The Bottom Line: Portfolio Risk Management

Portfolio risk management isn’t about eliminating risk — it’s about taking the right risks in the right amounts.

If you only take a few tips from this article, let them be these:

- Start with the basics: Proper position sizing and a cash reserve.

- Add stop losses and rebalancing triggers.

- Layer in more sophisticated strategies like hedging as your experience grows.

- Be willing to adapt. Review your portfolio risk management approach quarterly and adjust as needed.

(I’ll explain all of these concepts in more detail below.)

Stock picks with a proven track record…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Recent picks have delivered 76%, 59%, and 42% gains (as of December 2, 2025). Here’s what you get with your subscription:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What You’ll Learn in This Article

In this guide, I break down the nine essential portfolio risk management tools and strategies that will help you protect your capital while still capturing market gains.

You’ll learn practical techniques like position sizing rules, how to use stop losses without getting whipsawed, and strategies for emotionally preparing yourself for inevitable downturns.

Whether you’re a beginner building your first portfolio or an experienced investor looking to tighten your risk controls, these portfolio risk management strategies will give you the confidence to navigate any market condition.

Let’s dive in.

1. Get Smart About Position Sizing

Position sizing is your first line of defense against catastrophic portfolio losses. It’s the foundation of effective portfolio risk management.

Here’s what I mean: If you put 40% of your portfolio into a single stock and it drops 50%, you’ve just lost 20% of your entire portfolio. That’s a hole that takes months or years to dig out of.

Related reading: When to Sell Your Stocks?

I follow the 5% rule for individual positions. No single stock gets more than 5% of my portfolio at purchase. Some aggressive investors go up to 10%, but I find 5% gives me enough exposure without courting disaster.

For more volatile stocks — think small caps or speculative plays — I dial it down to 2-3%. The higher the risk, the smaller the position.

Sector concentration matters too. If you have five tech stocks at 5% each, you’re still 25% exposed to one sector. I cap sector exposure at 20-25% maximum.

Pro tip: Position sizing won’t save you if you’re picking the wrong stocks. That’s where quality research comes in.

