The Bottom Line: What’s the Best AI Technical Analysis Tool?

I’ve tried several; in my opinion, these are the best of the best:

- TrendSpider – Best for automated charting and pattern recognition

- Trade Ideas – Best for real-time trade signals and scanning.

- Danelfin – Best for multi-factor stock analysis

- Tickeron – Best for AI-powered autonomous trading

- WallStreetZen’s Zen Ratings – Best for long-term investing with AI + fundamentals

- Fiscal.ai (formerly FinChat) – Best for AI-Powered Conversations About Stocks

I’ll explain in more detail below. But first, you might be wondering…

Does AI Actually Work For Technical Analysis?

I’ll put it this way: If you’re still manually scanning charts for patterns, you’re working way harder than you need to.

I’ve spent the last few months testing AI technical analysis platforms, and the difference these tools make is staggering.

What used to take me hours of chart analysis now happens in seconds. The best AI for technical analysis can spot patterns I’d completely miss and process market data faster than any human ever could.

Here’s the thing, though: not all AI tools deliver on their promises. I’ve tested dozens of platforms claiming to revolutionize stock technical analysis AI, and many are just fancy marketing wrapped around basic algorithms.

After extensive testing, I’ve found six platforms that actually work. Whether you’re day trading, swing trading, or investing long-term, one of these AI technical analysis tools will transform how you approach the markets.

Let me show you which ones made the cut and why.

The 6 Best Technical Analysis Tools in 2026

1. TrendSpider – Best For Automated Pattern Recognition

- Cost: $52.38-$155.55/month (14-day free trial available with this link)

- What makes it stand out: AI Strategy Lab and automated trendline detection

- Track record: 4.0-4.9 ratings across platforms, award-winning software

- Best for: Professional technical traders, swing traders, intraday traders

TrendSpider dominates the AI technical analysis space for good reason. I’ve used this platform for over a year, and it consistently finds patterns I would have missed completely.

The AI Strategy Lab blew me away when I first tried it. You literally describe what you’re looking for in plain English. For example, “Find stocks breaking out of consolidation with high volume” and the AI builds a custom strategy.

No coding required. The system translates your words into precise technical criteria and automatically scans thousands of stocks.

