What’s the Best AI Portfolio Management Tool in 2026?

When it comes to AI in portfolio management, all-in-one wealth management platform Range stands out above the rest.

The platform seamlessly blends AI-powered insights with human advisor oversight to deliver personalized financial strategies; this combination not only results in highly accurate advice, but significantly lower fees than traditional advisors.

Of course, Range is also among the higher-cost options on the list, so it may be most appropriate for higher-net-worth investors. As an overall value pick, I suggest using WallStreetZen’s excellent tools — many of which are available for free.

With excellent user ratings and integrations with several financial platforms, it tops my list for efficiency and value.

Unlock 48%+ Returns with 7 AI-sourced stocks

A great portfolio starts with great stock picks. Join Zen Strategies now and be up and running in 10 minutes a month—with a 90-day money-back and performance guarantee. Here’s what you get:

✅ Backtested Quantitative Portfolios: Zen Strategies selects only the top 7 stocks per strategy, refined from over 115 factors, offering portfolios that span diverse themes — AI Factor, Momentum, Small Caps, Under $10, and more.

✅ Proven Performance: These strategies have delivered exceptional all‑time annual returns:

- AI Factor: +48.01%

- Momentum: +42.17%

- Under $10: +35.02%

✅ Easy to Start: Designed to be implemented in as little as 10 minutes per month, complete with a Quick Start Guide and weekly insights from Editor‑in‑Chief Steve Reitmeister.

✅ Risk‑Protected Access: A 90-day money-back policy and a 100% performance guarantee—if it doesn’t help you beat the market, you get a full refund. Plus, there’s a 50% off launch offer.

Do You Need AI in Portfolio Management?

Artificial intelligence is a relatively new phenomenon — but it has already reshaped the retail investing landscape, as evidenced by the proliferance of AI stock predictor and investing-related apps.

What was once the domain of hedge funds and large institutions is now much more accessible — to the point where you can easily leverage AI to manage your portfolio.

However, not all AI portfolio management tools are created equal, and we still haven’t reached the point where this approach is a no-brainer — something every investor should adopt by default.

That said, the benefits are hard to deny, and there’s a reason why these tools are becoming so popular — on top of sheer efficiency and time savings, you also get a personalized, data-driven way to handle your portfolio.

Artificial intelligence asset management is a step toward leveling the playing field with the smart money crowd — but to truly do that, you need to choose the right tools for your needs.

Best AI Portfolio Management Tools in 2026

1. Range – Best For Wealthy Investors

- Pricing: Starts at $2,655 per year ($221.25 per month)

- AI capabilities: Portfolio analysis, tax analysis and projection, retirement income analysis, personalized retirement strategies, insurance optimization,

- User experience: 4.5 / 5

- Integration with other financial platforms: Plaid, MX, and Array

Range is an all-in-one wealth management platform. It’s also a pioneer when it comes to utilizing AI in wealth management, and has attracted quite a lot of publicity. It’s one of the few tech-driven tools specifically designed for higher-net-worth individuals.

By using Rai (Range AI), the company’s proprietary model, Range claims to be able to deliver advice 10-20x faster, thus saving their members 75% to 90% in fees, at least when compared to traditional wealth advisors.

However, this isn’t a pure-play AI tool — Range maintains a team of human advisors who handle oversight and personalized guidance.

Moreover, there aren’t many client-facing AI features — most of the magic happens behind the scenes. Essentially, it’s the best of both worlds — a team of professionals leveraging AI to help you make the best decisions to meet your financial goals.

Unlike most wealth management platforms, Range’s pricing structure operates on a flat-fee model — so the costs are fixed, regardless of the size of your portfolio. For high net worth investors, that’s quite appealing, as fee structures based on assets under management (AUM) can easily pile up.

As I previously mentioned, Range is an all-in-one platform — so you’ll get access to portfolio analysis, tax projections, estate planning, and a bevy of other services. Because the suite is so expansive, you’ll have to input plenty of information into the platform, but thankfully Range supports integration with the likes of Plaid, MX, and Array.

After onboarding, you will receive a personalized plan in 1 to 2 weeks. While you won’t get a personal advisor, Range’s team will be at your disposal — the idea is to connect you with the person most qualified to help with your specific needs.

So, what do I think? Once all is said and done, Range gives you a comprehensive platform, a wide variety of services — all at a fixed price point. It’s definitely a platform to consider, particularly for high net worth investors — but investors looking for something a bit more DIY might be disappointed.

