Here’s some good news: We already did your stock research for you. Here’s what we’ll be watching this week. (Did you miss last week’s picks? Get them here)

- Why Kinross Gold (KGC) is still a Buy despite 150% gains since we first alerted

- Why Charles River Laboratories (CRL) could be an excellent value right now

- Nextracker (NXT) dominates its industry — and something big is afoot

- Why BioMarin Pharmaceutical (BMRN) is the jewel of our Buy the Dip portfolio

- Could Jabil (JBL) be the comeback play of the week?

_________________

Goldman Sachs: “More Than 1,600 New Millionaires Quietly Being Anointed Due to Breakthrough Technology” And that’s only the beginning… Jeff Bezos, Mark Zuckerberg, Bill Gates, Jensen Huang, and Elon Musk are all quietly investing millions in a secret revolutionary technology. You’ve never heard anything like this before… Click here to watch this special investigative documentary.*

*Our sponsors help keep this content free

_________________

1- Jabil (NYSE: JBL)

Jabil is a crucial behind-the-scenes player helping some of the world’s biggest tech and industrial companies scale production without sacrificing speed and efficiency. It maintains a strong level of exposure to high-growth sectors such as electric vehicles and healthcare — moreover, JBL is currently showing signs of recovery after a pullback.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $215.69 — get current quote >

Max 1-year forecast: $267.00

Why we’re watching:

- Jabil enjoys overwhelmingly positive coverage from Wall Street — the stock currently has 7 Strong Buy ratings and 1 Hold rating. See the ratings.

- The average 12-month price forecast for Jabil shares currently stands at $237.38, and implies a healthy 9.98% upside.

- Barclays researcher Tim Long (a top 4% rated analyst) maintained a Strong Buy rating on the stock following the company’s Q4 and FY 2025 earnings report, and hiked his price target from $223 to a Street-high $267.

- Long said the quarter delivered a “beat” and management’s guidance, although aligning with expectations, will probably turn out to be conservative.

- JBL is currently the 10th highest-rated stock in the Electronic Component industry, which has an Industry Rating of A.

- Jabil shares rank in the 94th percentile of equities — giving them a Zen Rating of A, a recent upgrade from B (Buy).

- JBL ranks in the top 10% of equities in terms of two Component Grade ratings — Safety and Artificial Intelligence.

- With that being said, Value is Jabil’s biggest strength — in this category, it ranks in the 96th percentile of stocks. (See all 7 Zen Component Grades here >)

2- Kinross Gold (NYSE: KGC)

Kinross Gold has gained 150% since it was added to our Zen Investor portfolio. As gold prices hover near record highs and investors look for safe-haven assets, Kinross stands out with a solid balance sheet — making it a relatively hassle-free way to get exposure to the precious metal.

Zen Rating: B (Buy) — see full analysis >

Recent Price: $24.95 — get current quote >

Max 1-year forecast: $27.00

Why we’re watching:

- Kinross Gold shares are tracked by 5 Wall Street analysts — their coverage is split between 2 Strong Buy ratings, 2 Buy ratings, and 1 Hold rating. See the ratings

- UBS equity researcher Daniel Major (a top 18% rated analyst) recently reiterated a Strong Buy rating on the stock, and hiked his price target from $20 to a Street-high $27.

- In a Mining sector preview note, Major said that the “soft patch” expected in Q3 2025 has not materialized, and UBS is positive on copper, aluminum, and gold, looking ahead.

- At present, KGC is the 13th highest-rated stock in the Gold industry, which has an Industry Rating of B.

- Kinross Gold ranks in the 89th percentile of the equities that our system tracks, giving it a Zen Rating of B.

- Value, in which KGC ranks in the top 13%, is one of the stock’s strongest suits — as it is trading at an attractive P/E of just 18.8x.

- Kinross Gold shares have rallied by 137.96% since the start of the year — so it’s no wonder that they rank in the 94th percentile in terms of Momentum.

