At first glance, Trade Ideas appears to be an intuitive platform with the potential to help you identify pre-market opportunities, breakout stocks, specific technical setups, and access to an artificial intelligence assistant.

But with plans starting at $1068 annually, is Trade Ideas worth it? Is the Trade Ideas scanner as impressive as it seems?

Here’s my take…

Trade Ideas may be worth the investment if you’re an experienced, high-frequency trader looking for a hands-on platform and can justify its premium pricing.

However, Trade Ideas is not without its limitations. The steep learning curve, additional time required to master its tools, and high cost mean it’s not suitable for everyone, especially those new to the game.

I’ll help you figure out if it’s right for you — and offer alternatives if it’s not a good fit — in this Trade Ideas review.

A high-quality alternative for a fraction of the cost…

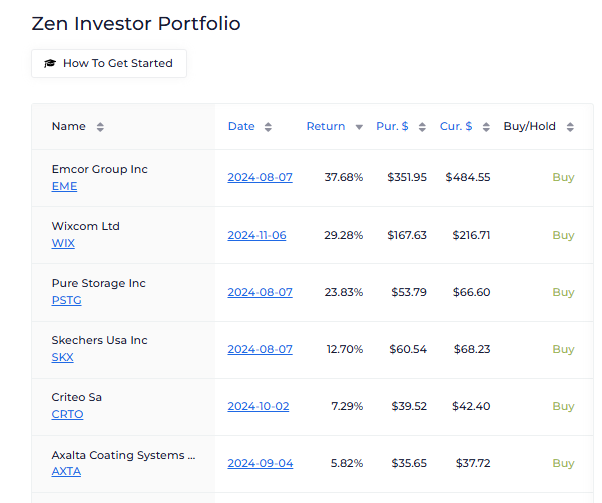

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. For just $99 per year (or $79 for a limited time, using this link), you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Each selection undergoes a careful review of 115 factors proven to drive growth in stocks, including proprietary AI algorithms, using our Zen Ratings system

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary

What Is Trade Ideas?

Trade Ideas is a stock scanning platform designed to give traders and investors the advanced tools needed to boost market performance. The platform has also gained popularity for its innovative use of artificial intelligence, specifically its virtual assistant, Holly.

The AI companion can comb massive pools of data in real time, find patterns, and give users trades it believes have a higher chance of success.

More than that, Holly backtests suggestions using historical data, further supporting the AI assistant’s recommendations.

Who is Trade Ideas For?

Trade Ideas is designed for active traders who demand precision and efficiency. Day traders and swing traders will benefit the most from its robust scanning capabilities and AI insights. However, long-term investors may find limited value in the platform, as its focus is on short- to medium-term trades.

The bottom line? Trade Ideas provides valuable tools for those ready to level up, but its features and cost make it best suited for those actively engaged in the market.

Trade Ideas Scanner: How It Works

The Trade Ideas platform comes equipped with real-time stock scanning capabilities. It allows users to find trading opportunities by leveraging advanced algorithms alongside customizable filters. Users can filter stocks to their preferred criteria, helping identify, for example, oversold opportunities.

The platform continuously monitors stock market data, attempting to find matches according to your parameters. You can filter by price, volume, technical indicators, and fundamentals. Preconfigured scans for popular strategies are also available, making it easy for novice investors to dive in.

Ultimately, scanners like that offered by Trade Ideas can help remove the burden of manually sifting through thousands of names.

Trade Ideas Scanner Features

- Real-Time Alerts: Stay ahead of the market with instant notifications when stocks meet your criteria.

- Custom Filters: You can tailor scans to your strategy by filtering by metrics like RSI, float, market cap, or even earnings dates.

- Pre-Market and Post-Market Scans: Identify opportunities outside regular trading hours.

- Holly AI Integration: Receive curated trade ideas backed by AI analysis and backtesting (Premium Plan).

- Simulated Trading: Test strategies without risking real capital.

How Would You Use a Scanner or Screener?

