What’s the Best Yahoo Finance Alternative in 2026?

So, a few months ago Yahoo Finance made some updates — and longtime subscribers were NOT pleased.

With Yahoo Finance losing much of its appeal, WallStreetZen has emerged as the clear top alternative.

The platform offers an impressive array of tools, guides, and educational content for free. Also free? A limited number of searches using its quant ratings system, Zen Ratings, which offers a clear and easy-to-use breakdown of the best and worst stocks to hold. Unlimited searches and more features are unlocked with a Premium membership, which is just $19.50 / month.

Go ahead — enter any ticker here and see its Zen Rating

Still, the top Yahoo Finance alternative for you will always depend on your investing style. For example, those who prioritize depth of research when trading will find even more value in Stock Rover, while Benzinga will always be the top pick in terms of speed.

Below, we’ll examine the top Yahoo Finance alternatives to help you determine which one is best for your particular needs. But first…

What Happened to Yahoo Finance?

Once the go-to platform for investors, Yahoo Finance has lost much of its luster following an update that hurt the software’s performance and introduced numerous glitches.

While the changes weren’t fatal, and recent Play Store reviews still show many users are giving the app 5-star reviews…

Many have been driven away by the bugs, unnecessary complexity, and, worse still, by the fact that the premium version appears worse overall than the basic plan.

Recent reviews also highlight how Yahoo is pushing news stories over asset insights, meaning there is less room for the key tickers investors are tracking.

Such a situation has left many traders wanting for a highly versatile and useful tool and in need of alternatives that offer similar, invaluable insights into the comings and goings of the market.

Under the circumstances, and while the community awaits the fixes Yahoo has promised in its replies to Play Store reviews, we decided to find and examine the 7 best alternatives for the once-beloved tool.

Related Reading: 11 Best Stock Research Websites & Tools

1. WallStreetZen – Best for Simple, Zen-Like Stock Analysis

- Overall rating: 4.5/5

- Cost: Basic plan available for free; $1 for a 2-week trial; Premium plan available for $19.50 per month if billed annually. See plans

If overcomplicating the program became the big drawback for Yahoo Finance, the simplicity paired with high-quality insights makes WallStreetZen’s Zen Ratings a standout alternative.

The platform was built for part-time investors who seek full-time quality, as it, under the hood, uses thousands of data points to assess assets while providing, at the user’s end, a clear rating system.

Zen Ratings are built to quickly reveal which stocks an investor should offload ASAP and which are strong buys, since it offers a familiar A-to-F grading system.

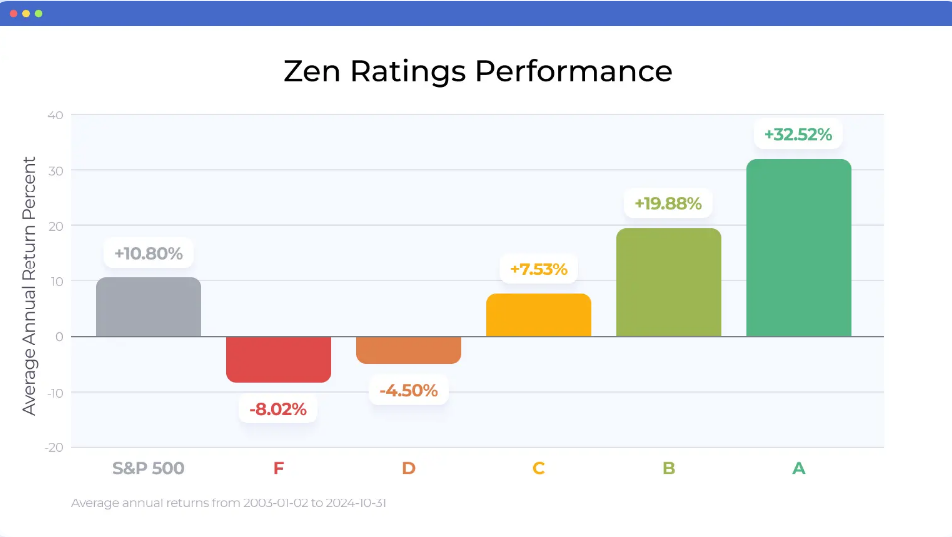

The D and F investments should be sold as soon as they are identified, as extensive backtesting shows they lead to negative returns. C assets—in line with the standard “hold” rating—are neither harmful nor stellar, as their average performance is close to the overall market.

