Stansberry Research is a stock picking service that’s been chugging along since the late 1990s.

With such a long track record, it’s got to be legit, right?

But as you dig deeper into Stansberry Research reviews — and spicy headlines about SEC lawsuits and CEO departures — you may wonder if Stansberry Research is a scam after all.

Before spending money on one of Stansberry Research’s services, let’s take a moment to understand what they offer and how trustworthy they are.

Is Stansberry Research Worth It?

Stansberry Research might be worth considering if you’re looking for stock or crypto picks and market analysis from an established publication.

On the plus side, this company has been churning out analyses since the late 1990s, and they have many different products to choose from.

As another perk, they make a big deal about their refund policy and customer support, so you shouldn’t have an issue getting your money back if you want out.

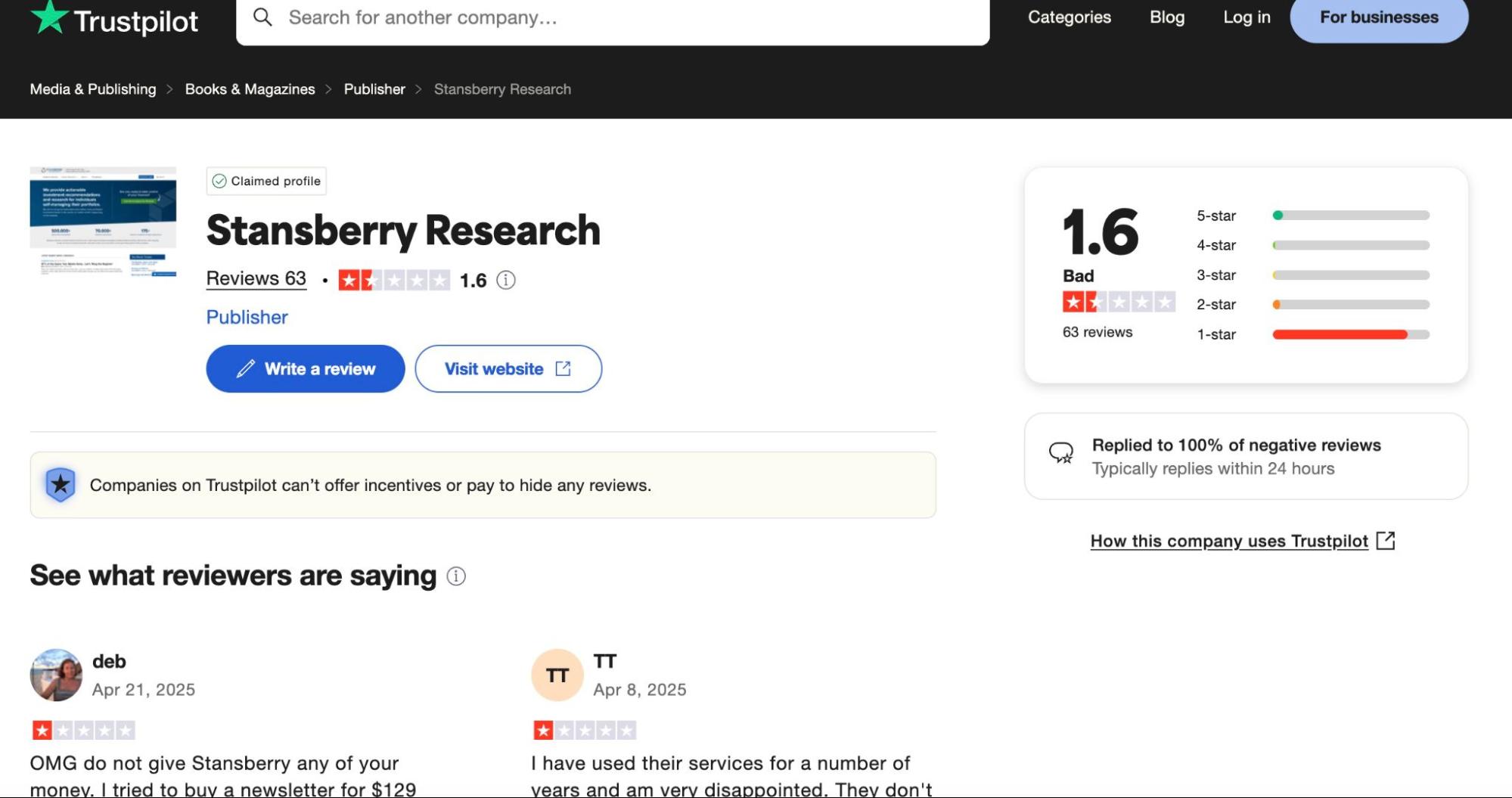

Just be forewarned: Many third-party Stansberry Research reviews on Trustpilot and the BBB aren’t pretty.

It’s also hard to gauge Stansberry Research’s long-term performance, and this company isn’t immune to lawsuits.

If you’re on the fence about Stansberry Research, maybe start with their free resources and YouTube channel.

After this initial investigation, you could consider going all-in with one of their paid subscriptions (taking full advantage of the 30-day trial period).

But if you find Stansberry Research’s dozens of offerings a bit overwhelming, you may want to use a streamlined stock-picking service like Zen Investor.

With our service, you’ll get high-conviction stock picks sent to your inbox that have undergone rigorous AI analysis and personal evaluation from Wall Street veteran Steve Reitmeister.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What is Stansberry Research?

Stansberry Research was originally one financial publication that has grown into a multimedia company offering info on investments.

