Deepseek is not publicly traded.

However, there are stocks that could benefit if it gains popularity. Discover 2 potential DeepSeek stock beneficiaries in this article. 👇

For regular investing ideas and Strong Buy alerts related to market-moving news like the release of DeepSeek, subscribe to our FREE newsletter, WallStreetZen Ideas.

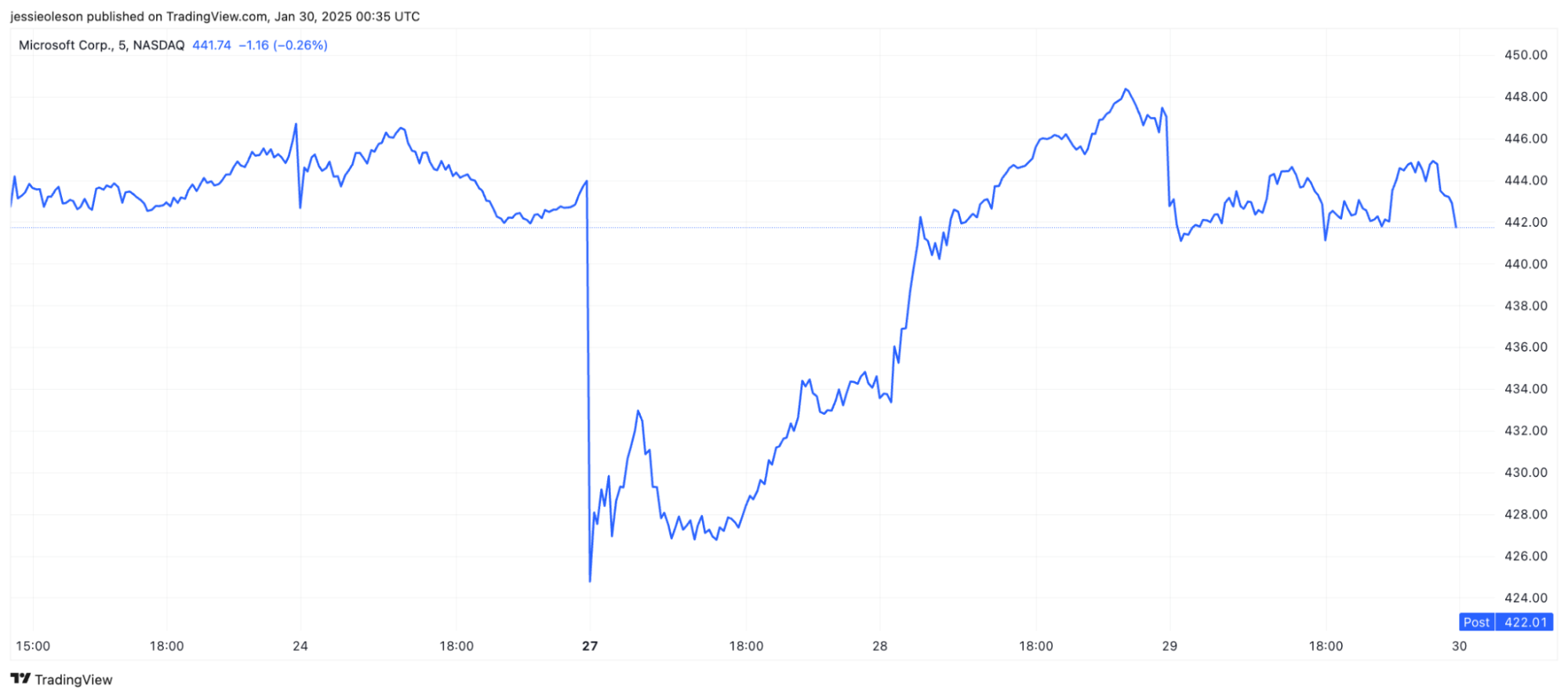

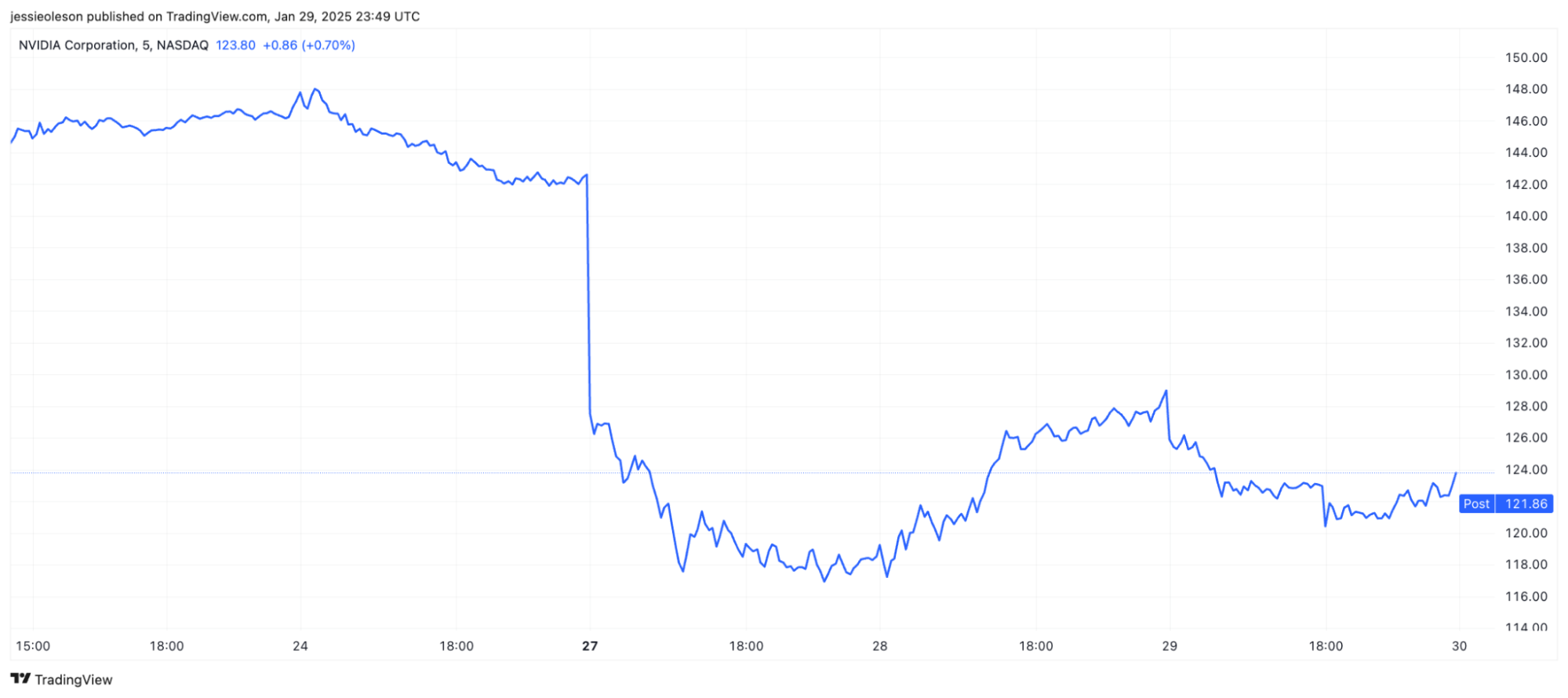

If you follow the stock market, you’ve quickly become familiar with the name DeepSeek. The debut of the ChatGPT competitor’s latest model caused an absolute bloodbath for AI stocks in January 2025, with big-name players like Nvidia (NASDAQ: NVDA) sacrificing significant value during the week of 1/27/2025.

DeepSeek has proven its power to move the markets. It might have you thinking … how can I invest in DeepSeek?

Spoiler: DeepSeek isn’t a public company, so there isn’t a DeepSeek stock. But there are stocks that could potentially benefit if it keeps trending. But before we get to them, a few basics…

What is DeepSeek?

