$150,000 is a solid sum to build long-term wealth — provided you invest it properly.

So, what is the “best” way to invest $150K? That’s the $150,000 question!

With a potential fortune on the line, it (literally) pays to take some time to research how to invest $150K.

After exploring multiple options, you’ll have an easier time figuring out how to invest $150,000 for your golden year goals.

The Bottom Line: How to Invest $150K

- There’s no one-size-fits-all strategy for how to invest $150K, but it’s standard advice to think long-term, calculate risk expectations, and diversify.

- Conservative investors lean toward assets with a long track record for steady price appreciation or cash flow, including precious metals, index funds, and real estate.

- For extra growth, consider alternative assets like fine art, self-directed IRAs, and small or mid-cap stocks for potentially higher price volatility.

How to Invest $150K in 2026 ‘s Market

1. Art + Collectibles

You don’t have to be artsy-fartsy to know that some paintings sell for a pretty penny.

Chances are you’ve seen a few headlines of auctions where someone spent a fortune to own a priceless work of art by someone like Picasso.

While these artistic treasures may seem out of reach for the average investor, there are easier ways to break into the art market.

For instance, the alternative investment platform Masterworks provides a simple way for investors (both accredited and non-accredited) to purchase shares in pieces by world-renowned artists.

Investors on Masterworks keep their ownership “shares” in their portfolio, and they’re free to either hold them and wait for the art market to rise or swap them with fellow investors on Masterworks’ marketplace.

