Bluesky Social has emerged as a refreshing alternative to mainstream social networks like Twitter and Facebook, capturing attention across the digital sphere in a social media landscape dominated by polarizing algorithms and privacy concerns.

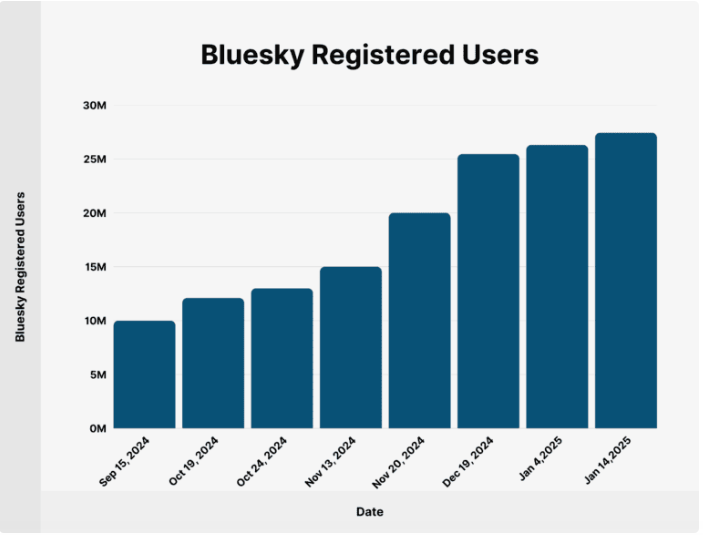

Initially conceptualized by Twitter co-founder Jack Dorsey, this decentralized social platform has experienced explosive growth in the last four years, expanding from just 1 million to over 27 million users.

Many investors wonder how to invest in Bluesky Social, given its focus on user control, customizable feeds, and decentralized architecture.

But is investing in this Twitter alternative possible? Let’s explore your options for gaining exposure to one of social media’s most talked-about platforms.

What is Bluesky Social?

Bluesky Social is a decentralized social media platform running on the AT Protocol, an open-source framework that gives users unprecedented control over their experience.

Founded as a Twitter project in 2019 but spun off in 2021, Bluesky is now an independent public benefit corporation led by CEO Jay Graber.

The platform offers over 50,000 customizable algorithmic feeds, allowing users to curate their content experience without being subject to a single company’s algorithm decisions.

While similar to Twitter in its microblogging format, Bluesky emphasizes user autonomy, privacy, and content control.

How we find stocks before they explode…

A Zen Investor subscription can save you time researching potential investments by letting a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Can You Buy Bluesky Social Stock? Is Bluesky Social Publicly Traded?

If you’re looking for the Bluesky Social stock price, or Bluesky Social stock symbol, you’ll be disappointed. Bluesky Social is not publicly traded.

As a private company operating as Bluesky Social PBC (Public Benefit Corporation), it doesn’t have publicly available shares or a stock ticker symbol.

Retail investors cannot simply log into their brokerage accounts to purchase Bluesky Social stock. The company would need to conduct an Initial Public Offering (IPO) before becoming available on public markets, which has not happened yet.

However, there are still ways to benefit from Bluesky’s growth trajectory, which we’ll explore below.

A Note About the Pre-IPO Market

Investors can invest in select private companies via pre-IPO marketplaces.

Participating in these pre-IPO marketplaces allow investors to potentially benefit from a company’s ascent upon going public. However, it’s important to note that these investments carry significant risk due to factors such as low liquidity and high market volatility.

There are several marketplaces for this type of investing — our favorite is Hiive.

At the time of writing, there are no Bluesky Social shares on Hiive. However, it may be listed in the future. Bookmark Hiive today and stay up to date on the latest offerings.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

Alternatives to Bluesky Social for Retail Investors

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

While you can’t directly invest in Bluesky Social stock, as a retail investor, you can gain exposure to the social media sector through these publicly traded alternatives:

1. Meta Platforms (NASDAQ: META)

Meta Platforms (NASDAQ: META) owns Facebook, Instagram, and WhatsApp, making it the largest social media company in the world.

Despite its massive size, Meta’s earnings grew by 60% year over year in 2024, driven by a focus on operating efficiencies.

Meta has also shown impressive AI-driven growth, and a successful AI integration strategy could be instructive for how other platforms like Bluesky might evolve.