- Identifying Breakout Stocks: Use volume and price filters to spot stocks approaching a breakout.

- Finding Reversal Opportunities: Set up scans to highlight oversold stocks with signs of a potential rebound.

- Sector Rotation: Track trends in specific industries to capitalize on sector momentum.

- Gap Scans: Pinpoint stocks with significant pre-market or intraday gaps for potential volatility plays.

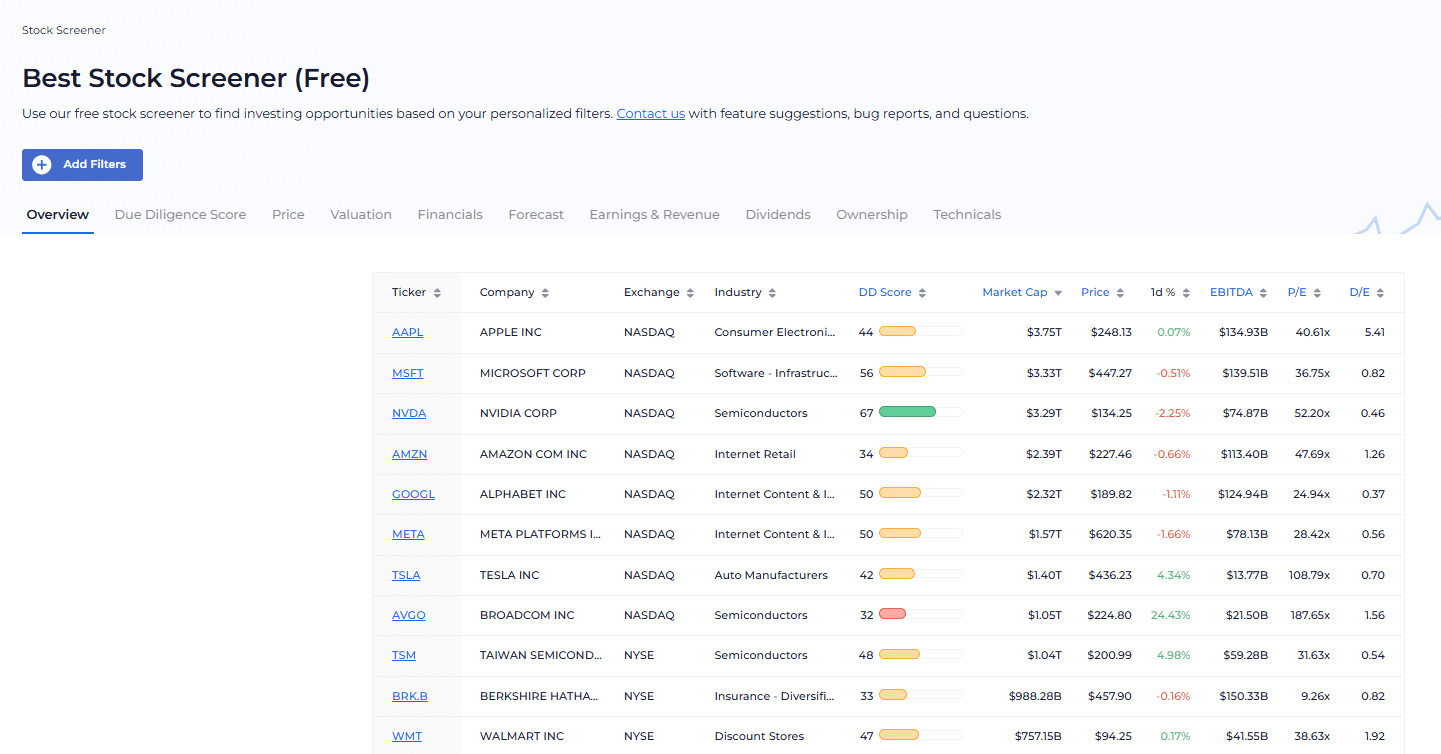

While the Trade Ideas scanner is excellent for day traders, long-term investors may prefer the simplicity of WallStreetZen’s stock screener.