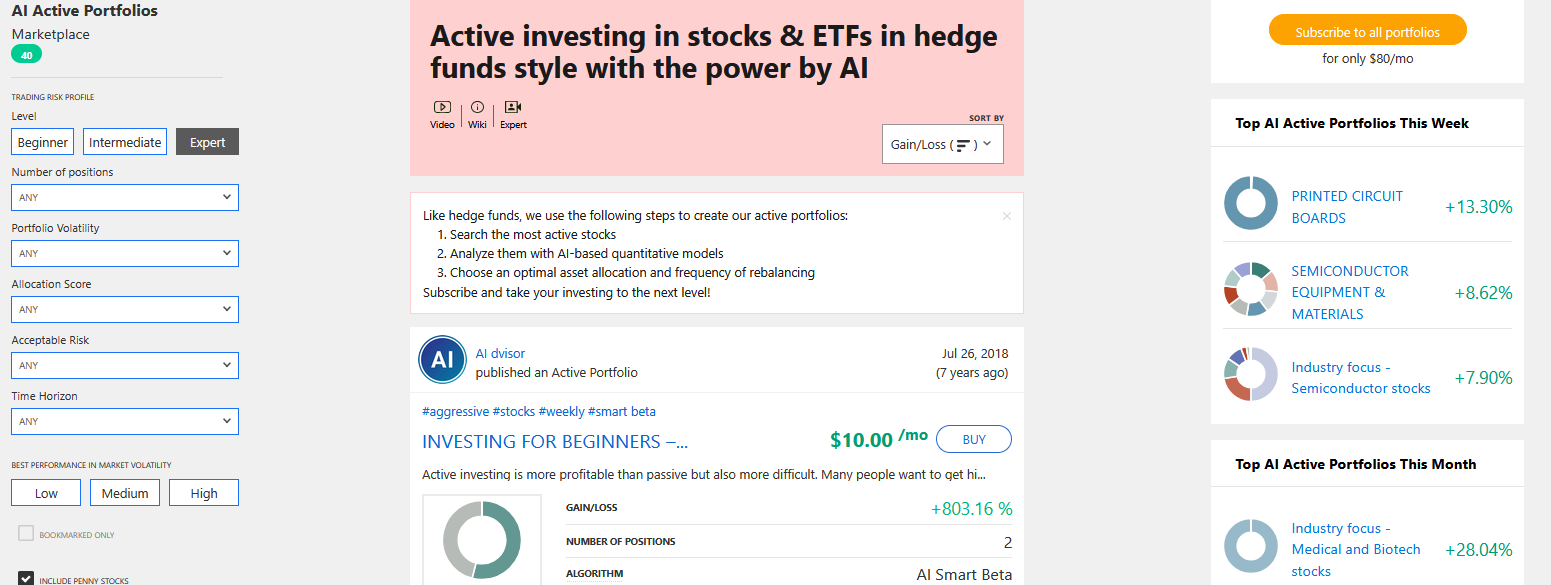

2. Tickeron

- Pricing: Free plan available, but with limited features; Paid plans start at $20 / month if billed annually, but final pricing depends on purchased features

- AI capabilities: Quantitative AI models and algorithms, AI trend prediction engine,

- User experience: 4 / 5

- Integration with other financial platforms: None so far, but integrations with Binance, Alpaca, Kraken, TD Ameritrade, and Interactive Brokers are on the way

Tickeron offers a very wide variety of services — and while you likely won’t be interested in absolutely everything on offer, if you’re after AI portfolio management, there’s quite a few things to like here.

The main selling point here is access to AI portfolios. Tickeron users can opt to get access to AI-based model portfolios for $20 per month, or AI-based active portfolios for $40 per month.

Opting for a free membership still allows investors to create portfolios and receive AI investment ideas on the platform — but the functionality is severely limited compared to the premium plans.

Related reading: Tickeron AI Review: Is It Worth It in 2025?

So, how do these AI portfolios work?

It’s simple — in the case of model portfolios, Tickeron leverages quantitative AI models and algorithms to construct a portfolio that follows a theme.

Some of the most popular choices currently available include top tech stocks, aerospace & defense, and generic drugs & beauty. Each portfolio is assigned a diversification score, and has a transparent track record.

When it comes to active portfolios, the same principles apply — except artificial intelligence is also used to automatically rebalance the portfolio.

Sidenote — Tickeron’s fee structure is…sorta convoluted. The $20 and $40 we mentioned buy you access to all available AI-based model portfolios or active portfolios.

However, access to a single portfolio can be purchased for as little as $1.99 per month, although most active portfolios cost $10 a month, while model portfolios will usually set you back $5 on a monthly basis.

In contrast with the fee structure, the platform is intuitive and user-friendly, while also being customizable.

If you prefer a more hands-on approach, you can leverage Tickeron’s trend prediction engine, AI-powered screener, and chart pattern search engine.