Spotting winners is just as easy as identifying the duds, as the B and A assets offer, on average, gains between 19.88% and 32.52% per annum.

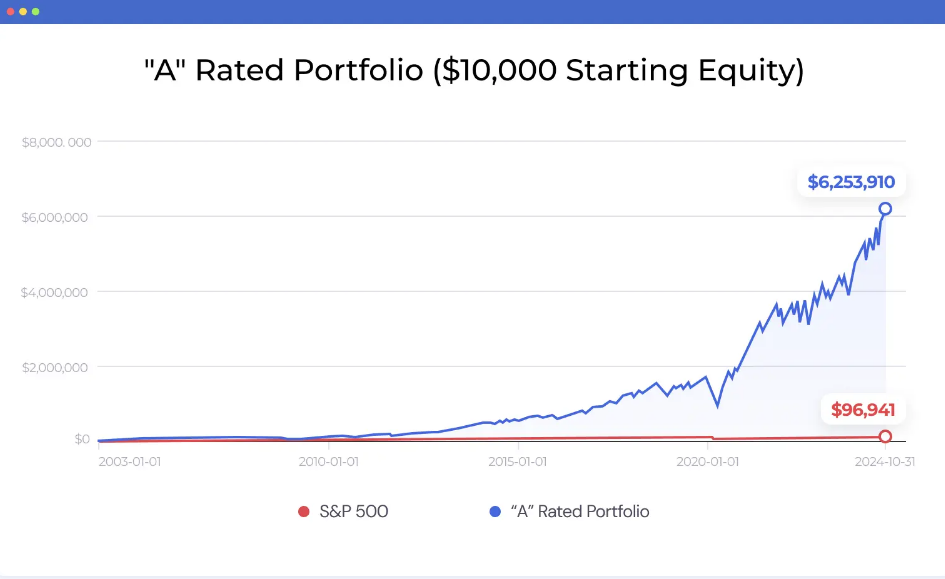

As you can see, the backtested returns on an A-rated portfolio are impressive:

Still, with the vast data array Zen Ratings is working with, there are thousands of A-rated stocks to choose from, and, thankfully, investors can then look closer at the system itself and its main components.

See the entire list of A-rated stocks with WallStreetZen Premium

Thus, traders can quickly identify which stocks best fit their strategy, depending on whether their portfolio is focused on safety, growth, momentum, sentiment, or overall value.

In one of the categories, Zen Ratings even leverages cutting-edge technology with the Artificial Intelligence” rating, which draws its conclusion from numerous factors and data points that might otherwise be difficult to spot.

Related Reading: The 6 Best AI Stock Screeners in 2025

Overall, ease of use is Zen Ratings’ major advantage as a Yahoo Finance alternative, although, due to the factors measured in the system, long-term investors stand to benefit the most.

