What’s the Best AI Stock Advisor in 2026?

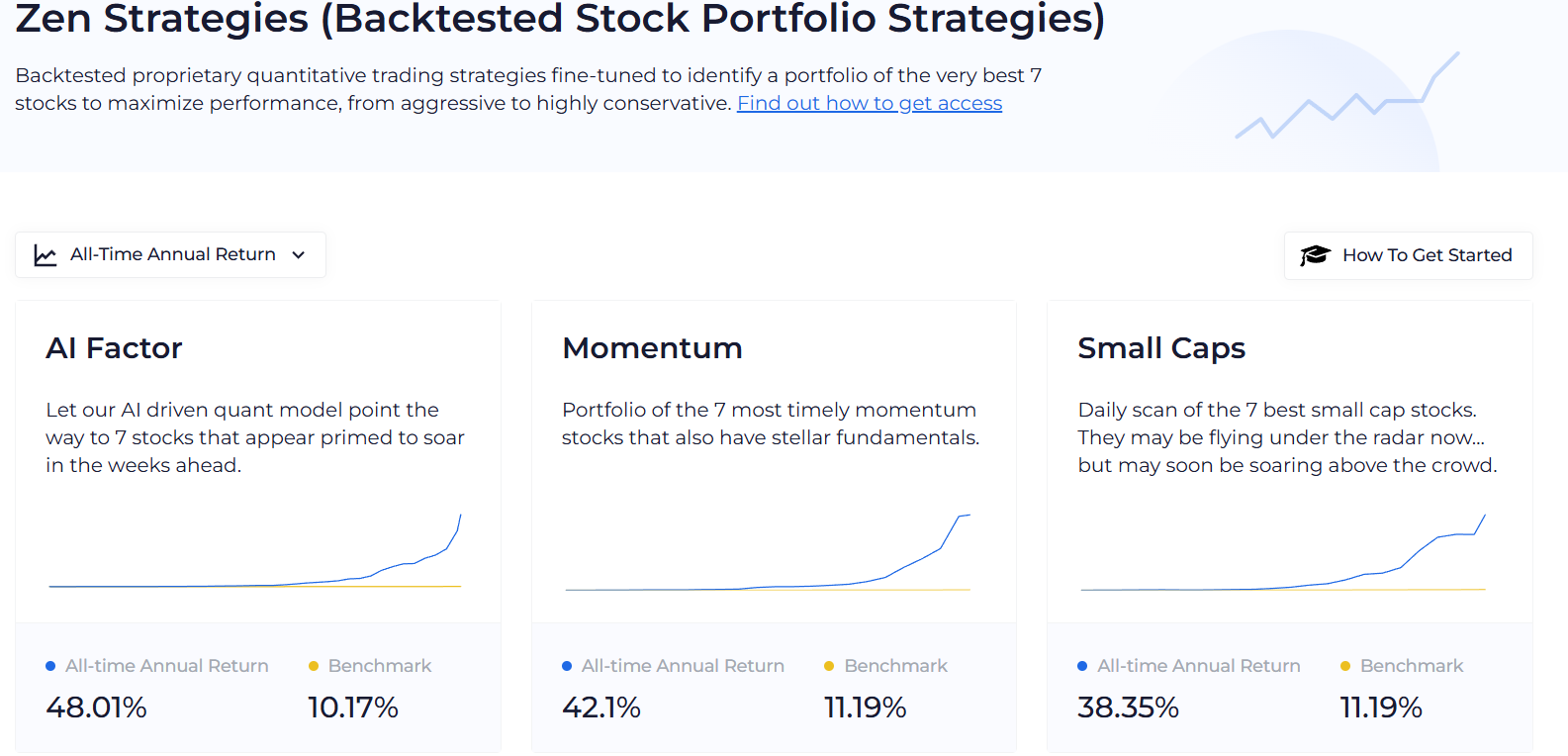

Zen Strategies is my top pick for the best AI stock advisor in 2026. Its AI stock strategy ably leverages a proprietary AI factor to locate the highest-potential stocks — supported by an average all-time annual return of over 48%.

Even better — with a Zen Strategies subscription you get access to a total of 11 Strategies, each of which includes a curated portfolio of 7 top stocks, which is updated daily (TL; DR: You get 77 stock picks total, at any given time). At the core of all of the picks is Zen Ratings, a quant ratings system that includes a comprehensive 115-factor review of each stock. This includes an AI rating factor powered by machine learning and 20+ years of historical data, plus integrated expert analysis to arrive at a trustworthy stock rating.

