Why I Wanted to Try edgeful

Overall rating: ⭐⭐⭐⭐⭐

I’ve tested dozens of trading platforms over the years — some good, some bad. edgeful seemed both novel and promising: a statistical trading platform that gives traders data-driven insights, at an affordable price.

For $49/month, you get over 100 custom reports that analyze historical price behavior with real-time monitoring.

After 30 days of hands-on testing, I can honestly say that edgeful impressed me. Most platforms throw technical indicators at you and call it a day. edgeful digs into five years of historical data to show you how specific trading patterns performed in the past.

So, here’s what I discovered about edgeful trading. Keep reading to find out if it’s a good fit for you and your trading style.

What Is edgeful?

edgeful transforms raw market data into statistical insights that make sense. The company positions itself as “your personal financial analyst,” and honestly, it delivers.

On the platform, you can trade stocks, futures, forex, and crypto. But here’s what makes edgeful different: instead of relying on intuition, you get probability-based trading strategies backed by real data.

Most platforms just hand you charts and indicators. edgeful analyzes years of historical data to show you how specific patterns performed, making it ideal for retail traders, derivatives analysts, and technical analysts.

How Does edgeful Work?

edgeful plugs directly into major exchanges such as the Nasdaq, CME, Coinbase, and Oanda. So, you get access to real-time data. Their algorithms crunch years of historical information to spot recurring patterns and calculate success rates.

When current market conditions match historical patterns, the “What’s in Play” feature sends you alerts in real-time. Think of it as your market scanner that never sleeps.

Every analysis comes with hard numbers: Success rates, average targets, optimal entry and exit timing. You’re not guessing anymore — rather, you’re making informed decisions based on what happened in similar situations.

edgeful’s Key Offerings (What I Actually Used)

Reports

The report library is edgeful’s bread and butter. The platform offers 100+ reports covering everything from gap fills to opening range breakouts to initial balance breaks. Each one comes packed with statistical analysis.