WallStreetZen focuses on helping users discover fundamentally sound stocks through simplified filters for valuation, growth, and financial health. For every ticker we track, you can also access a Zen Rating. That’s our proprietary grading system that evaluates stocks in seven key areas and reviews a total of 115 factors proven to drive stock growth. All of these checks are distilled into a simple, easy-to-read grade. For instance, A = Strong Buy, B = Buy, C = Hold, and so on.

Whether you’re trading daily breakouts or building a long-term portfolio, there’s a scanner for you. For active traders, Trade Ideas can be an effective tool; however, if your goals lean toward sustainable growth, WallStreetZen offers everything you need.

Who is Holly, and How Does Trade Ideas Integrate AI?

The exact details of Holly have not been disclosed, but it appears to be a system based on ChatGPT architecture. It evaluates trading strategies across thousands of stocks daily, identifying high-probability trade setups based on historical data and current market conditions.

While it might leverage ChatGPT, it’s not fair to call it a simple overlay. Holly is packed with 60 curated algorithms and is integrated into the Trade Ideas platform.

“Make Holly your Virtual Trading Assistant. Everyday, she utilizes dozens of strategies based on specific algorithms designed to recognize patterns, anomalies, or specific market conditions that have historically indicated profitable trading opportunities,” reads a description on the service’s website.

Where ChatGPT responds to prompts by generating text, Holly focuses entirely on trading. It reviews hundreds of strategies overnight, performs millions of backtests and selects the highest-performing setups for the next trading day.

How Much of Holly’s Trading Signals Are Actually AI?

A significant portion of Holly’s trading signals are genuinely AI-driven. Holly doesn’t just look for patterns; it rigorously backtests every strategy.

Holly assesses factors like the engine’s evaluation of the probability of success based on historical performance. Holly also accounts for risk, ensuring the potential upside of a trade is worthwhile.

Once Holly selects strategies, it runs them live during the trading day, dynamically adapting to market conditions. This ability to learn from historical data and respond to real-time events sets Holly apart as a true AI assistant.

What Stock Data Does Holly Look At?

Holly analyzes a wide range of market data, including:

- Price and volume data: Spotting trends, breakouts, and anomalies.

- Technical indicators: RSI, moving averages, and Bollinger Bands.

- Fundamental data: Earnings dates, news sentiment, and industry performance.

- Pre- and post-market activity: To identify potential early moves or after-hours opportunities.

Holly is a powerful, purpose-built AI that offers real, data-backed trading insights. It’s not just “smart” in the general sense; it’s built to make traders smarter by automating research and decision-making. If you’re a trader looking for cutting-edge tools, Holly could give you what you’re looking for.

However, if you want the AI to be backed by a human touch, you may find more value in a subscription like Zen Investor. While this stock-picking services does leverage AI as one of the components used in the proprietary Zen Ratings system used to review stocks, it also evaluates several other fundamental components, then a human touch as an expert analyst with 40+ years in the business hand-picks the stocks with the greatest potential.

Trade Ideas Pricing: Is It Worth It?