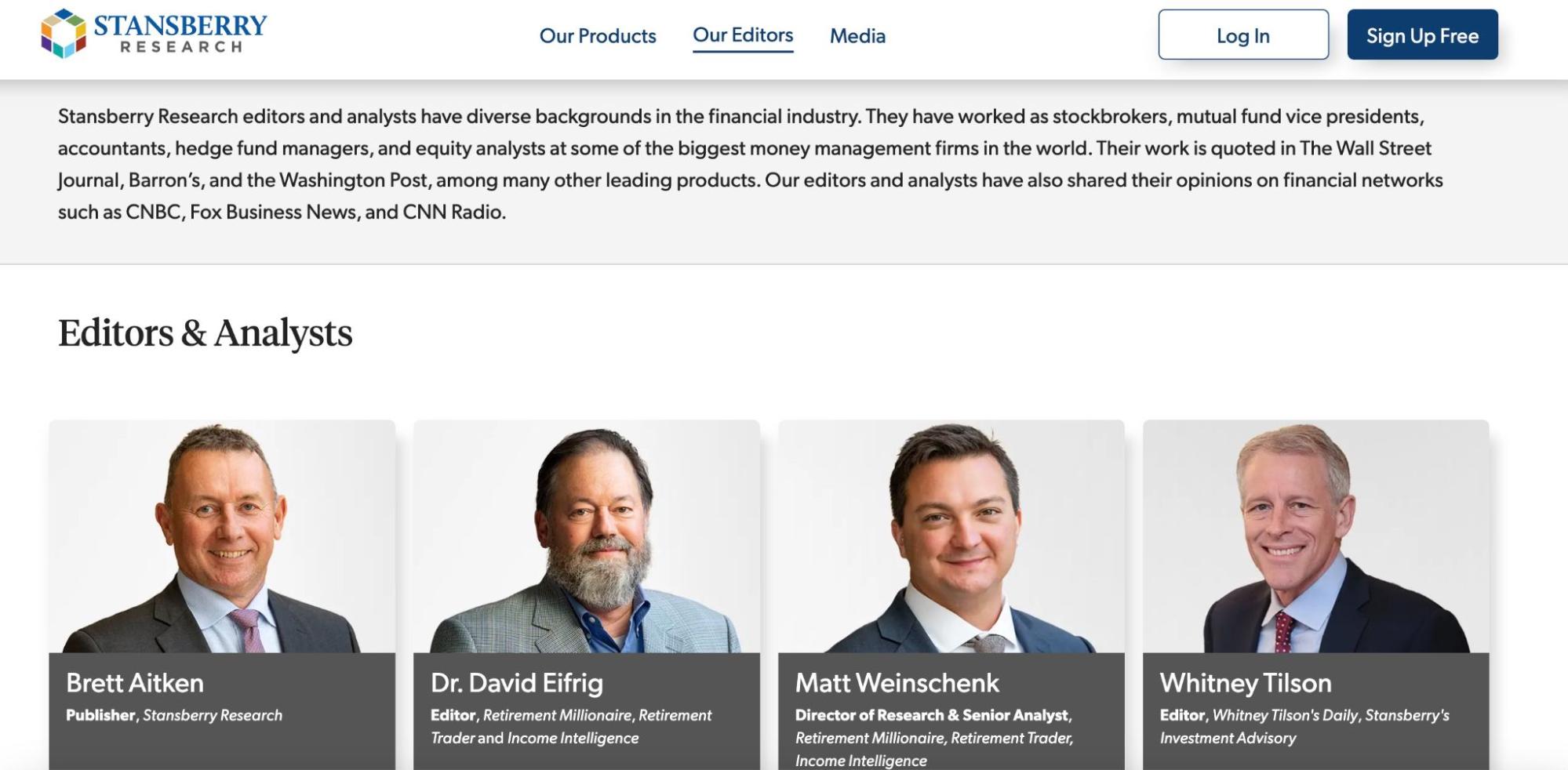

“Stansberry” is the last name of a real dude named Frank Porter Stansberry, who previously worked as a financial analyst and reporter for Agora.

Today, Stansberry Research is a part of the conglomerate MarketWise, and it’s arguably as well-known for its “the world is ending” headlines as it is for its YouTube channel and multiple paid subscriptions.

Despite sensational marketing practices — or perhaps because of them? — Stansberry Research has become a global financial publication with multiple reporters covering different asset classes.

Why Did Porter Stansberry Leave Stansberry Research?

There was a bit of brouhaha in 2020 when Porter Stansberry retired from MarketWise shortly before its IPO.

Apparently, Mr. Stansberry wanted to focus on writing and independent analysis.

That led him to create a new boutique investment advisory firm named after (who else?) himself: Porter & Co.

However, Stansberry returned to MarketWise’s Board of Directors in 2023…but only to resign again in 2024.

So, yeah, it’s pretty complicated, but it appears Mr. Stansberry is more focused on other investment services at the moment (even though he’s simultaneously obsessed with his OG brand).

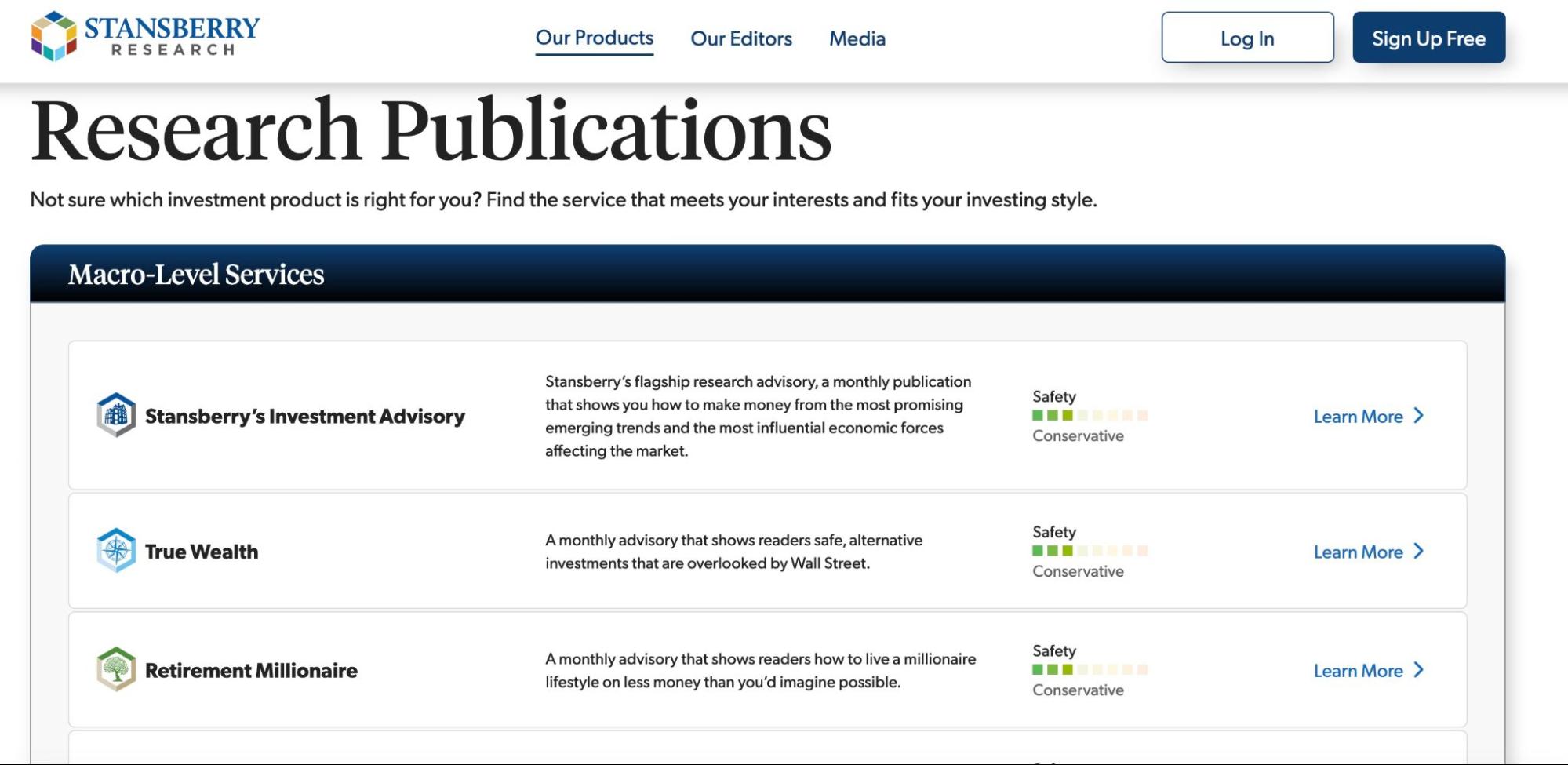

Key Services Offered

At its start, Stansberry Research was a monthly publication that offered an overview of the market and particular stocks, ETFs, and sectors.

