Ask not what you can do for your credit card, but what your credit card can do for you.

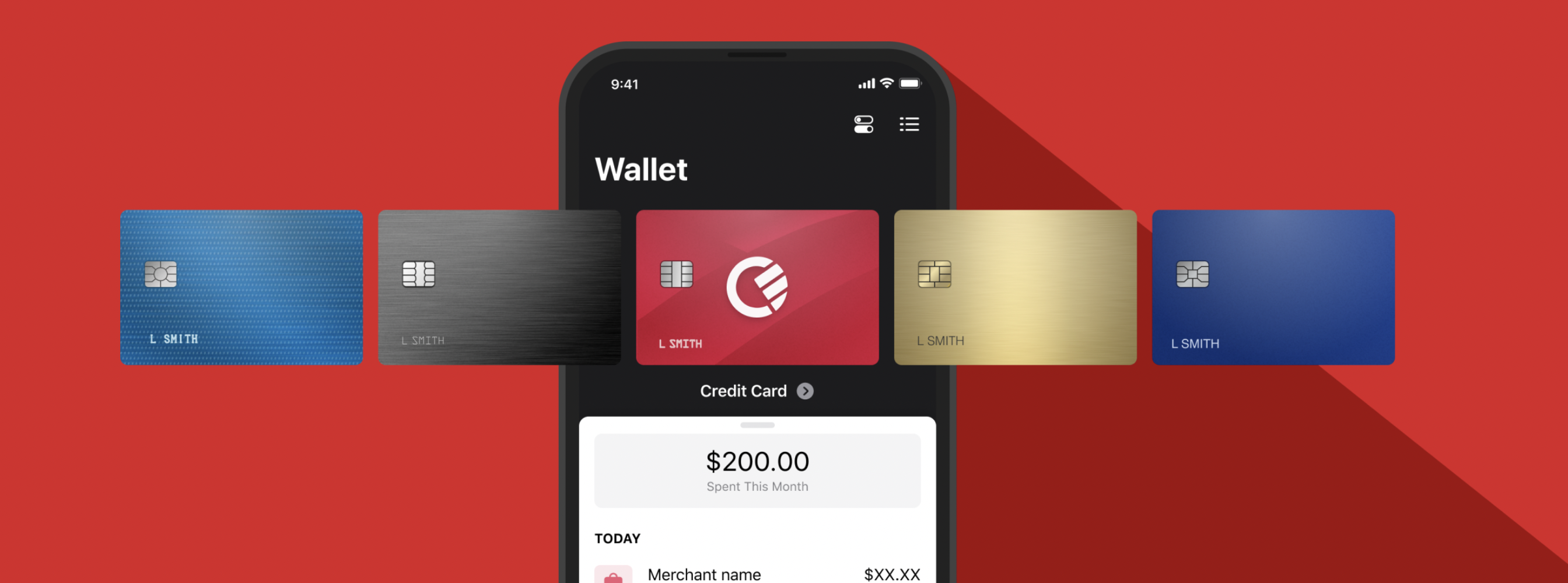

The Curve Credit Card boasts a ton of cool features, including:

- Anti-Embarrassment mode

- A Go Back in Time feature

- The ability to link all your cards together

But is it really worth it? One card to rule them all seems like an enticing concept, so I decided to do a deep dive Curve Card review and lay out what I found.

Want to know how this all-in-one smart card works — and whether or not it’s legit? In this article, I’ll explore these topics, plus highlight some important fine print notes, and rank its competitors.

Let’s go.

Is Curve the Best All-in-One Solution?

Keep reading and you be the judge! Here’s a sneak peek of the top-rated alternatives we’ll share:

- Chime: Best if you have low/no credit

- M1 Finance: Best if you’re a long-term investor who craves efficiency

- Varo Bank: Best for Low Minimums and convenience

Curve Credit Card: The Final Word

Overall Rating: 3.5/5

The Curve Card is an all-in-one smart card that links all of your credit cards into one account. It’s a convenient way to manage your finances under one single login.

The card is easy to use and has attractive features like cashback rewards and real-time notifications. However, the company’s customer service has a startling number of poor reviews. (More in a little bit…)

What is the Curve Credit Card?

The Curve Card has a handy app that consolidates all your debit and credit cards into a single, smart card.

Depending on your subscription, you can get rewards, insurance, fee-free foreign transactions, effortless currency conversion, and more.