I’ll break down why I think Zen Strategies takes the cake in the article below. However, I get that different people have different needs — so I’ll compare several other worthy AI-powered stock research platforms. I’ll share what makes each of them unique, who each is best for, and the cost of each tool.

The 6 Best AI Stock Advisors in 2026

1. WallStreetZen’s Zen Strategies

- Overall Rating: 4.5 / 5

- Cost: Zen Strategies Annual membership is $997

- Unique selling point: 11 backtested proprietary quantitative trading strategies fine-tuned to identify a portfolio of the very best 7 stocks to maximize performance. (As a subscriber, you get access to all of them — so 77 high-potential stocks total).

Zen Strategies was built on the success of Zen Ratings, a stock ratings system that boasts a track record of average annual returns of 32.52% for A-rated stocks.

Zen Strategies builds custom market-beating portfolios by paring down over 900 top-rated stocks into 7 specific stocks to create an investment portfolio for every type of investor (from aggressive to conservative).

Zen Strategies utilizes the power of AI combined with advanced cross-validation to find outperformance for every portfolio, regardless of market conditions.

There are 11 strategies in total within Zen Strategies to choose from:

Strategy | All-Time Annual Return |

|---|---|

AI Factor | 48.01% |

Momentum | 42.10% |

Small Caps | 38.35% |

Buy the Dip | 35.19% |

Under $10 | 34.84% |

Growth | 32.66% |

Income | 25.20% |

Value | 24.85% |

Technology | 23.10% |

Large Caps | 15.10% |

Stocks to Short | 5.19% |

* Average Annual Return is from the start of 2003 to the present. AI Factor and Stocks to Short from start of 2006.

Of note, the AI Factor portfolio leverages a neural network trained on 20+ years of data to find the highest performing stocks based on the Zen Ratings AI Factor. The AI factor alone merges key elements — earnings, cash flow, price movement, and industry trends — into a single, actionable insight. (Learn more about the AI factor here.)

The Zen Strategies AI Factor portfolio finds the top 7 stocks using this data, and has far outperformed the market over the last 20+ years with a 48.01% average annual return.

While you can access Zen Ratings for free, Zen Strategies represents a big step up — and one of the best ways to actually use the ratings. With your annual premium membership, you get daily updates for each strategy, the ability to choose any strategy you’d like, weekly email updates, and a money-back guarantee.

What You Get With Zen Strategies Membership

- Our most profitable solution for traders

- 11 amazing stock picking strategies (Top 7 stocks each / Updated daily)

- Quick Start Guide: Everything you need to know to start trading these proven strategies.

- Weekly email from WallStreetZen Editor-in-Chief Steve Reitmeister providing tips, insights & performance updates to increase your knowledge on how to best employ the Zen Strategies.

- Everything you need to start consistently beating the market!

2. Seeking Alpha

- Overall Rating: 4 / 5

- Cost: $299/year (Get $30 off and a free 7-day trial using links in this post)

- Unique selling point: AI-powered stock analysis, simple ratings system with multiple factors, access to Seeking Alpha’s industry-leading research platform

Seeking Alpha Premium offers access to AI-powered Virtual Analyst Reports to provide advanced market analysis and stock recommendations. Harnessing the power of AI and Seeking Alpha’s breadth of historical and current financial market data, Virtual Analyst Reports offers a digestible evaluation of thousands of stocks and ETFs.

The Virtual Analyst Reports use AI algorithms to analyze historical and current financial data, earnings reports, and analyst ratings, giving each stock a ranking to help you make better investment decisions.

Ratings are given for each stock based on several factors, including:

- Valuation

- Growth

- Profitability

- Momentum

- Earnings Revisions

Utilizes these reports, investors are armed with AI-driven investment strategies and stock ratings to help pick better investments.