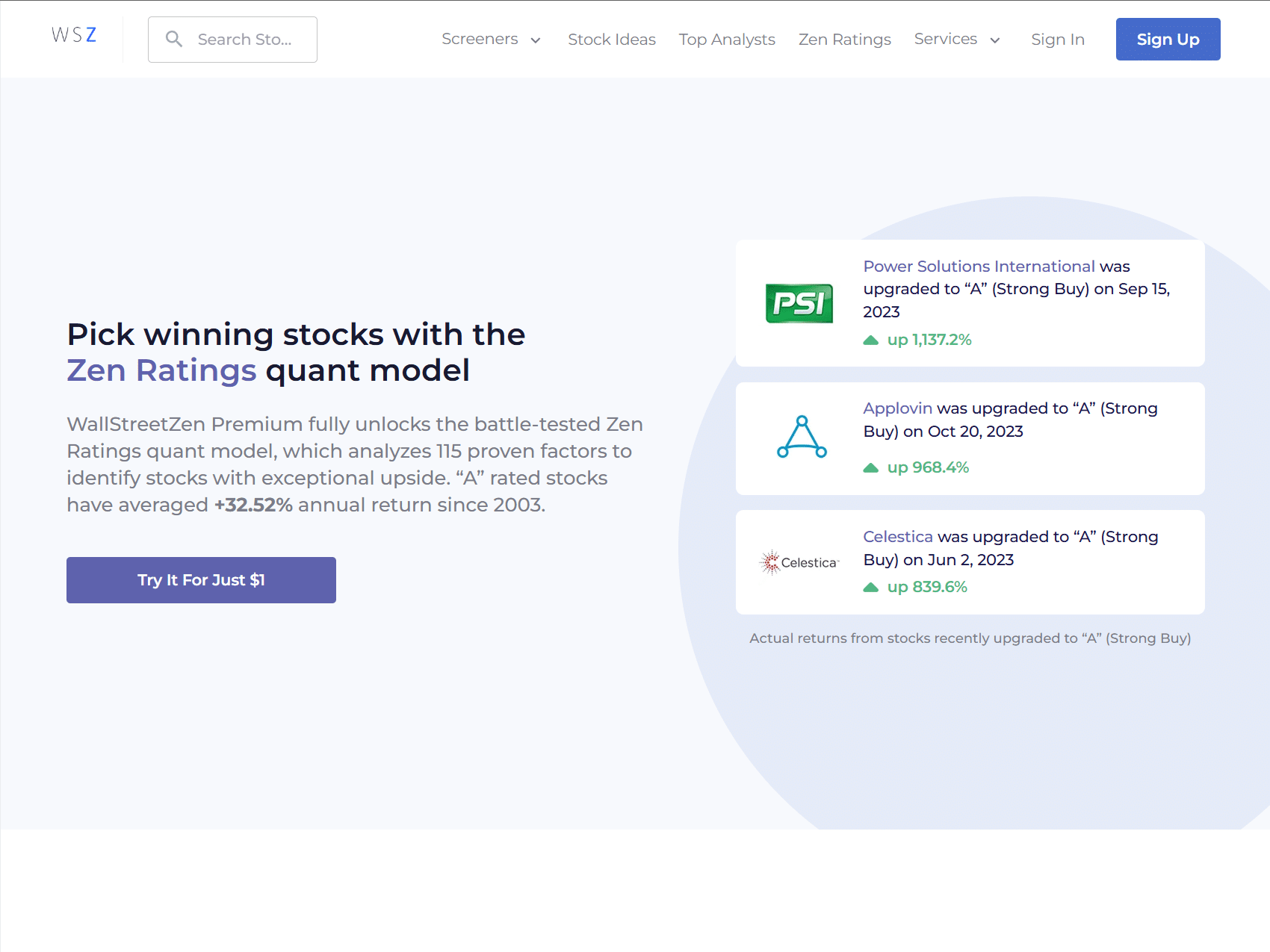

WallStreetZen’s stock analysis platform uses a proprietary Zen Rating to identify fundamentally strong companies, helping you build positions in stocks that deserve space in your portfolio.

Zen Ratings is a proprietary rating system from WallStreetZen that runs over 115 fundamental, technical and AI-driven factors on 4,600+ stocks every trading day — distilling the results into a simple letter grade (A–F) and seven component grades (Value, Growth, Momentum, Sentiment, Safety, Financials, AI).

That’s powerful because stocks rated “A” have historically averaged ~+32.5% annual return since 2003 — reliably outperforming the market by roughly 3:1 and giving investors a data-backed edge for stock selection.

The math is simple: smaller positions = smaller losses when things go wrong. And things will go wrong sometimes — that’s investing.

2. Leverage Stop Losses Intelligently

Stop losses are controversial. Some investors swear by them. Others think they’re a trap that gets you whipsawed out of good positions.

I’m in the middle. Used correctly, stop losses are powerful portfolio risk management tools. Used poorly, they’ll drain your account with death by a thousand cuts.

Here’s my approach: I use percentage-based trailing stops, not fixed stops.

A trailing stop moves up with the stock price but never down. If I buy at $100 and set a 15% trailing stop, it triggers at $85. But if the stock rises to $120, my stop moves to $102 (15% below the new high).

This locks in gains while giving the stock room to breathe.

The key is setting the right percentage. Too tight (5-7%) and normal volatility will trigger it. Too loose (30%+) and you’ve defeated the purpose.

For most stocks, I use 15-20% trailing stops. For volatile small caps, I widen it to 25%.

One critical rule: Never move a stop lower to “give the stock more room.” That’s how small losses become big ones.

Moomoo’s platform makes it easy to set trailing stops on every position. Their interface lets you visualize where your stops sit relative to current prices, so you’re never flying blind on your risk exposure.