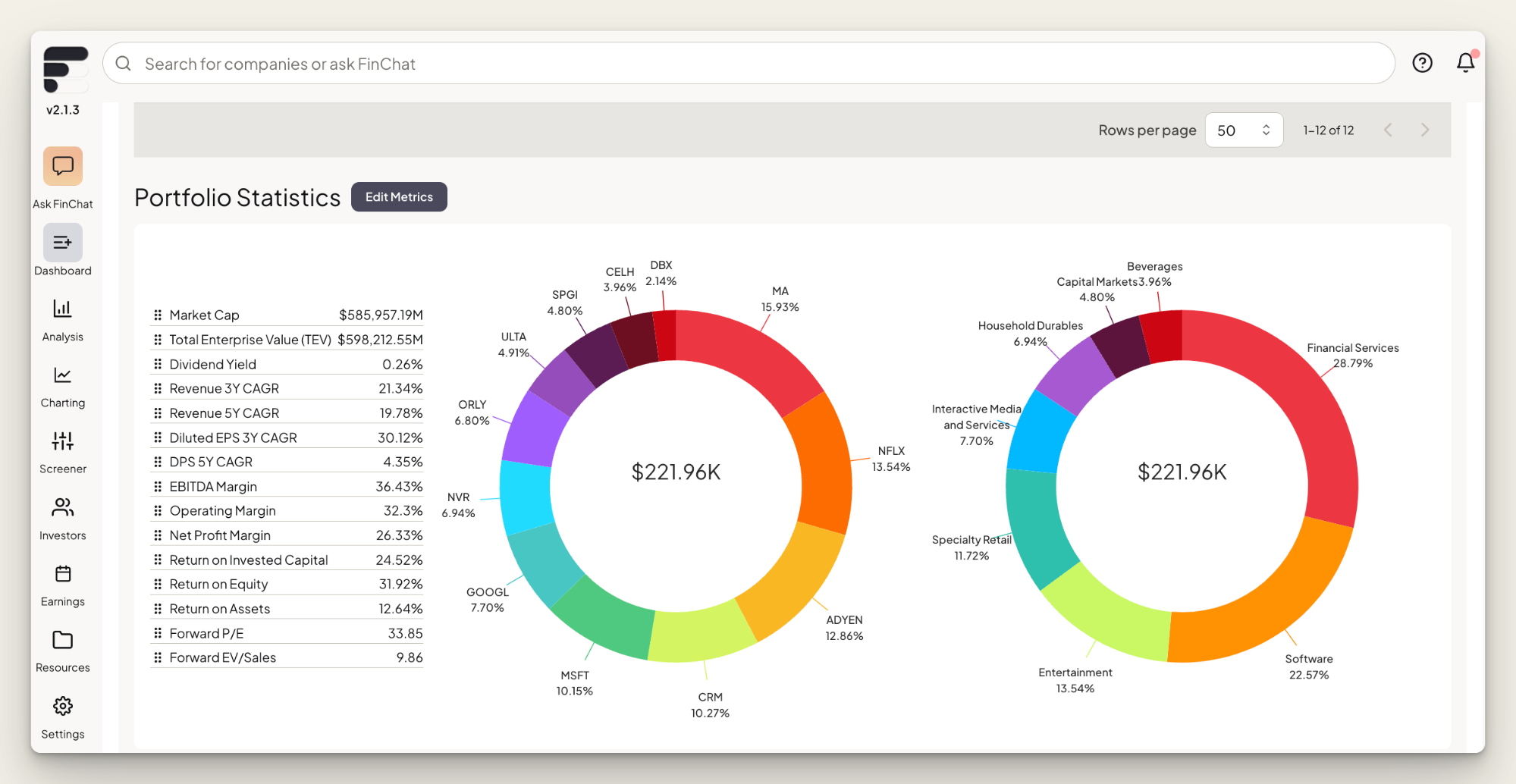

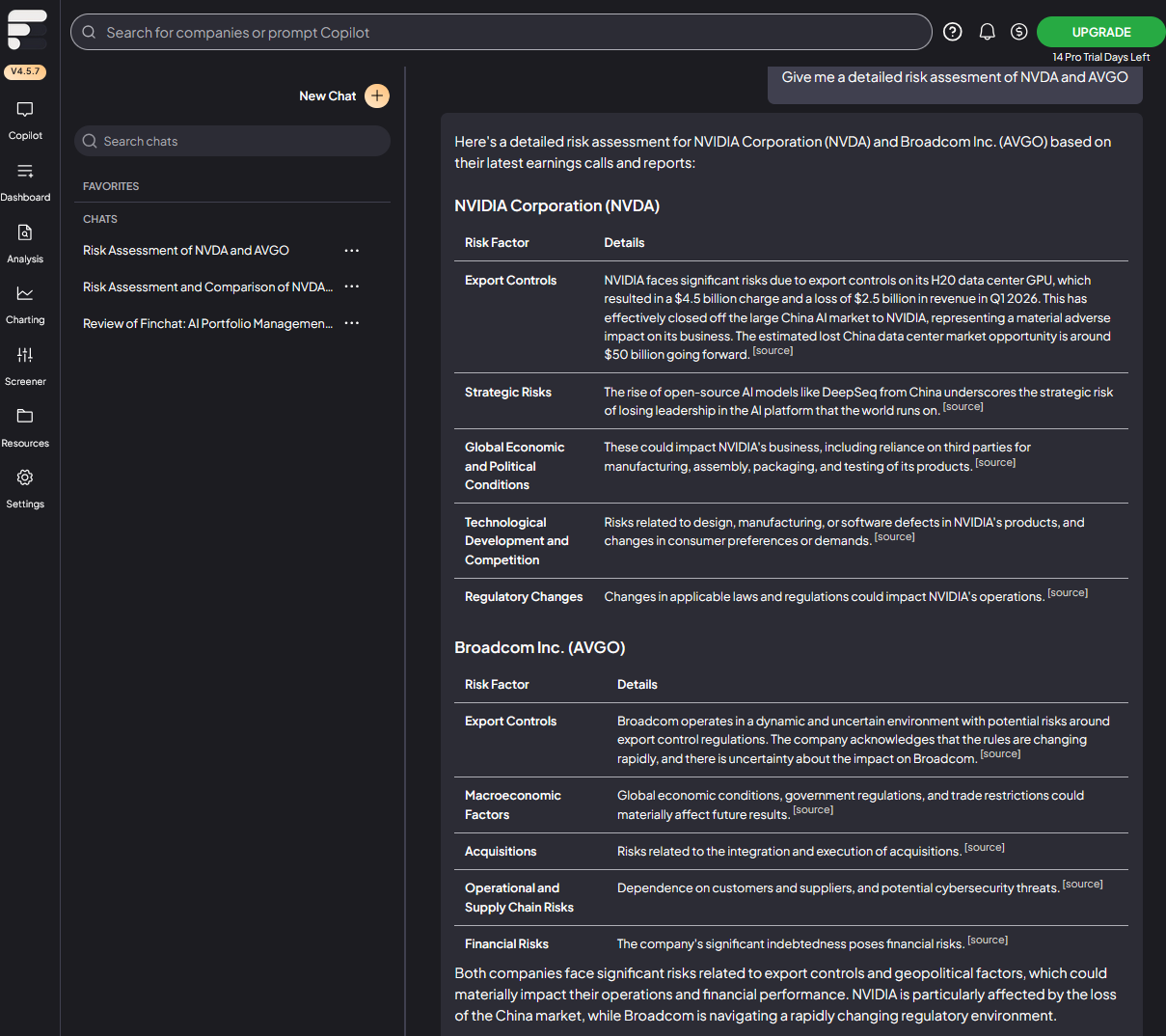

3. Fiscal.ai (Formerly FinChat)

- Pricing: Available for free with 10 Copilot prompts per month; Premium plan with 100 prompts per month starts at $24

- AI capabilities: (e.g., machine learning algorithms, predictive analytics, etc).

- User experience: 5 / 5

- Integration with other financial platforms: None

Fiscal.ai is a rather unique platform. It’s the intersection of market data and conversational AI — quite literally.

The idea is simple — combine institutional-grade data from S&P Market Intelligence and public company filings with a simple user interface akin to most of the large language models (LLMs) that you’re used to — think ChatGPT, but purpose-built for investing.

At present, the platform covers more than 100,000 companies across the world — although truly in-depth coverage, including KPI data, is available for approximately 2,000 of them.

Related reading: I Tried It: Fiscal.ai Review

Using the platform is as simple as it can be — simply ask the AI copilot a question you’re interested in, and you’ll get a straightforward, detailed answer in seconds.

Fiscal.ai also offers customizable dashboards that make monitoring portfolios a breeze, as well as plenty of data visualization tools to help make sense of everything, together with portfolio statistics, giving you a quick overview of facts such as returns, dividend yields, net profit margins, etc.

If this has piqued your interest, you can try Fiscal.ai out for free — although you’ll be limited to 10 Copilot prompts per month.

While it isn’t a pure-play AI portfolio management tool, there’s really something to be said about a single interface that allows you to track your holdings and converse with a powerful AI regarding potential additions or rebalancing.

On the other hand, lack of integration with other financial platforms represents a tangible drawback.

