If you frequent stock research sites, you’ve probably come across The Oxford Club, which offers a series of publications featuring stock picks and investment advice.

Many Oxford Club reviews make it seem like the newsletters are like a fast-forward button to riches — but are they really all that?

Let’s take a closer look.

Is The Oxford Club Legit? The Bottom Line

The Oxford Club is a legit publication with a long history plus analysts who have credibility in financial analysis.

However, there’s limited transparent data on the quality of their picks, and there are so many different newsletters that it can be hard to know where to get started.

On the positive side, the Oxford Club offers 365-day full-money refunds on products like its Oxford Income Letter, so you have that assurance when signing up.

Additionally, the prices for some of the more advanced trading services are hefty. As such, many investors may be better off with an alternative like Zen Investor for more actionable, to-the-point stock picks that have been through AI analysis and personal expert consideration.

A more affordable alternative…

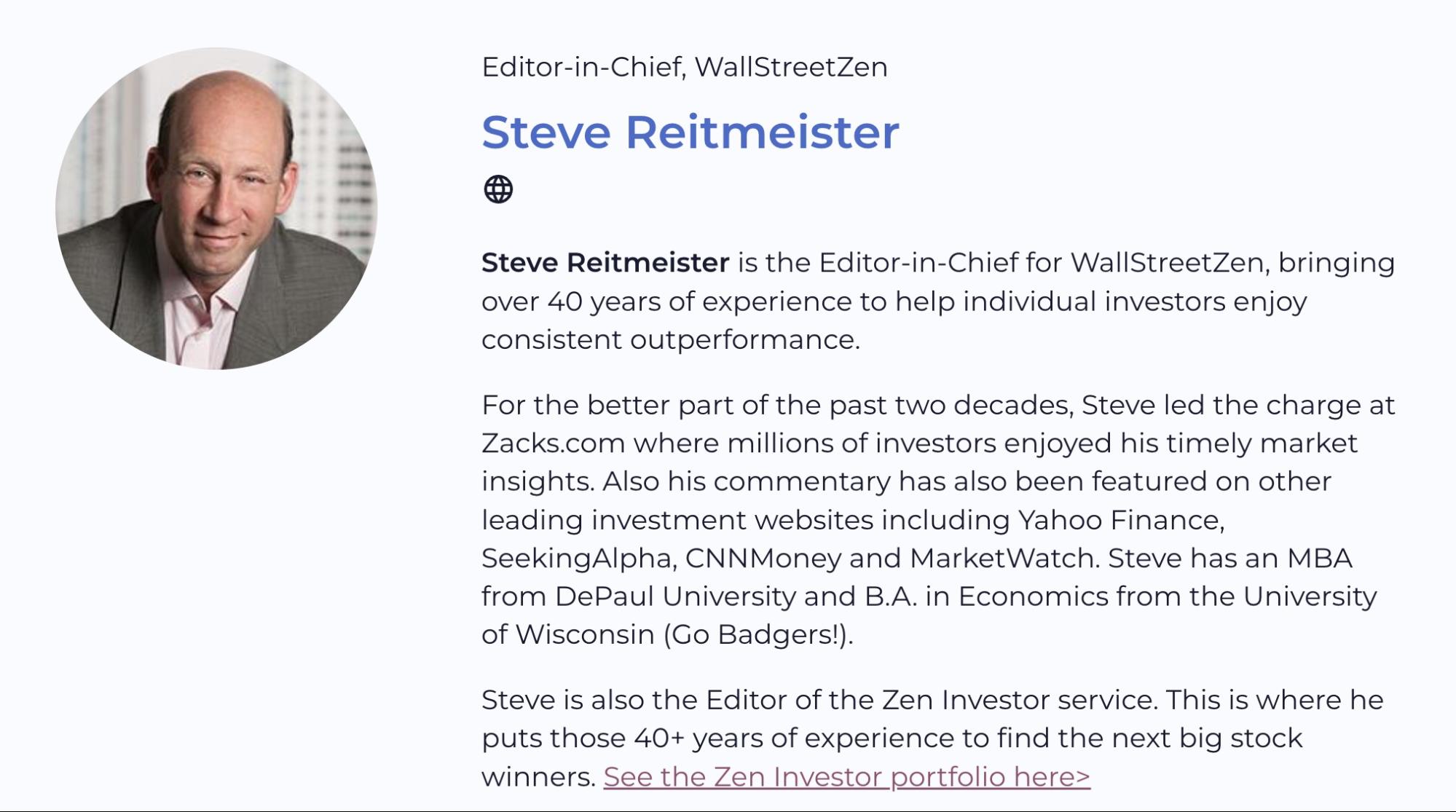

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

The Oxford Club Newsletters and Trading Services

One reason writing Oxford Club reviews is tricky is that there is no solo “Oxford Club” membership.

Instead, this site offers a plethora of financial publications, trading services, and even a “Voyager Club” for travel.

To make this easier to digest, let’s take a look at a few of the big Oxford Club offerings to give you a taste of their top financial flavors:

Oxford Communiqué

Say what you will about the Oxford Club, but they sure know how to make things look sophisticated.

Rather than call their publication something trite like “Tribune,” they went with “Communiqué” (complete with the oh-so-French accent aigu).

Kidding aside, this is the central publication at the Oxford Club with articles by the Chief Investment Strategist Alexander Green.

For a $99 yearly subscription, you’ll get the monthly newsletter with Green’s gander on the global market and investments he’s eyeing. (Using this link you can get a bunch of additional free extras, too)

And don’t worry if you’re impatient for Green’s goodies. You’ll also get a weekly Oxford Communiqué Portfolio Update with timely insights.

For even more intel, you could upgrade to the Oxford Communiqué Pro account, which includes key benefits like:

- “The Profit Accelerator” alerts on “buy the dip” opportunities.

- Priority access to a monthly “State of the Markets” video chat.

- The “Market Outlook Monthly,” which shares even more tips for the upcoming weeks.

Just keep in mind the Pro account is significantly higher at $995 per year.