Subscription Tiers

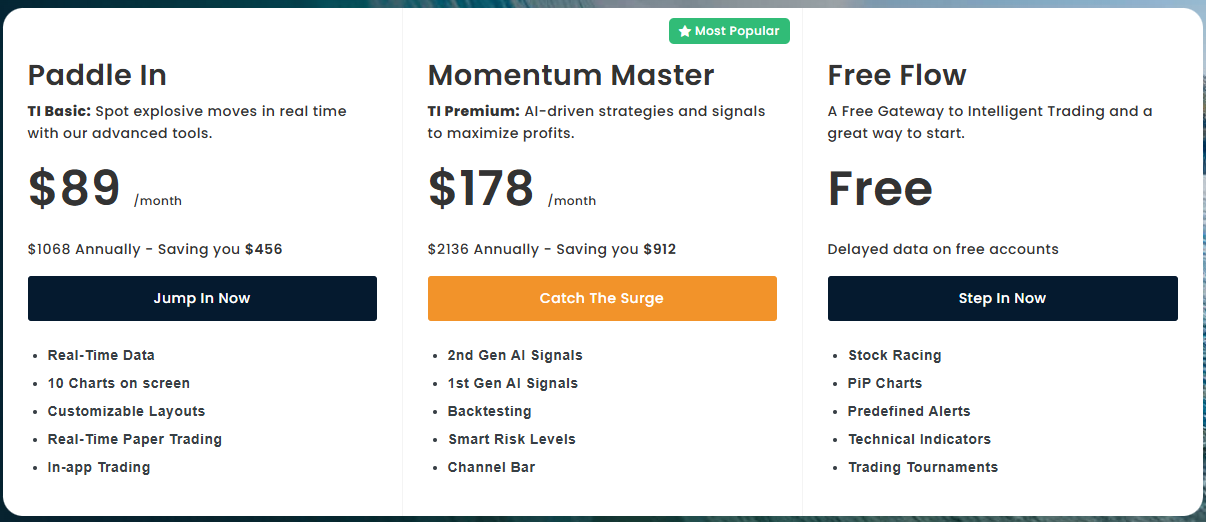

The amount Trade Ideas costs you depends on which membership tier you choose.

Free

The free tier is a scaled-down membership, lacking many advanced features in the paid tiers. It comes with technical indicators and predefined alerts and gives users access to trading tournaments.

Basic ($89/month)

The first paid tier starts to get interesting. For $89 per month or $1,068 for the entire year upfront, users can access real-time data, ten on-screen charts, customizable layouts, real-time paper trading, and in-app trading. They also get pre-market and after-hours data and customizable screeners.

Premium ($178 / month)

At the top end, you can subscribe to the Trade Ideas premium tier for $178 per month or $2,136 for the entire year.

This is where things get really interesting. Membership includes access to the AI companion, Holly, backtesting capabilities, smart risk levels, and over 20 curated trading templates.

Trade Ideas Premium Versus WallStreetZen Premium

There’s no question a premium subscription to Trade Ideas isn’t cheap. At $178 per month, it’s substantially more expensive than the $59 monthly fee for the premium version of WallStreetZen.

In other words, WSZ is nearly 60% cheaper than the Trade Ideas cost.

Both platforms also offer savings if you commit to an annual plan. With Trade Ideas, you can get an entire year for $2,136. For comparison, WSZ Premium would be just $234 for 12 months — almost 90% cheaper!

Still, Trade Ideas offers some incredible tools unique to the platform. Its real-time scanning, algorithmic trade ideas, and extensive customization make it a great solution for traders who want an extremely hands-on platform. Of course, this comes with a steep learning curve that some might balk at.

WallStreetZen Premium, on the other hand, is best for fundamental investors focused on long-term growth. It also boasts an intuitive platform, simple interface, and transparent process. If real-time trading is not a requirement, WallStreetZen wins hands down, especially when considering the vast delta between subscription costs.

Looking for long-term investment insights? For a fraction of the cost of Trade Ideas, you could subscribe to both WallStreetZen Premium (our DIY stock research software) and Zen Investor (our stock-picking newsletter) and gain access to high-quality investment ideas and tools to research stocks.

Alternative AI-Powered Stock Tools

Trade Ideas can offer great value for the right type of trader, but it’s far from the only available AI-powered stock tool. Here are our top five alternatives and what makes them stand out.

1. Zen Investor

While Zen Investor itself is not directly AI-powered, it employs Zen Ratings, a proprietary model that assesses 115 unique factors and leverages advanced AI algorithms to identify subtle patterns in market data and anticipate future trends. Zen Investor from WallStreetZen strikes the best balance.

It’s simple and user-friendly but backed by expert knowledge and a sophisticated artificial intelligence backbone via Zen Ratings. It’s not flashy; that’s not the point. It’s transparent, robust, and delivers clear and actionable advice.