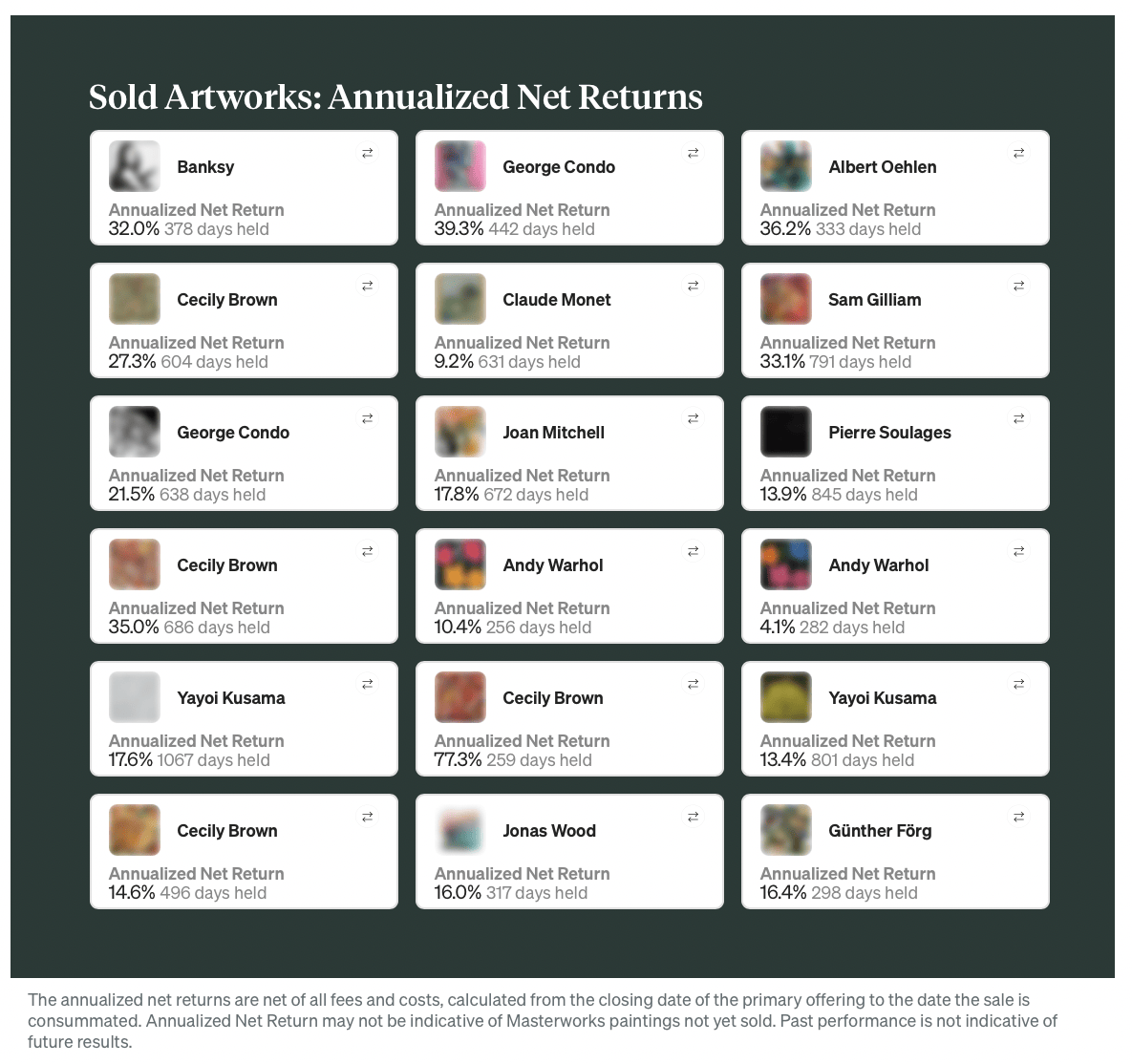

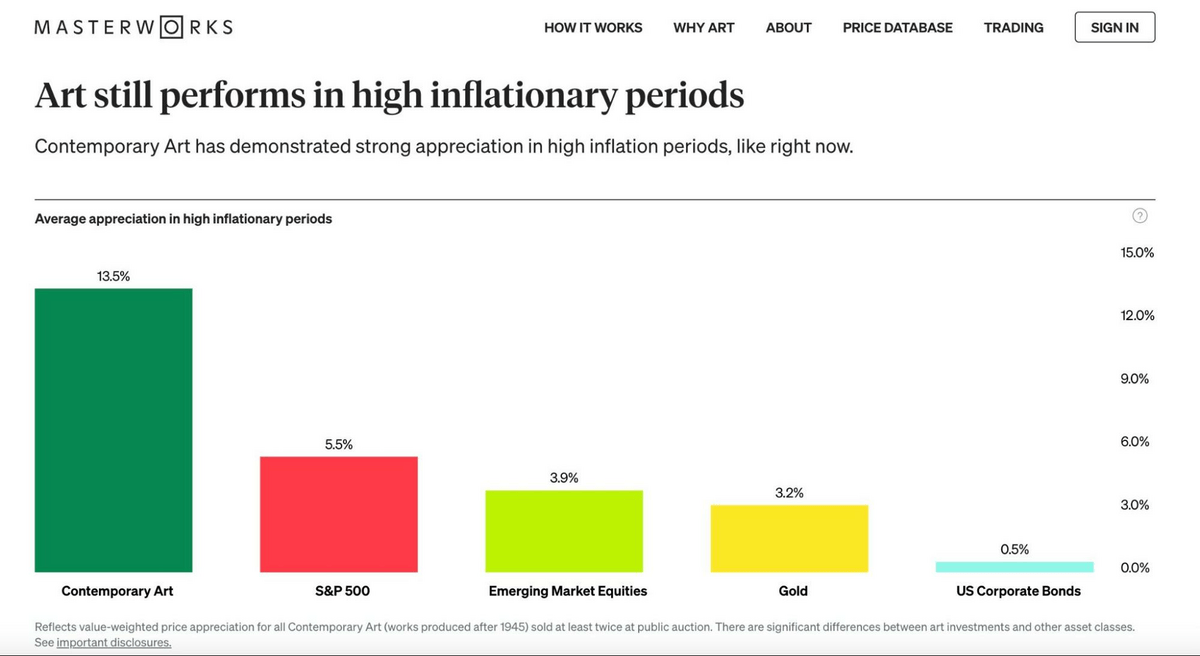

What’s more, art has a track record of performing well in high inflation periods, like right now. In the chart below, you can see that post-WW2 art has appreciated at a higher rate than many of the “standard” investment vehicles like indexes, gold, and bonds. This makes Masterworks well worth considering when researching how to invest $150,000.

Here’s an example of a recent event on Masterworks: An exited Banksy was offered to investors at $1.03 million after acquisition. As Banksy’s market took off, Masterworks received an offer of $1.5 million from a private collector. It resulted in 32% net annualized gain for investors in the offering.