Let’s take a look at the different tiers of Curve credit cards on the market. As you can see, some (but not all) are available in the U.S.

Types of Curve Credit Cards

Curve Standard | Curve X | Curve Black | Curve Metal | |

Monthly Fee | Free | £4.99 | £9.99 | £14.99 Or £150 Per Year |

Other Fees | Card Delivery Fee Of £4.99 | None | None | None |

Minimum Card Term | No Minimum | No Minimum | 6 Months | 6 Months |

Spending Limits | £200 cash withdrawal / day, £7,500 spending limit / day | £200 cash withdrawal / day, £7,500 spending limit / day | £200 cash withdrawal / Day, £7,500 spending limit / day | £200 cash withdrawal / day, £7,500 spending limit / day |

No-Fee Spending Abroad | Up To £1,000 every rolling 30 days; 2% fee after | Up To £2,000 every rolling 30 days; 2% fee after | Fee-free up to £15,000 / year; 2% fee after | Fee-free up to £60,000 / year; 2% fee after |

Cashback Rewards | Yes | Yes | Yes | Yes |

Other Rewards | None | None | Worldwide Travel Insurance | Car Rental Insurance, Access To Worldwide Airport Lounges, Travel Insurance |

No-Fee Conversion Atm Withdrawals Abroad? | Up to £200 / rolling 30 days, then 2% fee (£2 Min.) | Up to £200 / rolling 30 days, then 2% fee (£2 Min.) | Up to £400 / rolling 30 days, then 2% fee (£2 Min.) | Up to £600 / rolling 30 days, then 2% fee (£2 Min.) |

Travel Insurance | None | None | Yes | Yes |

Rental Car Insurance | None | None | None | Yes |

Customer Support Options | Standard Support | Standard Support | Priority Customer Support | Priority Customer Support |

Customer Protection | Up To £100,000 With Curve Customer Protection | Up To £100,000 With Curve Customer Protection | Up To £100,000 With Curve Customer Protection | Up To £100,000 With Curve Customer Protection |

Airport Lounge Access? | None | None | None | Yes |

Curve Card USA? | Yes | Not Yet | Not Yet | Beta |

How Does Curve Work?

That’s easy:

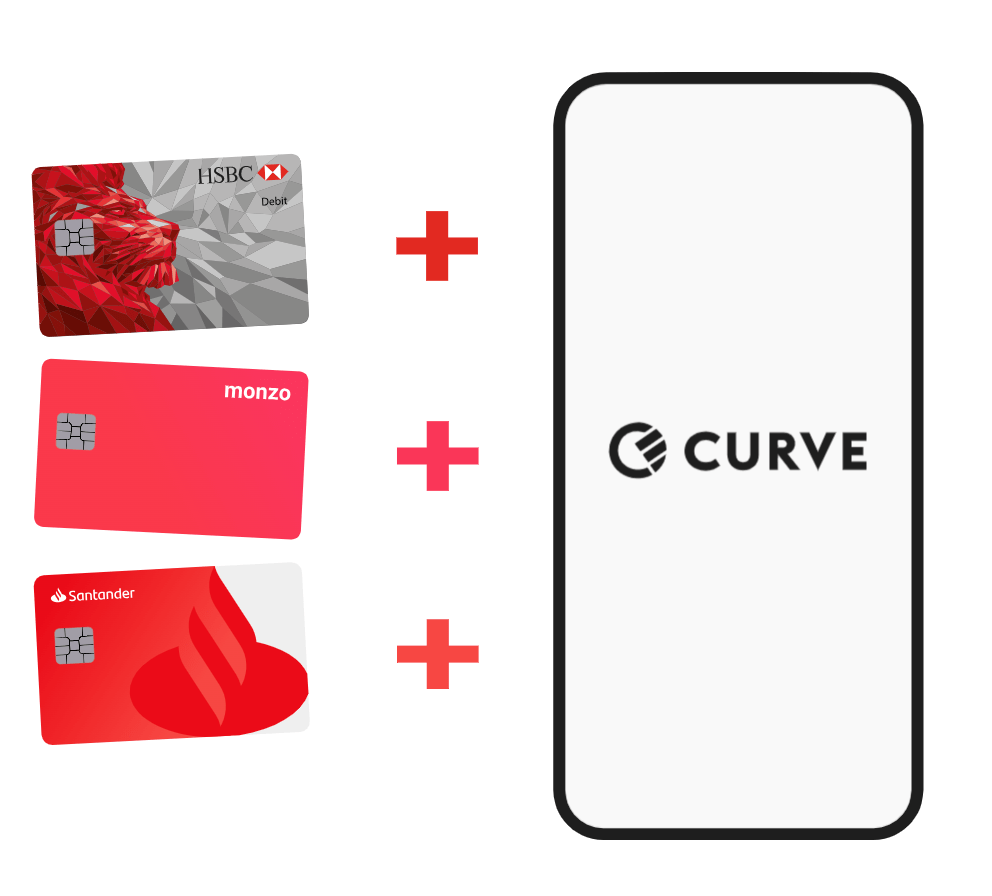

- Download the app and sign up for an account.

- Once signed up, you can link your existing Visa and Mastercard debit or credit cards to the Curve platform.

- When you make a purchase using the Curve card, the transaction is processed through the selected underlying card, allowing you to manage all your card spending from one place.

Curve Features

Curve offers a range of features designed to make managing your finances easier:

- Instant Spending Notifications

- Spending Categorization

- ‘Go Back In Time’ Feature: Switch Purchases to Another Card for Up To 120 Days For Purchases Up To £5,000

- Curve Cash: Earn 1% Cashback With Selected Retailers (For Subscription Curve Cardholders Only)

- Apple/Samsung/Google Pay Compatibility (Limited Based on Country)

- Anti-Embarrassment Mode: Automatic Backup Card Usage If A Payment Declines

- Free Credit Card Atm Withdrawals (Limits Apply)

- Fee-Free Atm Withdrawals Abroad (Limits Apply)

- Curve Customer Protection: Up To £100,000 Coverage

- Curve Flex: Pay Over 3-12 Monthly Installments

Curve Costs: Fees and Minimums

The Curve Standard is Curve’s most popular (and free) plan. However, it comes with many limitations — limited customer support, no lounge benefits, and no rental car or travel insurance.

Premium plans (Curve X, Curve Black, and Curve Metal) have a few more bells and whistles. Subscription prices vary from £4.99 – £14.99 per month (see table above) based on your selection.

There are also some miscellaneous fees including delivery charges, replacement card costs, and cancellations charges.

Curve Spending Limits

Curve imposes a transaction limit of £200 and a daily limit of £7,500. This will suit most people but might occasionally be a pain, especially during higher spending periods.

Curve Card USA: Is it Available in the U.S.?

Curve Card USA is now available! As of now, Curve is available for residents of 31 countries of the European Economic Area and the United States.

Unfortunately, many of the premium options are in beta right now. However, at writing, there’s a promotion: Anyone who signs up for Curve will automatically receive a Curve Card USA Metal and have access to the Mastercard World Elite Benefits.

The Curve team assured me they are working on making all premium subscriptions available worldwide and would update their subscription prices and FAQ when the full update became official.

Curve Customer Reviews: What Are People Saying?

Trustpilot: 3.8 Stars From 9,592 Total Reviews

BBB: Not Accredited (Not a USA-Based Company)

Google Reviews: 2.6 Stars From 49,652 Total Reviews

To sum it up: The Curve Card reviews have been mixed. Some praise its convenience and features; others criticize its customer service and response times.

Curve Controversy

In 2019, Curve received negative feedback regarding how they managed commercial cards for self-employed individuals.

People alleged that the corporation “tricked” self-employed cardholders into using commercial cards instead of personal cards, claiming it was the same card. In reality, the commercial card had higher fees. Multiple complaints and concerns arose about their practices.

It seems like this particular scandal is behind them, but the general complaints about their customer service are not. Customers continue to write poor reviews as recently as within a few days of writing this article.

Is the Curve Credit Card Safe?

Curve is regulated by the Financial Conduct Authority (FCA), which requires all user data to be protected under FCA security regulations.

On top of that, the company encrypts your information, refusing to share card details with retailers during transactions.

Important note: Curve is not covered by Section 75 of the Consumer Credit Act, meaning users may lose some protection on credit card purchases. Curve does offer its own Customer Protection, covering users up to £100,000 for specific claims.