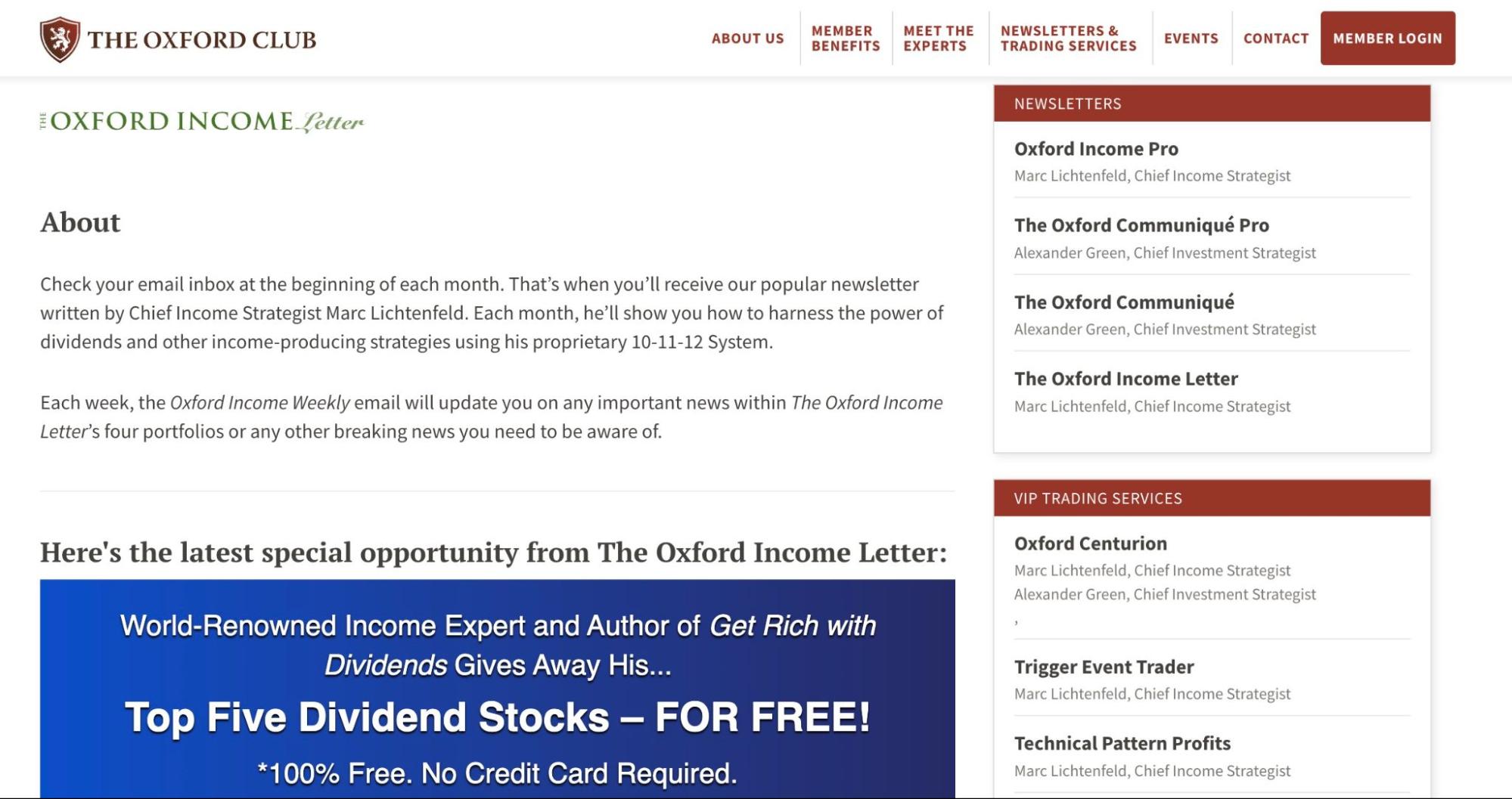

Oxford Income Letter

While most Oxford Communiqué reviews highlight this publication’s general focus on investing, the Oxford Income Letter has a more narrow area of interest:

Generating interest.

Specifically, this monthly newsletter focuses on promising investments that offer consistent yields through dividends.

Instead of getting insights from Mr. Green, you’ll hear from Chief Income Strategist Marc Lichtenfeld on what investments look the most attractive from a passive income perspective.

Similar to the Oxford Communiqué, you’ll also get an Oxford Income Weekly email with more timely insights into strategy changes.

The standard yearly subscription costs $79, but you can upgrade to the deluxe plan for $129 per year if you really want a doctorate in dividends.

