The world of investments is vast. Navigating it as a beginner can be daunting. Where should you start? Stocks? Bonds? Index funds? What about an automated investing platform? I’ll discuss all of those options in this guide, but first, we need to set the groundwork.

There’s no such thing as the best investment for everyone. Anyone who tells you there is probably wants to sell you something. Crafting the best investment strategy for you depends on your financial situation, risk tolerance, investment horizon, and other details about your life and personality.

In this guide, I’ll break down the ten best investments for beginners in 2025 as I see them right now. This list may change in the future, but for now, it’s a collection of the best ways to get started for someone completely new to investing. Here we go.

The Bottom Line: Best Investments for Beginners

The best investments for beginners are the ones that hit the sweet spot between being fun and exciting and reliable. The usual suspects — stocks, bonds, savings accounts, etc. — make an appearance, but I tried to include less common recommendations to spice things up a bit.

Creating an investment plan as a beginner is a bit like making a new workout plan for someone who’s never gone to the gym before. Some staples have to be included, but if the plan is too boring, they won’t stick with it long enough to see results.

Here are the principles I used to create this list:

- Focus on the fundamentals: I chose mostly tried-and-true investments because they work. Any solid investment strategy is going to be built around stocks, bonds, and cash, and I structured my recommendations around those assets.

- Spice it up a little: Sticking with an investment strategy is easier when you’re enthusiastic about its potential. I included art investments and real estate as a way to potentially capture more upside and make it more interesting if you’re just starting out.

- Cover retirement: New investors often don’t understand why they need a dedicated retirement account. I will devote an entire section to it later in the article.

- Explain the pros and cons of automated investing: Sometimes automated investing is the right choice for a beginner, but other times it holds them back because they don’t learn how to invest for themselves. I’ll explain who automated investing is for and how to know when it’s the right choice for you.

With that out of the way, let’s get started!

Here are my top ten picks for the best investments for beginners in 2025.

1. Stocks

Most people think of stocks when they hear investing, and for good reason. Investing in the stock market is one of the best ways to grow your wealth, but getting started is not so easy for beginners.

If you’re completely new to stock investing, you should sign up for our newsletter. It’s completely free and provides an overview of what’s happening in the markets, complete with in-depth analysis, possible trade opportunities, and a look at the stocks making waves on Wall Street.

Investors with a bit more experience can check out our curated stock ideas. These ideas use our stock screener to highlight opportunities in the market that are hard to spot if you don’t know where to look.

You’ll have to do your own analysis after we provide the core nugget of the idea, which is a good second step once you’ve gotten your feet wet.

Once you’re confident that you know your way around stock investing, you’ll need a broker to place trades. I like eToro because its platform is very beginner-friendly, but also because it has 0% commissions.

You can also invest in other assets like cryptocurrencies, ETFs, and options as you gain confidence as an investor.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

2. ETFs

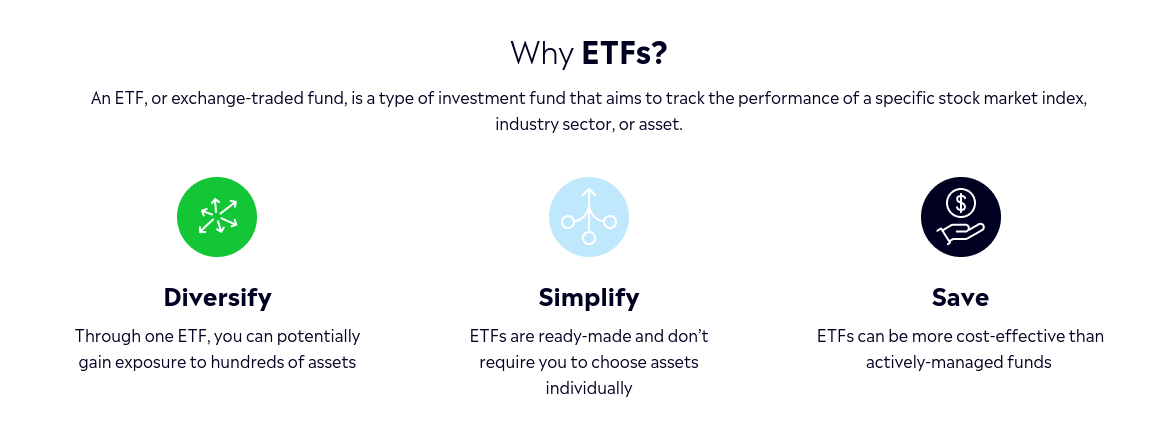

Exchange Traded Funds (ETFs) are collections of stocks chosen by an investment firm that you can invest in on the stock market. They make it much easier to diversify your investments since you don’t have to pick individual stocks yourself.

