and uses a tiered AUM fee schedule.

What is the best wealth management firm for wealthy people?

Range is a hybrid wealth management service that combines the advantages of tech-driven financial management with real-life CFPs that can give you direct financial advice. Range is aimed at high-income households that have more complex financial situations.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.