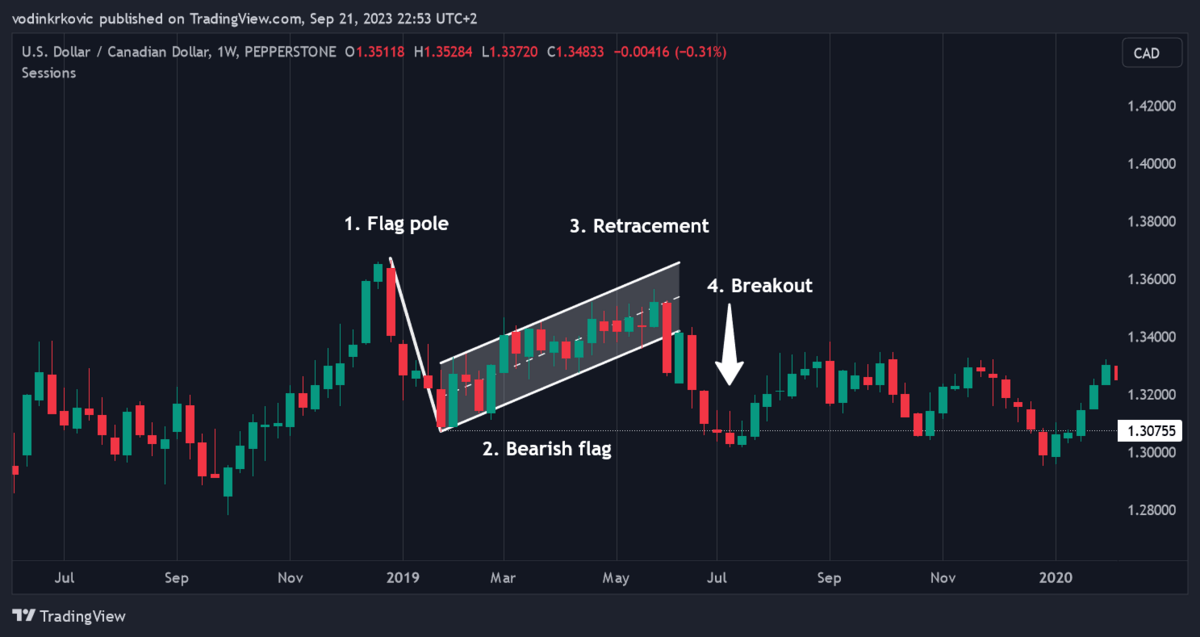

However, where TrendSpider excels is in pattern recognition. The AI continuously monitors charts across multiple timeframes, identifying triangles, flags, head-and-shoulders patterns, and dozens of other patterns with mathematical precision. Each pattern receives a probability score, allowing you to identify which setups are most likely to succeed.

The multi-timeframe analysis saves me hours every day. TrendSpider’s AI automatically plots trendlines, Fibonacci levels, and support/resistance across different timeframes. What used to be tedious manual work happens instantly. This is part of why TrendSpider is on a lot of “Best of” lists for its AI capabilities — including our post on the Best AI Stock Predictors.

But I’ll be honest. TrendSpider has a learning curve. The platform packs so many features that new users often feel overwhelmed. However, once you become comfortable with the interface, you’ll wonder how you ever managed without it. (For more details, check out our TrendSpider review.)

To sum it up: For serious technical traders, TrendSpider AI technical analysis capabilities are unmatched. The Standard plan offers excellent value, while the Enhanced plan unlocks all the features the platform has to offer.