Every artwork performs differently but overall, recent exits have delivered median returns of 17.6%, 17.8%, and 21.5%.

True, tastes in the art community can be fickle, but works by acknowledged masters like Warhol and Monet — both available on Masterworks — tend to transcend the times.

Another nice thing about Masterworks? In addition to its primary marketplace where you can invest in art, the platform also has a secondary market where you can trade shares of blue-chip art.

The bottom line? Masterworks offers a user-friendly way to get exposure to this high-potential alternative asset class.

2. Stocks + ETFs

If the question is “how to invest $150K,” some of the most common answers you’ll hear are stocks and exchange-traded funds (ETFs). Here’s why.

Equities have been around for centuries, and they’re amongst the most liquid and accessible financial products. Plus, with stock investing, you can easily adjust your risk setting and diversify your portfolio.

For instance, if you like to play it conservative, stick with blue-chip stocks like Microsoft (NASDAQ: MSFT) and major ETFs like the SPDR® S&P 500.

- Want more growth? Take a peek at smaller or more speculative companies in innovative fields like biopharmaceuticals, renewable energy, or self-driving vehicles.

- For those looking into how to invest $150K for passive income, consider buying reliable “dividend aristocrats.”

- Need investing ideas? Check out our FREE newsletter, WallStreetZen Ideas. It’s chock-full of investing inspiration that can alert you to opportunities in the market that you might not come across otherwise.

Whatever you feel is the best way to invest $150,000, it’s available with a brokerage account.

Ready to jump into the stock market? If you don’t already have a trusted broker, consider signing up for eToro.

Not only does eToro offer access to equities, it makes it easier for investors to put a little capital into hot cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Remember: WallStreetZen offers many educational resources to help you make the most informed stock decisions.

Sign up for WallStreetZen and enjoy access to our industry-leading tools, proprietary ZenScore, and our free newsletter to help you better decide where to invest $150K.

3. Index Funds

Can’t be bothered picking single stocks or sectors?

You may want to focus on a specific type of ETFs called index funds.

These ingenious financial vehicles mirror broad market indices like the S&P 500 or the Dow Jones, so you get ultra-diversified exposure to the market.

Sure, you’ll miss pops for solo stocks, but index funds also preserve your portfolio from severe price declines.

Plus, since index funds are such a popular investment choice, they’re some of the most accessible and liquid ways to put your money to work.

If you’re looking for where to invest $150K in index funds, consider signing up for eToro.

In addition to accessing high-quality index funds, eToro offers distinctive “social trading” features, so you can bounce ideas off of other investors.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

4. Real Estate

For investors who want minimal risk exposure, real estate may be the ideal route. But when it comes to how to invest 150k in real estate, it can be hard to choose a direction.

While there are never guarantees in investing, commercial and residential real estate tend to reward investors with steady price appreciation.

Plus, owning property gives you greater flexibility to collect steady cash returns if you play the role of a landlord.

With tools like Stessa and online courses like Skillshare’s “Sophisticated Real Estate Investing,” you have the know-how to manage your properties like a champ.

But don’t think buying property directly is the only way to invest in real estate.

If you’re looking into how to invest $150K in real estate without much fuss, there are many crowdfunding platforms where you own a stake in properties you like.

