Want to get a leg up on investing with a little machine assistance? Good news: I tested out about a dozen AI stock pickers so you don’t have to. And I’ve whittled it down to what I think are the best six.

Below, I’ll share the deets about each AI stock picking software or service, including pricing, features, and track record.

Each one has its positive attributes — read over the entries and choose the one that resonates most with you.

1. Zen Investor

- Overall Rating: 4.5 / 5

- Cost: $99/year (get it for $79/year for a limited time using the links in this post)

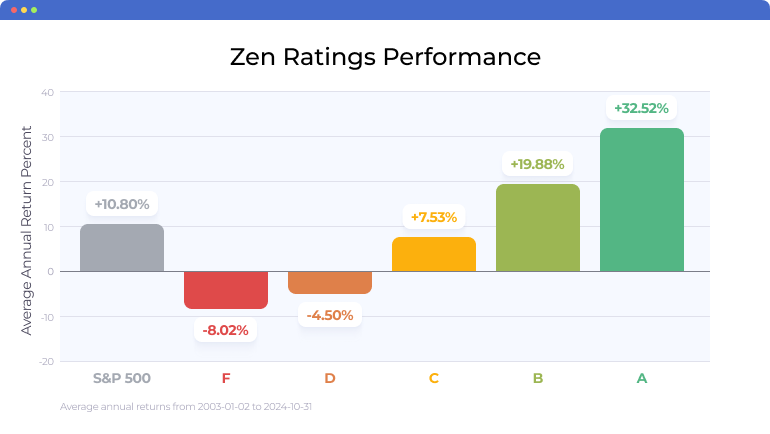

- Track Record: 32.52% returns on A-rated stocks since 2003

Zen Investor is a stock-picking service that gives you the best of both worlds, employing both an artificial intelligence and a human touch.

The newsletter and portfolio are managed by Steve Reitmeister, former Editor in Chief of Zacks.com and a market veteran with 40+ years of stock trading experience.

Before a stock gains a coveted spot in the Zen Investor portfolio, it goes through the ringer via a four-step selection process.

As part of that process, each potential stock is screened through the Zen Ratings system, a proven model that boasts a track record of average annual returns of 32.52% for A-rated stocks.

How does Zen Ratings work? Simply put, it screens every stock to look for 115 factors proven to drive stock growth.

One of the most innovative factors? The Artificial Intelligence (AI) factor.

The Zen Rating AI Factor

The Zen Rating AI factor stands out among AI investing tools by merging key elements — earnings, cash flow, price movement, and industry trends — into a single, actionable insight.

It employs machine learning using a Neural Network trained on 20+ years of fundamental and technical data. It can detect patterns beyond human capability, offering a deeper view of not only past performance but potential for future price movements.

Plus, with advanced cross-validation, the artificial intelligence avoids overfitting, ensuring it adapts to the market today and in the future, adjusting for things like market volatility rather than just past market trends.

But what truly really makes Zen Investor stand out in the AI stock picking space is the fact that incorporates human expertise — Reitmeister’s process also considers top analyst selections and leverages his decades of market experience to further refine stock selection.

What You Get With Membership

- AI-powered stock picking with Zen Ratings with an AI score for each stock

- Fundamental and technical analysis reports

- Human-vetted stock recommendations

- Weekly stock market insights

- Portfolio management tools and webinars

- Educational resources and investing tutorials

- A combination of quantitative AI analysis and qualitative expert insights for better decision-making

The best free AI stock picker

If you want to trade stocks, you need the right tools.

Zen Ratings is a stock analysis tool that offers a stock ranking system using AI to comb through 115 factors in real-time. This tool is free to use on WallStreetZen.com and you can research any stock to find out if it is a good choice based on the ratings system.

2. Zen Strategies

- Overall Rating: 4.5/5

- Cost: $997/year (discounts available for longer subscriptions)

- Track record: AI portfolio boasts a 48%+ average annual return

Zen Strategies is another service offered by WallStreetZen. But it ups the ante on how you leverage the Zen Ratings system.

It’s beyond a doubt that Zen Ratings offers an excellent starting point when evaluating equities.

However, it’s still quite easy to get overwhelmed. On any given day, a grand total of roughly 900 stocks are given a Zen Rating of A or B, equivalent to a Strong Buy rating or a Buy rating.

If you’re after a more curated approach, Zen Strategies portfolios are the next logical step.