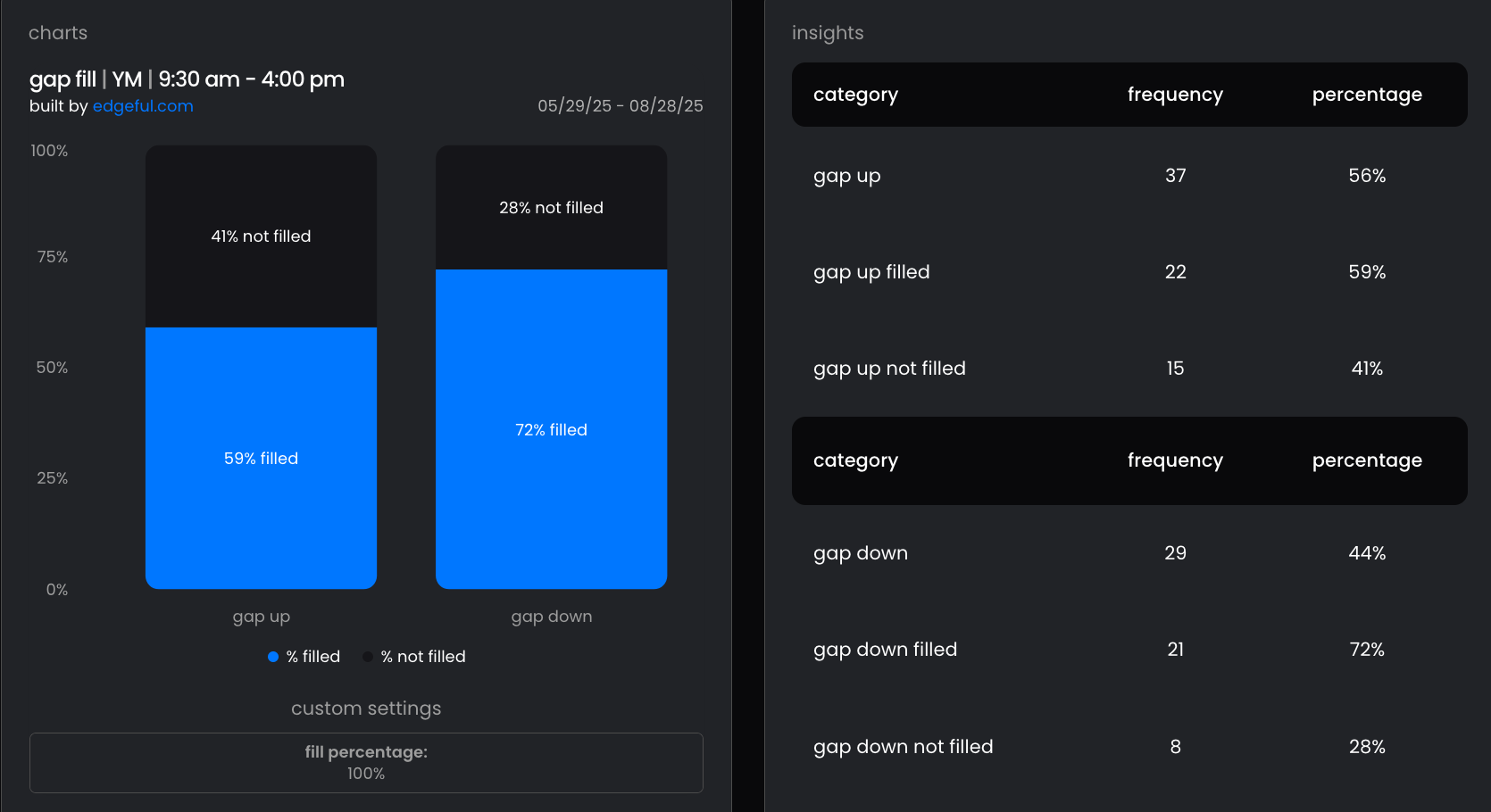

I spent most of my time testing the gap fill report for YM futures. Here’s what blew my mind: the platform showed me that gap-ups filled 59% of the time in the past three months.

Gap-down scenarios had an even stronger stat, with 72% of gaps down filling in the past 3 months. But it didn’t stop there. I got real-time updates showing gap formation probability based on size, timing, and market conditions.

The customization options were impressive as well. I could tweak date ranges, filter by specific days, modify session times, and set custom parameters for gap sizes. Your 9-to-5 job means you can only trade the first hour? No problem, as you can adjust the reports to match your schedule.

What’s In Play

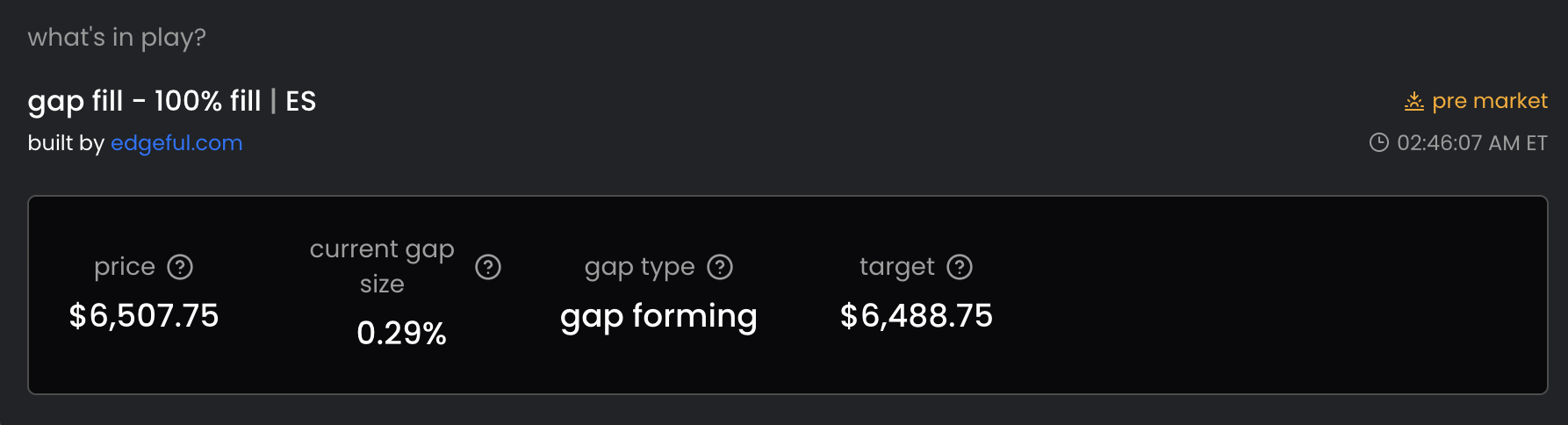

This dashboard tracks multiple trading strategies at once. During my testing, I watched it monitor gap fills, opening range breakouts (ORB), and initial balance (IB) strategies across ES, NQ, YM, and RTY futures.

Each strategy card shows current price, bias direction, key levels, and probability assessments. I’ll never forget watching a gap fill scenario play out live where the system spotted the gap forming at market open, calculated target levels based on historical patterns, and updated fill percentages as the price moved toward the target.