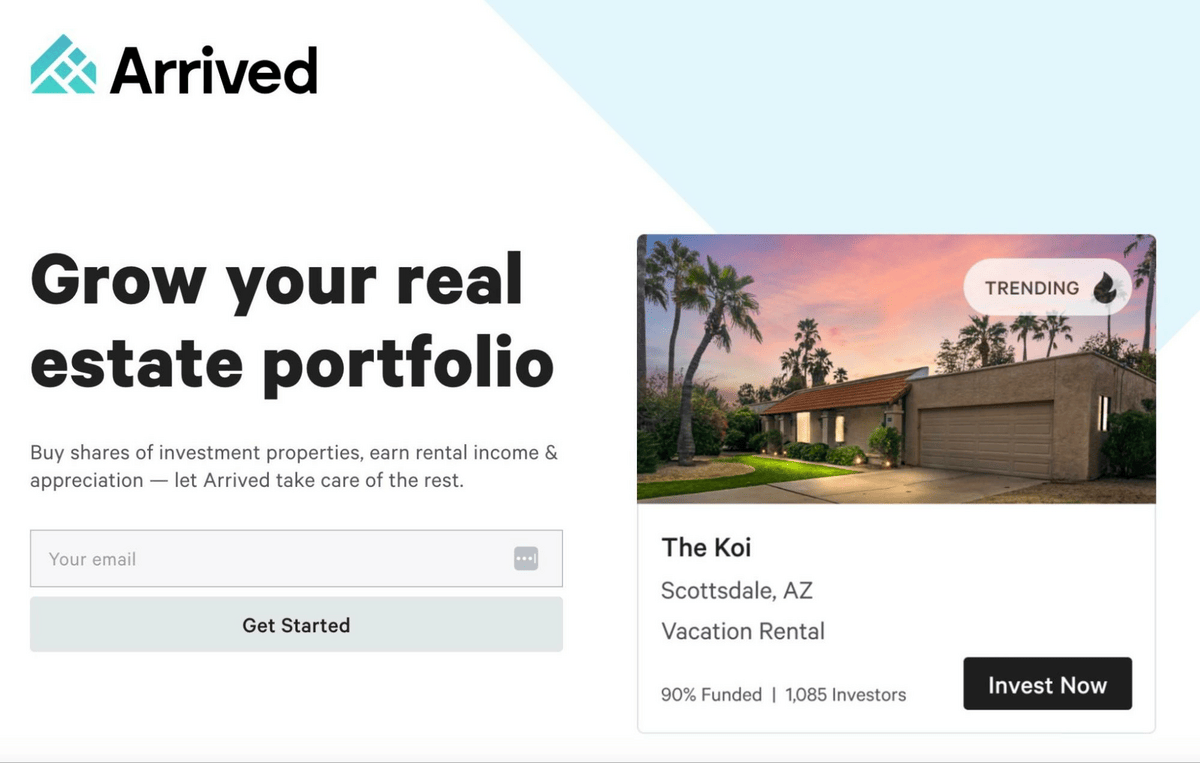

Sites like Arrived, Fundrise, and ARK7 let you own shares of residential or commercial real estate so you enjoy price appreciation and dividends without the hassle of managing properties. Which is the best? Depends on your objectives, but Arrived is one of the easiest platforms to get started with.

Arrived Homes is the best crowdfunded real estate platform for investing in single-family rental homes, with an extremely low $100 minimum. Plus, it’s backed by Jeff Bezos.

Arrived allows you to invest in single-family residential investment properties for as little as $100; from there, you’ll earn dividends in the form of monthly rental income.

Among its selling points? Arrived has a stringent vetting process, selecting less than 1% of the deals they review, and they offer both long-term rental and vacation rentals. While there are a few fees for each property (0.15% annual fee, 8% gross rents fee, additional fees for short-term rentals), expected net returns range from 8% – 20% APY.

5. Private Credit

Loaning private credit may be the best way to invest $150K you haven’t thought of — especially if you’re looking into how to invest $150k for cash flow.

This method works similarly to buying bonds, except you’re taking on debt from private entities (hence the name).

While arranging deals off public exchanges carries higher counterparty risk, these deals typically reward investors with greater returns and more flexible terms.

As a bonus, many highly-vetted platforms now offer easy access to private credit opportunities.