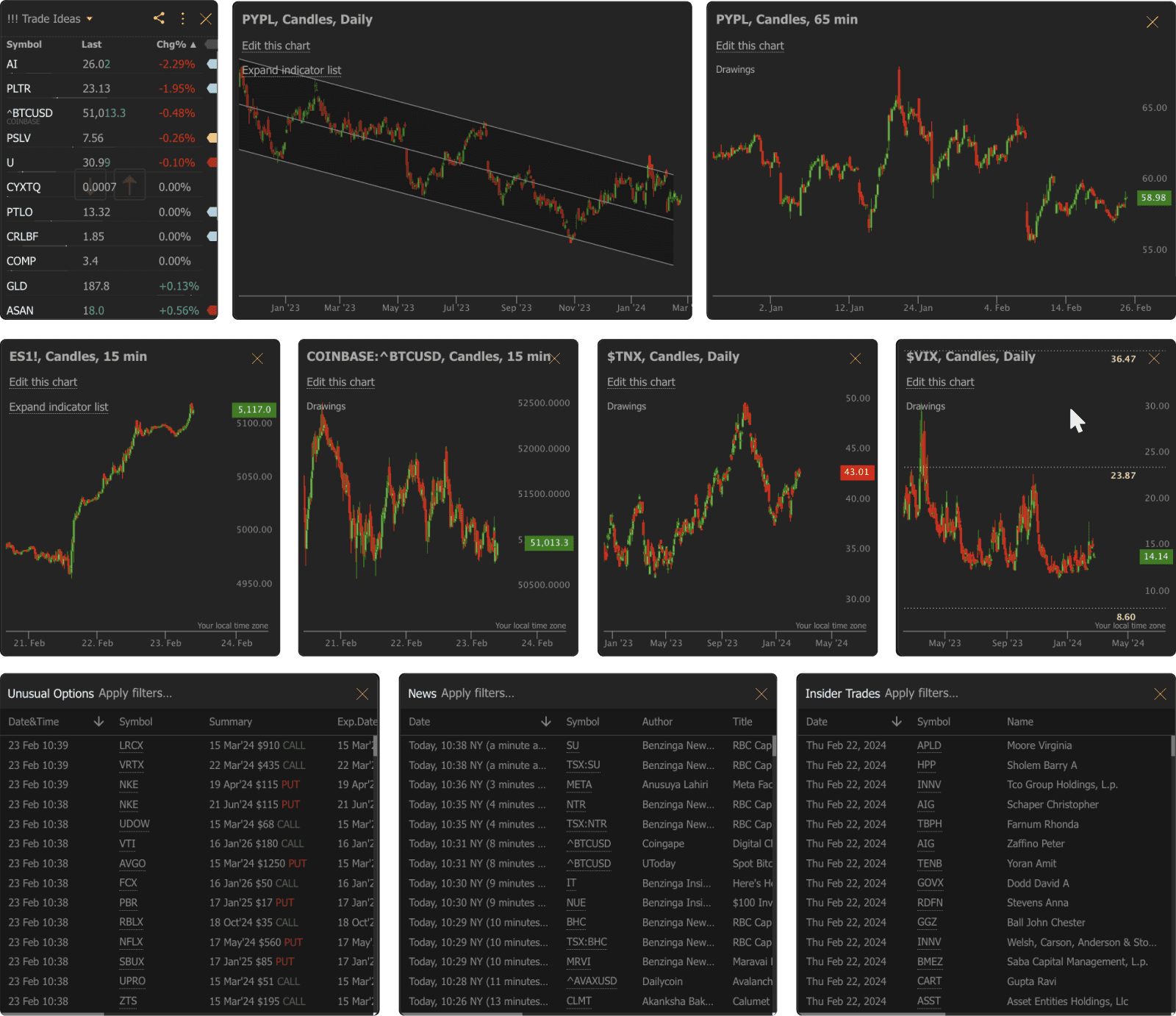

2. Trade Ideas – Best For Real-Time AI Trading Signals

- Cost: $89-$178/month (annual pricing)

- What makes it stand out: Holly AI virtual trading assistant with 60+ curated algorithms

- Track record: Established platform since 2003 with rigorous backtesting

- Best for: Active day traders, swing traders, high-frequency traders

Trade Ideas‘ Holly AI feels like having a professional trader working 24/7 on your behalf. Holly constantly scans the market, running millions of backtests overnight to identify the best setups for the next trading day.

This isn’t your typical pattern recognition tool. Holly utilizes over 60 algorithms to evaluate thousands of stocks, rating each opportunity based on the probability of success and associated risk factors. The platform doesn’t just tell you what to buy, but explains why the trade makes sense and what could go wrong.

Holly monitors price action, volume, technical indicators, and news flow simultaneously. When unusual activity happens, you know within seconds. The pre-market scanner has helped me catch gap plays that I would have otherwise completely missed.

What sets Holly apart is its ability to adapt to new situations. Static algorithms become obsolete when market conditions change, but Holly learns from every trade and adjusts these strategies accordingly. This AI tool is constantly evolving with the market. (Related: Trade Ideas nabbed a spot in our Best AI Stock Pickers post.)

Day traders will love the instant alerts and probability scores. Swing traders can utilize Holly’s longer-term strategies to identify setups that develop over several days or weeks. The platform also provides AI-driven technical analysis of crypto markets for traders seeking exposure beyond stocks.

Fair warning: Trade Ideas has a steep learning curve. The platform offers numerous features that can overwhelm beginners. But if you’re serious about active trading, the time investment pays off quickly.