The goal isn’t to avoid ever taking a loss. It’s to keep losses small and manageable so they don’t wreck your portfolio.

3. Understand the Role of Cash

Cash isn’t just what’s left over after you buy stocks. It’s an active position in your portfolio risk management strategy.

I keep 10-25% of my portfolio in cash depending on market conditions. When valuations look stretched and I can’t find compelling opportunities, that number creeps toward 25%. In corrections when quality names go on sale, it drops toward 10%.

Cash serves three purposes:

- First, it’s dry powder. Market corrections happen. When they do, investors with cash can buy quality stocks at discount prices while everyone else can only watch.

- Second, it reduces portfolio volatility. A portfolio that’s 80% stocks and 20% cash will swing less violently than one that’s 100% stocks. This makes it easier to stick to your strategy during rough patches.

- Third, it can earn returns. This is where most investors miss out.

Many investors leave cash sitting in their brokerage earning next to nothing. Moomoo offers competitive rates on uninvested cash, turning your cash position from dead weight into a productive portfolio component.

I treat cash as a strategic position, not a parking spot. When I’m holding 20% cash, I’m explicitly betting that I’ll find better opportunities in the future than I can find today.

Sometimes that bet pays off. Sometimes it doesn’t. But having cash gives you options, and options are valuable in portfolio risk management.

4. Manage Portfolio Risk With Hedging Strategies

Hedging gets complicated fast, but the basic concept is simple: you take positions that profit when your main holdings lose value.

The most common hedge is buying put options. If you own stocks, buying puts gives you the right to sell at a specific price. If the market crashes, your puts increase in value while your stocks drop.

Think of it like insurance. You pay a premium (the cost of the puts) for protection against a major loss.

I don’t hedge my entire portfolio all the time — that’s expensive and caps your upside. But during periods of extreme uncertainty or when I’m sitting on large unrealized gains, tactical hedging makes sense.

Alternative hedging strategies:

- Inverse ETFs: These go up when the market goes down. I use these sparingly because they’re designed for short-term holding and lose value over time due to daily rebalancing. My go-to source for stock research, WallStreetZen, doesn’t support ETF research, but a great site that does is Stock Rover.

- Defensive sector rotation: Moving some allocation to utilities, consumer staples, or healthcare. These sectors typically hold up better in downturns. (Here are links to the pages for each of these industries on WallStreetZen: Utilities — Consumer Staples — Healthcare. You can click on those links to filter for the best stocks in each industry.)