There are 11 strategies to choose from. Something to suit every type of investor. Then we narrow down to the 7 best stocks for each strategy.

And since you’re reading this article, I’m betting the AI Factor Strategy will interest you most.

As noted earlier, Zen Ratings’ AI leverages a neural network trained on 20+ years of data. The AI Factor portfolio represents the highest performers identified by the Zen Ratings AI factor. The portfolio has enjoyed average yearly returns of over 48%.

This past year has been even better — over 70%.

When you subscribe to Zen Strategies, you get even more than the AI Factor portfolio. You get access to a total of 11 portfolios, each with 7 stocks each — allowing you to locate high-potential stocks across a variety of sectors and strategies in minutes. Each strategy chooses stocks using the Zen Ratings system, meaning the AI factor plays at least some role in each and every pick.

Is it worth it? Consider this…

One of our Editors put the “Buy the Dip” Strategy to the test by investing his own money in the strategy. The result? A $68K gain in just 4 months. See the proof here.

If you’re looking to build a balanced portfolio that leverages AI in every stock pick but backs up the AI with traditional fundamental checks, Zen Strategies is the perfect solution.

You could be up and running with Zen Strategies in 10 minutes a month. Here’s what you get:

✅ Backtested Quantitative Portfolios: Zen Strategies selects only the top 7 stocks per strategy, refined from over 115 factors, offering portfolios that span diverse themes — AI Factor, Momentum, Small Caps, Under $10, and more.

✅ Proven Performance: These strategies have delivered exceptional all‑time annual returns:

- AI Factor: +48%

- Momentum: +42.17%

- Under $10: +35.02%

✅ Easy to Start: Designed to be implemented in as little as 10 minutes per month, complete with a Quick Start Guide and weekly insights from Editor‑in‑Chief Steve Reitmeister.

✅ Risk‑Protected Access: A 90-day money-back policy and a 100% performance guarantee—if it doesn’t help you beat the market, you get a full refund.

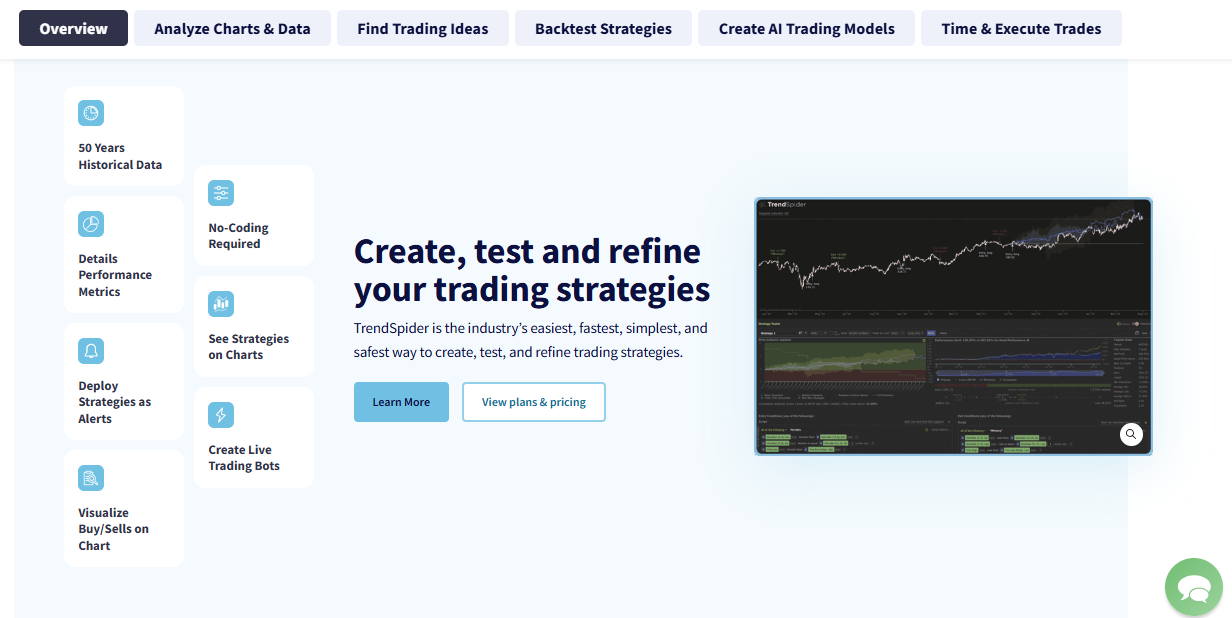

3. TrendSpider

- Overall Rating: 4.5 / 5

- Cost: Starts at $99.51/month

- Track record: Varies by trading strategy

TrendSpider is an AI stock picking software and trading bot that leverages technical analysis and AI to help create and execute trading ideas. It automates stock charting, identifies trends, and provides backtesting tools to help traders optimize their strategies.

