The Bottom Line: Is Kavout Worth It?

Kavout delivers robust and reliable AI-driven stock analysis through its Kai Score system, making it valuable for data-driven investors who enjoy breaking down numbers.

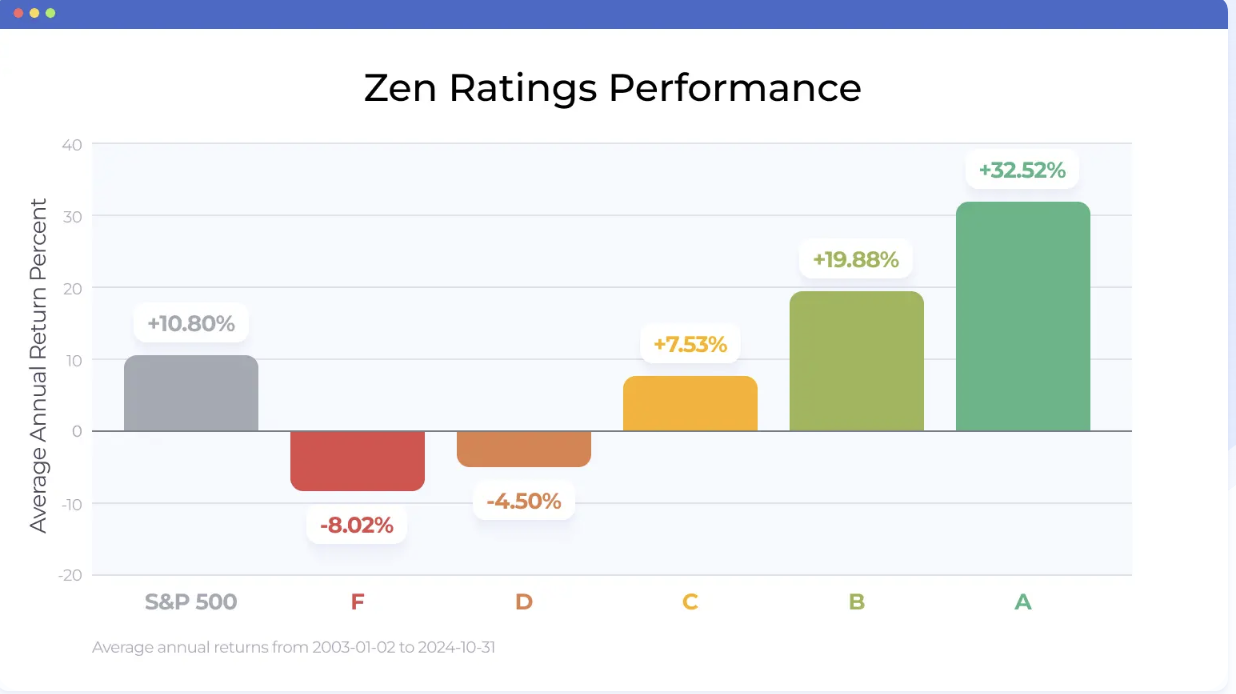

However, if you want proven market-beating returns with human expertise backing them up, the Zen Ratings system offered by WallStreetZen offers better accessibility and a track record you can verify.

Similarly, the Zen Investor stock-picking newsletter offers a professionally managed portfolio that leverages AI but also incorporates real-world experience and expertise.

But don’t just take my word for it.

This Kavout review delves into the platform’s features, examines user feedback, and compares it with top alternatives.

You’ll discover whether Kavout’s AI-driven approach aligns with your investment goals and budget, and explore potentially better options tailored to your needs.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Why Consider Kavout?

AI has completely changed investment analysis as AI-powered platforms can analyze massive datasets and identify patterns that would take humans weeks to detect. This shift has opened doors for regular investors to access tools that hedge funds have used for years.

Kavout stands out among AI stock prediction platforms by combining machine learning algorithms with interfaces that don’t require a computer science degree. The platform promises to transform how both individual and institutional investors select stocks and manage their portfolios.

This Kavout review covers the platform’s core features, including its signature Kai Score system. You’ll also see what real users have to say about it and how it compares to other AI and traditional investment services. By the end, you’ll know whether Kavout deserves space in your investment toolkit.