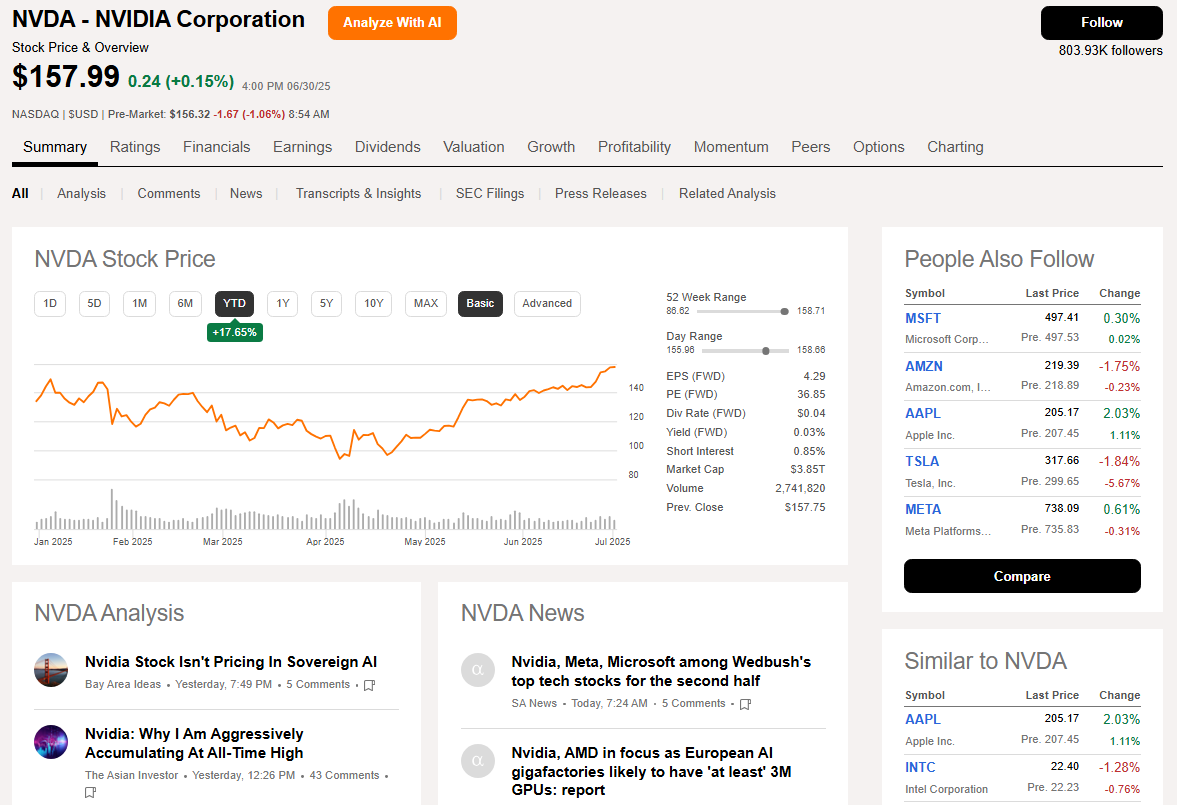

2. Seeking Alpha – Best for Crowdsourced and Premium Stock Research

- Overall rating: 4/5

- Cost: $299 / year — get 7 days free, and $30 off your first year using this link (limited time)

It is easy to see why Seeking Alpha is already a popular alternative to Yahoo Finance: it is a treasure trove of insights with an exceptionally active user base, and it boasts extensive coverage of dividends, earnings, and macro.

Indeed, Seeking Alpha offers a blend of in-depth analysis coming from a variety of angles, while also giving detailed at-a-glance information.

The ratings on the platform leverage breadth—they are an aggregate of Seeking Alpha, wider Wall Street, and algorithmic analysis—and depth as they utilize profitability, growth, momentum, valuation, and rating revisions.

The “Dividend Grades” add value by focusing on the consistency, growth, and safety of the yield, thereby providing income-seeking investors with a powerful and easy-to-use tool.

Though the annual $299 price tag for the paid version might appear daunting, it is both in line with other similar premium platforms and viewed as well worth it by most of the community.

Still, it is equally worth noting that some users report that Seeking Alpha insights are more of a jumping-off point for deeper research than a one-size-fits-all solution for market analysis. As with any other similar tool, the ratings are only as good as the trader reading them.