Plus there’s a built-in trading bot that automatically executes trades on your behalf — making it an even more automated experience.

TrendSpider’s AI algorithms scan stocks, drawing trend lines and pinpoint support/resistance zones automatically. AI-driven insights via heat maps and pattern recognition tools enhance market predictions. And you can train a custom AI model to find hidden trading signals and find the best stocks for your strategy.

TrendSpider also allows for multi-timeframe analysis — meaning it can detect trends across different time periods simultaneously. This is ideal for swing traders and day traders who need an edge in short-term price movements.

What You Get With Membership

- AI tools including an Assistant to get instant feedback on trading ideas

- Custom alerts based on price action

- Backtesting tools for technical strategies

- Heat maps and smart trend detection

- Custom AI model training based on your prompts

- Multi-timeframe analysis for your stock picks

- AI-powered trading bot for automatic trade execution

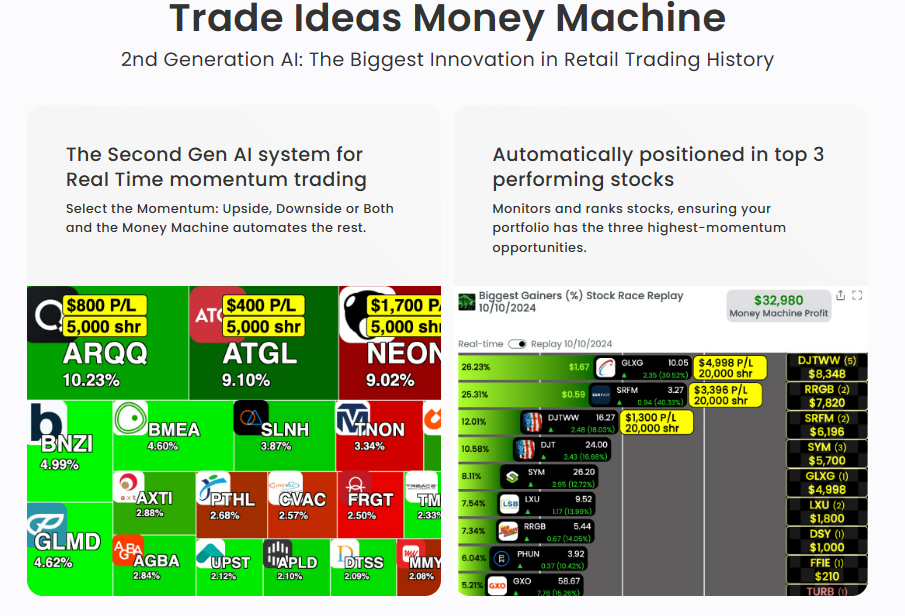

4. Trade Ideas

- Overall Rating: 4.0 / 5

- Cost: Starts at $89/month

- Track record: Varies by trading strategy

Trade Ideas is a real-time AI stock picking service that uses machine learning to generate high-quality stock picks and trade signals. It’s designed for active traders who need an edge in fast-moving markets.

The platform provides 1-click trading directly from the chart by linking your brokerage — allowing you to quickly execute trades to avoid missing an opportunity.

Trade Ideas’ AI system, Holly, runs thousands of backtests nightly to generate the best stock picks for the next trading session. Holly continuously adapts to market conditions by refining its predictions based on historical data.

The AI scans for profitable setups and automatically ranks stocks based on trade potential. Additionally, Trade Ideas offers a proprietary risk management system, suggesting optimal stop-loss and take-profit levels for each trade.

Related reading: Check out our Trade Ideas review

What You Get With Membership

- Holly AI assistant

- Pre- and post-market scans to identify trades outside regular trading hours

- AI-powered stock scanning

- Real-time trade alerts

- Simulated trading to test your ideas first

- Customizable filters for focusing on specific metrics

- Market replay for backtesting strategies

- Proprietary AI trade signals with risk management (SmartStop)

- Fully automated trading bot for hands-free investing

5. Tickeron

- Overall Rating: 4.5 / 5

- Cost: Free plan is very limited; other plans start at $60/month

- Track Record: Tickeron’s AI bots report a 86.6% win rate over a three-month period

Tickeron is an AI-powered trading platform featuring a robust suite of tools for traders.