What is Kavout?

Kavout is an InvesTech company that wants to make sophisticated investment analysis available to everyone through artificial intelligence.

It tackles a fundamental problem: everyday investors struggle to navigate increasingly complex and data-heavy financial markets.

The platform uses advanced machine learning algorithms to deliver actionable investment insights, stock ratings, and portfolio optimization tools. Kavout serves individual investors seeking an analytical edge and institutional clients requiring scalable, AI-driven solutions.

The company’s flagship feature is its Kai Score, a proprietary stock rating that simplifies sophisticated analysis into easy-to-understand scores.

The Kavout platform also offers stock screening, predictive analytics, portfolio-building tools, and real-time market signals.

How Does Kavout Work?

The Kavout platform runs on machine learning models that continuously analyze massive datasets to generate investment insights.

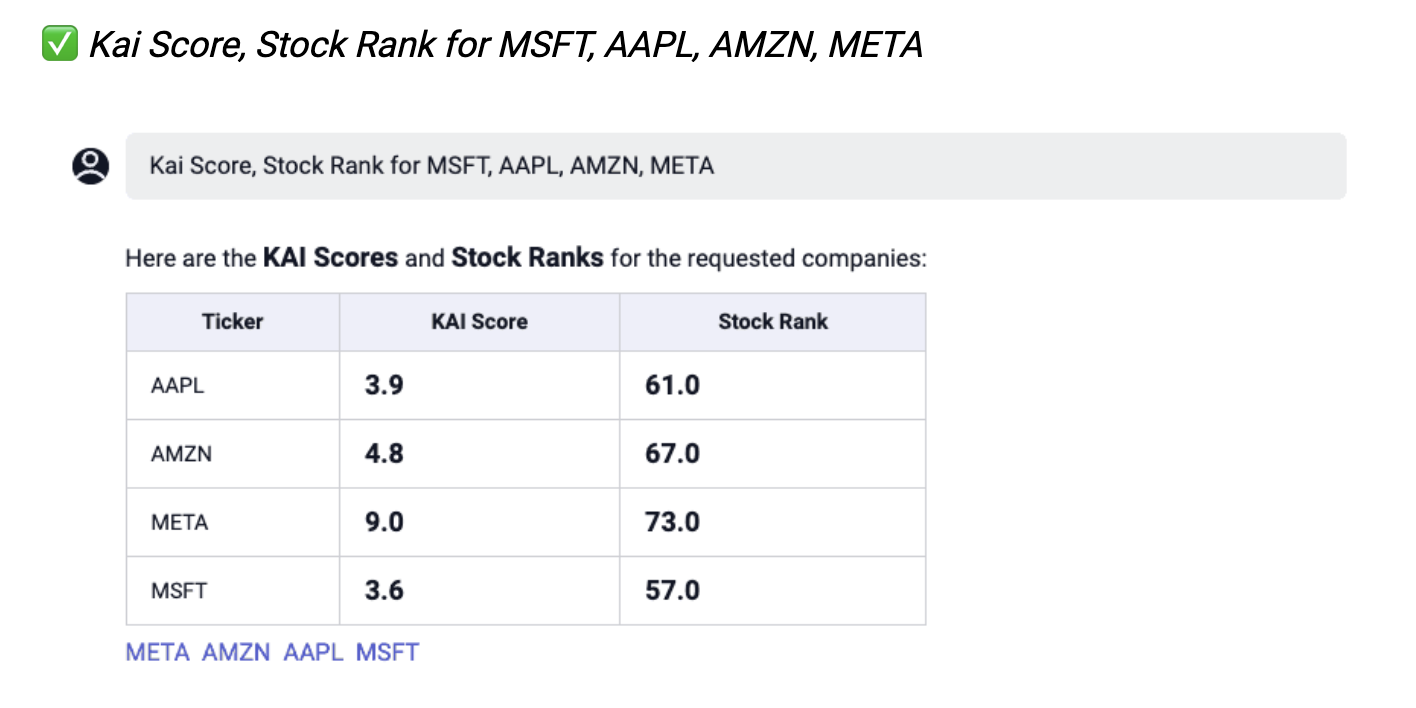

At the center of this system is the Kai Score, Kavout’s proprietary stock rating, which assigns scores from 1 (low potential) to 9 (high potential) for individual stocks.