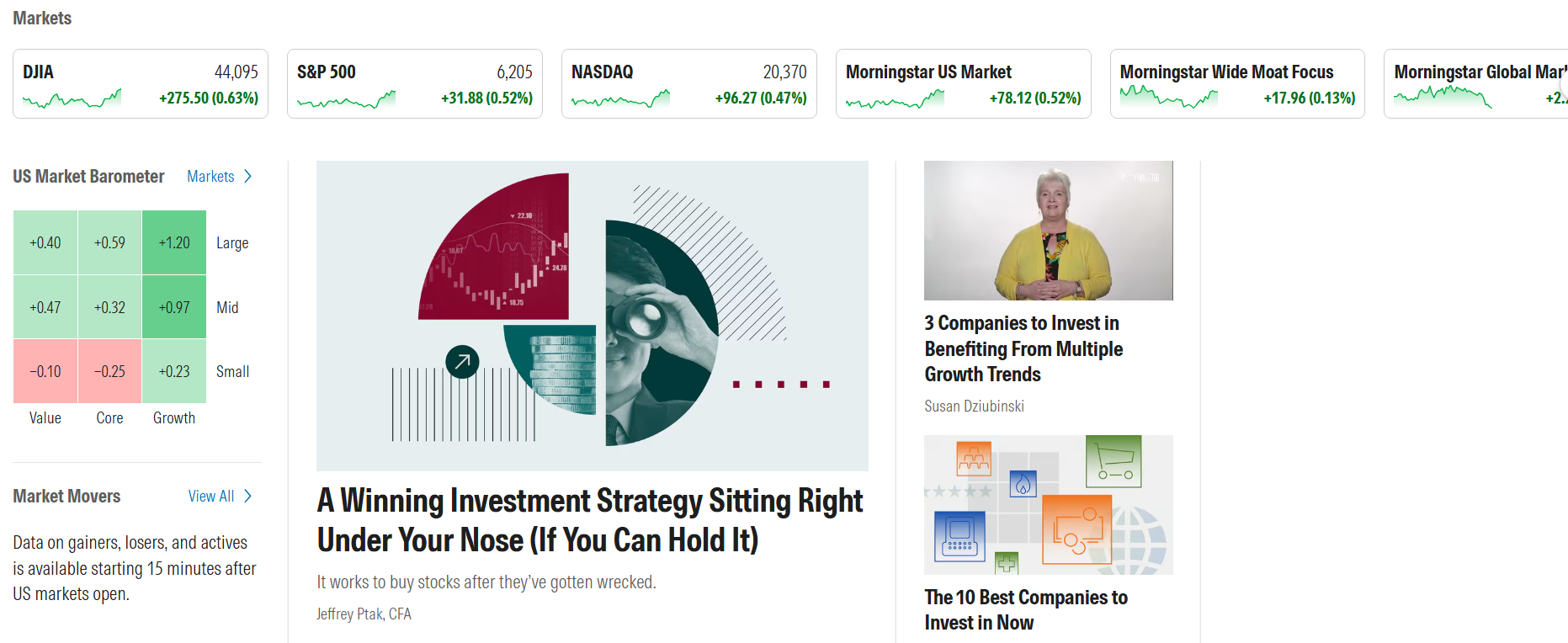

3. Morningstar – Best for Long-Term, Fundamental Investors

- Overall rating: 4.5/5

- Cost: Typically $249/year; available for $199/year using this link

If Seeking Alpha offers something unique for dividend investors, Morningstar is an excellent alternative to Yahoo Finance for fund enthusiasts.

Specifically, the platform provides somewhat hard-to-come-by metrics for mutual funds such as net asset value (NAV), yield, turnover, investment style, as well as essential fundamentals like expense ratio and performance.

Clearly, Morningstar didn’t get its reputation for professional, high-quality analysis by focusing on a single asset class. Its insights cover stocks and various derivatives to such a high standard that it is also the go-to source for many financial advisors.

Related Reading: The 7 Best Bloomberg Terminal Alternatives for Individual Investors

Still, the high-level content needn’t scare more casual investors away as the platform also provides news, long-form articles, and a Market Barometer that shows how the individual stock categories are performing on any given day.

Along with the free tools, Morningstar also boasts the premium “Morningstar Investor”, which unlocks a proprietary stock rating system, even more top-tier analysis, and a portfolio manager, making it an excellent subscription for value and retirement-focused investors.

The Portfolio X-Ray tool is a standout part of the package, given that it provides in-depth analysis of your holdings based on a large number of benchmarks you can choose from.

All in all, Morningstar offers great value with the special $199 per year offer for its premium tier, as it provides professional-grade tools at a competitive price.

4. TradingView – Best for Charting and Technical Analysis

- Overall rating: 4/5

- Cost: After a 30-day free trial using this link, it ranges from $167.88 per year to $2,399.40.

TradingView is another exceptional Yahoo Finance alternative, though it is geared toward visual thinkers first and foremost.

It is arguably the best-known charting platform and boasts both simpler charts for preliminary examination and significantly more detailed “Supercharts.”

Furthermore, TradingView enables its users to overlay a vast array of technical indicators on top of charts to analyze, understand, explain, and outline any available trading setups.