DeepSeek is a Chinese artificial intelligence (AI) company. It was founded in 2023 by Liang Wenfeng, a Zhejiang University grad. DeepSeek specializes in developing open-source large language models (LLMs).

In a relatively short period of time, DeepSeek has gained significant attention for its innovative approaches in AI development. Why?

Well, one of its jewels is the DeepSeek-R1 model, which is a direct challenger to OpenAI’s GPT-4 which is a fraction of the cost.

How do they charge so much less? Lower costs. DeepSeek claims that training their recent models cost approximately $5.6 million — mega millions less than the $100 million to $1 billion tallies racked up by American labs like OpenAI.

This cost-effectiveness is attributed to innovative technical approaches and the use of existing open-source models as a foundation.

DeepSink vs. Nvidia

On the week of 1/27/2025, it looked like DeepSeek could deepsink Nvidia (NASDAQ: NVDA).

DeepSeek fear/excitement also led to significant losses for Tesla (NASDAQ: TSLA), Google (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), and Microsoft (NASDAQ: MSFT).

The company’s achievements also highlight China’s potential to compete with the U.S. in AI technology, even under export controls, by optimizing resources and leveraging open-source tools.

However, there are concerns regarding data privacy and potential censorship; DeepSeek’s models may adhere to Chinese regulations on sensitive topics. Because of these concerns, ChatGPT could maintain an edge.

Related reading: How to Invest in AI

Can You Buy DeepSeek AI Stock? Is DeepSeek Publicly Traded?

Nope. DeepSeek is not publicly traded. We don’t know if or when it ever will be. However, there are still ways to attempt to invest in the company’s potential success. Let’s discuss.

How to Buy DeepSeek Stock as a Retail Investor

Need more help finding great stocks to invest in?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. For just $99 per year ($79 using links from this post), you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

DeepSeek Stock Alternatives

No, you can’t buy DeepSeek stock. There’s no DeepSeek stock symbol. So how to invest? Invest in the types of companies that could benefit from DeepSink’s ascent:

Companies Related to AI Infrastructure

For example, as we noted in a recent article, data center company Vertiv Holdings Co. (VRT) could be in a great position to benefit.

Infrastructure is right up the company’s alley. Vertiv does everything from installation, maintenance, and repair. In other words, the entire lifecycle, to monitoring and management for data centers. The business also provides power management and, most importantly, cooling solutions.

Oh, and there’s this: A $500 billion project aimed at AI infrastructure will require an immense number of data centers.