Related reading: Check out our Seeking Alpha review

What You Get With Membership

- Premium investing tools and analysis

- Unlimited investing expert content

- AI-powered Virtual Analyst Reports

- Stock ratings based on financial metrics

- Exclusive research reports

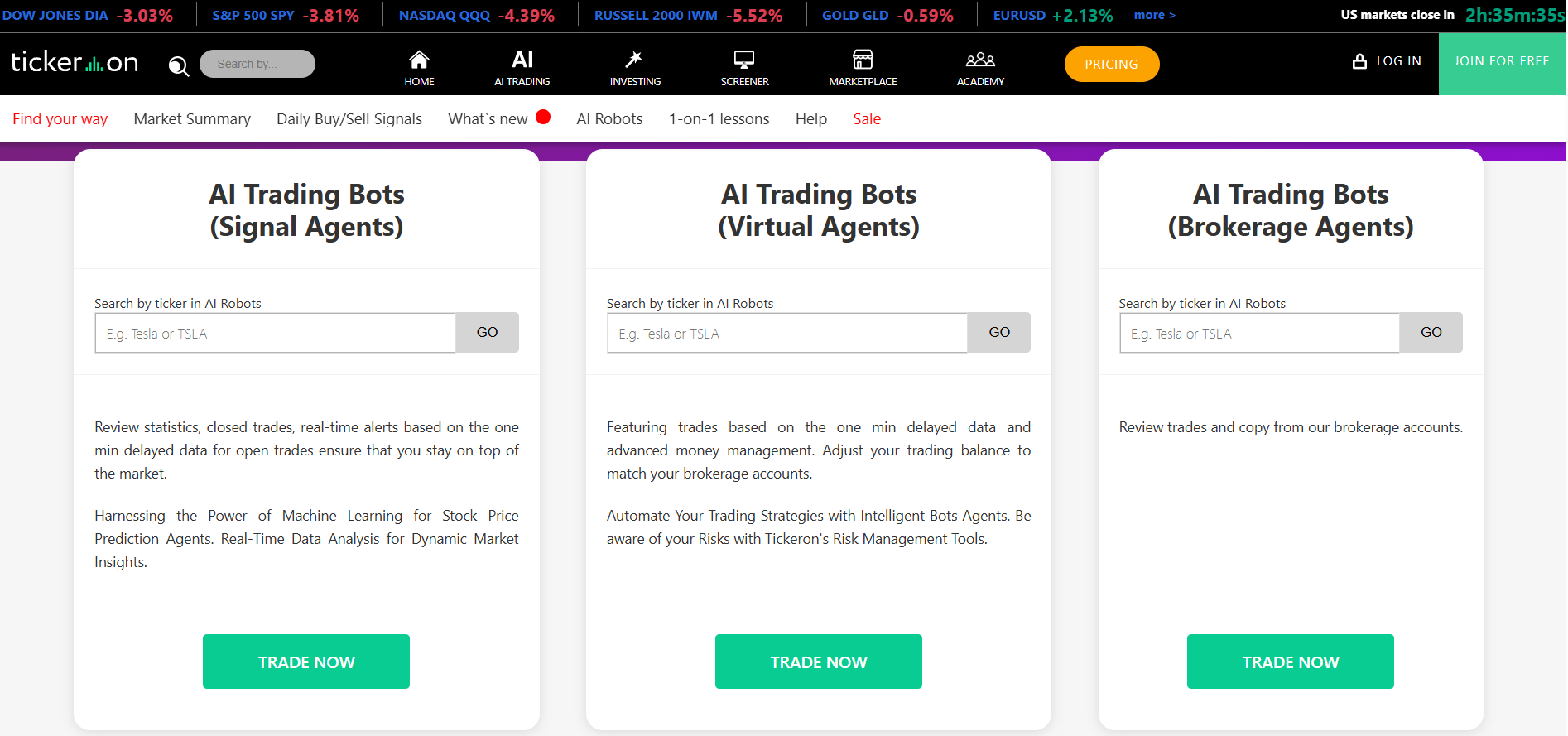

3. Tickeron

- Overall rating: 3.5 / 5

- Cost: $60/year for daily buy/sell signals, trading bots start at $90/month. See plans here

- Unique selling point: AI-powered trading bots, technical analysis, pattern recognition, and buy/sell signals

Tickeron is a marketplace for AI bots and research tools that can help you find trade signals, trade setups, and even copy trades. The basic membership gives daily buy/sell signals, and you can add on trading bots, AI search engines, AI patterns, an AI stock screener, and other real-time analysis tools for a monthly fee.

Tickeron offers AI-powered technical analysis and pattern recognition tools, AI stock prediction, and an AI-powered stock screener with buy/sell signals for each stock. This combines the power of AI to quickly crunch an overwhelming amount of market data and analysis to give you signals and ratings for stocks and other investments.