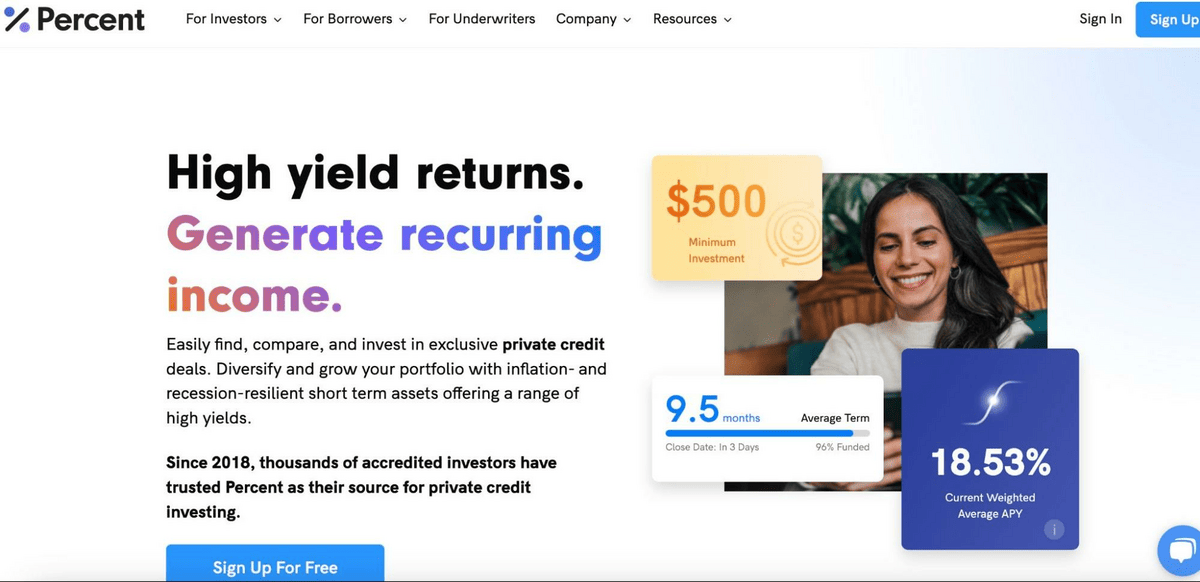

For example, Percent is dedicated to offering interested accredited investors pre-screened private credit deals, including a diversified “Blended Notes” option to spread out your risk.

Not an accredited investor? Fintech company Fundrise also offers attractive private credit products for non-accredited clients who want consistent yield without scouting out opportunities.

Note: We earn a commission for this endorsement of Fundrise.

The bottom line? Although private credit is slightly higher risk than bonds, it’s worth putting on your radar if you want consistent yield.

6. Automated Investing

Let’s say your idea of investing is to hand over $150,000 to the reliable hands of a financial expert.

No shame in that!

While you won’t enjoy much control over your portfolio’s arrangement, this method is the best way to invest $150K for people who don’t have the time, energy, or inclination to monitor their holdings.

Thanks to the power of automation, there are multiple ways to recalibrate your $150K portfolio with minimal legwork.

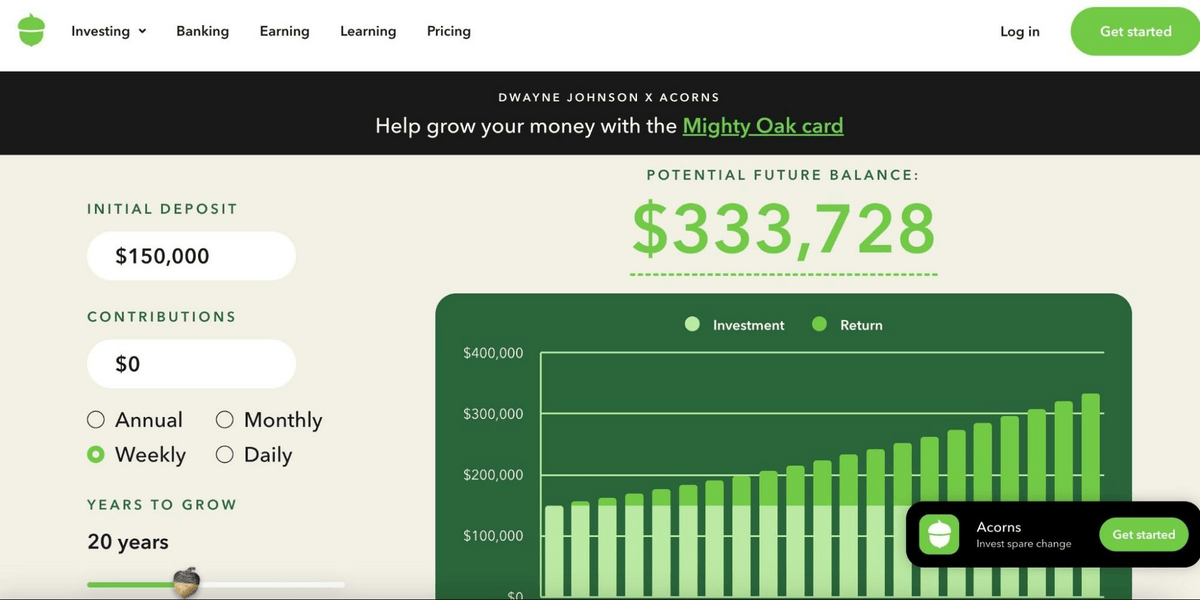

For instance, Acorns automatically invests your $150K (or whatever portion of it you choose) in whichever expert-picked ETF portfolio suits your specific goals.