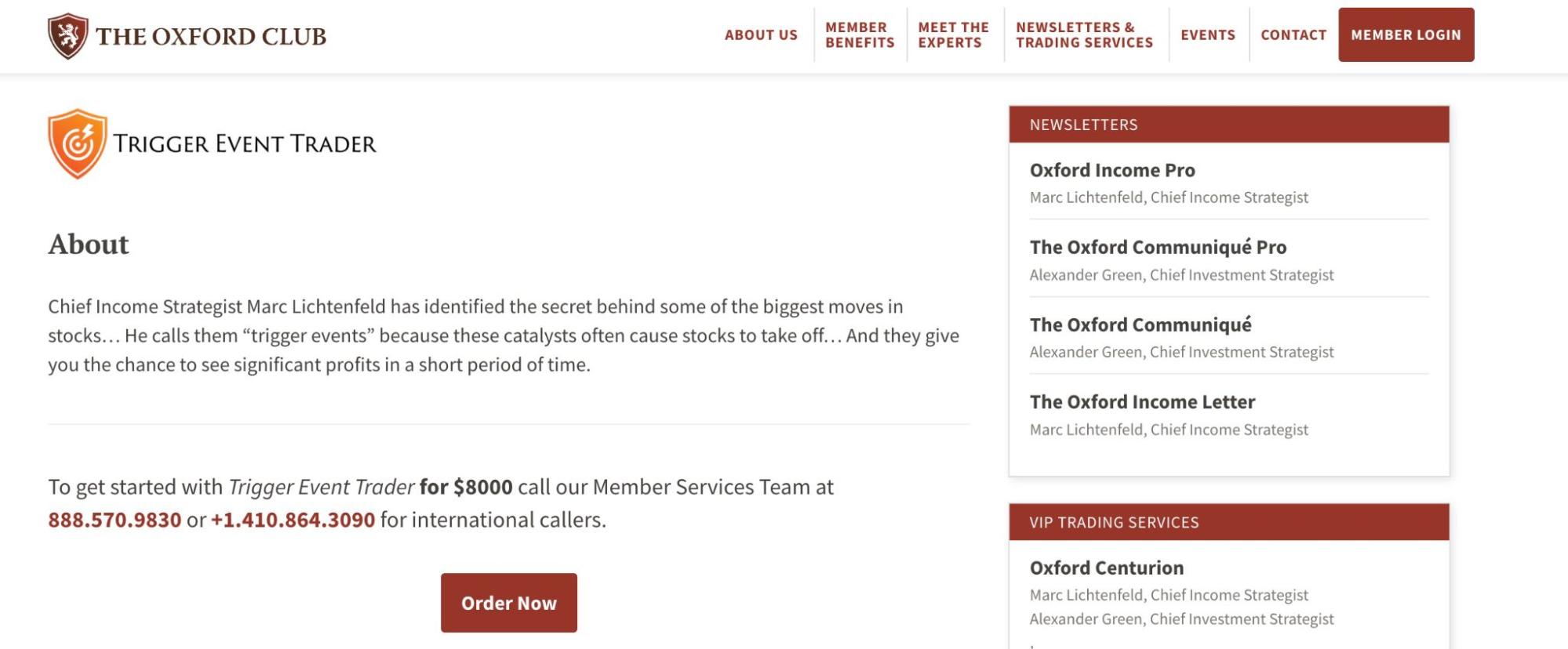

Trigger Event Trader

When you start looking into the “VIP trading strategies” categories on the Oxford Club, you’ll notice the entry prices shoot up quickly.

For instance, the Trigger Event Trader costs $8,000 to join.

And what do you get with this membership?

According to the Oxford Club, you get an in on stocks primed to take off thanks to a pattern Chief Income Strategist Marc Lichtenfeld identified.

Unfortunately, these VIP services are a bit more secretive, and you need to call Oxford Club directly to learn more.

So, you’ll have to take the club’s word for it that they’ve cracked a technical code and can get you into tickers before they explode.

Oxford Microcap Trader

Even freshmen in finance know that smaller stocks have a greater risk-to-return profile.

However, it takes a real genius to pick out promising penny stocks that get investors closer to early retirement.

For those willing to take on this high-risk game, Oxford Microcap Trader might provide some insights (for a price, of course).

In this case, you have to shell out $10,000 to figure out how Alexander Green is throwing around his green.

While this VIP offering advertises potential 10x gains, remember the steep entry price.

Technical Pattern Profits

Whatever you believe about technical analysis, there are tons of patterns and indicators that can give you insights — especially in the short term.

If you believe in the power of charting patterns but can’t be bothered learning the technicalities, then the Oxford Club offers its Technical Pattern Profits VIP program.

With this package, you get to hear about a unique pattern Chief Income Strategist Marc Lichtenfeld uses to take advantage of big swings in the market.

This plan even has an enticing backstory where Marc received this wisdom from a Wall Street wizard before he became one with the charging bull above.

Is it true? Does it work?

It’ll cost you $4,000 to find out.

The Momentum Alert

If you’re more into fundamental analysis, then the Momentum Alert might be a better fit.

Supposedly, this VIP trading service uses 100-plus years of data that Alexander Green put into a fabulous formula.

According to the advertisement, this indicator produced a portfolio with an average total win of 63% (even with the “losers”).

The entry fee into this Oxford Club trading feature is $4,000.

The Insider Alert

As much as the SEC tries to squash insider trading, let’s get real: Some people have juicy info to use to their advantage.

The Insider Alert claims to make you one of these savvy investors by sending monthly insights compiled by (of course) Alexander Green.

If you want to get the latest gossip in the hidden corners of hedge funds, you’ll need to send the Oxford Club $4,000.

Oxford Bond Advantage

The Oxford Club claims its Bond Advantage is one of the most popular VIP trading services thanks to its predictability.

After all, bonds have fixed interest rates, and there’s little risk of default if the issuers have a good reputation.

Investors apparently love that this offering lets you know your expected returns and pay dates.

You’ll need to invest at least $4,000 to get started with the Oxford Bond Advantage.

Oxford Centurion

If you want the crème de la crème of Oxford Club experiences, then consider joining the Oxford Centurion group.

This highest tier will make you a part of a collaborative investing team with all of the Oxford Club’s bigwigs (sort of like a wealth management service).

Unfortunately, access to this tier isn’t currently available, and there are no details on pricing.

However, you could join the waitlist if you really want to don the figurative Roman helmet and be a part of this elite team.

Are The Oxford Club Newsletters Worth the Cost?

Without knowing what the Oxford Club recommends in its communications, it’s hard to say whether their analysis is “worth it.”

Even if the ideas in the Oxford Club don’t perform better than the S&P 500, everyone will probably judge their opinions differently depending on their goals and investing style.

That being said, this publication has a long history, and the prices for the standard issues of the Oxford Communiqué and Oxford Income Letter aren’t too bad.

Also, don’t forget that you can get a refund within 365 days if you don’t vibe with the Oxford Club.

If you’re intrigued by what the Oxford Club is selling, consider trying it and taking them up on their refund policy.

For those more interested in general knowledge, stick with the flagship Communiqué. However, anyone who wants more dividend-style strategies should check out the Oxford Income Letter.

Who is Behind The Oxford Club?