Learn More: Full Tickeron Review

Tickeron also offers AI-powered model portfolios that you can purchase individually (for around $5). These portfolios use AI quantitative models to build out portfolios for different investor goals. Each portfolio comes with a DivScore to rate the diversification of the asset allocation, and showcases the number of positions and historical returns. All portfolios come with instant trade signals created by AI.

What You Get With Membership

- AI-powered daily buy/sell signals

- Upgrade to get a trading bot of your choice

- Add-on AI pattern-recognition tools

- Add-on AI trend prediction analysis

- Add-on AI stock screener with buy/sell signals

- Add-on AI-based model portfolios for longer-term investors

- Add-on AI-based active portfolios for active traders

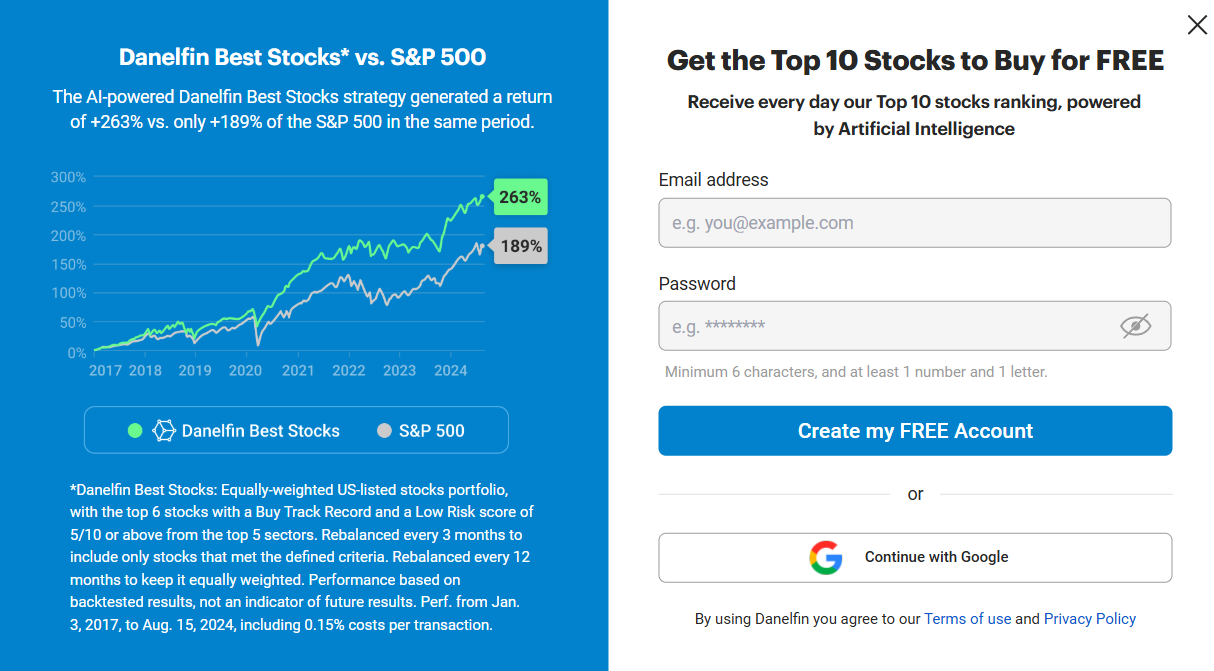

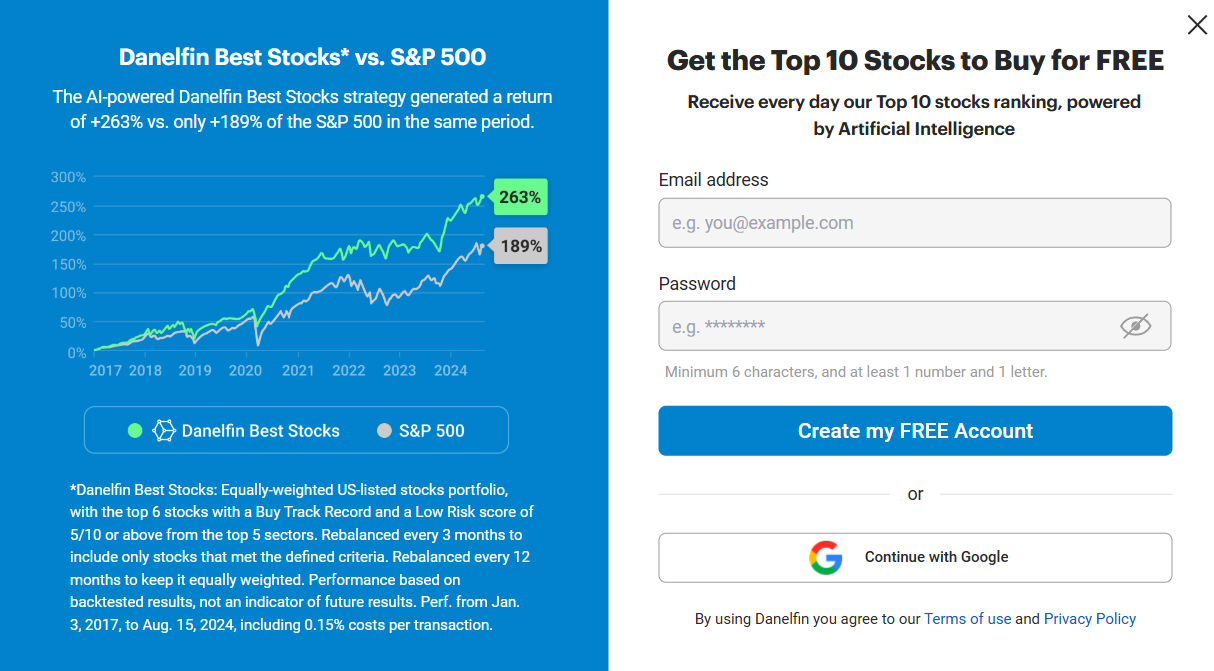

4. Danelfin

- Overall rating: 4.0 / 5

- Cost: $25/month up to $70/month. Free plan available.

- Unique selling point: AI-powered “best stocks” list, DanelFin ranking, AI Score for U.S. stocks & ETFs and European stocks

Danelfin is an AI-powered stock research and advisor platform that offers a list of “Best Stocks” that update on a rolling 3-month period. These stocks have outperformed the S&P 500 since 2017, and come with a DanelFin 1-10 ranking. Rankings are included for both U.S. and European stocks.

There’s also an “AI Score” for all U.S. stocks, Europe 600 stocks, and U.S. ETFs. This score is based on the probability for a stock to beat the market over the next three months.

Learn More: Full Danelfin review

DanelFin also utilizes AI to create trade ideas for specific stocks, with multiple price targets and buy/sell signals. This allows you to create trade setups and strategies for winning short- and medium-term trades.

There’s a free version to get the list of top 10 stocks, but you can upgrade to a $25/month plan for trade ideas and access to all AI scores for all stocks and ETFs. The Pro plan allows you to download historical data back to 2017 for a deeper dive into AI scores for stocks and ETFs over time.

What You Get With Membership

- Access to historical data and advanced filtering

- Daily updated AI Scores on U.S. stocks and ETFs

- Global AI scores for the Europe 600 top stocks

- Portfolio tools that allow investors to track performance against AI insights

- Simple scoring system (1–10) that helps beginners and pros alike quickly assess stocks