Flashforward to today and you can still get Stansberry’s broad look into the market with the “Investment Advisory,” but it has so much more to offer.

This site splits its services into “macro-level” and “specialized investment research,” but each of the individual newsletters offers a closer look into specific asset categories.

There are also various degrees of risk in each Stansberry Research service, ranging from conservative to extreme.

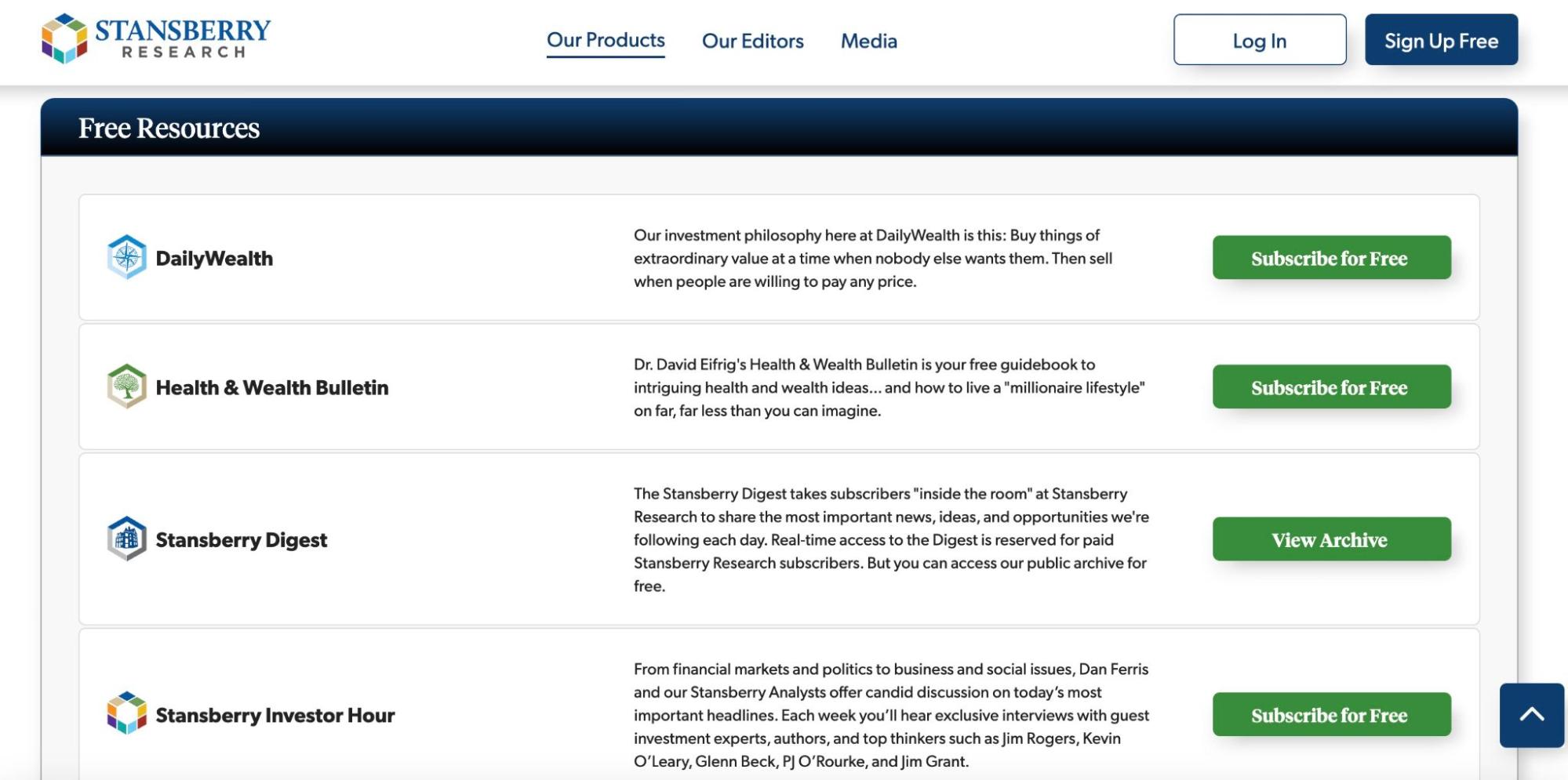

Beyond these paid subscription packages, there are free ways to review Stansberry Research’s usefulness.

For starters, Stansberry Research has a YouTube channel with over 575K subscribers and regularly posts videos on a wide range of topics.

There are also a few free guidebooks and email subscriptions, like DailyWealth and Stansberry Investor Hour, that allow you to check out Stansberry Research’s playbook.

Popular Products Breakdown

If I were to write exhaustive Stansberry Research reviews for every product, we’d be here all day.

There are currently 17 different paid subscriptions on Stansberry Research, each offering slightly different perspectives and focus areas.

On top of that, there are six free services.

Rather than bore you with details on every one of these offerings, let’s run through a few of the more popular picks.

Stansberry’s Investment Advisory

- What it’s about: This is the monthly subscription that sets Stansberry off and running. For an annual fee of $499, you’ll get a newsletter with Stansberry Research’s latest dish on what’s happening in the market, plus their core portfolio allocations.

- Who it’s for: Reviews of Stansberry Research list the Investment Advisory’s portfolio as “conservative,” which makes it an ideal fit for long-term holders who want chances for growth without high risk. Also, Stansberry Research says this portfolio works best if you have at least $1,000 to start investing.

True Wealth

- What it’s about: Contrarians can make serious money picking up assets when they’re ignored and at a discount. That’s the thinking behind the True Wealth monthly subscription, in which analyst Brett Eversole uncovers alternative assets while they’re under the radar. For $499 per month, you’ll get an insight into what’s in Brett’s bags and how to potentially make outsized gains.

- Who it’s for: While Stansberry Research reviews list True Wealth as a “conservative” strategy, keep in mind it might involve buying alternative assets that are harder to access (e.g., farmland or foreign stocks). If you have $1,000 to invest and want high-conviction alternative ideas, this may be the right call.

Crypto Capital

- What it’s about: Editor Eric Wade considers himself a true “crypto bro” with experience as a Bitcoin miner. Today, Wade shares his knowledge of web3 with readers of Crypto Capital to suggest high risk-to-return ideas in the cryptoverse. Even if you can’t tell BAT from BTC, the videos in this subscription will get you up to speed.

- Who it’s for: Investing in cryptocurrencies is only for those who have a high tolerance for volatility. While you can make outsized gains, it could also result in serious pain if you don’t have a risk management strategy. Also, keep in mind that it costs $5K per year to get Eric Wade’s wisdom.

Whitney Tilson’s Daily

- What it’s about: For those into investing or politics (or pro rockclimbing), you may have run across the name Whitney Tilson. This guy has an impressive resume as a hedge fund manager and politician, including ties with the legendary Warren Buffett. Here’s the excellent news for you: If you sign up for Stansberry Research, you can see Tilson’s perspective on the markets for free!