Related Reading: 10 Best Stock Chart Apps, Software & Websites in 2025

While its visual offering is impressive in its own right, the platform provides additional tools, such as aggregated technical analysis and Wall Street analyst ratings. It also serves as a social network for investors, enabling discussions and community-generated trading ideas.

Still, TradingView’s power can be something of a drawback. While investors who would not recommend it are almost as few as those who do not use it, it can be overwhelming for beginners, and the charts themselves can be finicky.

Fortunately, TradingView offers readers of this blog a free version and a free two-week trial, providing ample opportunity to test the features and determine if one of the premium options is the right fit.

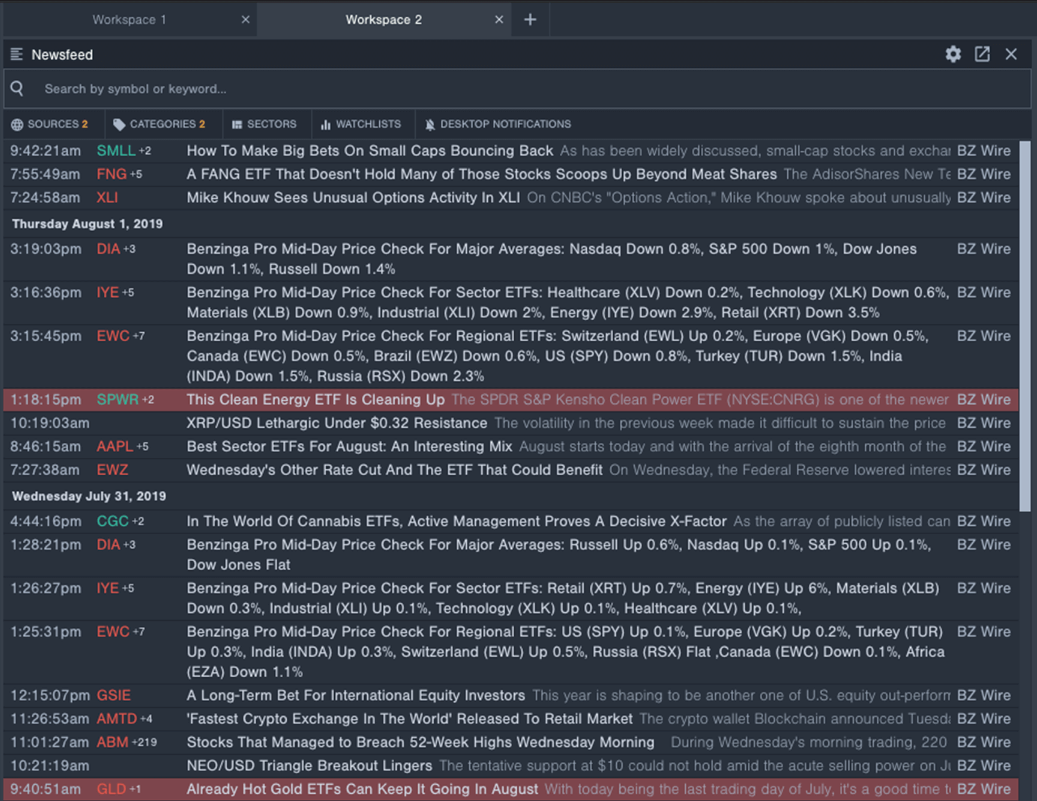

5. Benzinga – Best for Real-Time News and Trading Insights

- Overall rating: 4/5

- Cost: Available from $37 per month with monthly billing, or $30.58 with an annual commitment. See plans

If the previous Yahoo Finance alternatives were mostly geared toward long and mid-term investors, Benzinga is an excellent fit for the shorter timeframes and active traders.

In a nutshell, it is a platform that combines a real-time news feed with clear insights into quantifiable factors like analyst ratings, earnings reports, corporate announcements, and more.

The overall style has been optimized for speed, as best exemplified by Benzinga’s headline and summary craft, which ensures all the key information is immediately visible.

Overall, Benzinga is a platform that has more than earned its fame and popularity, though the success has, by mid-2025, begun extracting its toll.

Specifically, the platform’s free tier has become less clear over time, and the optimal experience is hidden behind a rather steep paywall, starting at $37 per month for the least expensive premium version.

