Reflektive is not publicly traded at this time. However, there are still ways for investors to gain indirect exposure.

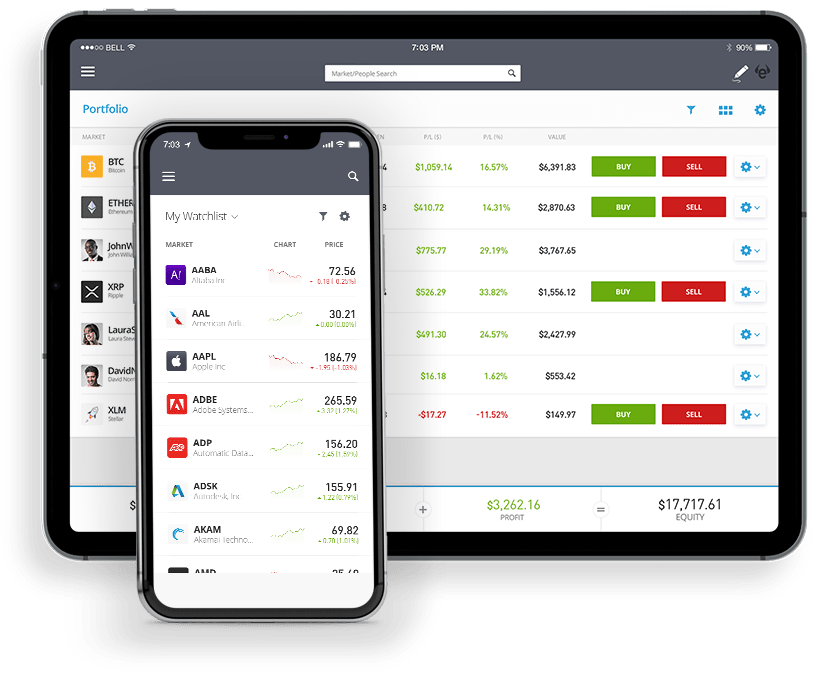

Discover like-minded companies (and public companies with a connection to Reflektive) below. If you choose to invest in any of them, consider one of our favorite brokers — eToro. (Use that link for a $10 bonus — terms and conditions apply.)

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Communication between remote-work employees and reporting managers can be tough — but HR software firm Reflektive appears to truly understand the challenge.

Beyond HR software, Reflektive offers solutions to help organizations streamline an often sensitive area. Investors seem to like their vision — the company has raised over $100 million over the course of four funding rounds.

Sounds compelling, right? Interested in how to buy Reflektive stock? While the company’s still private, there are potential ways to gain exposure. Keep reading to find out more…

Reflektive: The Basics

Reflektive helps establish a strong link between an employee’s objectives and that of the manager, department, and, ultimately, the broader organization.

For many companies and employees, Reflektive is a dream come true.

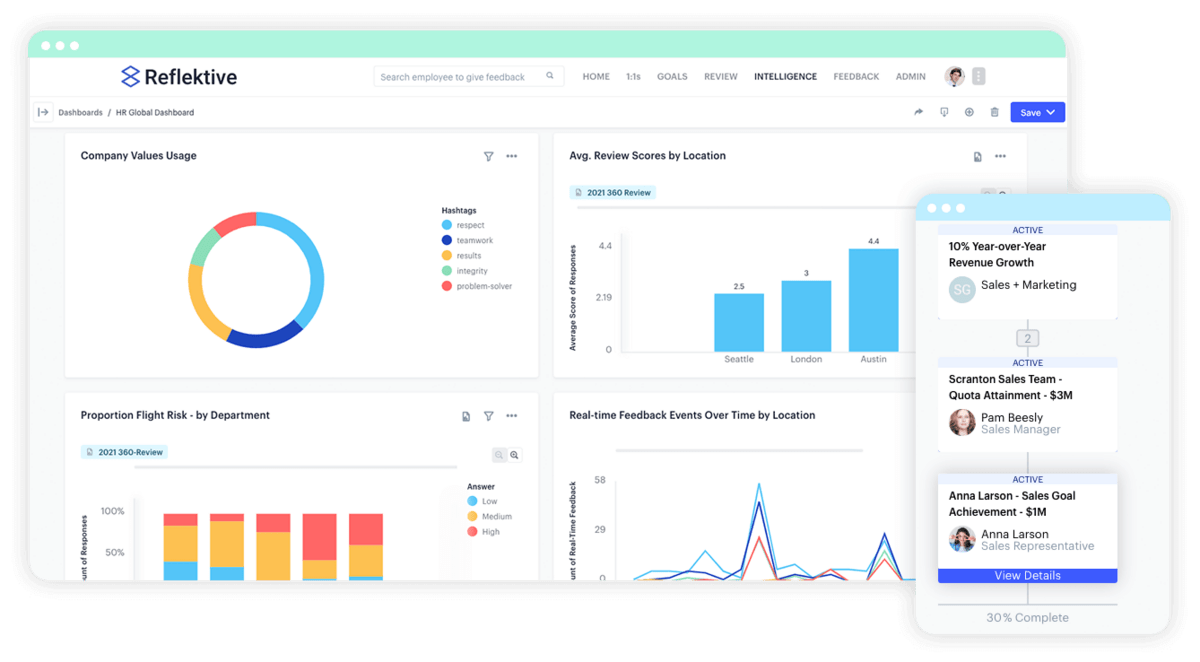

What makes Reflektive stand out is its ability to produce customized dashboards to assess any segment of an organization. Performance metrics can be drilled down to individual employees or zoomed out by team, department, or division.

Here are some fast facts about this human resource startup:

- Reflektive was founded in San Francisco in 2014 by Rajeev Behera, Jimmie Tyrrell, and Erick Tai.