The AI algorithms behind Kavout stock price prediction capabilities process multiple data sources:

- Company Fundamentals: Financial statements, earnings reports, revenue growth, and balance sheet metrics.

- Technical Signals: Price trends, trading volumes, momentum indicators, and volatility patterns.

- Market Sentiment: News analysis, social media buzz, and analyst rating changes.

- Alternative Data: Non-traditional datasets that provide unique company performance insights.

Investors typically use the Kavout platform for quick stock screening, idea generation, and portfolio optimization.

The system identifies high-potential stocks using its AI algorithms, sending real-time alerts for significant market movements or score changes.

Different Approach: While Kavout relies heavily on AI algorithms, Zen Ratings combines artificial intelligence with traditional fundamental analysis.

This hybrid approach combines AI efficiency with the expertise of market veterans, providing a balanced perspective for investors who value both data-driven analysis and human insight.

Key Features of Kavout

Kai Score Explained

The Kai Score is Kavout’s signature feature. It distills complex analysis into a simple 1-9 rating system.

This scoring mechanism serves as the foundation for the platform’s stock analysis capabilities. The Kai Score enables investors to identify promising opportunities without spending hours on manual research.

The score updates dynamically as new data becomes available, reflecting changing market conditions and company fundamentals.

High Kai Scores (7-9) indicate stocks with strong potential, while low scores (1-3) suggest potential underperformance.

Smart Stock Screeners

Beyond the fundamental Kai Score metric, Kavout offers AI stock screening that uses predictive analytics to filter stocks based on multiple criteria.

These stock analysis tools go beyond traditional fundamental filters by incorporating machine learning insights to identify stocks that match specific investment strategies or market conditions.

You can combine technical, fundamental, and AI-driven signals to create custom screens that align with your investment approach, whether you’re focused on growth, value, momentum, or other factors.