The best part? Access to WallStreetZen’s in-house analyst, Steve Reitmeister.

Whether you’re just getting started or an advanced trader wanting an edge in the markets, Zen Investor is the service of choice.

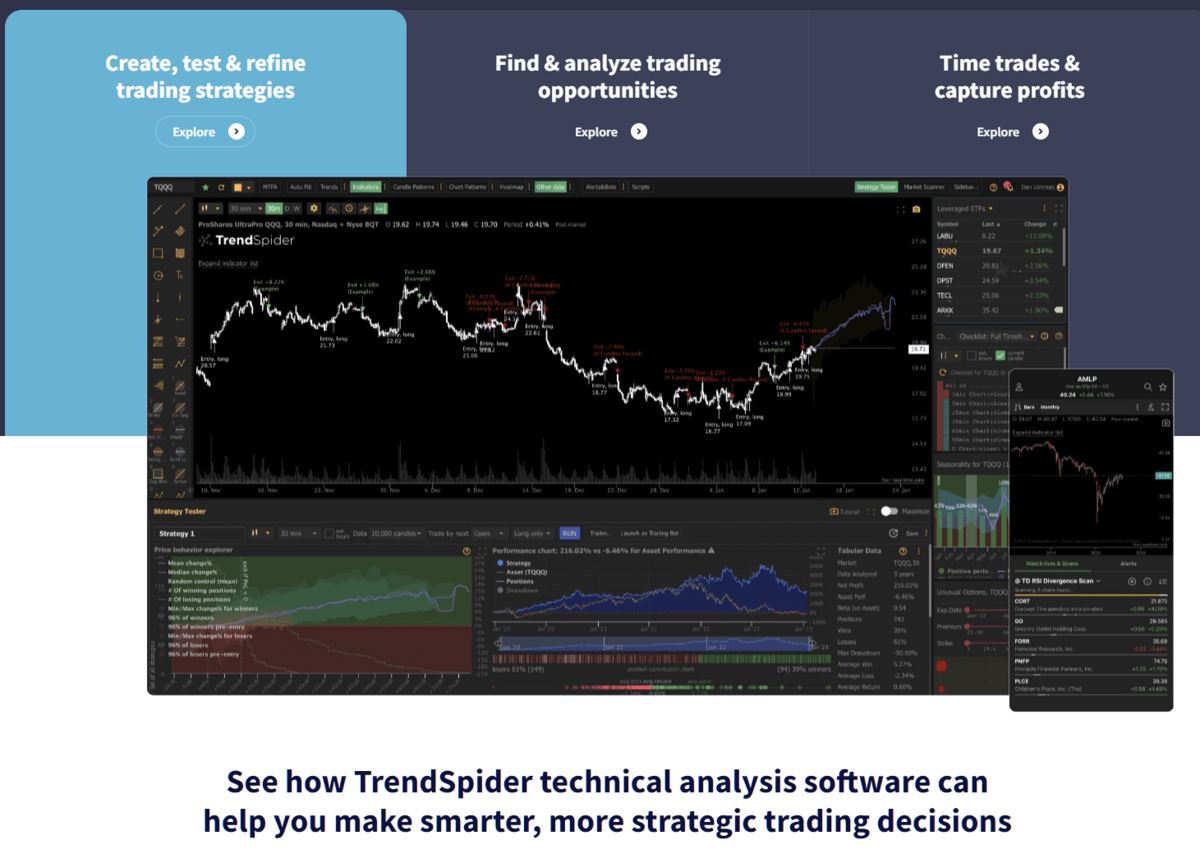

2. TrendSpider

This one is for the technical artists out there. When it comes to charting and technical analysis, few platforms do it better than TrendSpider. You’ll find an extensive library of charting options, automated trendlines, and heat maps backed by powerful AI.

The platform is designed to identify trendlines and patterns. It can also help you test strategies to see how they hold up against real-world data.

While it can be complex, the platform fortunately boasts a suite of comprehensive guides and tutorials.

