The Bottom Line: Is Warrior Trading Worth The Money in 2026?

In my opinion, Warrior Trading is too expensive for what you get. While the platform is legit and effectively aggregates all of the information traders need in one place, the fact that its programs start at $797 may be prohibitive. With a little legwork, you can assemble a toolkit of educational and stock research resources including WallStreetZen for a lot less money.

That said, Warrior Trading may be a good fit for you if you’re a day trader looking for an education and community rolled in one. To better determine if you fall into that category, keep reading.

What is Warrior Trading? Who is Ross Cameron?

Warrior Trading is an online trading education platform run by Ross Cameron. The Ross Cameron Warrior Trading universe is well-known in the day trading community. You may have even stumbled across the Ross Cameron YouTube channel, which is how many people learn about Warrior Trading.

Ross’s trading style focuses on short scalps on low float momentum stocks. No big surprise here: His educational material focuses on exactly that method of trading.

Warrior Trading offers several different products and services, including:

- Day trading courses

- Live streams and chat rooms

- Real-time data simulations

- A trading platform

- Momentum scanners

Related reading: The Best Way to Learn Day Trading for Beginners

Unfortunately, you can’t pick and choose services à la carte because you need membership access. For example, if you’re not interested in the courses and only want access to the chat rooms, you still need to subscribe to one of the membership tiers first, which makes it much more expensive than it seems if you just look at the price for chat room access.

A free stock research tool to try…

Our Zen Ratings system lets you find interesting stocks, including momentum stocks, and is much more affordable than access to Warrior Trading’s scanners.

Go ahead — enter any ticker here.

How Much Does Ross Cameron Make From Trading?

Ross Cameron made $12.6 million from a starting account size of just under $600, according to an audit performed by an independent accountant. If you want to take a look for yourself, Ross makes his earnings statements available here.

As for Ross Cameron’s net worth — that’s a little harder to answer since that information is not public. However, knowing that he made more than $12 million trading since 2017 and using estimates of the size of his chat rooms, I think it’s a safe bet to assume that his net worth is north of $20 million.

Some analyses suggest that he was making $80,000 per month from memberships and book sales, with some suggesting that there was a span of a few months where he was making more than $400,000 per month. Those claims are just guesses and it’s difficult to estimate the cost of running Warrior Trading, so it’s hard to get more precise.

What’s the Success Rate of Warrior Trading Students?

In general, Warrior Trading doesn’t track comprehensive stats about its students because some people don’t want to make their earnings public.

However, some students provide verified brokerage statements, which you can view here. As of this writing, there are dozens of students with verified earnings above $100,000 and several who have gained more than $1 million.

I should point out that focusing on the successful students doesn’t tell you anything about the overall success rate since we don’t know how many students have lost money trading with Ross’s system. Focusing solely on the wins is an example of survivorship bias.

Beat the Market in Just 10 Minutes a Month… See how WallStreetZen’s Editor-in-Chief turned a simple ‘Buy the Dip’ strategy into $68,264 in real profits in just 4 months—with full proof straight from his Schwab account. Watch the presentation now.

Warrior Trading: What’s Good / What Works

Let’s start the in-depth portion of this Warrior Trading review with a look at the good stuff.

Reviews of Warrior Trading have mostly good things to say about Ross’ teaching style and presentation. Countless testimonials across the internet on Reddit and similar forums praise his ability to present complicated topics clearly and concisely. His courses are well-organized, and the material is accessible enough to get you started even if you’ve never traded before.

Praise for the Warrior Trading chat room is less universal, but most people who’ve tried it still have good things to say. The chat is one of the best aspects of Warrior Trading, in my opinion. Trading with other people with varying perspectives and experience levels exposes you to new perspectives that you’d never encounter if you only trade alone.

Warrior Trading’s live stream and chat are always packed, for better or for worse, so you always feel like you have backup and people in your corner when things don’t go your way. The psychological benefit alone is worth it, but you also get the practical benefit of mirror trading.

I don’t recommend signing up for Warrior Trading’s chat if you’re only interested in mirror trading, but it is something that some people enjoy.

Interested in mirror trading? Try eToro’s CopyTrader

Whether you’re new to crypto or just don’t have time to track the markets, eToro’s CopyTrader makes it easy to tap into the expertise of top traders. With one click, you can automatically mirror their trades in your own portfolio.

Cost vs What You Get

Alright, now we’re getting to the nitty-gritty details. I won’t sugarcoat this for you: Warrior Trading is expensive. The most affordable membership tier, the Warrior Starter plan, comes with one 18-hour course and will run you a cool $797. While that does give you access to the course for three years, it still costs quite a bit more than similar options.