- Who it’s for: Anyone who’s a fan of Warren Buffett-style value investing will most appreciate Tilson’s comments on the market.

Pricing and Subscription Options

Honestly, you could get a lot of Stansberry Research reviews on the market without spending a dime.

You can access six publications just by signing up for a Stansberry Research account, including Whitney Tilson’s Daily, Stansberry Digest, and DailyWealth.

You could also peruse the Stansberry Research YouTube channel at your leisure.

However, when you get into the paid publications, each has a different yearly price that typically ranges from $500 – $5,000.

Remember, there’s a 30-day free trial with all of these subscriptions.

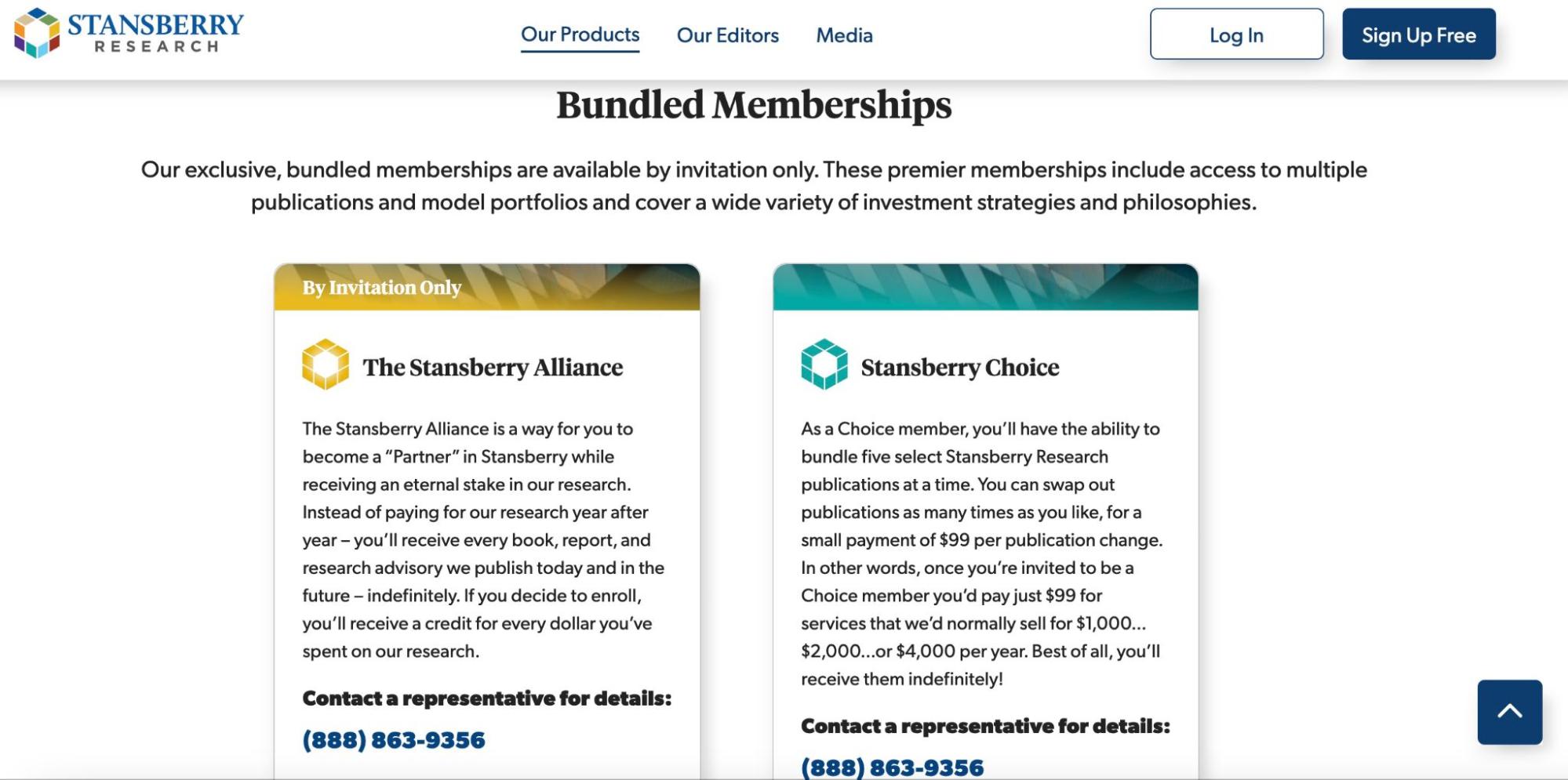

Also, Stansberry Research offers two “bundled memberships,” where you can buy a few subscriptions at a cheaper rate.

For instance, with “Stansberry Choice,” you get five subscriptions for $99 each.

There’s also a super fancy “Stansberry Alliance” where you get the whole shebang of Stansberry subscriptions as well as a “credit for every dollar you’ve spent on [their] research.”

The price?

Unfortunately, you need to know someone to get the opportunity to join the Stansberry Alliance, but chances are it’s a pretty penny.

Track Record: How Good Are the Picks?

It’s hard to judge Stansberry Research’s overall performance because it has multiple publications and various positions over the years.

That being said, it’s fair to say this firm has a mixed reputation considering some of their more public calls, as well as a few controversies and negative Stansberry Research reviews.

On the positive side, Dr. Steve Sjuggerud has made some solid real estate calls, and Stansberry Research has generally been on the right side of gold and Bitcoin.