Instead of generic “gap detected” alerts, you get the full story: historical success rates for similar gaps, typical fill times, and whether the gap will likely fill completely or partially.

Screener

Traditional stock scanners look for basic technical indicators. edgeful’s screener shows you which strategies are setting up across multiple tickers simultaneously with statistical backing.

I set mine to monitor four strategies across major futures contracts. The table format made it easy to compare opportunities at a glance.

Here’s what I noticed: On trending days, multiple strategies aligned in the same direction across different contracts. That’s your confirmation of market sentiment right there. When strategies conflicted? Usually meant choppy conditions where smaller position sizes made sense.

Watchlist

The watchlist feature, while seemingly simple, proved essential for efficient platform navigation. I could quickly switch between my preferred tickers (NVDA, GOOGL, etc) without losing my report configurations or having to re-enter parameters.

This might seem like a minor feature, but when actively trading, the ability to rapidly switch contexts while maintaining your analytical setup saves valuable time and reduces the chance of errors. The watchlist integrates seamlessly with all other platform features, maintaining consistency across reports, screener, and What’s in Play sections.

Algos

edgeful’s four algorithmic strategies tackle the core problems most retail traders face: Emotional decision-making and inconsistent execution.

built on five years of historical price data from their gap fill, ORB, initial balance, and engulfing bar reports, these algos automatically identify high-probability setups without the guesswork. each one of the algos lets you customize your:

- Entry criteria

- Exit criteria

- Position sizing

- Take profit targets

- And more.

The engulfing candles algo stands out as their newest algo, and is the first one to provide multiple trade opportunities throughout each session, making it particularly valuable for prop traders who need consistent daily action to meet funding requirements.

With default settings alone, the platform has demonstrated a 250% return on a $10,000 account over seven months.

The best part about the aglos? They’re fully automated. All you have to do is integrate with your broker, make sure your settings are correct, and let the algo trade for you. You can find out more here.

Educational Resources & Support

Most stock apps have an “education” section. Usually, they’re an afterthought. Not edgeful’s library — it’s legit, and worthwhile.

Every major feature includes explanation videos that walk users through practical applications with real chart examples.

Every major feature includes explanation videos that walk users through practical applications with real chart examples.

I found these videos invaluable for understanding not just how to use the tools, but why specific statistical patterns matter for trading success.

The platform offers live video pre-market preparation sessions three days per week through their Discord community. These sessions demonstrate how to interpret edgeful reports in real-time market conditions, showing traders what to look for before the market open.

Additionally, live trading sessions occur twice weekly on YouTube and X (formerly Twitter), where the team demonstrates using edgeful reports to set targets and identify key levels in real-time.

The five-step onboarding flow deserves a special mention. edgeful guides traders through a logical progression: choosing assets, selecting tickers, understanding report types, and customizing parameters.

Each step includes video walkthroughs and practical examples that make the learning curve manageable.

Blog

edgeful’s “Stay Sharp” blog provides weekly data-backed trading strategies and step-by-step breakdowns that teach traders how to build consistent systems using actionable reports, setups, and statistical analysis.

A recent article I particularly enjoyed was “Day Trading Strategies for Beginners: 3 Data-Driven Setups That Actually Work,” which provides specific win rates for different strategies: ORB (70% win rate), IB (51% win rate), and Gap fills (40% win rate).

This level of statistical transparency is rare in trading education and demonstrates edgeful’s commitment to data-driven decision-making.

The blog covers a diverse range of topics relevant to modern traders. This practical focus makes the educational content immediately applicable to real trading situations.

TradingView + NinjaTrader Indicators

edgeful’s integration with TradingView and NinjaTrader through 35+ custom indicators represents a significant value addition. These indicators automatically plot key levels without requiring manual drawing, eliminating human error and saving considerable time during active trading sessions.

The indicator suite covers all major trading concepts that align with edgeful’s statistical reports. Market session indicators automatically plot ranges for different time zones (New York, London, Asia), while gap level indicators identify and mark gap fill targets in real-time.

The IB/ORB indicators plot Initial Balance and Opening Range Breakout levels with precision, and retracement indicators calculate Fibonacci and other key retracement levels automatically.

The visual customization options include colors, line styles, and display preferences that integrate seamlessly with existing chart setups.

The real-time updates ensure that levels remain current throughout the trading session, providing reliable reference points for entry and exit decisions.

Discord Community

The Discord community integration provides a level of real-time support that distinguishes edgeful from purely software-based solutions.