Membership Options for Warrior Trading

Here’s a quick breakdown of the three main membership options and what you get with each:

- Warrior Starter: $797 one-time fee for access to the Day Trading: The Basics course.

- Warrior Pro: $2,997 one-time fee for access to the Day Trading: The Basics and Day Trading: Strategies & Scaling courses. It also comes with access to information about trading psychology, options trading, and trading in retirement accounts.

- Warrior Pro Special: A $3,997 one-time fee gets you everything from the Warrior Pro tier, plus one year’s worth of live stream and chat access, a 90-day license for the Day Trade Dash trading software, 90 days’ worth of real-time data in the simulator, and a seven-day money-back guarantee.

I told you Warrior was expensive.

All of those plans give you three years’ worth of access to the courses, which makes their prices a bit easier to stomach but also means you’ll have to re-up after three years if you want continuing access to the course material.

If you go for the Warrior Starter or Warrior Pro options, you miss out on access to live streams and chat, which is one of the major draws of Warrior Pro, in my opinion.

Streaming and chat access costs an additional $147 per month on top of your membership, which I must say, feels like overkill. $150 for a chat room membership isn’t unheard of, but since you can only add access to an existing membership, it makes it even more expensive.

Warrior also offers two additional add-on services: A trading platform called Day Trade Dash and a Real-time simulator. Day Trade Dash costs $147 per month, and the simulator costs $97 per month. I don’t think that either option is worth the price. Day Trade Dash doesn’t offer anything over much cheaper alternatives, most notably TradingView, which Day Trade Dash appears to be based on.

Real-time simulation is nice when you’re starting out, but you can find more affordable options that work just as well. Your brokerage may offer delayed data you can use to practice for free, which is good enough if you’re just trying to learn your platform.

What’s Not So Great / Weaknesses

The most obvious downside of Warrior Trading is the price. Sure, if you were guaranteed to make $100,000 or more, it’s a non-issue, but you don’t know what your performance will be ahead of time. Dropping $1,000 at a minimum for access to the intro course and chat room is a serious commitment and not possible for everyone.

If you’re interested in mirror trading, eToro’s CopyTrader is a viable alternative.

A less obvious problem is that Ross’s trading style makes mirror trading, where you follow along and copy his trades, difficult. Momentum-based scalps require lightning-fast entries and exits, which means that by the time you enter his trade, you’ve likely already missed it.

If you’re only interested in Warrior Trading to get access to the chat room to mirror trade, you’ll most likely be disappointed.

Another issue with Warrior Trading is that the company had a run-in with the FTC over misleading claims in the past. The FTC claimed that Warrior was misleading potential customers by overstating the average student’s performance.

Ross has disputed this claim and insisted that the FTC kept changing its claims until it found something he couldn’t produce data for, but in the end, Warrior settled for $3 million.

Who It’s Best For / Use Cases

Warrior Trading is best for beginners who have some money to burn on expensive courses and tools. If you’re starting from zero, Ross’s courses will get you up to speed quickly.

There is one caveat, however: You have to be interested in quick scalps, not long-term investing or swing trading. The Warrior Trading method is pure scalping, so you won’t learn anything about valuing stocks or investing for retirement.

Real User Reviews and Experiences

Here are a few user reviews I pulled from TrustPilot to give you a sense of the overall sentiment in the average Warrior Trading course review:

“Ross has a gift for teaching. I have never felt myself learn any subject so comprehensively and it’s all because of his teaching style. I have him to thank for incredible results and a new career.” – Carla G

“Nothing against Ross. He provides good free YouTube content but aware of alternative motive to promote WT expensive courses and membership. My feedback is that membership is very EXPENSIVE where vast amount of information can be found on his YouTube or online for FREE.” – John

I should mention that the reviews of Warrior Trading are mostly positive, but there are a handful of reviews like John’s that point out how overpriced the material is compared to freely accessible content.

Comparisons / Alternatives

If Warrior Trading’s prices are a bit too rich for your blood, don’t worry. Here are some of my favorite affordable alternatives that provide similar content.

1. Investors Underground

Cost: $297 per month with annual discounts available

What you get: Memberships include access to chat rooms, watchlists, trade alerts, and video lessons covering momentum trading, swing trading, and tons of other topics.

How it compares: Investors Underground is a direct competitor to Warrior Trading. Its primary advantage over Warrior Trading is that you can get started for significantly less upfront cost. It’s pricing structure is also easier to understand, with comprehensive access included for one transparent price. For more info, check out our detailed Investors Underground review.