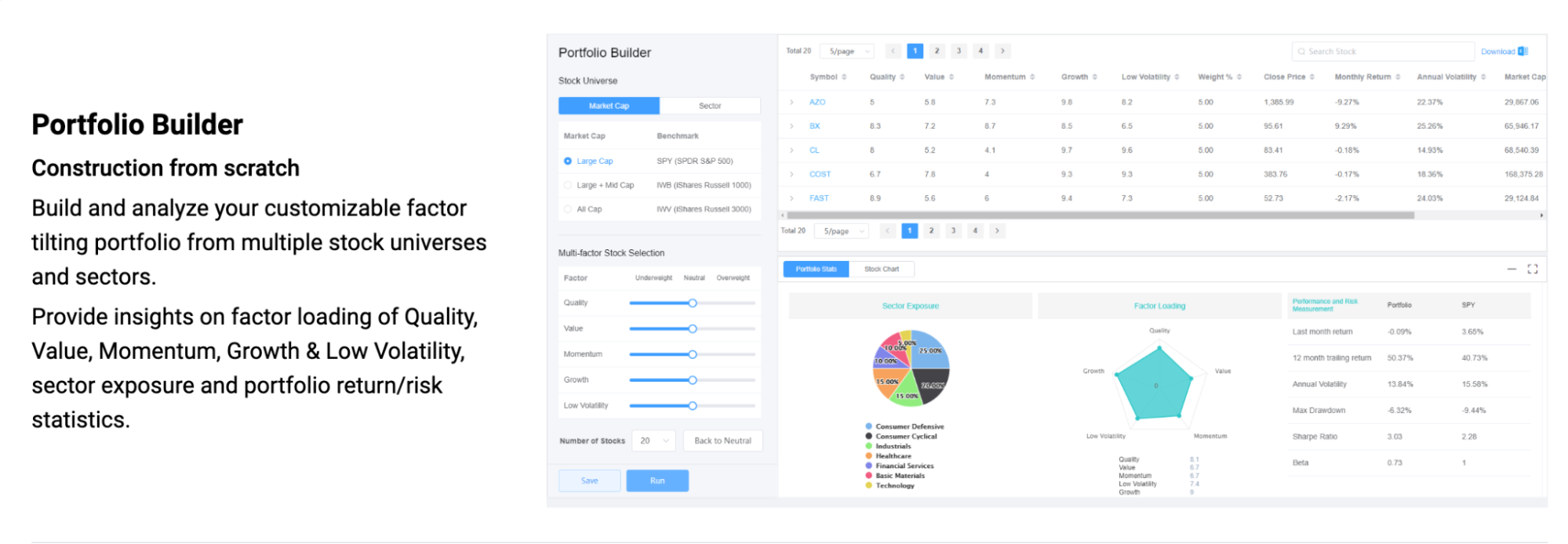

Portfolio Builder and Alerts

The Kavout AI platform features portfolio management tools that enable you to construct factor-tilted portfolios based on specific investment themes.

The system analyzes your portfolio’s exposure to various risk factors and provides optimization suggestions to improve diversification or target particular outcomes.

Real-time alerts notify you of key developments, including changes to your Kai Score, market movements, or when stocks meet your predefined criteria. These notifications allow you to make informed decisions and capitalize on emerging opportunities.

API Access for Advanced Users

For quantitative funds and sophisticated individual investors, Kavout provides API access to its data and signals. This feature lets advanced users integrate Kavout’s predictive analytics directly into their trading systems, research platforms, or algorithmic strategies.

API access is beneficial for institutional clients and quant-focused investors who require raw data for backtesting, model development, or the implementation of automated trading strategies.

What Are Real People Saying About Kavout?

Kavout reviews from actual users show generally positive sentiment, especially regarding the platform’s innovative AI capabilities and intuitive interface.

Many investors appreciate how the Kai Score simplifies complex stock analysis and provides insights for screening a large universe of stocks.

Users frequently praise the platform’s comprehensive data integration and its speed in processing market information. These AI-driven insights are often highlighted as valuable for generating investment ideas and validating existing research.

However, some Kavout reviews point to areas that need improvement. Common concerns include limited transparency about the specific methodologies behind the AI models and the data sources that contribute to Kai Score calculations. Some users want more granular control over AI parameters or deeper customization options.

Pricing discussions appear frequently in user feedback. Some investors note that the cost structure may create barriers for casual or budget-conscious investors.

Alternatively, advanced users find more value in the platform’s capabilities, particularly those comfortable with quantitative analysis approaches.

Kavout Pros and Cons

Based on user feedback and my personal platform analysis, here are the key advantages and disadvantages:

✅ Pros:

- Innovative Kai Score System: Provides simplified yet sophisticated stock ratings powered by advanced AI.

- Comprehensive Tools: Offers diverse functionality, including screening, alerts, and portfolio analysis.

- User-Friendly Interface: Makes advanced AI accessible to a broader range of investors.

- Real-Time Processing: Delivers timely insights and market signals.

- API Integration: Serves both retail and institutional clients with scalable solutions.

❌ Cons:

- Limited Transparency: Some users desire greater insight into the underlying methodologies and data sources.

- Pricing Barriers: May be cost-prohibitive for casual or budget-conscious investors.

- Quantitative Focus: Heavy reliance on AI may not appeal to traditional fundamental analysis advocates.

- Complexity for Beginners: Despite a user-friendly design, the volume of features might overwhelm investing newcomers.