When you join, you’ll be prompted with a short questionnaire to maximize your experience:

The community operates with structured activities, including pre-market preparation sessions three days per week, where experienced traders demonstrate how to interpret edgeful reports before the market open.

Members share real-time insights about developing setups, discuss successful implementations of edgeful strategies, and provide peer support during active trading sessions.

The real-time nature of these discussions provides immediate feedback and validation for trading ideas.

Mentorship Calls

The monthly mentorship calls included in the base subscription provide personalized guidance that goes beyond generic platform training. These live video sessions focus on building A+ trading strategies using edgeful tools, with emphasis on fine-tuning individual approaches and mastering platform capabilities.

The sessions cover strategy development, platform optimization, performance review, and direct Q&A with experienced traders and platform developers. This level of personal attention is typically associated with much more expensive coaching programs.

The mentorship approach addresses individual challenges and obstacles that traders face when implementing data-driven strategies.

Stay Sharp Newsletter

The weekly “Stay Sharp” newsletter serves as a practical implementation guide that transforms edgeful’s statistical insights into actionable trading strategies.

Available to both members and non-members through blog subscription, the newsletter provides step-by-step trading strategies built using edgeful reports.

Each newsletter shows precisely how to use statistical data to build high-probability trading strategies, complete with entry criteria, risk management, and profit targets.

By showing real examples of how successful traders use edgeful’s data, the newsletter serves as a bridge between platform features and profitable trading.

Each edition includes statistical backing for recommended strategies, ensuring that readers understand both the methodology and the historical performance data supporting each approach.

Coming Soon: edgeful AI

edgeful is preparing to launch its AI platform in Q4 2025, which may be the most sophisticated AI integration in the trading platform space.

The AI will allow you to find insights across multiple reports, on different tickers, and answer any questions users have about specific patterns.

So, for example, you’ll be able to ask “how often has price dipped ‘x%’ after CPI in the past 3 years” and edgeful AI will scan all the price data to give you a specific answer. Pretty cool, right?

Example of How to Use edgeful

Let me walk through a typical trading session using the platform’s core features.

The trading day begins with checking the “What’s in Play” dashboard, which immediately shows active opportunities across multiple strategies. On a typical morning, I might see gap fill setups on ES futures showing a gap up of 0.43% with a target of 6,310.75.

The platform displays that similar gaps have a 100% fill rate historically, with an average fill time of 19:32 minutes after market open.

As the market opens, the real-time monitoring capabilities become crucial. The “What’s in Play” section updates continuously, showing the gap fill progress and any changes in statistical probabilities. If the gap begins filling as expected, the platform tracks the progress and provides updated timing estimates based on historical patterns.

The platform’s integration with TradingView indicators means all key levels are automatically plotted on charts, eliminating manual calculations and reducing execution errors. The combination of statistical probability and precise level identification creates a systematic approach to both entry and exit decisions.

edgeful enables the customization of trading approaches. The report customization features allow traders to modify parameters based on their trading style and risk tolerance.

The educational integration ensures that traders understand not just what to do, but why specific approaches work. The explanation videos and statistical breakdowns provide the context necessary for confident decision-making and continuous improvement.

edgeful Data Sources

edgeful’s data infrastructure represents one of its most significant competitive advantages, built on direct connections to the world’s most critical financial exchanges. The platform connects straight to Nasdaq, CME Group, Coinbase, and Oanda, ensuring users never rely on stale or incomplete data that could compromise trading decisions.

This direct connectivity approach eliminates the delays and inaccuracies common with third-party data providers. When precision matters most, during volatile market openings, news events, or rapid price movements, edgeful’s tools match the quality of the underlying data source.

Getting Started on edgeful

Setting up an account on edgeful is straightforward. After signing up, I took a welcome quiz that customized my experience based on my trading background and preferred markets.

The interface follows a logical flow: pick your asset, choose your ticker, select report type, then customize parameters. Beginners and pros can both navigate it, though all the options might feel overwhelming at first.

The learning curve isn’t too steep thanks to all the educational content. I found myself watching explanation videos constantly during my first week, but the interface clicked after a few days of regular use.