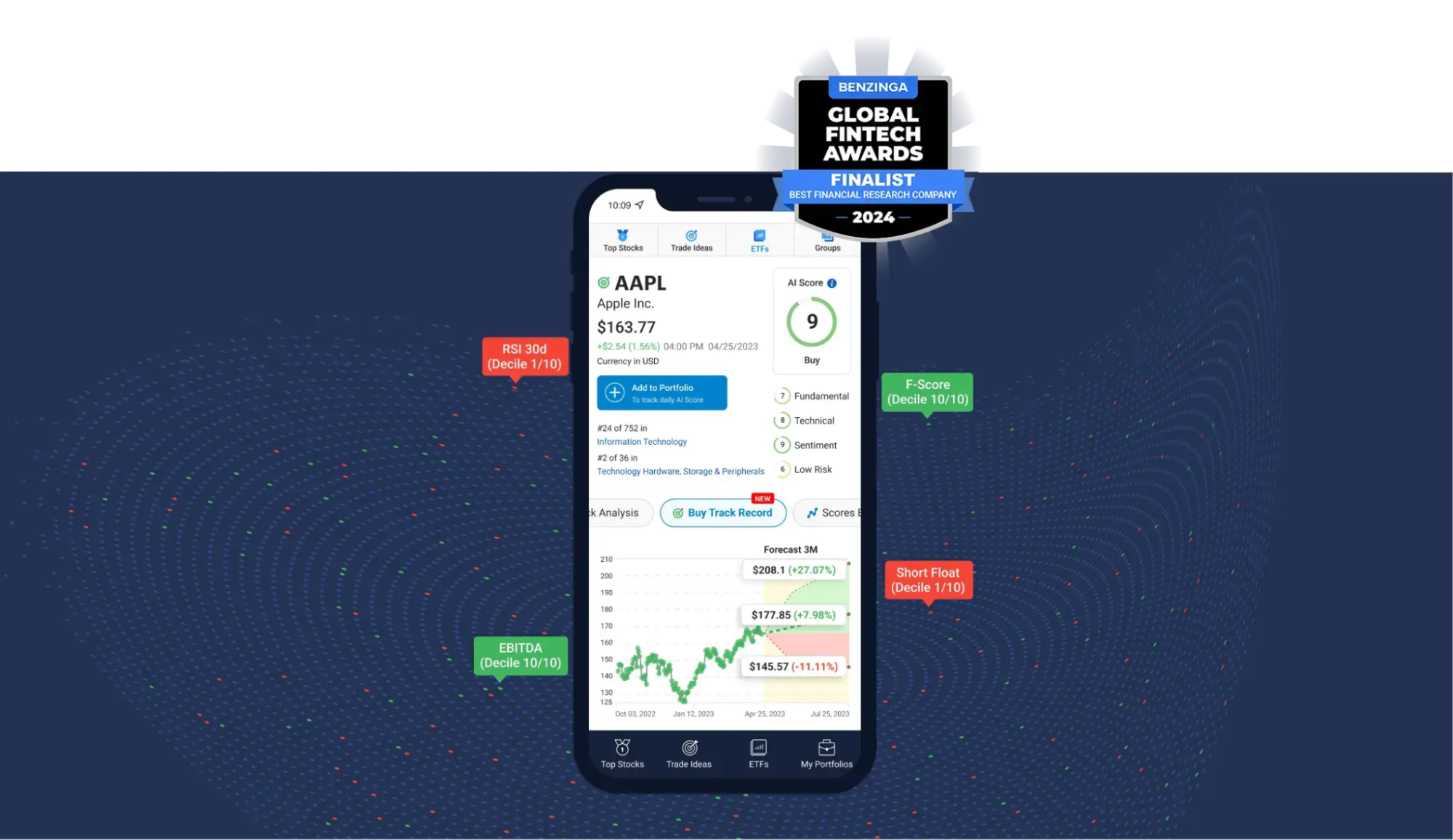

3. Danelfin – Best For Multi-Factor AI Analysis

- Cost: Free tier available, Plus $25/month, Pro $70/month (14-day free trial using this link)

- What makes it stand out: Analyzes 10,000+ features per stock daily using 900+ indicators

- Track record: Positive user reviews, focuses on 3-month outperformance predictions

- Best for: Tech-savvy swing traders, medium-term investors

Danelfin takes a completely different approach to AI technical analysis of stocks. Instead of focusing solely on price patterns, the AI analyzes over 600 technical indicators, 150 fundamental metrics, and 150 sentiment factors for each stock.

The platform processes more than 10,000 data points per stock daily. That’s an insane amount of information that no human could ever handle. However, Danelfin’s AI distills all this complexity into a simple 1-10 score that indicates the system’s confidence level in each stock.

What I love about Danelfin is the transparency. Many AI platforms operate like black boxes, providing recommendations without explaining their reasoning.

Danelfin clearly indicates which factors contribute to each score. You can see whether a high rating comes from strong technicals, improving fundamentals, or positive sentiment.

The AI focuses on 3-month predictions, which work perfectly for swing trading strategies. I’ve found the scores remarkably accurate for identifying stocks that outperform over medium-term timeframes.

Danelfin covers both US and European markets, with daily updates ensuring scores reflect current conditions. The platform also provides trade ideas for various time horizons, allowing you to match signals with your preferred trading style.