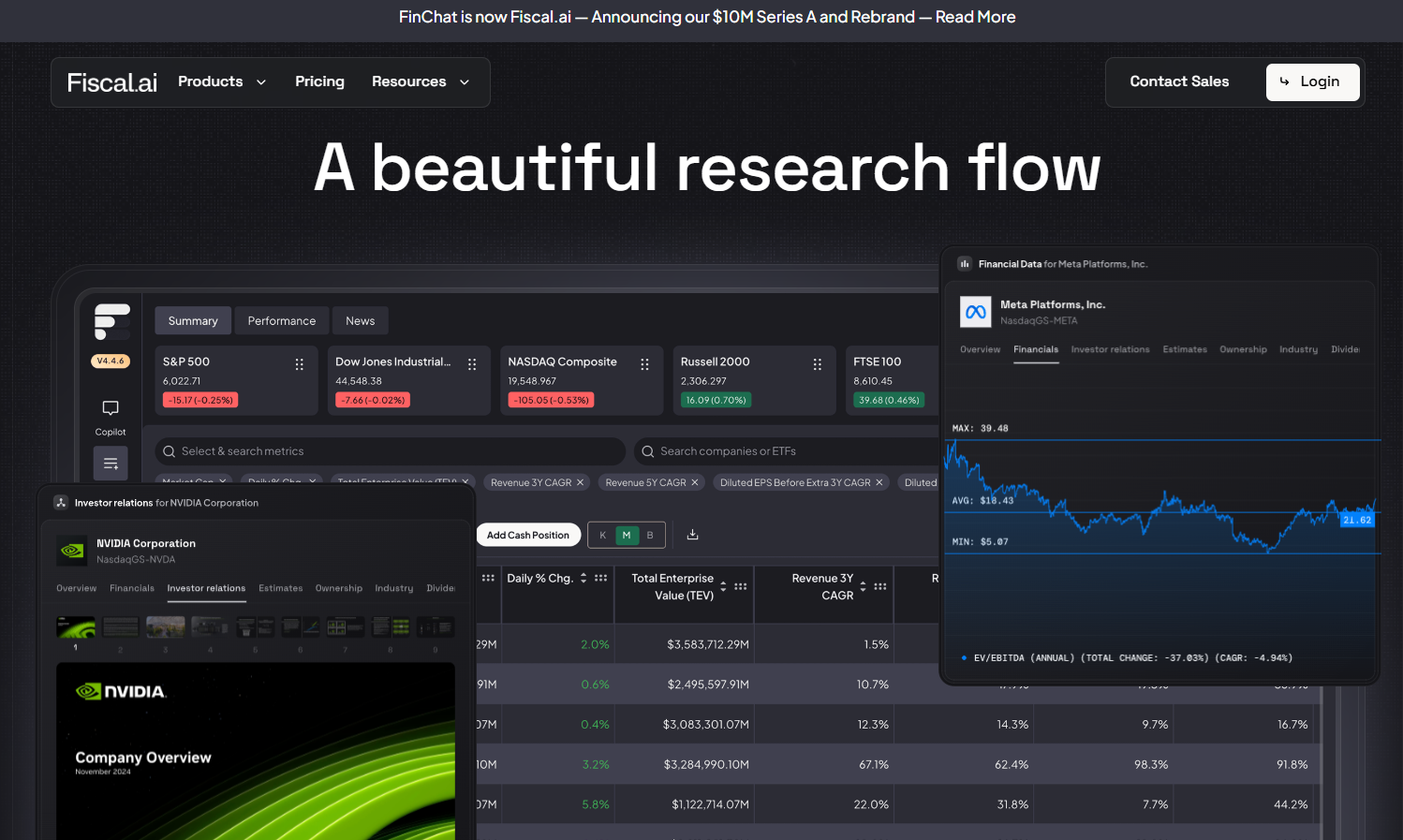

5. Fiscal.AI

- Overall rating: 3.7 / 5

- Cost: $24/month up to $199/month. 2-week free trial available. See plans here

- Unique selling point: Live chat AI stock research, access to data from 100,000+ investments globally, AI summaries, 20+ years of data

Fiscal.ai is a fundamental research terminal for investors that is powered by AI. If you want deep, accurate data analysis in an easy-to-read dashboard, Fiscal.ai is a great solution. Fiscal.ai uses AI to help summarize important company information quickly, with a built-in “Chat” feature to get real-time insights from AI. Fiscal.ai overlays Microsoft’s Copilot AI chat tool on its deep datasets — allowing you to ask for quick summaries of over 100,000+ investments globally.

Fiscal.ai recently upgraded their platform to offer even more deep dive research, and an Enterprise offer for unlimited prompts and team support. And the platform supports over 100,000 global investments.

While Fiscal.ai is aimed at long-term investors that want to review company fundamentals — you can use the AI chat feature, stock screener, analyst ratings, and other datasets to form a trading thesis. This can help you pick stocks that are moving in the right direction — ideal for swing or momentum traders.