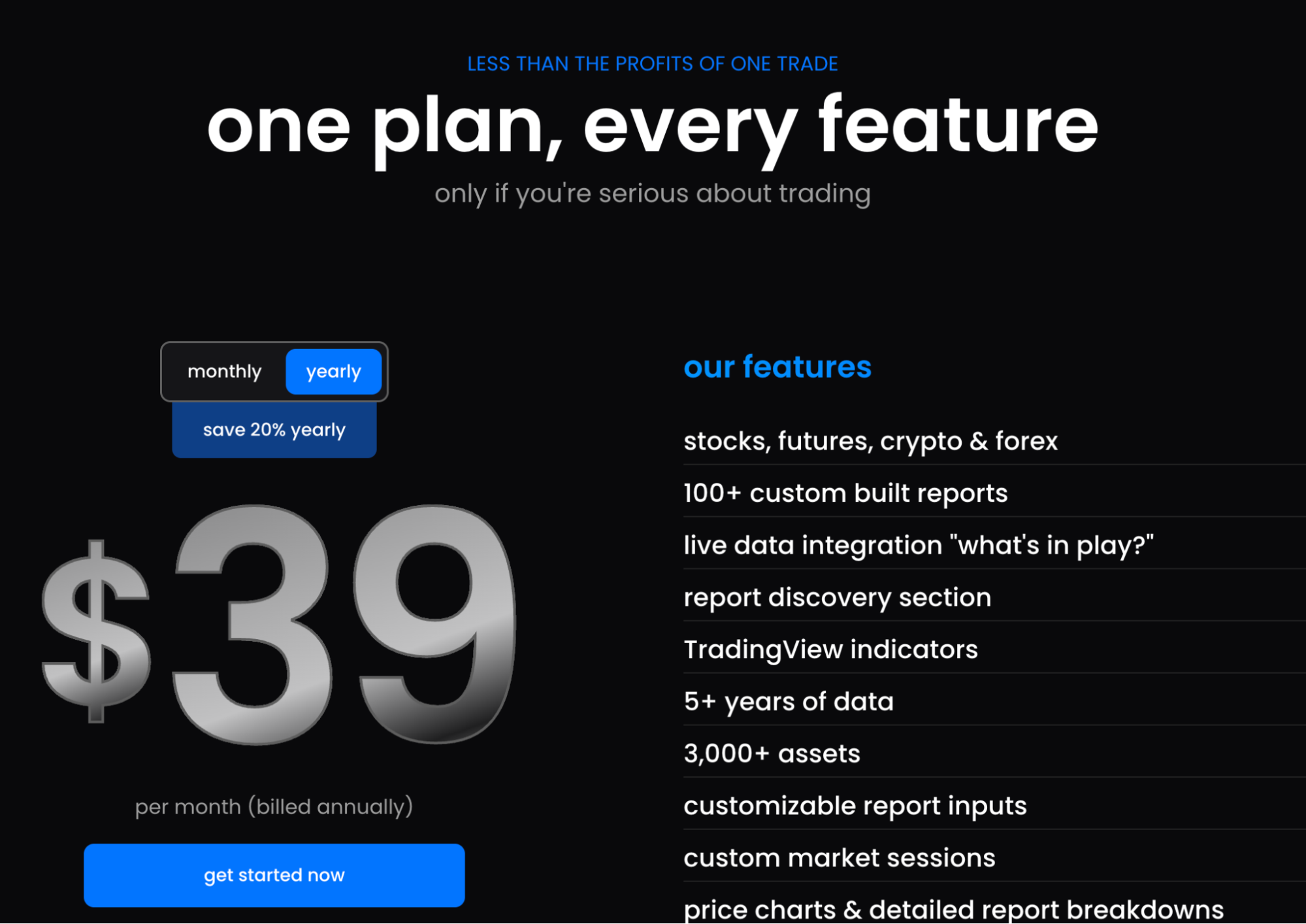

edgeful Pricing and Plans

edgeful employs a refreshingly simple pricing model: one plan at $49 per month, with a 20% discount for annual subscriptions (effectively $39.20 monthly when paid yearly). This single-tier approach eliminates the confusion often associated with complex pricing structures on competing platforms.

The base plan includes comprehensive access to all core features: 100+ custom reports, live data integration, TradingView indicators, 5+ years of historical data, 3,000+ assets, customizable report inputs, custom market sessions, detailed report breakdowns, personalized report development, and monthly mentorship calls.

Notably absent from the base plan are the algorithmic trading features, which require an upgrade to the premium tier at $299 monthly (This does include access to the base plan as well, so you don’t have to purchase multiple subscriptions).

This pricing structure makes sense given the sophisticated nature of automated trading tools and their target audience of professional traders.

How does this pricing stack up?

At $49 monthly, edgeful positions itself competitively against major platforms.

To put it in context:

- TradingView’s premium plans range from $59.95 to $239.95 monthly

- Trade Ideas starts at $89 monthly

- TrendSpider begins at $107 monthly

edgeful’s pricing advantage becomes more pronounced when considering the depth of statistical analysis included in the base plan.