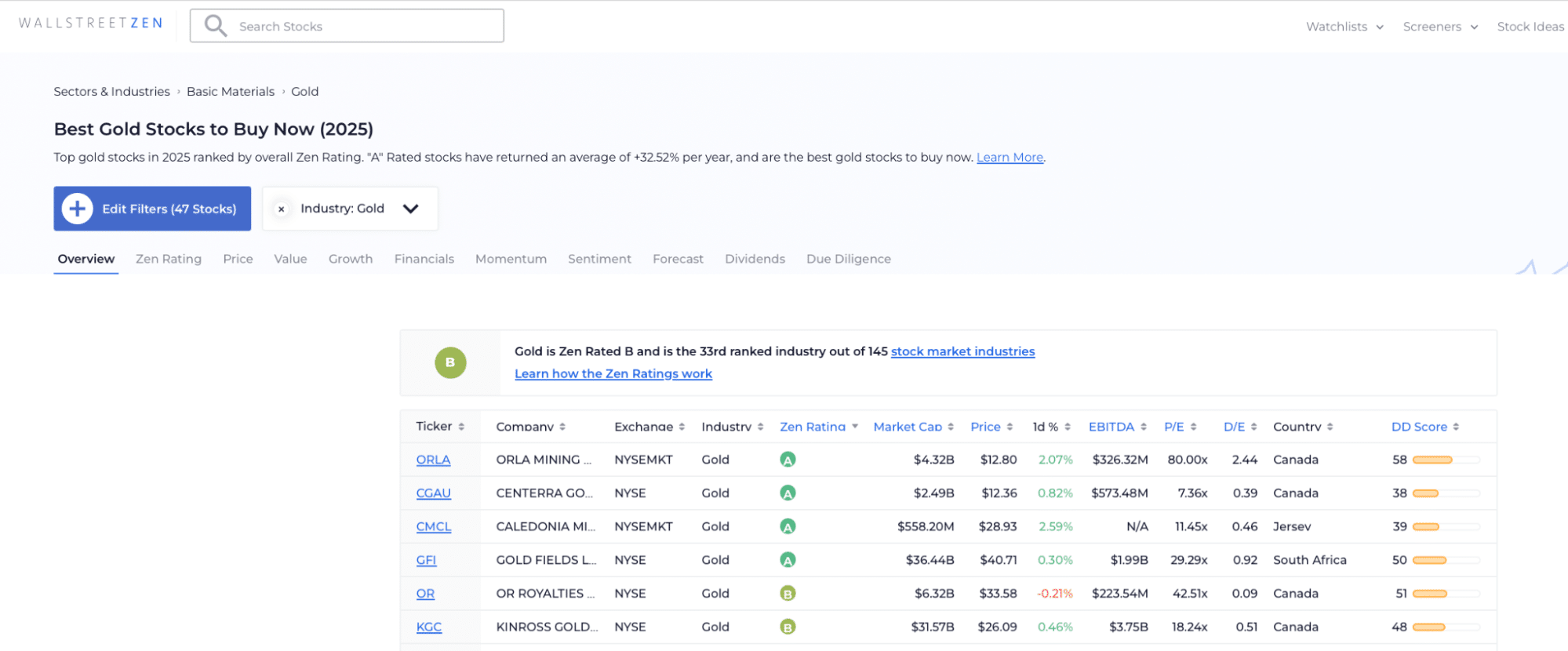

- Gold exposure: I keep 5-10% in gold ETFs or mining stocks. Gold often rises when stocks fall, though the correlation isn’t perfect. (Check out our Best Gold Stocks screener here.)

The key is understanding that hedging costs money. You’re buying protection, and protection has a price. I only hedge when I believe the cost is justified by the risk.

Research is critical for hedging decisions.

WallStreetZen’s platform provides sector analysis and comparative valuation metrics that help identify when certain market areas are overextended and might benefit from hedging.

5. Get to Know Your Personal Risk Tolerance

Here’s an uncomfortable truth: most investors don’t actually know their risk tolerance until they’re tested.

You might think you’re comfortable with volatility when your portfolio is up 20%. But what happens when it’s down 30% and the financial media is screaming about recession?

Risk tolerance has two components:

- Risk capacity is how much loss you can afford based on your financial situation. If you’re 35 with a stable job and decades until retirement, you have high risk capacity. If you’re 65 and need to start withdrawing from your portfolio in two years, your capacity is lower.

- Risk appetite is psychological — how much volatility you can stomach without panicking and selling at the bottom.

Both matter for portfolio risk management.

Here’s how I assess true risk tolerance:

Ask yourself: “If my portfolio dropped 40% tomorrow, would I buy more, hold steady, or sell?” Be honest. If your gut answer is “sell,” you’re overexposed to risk regardless of what any calculator tells you.

I use this framework:

- Conservative: 40-60% stocks, 40-60% bonds/cash

- Moderate: 60-75% stocks, 25-40% bonds/cash

- Aggressive: 75-90% stocks, 10-25% bonds/cash

- Very Aggressive: 90-100% stocks

There’s no right answer. A conservative portfolio that lets you sleep at night and stay invested through downturns will outperform an aggressive portfolio you panic-sell during crashes.

Match your portfolio to your actual risk tolerance, not the risk tolerance you wish you had.