Plus, right now, you can score a $20 bonus when you set up an account and your first recurring deposit on Acorns! Just use the link below.

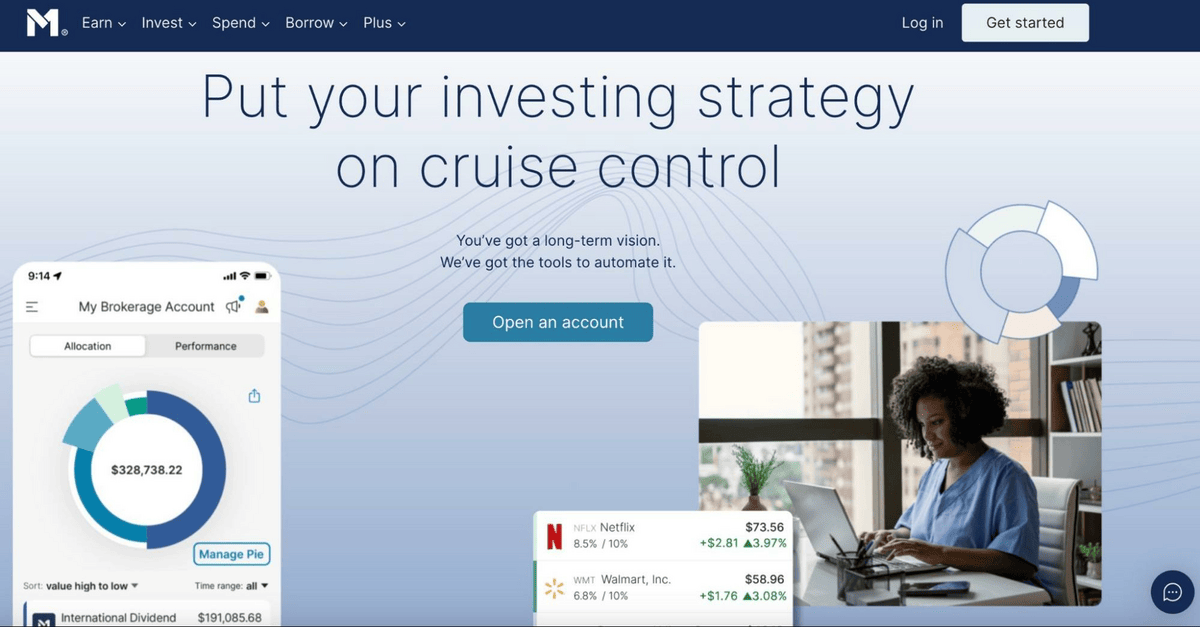

M1 Finance is another investing app offering “Model Portfolios” filled with pre-screened stocks best suited for your unique preferences.

The bottom line? If time is your most valuable commodity, automation may be the best way to invest $150K.

7. Gold

From the perspective of eternity, Robert Frost was right when he wrote, “Nothing Gold Can Stay.” However, from an investor’s perspective, gold is an asset with “staying” power.

Although gold isn’t as practical as other precious metals, it has been the symbol of wealth since the dawn of time — hence, it’s arguably the best way to invest $150K if you’re conservative with your money.

Although gold typically doesn’t offer the same upward momentum as other asset categories, it’s usually less volatile and a solid performer over the long haul.

If you’re looking for where to invest $150K in gold, you must triple-check that you’re working with a reputable company with a long track record and strict authentication procedures.

For instance, Noble Gold and Silver Gold Bull have a solid reputation for shipping high-quality, authentic precious metals to customers’ doorsteps.

Also, some companies like Augusta Precious Metals offer ways to invest in gold with a tax-advantaged IRA.