This is great for beginners because most new investors don’t know enough about picking stocks to create a balanced portfolio themselves.

I recommend eToro for ETFs for the same reasons they’re my go-to broker for stocks. You get access to tons of ETFs via the same easy-to-use platform eToro provides for stock investing and the same zero-commission fee structure.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Need help finding smart investments?

FINQ is an AI-driven investment platform that cuts through market noise by offering clear, objective stock rankings based on expert analysis, crowd sentiment, and financial fundamentals.

With continuously updated insights, FINQ empowers you to make smarter investment decisions through their AI-based portfolios like top stocks to buy, short-sell opportunities, and market-neutral strategies. Designed to outperform traditional investing, FINQ provides a bias-free, science-based approach that empowers you to navigate the stock market with confidence. Try FINQ for FREE today.

3. Index Funds

Building on the last entry, index funds are basically ETFs that track the major indices. The most popular indexes they track are the S&P 500, the Nasdaq 100, the Dow Jones Industrial Average, and the Russell 2000.

Investing in index funds is an easy way to diversify because the index fund’s value comes from the value of the hundreds of stocks that make up the index.

One of the most popular investing strategies that has stood the test of time is to put 70–80% of your money in an index fund, wait for 30 to 40 years, and then retire. It’s not sexy, but it works.

My favorite broker to use for index fund investing is — you guessed it — eToro. It’s hard to beat eToro’s commission-free trading and user-friendly platform for index fund investing. eToro also lets you access other types of funds, such as sector funds and industry funds.

Investing in specific sectors and industries requires more skill and knowledge than investing in broad-market index funds, so it’s not something I recommend to beginners.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

4. Art + Collectibles

Investing in art and collectibles is not something you hear much about if you’re a beginner investor. It’s easy to think that art investing is only accessible to people who wear top hats and monocles, and that used to be true.

Now, thanks to online art investment platform Masterworks, anyone can get into art investing.

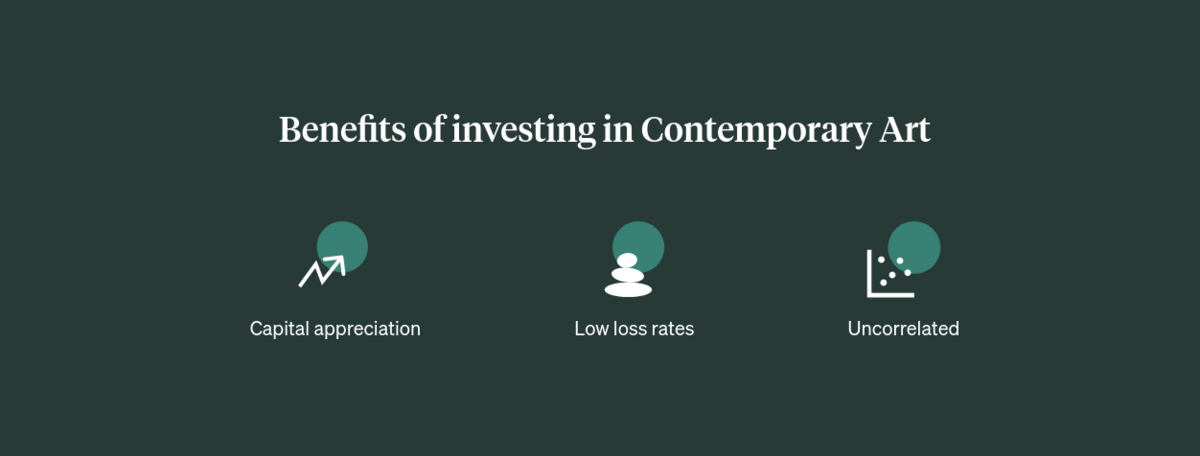

Investing in art is a good decision for two main reasons:

- Potential for high returns: Art has the potential for outsized gains compared to stocks and other traditional investments. For example, according to Yahoo Finance, post-war and contemporary art gained an average of 12.6% between 1995 and 2022, while the S&P 500 only gained an average of 9% over the same time period.

- Diversification: Art is uncorrelated to other common investments like stocks, bonds, and real estate. That means that it’s unlikely that your stock investments and art investments will lose money together. Diversification helps smooth out returns and make your gains more predictable.

So investing in art is a good idea, but I don’t have millions of dollars to spend on a Picasso, I hear you say. Don’t worry. Masterworks makes art investing a lot less complicated.

Masterworks lets you purchase shares in a piece of art. You become part owner of any piece you invest in and can sell your shares whenever you want to realize gains when the piece appreciates in value.

One of the best things about Masterworks — besides how easy the platform is to use — is that it’s accessible to all investors, both accredited and non-accredited.