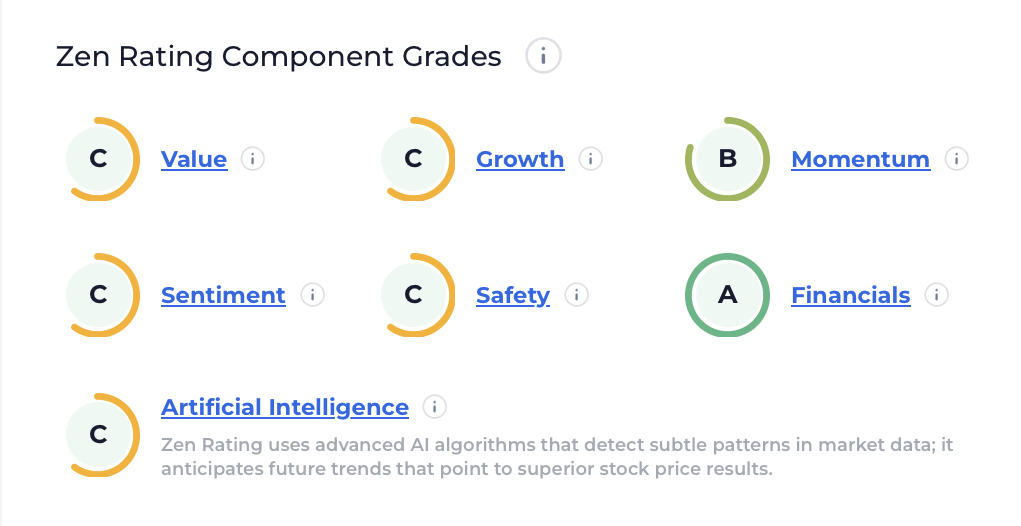

META also scores highly according to our quant ratings system, Zen Ratings. It earns an overall grade of B, which is reached through a rigorous 115-factor review. Stocks with an overall B rating have historically outperformed the market, delivering an average of 19.88% annual returns.

Digging into the 7 Component Grades that make up the overall Zen Rating, you can see that META scores highly for Financials and Momentum — two key areas that point to potential for long-term success.

Note: Zen Ratings are updated daily. See all 7 Component Grades for META here.

2. Match Group (NASDAQ: MTCH)

While not a traditional social media company, Match Group’s (NASDAQ: MTCH) dating platforms represent a unique social networking niche.

Unlike ad-supported models, Match derives revenue primarily from subscriptions. With the continued growth of online dating globally, Match offers a differentiated business model.

At writing, it’s a slightly less appetizing alternative than META as it maintains an overall C Zen Rating, with an F rating for Growth.

However, considering its A ratings for Value and Financials, it may be worth putting MTCH on your free watchlist to see if it gets an upgrade to an A or B rating, at which point it might be a great alternative to Bluesky Social.

3. Pinterest (NYSE: PINS)

Pinterest (NYSE: PINS) offers a visual discovery platform distinct from text-based networks like Bluesky. With over 450 million monthly users, Pinterest provides a unique advertising format through pictures and videos.

The company has successfully monetized its platform while maintaining positive free cash flow, making it an enjoyable alternative for those seeking social media exposure.

Like MTCH, PINS currently has a C (Hold) rating, according to Zen Ratings. This is largely due to a Component Grades of D for Sentiment, which considers factors like insider buying activity, analyst upgrades and downgrades, and institutional stakes.

However, as previously mentioned, Zen Ratings are updated daily. Consider adding PINS to your watchlist to see if things change.

Who Owns Bluesky Social?

Bluesky Social is owned by Bluesky Social PBC, a U.S. public benefit corporation headquartered in Seattle, Washington.

Its key stakeholders include:

- Jay Graber, CEO and board member

- Jeremie Miller, board member

- Mike Masnick, board member

- Kinjal Shah, a board member from Blockchain Capital

The company has raised approximately $23 million through two funding rounds:

- An $8 million seed round in 2023 led by Neo

- A $15 million Series A round in 2024 led by Blockchain Capital

Key investors include Blockchain Capital, Alumni Ventures, True Ventures, SevenX, and individual investors like Amir Shevat and Joe Beda.

Does Jack Dorsey Own Bluesky Social?

Despite the widespread belief that Jack Dorsey owns Bluesky Social, the answer is no. While Dorsey initiated the Bluesky project while serving as Twitter CEO, he stepped down from the board in May 2024 and deleted his account from the platform.

This situation parallels Elon Musk’s relationship with companies like The Boring Company or Neuralink—he may have sparked their creation, but his current involvement differs from public perception.

Dorsey’s departure from Bluesky’s governance structure means the platform now operates independently from its original visionary.

How Much is Bluesky Social Worth?

According to multiple reports, Bluesky Social is valued at $700 million following its last funding round, which was led by Blockchain Capital. This valuation is quite impressive, given that the company has raised just $23 million to date.

Alternatively, the valuation could be driven by the platform’s impressive growth, as its rapidly expanding user base positions Bluesky as an alternative to Twitter.

The steep valuation also reflects confidence in Bluesky’s potential to capture market share in the ever-evolving social media landscape.

Is Bluesky Social Better Than Twitter?