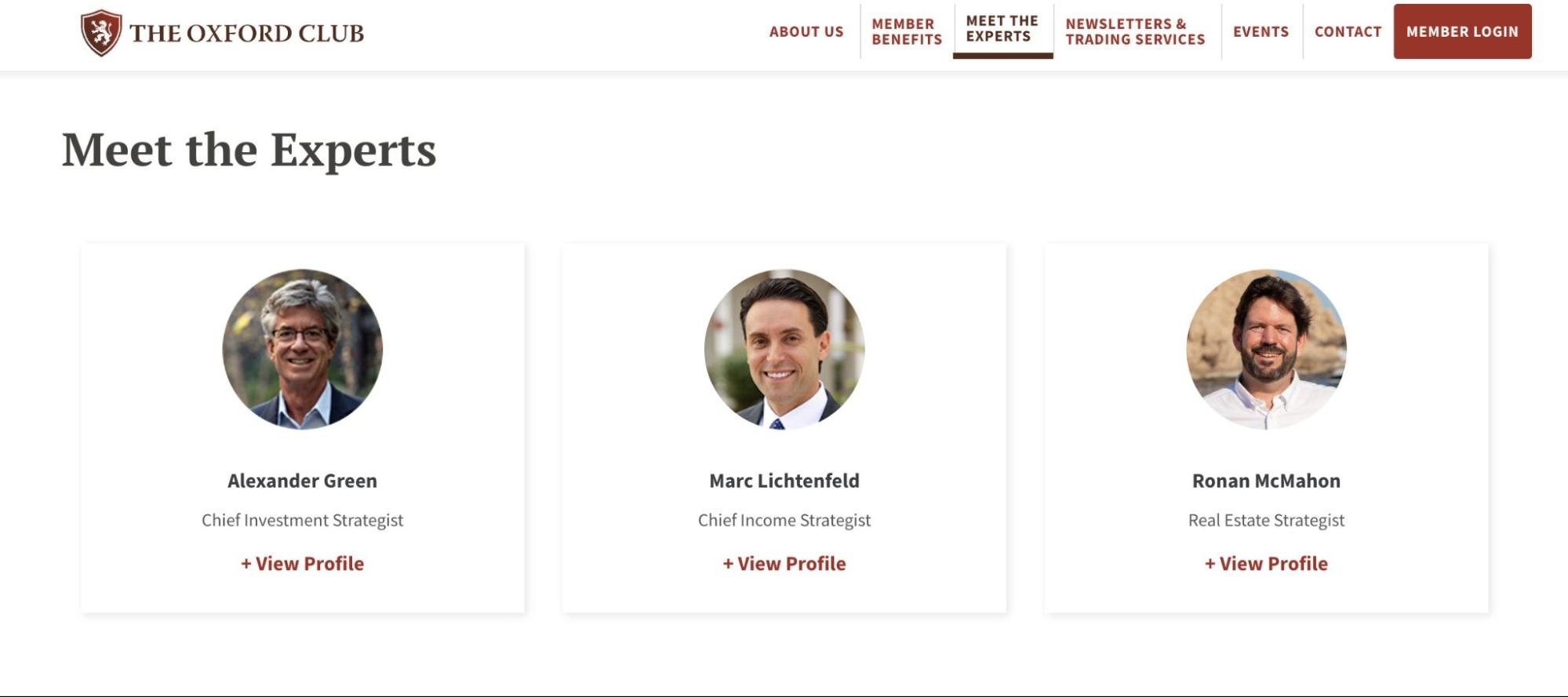

Now you know all about the Oxford Club’s core offerings, but who are the supposed savants making these stock picks?

Here’s a quick rundown on the top three names at the Oxford Club and their reputation in finance.

Alexander Green

Before serving as Chief Investment Officer at the Oxford Club, Alexander Green worked primarily as a portfolio advisor for over a decade on Wall Street.

This previous work gave Green insights into how money moves and allowed him to retire in his 40s.

According to Green, he wants to share these financial strategies with readers through both the Oxford Club and other books and publications.

Aside from the Oxford Club, Green has a few best-selling titles like The Gone Fishin’ Portfolio and he works for the Liberty Through Wealth publication.

Marc Lichtenfeld

Marc Lichtenfeld serves as the Chief Income Strategist on the Oxford Club’s team, and he’s best known for heading the dividend-focused Oxford Income Letter.

So, how did Mr. Lichtenfeld get into the markets? According to his bio, he got his start as an analyst for Carlin Equities and Avalon Research Group.

With the expertise he gained at these positions, Marc Lichtenfeld moved on to contribute to various financial publications, including Jim Cramer’s TheStreet and The Wall Street Journal.

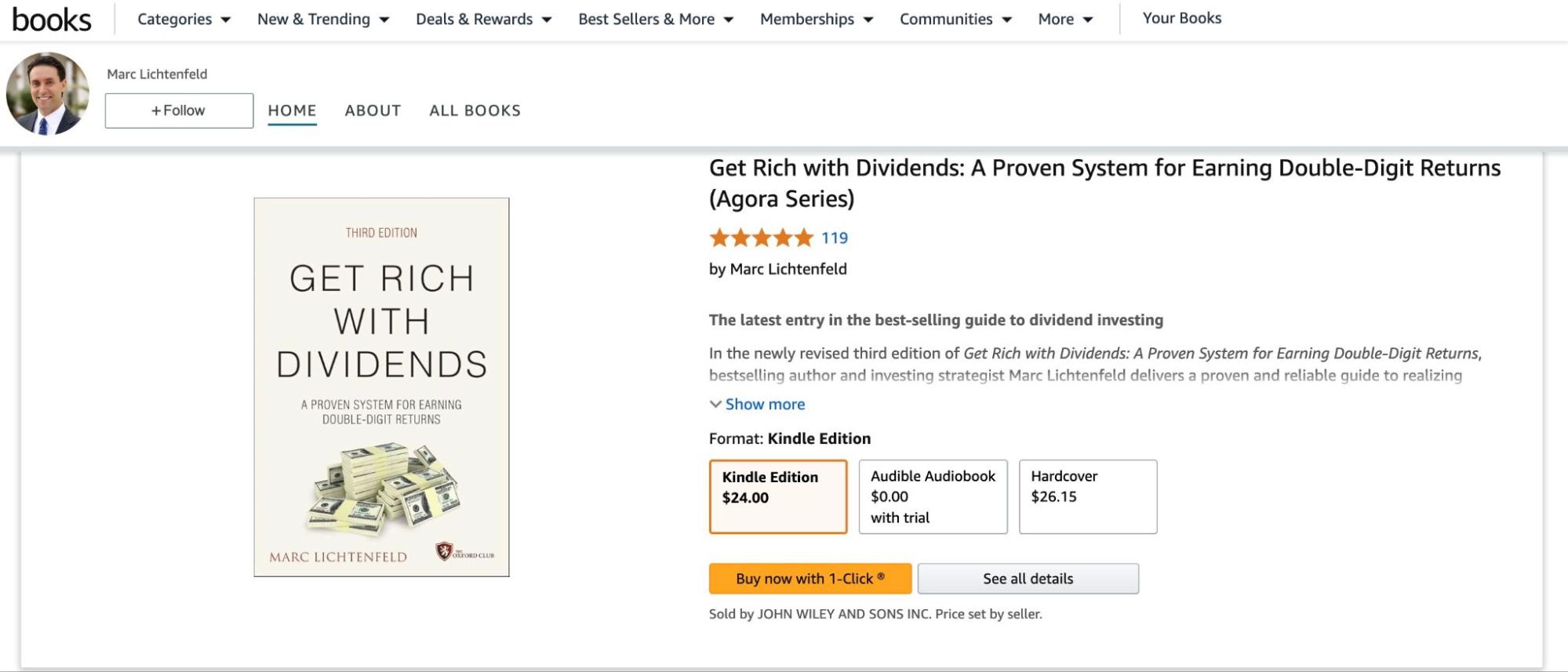

Like Mr. Green, Marc Lichtenfeld has a few books to his name, including Get Rich With Dividends: A Proven System for Earning Double-Digit Returns.