Since precious metals typically take decades to mature, using a gold IRA may save you considerable money over your term.

Check out some of our favorite gold IRA providers here:

8. High-Yield Savings

If you can’t pick a place to park your funds, at least put them in a high-yield savings account while you’re waiting.

These savings accounts offer all the protections you find at other banks and credit unions (think FDIC insurance), but they reward you with more competitive monthly yields.

So, honestly, there’s no way to “lose” by keeping your $150K in one of these accounts, especially if you’re interested in reliable cash flow.

The only downside with high-yield savings accounts is these rates fluctuate monthly, so you may not get the best offer depending on the latest interest rate policies.

Looking for where to invest $150K in a high-yield account?

Consider CIT Bank.

This FDIC-insured bank makes it simple to deposit however much you want into a savings account and take advantage of higher-than-average yields.

9. CDs

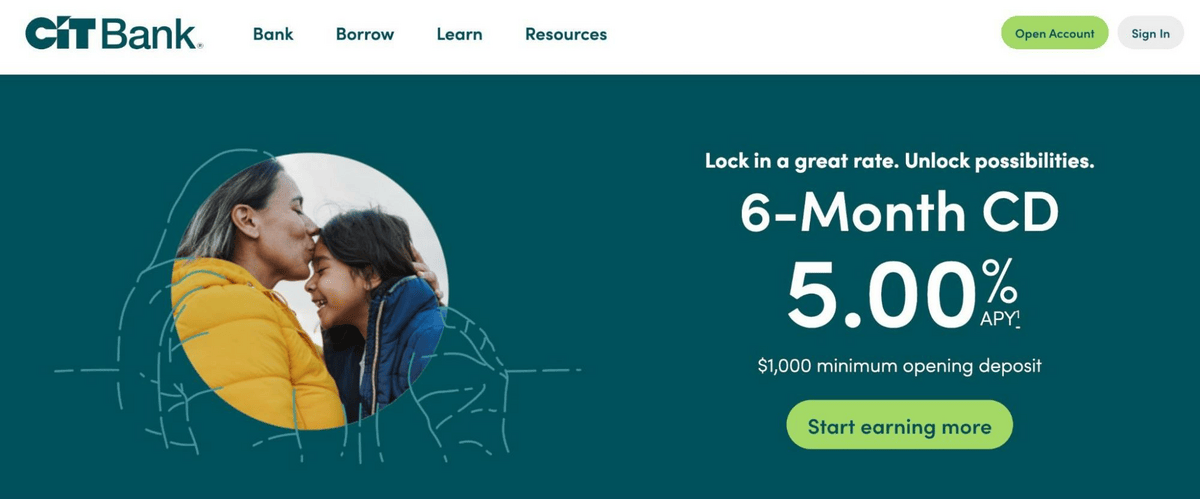

If rate variability isn’t your vibe, you may want to look into locking your $150K in a CD.

Short for “Certificate of Deposit,” CDs give you a fixed interest rate, but you have to lock away funds for a pre-agreed term.

While this isn’t ideal for investors who prioritize liquidity, it’s a great option if you’re looking into how to invest $150K for passive income.

CIT Bank also offers CDs to investors.

So, if you can’t decide between high-yield savings or CDs, CIT Bank offers both products with FDIC protection.

10. Pay off Debt

While it’s tempting to put money to work rather than pay down a debt load, you will be paying more for your debt down the line if you don’t get it under control.

Yes, you won’t get to collect dividends, and you may miss opportunities to make more with certain investments by paying off debt.

But remember this: There is no certainty what you invest in will go up in value. That’s just a harsh fact of life.

In this scenario, the only sure thing is to cut the stinky albatross of debt off your neck ASAP.

We know this isn’t the most glamorous tip on our list of how to invest $150K, but it’s the best advice if you have a debt burden.

11. Save For Retirement

If you’re most concerned with how to invest $150K for your future, consider maxing out retirement accounts.

Whether you opt for individual accounts like Traditional and Roth IRAs, or you want to contribute to your 401(k), spreading out $150K in these accounts ensures you’re putting aside plenty for your golden years.

As a bonus, retirement accounts have attractive tax incentives, so you’ll get to keep more of your potential earnings.