Before Masterworks, you had to purchase art directly, which meant sinking thousands of dollars or more into pieces by relatively unknown artists. Now you can own part of famous paintings by world-renowned artists even if you don’t have a lot of capital.

Art investing is a great way for beginners to get started with investing because it’s more interesting and exciting than stock investing, in my opinion.

Owning part of a famous painting is fun to think about, and the potential for high returns makes it easier to hold your asset for longer, which is a skill many beginners don’t have.

5. Real Estate

Another fun investment for beginners is real estate. Many new investors have heard that real estate investing is the way to generate wealth, but the thought of buying and managing their own properties is intimidating.

Owning your own income-generating property is one of the best long-term investments you can make, but it’s not the only option anymore.

One of the best real estate investments for beginners is to buy shares of an income-generating property through an investing platform like Fundrise.

One of the biggest barriers to real estate investing for beginners is the amount of capital you need to buy your own property.

Fundrise makes it a lot more accessible, meaning you can reap the benefits of real estate investing without a mortgage or the headaches of managing your own property.

If you’d rather go the more challenging route and purchase a property the old-fashioned way, you’ll need to learn the ins and outs of traditional real estate investing.

That means you need to understand how to value a property, how to make an offer, and how to manage the property once you have tenants, along with a thousand other things that are beyond the scope of this article.

The complexity of real estate investing is why I don’t think buying your own property is one of the best real estate investments for beginners. Getting into real estate investing through Fundrise is much simpler and is something even new investors can handle.

Note: We earn a commission for this endorsement of Fundrise.

6. High-Yield Savings

Back to less-exciting (but still important) investments for beginners. Namely, high-yield savings accounts (HYSAs). If you have a chunk of money in a traditional savings account earning 0.01%, you need to move it to an HYSA immediately.

HYSAs have much higher rates than traditional savings accounts. The Platinum Savings HYSA offered by CIT Bank currently has a rate of up to 4.35%.

You might think that you need to fund such an account with at least $100,000 or more to get such a good rate, but CIT only requires a minimum deposit of $100, although you need to maintain a balance of at least $5,000 to get the current 4.35% rate.

These accounts are great for beginners because they don’t require any decisions or maintenance. All you have to do is plop your money into the account and start earning more. That’s it.

There’s not much else to say about HYSAs. You should open one right now. Go ahead. I can wait.

7. CDs

Now that you’ve opened your HYSA (you did, right?) we can talk about another one of the best investments for beginners: CDs. I’m not talking about buying the rerelease of Abbey Road, I’m talking about certificates of deposit.

CDs are excellent investments for beginners because they’re easy to understand and safe. When you invest in a CD, you get a fixed rate over the term of the CD.

For example, if you buy a 12-month CD with a 4% rate, the amount you invest will increase by 4% after one year.

CIT Bank has a solid selection of CDs to choose from with terms between six months and five years and competitive rates. They’re a great investment for beginners because they’re insured, require no maintenance, and earn much more than a regular savings account.

8. Mutual Funds

I mentioned we’d talk about more funds earlier … Here we are. Mutual funds are similar to ETFs, but there are a few key differences that are important to understand.

Both mutual funds and ETFs are baskets of stocks, so they offer similar levels of diversification, which is perfect if you’re a beginner.

One of the main differences is that mutual funds are only traded once per day, while ETFs are traded continuously throughout the day, like stocks. Mutual funds are also purchased directly from the company that manages the fund, not on an exchange like ETFs.

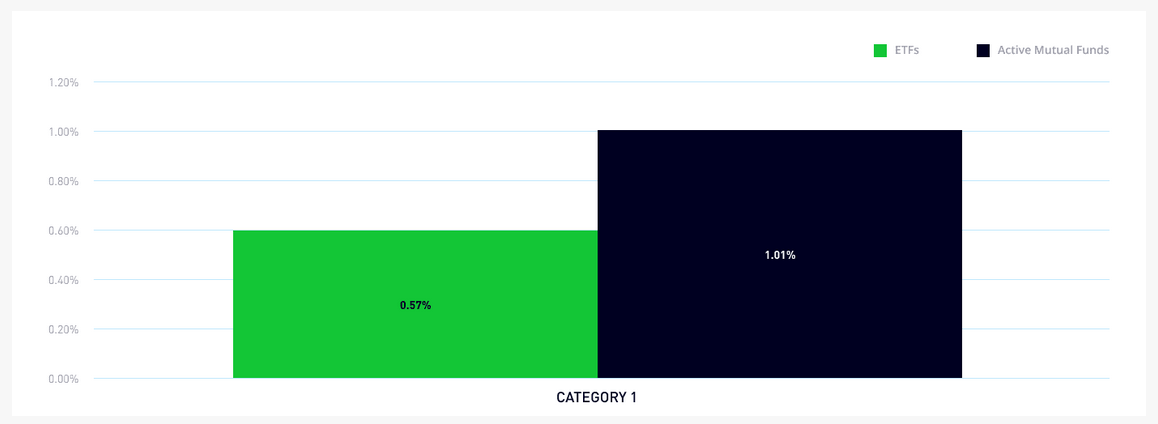

A major practical consideration is that many mutual funds have active management fees, which make them more expensive to own than most ETFs.