Ronan McMahon

If you want to know the Oxford Club’s opinion on real estate, Ronan McMahon is your man.

As the Chief Real Estate Strategist, Mr. McMahon focused on the international real estate market and aims to provide insights in his Oxford Club contributions.

According to McMahon’s LinkedIn page, he worked for Pangea Research Group before creating his own company Real Estate Trend Alert in 2008.

Pros and Cons of The Oxford Club

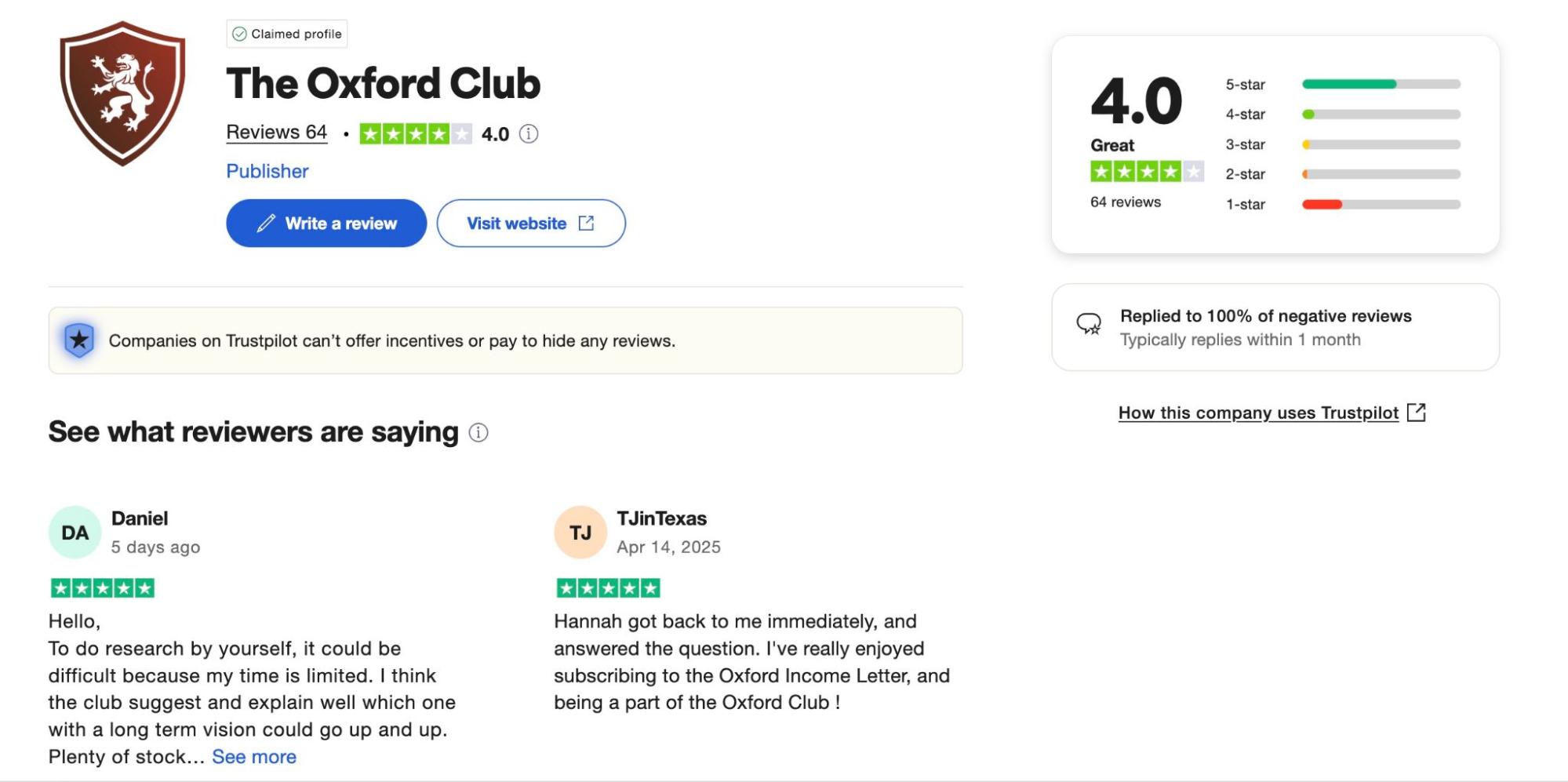

If you go on review sites, you’ll quickly find that the Oxford Club’s reviews are mixed.

While things look OK on Trustpilot, there are plenty of complaints to consider on the BBB.

Also, it’s always hard to tell genuine from fake reviews online, especially when there aren’t many to go by.