- The company has raised over $100 million over the course of four funding rounds.

- It’s received backing from prominent investors like Andreessen Horowitz, Base10 Partners, Lightspeed Venture Partners, and TPG Growth.

- In 2021, talent management software company PeopleFluent, owned by Learning Technologies Group plc (which is listed on the London Stock Exchange as LTG), acquired Reflektive.

- Reflektive was shown to boost organizational productivity by 1.9X (92% of employees surveyed found Reflektive’s feedback helped them perform better compared to 48% pre-Reflektive).

- The platform has been shown to double employee engagement and has improved employee retention by 1.3X.

- Major brands like Squarespace, Dropbox, and Allbirds rely on Reflektive for day-to-day HR activity.

- Reflektive can be integrated with popular services and tools like Slack, Outlook, and Teams.

That’s wonderful, but you’re here to learn how to buy Reflektive stock, so let’s get on with it!

Can You Buy Reflektive Stock? Is Reflektive Publicly Traded?

Unfortunately, we cannot show you how to buy Reflektive stock because it doesn’t exist. As a private company, Reflektive is not listed on any public exchanges.

That said, below, we’ll describe exactly how you’ll be able to purchase it should it become publicly traded. After all, a company this popular and well-reviewed could easily IPO in the future.

So, is that it? Are you out of luck until an IPO?

Not even close.

How to Buy Reflektive as a Retail Investor

At this time, retail investors cannot purchase Reflektive since it is a privately owned company. That could easily change, so keep an eye out for a Reflektive IPO in the future.

Both retail and accredited investors can explore other public market alternatives, like those detailed below.

Who Owns Reflektive?

Reflektive was founded by Rjeev Behra, Erick Tai, and Jimmie Tyrrell and is a privately-owned company.

In 2021, Reflektive was purchased by Learning Technologies Group (LTG), the parent company of PeopleFluent.

Does Andreesen Horowitz Own Reflektive?

While venture capital firm Andreessen Horowitz doesn’t own Reflektive, they are one of six major investors to back the company during multiple funding rounds.

Reflektive is owned by PeopleFluent, part of Learning Technologies Group (LTG).

How to Invest in Reflektive Stock as a Retail Investor

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

While you can’t invest directly in Reflektive stock as a retail investor, that doesn’t mean you can’t obtain exposure to the industry where the company operates. In fact, numerous potential Reflektive competitors are already available for investment today by retail investors.

Here are a few examples:

Kelly Services Inc. (NASDAQ: KELYA): Kelly Services is a Michigan-based office staffing company with a global footprint. The company provides various workforce management solutions, including KellyConnect, “a holistic quality monitoring approach,” according to their website.

KellyConnect provides companies with extensive performance management services, including tools for measurement, feedback, and, importantly, insightful analytics.

If you’re a retail investor looking for exposure to an exciting HR-focused company, you might want to consider shares of Kelly Services.

Insperity Inc. (NYSE: NSP): HR company Insperity is another publicly-traded company that may be suitable for retail investors seeking an alternative to Reflektive. Among a wide range of HR services, Insperity offers performance management support, including helping firms develop customized performance standards and appraisal processes.

Insperity also offers compensation services, recruitment support, and liability management training, among other offerings.

Automatic Data Processing (ADP) Inc. (NASDAQ: ADP): Automatic Data Processing, Inc., better known as ADP, is a giant human resources management software developer and HR services provider. With over 60,000 employees, ADP is far from a startup, and that’s a good thing for some investors.

ADP Performance Management is a vital part of the company’s offering. The service helps connect workers to the goals of the wider business. Like others in the sector, their focus is increasingly tilting towards continuous employee feedback.

How to Buy the Reflektive IPO

When and if Reflektive becomes publicly traded, you want to ensure you have the ability and know-how to purchase shares as quickly as possible.

To that end, here are the steps on how to buy Reflektive stock if and when it becomes available on public exchanges:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro). While the signup process can be relatively quick, it’s far from instant. Don’t wait until the IPO before signing up.

- Search for Reflektive

- Select how many shares you want to buy

- Place your order

- Monitor your trade

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Reflektive Stock Price Chart

Since Reflektive is not publicly traded, no Reflektive stock price chart is available.

If Reflektive were available to purchase, it would include a stock ticker that you could enter into most major charting platforms.

For example, imagine you wanted to see the five-year history of Automatic Data Processing (NASDAQ: ADP); you could simply enter the full name or ticker into a platform like TradingView.

As the following chart shows, ADP – one of the largest names in the staffing and employment services sector – has outperformed the broader market over the past five years.

FAQs:

How to buy Reflektive stock?

Reflektive is not a publicly traded company, so it does not have shares available for sale. As a result, we cannot show you how to buy Reflektive stock.

Reflektive is a private company and does not issue stock that retail investors can purchase. However, during past funding rounds, of which Reflektive has had four, backers have invested in the company via private deals.

How much is Reflektive stock?

Since Reflektive doesn’t trade on public exchanges, it does not issue stock, and therefore there is no Reflektive stock price or Reflektive stock price chart. As of their most recent round, Reflektive has secured over $100 million in private investment.

What is the Reflektive stock symbol?

As a private company, there is no Reflektive stock symbol. Reflektive does not trade publicly and thus does not maintain publicly listed shares. As a private company, there is no Reflektive stock symbol. A unique Reflektive stock symbol will be assigned if they IPO in the future.

Who owns Reflektive stock?

As of 2021, Reflektive is owned by PeopleFluent - a division of Learning Technologies Group plc (LTG). Reflektive was founded in San Francisco in 2014 by three individuals: Erick Tai, Jimmie Tyrrell, and Rajeev Behera, and boasts investment from major backers like Andreessen Horowitz.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.