What are the best cheap stocks to buy right now?

Sound like something you’ve asked Google before? You’re not alone.

It can be tricky to find the best cheap stocks to buy now out of the thousands of options available if you don’t have the right tools.

The good news is we’ve got you covered with 5 of the best cheap stocks to buy now based on a proven set of fundamental metrics and due diligence checks.

Want to know how we find stocks before they explode?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Methodology for Finding the Best Cheap Stocks

To find the best cheap stocks to buy in February 2026, we used a combination of tools on WallStreetZen:

- WallStreetZen’s preset stock screeners: Notably, the Best Undervalued Stocks to Buy Now screener. It incorporates a minimum Zen Score (see #2 below) of 50 and a valuation score of 80 based on factors such as Benjamin Graham’s valuation formula, Discounted Cash Flow (DCF) valuation, and various price ratios, such as price-to-earnings and price-to-book.

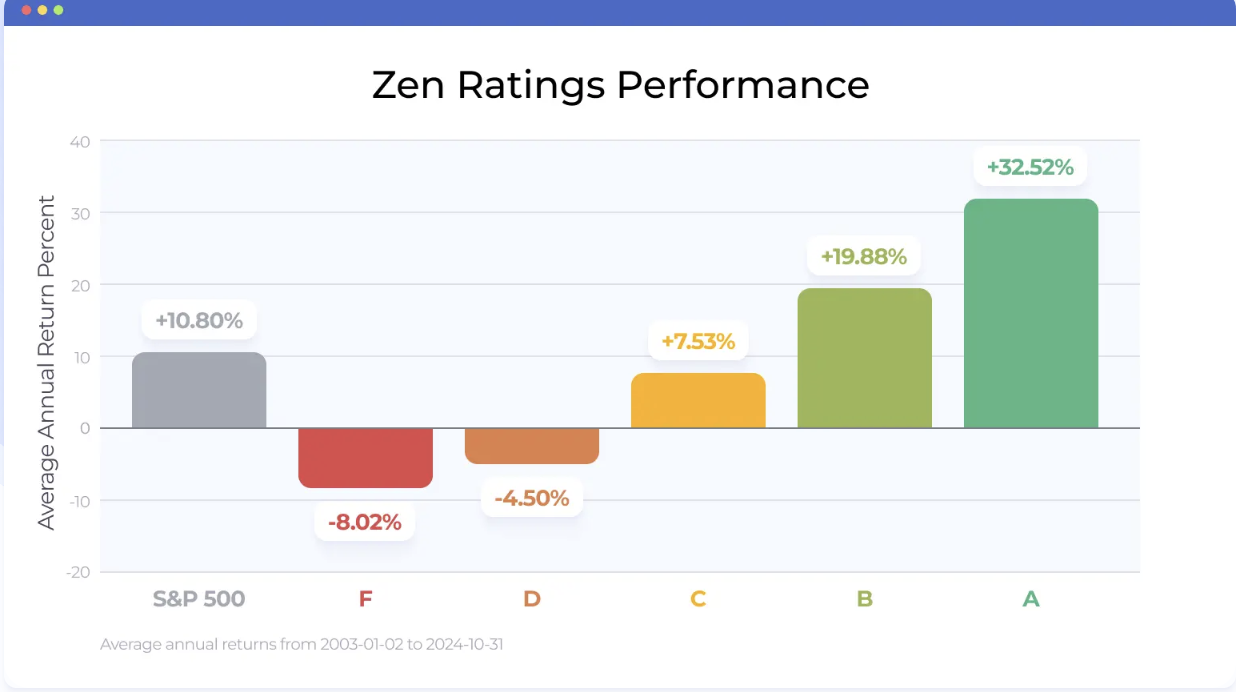

- Zen Ratings: Our proprietary system that distills 115 factors that drive growth into an easy-to-read letter score. In addition to an overall score, you can see how each stock scores in different areas, including value, growth, momentum, and more. Stocks rated “A” through the Zen Ratings system have produced an average annual return of +32.52% since 2003.