What You Get With Membership

- 10 – 500 Monthly Copilot AI prompts (Free to Pro plan, Unlimited for Enterprise)

- Access to data from over 100,000 stocks, funds, and ETFs

- Notifications (on Plus, Pro, and Enterprise plans)

- Access to company filings, investor relations data, earnings calendar, and more

- API access to your own analysis tool integration

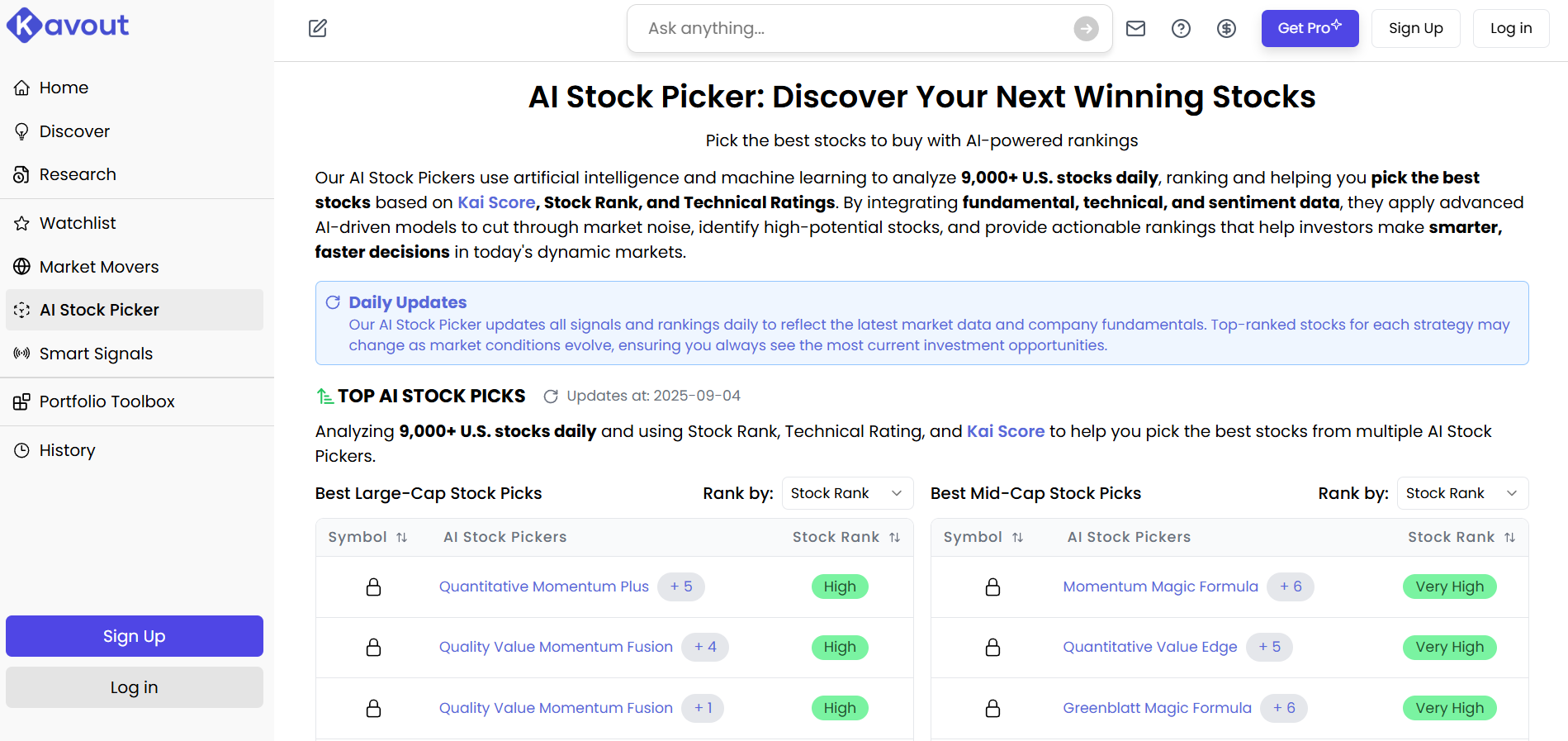

6. Kavout

- Overall Rating: 4.3 / 5

- Cost: Free tier available; Pro plans begin around $20/month (exact pricing may vary)

- Unique Selling Point: Kai Score (1–9) ranks stocks using fundamentals, technicals, and alternative data; natural-language AI stock screening; real-time intraday signals every 30 minutes

Kavout is a robust AI stock advisor designed for investors who want powerful analytics and customizable AI-driven stock screening. At its core is the Kai Score — a proprietary, deep-learning-based ranking from 1 to 9 that indicates a stock’s probability of outperforming. This score is based on a blend of fundamental data (valuation, financials), technical indicators (momentum, trends), and alternative signals (market sentiment, institutional activity).