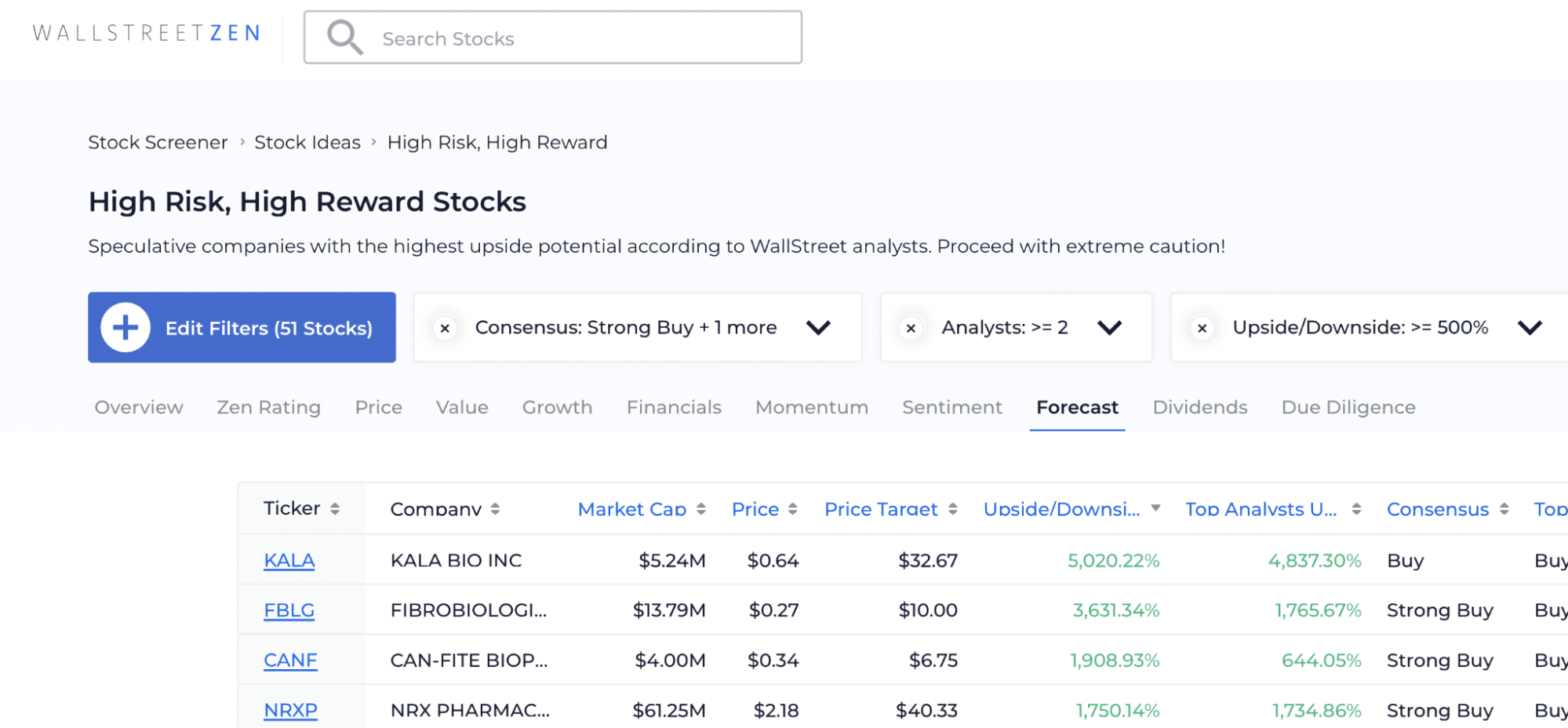

Check out our Best High-Risk, High-Reward Stocks screener for top-rated picks.

6. Learn Rebalancing Triggers and Strategies

Rebalancing is how you maintain your target asset allocation over time. Without it, your portfolio drifts away from your risk management plan.