2. Stock Market Guides

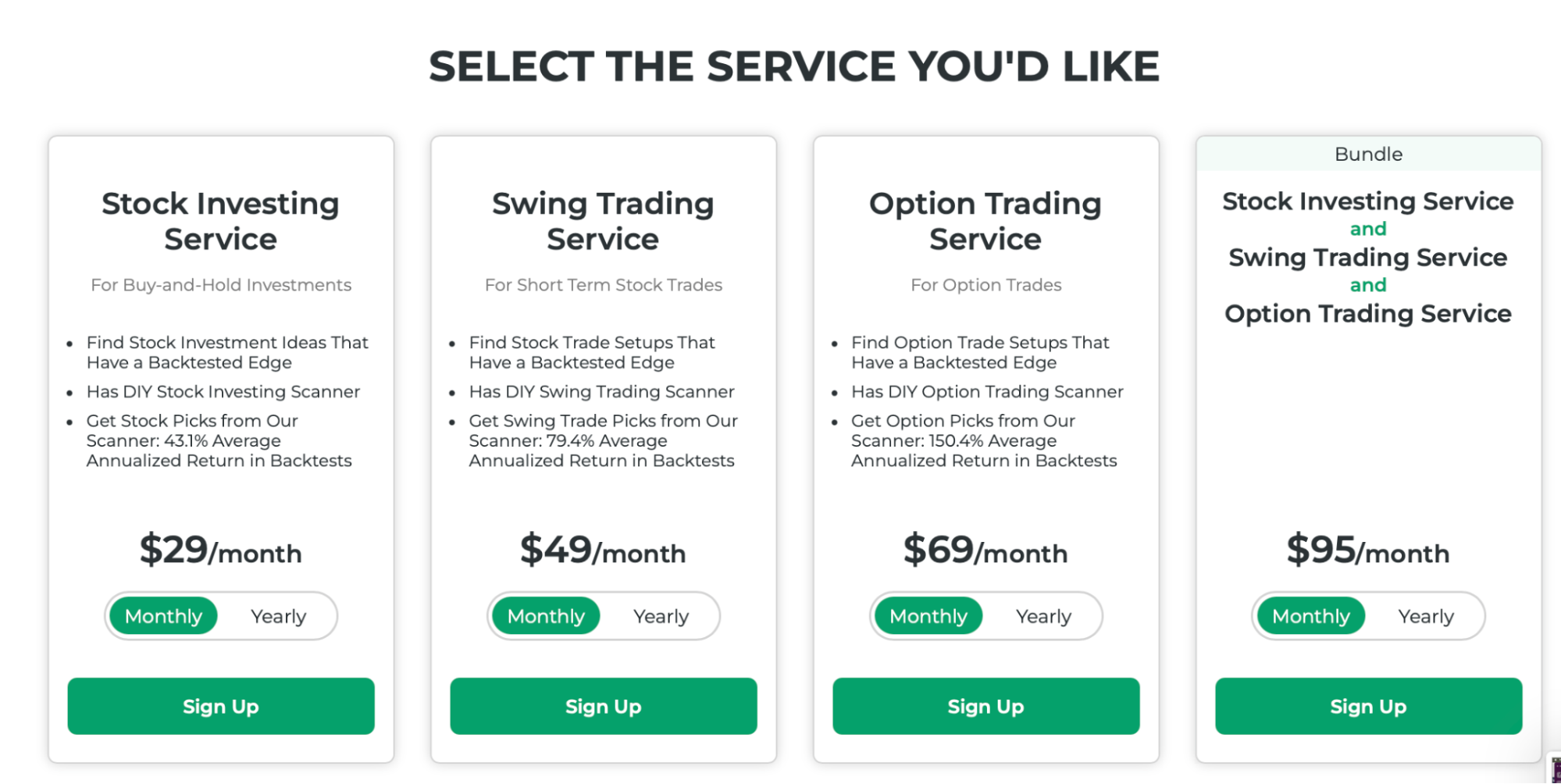

Cost: $29/month, $49/month, $69/month, or $95/month

What you get: Stock Market Guides separates its service into three separate packages, and there’s an option that includes all three in one package:

- Stock Investing Service: This package costs $29 per month and gives you access to a stock scanner, stock picks based on rigorous backtesting, and video tutorials to learn stock investing from the ground up.

- Swing Trading Service: For $49 per month, you get access to a tunable scanner, stocks handpicked for swing trading with a historical annualized return of just under 80%, alerts for entering and exiting potential swing trades, and video tutorials that help you learn swing trading.

- Option Trading Service: If options are more your speed, the Option Trading Service gets you access to a specialized options scanner, data-driven options picks, an options watchlist, trade alerts, and video tutorials. It costs $69 per month.