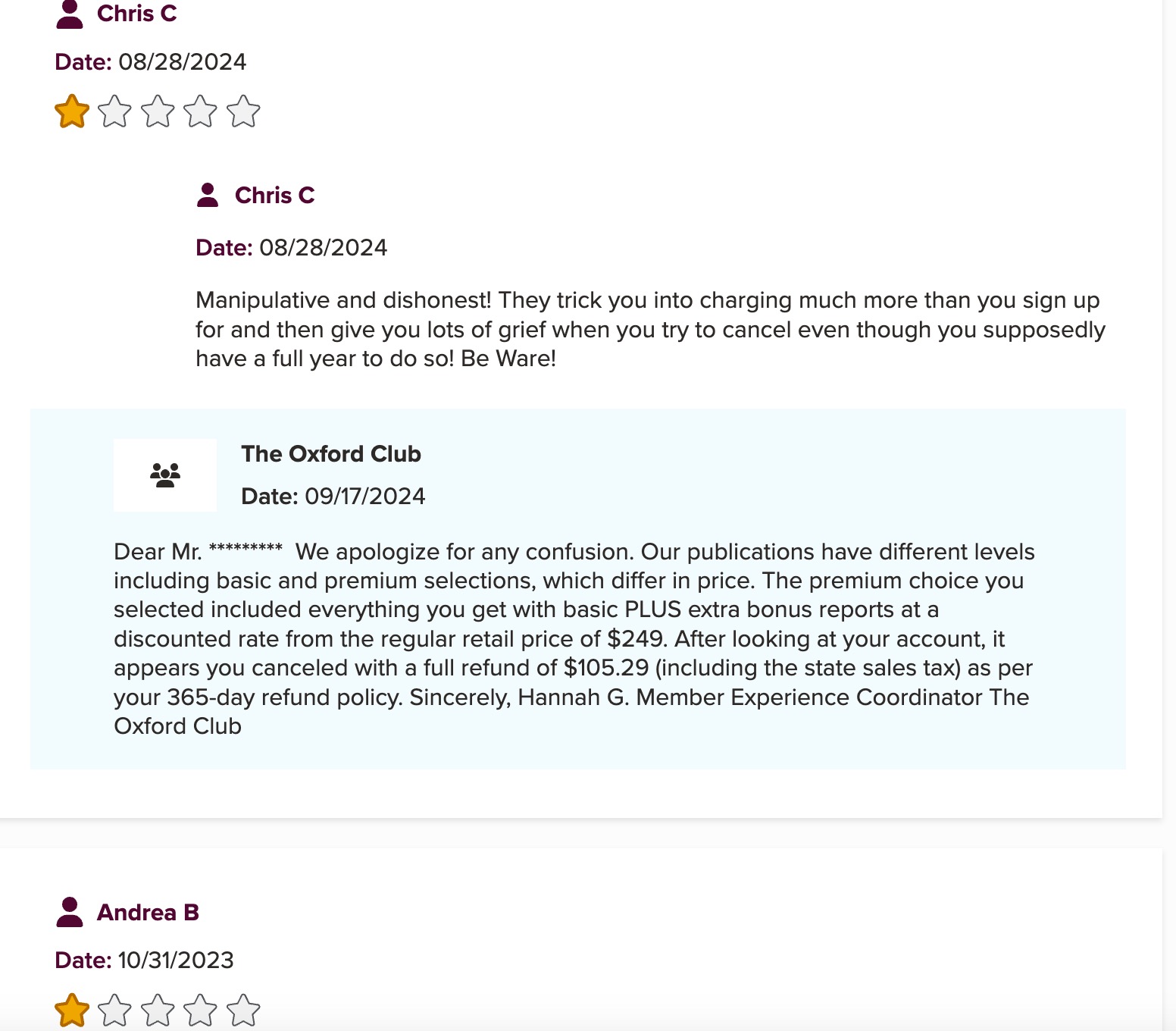

The biggest cons in Oxford Club reviews center around customer service issues and difficulties canceling a subscription.

A few reviews claim that the investment advice Oxford Club gave turned out to be low-quality.

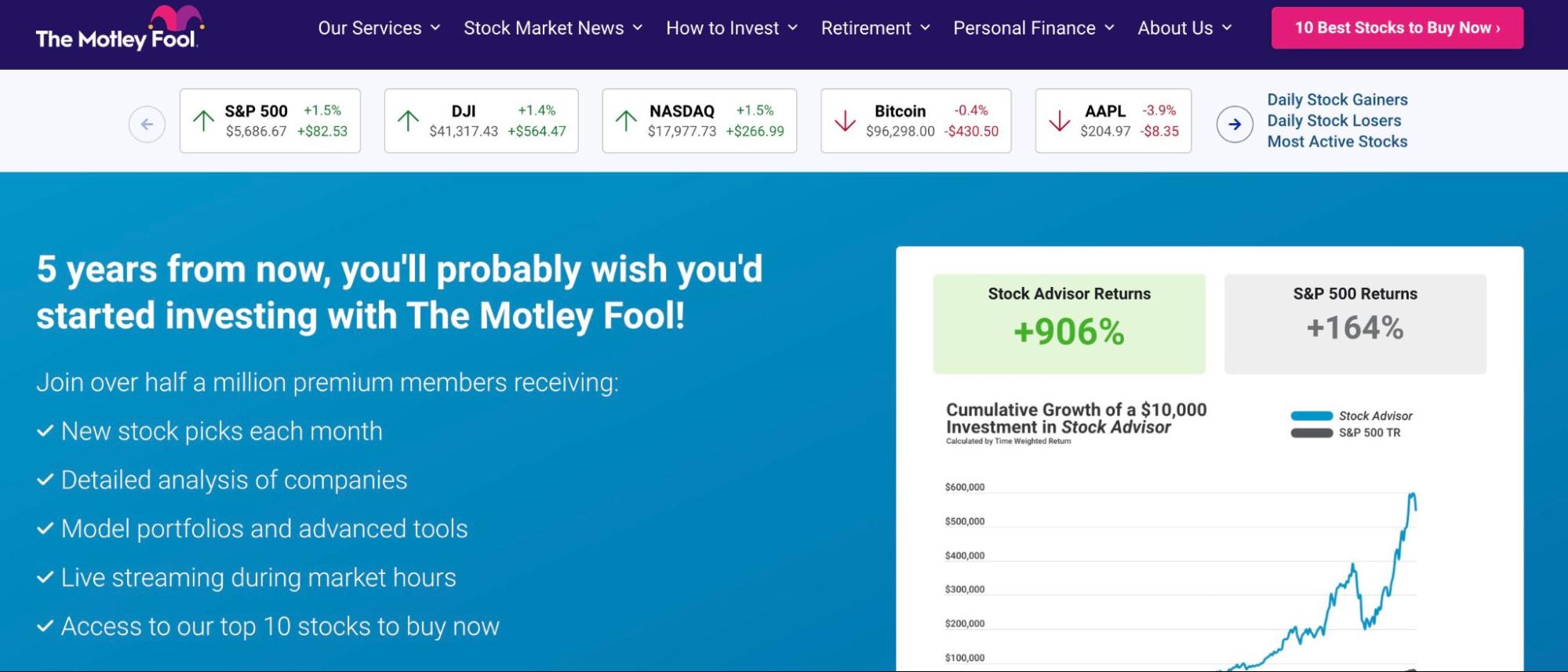

Unfortunately, the lack of reputable reviews and transparency from the company makes the Oxford Club a riskier choice compared to more established names like the Motley Fool.

This is especially true with the VIP trading services that cost a lot of money and don’t give you a ton of transparency on trade performance or strategies.

But to be fair, the Oxford Club has a long history, and its expert panel is transparent.