Curve Credit Card: Pros and Cons

Pros | Cons |

Easy-to-use app | Limits on spending and cash withdrawals |

Basic card is free | Requires data or wi-fi access to switch cards |

Consolidates multiple cards into one | No Section 75 protection |

No hidden fees abroad | No FSCS protection on standard |

Curve customer protection | Poor customer service |

Comes with an app & physical card | Limits to the free and lower-tier perks |

Premium perks (travel insurance) | Only MasterCard and visa cards accepted |

Auto-switch card feature for declined transactions |

Curve Credit Card Alternatives

No Curve Card review would be complete without exploring some alternatives. Let’s start with its most direct competitors, Monzo and Revolut:

Curve | Monzo | Revolut | |

Account types offered (personal, business, both?) | Personal and Business | Personal and Business | Personal and Business |

UK-registered? | No | Yes | No |

FSCS protected? | No | Yes | No |

Overdraft protection? | No | Yes (Limited Eligibility) | No |

No-fee spending abroad? | Yes (limits apply) | Yes | Yes (limits apply) |

No-fee withdrawals abroad? | Yes (£200 limit apply) | Yes (£200 limit apply) | Yes (£200 limit apply) |

Exchange rate? | FX Interbank exchange rate | DDC Mastercard exchange rate | FX Interbank exchange rate |

Apple Pay & Google Pay – Free Curve Credit Card Alternatives

Apple Pay and Google Pay are worth a mention because they do a lot of what Curve does, but without the fees. Both are widely accepted in places worldwide. With a $2,000 Google Pay transaction limit and the $10,000 Apple transfer limits, it’s a great solution for most users.

Unfortunately, they limit their perks and you need an Android or Apple product to use them, whereas Curve has a physical card.

Good All-in-One Finance Solutions

Though the following companies do not link your cards together into an all-in-one smart card, they do “solve” a lot of financial problems in one fell swoop. Their convenient features and attractive credit card offers made it all too enticing not to mention as a suitable alternative.

Chime – Best for Those With No/Low Credit

Chime is a partner of The Bancorp Bank and Stride Bank, both FDIC members, which presents a comprehensive package of top-quality financial solutions.

They have direct deposit options, innovative features like SpotMe no-fee overdraft service, auto-save features, and even offer a service where you can send unlimited checks on the go through Chime Checkbook.

The Chime Card

The company offers a Chime Credit Builder Visa Credit Card and a Chime Card Debit Card.

The Credit Builder Credit Card helps you create and build your credit score through regular purchases and on-time payments. Instead of a credit check, you would simply need to direct deposit at least $200 into your Chime Checking account.

The debit card works just as a traditional debit card would except that there are no monthly fees, no minimum balances, and more fee-free ATMs than most traditional banks.

Worldwide Use

You must be a US citizen or permanent resident to open a Chime account. However, if you travel, your Chime Card will still work so long as you enable international transactions on your app settings.