The main limitation is mobile access. Danelfin runs in web browsers, which work fine on phones but aren’t optimized for smaller screens. For traders who prefer dedicated apps, this might be frustrating.

4. Tickeron – Best For AI Trading Robots and Pattern Recognition

- Cost: Free tier, Beginner $60/year, Intermediate $15/month, Investor $60/month, Expert $250/month (See plans here)

- What makes it stand out: AI Robots for automated trading and a comprehensive marketplace

- Track record: Established platform with audited AI portfolio performance

- Best for: Quantitative traders, algorithmic trading enthusiasts, intermediate to advanced traders

Tickeron goes beyond traditional AI for technical analysis by offering AI Robots that execute trades on your behalf. These aren’t simple algorithms; they’re sophisticated systems that continuously learn and adapt to market conditions.

The pattern recognition engine scans stocks, ETFs, forex, and crypto markets in real-time. Each pattern receives a success probability and certainty score, providing you with solid data on which setups are worth trading. The AI doesn’t just identify patterns, it evaluates their historical success rate under current market conditions.

Tickeron’s Trend Prediction Engine uses machine learning to forecast future price movements. The system provides “Likeliness” scores that tell you whether a stock will likely continue its current trend or reverse course. This predictive capability goes well beyond traditional technical analysis.

However, it is the AI robots that make Tickeron special. These autonomous trading systems analyze market conditions, identify opportunities, and execute trades based on your parameters.

The marketplace feature lets you buy and sell trading algorithms from other users. Successful traders can monetize their strategies, while others can access proven systems. All offerings include detailed performance metrics and user reviews.

Tickeron also offers AI-managed portfolios that automatically adapt to market conditions. Unlike traditional model portfolios, these AI systems continuously adjust holdings based on changing market dynamics.

The complexity can be overwhelming for new users. Tickeron offers so many features that it takes time to fully understand everything the platform has to offer. However, for traders interested in algorithmic strategies, the learning curve is worthwhile.