Here’s what happens: Your stocks have a great year and go from 70% to 85% of your portfolio. Now you’re taking more risk than you intended. When the correction comes, you get hit harder than your risk tolerance would suggest.

I use two rebalancing approaches:

- Calendar rebalancing: I review my portfolio every quarter. If any position has grown beyond 8% of my total portfolio or any sector exceeds 25%, I trim it back.

- Threshold rebalancing: If my overall stock allocation drifts more than 5 percentage points from my target, I rebalance immediately regardless of the calendar.

Here’s the practical process:

Let’s say my target is 75% stocks and 25% cash/bonds. After a rally, I’m at 82% stocks. I sell enough stock (usually trimming my biggest winners) to get back to 75%.

This forces a critical behavior: selling high and buying low. You’re taking profits from winners and redirecting capital to assets that have underperformed.

Rebalancing within your stock portfolio matters too. If tech stocks have run up and now represent 40% of your equity exposure instead of your target 25%, trim them back. This prevents concentration risk from creeping into your portfolio.

Tax considerations matter here. I prioritize rebalancing in tax-advantaged accounts (IRA, 401k) where selling doesn’t trigger capital gains. In taxable accounts, I’m more likely to rebalance by directing new contributions rather than selling.

The discipline of rebalancing is a core portfolio risk management tool because it prevents emotional decision-making. You’re following a rules-based system, not your gut.

7. Be Emotionally Prepared For Downturns

Portfolio risk management software and strategies are important, but they’re worthless if you abandon them the moment markets get scary.

I’ve been through enough market cycles to know this: the hardest part of investing isn’t the technical analysis or portfolio construction. It’s managing your own psychology when your account balance is dropping $10,000 a day.

Here’s what helps me stay rational during downturns:

- Expect them. Markets experience 10% corrections roughly once per year and 20%+ bear markets every 3-4 years on average. If you’re surprised when they happen, you’ll panic.

- Have a written plan. Before volatility hits, I write down my actions: “If the market drops 10%, I will do nothing. If it drops 20%, I will deploy X amount of cash into positions A, B, and C.” When emotions are high, I follow the script.

- Stop checking your portfolio constantly. During corrections, I limit myself to one portfolio check per week. Obsessively watching daily swings amplifies anxiety and increases the chances of emotional selling.

- Study history. Every major market bottom looked like the end of the world at the time. 2009, 2020, even October 2023 — if you sold at the bottom, you missed the recovery. This isn’t optimism; it’s data.

Consider learning from experienced investors who’ve navigated multiple market cycles.

Zen Investor provides stock picks from an investor with 40+ years of experience across bull and bear markets. Sometimes the best portfolio risk management tool is the perspective of someone who’s been through it all before.

Your emotions will try to convince you that “this time is different.” Sometimes it is different in the details, but the overall pattern — fear at the bottom, greed at the top — remains constant.

The investors who survive and thrive are the ones who can sit still and stick to their risk management portfolio strategy when everyone else is panicking.

8. Key Recovery Tips for Drawdowns

Even with perfect portfolio risk management, drawdowns happen. What matters is how you respond.

First, don’t try to recover your losses quickly. The temptation after a big loss is to take bigger risks to “make it back.” This is how manageable drawdowns become catastrophic ones.

If you lose 20% of your portfolio, you need a 25% gain to break even. Lose 50%, and you need a 100% gain. The math gets brutal, which is why preventing large losses through position sizing and stop losses is so critical.

When recovering from a drawdown:

- Reassess your positions. Are you holding garbage stocks that deserve to be down? Or quality companies that got caught in broad market selling? I cut the garbage and add to quality if I have cash available.

- Don’t average down blindly. “Catching falling knives” — buying more of a stock as it drops — only works if the fundamental thesis remains intact. If the reason you bought it is no longer valid, accept the loss and move on.

- Increase your savings rate. If possible, funnel more cash into your portfolio during drawdowns. Market bottoms are the best time to deploy capital, but only if you have capital to deploy.