The platform’s tagline, “less than the profits of one trade,” reflects confidence in its value proposition. For active traders, the cost can be recovered through improved trade selection and risk management based on statistical probabilities rather than guesswork.

Does edgeful offer a Free Trial?

Unlike many competitors, edgeful doesn’t offer a traditional free trial. However, the platform provides extensive preview materials, including a comprehensive overview video that demonstrates every feature with chart examples. It’s VERY thorough, and the next best thing to “try before you buy.”

This approach suggests confidence in the product’s value and reduces the likelihood of casual users overwhelming support resources.

The absence of a free trial might deter some potential users. Still, the extensive educational content and transparent feature demonstrations provide substantial insight into platform capabilities before committing to a subscription.

My Real Experience Using edgeful

The edgeful interface balances power with usability. While there’s a ton of data available, the logical organization made navigation intuitive after a few sessions.

You get specific entry points, target levels, and probability assessments based on historical performance. That level of detail lets you trade with confidence even when markets get weird.

Based on my testing experience, I would continue using edgeful for several reasons. The statistical backing for trading decisions provides a level of confidence that’s difficult to achieve with traditional technical analysis alone.

The real-time monitoring capabilities through What’s in Play eliminate the need for constant chart watching while ensuring I don’t miss high-probability setups.

What Other Traders Are Saying

edgeful rocks a 4.5-star rating on Trustpilot from 77 reviews. That’s “Excellent” status with consistently positive feedback in edgeful reviews.

Let’s take a closer look at specific user feedback…

One user wrote: “All new software is overwhelming at first. Follow the detailed videos from Andre, take notes, and watch again… He gives you a blueprint and DETAILED tools to fine tune…”

Another user kept it simple: “Good product. Simple to use and understand. Tutorials on reports sets it apart from other trading tools.”

But here’s my favorite testimonial: “edgeful has changed my LIFE… It gives me DATA-BACKED targets, entries, stop-losses and a bias for the day. There are no words to describe how thankful I am for the service they provide.”