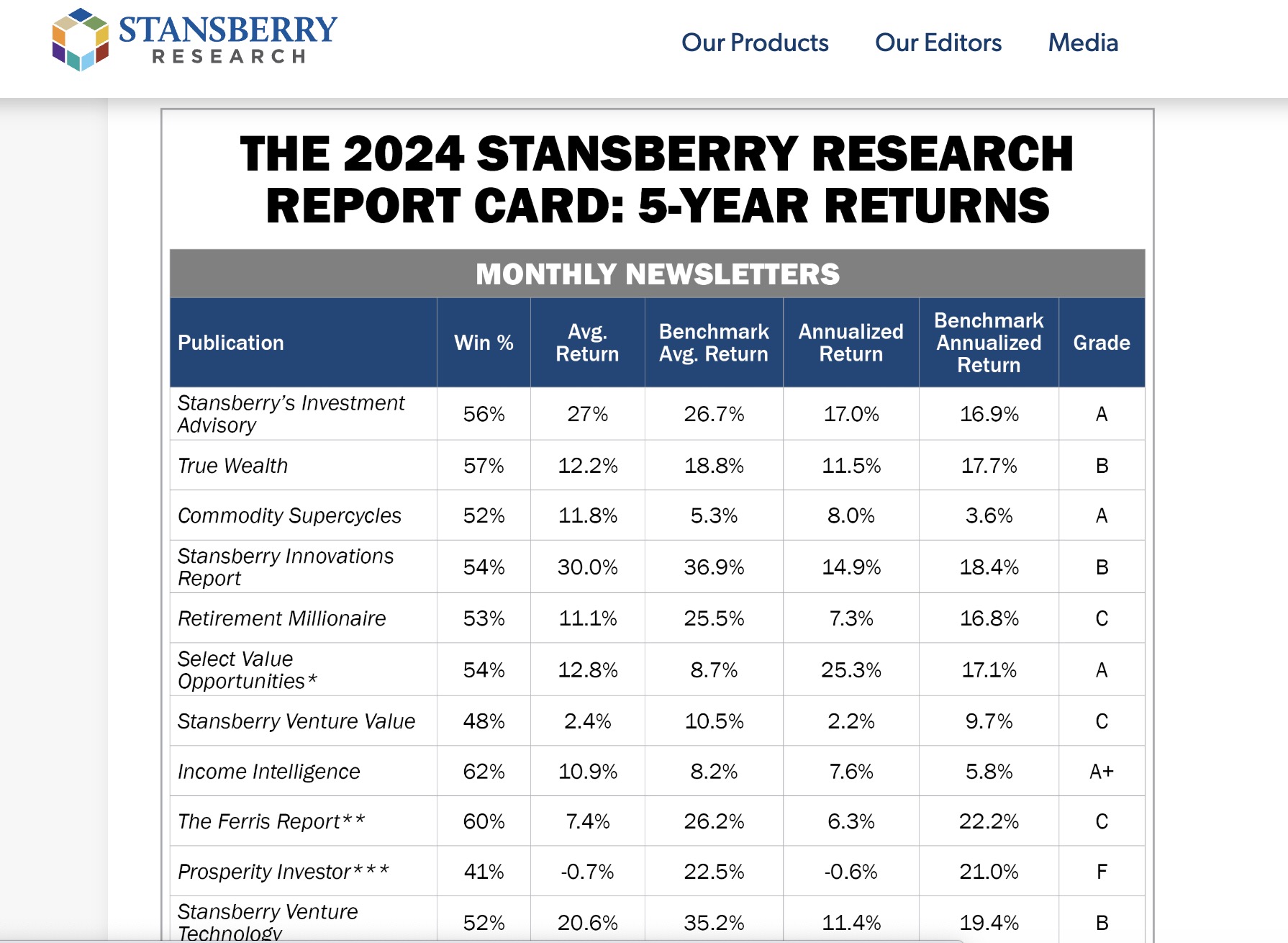

Stansberry Research also advertises win rates between 40% – 90% for its products — but would you expect an objective analysis in their own research report?

Look, that doesn’t mean Stansberry Research is a scam, but there are some concerning features to consider when sifting through the data.

Most notably, this company had a legal skirmish with the SEC over securities fraud and false investment claims.

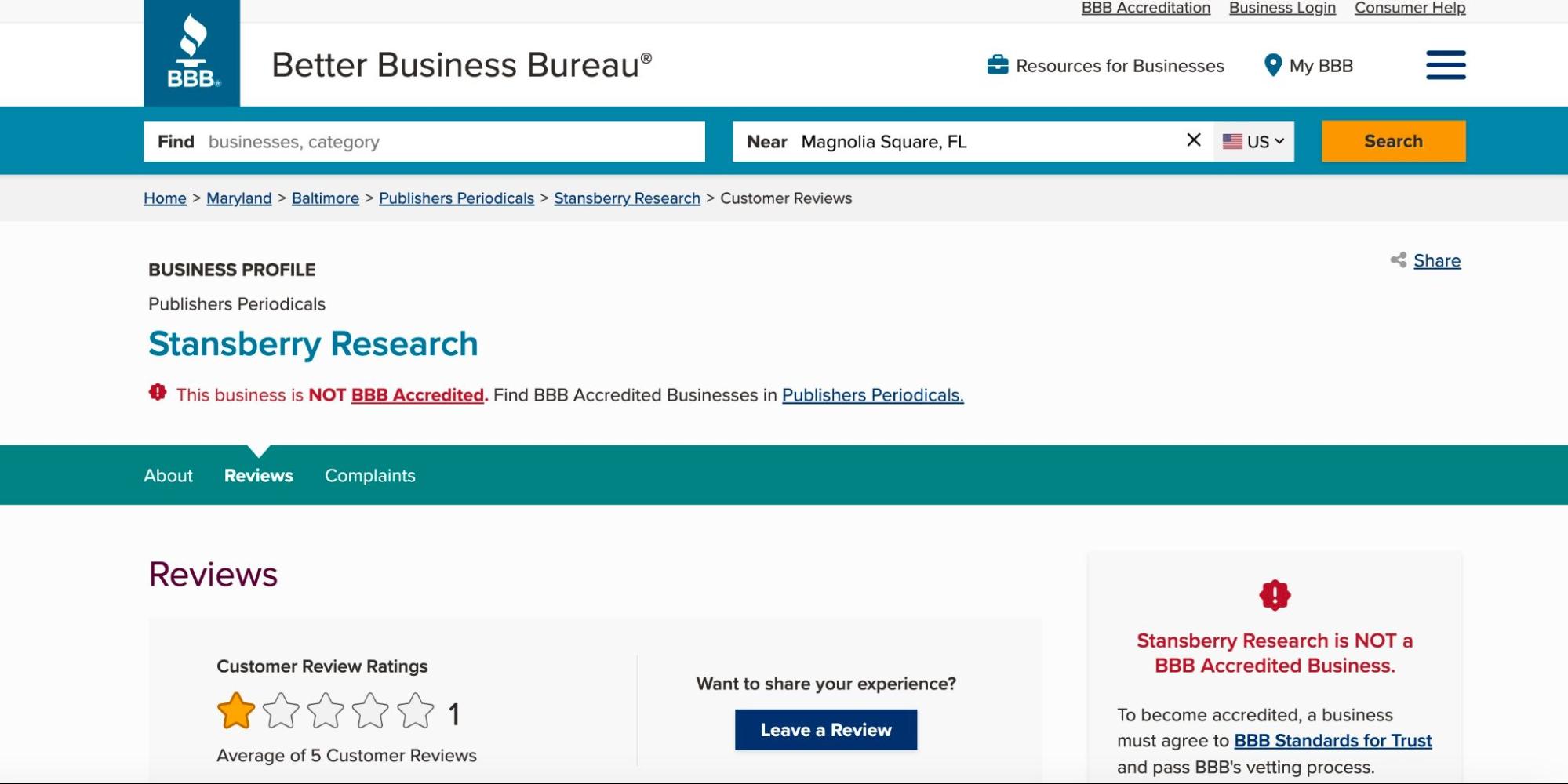

There are also negative Stansberry Research reviews to take note of both on the BBB and Trustpilot.

Many people who had gripes with Stansberry Research expressed disappointment with their picks and issues with billing, cancellations, or customer service.

Again, this isn’t to say Stansberry Research is a scam, but it’s important to consider these factors when deciding whether to use them.