Kavout vs. Other AI Stock Pickers

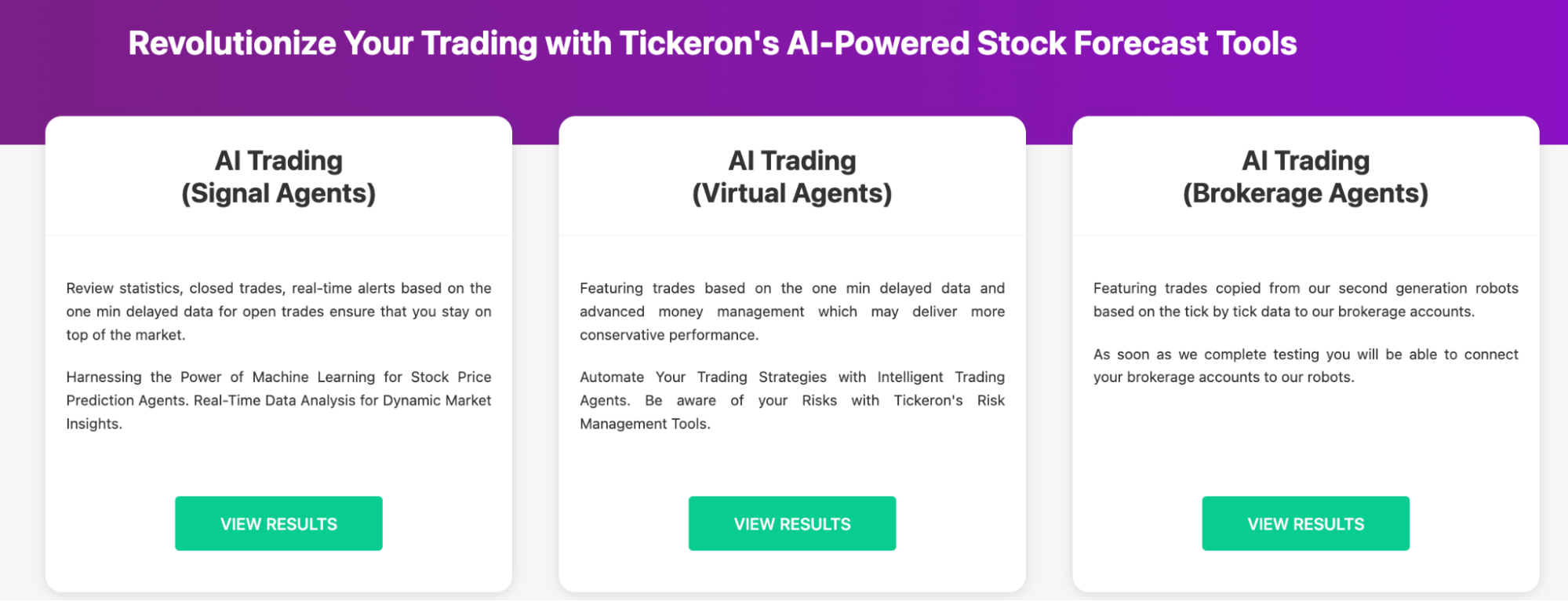

Kavout vs. Tickeron

Price: Kavout offers a free tier with Pro plans from $20/month, while Tickeron provides a free tier with paid plans starting around $60/year.

The main difference is that Kavout focuses on its Kai Score system and comprehensive AI analysis for investment research, whereas Tickeron focuses on pattern recognition and automated trading capabilities.

Tickeron is a better choice if: You’re an active trader seeking automated trading bots and pattern recognition for short-term opportunities.

Tickeron specializes in automated trading strategies and real-time pattern recognition, making it suitable for traders who want hands-off execution.

While Kavout provides holistic AI-driven investment insights through its Kai Score system, Tickeron digs deeper into execution automation and short-term trading strategies with its AI robots marketplace.

Kavout vs. Zen Investor

Price: Kavout offers a free tier with Pro plans starting at $20/month, while Zen Investor is priced at $99 per YEAR ($79 for a limited time).

Note: If you just want WallStreetZen’s rating system, you can gain access for free — click here and type in any ticker. There’s an upsell for additional searches once you hit your quota – see plans here

Main difference: Kavout provides purely AI-driven insights and automated analysis, while Zen Investor combines AI insights with over 40 years of human market expertise to offer you a managed portfolio of high-potential stocks.

Zen Investor is a better choice if: You want AI-enhanced analysis with personalized human guidance and education. Unlike Kavout’s algorithm-focused approach, Zen Investor combines artificial intelligence with decades of human market experience.

This isn’t an “AI black box” solution; it’s AI-enhanced analysis with a human touch from a market veteran with over 40 years of experience.

Zen Ratings incorporates AI and traditional fundamental analysis checks into the stock selection process, providing a balanced approach that combines technological efficiency with seasoned market expertise.