There’s also a one-year refund policy on the core publications, and the prices for the standard editions are reasonable.

The big question mark here is whether any of the info or trading advice the Oxford Club dishes is worth the entry dollars.

If you want to try the Oxford Club, start by reading all of the BBB complaints to prepare for the worst-case scenario.

You can then consider starting with the flagship Oxford Communiqué or Oxford Income Letter to test the waters and see if their analyses jive with your mind.

Alternatives to The Oxford Club Newsletters

The Oxford Club may have a history going back to the 1980s, but it’s far from the only newsletter covering Wall Street.

If you don’t feel like the Oxford Club is your cuppa Earl Grey, consider an alternative analysis or stock picking service.

1. Zen Investor – Best for Investors Who Want to Keep it Simple

- Cost: $99/year ($79 for a limited time, using links in this post)

Researching stock opportunities can get super complex super fast.

Sure, it can be thrilling to look through companies and try to spot the next stock with 10x potential, but who has time for that?

If you want to stay involved in the markets but aren’t keen on spending hours evaluating equities, then Zen Investor may be the solution.

Our proprietary stock-picking service blends the best of both Deep Learning analysis and human expertise to give you some of the highest conviction stocks to consider.

And, yes, we have data to back up the quality of our findings.

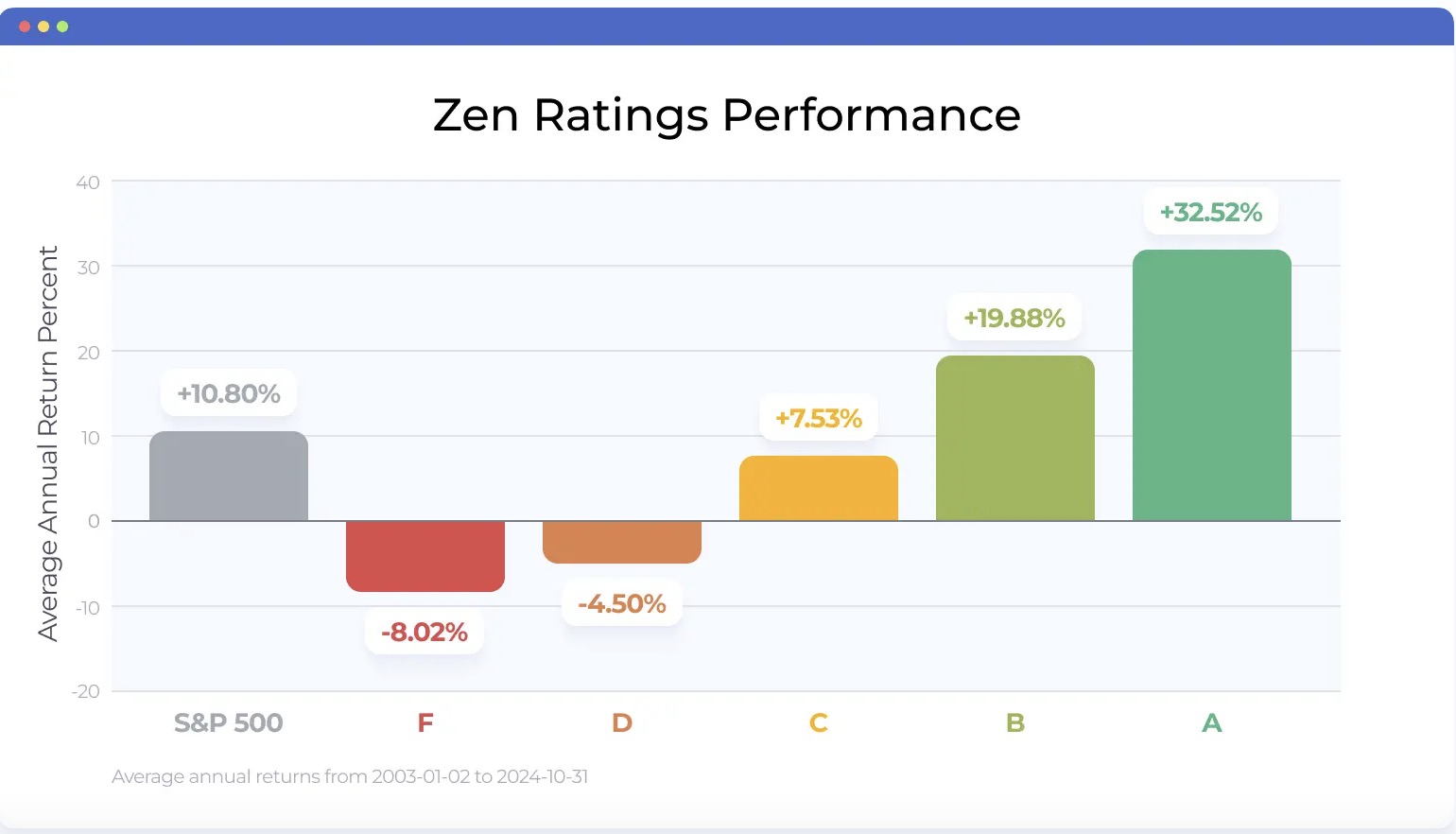

On average, stocks that rank an “A” using WallStreetZen’s rating system have rewarded investors with a 32.52% gain.

But remember that we don’t just consider our AI system when making stock picks.

We also send all of these well-vetted stocks to Wall Street veteran Steve Reitmeister for the final green light.

Even if you’re new to investing, you’ll get all the details you need to take action with our easy-to-understand analyses.

2. Motley Fool Epic – Best for Investors Who Want an All-in-One Resource

- Cost: $499 per year ($299 for a limited time using links in this post)

The word “epic” gets tossed around a lot nowadays, but many investors feel it’s justified in the Motley Fool’s premium subscription service.

Anyone interested in stocks and investing has probably run across the Motley Fool’s website or headlines at some point.

With a history going back to the 1990s, this site has become one of the most trusted brands for stock picking, particularly thanks to the performance of its hot Motley Fool Advisor portfolio.

While the Motley Fool Advisor is still available and attractive, you’ll get way more analytics and stock picks by upgrading to Motley Fool Epic. (Read our Motley Fool Epic review to find out more.)

On top of five well-researched stock ideas each month, a Motley Fool Epic account gives you financial tools like quant projections, retirement planning, and an exclusive podcast.

As a bonus, you can get a full refund within 30 days if you aren’t crazy about the advice or tools in your Epic account.