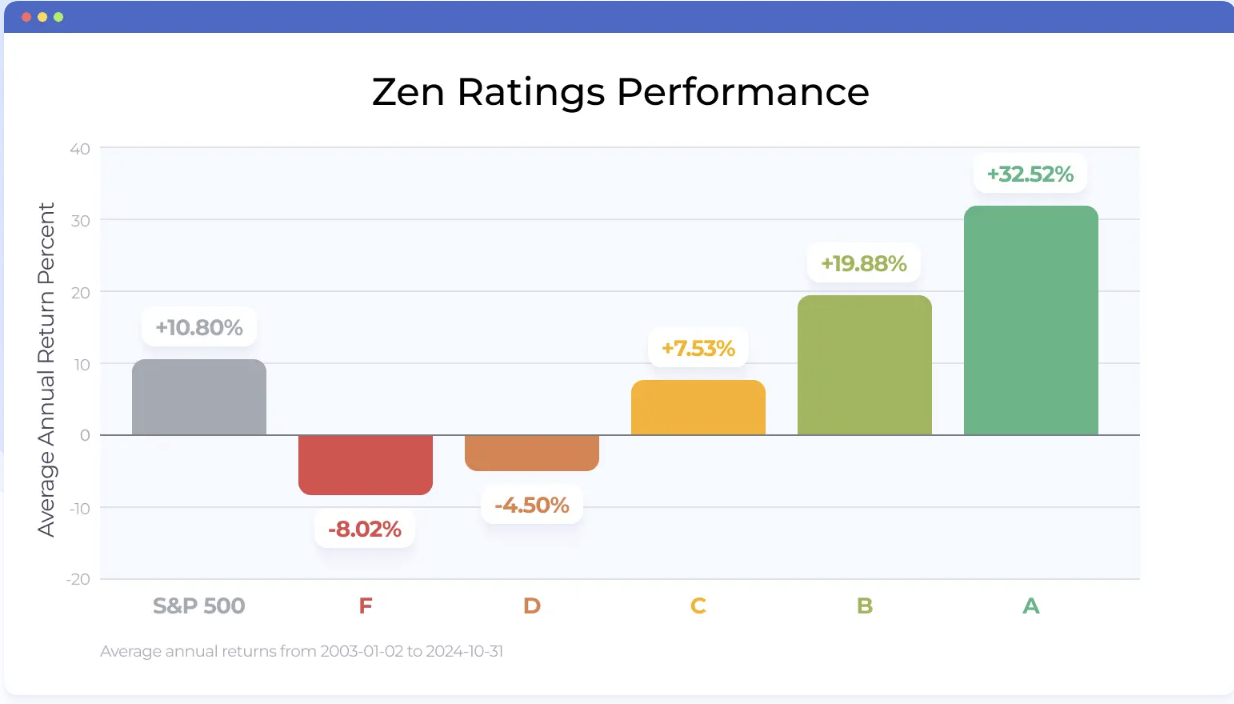

5. WallStreetZen’s Zen Ratings – Best For AI-Enhanced Fundamental Analysis

- Cost: Free tier available, Premium $19.50/month (when billed annually) – Try it for $1 here

- What makes it stand out: 115-factor analysis with proven 20+ year track record

- Track record: “A” rated stocks in the Zen Ratings system averaged +32.52% annual returns since 2003

- Best for: Long-term investors, fundamental analysts seeking AI enhancement

WallStreetZen’s Zen Ratings prove that AI technical analysis doesn’t have to sacrifice fundamental research. Our proprietary AI model analyzes 115 factors for every stock, combining traditional metrics with technical patterns and exclusive AI factors that detect subtle market signals.

The Neural Network behind Zen Ratings was trained on over 20 years of market data. The system understands how different factor combinations have led to outperformance throughout various market cycles. This isn’t theoretical, as “A” rated stocks have generated average annual returns of 32% since 2003.

What makes our approach unique is the way we combine fundamental analysis with technical insights. The AI doesn’t just look at earnings growth or price momentum in isolation.

It synthesizes cash flow trends, price patterns, industry dynamics, and dozens of other variables into unified recommendations.

The letter grade system makes complex analysis accessible to any investor. Behind each A-F rating lies sophisticated analysis that would take human researchers hours to complete. But you get the insight instantly.

Our Top Analysts Database adds another layer of intelligence by tracking over 4,000 Wall Street analysts. The AI identifies analysts who consistently outperform the market and weights their recommendations accordingly.

The main limitation compared to pure technical platforms is our focus on longer-term investing. While the AI incorporates technical factors, Zen Ratings work best for investors with time horizons measured in months and years rather than days.

For the track record and depth of analysis, the pricing is remarkably reasonable. The Premium subscription provides access to the full Zen Ratings system, top analyst recommendations, and unlimited research capabilities.

6. Fiscal.ai – Best For AI-Powered Financial Research

- Cost: Free tier available, Plus $24/month, Pro $64/month (20% discount annually using this link)

- What makes it stand out: Natural language AI queries for financial data analysis

- Track record: Focuses on fundamental analysis with some technical capabilities

- Best for: Fundamental analysts, long-term investors, financial professionals

Fiscal.ai (formerly FinChat) takes a research-first approach to AI market analysis. The platform’s AI Copilot understands complex financial questions in plain English and provides detailed, data-driven responses.

You can ask sophisticated questions, such as “Show me technology companies with accelerating revenue growth and improving profit margins,” and receive comprehensive answers.

The AI doesn’t just retrieve data but analyzes trends, compares companies, and generates investment insights.

The platform provides financial data for over 100,000 global companies, with up to 10 years of historical information. The granular segment data for major corporations helps you understand how different business units perform within larger companies.

While Fiscal.ai focuses primarily on fundamental research, it includes charting capabilities and can incorporate technical indicators into its analysis. The AI integrates price trends with fundamental metrics to provide a more comprehensive investment picture.

The platform excels at processing earnings calls, management commentary, and analyst revisions to provide insights beyond simple financial metrics. This comprehensive approach works particularly well for long-term investment decisions.

The main drawback is limited real-time capabilities. Fiscal.ai works great for research and analysis, but isn’t designed for day trading or short-term technical strategies.

Tell Me More: How Can AI Assist With Technical Analysis for Stocks?