Zen Investor offers personalized coaching, educational resources, and stock picks to help you learn while investing.

Kavout vs. Motley Fool Stock Advisor

Price: Kavout offers a free tier. While Motley Fool Stock Advisor is typically $199, you can get your first year for $99 by using the links in this post.

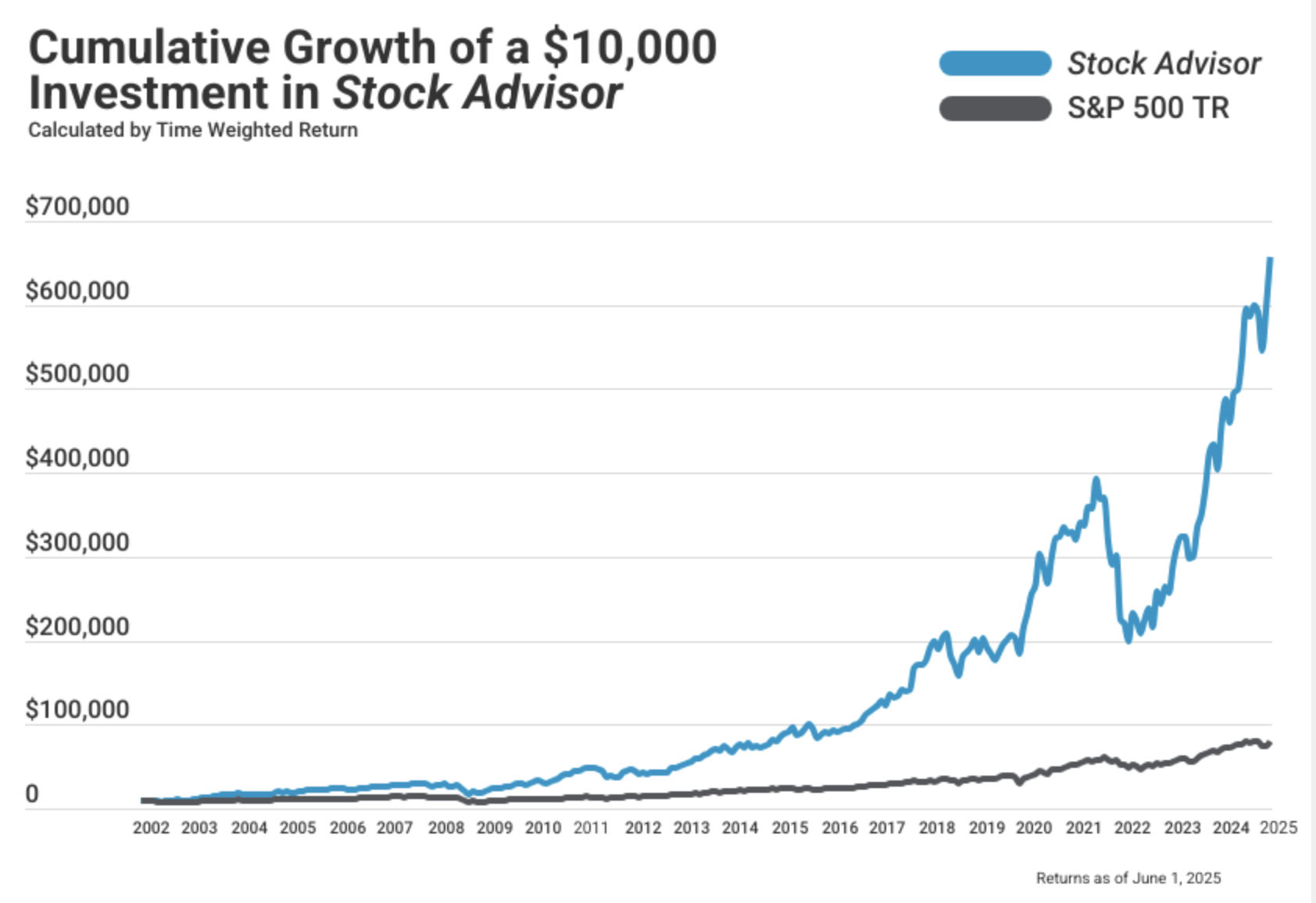

The main difference is that Kavout relies on AI-driven stock picking and predictive analytics. At the same time, Motley Fool Stock Advisor provides human-curated recommendations backed by a proven market-beating track record.