- Strong Buy Ratings from Top Analysts. With WSZ’s Strong Buys from Top Analysts feature, you can zero in on ratings from ONLY top-rated analysts, and you have easy access to their track record and average win rate. In each entry, you can easily see the analyst’s track record, plus the “why” behind their rating.

Let’s dive in…

What are the Best Cheap Stocks to Buy Now?

Here are some of the potential best cheap stocks to buy now:

- LSI Industries (NASDAQ: LYTS)

- NetScout (NASDAQ: NTCT)

- Electromed (NYSEMKT: ELMD)

- Kimball Electronics (NASDAQ: KE)

- Kanzhun (NASDAQ: BZ)

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

1. LSI Industries (NASDAQ: LYTS)

Just about every type of business needs lighting. LSI Industries specializes in non-residential lighting solutions of all shapes and sizes, from trade show displays to parking lots and more. The company recently delivered a strong earnings beat — what’s more, both insiders and Wall Street analysts seem quite optimistic regarding LYTS’ future prospects.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $22.93 — get current quote >

Max 1-year forecast: $30.00

Why we’re watching:

- LSI Industries shares currently have 1 Strong Buy rating and 1 Buy rating. See the ratings

- The average 12-month price forecast for LYTS, currently pegged at $27.50, implies a 19.93% upside.

- Canaccord Genuity equity researcher George Gianarikas (a top 13% rated analyst) maintained a Strong Buy rating on the stock following the company’s Q4 and FY 2025 earnings report, and increased his price target from $22 to $25.

- In line with management’s high “say/do” ratio, the company delivered robust results, Gianarikas told readers.

- LSI Industries’ quarterly revenue was boosted by “improved demand across both its lighting and display solutions markets, ” the analyst detailed.

- Overall, the company’s pipeline was up 11% Y/Y “as orders matched a strong sales quarter,” Gianarikas said.

- LYTS is the 2nd highest-rated stock in the Electronic Component industry, which has an Industry Rating of A.

- Our quant rating system, Zen Ratings, uses 115 proprietary factors to evaluate stocks. It keeps track of roughly 4,600 equities — and equities that rank in the top 5% based on this analysis have a Zen Rating of A, which has historically corresponded to average annualized returns of 32.52%. LSI Industries shares currently rank in the top 2% of stocks.

- Each Zen Rating is a composite score of 7 Component Grade ratings. For example, LYTS ranks in the 79th percentile of stocks in terms of Value, Growth, and Momentum.

- Our Safety Component Grade rating is a measure of stock price stability and the predictability of revenue inflows and earnings. In this category, LSI Industries ranks in the top 20% of stocks.

- However, the star of the show is Sentiment, which measures earnings surprises, analyst ratings, short interest, and insider transactions. It’s the last point that’s important here — in the past 12 months, 39.58% of insider transactions tied to LSI have been purchases. In this category, LYTS ranks in the top 1% of stocks. (See all 7 Zen Component Grades here >)

2. NetScout (NASDAQ: NTCT)

NetScout develops tools that help organizations detect threats, manage service disruptions, and ensure the reliability of complex, high-volume networks. The company has flown under the radar thus far — however, it has notched an impressive series of consecutive earnings beats, and one of Wall Street’s premier analysts is convinced that NetScout is poised to benefit from two high-growth areas in network security and network monitoring.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $24.89 — get current quote >

Max 1-year forecast: $33.00

Why we’re watching:

- Thus far, NTCT has flown under the radar — the stock is only covered by a single Wall Street analyst, who issues a Strong Buy rating. See the rating

- The researcher in question is Erik Suppiger of B. Riley Securities (a top 4% rated analyst), who initiated coverage on NetScout shares on August 26 with a Strong Buy rating and a $33 price target, which implies a 32.58% upside.

- Suppiger recommended that readers buy the network services technologies provider’s stock on the recent pullback because “the company addresses two attractive growth markets.

- The analyst argued that NetScout Systems is positioned to benefit from the emergence of AI in both of its markets.

- The Software Infrastructure industry consists of 122 stocks and has an Industry Rating of A. At present, NTCT is the highest-rated stock in the industry.

