Are Tom Luong’s Stock Picks Legit?

To summarize quickly: The service is legit, but it’s pricey — and it’s best suited to active day traders. If you don’t like being glued to your monitor watching every tick of a stock but still want quality stock picks, you might fare better with a service like Zen Investor.

In this Stock Navigators review, I’ll dissect this stock trading school and its frontman and co-founder, trader Tom Luong so you can figure out for yourself if it’s a good match for you.

A cheaper alternative for longer-term traders…

Stock Navigators can cost up to several thousand dollars. Here’s a service that’s just $99 ($79 for a limited time)…

Zen Investor is focused on locating medium and long-term investments that deliver superior returns. With a subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you before you invest. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com

✅ Stocks selected with a 4-step process using our Zen Ratings system (Stocks rated “A” through this system have historically generated 32.52% annual returns)

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Who is Tom Luong?

To understand the Stock Navigators service, you’ve got to know a little bit about its co-founder, Tom Luong.

Luong grew up in Vietnam and fled to the United States in the 1980s with little to no money. It wasn’t until a decade after his arrival that he began trading stocks.

This endeavor quickly evolved from a hobby to an obsession, and Luong dedicated himself to an intense study regimen to learn the ins and outs of the market.

Luong reportedly took numerous stock trading courses to help hone his skills. In fact, between books and courses, Luong reportedly invested more than $100,000 in his stock trading education and over $30,000 in trading software.

Quick aside … Do you actually need $30k in software to be a day trader? Nah.

But you do need three things:

- A solid internet connection

- A computer

- A great brokerage

You’re gonna have to deal with the internet yourself, but we do have tips for #2 and 3. In my humble opinion, the best day trading (and swing trading too) computer is the Gladiator X14 EZ Trading Computer. It’s typically $3299 (or $3099 using our links!), which isn’t cheap, but certainly a lot less than $30k!

As for a brokerage? Our favorite brokerage, hands down, is eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

The investment seemingly paid off. Luong watched his portfolio skyrocket through tech investments made during the 90s and early 2000s. Unfortunately, that bull run would come to a screeching halt, with the tech bubble popping and, with it, half of Luong’s portfolio value evaporated.

Following the tech implosion, Luong pivoted to develop a more sustainable and profitable strategy. Using his experience and vast trading education, he created a comprehensive trading method that would form the foundation of the Stock Navigators platform.

The educational platform is designed to teach people how to successfully day trade.

What it isn’t is a platform for individuals looking for insight into longer-term buy-and-hold strategies.

So, to the original question: is Tom Luong legit?

The answer is yes. His extensive market background and history of relatively satisfied customers work in his favor, though as you’ll learn in a minute, his marketing tactics can be pushy.

Stock Navigators: What It is + What You Get

With your Stock Navigators membership, you get:

- Refined curriculum with a long history and plenty of positive reviews from subscribers.

- An extensive library of trading strategies is covered.

- Supervised day trading with experienced coaches.

The program is thorough, too. While some trading schools offer short courses, the Stock Navigators program takes most people between three and six months.

After all, there is no magic formula with stock trading that you can simply learn in a few hours. Most veterans will tell you it takes time to become proficient.

On the surface, these are all great aspects of Stock Navigators. But don’t just take my word for it. Here’s one review from a happy customer:

“Based on my experience and time spent in these courses, I’ve had the best experience… Their instructors are super knowledgeable and fun human beings to learn from. Additionally, their course is mapped out and put together in a way that just makes sense from both a beginners perspective as well as from someone who might already have experience to build upon” wrote a user on Reddit.

But I’d be remiss if I didn’t share a few red flags.

Stock Navigators: What I Don’t Like

When you go to the Stock Navigators website, you’ll see an image of Tom Luong with what appears to be a successful student, with the statement “Join Thousands of Students Who Use Tom’s 25-Year Proven Trading System to Build and Protect Their Wealth – No Experience Needed.”

To me, this raises an alarm bell.

Platforms like Stock Navigators highlight the very best results they’ve helped achieve, but say very little about the money that may have been lost using their guidance.

To a certain degree I understand that this is marketing. However, you need to know that there are no guarantees that you’ll make money in this program — or any program.

The bottom line: Stock Navigators is an extensive stock trading program with much to offer. Its founder, Tom Luong, has a strong background in equities markets and can share much of what he’s learned with eager and engaged students. For the right person, Stock Navigators can undoubtedly offer substantial value.