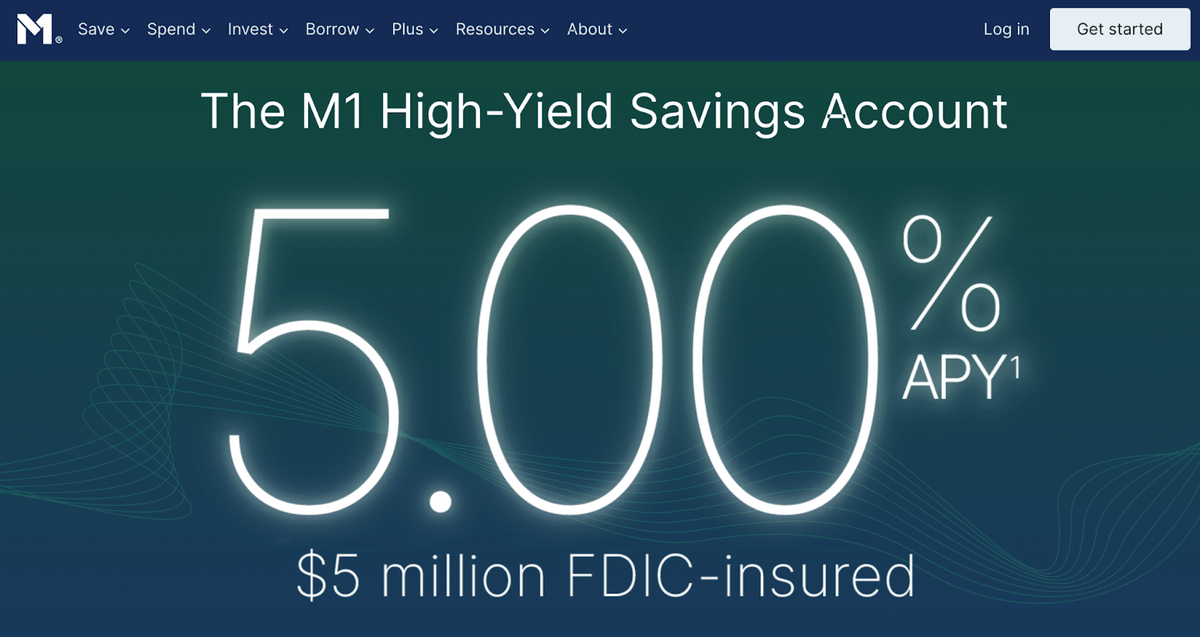

M1 Finance – Best for Investors Who Crave Efficiency

M1 Finance caters primarily to long-term investors seeking hands-off investment through its highly sophisticated financial technology platform. It has exceptional options like automatic rebalancing and low-cost fractional shares.

With its easy-to-use interface, the creation of customized “pies” helps you to allocate investments optimally to achieve individualized financial goals and manage associated risks effectively.

Most impressive, however, is how much they offer on one platform. Save, spend, invest, or borrow- either way, you can do it with M1’s all-in-one financial platform through their savings account, credit card, debit card, investment portfolio, and margin lending.

Owner’s Reward Credit Card

This credit card is unique. Not only does it allow you to earn up to 10% back in rewards, but you can automate investing your rewards back into your portfolio. Throw in the lack of an annual fee, its tap-to-pay feature, and its zero liability theft protection, and this is a card worth considering.

Worldwide Use

Your M1 Checking Visa debit card may work where international credit cards are accepted, but it will likely incur a fee with each transaction. The Owners Credit Card will not and you do not need to inform M1 you are traveling, something that is very convenient.

However, to open an M1 investment account, you must be a US resident and have a non-VOIP US number. Additionally, not all features are available for US Territory Residents.

While traveling, you may be able to “trick” your M1 investment account into working with a VPN, however. It is important to note that VPNs can slow the internet down and cause errors, all of which could be costly if a mistake was made in the purchasing or selling of shares. Also note, trading crypto is illegal in some countries, so do your research before attempting any trades.

Varo Bank – Best for Low Minimums and Convenience

Varo Bank’s mobile-first approach prioritizes your convenience while simultaneously removing any potential barriers between you and your money, such as minimum balance requirements and hidden fees.

They offer high-yield savings accounts, 2-day early pay, a Varo Debit Card, and have customizable tools like ‘Save Your Pay’ or ‘Save Your Change.’

Varo Bank Card

The Varo Believe Card is a credit card designed to help you build your credit score.

Most customers who followed their recommendations (regular purchases and on-time payments) saw a 40+ point score increase after three months.

This card has 0% APR, no fees, and no credit checks to get started. Open a Varo Account with money and no overdue Varo Advance and link $500 in direct deposits to get started.

Worldwide Use

The downside is that you must be a US resident or citizen to open an account and Varo will not work in some countries (see the updated list here). As their website and app will not work with a VPN, it is not an ideal option if you live or travel internationally.

Final Word:

Curve Credit Card’s consolidation of multiple credit cards onto an all-in-one smart card is a standout feature.

There are concerns about their customer service delivery and transparency levels. Despite this dark cloud, countless individuals feel that this card option makes sense for them.

My Curve Card Review? If you frequently make expensive purchases, you may not find the Curve Credit Card ideal. But, if that’s not an issue and you’re in search of a card with shopping rewards, convenience, safety, and ATM reimbursements, you should certainly consider this option.

FAQs:

Is it worth getting Curve card?

It may be worth getting a Curve Card if you want a convenient way to consolidate multiple cards, earn rewards, and get ATM reimbursements. You may also consider free alternatives like Apple Pay or Google Pay.

What is the Curve card controversy?

The Curve Card controversy resulted after they received negative feedback in 2019 about their lack of transparency with their commercial card service offered to those who were self-employed. Reports showed that their personal cards were wrongly identified as business-related, tacking on higher fees, which resulted in a number of customer complaints.

How does Curve card work?

The Curve Card and the Curve Card USA work by bringing together all your Visa and Mastercard debit and credit cards on one platform. The innovative system processes purchases using the selected underlying card, streamlining spending.

Is Curve card a hard pull?

No, signing up for a Curve card does not involve a hard credit pull, as the service does not provide a line of credit. Even the Curve Flex, which allows payment over time, is a soft credit check pull.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our April report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.