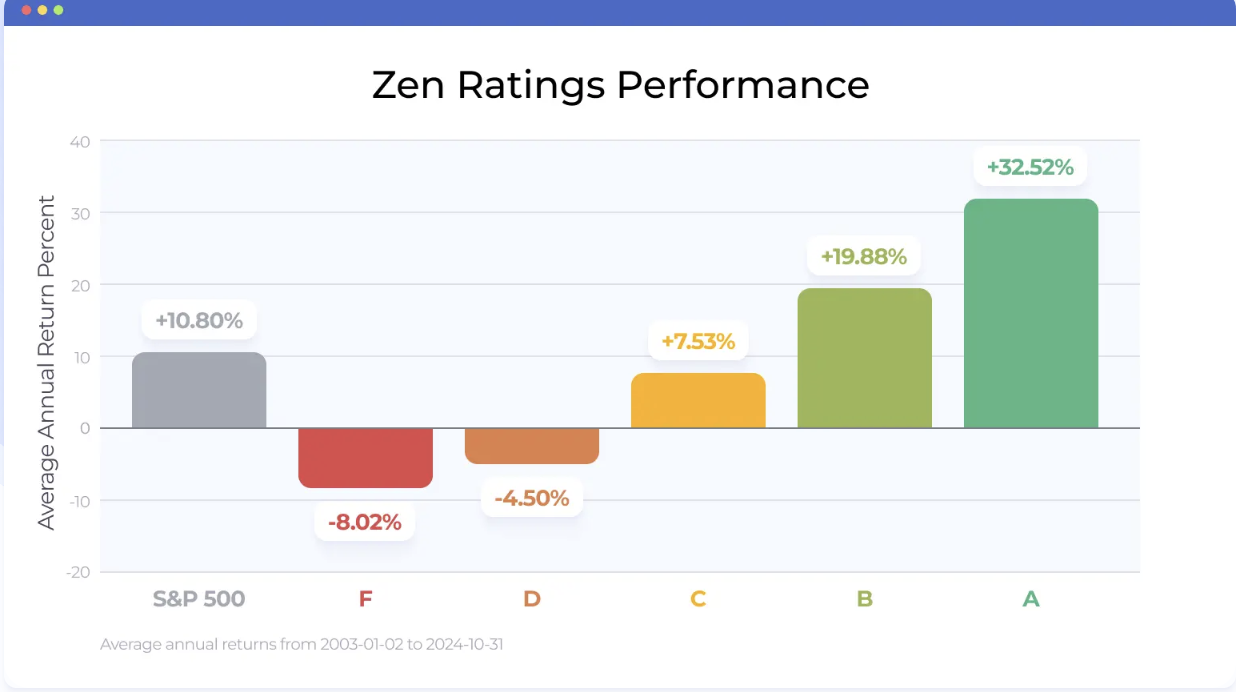

Vertiv stock also happens to have a Zen Rating of A or Strong Buy. It belongs to a class of stocks that have, historically, overperformed the market since 2000, and provide an average annual return of 32.52%.

Companies that Benefit From AI

Investors are starting to realize the next big AI play isn’t just in the hardware. It’s in the companies actually using AI to transform business. And Salesforce (NYSE: CRM) is leading that charge … Here are a few reasons why it has a Zen Rating of B, or Buy.

Recurring Revenue & Strong Fundamentals – Unlike speculative AI stocks, Salesforce has a solid foundation. It’s a cash-generating machine with a massive installed customer base and a wide economic moat.

We can see this in CRM’s earnings and earnings growth:

- CRM’s earnings have grown faster (44.09% per year) than the US market average (24.92%)

- CRM’s earnings growth is accelerating – its growth over the last year (131.2%) is above its 5-year compound annual rate (44.09%)

AI Adoption at Scale – Companies are scrambling to integrate AI, and Salesforce’s platform is a plug-and-play solution. Businesses can deploy AI agents without having to rebuild their entire tech stack.

With over 150,000 companies globally leveraging its platform, Salesforce is already the undisputed leader in the customer relationship management (CRM) space … and it can easily roll out or cross sell new AI solutions to these customers.

These are just a few of the reasons CRM could be a DeepSeek beneficiary — click here to continue researching CRM.

How to Find High-Potential DeepSeek Sympathy Plays

Want to find more stocks like the ones we shared above?

First, check out what top-rated analysts are watching. On WallStreetZen, you can check out the Strong Buy Stocks from Top Wall Street Analysts feature to see the latest Strong Buy recommendations. See if any of the commentary mentions DeepSeek.

As a side note, if you feel like you need help picking stocks, consider subscribing to our stock-picking newsletter, Zen Investor.

With your subscription, you get a portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com, who uses a 4-step process to select the highest-potential stocks.

No, not all of Reitmeister’s picks will be AI-related. But they are vetted by a 40+ year market veteran and carefully screened using WallStreetZen tools like the market-beating Zen Ratings system mentioned above. With monthly members-only webinars, sell alerts if the thesis changes, and regular commentary and portfolio updates, it’s well worth the ticket price of $99 ($79 for a limited time) per year for entry.

Next, see how the stock stacks up in the scheme of things. Once you’ve found a stock you’re interested in, plug it into the search bar on WallStreetZen. From there, our Zen Ratings system can help you quickly see the company’s strengths and weaknesses.