- NetScout shares rank in the top 2% of the equities that we track, giving them a Zen Rating of A.

- In terms of its Growth Component Grade rating, NTCT ranks in the 82nd percentile of stocks.

- Sentiment is another of NetScout’s strong suits — in this category, it ranks in the top 14%.

- Lastly, we have Growth — NTCT’s main selling point. With regard to this Component Grade rating, the stock ranks in the top 2%. (See all 7 Zen Component Grades here >)

3. Electromed (NYSEMKT: ELMD)

Electromed makes medical devices for treating lung conditions. ELMD shares have shot up by 28.63% in the past month — however, the stock remains undervalued. The company has delivered 7 earnings beats in a row — and it has a balance sheet that is more than healthy enough to finance new growth.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $23.95 — get current quote >

Max 1-year forecast: $36.00

Why we’re watching:

- Electromed is currently tracked by 2 Wall Street analysts — both of whom issue Strong Buy ratings. See the ratings

- The average 12-month price forecast for ELMD shares currently stands at $35, and implies a 48.23% upside.

- Roth Capital researcher Kyle Bauser (a top 24% rated analyst) maintained a Strong Buy rating on the stock after the company reported its Q4 and FY 2025 earnings, and increased his price target from $29 to $35.

- Bauser referred to the quarter’s results as “better-than-expected.”

- Management outlined an expectation that FY 2026 will deliver double-digit revenue growth and expanded operating leverage.

- From an investment perspective, Bauser said the stock is highly undervalued in view of (1) the company’s market-leading position in the underserved bronchiectasis space, and (2) the company’s strong earnings profile, clean balance sheet, and improving operating efficiencies.

- Electromed shares currently rank in the top 4% of the equities that we track, giving them a Zen Rating of A.

- ELMD is currently trading at a price-to-earnings (P/E) ratio of 26.91x, which is below both industry and wider market averages. In terms of its Value Component Grade rating, the stock ranks in the 82nd percentile.

- With regard to its Sentiment Component Grade rating, Electromed ranks in the 87th percentile of equities.

- On top of that, ELMD ranks quite highly in Safety and Financials — in the top 4% and top 2% of stocks, to be exact. (See all 7 Zen Component Grades here >)

4. Kimball Electronics (NASDAQ: KE)

Kimball Electronics recently reported its Q4 and FY 2025 earnings. The quarter brought a double beat — however, management laid out rather pessimistic guidance. One of Wall Street’s best analysts isn’t convinced, however, and recently reiterated a Strong Buy rating on KE — more to the point, our quant rating system also paints a rather bullish picture.

Zen Rating: B (Buy) — see full analysis >

Recent Price: $28.66 — get current quote >

Max 1-year forecast: $28.00

Why we’re watching:

- Kimball Electronics is quite a low-profile stock — KE currently only has 1 analyst rating, which is a Strong Buy. See the rating

- Jaeson Schmidt of Lake Street recently maintained his Strong Buy rating and increased his price target from $21 to $28.

- Schmidt said consensus-beating top and bottom lines headlined a “strong finish to Kimball Electronics’ year.”

- Expressing “disappointment ” that management guided FY 2026 to a third consecutive year of declining revenue, the analyst said they do not believe revenue headwinds reflect “any meaningful market share loss or changes in the company’s long-term growth opportunities.”

- Kimball Electronics is the 10th highest-rated stock in the Electrical Equipment & Part industry, which has an Industry Rating of B.

- KE shares rank in the top 10% of equities based on a holsitic analysis of 115 proprietary factors, giving them a Zen Rating of B.

- Kimball Electronics has surged by 56.12% since the start of the year — so it comes as little surprise that the stock ranks in the 80th percentile with regard to Momentum.

- Based on the company’s stable stock price and predictable earnings, KE ranks in the top 17% of equities when it comes to Safety.

- While Schmidt’s price target currently implies downside, KE ranks in the top 5% of stocks according to its Artificial Intelligence Component Grade rating — in simple terms, a neural network trained on two decades of market data has selected the stock as a likely outperformer.