- Finally, we have Financials — and due to the company’s exceedingly healthy balance sheet, KGC ranks in the top 1% of stocks in this category. (See all 7 Zen Component Grades here >)

_________________

Goldman Sachs: “More Than 1,600 New Millionaires Quietly Being Anointed Due to Breakthrough Technology” And that’s only the beginning… Jeff Bezos, Mark Zuckerberg, Bill Gates, Jensen Huang, and Elon Musk are all quietly investing millions in a secret revolutionary technology. You’ve never heard anything like this before… Click here to watch this special investigative documentary.*

*Our sponsors help keep this content free

_________________

3- Charles River Laboratories (NYSE: CRL)

Cutting-edge medicine stuff is the name of the game for CRL. It’s involved in a variety of preclinical and clinical laboratory, gene therapy, and cell therapy services. The stock has seen a bevy of insider purchases and demonstrated a stable growth trajectory — to boot, growth prospects are high, and CRL is still trading at quite an attractive valuation.

Zen Rating: B (Buy) — see full analysis >

Recent Price: $175.46 — get current quote >

Max 1-year forecast: $200.00

Why we’re watching:

- Per Wall Street analysts, CRL is a consensus Buy — the stock has 3 Strong Buy ratings, 1 Buy rating, and 4 Hold ratings. See the ratings

- However, the average 12-month price forecast for Charles River Laboratories paints a much more bullish picture, as it sits at $173.38, a figure that implies a hefty 16.01% upside.

- Jefferies researcher David Windley (a top 22% rated analyst) recently upgraded the stock to a Strong Buy rating and increased his price target from $142 to $195.

- CRL stock ranks in the top 10% of the stocks that we track, giving it a Zen Rating of B.

- Charles River Laboratories offers a compelling mix of Value and Growth, as the stock ranks in the 81st and 86th percentile in these categories, respectively.

- Sentiment is another strong suit — 72.51% of the insider transactions tied to the stock in the past 12 months have been purchases, so CRL ranks in the top 11% in this category despite the aforementioned Hold ratings.

- However, Safety is the star of the show — in terms of this Component Grade rating, the stock ranks in the top 6% of equities. (See all 7 Zen Component Grades here >)

4- BioMarin Pharmaceutical (NASDAQ: BMRN)

BioMarin maintains a robust pipeline of treatments aimed at rare diseases. Despite an impressive performance in the company’s last earnings report, BMRN shares are down by 8.12% on the monthly chart. However, the fundamentals are there — so now might be an opportune time to buy the dip.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $55.57 — get current quote >

Max 1-year forecast: $114.00

Why we’re watching:

- Analyst coverage of BMRN skews strongly to the bullish side. The stock currently has 5 Strong Buy ratings and 2 Hold ratings. See the ratings

- Guggenheim researcher Debjit Chattopadhyay (a top 10% rated analyst) maintained a Strong Buy rating on the stock last month, and hiked his price target from $101 to $106.

- In addition, Eliana Merle of UBS (a top 18% rated analyst) also doubled down on a Strong Buy rating, and increased her price target from $113 to a Street-high $114.

- BioMarin Pharmaceutical shares have seen an 8.12% dip in the past month, but retain stellar fundamentals. This has secured a spot for the stock in our exclusive Zen Strategies Buy the Dip portfolio, which has an all-time annual return of 35.29%.

- BMRN has a Zen Rating of A, and currently ranks in the top 2% of the more than 4,600 stocks that we track.

- BioMarin enjoys the benefits of a strong balance sheet — the stock ranks in the 92nd percentile in terms of Financials.

- Our Artificial Intelligence Component Grade rating uses a neural network trained on two decades of market data to identify likely outperformers. In this category, BMRN ranks in the top 5% of stocks.

- Sentiment and Value are also areas where BioMarin truly shines — in both of these areas, the stock ranks in the top 3% of equities. (See all 7 Zen Component Grades here >)

5- Nextracker (NASDAQ: NXT)

Nextracker has a 23% share of the global solar tracker market. The company’s products are essential for keeping large-scale renewable energy projects efficient. NXT has surged by more than 80% since the start of 2025 — the company recently delivered an earnings beat (its 9th consecutive one), and we also have a hefty $4.5 billion (yes, with a b) backlog. Wanna know the best part? The stock is still trading at roughly half the wider market’s average P/E ratio.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $79.36 — get current quote >

Max 1-year forecast: $88.00

Why we’re watching:

- Nextracker shares enjoy broad support from Wall Street analysts. The stock currently has 10 Strong Buy ratings, 1 Buy rating, and 2 Hold ratings. See the ratings

- JP Morgan researcher Mark Strouse (a top 6% rated analyst) recently maintained a Strong Buy rating on the stock and hiked his price target from $69 to $77.