With Kavout Pro, you can create custom AI stock screens using plain-language prompts such as “large-cap stocks with P/E less than 20 and a Kai Score over 7.” The platform returns stock lists ranked by Kai Score, Stock Rank (0–100, based on quality, value, momentum, growth), and Technical Ratings (0–100, from Strong Sell to Strong Buy).

Learn More: Full Kavout Review

Advanced traders also get access to Intraday Kai Score — live, real-time rankings and alerts updated every 30 minutes within Market Movers and Watchlist tools. This enables quick reactions to short-term trends and emerging setups.

What You Get With Membership

- Kai Score (1–9) AI-driven performance ranking using multi-dimensional data

- AI Stock Picker with natural-language queries and customizable screens

- Stock Rank and Technical Ratings for multi-factor scoring and trend strength

- Intraday AI signals updated every 30 minutes

- Portfolio tools and API access for integrating AI insights into custom workflows

What is an AI Stock Advisor?

An AI stock advisor is an online tool that utilizes AI to help you comb through mountains of stock market data to formulate an investing ranking for stocks and ETFs, as well as a strategy for investing. Most good AI stock advisors review fundamental and technical data to understand the health of a company, but also add in proprietary factors to find an edge.

Some AI stock advisors offer full portfolio constructions, while others offer automatic trading bot to execute trading strategies in real-time. The top AI stock advisors combine AI research and human analysis to put together investing strategies for your specific financial goals.

Is AI Good for Stock Advice?

While AI is only as good as the data it has access to, the top AI stock advisors leverage a huge breadth of market data to find better investment strategies than most other types of market analysis. AI can review years of market data in minutes, identify trends in real-time, and formulate investment rankings for stocks, ETF, and other assets quickly.

You can use AI tools to sort and filter market data for your specific investment strategy, and have AI help you put together an investment plan. And the best AI advisors offer both market analysis and sentiment scores, as well as the ability to predict future stock prices.

Need Help Managing Your Portfolio?

If you want to track your portfolio for free, you can use a tool like Empower Personal Dashboard (it’s free!). Empower offers free portfolio management and financial tools that help you track your investments.

You can quickly connect your investment accounts to Empower’s dashboard, and review how your portfolio has performed against industry benchmarks. And the free investment analysis tools, like the fee analyzer, shows you how much fees can affect your overall returns. Plus the built in retirement planner lets you create future projections on your retirement needs and if you’re on track.

Prefer Stocks Chosen By People?

While AI can be a helpful tool for picking stocks and building an investment portfolio, a human touch can’t ever be fully replaced.

Zen Investor, the portfolio service managed by Steve Reitmeister, uses the Zen Ratings AI factor as part of the selection process. But every stock in the portfolio is hand-picked by a human (and Reitmeister has over 40 years of stock picking experience). As a subscriber, you get monthly webinars, access to all past and present picks and recommendations, and loads of commentary.

At just $99 per year ($79 for a limited time, using the link below), it’s hard to find a better deal — especially considering this portfolio has delivered winning picks like Tapestry (NYSE: TPR), which is up over 30% since its addition to the portfolio, as well as Kinross Gold (NYSE: KGC), which is up a staggering 141% since its addition.

If you prefer the best of both worlds (AI and human resources), check out Zen Investor below.

Final Word:

AI stock advisors are only getting better, and the top platforms have been outperforming the market handily. It’s important to find a platform that doesn’t just ask Chat GPT “how to invest” — but has a framework to filter out the most important market information to help you find those hidden gem investments before everyone else does.

AI stock advisors can help you invest smarter, but it’s up to you to execute the trading strategy that works for your financial goals.

FAQs:

What is the best AI stock advisor?

Zen Strategies is a modern AI stock advisor that combines the power of a proprietary 115-factor ratings system with AI analysis to create 11 investment portfolios to choose from. Zen Strategies keeps it simple, with only 7 stocks in each portfolio, including an AI driven portfolio that has averaged 48% returns since 2003.

Can AI give stock advice?

While AI isn’t a registered investment advisor and can’t legally give “financial advice” — many AI platforms offer stock ratings, investment strategies, and AI-driven stock picks for investors.

What’s the best free AI stock advisor?

Zen Ratings is a free stock rating system that utilizes AI to rank stocks that have averaged 32% returns over the last 20+ years. As part of its 115-factor review of each stock, it includes a proprietary AI factor that leverages machine learning to locate stocks with market-beating potential. You can sign up and use Zen Ratings free to find stocks that are poised to outperform.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.