Whether Bluesky Social is better than Twitter (now X) depends on what you value in a social platform:

Bluesky advantages:

- A decentralized structure gives users control over data and interactions

- Its customizable algorithms allow personalized feed curation

- Modular moderation systems where communities set their policies

- An ad-free experience (currently)

- A domain-based handle system for user verification

Twitter/X advantages:

- Massive global audience for maximum reach

- Broader feature set, including Spaces, Communities, and monetization tools

- Centralized moderation ensures consistency across the platform

- An established ecosystem for brands and creators

Bluesky is generally preferred by privacy-conscious users and niche communities seeking self-governance, while Twitter remains superior for its global reach and advanced features. For investors, both represent different approaches to monetization and user growth.

Will Bluesky Social Be the Next Twitter?

Bluesky Social has shown impressive growth, but several factors will determine whether it will become “the next Twitter.”

For instance, Bluesky has expanded from 10 million to 27 users, which is remarkable. However, it is still much smaller than Twitter, which has nearly 340 million users. Alternatively, a younger user base (62% under 35) positions it for long-term growth as users age and bring more economic value.

Bluesky’s decentralized moderation approach presents opportunities and risks as it scales. Moreover, unlike Twitter’s established advertising model, it lacks a clear monetization strategy.

To truly compete with Twitter, Bluesky will need to match or exceed its feature set while maintaining its decentralized principles.

While Bluesky has shown promising signs, becoming a mainstream Twitter alternative requires overcoming significant monetization, scale, and feature development hurdles.

How to Buy the Bluesky Social IPO

Here are the steps on how to buy Bluesky Social stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for BlueSky Social

- Select how many shares you want to buy

- Place your order

- Monitor your trade

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Bluesky Social Stock Price Chart

As shares of Bluesky Social aren’t traded, there isn’t a Bluesky Social stock price or a stock price chart.

However, you can use publicly available information to analyze the company’s impressive growth trajectory in the near term.

For instance, Bluesky downloads peaked at 7.85 million in November 2024. In fact, in the last six months of 2024 its downloads stood at 16 million, up from 2.23 million in the first half of the last year.

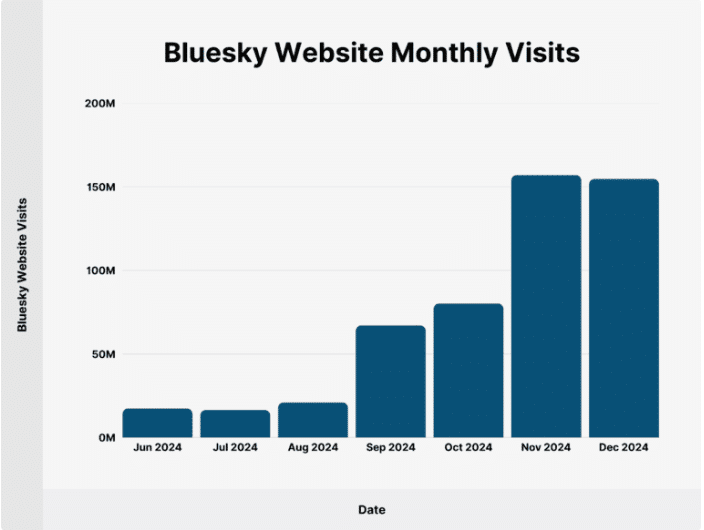

The platform’s website visits have also seen a significant uptick in recent months, growing to 155 million in December, up from 17 million in June.

Conclusion

Until Bluesky Social announces an IPO, retail investors can gain exposure to similar trends through publicly traded social media companies or relevant ETFs. Accredited investors may have opportunities through pre-IPO marketplaces if existing shareholders decide to sell.

Whether through direct pre-IPO investment for accredited investors or indirect exposure through public companies, Bluesky Social remains an essential player in the future of social media.

FAQs:

How can I buy Bluesky Social stock?

Retail investors cannot buy Bluesky Social stock because the company is not publicly traded. However, accredited investors may access shares through pre-IPO marketplaces if and when Bluesky Social is listed.

How much is Bluesky Social stock?

Bluesky Social's stock price is not public because the company is privately held. However, after raising $15 million in 2024, it was recently valued at approximately $700 million.

What is the Bluesky Social stock symbol?

There is no Bluesky Social stock symbol because it is not listed on any public stock exchange. A stock symbol will only be assigned if the company decides to go public through an IPO in the future.

Who owns Bluesky Social stock?

Bluesky Social stock is owned by the company's founders, employees, and private investors including Blockchain Capital, Alumni Ventures, True Ventures, SevenX, Neo, and individual investors like Amir Shevat and Joe Beda.

Jack Dorsey, who initiated the project, is no longer involved with the company and is not a current stockholder.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.