3. Stock Market Guides – Best For Investors Who Just Want Stock Picks

- Cost: $19 per month or $149 per year (Stock Investing Scanner service)

Sorry Harry Potter fans: Time-turners don’t exist.

But just because we can’t go back in time doesn’t mean we can’t learn from the past.

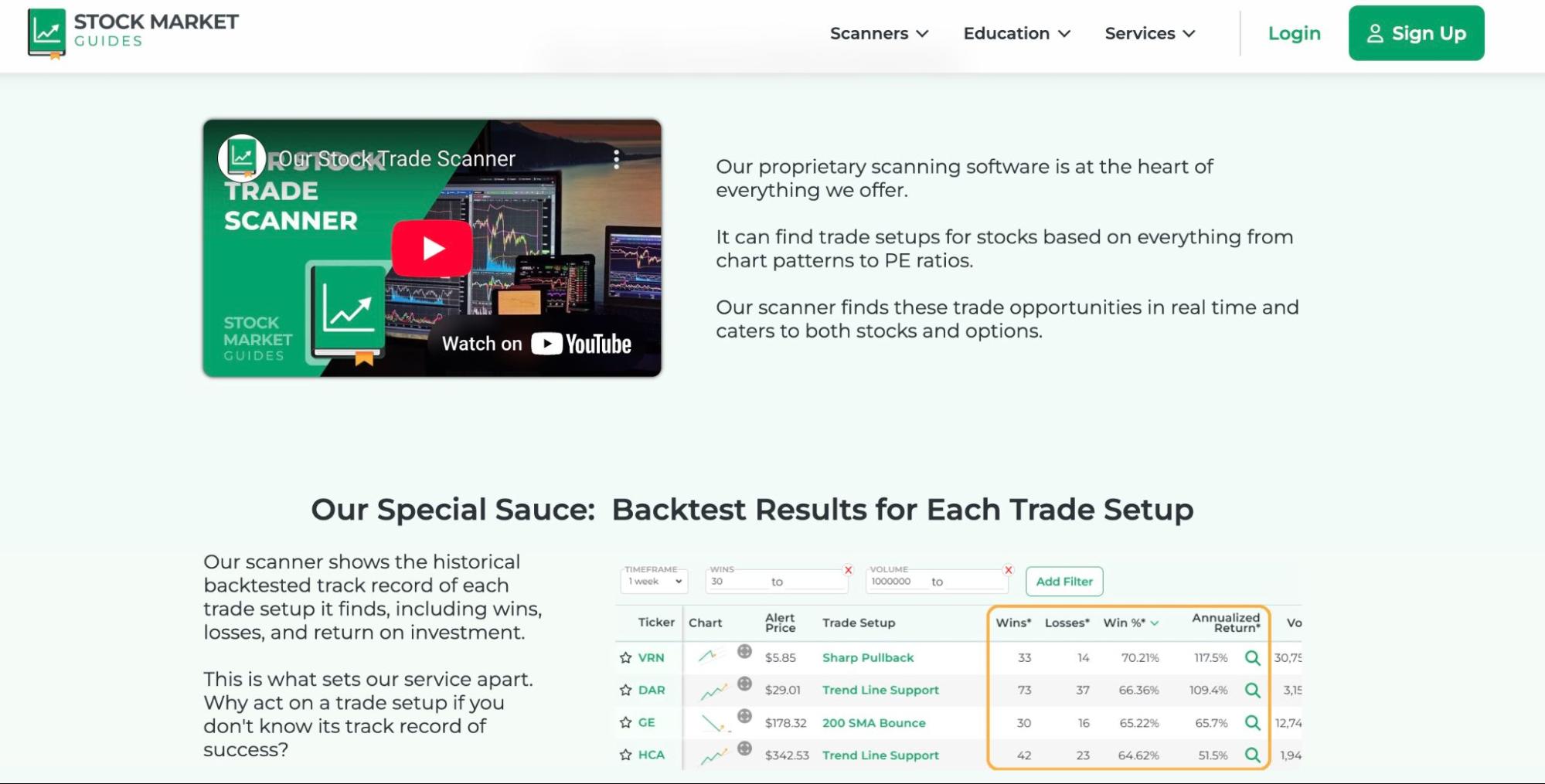

In fact, many stock traders use historical data through “backtesting” algorithms to better predict future movements.

Case and point: Stock Market Guides uses its backtesting algorithm to deliver stock picks to your inbox.

A great feature about Stock Market Guides is how simple these emails are formatted. This allows you to gain quick insights and figure out how and whether or not to take action.

If you prefer swing trading or options, Stock Market Guides also has separate plans focused on these strategies.

Anyone who wants to harness the power of historical patterns may want to consider giving Stock Market Guides a try.

Final Word on The Oxford Club

Not all Oxford Club reviews are bad — but then again, there aren’t many to go by online.

For a company that has been around for decades, seeing that there aren’t tons of online ratings is a bit concerning.

Also, the minimums for the professional trading services are steep compared to other more transparent stock picking services.

Does that mean the Oxford Club is bad? Not necessarily.

It’s just there’s not enough info or special features to get really crazy about this service.

To understand Alexander Green’s investment philosophy, you could read a few of his best-sellers before signing up for the Oxford Club.

If you’re still interested in the Oxford Club, it’s probably best to stick with the signature Oxford Communiqué or Oxford Income Letter and get a sense of their financial analysis.

Alternatively, consider using another stock picking service like Zen Investor for more actionable guidance with a proven track record.

FAQs:

Is Alexander Green legit?

Alexander Green is a real financial analyst and author who contributes to multiple publications and has written a few best-selling books, including The Gone Fishin' Portfolio.

How much does it cost to join the Oxford Club?

There isn't one flat fee to join the Oxford Club, so you have to look into the specific publication or feature you're most interested in.

However, the flat fee for the flagship Oxford Communiqué is currently $99 per year.

Is the Oxford Communiqué worth it?

If you dig Alexander Green's investment style from his books, then the Oxford Communiqué may offer a fresh perspective on global markets.

What does the Oxford Club do?

The Oxford Club claims to help its members live wealthier lives by providing education, analysis, and services to achieve financial independence.

How much does the Oxford Club Chairman's Circle cost?

You have to call the Oxford Club for the latest details on the one-time payment to become a Chairman's Circle member.

However, some Oxford Club reviews suggest it's about $7,000 to get this VIP status.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.