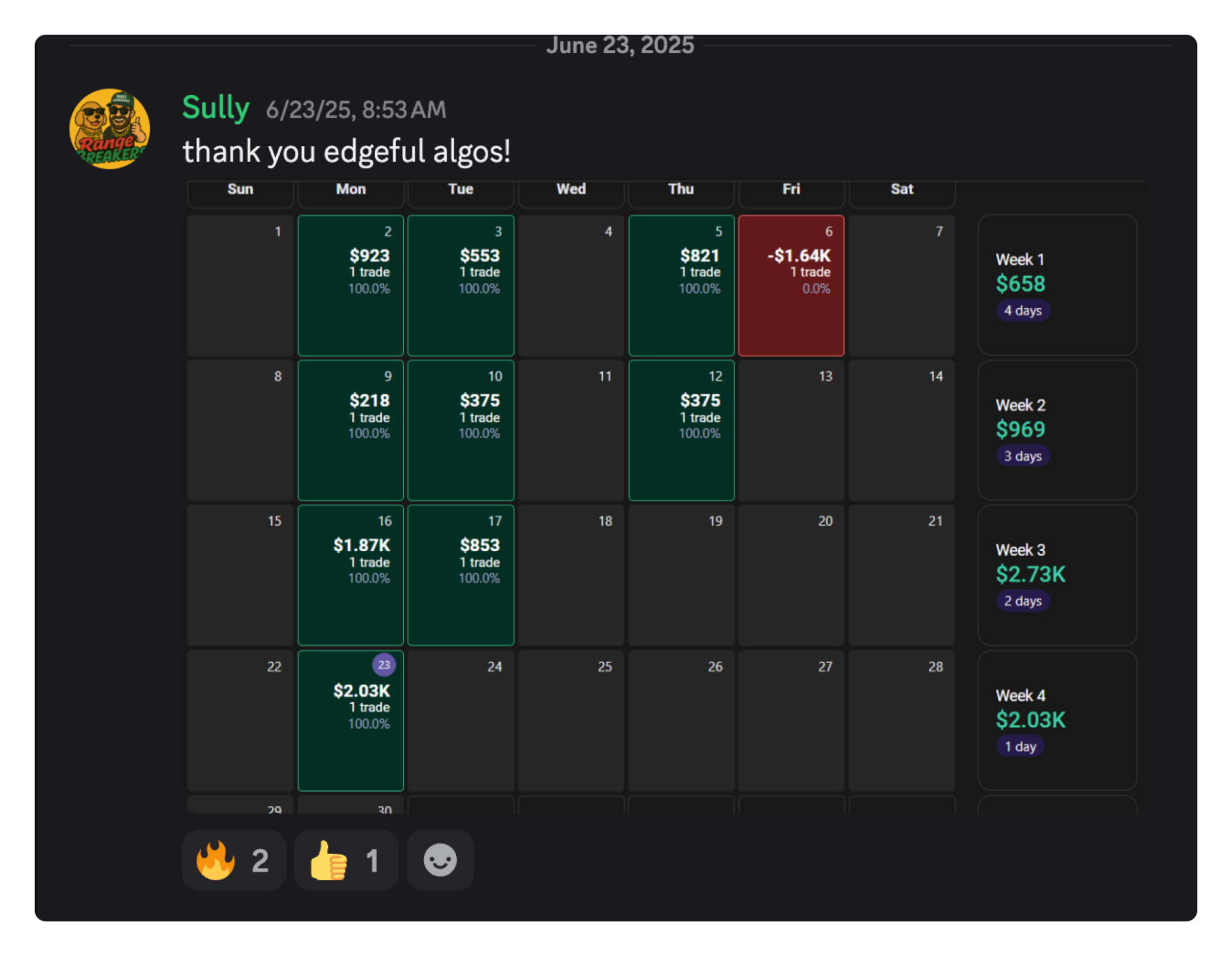

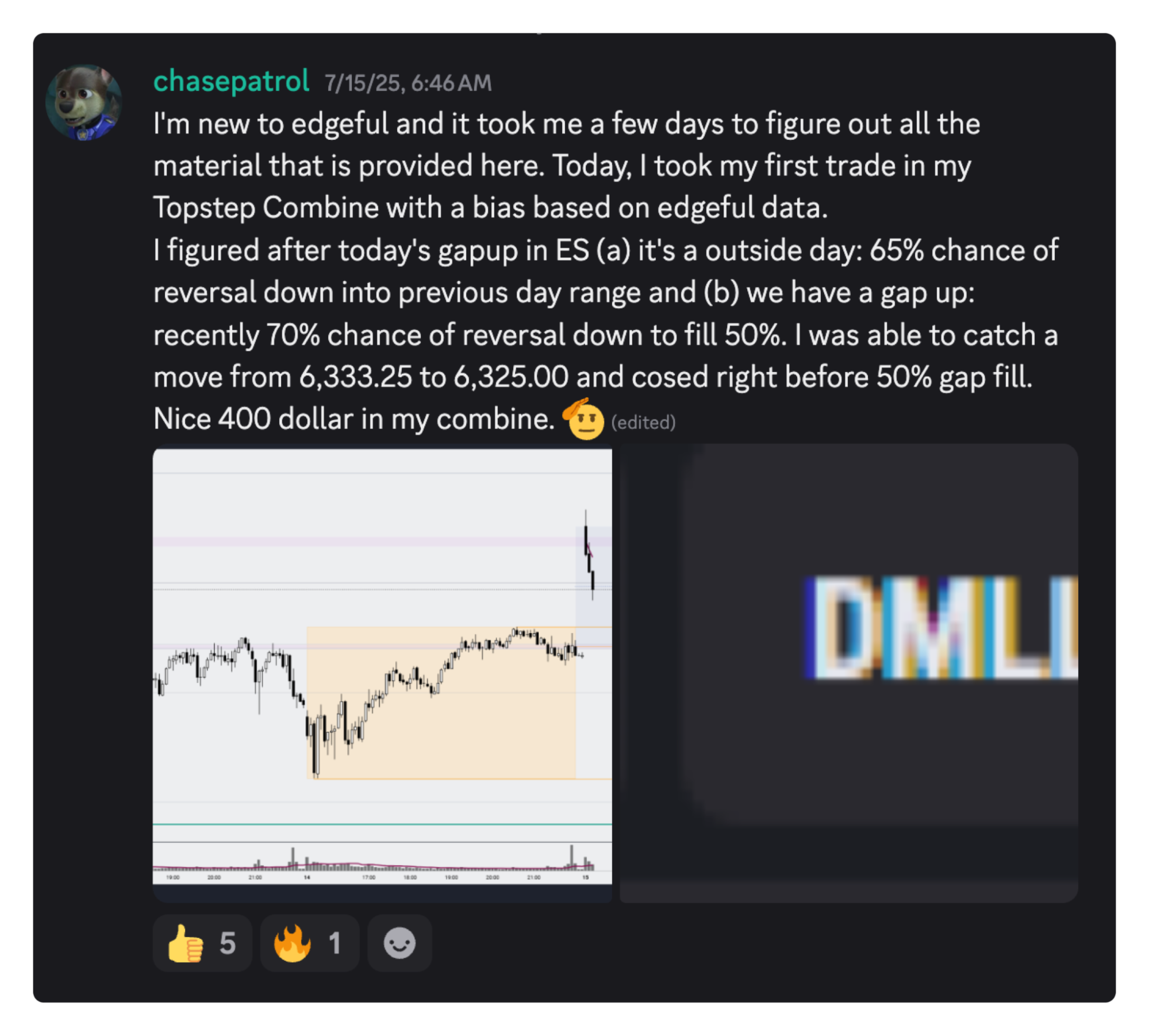

Other users choose to “review” the platform by posting results, like this:

And this:

…and this:

Common themes in edgeful reviews: love for educational resources, solid data quality, unique statistical approach, and responsive customer support.

edgeful vs Competitors

Most platforms excel at either technical analysis or AI capabilities, but rarely both. edgeful bridges this gap by providing statistical technical analysis backed by historical data while simultaneously developing sophisticated AI to help traders find the exact information they’re looking for.

edgeful is ideal for traders who want both reliable technical signals and intelligent, AI-powered insights working together rather than choosing between separate, specialized tools.

This addition perfectly positions edgeful as the platform that uniquely combines both capabilities, making it stand out in a crowded market where competitors typically focus on just one strength.

edgeful Vs. TradingView

These platforms complement each other more than compete. TradingView dominates charting, social features, and global market access. edgeful specializes in statistical analysis and probability-based insights.

The integration works beautifully. Use edgeful’s statistical insights to find high-probability setups, then execute trades using TradingView’s superior charting.

edgeful Vs. Trade Ideas

Trade Ideas and edgeful target similar traders but use different approaches. Trade Ideas focuses on AI-powered scanning and real-time alerts. edgeful emphasizes historical statistical analysis.

Trade Ideas starts at $89 monthly versus edgeful’s $49 base price. User feedback for Trade Ideas is mixed, while edgeful maintains consistently positive reviews.

edgeful Vs. TrendSpider

Both platforms emphasize automation but approach it differently. TrendSpider excels at automated pattern recognition. edgeful focuses on statistical probability analysis.

TrendSpider starts at $107 monthly, making it pricier than edgeful’s base plan. The key difference: TrendSpider automates traditional technical analysis, while edgeful provides statistical backing for decisions.

Should You Use edgeful? Final Thoughts

Perfect for: Day traders and swing traders who want to ditch emotional decision-making for statistical analysis. Active futures traders will love the session-specific analysis and real-time monitoring.