How it compares: The primary difference between Stock Market Guides’ three packages and Warrior Trading is that Stock Market Guides focuses on longer-term trading and investing. Stock Market Guides is better for you if you don’t enjoy the high-pressure, hectic nature of Warrior Trading’s high-frequency approach.

The Stock Investing Service is designed for investors who like to hold their positions for at least three months. The Swing Trading and Option Trading Services are for people who like to hold their positions for between one week and one month, which is still an eternity compared to Warrior Trading’s trade durations.

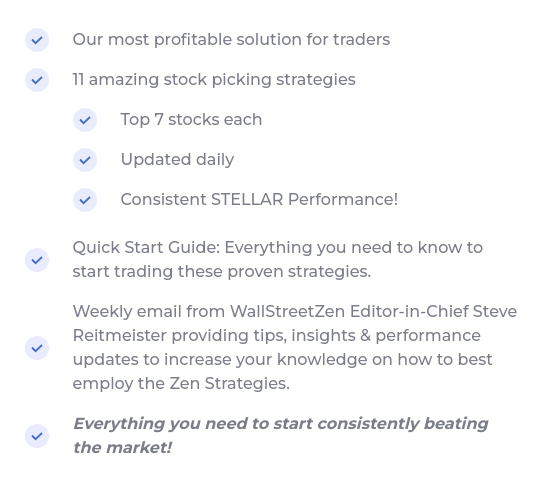

3. Zen Strategies

Cost: $997 per year with a 90-day refund policy

What you get: A membership to Zen Strategies gets you access to 11 different stock-picking strategies, each with seven promising candidates per day (so, you get access to 77 stocks at any given time).

You also get a starting guide that explains how the strategies work, how to make decisions within each strategy, and the rationale behind stock picking.

How it compares: Zen Strategies is also very different from Warrior Trading. Rather than focusing on short-term scalps that require your constant attention and decisive action, Zen Strategies gives you all the tools you need to make informed decisions over longer time periods. It also gives you access to 11 different strategies, so you can pick and choose the ones that suit your investing style.

Verdict / My Take

Warrior Trading is a legitimate trading education company run by a proven momentum scalper in Ross Cameron. His transparency is one of Warrior Trading’s biggest selling points and should make you feel comfortable that you’re learning from a bona fide expert if you choose to purchase a membership.

With that said, there’s no denying that Warrior Trading is pricey. Between the membership fees themselves and the cost of essential add-ons like access to live streams and chat rooms, Warrior Trading is only a viable option for people who don’t mind dropping serious cash for trading educational materials. What you get is quality information, but in most cases, you can find similar information elsewhere for a lot less money.

Final Word:

Unless you have deep pockets and don’t mind spending several thousand dollars on information that’s available for less money elsewhere, Warrior Trading is not your best option. Zen Strategies, Stock Market Guides, or Investors Underground are all worthy alternatives depending on your style and objectives.

FAQs:

Is Warrior Trading legit?

Yes, it is a legitimate educational company founded by Ross Cameron. Ross has verified his trading performance via external audits.

How much does Warrior Trading cost?

The most affordable course costs $797 for three years’ worth of access to the course material. The most expensive Warrior Pro Special package costs $3,997 for three years’ worth of access. Features like chat room access cost additional monthly fees.

Can you actually make money with Warrior Trading?

Yes, it’s possible. Warrior Trading has some students who have made significant profits using its system, but those results are not typical.

What trading style does Warrior Trading teach?

Warrior Trading focuses on high-frequency momentum scalping of low-float momentum stocks.

Is Warrior Trading good for beginners?

Yes and no. The educational content doesn’t assume prior knowledge and will get you up to speed, but the style of trading requires a lot of capital and a high tolerance for risk.

What are the downsides of Warrior Trading?

The biggest downside of Warrior Trading is its price. Access to all of its services starts at $3,997, not including monthly fees for chat room and live stream access.

Has Warrior Trading faced any legal issues?

Yes. In 2022, Warrior Trading settled with the FTC for $3 million over allegations that the company made misleading claims about its students’ typical earnings.

What are the best alternatives to Warrior Trading?

In my opinion, the best alternatives to Warrior Trading are Zen Strategies, Stock Market Guides, and Investors Underground.

Do you need a lot of money to start with Warrior Trading?

Yes. Not including the cost of the membership or courses, you need $25,000 to avoid Pattern Day Trader restrictions in the U.S. The type of trading Warrior Teaches also requires more capital than other strategies.

Does Warrior Trading offer a free trial?

No, but there is a free intro class that gives you an idea of what to expect from a full membership.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.