As a silver lining, the premium offerings are quite hefty as they provide access to a top-tier asset screener and actionable signals for active traders.

However, one of the best features of Benzinga, the real-time news service called Audio Squawk, which helps investors stay in the loop even when executing trades in a different browser window, is available at higher tiers that start at $166.42 per month.

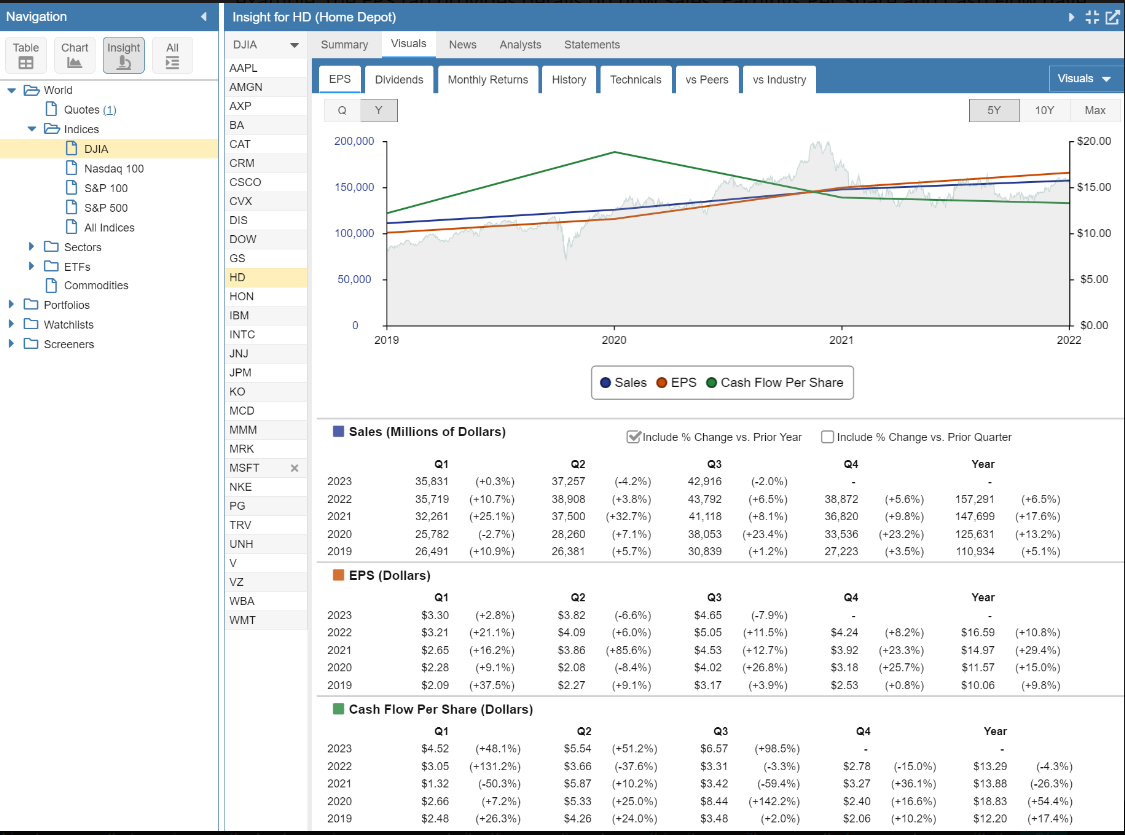

6. Stock Rover – Best for In-Depth Fundamental Screeners

- Overall rating: 4/5

- Cost: The basic plan is available for free, while premium tiers start at $79.99 in the first 12 months and $179.99 per year after. See plans here

Stock Rover offers a break from Benzinga’s fast pace. Indeed, it’s geared toward meticulous, detail-oriented investors.

It offers its users in-depth fundamental analysis with more than 650 screeners and metrics, and the ability to back-test market plays. That said, such complexity ensures it isn’t particularly beginner-friendly and is more of a companion tool for sophisticated traders.

Related Reading: How to Predict When a Stock Will Go Up or Down?

Furthermore, though not a brokerage, it can be linked to a trading account and provides a degree of portfolio management in the form of in-depth email performance reports and analyses.