Skip if: You’re a complete beginner with zero trading experience. The platform might overwhelm you initially. Long-term investors won’t find much value in short-term statistical analysis either.

Worth the money? At $49 monthly, edgeful delivers exceptional value for traders who actually use its statistical insights. Consistent usage and application of platform insights determines your ROI.

After extensive testing, I recommend edgeful for active traders ready to embrace statistical analysis. The platform delivers on its promise of data-backed insights that improve trading decisions and reduce emotional mistakes.

Historical analysis plus real-time monitoring plus ongoing education creates serious value for traders committed to improvement. The learning curve requires some investment, but the long-term benefits of statistical trading insights justify the effort.

For traders serious about edgeful trading strategies and statistical analysis, this platform offers something genuinely different in today’s crowded market.

FAQs:

Is edgeful good for swing trading or day trading?

edgeful works great for both swing trading and day trading, with stronger day trading applications. Real-time monitoring and session-specific analysis make it ideal for day traders, while historical statistical analysis helps swing traders find high-probability setups.

How reliable is edgeful?

edgeful shows strong reliability through direct exchange data feeds and consistent platform performance. The 4.5-star Trustpilot rating and positive user feedback confirm reliability in both data accuracy and platform stability.

Does edgeful support crypto or forex?

Yes, edgeful supports cryptocurrency and forex markets along with stocks and futures. The platform covers 3,000+ assets across multiple asset classes, making it versatile for traders working different markets.

Can edgeful replace TradingView or TrendSpider?

edgeful complements rather than replaces these platforms. It provides superior statistical analysis, but TradingView offers better charting and TrendSpider provides automated pattern recognition. Many traders use edgeful alongside these platforms.

Is there a mobile app or browser extension for edgeful?

edgeful runs as a web-based platform accessible through any browser. No dedicated mobile app exists, but the platform works on mobile devices through web browsers. Desktop experience provides optimal functionality though.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.