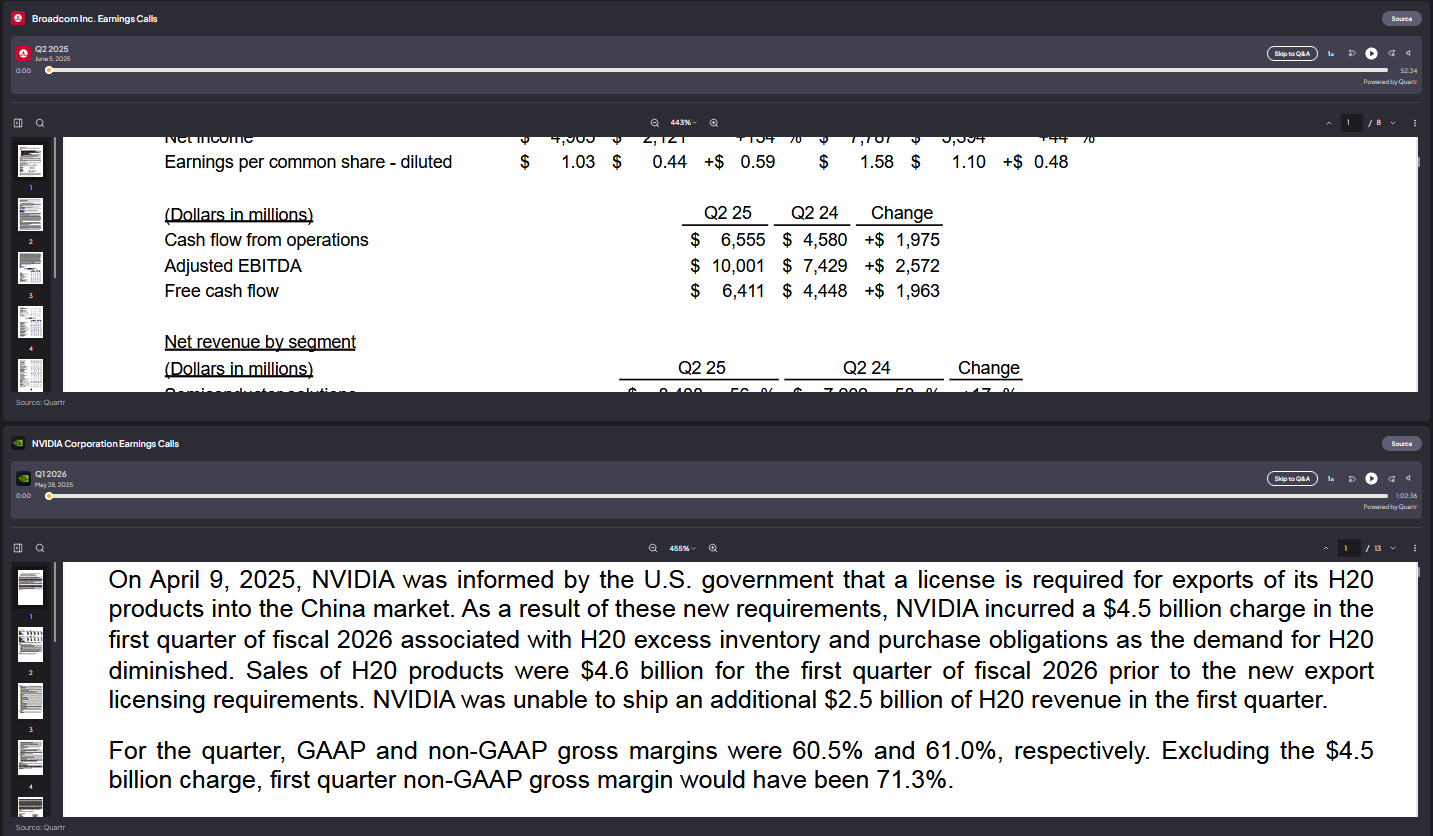

With everything in mind, we still think you should give this one a try, at least — I did, and was quite impressed. You can see a generic prompt I gave the Copilot in this section’s first image.

It even pulled up the company’s latest earnings presentations, with the audio of the actual earnings calls — and the entire process took mere seconds.

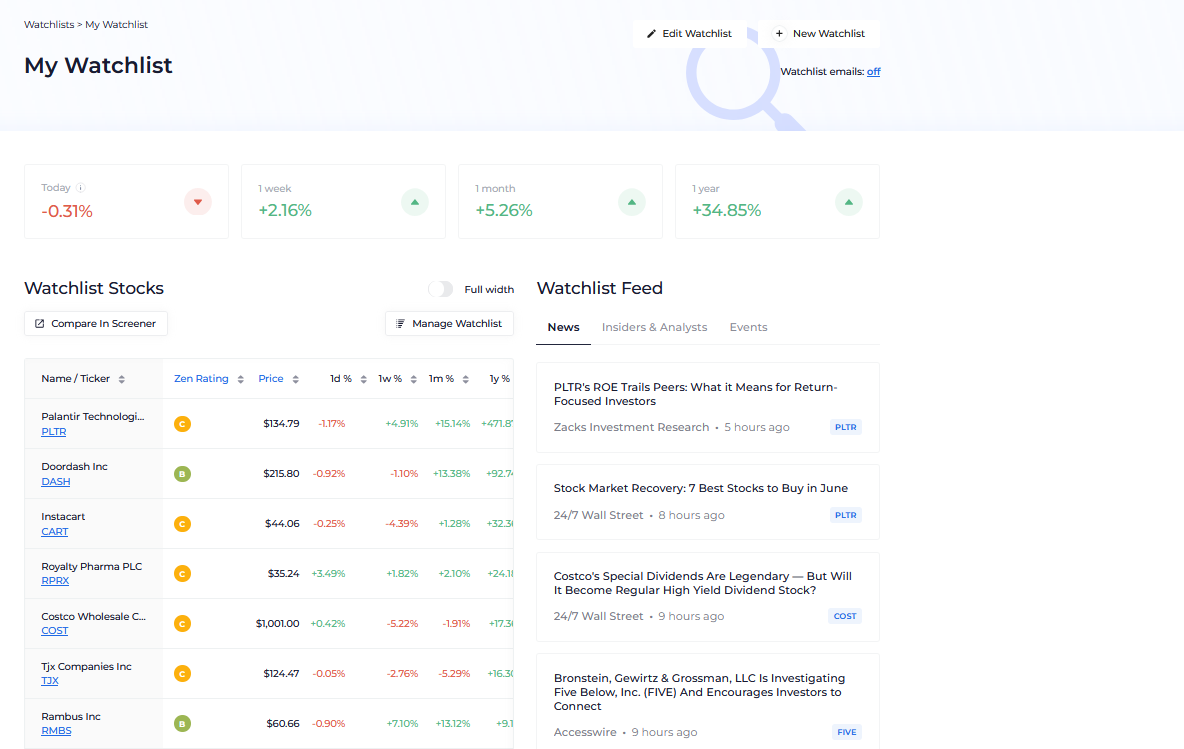

4. WallStreetZen

- Pricing: Basic plan available for free; $1 for a 2-week trial; Premium plan available for $19.50 per month if billed annually. See plans

- AI stock portfolio selection tools: Zen Strategies is offered at $997/year. Find out more

- AI capabilities: (e.g., machine learning algorithms, predictive analytics, etc).

- User experience: 5 / 5

Last but not least, we have our very own service. WallStreetZen isn’t an AI portfolio management tool in the same way the other platforms featured are — but it can help cover some of the functionality that such a tool should provide.