Stansberry Research Pros And Cons

Pros of Stansberry Research | Cons of Stansberry Research |

Wide Array of Options: Stansberry Research is far more than a solo monthly newsletter. While this publication began with its signature Investment Advisory subscription, you can now find many other services covering different asset categories and risk profiles. | Customer Complaints: Stansberry Research doesn’t have the most confidence-boosting reviews on Trustpilot or the BBB. Quite the contrary — there are many issues involving cancellations, poor customer care, and lackluster investment suggestions. |

30-Day Trial, Refund Policy, and Free Features: You’ll enjoy a 30-day free trial no matter the subscriptions you choose. Plus, Stansberry Research advertises the most generous refund policy if you aren’t satisfied. You can also explore Stansberry Research’s many free features before committing to a publication. | Prior Controversies: Even with a long history, Stansberry Research has experienced many salacious situations. The most significant was an SEC case in 2003, and there are still questions over why Porter Stansberry left (and then came back and then left again). |

Long History: With over two decades of continuous operation and thousands of subscribers on YouTube, Stansberry Research is unquestionably a big operation. | Steep Pricing: Even “lower-tier” offerings on Stansberry Research will usually set you back $500 for the year (provided you don’t get five subscriptions for $99 each (which is still $500)). Sure, when you break it down, that’s just $42 per month, but some subscriptions are significantly higher, and there are plenty of competitors at lower prices. |

Who Should Subscribe?

Stansberry Research has some good and some bad in its past.

However, even critics have to admit that a brand with such a long history and 575K YouTube subscribers has something worthwhile to say.

It can’t all just be fear-mongering and clickbait, right?

For those looking for comprehensive market analysis from a long-standing firm, consider trying Stansberry Research’s free options.

Binge watch some of their YouTube videos, and read through their free services to get a feel for whether you’re getting value from these offerings.

After freeloading — er, “researching” — Stansberry Research’s offerings, you could look at their paid subscriptions and consider using the free trial.

Stansberry Research Alternatives

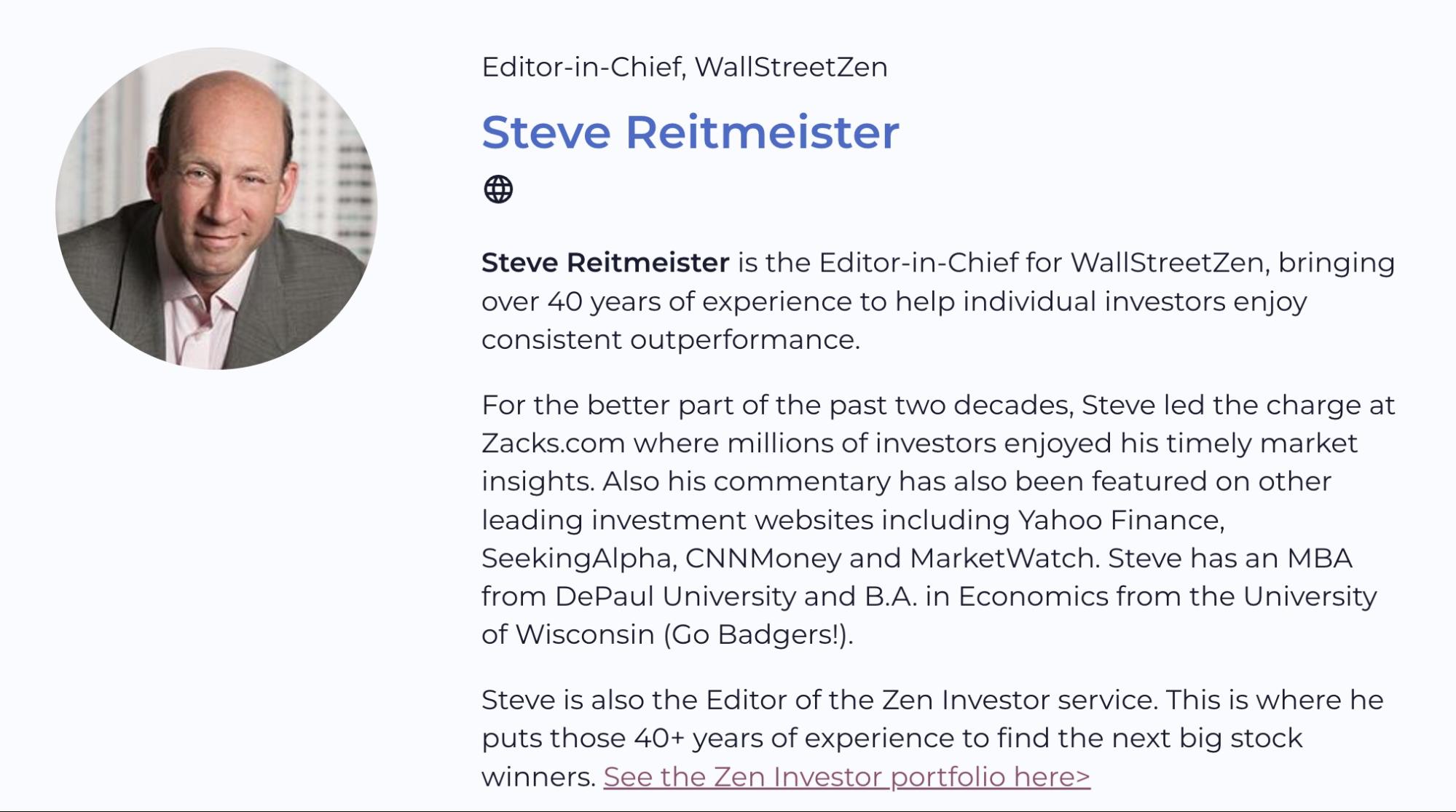

Zen Investor

- Price: $99 ($79 for a limited time, using links in this post) for 1 year

- Best For: Straightforward stock picks from a Wall Street legend

If you’re a DIY investor, you should somewhat enjoy researching companies you want to invest in.

But, let’s be honest, not all of us have finance degrees. It takes a lot of time to read through earnings reports and learn all those weird-sounding metrics like EBITDA and P/E ratios.

If you want the “straight sauce” on which stocks are the boss, Zen Investor is here to satisfy.