3. Tickeron

Tickeron is an ideal platform for active day traders. Expect constant and trusted information updates alongside powerful preset screen options.

More than just AI trading software, Tickeron will present you with potential trades and expert advice. Ultimately, Tickeron aims to give you concrete advice on which you can act.

The AI portion of the Tickeron platform focuses on live data and predicting potential bull markets. Tickeron is also transparent, providing insight into how it produced particular predictions. More than that, it will assess and report how accurate past predictions turned out to be.

4. FINQ

If you like the idea of leveraging AI to make smarter investing decisions, FINQ might be what you’re looking for. Its tagline? “Where big data and AI replace the outdated human intermediary.”

Here’s how FINQ works. First, its engine researches thousands of sources like analysts, media (both social and traditional) traffic, and company fundamentals. Then, its system breaks down that pile of data using AI to identify trends and patterns. These are then passed on to investors.

Here’s what you get with your membership:

- STOCKS DEPOT: FINQ’s Daily-updated ranking of all S&P 500 stocks

- FINQFIRST portfolio: FINQ’s 10 stocks to buy (long strategy)

- FINQLAST portfolio: FINQ’s 10 stocks to short-sell (short strategy)

- FINQNEUTRAL portfolio: FINQ’s top 10 stocks to buy + 10 to short-sell (dual strategy)