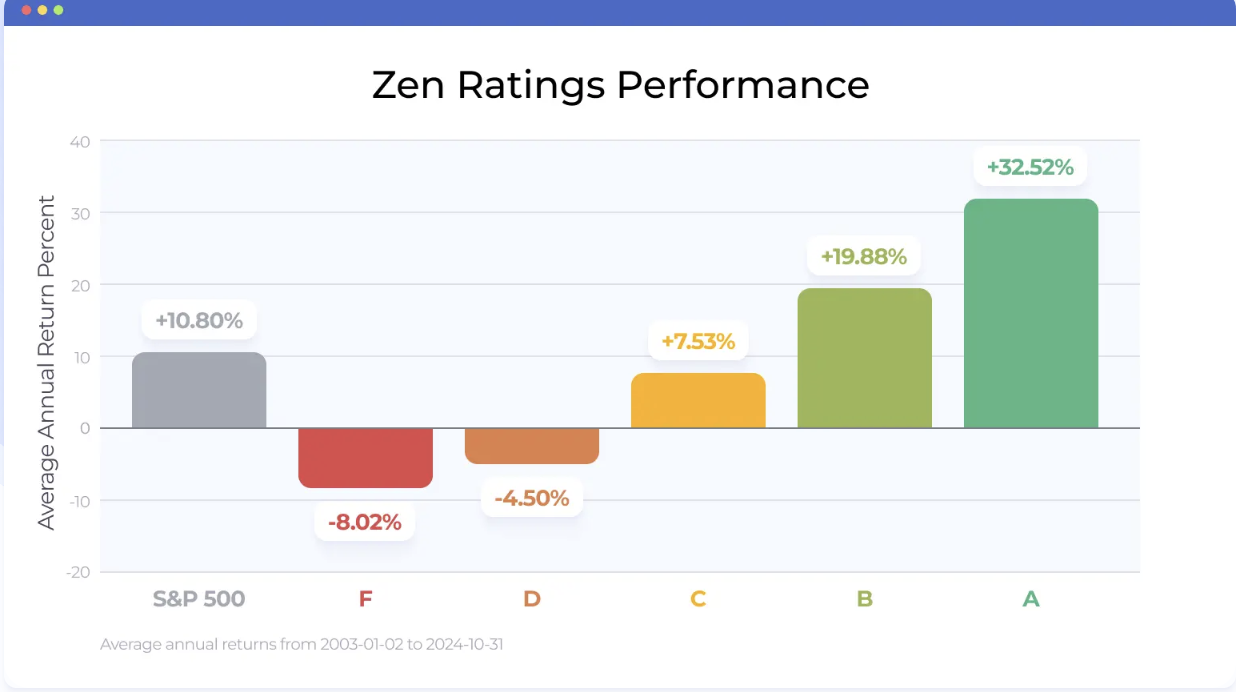

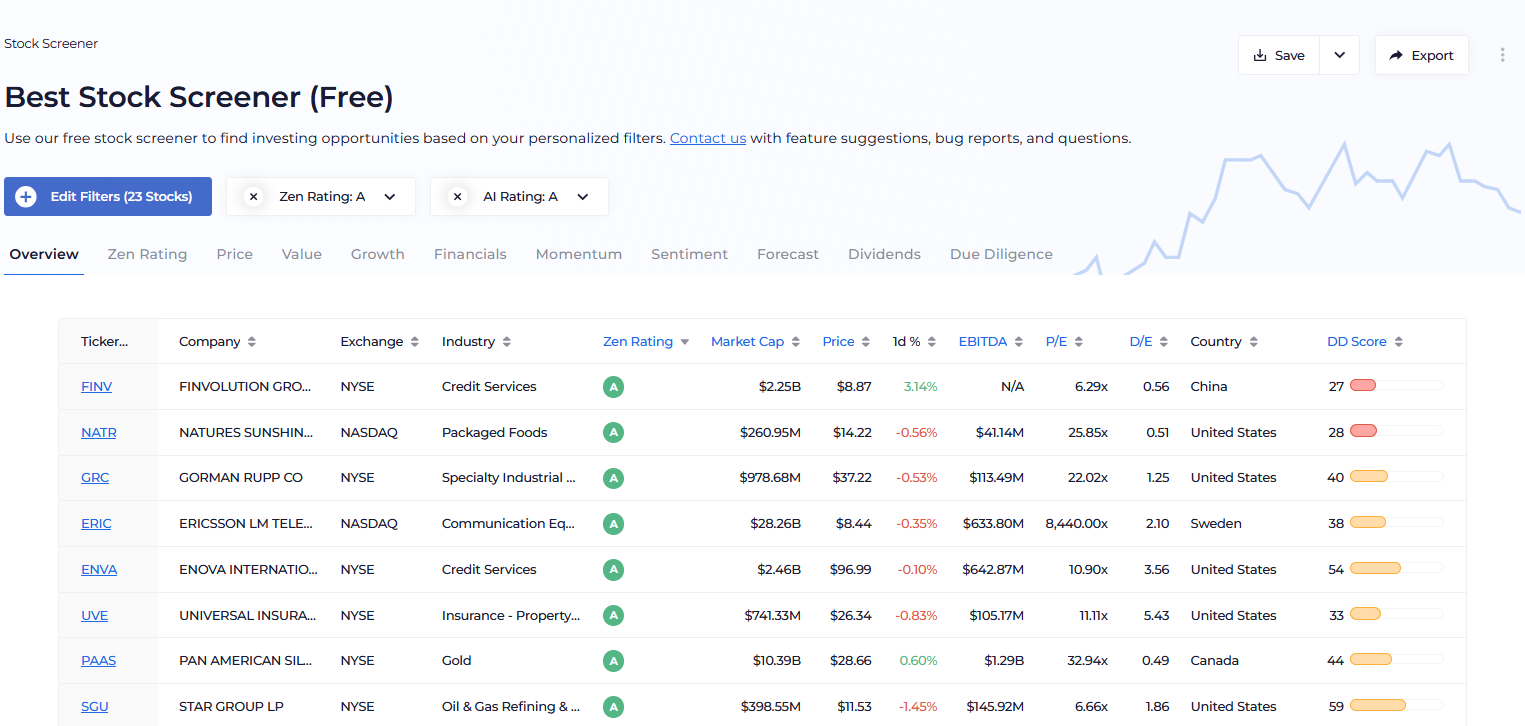

Let’s start with the star feature of WallStreetZen, Zen Ratings. Our quant rating system distills 115 proprietary factors into 7 categories, which make up an overall Zen Rating score.