However, the program’s heavy use of cherry-picked returns in its marketing material is offputting. This doesn’t immediately disqualify them, but it is worth noting.

Stock Navigators Price: How Much Does It Cost?

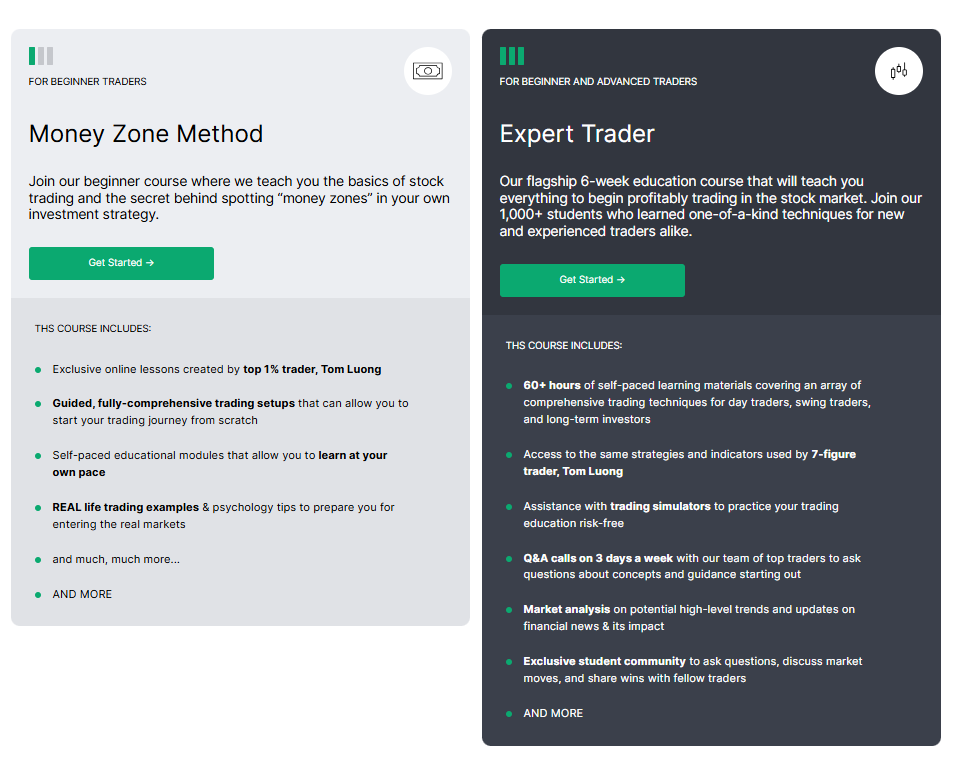

This Stock Navigators review would be incomplete without a discussion of Stock Navigators price. The online school offers two main program tiers on its website: Money Zone Method and Expert Trader.

The Money Zone Method is advertised as suitable for beginner traders. It offers lessons from Luong, guided trading setups, and real-life trading examples.

At a current offer price of $97, the Money Zone Method is not a bad value. You’re not getting nearly the same suite as the higher tier, but for under $100, this program offers impressive pound-for-pound value.

The same, however, can’t be said of the Expert Trader program.

Sure, it’s packed with features like access to Luong’s strategies and indicators, Q&A calls three times per week, market analysis, and a student community. These are all great features and services to include in a stock trading program.

The problem, however, lies in the price.

While the price for the Expert Trader program is not disclosed anywhere on the website, it reportedly ranges between $4,500 and $7,800.

Yes, almost $8,000!

And this doesn’t include reports of upsells and hidden fees.

For my money, the Money Zone Method program is worth it, while the Expert Trader program is simply too rich to justify.

Of course, if you’re looking for a comprehensive program that can elevate your game without breaking the bank, consider Investors Underground. At $297 per month (less for longer commitments), you could be a member for more than two years before hitting the same price as the Expert Trader Program.

World-class trader Nathan Michaud leads this platform and offers access to over 1,000 videos, pre-market broadcasts, trade recaps, and IU’s Live Trading Floor. Best of all, IU has a Trading Encyclopedia that ensures those new to the markets can quickly grasp the basics when needed.