It can also help in the journey from a beginner to a pro as it hosts a large and expanding catalogue of educational content and important market reports, including research for Dow 30 stocks.

Its design can also help users at all levels, as it offers a clean and data-rich spreadsheet style.

Lastly, you have a degree of flexibility in terms of subscription and can incrementally upgrade to higher tiers as you get to know the platform and as you discover whether you love or hate its tools.

The free plan is, well, free, with the most affordable tier—“Essential Account”—setting you back by $79.99 per year. A “Premium Account” costs $179.99, and Premium Plus is priced at $279.99 annually.

7. Motley Fool Stock Advisor – Best for Stock Picks and Long-Term Growth Ideas

- Overall rating: 4/5

- Cost: Stock Advisor starts at $74.50/year for a two-year commitment, Epic at $299 in the first 12 months and $499 after.

Motley Fool Stock Advisor is another strong “buy and hold” alternative to Yahoo Finance, though its long-term focus should not fool investors: the service famously flagged Amazon and Nvidia early as top picks.

There are plenty of opportunities to find stocks just like the two giants, as the Stock Advisor provides two picks each month, occasionally issues bonus reports that cover additional analysis of recommendations and macro conditions, or just good old-fashioned investing education.

The service also includes a vibrant investing community, making it a highly valuable product, especially at $99 in the first year, and $199 after, with an annual commitment.

Motley Fool also has a “heavy artillery” offering for those who find Stock Advisor too basic: Motley Fool Epic.

Motley Fool Epic is a powerful (and pricey) mix of tools focused on providing expert-level stock picks, professional tools, and strategies with a proven track record.

Perhaps the most interesting part of “Epic” is the exclusive podcast, as it gives access to insights and discussions from top-tier experts.

Considering the price tag—$299 in the first year and $499 after—the guaranteed refund for those who cancel in the first 30 days is a crucial benefit and even in its freest version—Motley Fool’s extensive market coverage with news and other articles—the platform is well worth a visit for any serious investor.

Final Thoughts: Which Yahoo Finance Alternative Is Right for You?

As with most tools, the best Yahoo Finance alternative ultimately depends on your investing style and goals.

Nonetheless, it is fairly easy to see that Zen Ratings on WallStreetZen is a prime choice for those seeking easy-to-understand, yet profoundly useful information. Similarly, those with the time and patience can’t find an alternative better suited than Stock Rover.

Benzinga, on the flip side, is perfect for traders whose strategy depends on being fast and decisive, while Motley Fool Stock Advisor — and, perhaps even more, Motley Fool Epic — is great for those who take the Warren Buffett route of getting rich slowly.

Related Reading: 10 Best Investing Books for Beginners to Read

There’s not a BAD alternative on this list. But ultimately, choose the one that aligns with your goals and elevates your investing strategy beyond Yahoo Finance.

FAQs:

What happened to Yahoo Finance?

Yahoo Finance lost much of its appeal with an update that reduced the app's functionality by making it overall more complex, while introducing new bugs and hiding information users want to see at the top behind a selection of news headlines. The fact that the paid version of the platform is reported as breaking more than the free one drove more users away.

Is Yahoo or Google Finance better?

Despite the recent Yahoo Finance changes being unpopular among users, it remains the superior pick to the current state of Google Finance, particularly as recent changes and experimentation with artificial intelligence have made Google an overall less reliable platform.

What’s the best Yahoo Finance API alternative?

While many unofficial workarounds enabling access to the Yahoo Finance API emerged after official support was cut in 2017, the best official alternative comes in the form of Benzinga. Be warned, however, that complete access is not available for free.

What is the best alternative to Yahoo Finance?

The best easy-to-use Yahoo Finance alternative is WallStreetZen’s Zen Ratings, thanks to the numerous data points used in analysis and multiple rating angles for all types of investments. Traders focusing on a more visual analysis would also find much to love about TradingView, while the most meticulous ones are likely to gain much mileage from Stock Rover.

What’s the best free alternative to Yahoo Finance?

There are no great alternatives to Yahoo Finance that are entirely free, but platforms like Wall Street Zen, TradingView, and Morningstar offer significant data access without charge and enticing trial periods, giving investors an opportunity to pick their favorite.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.