Only the top 5% of stocks qualify for an A rating, and those have provided an average yearly return of 32.52% since 2003, per backtesting.

One of those Component Grade ratings is Artificial Intelligence. Before we added it into the mix, stocks with an A rating were closer to the 28% mark in terms of average annual gains.

So, how does the AI rating work? It’s simple — a neural network trained on more than two decades of technical and fundamental data evaluates a stock, and voila — you have your AI Component Grade rating.

Related reading: How Can AI Help My Stock Investing?

The biggest advantage here is that the same system allows you to evaluate stocks based on other factors, such as Value, Growth, Financials, or Momentum.

It’s the best of both worlds — you get both the benefit of AI evaluation, as well as traditional fundamentals.

Moreover, it’s great for DIY investors — the black box issue is ameliorated by the fact that you can sift through more than 4,600 stocks, using our ratings, to find the equities that match your specific criteria.

Portfolio Management Tools

In terms of portfolio management, first and foremost, you can take advantage of our watchlists — giving you a clean, tidy overview of your holdings, as well as how they’ve performed across multiple timeframes.

The watchlists also feature a news aggregator, updates to analyst coverage of the stocks in your portfolio, as well as a built-in economic calendar that helps you keep track of events such as earnings calls and dividend payments.

AI-Powered Stock Portfolio

If you want AI to take a heavier hand in helping you select stocks FOR your portfolio, we also have a tool for that: Zen Strategies, a collection of backtested proprietary quantitative trading strategies fine-tuned to identify a portfolio of the very best 7 stocks to maximize performance.

One of our most popular portfolios centers around the AI Factor strategy. All of the stocks featured in this portfolio are selected using the Zen Ratings system’s AI factor, which leverages a neural network trained on 20+ years of data. These are the highest performers as identified by this network.

As you can see, the system has delivered impressive returns:

With Zen Strategies, you gain access to an AI-powered portfolio (and 10 other portfolios centered around different strategies) that you can manage in minutes per month.

What Is AI Portfolio Management?

AI portfolio management uses algorithms and data-driven systems to build, monitor, and adjust investment portfolios. These tools can handle tasks like asset allocation, trade execution, rebalancing, and even personalized strategy recommendations – often with little or minimal human input.

The main use cases include rebalancing portfolios when allocations drift, running ongoing risk analysis based on market volatility and user behavior, and optimizing for things like tax efficiency.

Some platforms even generate forward-looking insights or flag potential opportunities based on historical patterns.

At its best, artificial intelligence asset management brings consistency, speed, and customization to the table — helping investors stay aligned with their goals without having to micromanage every move.

How AI Is Used in Asset Management

At present, AI in portfolio management is dependent on a three-pronged foundation — that of machine learning, big data, and automation. Each plays a distinct role in how these new suites of tools operate.

Machine Learning

Machine learning is leveraged to analyze patterns — whether they appear in economic indicators, stock prices, earnings reports, or even news sentiment. Unlike static models, ML models improve with time.

Related reading: AI For Stock Analysis: The 6 Best AI Stock Analyzers in 2025

Big Data

Next up is big data. Up to relatively recently, even the most well-equipped portfolio managers relied on a relatively limited number of inputs.

In contrast, AI systems are equipped to ingest and analyze vast quantities of data. Simply put, AI operates on a big-picture scale that humans simply can’t compete with.

Automation

Lastly, we have automation — arguably the most direct way artificial intelligence asset management enhances investing.

Whether it’s executing actions without human input — for example, rebalancing a portfolio, or executing trades when preset conditions are met, automation offers a time-efficient way to invest.

While we’re still in the infancy of AI’s usage in retail investing, the smart money crowd is, predictably, ahead of the curve.

The world’s largest asset manager, BlackRock, leverages machine learning and automation with Aladdin, its in-house platform, to monitor portfolio risk and generate strategy recommendations for institutional clients, for example.

In a similar vein, retail investing platforms deploy these technologies to generate portfolio recommendations based on risk tolerance and individual goals.

Key Features of AI Portfolio Management Software

Since this is a new phenomenon, there isn’t really a solid, well-established baseline that we can refer to. However, it isn’t particularly hard to pin down the most common and essential features of AI portfolio management software.

Real-Time Data Analysis

Whereas traditional tools mostly relied on delayed updates or end-of-day figures, AI based portfolio management tools can function in a much more reactive way, as they have the ability to process both live market data and alternative inputs such as news coverage or social sentiment in real time.

This allows these tools — and, in turn, investors, to adapt more quickly to changes, providing a critical edge in fast-moving markets.

Automated Rebalancing and Risk Profiling

Beyond being just a timesaving feature, automated rebalancing ensures that when a portfolio’s allocation drifts, the adjustments are instantaneous and, more importantly, in line with an investor’s goals.

In addition, AI has elevated risk profiling from a simple, static questionnaire to a dynamic system that can adapt to both user behavior and shifting market conditions.

In addition to these features, predictive analytics allow AI to forecast likely scenarios to forecast potential market movements, which allows investors to plan and prepare for likely possibilities ahead of time.