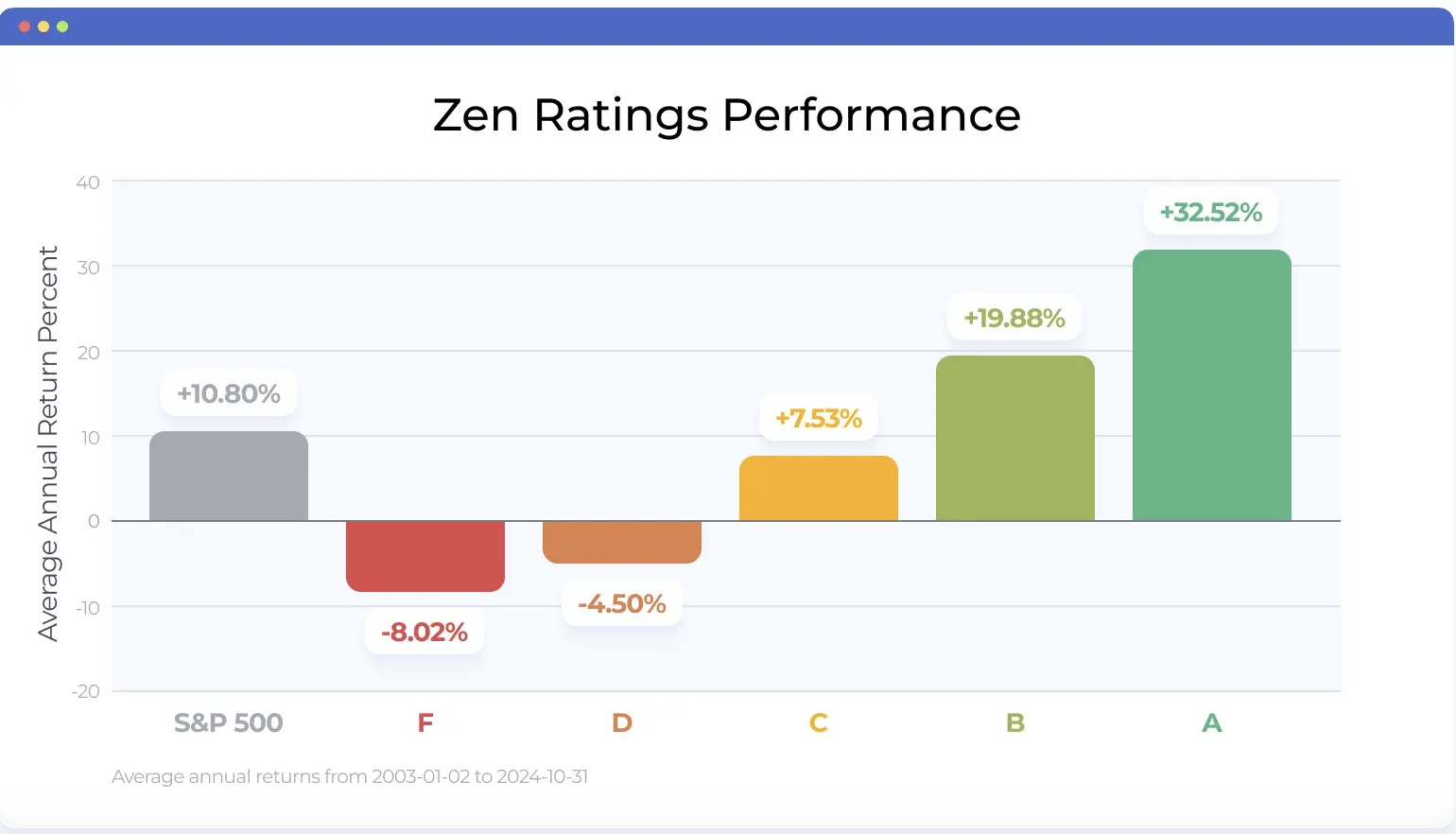

First, we run stock picks through our advanced Deep Learning algorithm to determine which companies have the most potential to outperform.

From here, we send the shortlist of “A” rated stocks to our resident Wall Street guru, Steve Reitmeister, who has experience at publications like Zacks.com and decades of first-hand knowledge on Wall Street.

This combination of AI analysis and a “gut hunch” gives you some powerful stock picks to consider every month.

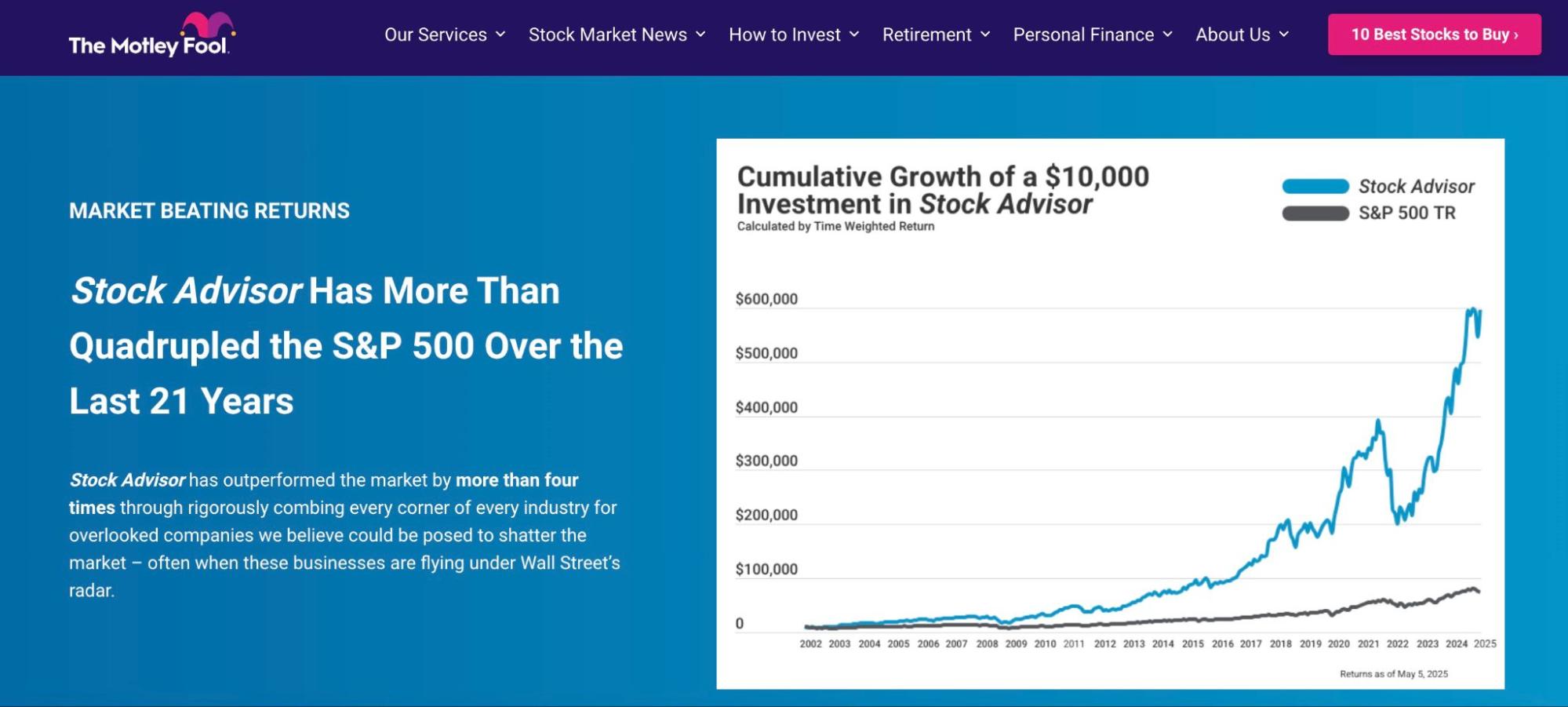

Motley Fool Stock Advisor

- Price: $199

- Best For: Combination of stock picks and DIY investment tools

Although the Motley Fool likes to play court jester, these analysts are serious about stocks.

Since the start of its Stock Advisor subscription in 2002 until mid-2025, the Motley Fool’s portfolio ballooned by over 900% versus the S&P 500’s still respectable 162% gain.

If you’re curious about which companies make the cut on the Motley Fool’s buy list, you could subscribe for an Advisor membership.

Advisor members also receive two new stock picks every month in their email.