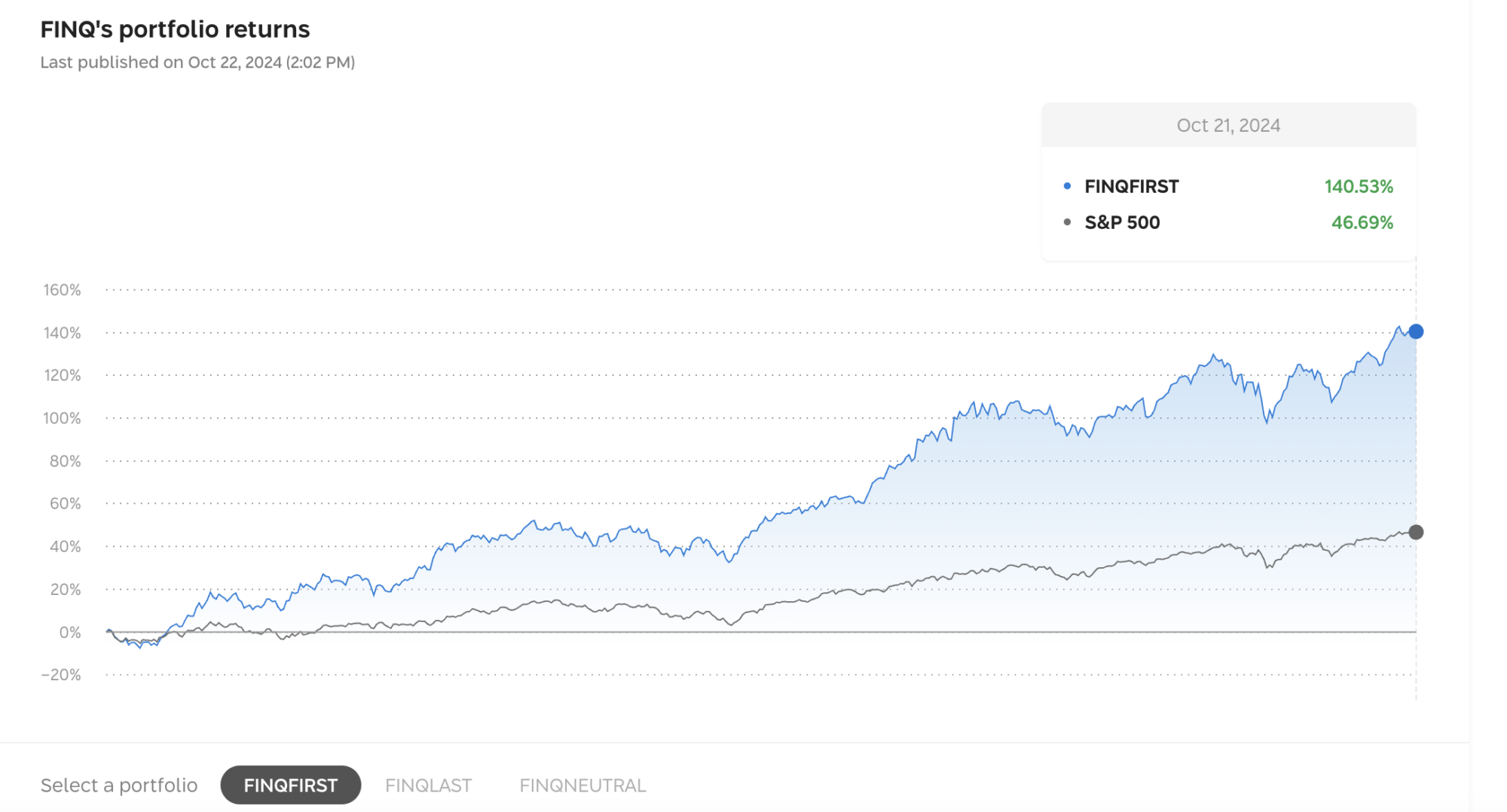

Does it work? Here’s how the FINQ portfolio is faring…

It’s a cool idea, and overall a solid value at $50 per month (but you can get a free trial using the link below). In addition, it’s also a great source for finding stocks to short sell — a feature you won’t find many places. The bottom line? If you’re looking for an investment platform that bases its ratings + portfolio picks on science rather than intuition, FINQ might be the perfect fit.

Final Word:

So, is Trade Ideas worth it?

If you’re an experienced trader looking for a hands-on platform and can justify its premium pricing, Trade Ideas may be worth the investment.

However, Trade Ideas is not without its limitations. The steep learning curve, additional time required to master its tools, and high cost mean it’s not suitable for everyone, especially those new to the game.

For long-term investors or those focused on building a sustainable, growth-oriented portfolio, Trade Ideas offers far more features than necessary — and at a much higher price point than alternative platforms. Not only that, but the feature set may also overwhelm most people.

In short, many folks would end up paying a premium subscription for too many tools and too much confusion when a simpler platform would be superior.

This is where Zen Investor comes into play.

Unlike Trade Ideas, which focuses on short-term trade setups, Zen Investor is tailored for fundamental investors who want clear, actionable insights to grow their wealth over time.

Zen Investor is built for simplicity, offering expert-backed recommendations, a transparent, easy-to-use interface, and is supported by Zen Ratings’ advanced AI algorithms.

Not only that, at $99 per year, it’s so affordable that you could also get a WallStreetZen Premium membership in tandem ($234/year) and it would still cost you nearly $700 less than a year of Trade Ideas.

The bottom line? If you’re a professional trader hunting intraday opportunities, Trade Ideas might be worth the cost. But for most investors — especially those aiming for long-term success — WallStreetZen Premium and Zen Investor provide better value, clarity, and ease of use.

FAQs:

Is Trade Ideas worth the cost?

Trade Ideas may be worth the cost for experienced day traders and swing traders who want a hands-on approach and need access to an extensive library of tools. However, other excellent tools such as WallStreetZen Premium and Zen Investor are available for a fraction of the cost.

What features does the Trade Ideas scanner offer?

The Trade Ideas scanner features real-time scanning and alerts, customizable filters, pre-configured scans, pre- and post-market scanning, and access to the AI-powered assistant, Holly.

Who should use Trade Ideas?

Seasoned day traders and swing traders looking to take their game to the next level should consider Trade Ideas, but long-term investors should consider alternative services like Zen Investor or WallStreetZen Premium.

What are the best alternatives to Trade Ideas?

Zen Investor, backed by AI-powered Zen Ratings, and TrendSpider are the best alternatives to Trade Ideas.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.