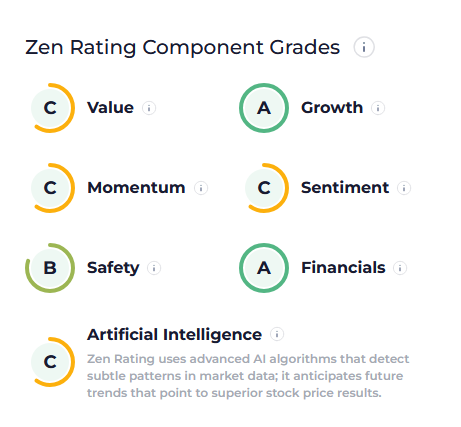

Every stock has a letter grade, which is based on a careful review of 115 factors proven to drive stock growth. These are further itemized into Component Grades, which let you see where a stock really shines.

For instance, in the case of the aforementioned stock, VRT, the stock has an overall rating of B, or Buy. But when you dive a bit deeper into the Component Grades, you can see its areas of strength: A scores for Growth and Financials. At writing, in both categories, Vertiv ranks in the top 5% of all the stocks we track.

That’s just one example. In general, if you’ve located a stock that you think could be a DeepSeek sympathy play, plug it into WallStreetZen — you’ll instantly see how it fares on our market-beating stock rating model.

Oh, and if the volatility of the AI industry is a massive turnoff? Use WallStreetZen and Zen Ratings to find stocks in completely separate sectors. For instance, you could check out the Best Healthcare Stocks to Buy Now Screener, or the Best REITs to Buy Now screener.

Who Owns DeepSeek?

Liang Wenfeng, who also serves as its CEO. The company is owned and funded by High-Flyer, a Chinese hedge fund co-founded by Liang Wenfeng.

High-Flyer is the primary investor in DeepSeek, and there is no public information indicating additional external investors.

Does ChatGPT Own DeepSeek?

Nope. ChatGPT is actually a primary competitor of DeepSeek. Microsoft, a company with strong ties to ChatGPT, dropped sharply the week of 1/27 as DeepSeek introduced its latest model.

How to Buy the DeepSeek IPO

To be clear, no DeepSeek IPO announcement has been made. But it never hurts to be prepared.

Here are the steps on how to buy DeepSeek stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Twitter

- Select how many shares you want to buy

- Place your order

- Monitor your trade

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

DeepSeek Stock Price Chart

Since DeepSeek is not public, there’s no DeepSeek stock price chart. The data also remains murky on the company’s valuation.

However, here’s a chart that shows how powerful the company is: Here’s the chart for NVDA the week that the latest DeepSeek model made its debut:

In effect, NVDA lost $500 billion of market cap in a single day. Due to various factors including the DeepSeek ripple effects, its stock also dropped from a Zen Rating of B (Buy) to C (Hold) within a matter of days. How is it scoring now? See the latest price, analyst ratings, price targets, and more for NVDA here.

The takeaway? Investors are taking DeepSeek seriously.

Conclusion

Overall, DeepSeek represents a significant development in the AI landscape, demonstrating that advanced AI models can be developed more cost-effectively and challenging the dominance of established tech giants.

Its impact on the AI landscape and stock market remains to be seen. However, we’ll be tracking stocks that could benefit from its growth in our free newsletter, WallStreetZen Ideas. Subscribe today and get more great investing ideas and strong buy alerts several times a week.

FAQs:

How can I buy DeepSeek stock?

As of early 2025, DeepSeek stock is not publicly traded. The company is private. However, some companies could benefit from its continued growth, such as companies providing AI infrastructure including data storage and more.

How much is DeepSeek stock?

DeepSeek is not publicly traded, so there is no DeepSeek stock price.

What is the DeepSeek stock symbol?

DeepSeek is not publicly traded, so there is no DeepSeek stock symbol.

Who owns DeepSeek stock?

DeepSeek is not publicly traded. The company was founded by Liang Wenfeng, who also serves as its CEO. DeepSeek is owned and funded by High-Flyer, a Chinese hedge fund co-founded by Liang Wenfeng.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.