- Finally, we have Sentiment — a category in which Kimball Electronics ranks in the top 2% of stocks. Why does KE rank so highly in this category? It’s simple — 38.96% of the insider transactions associated with the stock in the past 12 months have been purchases. (See all 7 Zen Component Grades here >)

5. Kanzhun (NASDAQ: BZ)

Kanzhun operates a mobile-native and AI-powered recruitment platform that caters to the ever-relevant and increasingly competitive Chinese market. The business has beaten earnings estimates for nine quarters in a row. BZ shares have surged by almost 70% since the start of the year — and with no signs of stopping, it’s reasonable to assume that the company’s strong balance sheet will be able to support further gains.

Zen Rating: B (Buy) — see full analysis >

Recent Price: $23.22 — get current quote >

Max 1-year forecast: $26.00

Why we’re watching:

- At present, 3 Wall Street researchers track Kanzhun stock and issue ratings for it — all 3 of them have given the stock a Strong Buy rating. See the ratings

- Barclays researcher Jiong Shao (a top 6% rated analyst) maintained a Strong Buy rating on BZ after the company’s Q2 2025 earnings call, and increased his price target from $22 to $25.

- Shao said they took away from the print that the company’s operating trends continue to improve and its revenue growth is ready to accelerate.

- Kanzhun is currently the 4th highest-rated stock in the Staffing & Employment Service industry, which has an Industry Rating of B.

- BZ shares rank in the 89th percentile of the more than 4,600 equities that we track, giving them a Zen Rating of B.

- Kanzhun stock has surged by 69.58% since the start of the year — so it will come as little surprise that it ranks in the top 11% when it comes to Momentum. BZ also happens to rank in the top 11% with regard to Financials.

- With that being said, Sentiment is the star of the show here — in this category, BZ ranks in the top 5% of stocks. (See all 7 Zen Component Grades here >)

Gain access to dozens of alerts like this per week — Click the button below.

👉👉 Try WallStreetZen Premium for just $1

What Makes a Stock Cheap?

What makes a stock cheap depends on your perspective and investment strategy.

Some investors may consider stocks under $30 (or any other number) cheap.

On the other hand, value investors would consider undervalued stocks cheap because they’re trading at a price under their intrinsic value — like the stocks on this list. But it depends on your chosen valuation metric.

One of the hardest parts of stock market investing? Choosing the right stocks.

WallStreetZen offers one of the top stock-picking services out there.

To find these stock picks, I used one of WallStreetZen’s preset stock screeners, Best Undervalued Stocks to Buy Now. But it’s not the only tool the platform has to offer. Not by a long shot.

WallStreetZen’s Top Analysts is our most frequently visited page — here’s why:

Other stock-picking services constantly brag about their winning stock picks — but fail to mention when they’re wrong.

Instead of providing direct picks, we built a service that aggregates the research and recommendations from nearly 4,000 Wall Street analysts — then backtests their performance over multiple years.

Based on this research, analysts are ranked based on average return, frequency of ratings, and win rate — so you can rest assured you’re only following top performers.

Summary: Cheap Best Stocks to Buy Now

In this list, we covered 5 of the best stocks to buy now cheap based on key valuation metrics, such as Discounted Cash Flow and price-to-earnings.

But, while these are potentially good investment candidates, they must be part of a balanced portfolio.

Make sure you understand the risks you take with small and micro-cap stocks as they tend to be much more volatile than larger companies.

For that reason, their performance is less predictable, so it’s wise to spread your bets rather than concentrate them on just a few companies.

And always remember, stocks can stay undervalued for a long time so you need an investment horizon of at least a few years. But that’s not to say that one of these stocks couldn’t surge tomorrow — anything can happen and understanding that is key!

Try out our screener to discover more of the best cheap stocks to buy right now.

FAQ:

What are the best cheap stocks to buy right now?

At writing, the best cheap stocks to buy right now based on analyst ratings include:

1. LSI Industries (NASDAQ: LYTS)

2. NetScout (NASDAQ: NTCT)

3. Electromed (NYSEMKT: ELMD)

4. Kimball Electronics (NASDAQ: KE)

5. Kanzhun (NASDAQ: BZ)

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.