Pros and Cons of Stock Navigators

Pros | Cons |

|---|---|

Comprehensive Course Content: Stock Navigators offers a broad curriculum, covering everything from foundational trading concepts to advanced strategies, making it suitable for traders at all levels. | High Price Tag: Programs, particularly the Expert Trader course, which carries many of the features people will likely want, can cost between $4,500 and $7,800, which is a substantial barrier for many learners. Some users also note additional upsells. |

Community Engagement: Members gain access to a private Discord group where they can interact, share strategies, ask questions, and learn from peers and instructors. | Refund Challenges: Some users have experienced difficulties securing refunds. |

Expert-Led Training: Founders Tom and Tim Luong bring years of real-world trading experience, lending credibility and practical insights to the course material. | Aggressive Sales Tactics: Some users have reported feeling pressured by intense marketing strategies to promote the courses |

Practical Tools for Application: The program includes helpful tools like simulators and real-world trading exercises to ensure students can apply what they learn. |

The Best Alternative to Stock Navigators for Day Traders

Investors Underground – Best Overall Day Trading Course

I’ve said it before, and I’ll say it again: Investors Underground is a great alternative to Stock Navigators’ premium tier. With Investors Underground, you can expect a polished curriculum, great feedback from members, and access to skilled mentors.

At $297 per month, $697 per quarter, or $1,897 per year, this program is substantially cheaper than Stock Navigator’s Expert Trader tier. However, it is essential to note you could spend even more if you opt for some of the program’s optional trading courses.

The Best Alternative For Longer-Term Traders

Let’s face it: Day trading isn’t for everyone. In fact, it’s mighty difficult if you have a job, or if you just prefer not to be glued to your monitor.

If you’re interested in investing, and interested in potentially maximizing gains, but don’t want to sacrifice too much time or money, you may be interested in Zen Investor. This is our own, in-house stock-picking newsletter, designed for long-and medium-term investors.

Which is right for you? Well, choosing between Stock Navigators and Zen Investor depends on your goals and experience level.

Stock Navigators focuses on trading education, offering in-depth courses and tools to teach technical analysis and trading strategies. It’s ideal for aspiring traders looking to build actionable skills.

On the other hand, Zen Investor emphasizes long-term, fundamental investing with simplified tools and insights. It’s best for those who prefer a hands-off, buy-and-hold approach.

With it, members get a portfolio comprised of up to 30 of the best stocks, chosen using a proprietary 4-step stock picking process that involves WallStreetZen’s Zen Ratings tool and more. You also get monthly commentary & portfolio updates by our resident in-house analyst, the great Steve Reitmeister, exclusive members-only webinars each month, and 24/7 access to the Zen Investor website.

This simple but powerful newsletter details exactly how the handful of stock recommendations were picked. It’s also considerably cheaper, regularly priced at $99 per year ($79 for a limited time, using the links in this post!), and is currently available to trial right now for just $1.

If you want to actively trade, Stock Navigators may be the better fit. For long-term portfolio growth and analysis and an attractive price, Zen Investor is the easy winner.

Final Word:

Stock Navigators offers a comprehensive trading curriculum led by traders with extensive market experience. The platform’s standout features are its community aspect and supervised sessions for those willing to put in the work.

That said, its high cost, aggressive sales tactics, and overhyped marketing claims are serious blemishes on a likely otherwise great program. And at nearly $8,000 for the Expert Trader program, it’s a significant financial commitment that is hard to justify.

If you’re looking for a smarter, more affordable alternative, Zen Investor is an excellent option. Focusing on long-term, fundamentals-based investing, Zen Investor delivers proven stock recommendations and insightful portfolio updates for just $99 annually.

With guidance from market veteran Steve Reitmeister, you’ll learn sustainable strategies to grow your portfolio without breaking the bank.

For a simple, effective, and budget-friendly way to level up your investing, Zen Investor is hard to beat.

FAQs:

What is Stock Navigators?

Stock Navigators is a stock trading program founded by Timothy Luong and Tom Luong, offering educational courses, real-time trading sessions, community support, and continuous curriculum updates.

How much does Stock Navigators cost?

Stock Navigators programs range in price from $97 to $7,800.

Is Stock Navigators legit?

Stock Navigators is legit but overemphasizes the performance results students should expect.

Are there better alternatives to Stock Navigators?

Yes, there are better and cheaper alternatives to Stock Navigators, like Zen Investor from WallStreetZen, which provides a transparent and robust stock-picking service that offers members a powerful and easy-to-use system backed by Steve Reitmeister at a fraction of the cost of Stock Navigators.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.