I’ll sum it up as succinctly as possible:

- AI transforms technical analysis by bringing speed, consistency, and pattern recognition capabilities that humans can’t match. Traditional chart analysis required manually scanning hundreds of stocks looking for setups, a process that could take hours and often led to missed opportunities.

- Modern AI systems process thousands of charts simultaneously, identifying complex patterns across multiple timeframes in seconds.

- Machine learning algorithms identify correlations in market data that human analysts would likely overlook, combining price movements, volume patterns, and technical indicators in sophisticated ways.

- The speed advantage matters more than ever in today’s markets. While you might analyze ten stocks thoroughly, AI systems evaluate thousands in the same timeframe. This comprehensive scanning helps you find the best opportunities while filtering out weak setups.

- AI also eliminates emotional bias from technical analysis. Human traders often perceive patterns that aren’t truly there or overlook signals that contradict their existing positions. AI systems apply consistent criteria regardless of market conditions or external factors.

- Perhaps most valuable is AI’s ability to learn and adapt. Traditional technical indicators remain static, whereas AI algorithms continuously evolve in response to changing market conditions. This adaptability helps maintain effectiveness even as market dynamics shift.

Tips For Using AI For Technical Analysis

Maximizing the benefits of AI technical analysis requires a thorough understanding of both the capabilities and limitations of these powerful tools. Here’s what I’ve learned from extensive testing:

- Don’t treat AI signals as gospel. These tools provide valuable insights, but markets can behave unpredictably during unusual events. Use AI recommendations as one input in your decision-making process, not the only factor.

- Match the tool to your trading style. TrendSpider excels at pattern recognition for swing traders, while Trade Ideas focuses on real-time signals for day traders. Choose platforms that align with your time horizon and risk tolerance.

- Track performance over time. Keep detailed records of AI-generated trades to evaluate accuracy. Not every recommendation will be profitable, so focus on long-term performance rather than individual winners or losers.

- Start small and scale up. Begin with smaller position sizes while you learn how each AI system behaves. Gradually increase exposure as you gain confidence in the signals.

- Use proper risk management. AI tools help identify opportunities, but they cannot eliminate risk. Maintain appropriate position sizing, stop-loss orders, and portfolio diversification regardless of signal confidence.

- Take advantage of free trials. Most quality platforms offer trial periods or money-back guarantees. Test multiple systems to find the best fit before committing to paid subscriptions.

Final Word:

AI has fundamentally changed how we approach stock technical analysis. The platforms covered here represent the best available tools, each with unique strengths for different trading approaches.

Success doesn’t come from finding the “perfect” platform but from choosing one that matches your trading style and using it consistently. Take advantage of free or low-cost trials (like WallStreetZen for just $1!), start with smaller positions, and remember that even the best AI tools require proper risk management.

The future of trading is here, powered by artificial intelligence. The question isn’t whether you should embrace these tools; it’s which ones will best serve your path to trading success.

FAQs:

Does AI work for technical analysis?

Yes, AI works exceptionally well for technical analysis. AI systems process vast amounts of market data, identify complex patterns, and generate signals more quickly and consistently than human analysts. However, you shouldn't rely on a single AI-assisted tool — look for apps like WallStreetZen that combine AI and traditional fundamental due diligence checks.

How can AI enhance technical analysis?

AI can enhance technical analysis through automated pattern recognition, real-time market scanning, multi-timeframe analysis, and objective signal generation. AI eliminates human bias and emotional decision-making while simultaneously analyzing thousands of stocks to identify trading opportunities that manual analysis would miss.

What is the best AI for technical analysis?

The best AI for technical analysis right now is TrendSpider. It offers automated pattern recognition, an AI Strategy Lab, and comprehensive multi-timeframe analysis. Trade Ideas also excels in providing real-time trading signals, while platforms like Danelfin offer excellent multi-factor analysis capabilities.

Are there AI tools for technical analysis?

Yes, numerous AI tools are available for technical analysis, including TrendSpider, Trade Ideas, Danelfin, Tickeron, and others. These platforms offer AI-powered features like automated pattern recognition, real-time signal generation, trading robots, and comprehensive market analysis. Most platforms offer free trials to test their capabilities before subscribing.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.