The management expense for an ETF or a mutual fund is called its expense ratio. Here’s how the average expense ratio for ETFs and mutual funds compare, courtesy of eToro:

Not all brokerage firms have mutual fund trading, so you’ll have to choose one that does if you’re interested in mutual fund investing.

Interactive Brokers is one of my favorite brokers, and it offers mutual fund trading. It also offers stocks, bonds, ETFs, crypto, options, and pretty much anything else you can think of. It’s a great all-in-one platform.

9. Retirement Investing

This one is a little bit different than the other types of investments I’ve covered so far. It’s not about a particular type of asset. Instead, it’s about a specific investment goal: retirement.

Setting up a financially sustainable retirement is about making the right investments 30 years ahead of time. If that sounds like a lot of pressure to you, don’t worry; I’m going to make it easy.

Retirement investing for beginners is as simple as understanding why individual retirement accounts (IRAs).

The benefit of investing in an IRA is decreased tax liability. In a traditional IRA, you contribute money pre-tax, which means you have more to work with right now.

The downside is you have to pay taxes later. Another option is a Roth IRA. Contributions to a Roth IRA are made after you pay taxes and grow tax-free, which means you don’t pay any taxes when you take money out later.

In both types of IRAs, you keep more of your money. A traditional IRA makes sense if you think your income now is higher than your income will be in retirement, while a Roth IRA makes sense if you expect to draw higher income during your retirement than you do now.

You can have both types of IRAs if you want to, just know that your total contribution to both types is limited to the annual IRA contribution limit. No double dipping.

Most brokers offer IRA investing, but I like M1 Finance for IRAs because they have a bunch of handy tools that make it easy to set up automatic contributions. This is great for beginners because you don’t have to manage your IRA manually.

If you want a little bit more flexibility, Rocket Dollar offers IRAs that let you hold alternative assets like precious metals and real estate investments in an IRA. This type of retirement investing is a bit more advanced, but it’s something to consider once you gain a bit of experience.

10. Automated Investing

Finally, I want to mention automated investing. You might think that automated investing would be one of the best investments for beginners because it’s hands-off, but I actually think it can do more harm than good if you start too soon.

One of the most important things you can do as a beginner is learn the fundamentals of investing, and automated investing takes that away from you.

With that said, once you understand what you’re doing, automated investing will make your life a lot easier. You can set up automated allocations, which means you can schedule asset purchases based on your overall investment strategy.

That makes it easy to keep your portfolio balanced with your desired asset allocation, saving you a lot of clicking around in your broker’s platform.

When you think you’d like to give automated investing a try, I recommend M1 Finance. The platform is organized with automated investing in mind, which makes it a little bit easier to get going than it is with some other brokers.

Final Word: Best Investments for Beginners

Whew, that was a lot to cover. The bottom line is that investing for beginners doesn’t have to be as daunting as it seems at first.

Starting slowly with investment staples like index funds, CDs, and high-yield savings accounts makes it easy to dip your toes in the water without getting in over your head.

Once you’re comfortable with the basics, spreading out to invest in more interesting things like artwork through Masterworks or real estate is a great way to give your portfolio some more upside potential.

Having some more interesting investments in your portfolio makes it easier to stick with your plan long-term, and that’s the ultimate key to success as an investor.

FAQs:

What are the best investments for beginners?

The best investments for beginners are high-yield savings accounts, CDs, stocks, and an alternative asset like art. Investing in those assets will give you exposure to the fundamentals of investing and teach you how to make trades, preserve capital, and speculate for some higher returns.

They will also give you experience using online investment platforms, which will be useful as you spread out and consider other types of investments.

What is the best stock investment for beginners?

The best stock investment for beginners is an index fund. Index funds are exchange-traded funds (ETFs) that derive their price from a collection of individual stocks.

This gives you automatic diversification, so you don’t have to agonize over picking individual stocks yourself.

What is the best thing to invest in first?

The best thing to invest in first is a broad market index fund. Doing so will give you experience using online investing software and teach you the basics of how investing works.

It will also teach you the benefit of being consistent since putting money in an index fund regularly will quickly show you the value of compounding interest.

How should a beginner start investing?

An investing beginner should start investing by signing up for an online broker and buying a few shares of a broad market index fund.

It’s a low-risk strategy that doesn’t require a lot of skill or knowledge and is the core pillar of many timeless investment strategies.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.