Beyond these stock recommendations, you can use DIY research tools like the Fool IQ and the retirement-focused Gameplan portal.

Find out more about Motley Fool’s Stock Advisor here.

Seeking Alpha

- Price: $299 per year (Premium)

- Best For: A wealth of screening metrics and opinion articles

If you thrive on diverse opinions and heated dialogue, Seeking Alpha may be the best homebase for research.

Founded in 2004, this website constantly churns out news articles, expert analyses, and reviews on different investments to give you a better clue on where to put your money.

Those with a Seeking Alpha Premium pass can also explore detailed fundamental metrics on companies and see how each pick performs in Seeking Alpha’s Quant rating system.

Just keep in mind that the SA Premium subscription won’t give you specific stock picks.

For those not keen on DIY research, you’ll have to look into the separate Seeking Alpha Picks plan, which delivers two high-conviction stocks to your inbox each month.

In either case, Seeking Alpha has gained a positive reputation amongst Wall Street junkies for its wealth of resources and algorithm-powered analytics.

Those who favor a more hands-on approach will most appreciate SA Premium, while people who just want stock ideas can check out Alpha Picks.

Learn more about Seeking Alpha here.

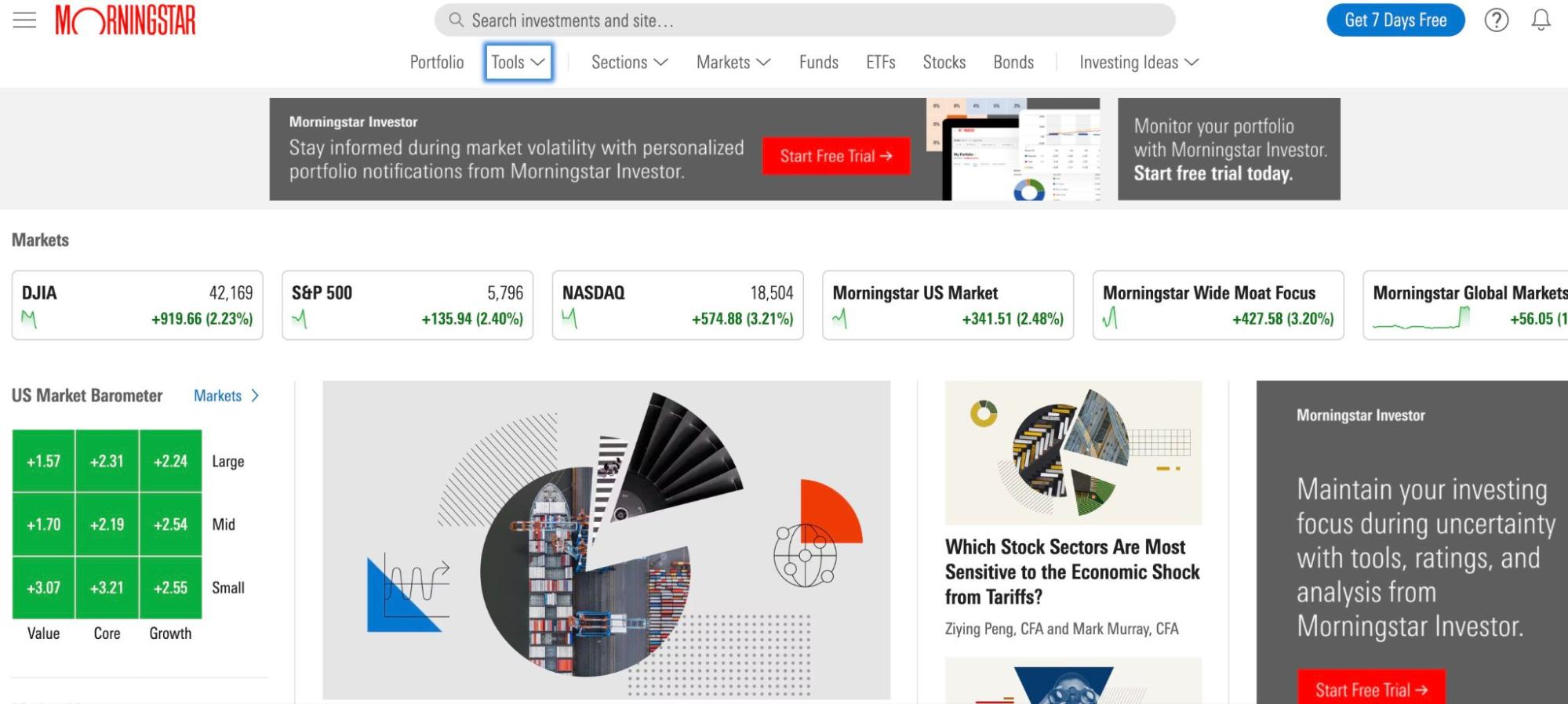

Morningstar

- Price: $249 annually

- Best For: DIY investors who want fundamental research

Henry David Thoreau would have a fit if he knew a financial publication used his image in their name.

But that’s exactly what happened with Morningstar in 1984.

Since its inaugural issue, Morningstar has become increasingly well-regarded on Wall Street for its proprietary ranking system, especially for ETFs and mutual funds.

Subscribers to Morningstar get a wealth of tools that center around fundamental analysis and might help you get a better sense of which investments offer the most promising prospects.

There’s also an X-Ray tool where you can get a more in-depth look into the “health” of your portfolio and consider making adjustments.

While you won’t receive specific stock picks on Morningstar, you’ll get a lot of data and articles to inform your opinions on different investments.

Find out more about Morningstar here.

Final Word: Is It Worth It?

If you’re looking to bulk up your market analysis and find potentially promising investments, Stansberry Research might be worth a trial run.

However, the best strategy would be to take full advantage of their YouTube channel and all their free features before buying a specific subscription.

Be sure you feel comfortable with all Stansberry Research has to offer regarding analysis and research tools — as well as common complaints in Trustpilot — before committing money.

For those not sold on Stansberry Research reviews, consider a more straightforward stock picking service like Zen Investor.

Find out more about Morningstar

FAQs:

Is Stansberry Research worth the money?

Stansberry Research is a legit publication with many newsletters offering different market perspectives. Whether it's "worth it" depends on your preferences and if you believe in the quality of their research.

How much does Stansberry Research cost per year?

There are over a dozen subscriptions on Stansberry Research, each with a different annual fee. Generally, the lowest you'll pay for these subscriptions is $500, but they could be in the thousands of dollars annually.

What is the most popular Stansberry Research newsletter?

It's hard to say which Stansberry Research publication has the most paying subscribers at any given moment, but its flagship Stansberry's Investment Advisory remains popular.

Can I trust Stansberry Research stock picks?

That depends on who you ask. Some reports claim these services have a high win rate, while third-party reviews suggest otherwise. Consider watching Stansberry Research's YouTube channel and using their free research to see whether you agree with their analysis.

What is the Stansberry research scam?

Stansberry Research is not a scam, but reviews are mixed and it might not be the best option for you. Stock-picking newsletters like Zen Investor and fundamental research platforms like Morningstar have more to offer for a lower price tag.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.