Among them? Customizable AI trading bots, real-time pattern recognition, and predictive analytics that cater to various trading styles, including day trading and swing trading. Users can access daily buy/sell signals, AI-driven stock screeners, and portfolio optimization tools.

While the platform advanced functionalities, some users may find it has a steep learning curve. That said, Tickeron stands out for its comprehensive AI-driven approach to stock trading. Find out more in our detailed Tickeron review.

What You Get With Membership

- AI Trading Bots: Auto-generate trade signals based on market data and strategies.

- Pattern Recognition: Spots real-time chart patterns to uncover trade setups.

- Trend Predictions: Forecasts stock movements using AI and historical data.

- AI Screener: Finds stocks using custom filters and AI insights.

- Portfolio Tools: Includes optimization, backtesting, and cloning features.

- Community Access: Connect with other traders and share strategies.

6. Seeking Alpha Premium

- Overall Rating: 3.5 / 5

- Cost: Try it free for 7 days — then $299 year (Hey! Get $30 off your subscription for a limited time here)

- Track record: Varies by trading strategy

Seeking Alpha Premium isn’t pure AI stock picking, but as a Premium or PRO member, you can access AI-powered Virtual Analyst Reports to provide advanced market analysis and stock recommendations.

The Virtual Analyst Reports use AI algorithms to analyze vast amounts of financial data, earnings reports, and analyst ratings — helping you make informed investment decisions based on data-driven insights.

These reports help you understand the most important details about a given stock, and whether or not you should own it.