Since consistency is the key to great retirement planning, it helps to use an IRA platform with automated deposits.

For example, Acorns’ “Later” feature lets you open a SIPC-insured IRA with automatic recurring contributions.

If you’d like a little extra “alpha” in your retirement account, consider researching alternative IRA assets on Rocket Dollar.

With a self-directed IRA, you have the option of investing in non-traditional assets, including cryptocurrencies, private equity, and startups.

Lastly, for any gold bugs out there, Augusta Precious Metals offers a tax-advantaged IRA for physical gold and silver bars.

Tips for How to Invest $150K

Even if you know where you want to invest your $150K, it helps to hit the pause button before making a purchase and review a few investing basics.

Diversify

It doesn’t matter if you think your investment is a “sure bet,” it’s never wise to place all your eggs in one basket.

Sure, you could pick the next Tesla (NASDAQ: TSLA) in its early innings; however, when it comes to building long-term wealth, the safest move is to diversify across multiple asset categories and manage your risk.

With a well-diversified portfolio, there’s greater odds you won’t suffer intense drawdowns and still experience plenty of gains over the long haul.

Focus on the Long Term

Try envisioning your $150K as the sapling for your future self.

While swing trading offers potentially quicker gains, it’s safest to use this sum of money for slow and steady growth rather than potentially lose it on short speculative plays.

Not only is it safer to think of investing $150K as a long-term commitment, it takes a lot of pesky trading costs, commissions, and taxes off your plate.

Seek Financial Advice + Tools

Please don’t let financial jargon freak you out!

We get it — learning about investing is intimidating, especially if you’ve never done it before.

However, thanks to the wonders of the Internet, there are plenty of high-quality resources at your fingertips.

For instance, the retirement planning platform Empower offers users loads of educational content, tools, and professional help to ensure they have complete confidence in their investing decisions.

Also, don’t forget WallStreetZen offers financial guides, analyst ratings, and stock forecasts to help you become a better investor.

Take advantage of all the online tips and tools when deciding how to invest $150K.

Review + Adjust As Needed

While some investments are “set it and forget it,” you should monitor your portfolio’s performance at regular intervals.

Set a reminder at least once per month to review your investments and note any changes in your thesis.

As you gather more data, you’ll begin to see patterns in your portfolio and generate ideas on maximizing gains and minimizing losses.

While constantly ” reviewing the books” can be tedious, this step is crucial to ensure you’re on a consistent path to greater prosperity.

Stay Educated

In addition to reviewing your portfolio regularly, staying “in the know” about the products or sectors you’re investing in is essential.

For instance, if you’re involved in stocks and ETFs, it makes sense to stay on top of global equities markets.

Not only will this help you monitor the assets in your portfolio, it could help you generate ideas for future investment decisions.

Can’t be bothered scouring through financial websites for the latest headlines? Let WallStreetZen deliver the alpha to your inbox.

With WallStreetZen’s free newsletter, you’ll receive the latest insights on market movers, plus easy-to-read analysis of the latest financial trends.

Final Word: How to Invest $150K

There are no “wrong” answers to how to invest $150K, but you have to make sure your decisions fit your financial goals.

Before making any big movements, take some time to carefully review factors like your time horizon, risk profile, and average returns to get a clearer sense of how to invest $150K.

After brainstorming different scenarios, you should develop a great game plan for glorious gains.

FAQs:

What is the best way to invest $150000?

The "best" way to invest $150,000 depends on multiple factors, especially your risk tolerance and time horizon. Consider the average volatility and rate of return for different asset categories to figure out the best investment for your needs.

How to invest $100 000 to make $1 million?

While turning $100K into $1 million is challenging, it's possible if you choose assets with a high-risk-return profile (think growth stocks or cryptocurrencies). Just bear in mind you need to make at least $100K off this initial $100K annually for ten years to reach this lofty $1 million mark.

What to do with 150k inheritance?

If you have a $150K inheritance, you can use it to invest in multiple sectors, including real estate, stocks, or precious metals. Let this money sit in high-yield savings accounts or CDs if you prefer consistent, low-risk cash flow.

How much money do I need to invest to make $3000 a month?

$3,000 is 2% of $150,000, so you need to invest $150,000 in an asset that rewards at least 2% per month to consistently make this amount.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.