Related reading: What is the Most Accurate AI Predictor? The 6 Best AI Stock Prediction Apps

Sentiment Analysis

As we’ve mentioned before, AI models can employ a wide variety of inputs — and the ability to tap into news coverage, earnings call transcripts, or even social media coverage allows these tools to gauge market sentiment.

Pros and Cons of AI-Based Portfolio Management

As with any new technology, AI portfolio management software has both advantages and drawbacks. There’s no denying how compelling efficiency, personalization, and real-time adaptability are — however, investors should also consider the risk of overreliance and transparency issues, for example.

Pros | Cons |

|---|---|

Efficiency: Automates routine tasks like rebalancing and trade execution, saving time. | Transparency: Some systems operate as a black box, making decisions hard to interpret. |

Lower Fees: Many AI platforms offer services at a fraction of the cost of human advisors. | Overreliance Risk: Users run the risk of becoming too dependent on AI based portfolio management, ignoring broader strategy and neglecting personal research and due diligence. |

Consistency: Using data-driven logic removes human emotional bias from investing decisions. | Limited Customization: Some tools may offer relatively rigid templates that might not be a fit for complex portfolios. |

Data-Backed Decisions: AI incorporates vast datasets to make decisions informed by an amount of information that humans simply can’t match. | New Technology: AI portfolio management tools currently vary in quality and reliability. |

Real-Time Adaptability: Artificial intelligence tools have the ability to actively monitor live market data and sentiment for timely adjustments. | Data Privacy Concerns: These platforms often require access to users’ sensitive financial information. |

Personalization: Many tools adjust strategies based on individual goals and risk profiles. | Lack of Human Oversight: Purely AI-driven platforms are liable to sometimes miss key context or deliver nuanced judgment. |

How to Choose the Right AI Portfolio Management Tool

Your investing goals and your comfort with risk should guide your choice from the start.

If possible, compare features side by side. While no two tools are completely alike, finding something to benchmark a service against is generally a wise choice.

Speaking of features, before you even embark on a comparison, try to zero in on what it is that you’re trying to accomplish. This will help you figure out what features are a priority for you, and which ones are not.

Some platforms specialize in real-time alerts or strategy suggestions, while others lean toward automation and minimal input.

With that being said, there are a few capabilities that are more or less essential when looking for an AI for portfolio management.

Evaluate the Features

Check for built-in risk profiling, rebalancing, and whether the tool lets you tweak strategy parameters.

The “black box” nature of AI sometimes makes it difficult to discern its rationale — so it’s important that you always have the last word. For platforms that aren’t really DIY, this corresponds to human oversight from certified professionals.

Try to be realistic as to whether or not the cost of an AI portfolio management tool is worth it for you. At the end of the day, if the expense isn’t covered by gains, it’s not worth it.

User Experience

Last, but certainly not least, is user experience — if the platform feels clunky and confusing, you’re likely not going to stick with it.

If this is your first time using AI for investing, keep it simple. Start with a small allocation, experiment with settings, and see how the tool reacts to market shifts. The right tool should feel more like a co-pilot than a replacement for what you did up to this point.

The Future of AI in Portfolio Management

Going forward, you should expect more platforms to adopt hybrid models, where algorithms handle the heavy lifting but human advisors step in for strategic guidance or major decisions. It’s a best-of-both-worlds approach that keeps efficiency without losing nuance.

Another trend is deeper personalization. As platforms collect more data — not just on markets, but on user behavior, they’ll get better at tailoring strategies to individual preferences, timelines, and risk patterns. Over time, investors may see fewer one-size-fits-all portfolios.

In addition, as sustainability issues become more important to investors, AI systems are starting to incorporate environmental, social, and governance factors into screening and selection. With that being said, there’s the issue of data quality to consider with this point.

On the whole, we’re at an interesting point right now. With how widespread AI has become in portfolio management tools, it’s more than likely that they will transition to something foundational in the next couple of years.

We can reasonably expect that most of the gruntwork is going to go the way of the dinosaur — but to what extent, exactly, artificial intelligence asset management can automate away that which is currently done manually remains to be seen.

Conclusion

Each of these tools approaches AI in portfolio management differently. Some prioritize automation, others emphasize insight and customization.

So, how do you choose the best one? Start by narrowing down what it is that you want help with — whether it’s idea generation, rebalancing, risk tracking, or deep research.

Once you have a clear overview of what your priority is, it will be easier to select which one of the tools we’ve covered fits the bill best

Getting a head start is the wisest course of action — while all of this is novel now, it will become essential sooner rather than later — so take advantage while it still gives you an edge. Try one of these AI portfolio management platforms today to upgrade your investing strategy.

FAQs:

How can AI be used in portfolio management?

AI can rebalance your holdings automatically, flag risks, and suggest adjustments based on market changes — all without you needing to monitor things constantly.

Can I use AI to manage my investments?

Yes. Plenty of platforms let you hand off the day-to-day management to AI systems. You set the goals and risk level; the software handles allocation, monitoring, and adjustments.

Can I use AI to make a portfolio?

Absolutely. Most AI tools start by asking about your goals and risk tolerance, then generate a portfolio tailored to your inputs

What is the best AI investment tool?

This chiefly depends on your specific needs. Range offers a great, one-stop shop solution. On the other hand, FinChat is a better choice for stock picking, while WallStreetZen offers a middle-road approach that appeals to hands-on investors.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.