- In a technical note, Strouse told readers they adjusted their price target after updating the target date in their Clean Energy sector model from 2025/12 to 2026/12.

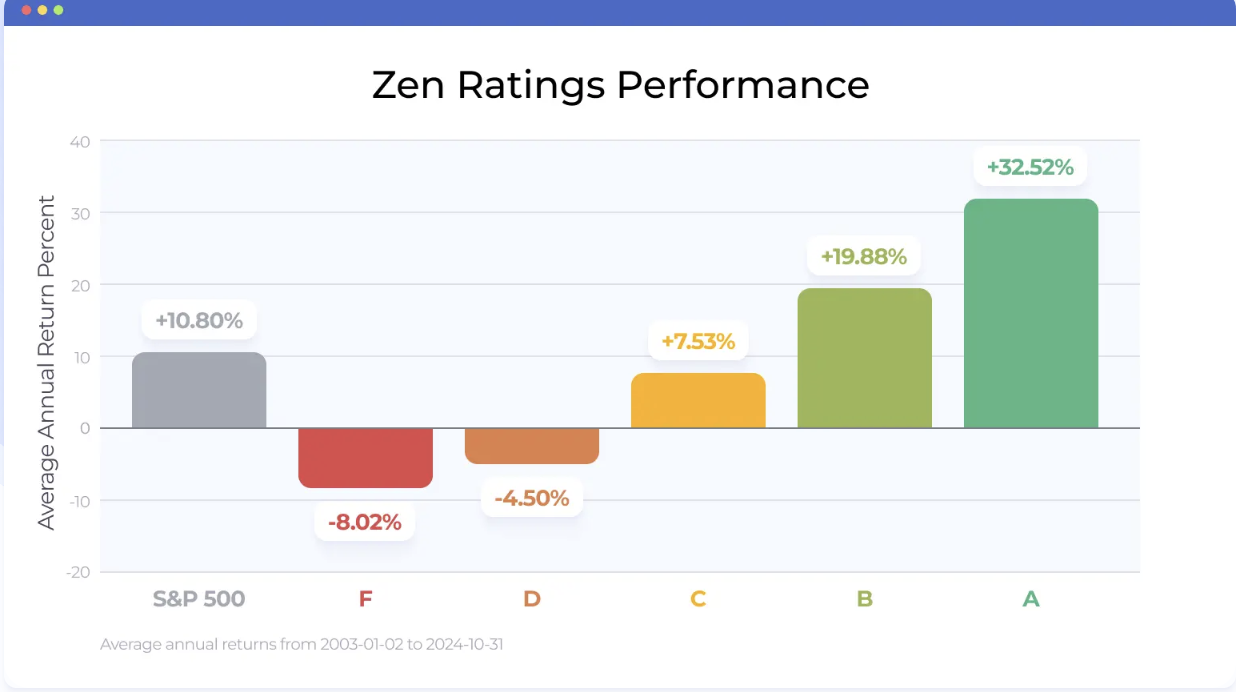

- Our quant rating system, Zen Ratings, evaluates more than 4,600 stocks on the basis of 115 proprietary factors every day. Stocks that rank in the top 5% have a Zen Rating of A, which has historically corresponded to an average annualized return of 32.52%. At present, NXT ranks in the top 5% of equities.

- Each Zen Rating is a composite score made up of 7 Component Grade ratings. For instance, Nextracker ranks in the 85th percentile in terms of Value, on account of a very attractive 19.4x price-to-earnings (P/E) ratio.

- NXT also ranks in the top 9% of stocks when it comes to Momentum, and the top 7% with regard to Financials. (See all 7 Zen Component Grades here >)

What to Do Next?

- 77 Best Stocks NOW! >

- See All “A” Rated Stocks with +32.52% Average Annual Return >

- 2 New Stocks to Buy from Steve Reitmeister >

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.