Related reading: Check out our Seeking Alpha review

What You Get With Membership

- Premium investing tools and analysis

- Unlimited investing expert content

- AI-powered Virtual Analyst Reports

- Stock ratings based on financial metrics

- Exclusive research reports

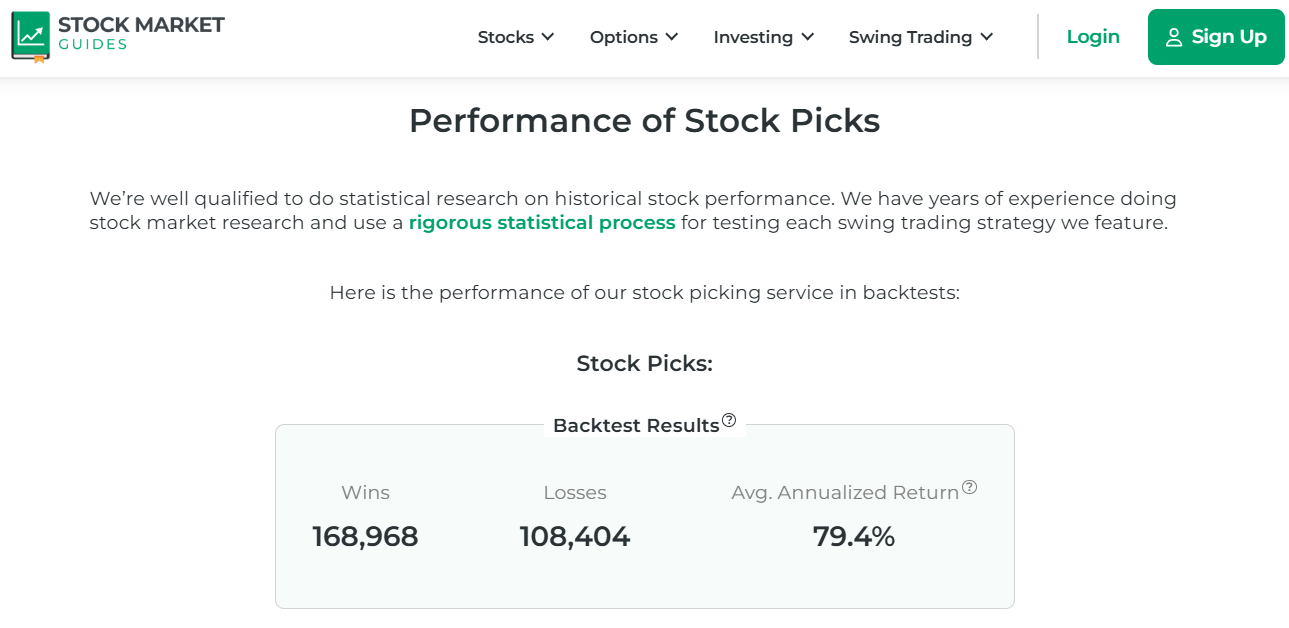

BONUS: Stock Market Guides

- Overall Rating: 3.5 / 5

- Cost: Plans start at at $29/month

- Track record: 79.4% average annual returns on swing trading stock picks

No, it’s not a pure AI stock picker, but Stock Market Guides does leverage cutting-edge technology to deliver superior stock picks, to the tune of 79.4% average annual returns. (Check out our Stock Market Guides review to learn more.)

offers backtested investment strategies designed to help traders buy low and sell high in the stock market. It provides stock and options picks by backtesting hundreds of thousands of trades using historical data.

The idea is to analyze longer-term trade setups with detailed backtesting to find patterns that can be used to pick future winners.

What You Get With Membership

- Historical backtested investment strategies

- Trade alerts from 3 days up to one year

What the Best AI Stock Pickers Have In Common

While there are several AI stock-picking tools out there, the best ones give you access to a wide range of tools and data to help you analyze and pick the best stocks for your goals. Here are a few things you’ll want to make sure your AI stock picker excels at:

- Predictive Modeling: AI tools leverage historical market data to generate predictive insights and perform accurate stock analysis, helping you find stocks with high potential growth.

- Signals: Using AI to create and track trading signals based on popular technical indicators. This helps you find stocks that have eclipsed a specific indicator which may signal a “Buy” or “Sell” action.

- Risk Management Tools: The best AI stock picking services aren’t just about stock prediction. They also have built-in risk management tools to help you analyze your portfolio and risk level of specific stocks.

- User-Friendly Interfaces: Stock analysis platforms that leverage AI tools should have an intuitive user interface and simple reporting for both beginners and advanced traders alike.

- Machine Learning & Data Analysis: By leveraging AI, stock pickers can process large datasets and analyze information quickly to help you find winners.

Ready to Invest? You need a broker.

Limited-Time Deal for U.S. Residents!

eToro is one of the world’s most popular investing platforms with over 28.5 million users.

Right now, eToro is offering a $10 bonus* for U.S. residents who open and fund a new account.

$10 bonus for a deposit of $100 or more. *Only available to U.S. residents. Additional terms and conditions apply.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Final Word: AI Stock Picking

AI stock picking can be a powerful source of investment ideas for stock traders. Finding valuable stocks before they take off requires a lot of number crunching and data analysis — making AI the perfect companion for any day trader or active investor.

But AI can get things wrong, and there are no guaranteed results with any stock trading strategy. Utilizing an AI-powered stock picker can help point you in the right direction and make better trades, but it’s ultimately up to you to know what the best trading strategy is for your temperament.

If you feel you still need assistance, a stock-picking service like Zen Investor can help you leverage AI while also enjoying the benefits of a human touch with a 44-year market veteran vetting every stock pick on criteria that includes an AI review.

FAQs:

Which AI is the best for picking stocks?

While there are several well-designed AI platforms for helping with data analysis for picking the top stocks now, the Zen Investor stock picking newsletter leverages AI with human analysis and discernment as part of the process.

It can help make sense of the data and find winners over the long-term — which is evident based on its 20+ year track record.

What is the most accurate AI stock predictor?

As AI stock pickers are very new to the market, it’s hard to pick just one as the most accurate. Trade Ideas Holly assistant offers real-time stock picks with entry and exit points based on immediate market data. And Zen Investors has a 20+ year track record of handily beating the S&P 500.

What is the best free AI stock picker app?

Zen Ratings is a stock analysis tool that offers a stock ranking system that incorporates an AI score as part of its 115-factor review for over 4,600 stocks on the platform. This tool is free to use on WallStreetZen.com and you can research any stock to find out if it is a good choice based on the ratings system.

Who is the most accurate stock picker?

WallStreetZen’s Zen Strategies is the most accurate AI stock picker, with an entire AI Factor portfolio dedicated to AI stock picks that has delivered 48% average annual returns over the past 20 years. It employs machine learning using a Neural Network trained on 20+ years of fundamental and technical data, and can detect patterns beyond human capability, offering a deeper view of not only past performance but potential for future price movements.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.