- Review what went wrong. Did you violate your position sizing rules? Did you ignore warning signs? Were you overconcentrated in one sector? Learn from the loss.

- Be patient. Recovery takes time. The S&P 500 took 13 years to recover from the 2000 tech bubble peak. Most bear market recoveries are faster, but you need the emotional stamina to stay invested.

I keep a “lessons learned” document where I record every significant loss and what I should do differently next time. Reviewing it before making major portfolio decisions helps me avoid repeating mistakes.

The best portfolio risk management tools can’t prevent all losses. But they can keep losses manageable and improve your odds of recovery.

Final Word

Portfolio risk management isn’t about eliminating risk — it’s about taking the right risks in the right amounts.

You now have nine concrete portfolio risk management strategies to implement:

Smart position sizing keeps individual losses contained. Stop losses prevent small problems from becoming big ones. Cash gives you flexibility and opportunity. Hedging provides insurance when you need it. Understanding your personal risk tolerance prevents emotional mistakes.

Rebalancing enforces discipline. Emotional preparation helps you survive volatility. And solid recovery strategies help you bounce back from inevitable drawdowns.

The investors who build lasting wealth aren’t the ones who never experience losses. They’re the ones who manage risk systematically and stay in the game long enough for compound returns to work their magic.

Start with the basics: proper position sizing and a cash reserve. Add stop losses and rebalancing triggers. Then layer in more sophisticated strategies like hedging as your experience grows.

Your portfolio risk management approach should evolve as your situation and the market environment change. Review it quarterly. Adjust it as needed. But always have a plan.

The market will test you. Make sure you’re ready.

FAQs:

What is portfolio risk management?

Portfolio risk management is the process of identifying, measuring, and controlling potential losses in your investment portfolio.

It involves using strategies like position sizing, diversification, stop losses, and hedging to protect capital while still capturing market returns.

Effective portfolio risk management balances risk and reward based on your financial goals and risk tolerance.

What is risk management vs opportunity management?

Risk management focuses on protecting capital and preventing losses, while opportunity management focuses on identifying and capturing potential gains. In investing, you need both.

Portfolio risk management tools help you avoid catastrophic losses so you can stay invested long enough for opportunity management to generate returns.

The best investors manage risk first, then pursue opportunities within those risk parameters.

How can AI help with portfolio risk management?

AI can analyze vast amounts of market data to identify risk patterns, predict volatility, and optimize portfolio allocations faster than manual analysis.

AI-powered portfolio risk management software can monitor real-time exposure across multiple assets, alert you to concentration risks, and suggest rebalancing actions based on your risk parameters.

However, AI tools work best when combined with human judgment about risk tolerance and market conditions.

What's the best broker for managing portfolio risk?

The best broker for portfolio risk management offers robust tools for setting stop losses, position sizing alerts, portfolio analysis dashboards, and competitive rates on uninvested cash.

Moomoo stands out with its advanced charting tools, easy-to-implement trailing stops, and strong cash management features that let you earn returns on idle capital while maintaining your risk management strategy.

What are the 3 biggest portfolio risks?

The three biggest portfolio risks are concentration risk (too much money in one stock or sector), timing risk (investing too much capital right before a major downturn), and emotional risk (panicking and selling during market corrections).

Concentration risk causes permanent capital loss when individual positions fail. Timing risk can delay your returns for years. Emotional risk leads to buying high and selling low, destroying long-term wealth accumulation.

What is risk budgeting?

Risk budgeting is allocating your total acceptable risk across different investments based on their risk contribution. Instead of treating all positions equally, risk budgeting assigns more portfolio space to lower-risk assets and less to higher-risk ones.

For example, you might allocate 5% to blue-chip stocks, 3% to growth stocks, and 1% to speculative plays, ensuring your total portfolio stays within your risk tolerance while still capturing different return opportunities.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.