Stock Advisor is a better choice if you prefer expert recommendations from a service with a proven track record of long-term success. Motley Fool Stock Advisor isn’t an AI stock picker, but it has consistently delivered market-beating returns over its long history.

The service provides two new stock recommendations each month, along with a curated list of the best buys now.

Motley Fool’s strength lies in its proven track record of identifying long-term growth opportunities through expert analysis. For investors who value documented success and traditional research approaches, Stock Advisor offers compelling value and peace of mind that algorithmic predictions simply can’t match.

Who is Kavout Best For?

Kavout works best for specific investor profiles:

Ideal Kavout Users:

- Data-Driven DIY Investors: People comfortable with number-heavy analysis who want AI enhancement for their research process.

- Active Traders: Investors who trade frequently and can benefit from real-time signals and predictive analytics.

- Efficiency Seekers: Those looking to streamline research processes and reduce manual analysis time.

- Tech-Savvy Investors: People interested in exploring cutting-edge AI applications in investment strategies.

Investors Who Should Look Elsewhere:

- Complete Beginners: The platform may present a steep learning curve for those entirely new to investing.

- Traditional Investors: Those preferring purely qualitative analysis approaches may find limited value.

- Budget-Conscious Investors: While offering a free tier, full features require subscription costs that may be prohibitive.

- Personal Advice Seekers: Kavout provides tools, not personalized financial guidance or portfolio management services.

Is Kavout Good? Honest Verdict

So, is Kavout worth it? Our assessment reveals that Kavout is a robust platform that delivers significant value to specific investor segments.

Its core strength lies in processing vast amounts of market data through advanced AI, translating complex information into actionable insights via the Kai Score and comprehensive screening tools.

Kavout excels at providing quantitative advantages, making it valuable for investors who are comfortable with technology and data-driven decision-making.

The platform reduces the time and effort required for stock research, offering a streamlined approach to identify potential investment opportunities.

The AI-driven insights and real-time signals can be game-changing for active traders and those seeking to capitalize on market movements. However, Kavout is a sophisticated tool, not a guaranteed path to investment success.

When Kavout Makes Sense:

- You’re comfortable integrating AI into your investment strategy

- You appreciate quantitative analysis and data-driven insights

- You want to enhance traditional research with predictive analytics

- You’re willing to invest in premium, technology-enhanced services

When to Consider Alternatives:

- You prefer proven track records over cutting-edge technology

- You value human expertise and personalized guidance

- You’re working with limited budgets or starting your investment journey

- You favor traditional fundamental analysis approaches

For investors seeking documented success and expert guidance, Motley Fool Stock Advisor offers compelling value with its market-beating track record and accessible pricing.

Those seeking AI-enhanced analysis with human expertise should consider Zen Investor, which combines technological innovation with decades of market expertise.

FAQs:

Is Kavout good?

Kavout is a solid AI-driven platform for investors seeking data-driven insights through its Kai Score system and comprehensive screening tools.

What is the best AI investment tool?

Tickeron works better for automated trading and pattern recognition, while Zen Investor combines AI with human expertise for a balanced approach.

What is the best AI stock picker?

The best choice depends on your trading style. Tickeron suits active traders, while Zen Investor leverages AI with human market expertise.

How does Kavout work?

Kavout uses advanced machine learning algorithms to analyze vast amounts of financial data, including fundamentals, technical indicators, and market sentiment.

What is Kavout’s track record?

While Kavout showcases performance data for portfolios constructed with high and low Kai Scores, specific audited track records for individual stock picks aren't prominently displayed.

What’s cheaper than Kavout?

Kavout offers a free tier with limited features and Pro plans starting at $20 per month. Motley Fool Stock Advisor typically costs around $99 per year, with introductory offers, making it a more cost-effective option on an annual basis. Zen Investor's pricing varies, but it may offer better value given its annual pricing plan.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.