The Verdict: Is Magnifi Worth It in 2025?

Here’s my quick take. If you’re comfortable with tech and want AI to simplify your investment research, Magnifi offers solid value.

The platform shines at making investment research less intimidating through its conversational interface and portfolio analysis tools. While some Magnifi reviews mention inconsistent AI responses and occasional app glitches. The 7-day free trial lets you test drive the platform before committing.

From there, at $14 monthly (or $132 yearly), Magnifi costs less than a couple of coffee shop visits per month.

New investors who need guidance but aren’t ready for a financial advisor will find it helpful. Experienced investors might appreciate how it spots hidden risks across multiple accounts.

But Magnifi isn’t for everyone:

- If you prefer tools that go beyond the “black box” AI approach and mix tech with a human touch/traditional fundamental research, you may appreciate WallStreetZen’s easy-to-use Zen Ratings system.

- If you prefer a more technical approach, TrendSpider or Tickeron might be a better fit.

(We’ll dig into these alternatives and more below.)

A More Affordable Alternative…

With a Zen Investor subscription, you can save time and let a 40+ year market veteran do the heavy lifting for you. Here’s what’s included:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Why Consider Magnifi?

Because AI is changing how we invest. If you want a digital financial sidekick, Magnifi is eager to take up the position. This investing platform promises to help you research investments, build portfolios, and execute trades, all with an AI assistant guiding you.

But is it worth your money? In this Magnifi review, I’ll cut through the hype to tell you what works, what doesn’t, and whether it deserves a spot in your financial toolkit.

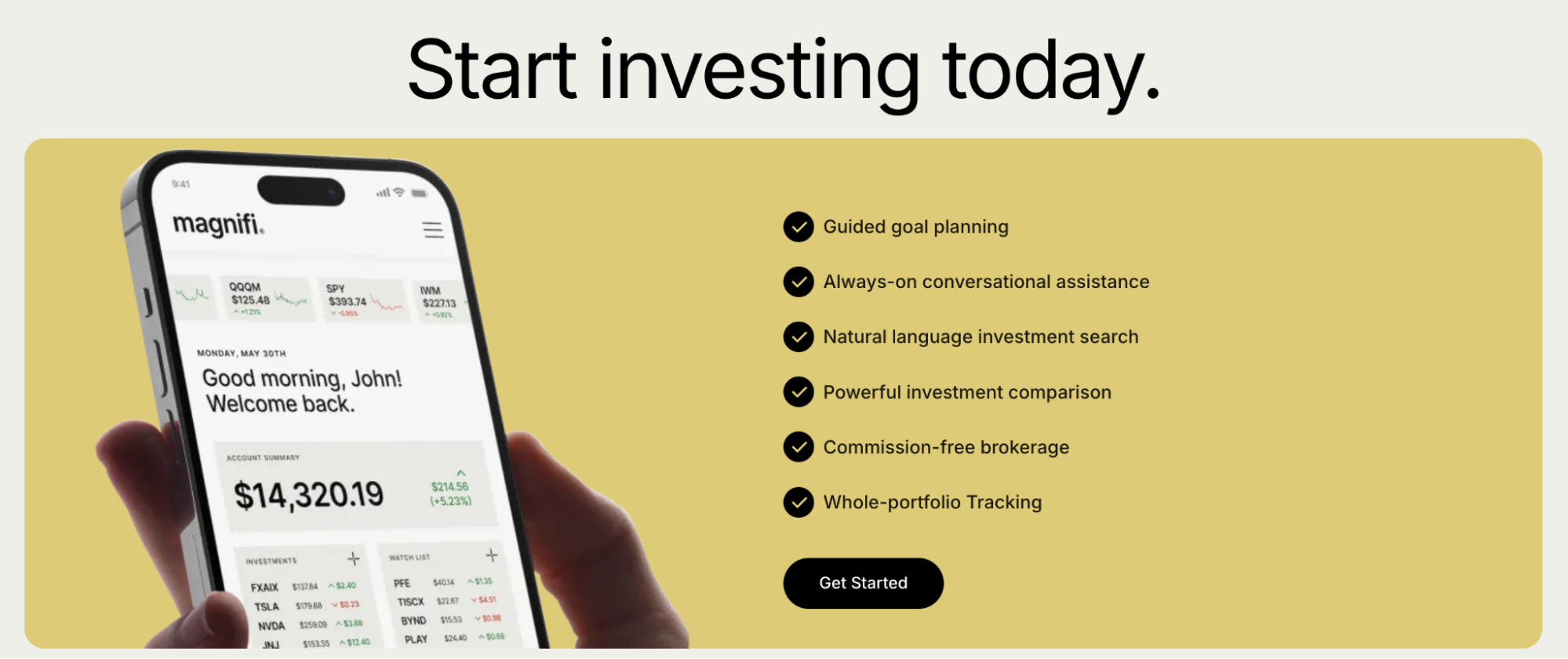

How Magnifi Works

Think of Magnifi as your investing conversation partner. Instead of digging through complex menus, you just ask questions like “Find tech stocks under $100” or “What are the best dividend ETFs?” and it delivers relevant options with supporting data.

What You Get

Here’s what you get with a Magnifi subscription:

- Easy Investing Research: Access 15,000+ stocks, ETFs, and mutual funds through a simple search engine. Type “companies investing in green energy” and it’ll show you relevant picks. Overall, this feature is comparable with tools offered by Trade Ideas and Finchat.

- Portfolio Building Tools: Magnifi helps you create a diversified portfolio aligned with your goals. It can spot concentration risks and suggest alternatives that maintain returns while reducing risk.

- Trade Execution: Buy and sell directly within the platform without commissions. The checkout-style interface makes trading straightforward even for beginners.

- Themed Portfolios: Magnifi offers managed portfolios centered around specific themes if you prefer a hands-off approach. These cost an extra 0.23% annually on top of your subscription.

- Cross-Account Analysis: One of Magnifi’s best features lets you link multiple brokerage accounts to get a unified view of your investments. This helps spot overlapping exposures you might miss otherwise.

You can access Magnifi through a website or mobile app. The mobile experience feels polished as they know many investors prefer managing money on the go.

How Magnifi Uses AI

The AI is what sets Magnifi apart from traditional investing platforms. Multiple Magnifi AI reviews highlight how the technology improves the investing experience:

- It’s Conversational: Ask Magnifi questions in plain English, not investment jargon. The AI translates your everyday questions into proper investment searches. If you like this particular aspect of the service, you should also check out our FinChat.io review.

- Personalized Suggestions: Based on your goals, risk tolerance, and current holdings, Magnifi recommends investments tailored to your situation, not generic advice.

- Portfolio Health Checks: The AI constantly scans your investments for potential problems, such as too much concentration in one sector, hidden risks, or opportunities to optimize.

- Market Context: Magnifi processes market data, financial reports, and news to provide relevant insights to inform your decisions.

Does Magnifi Use ChatGPT?

Magnifi Financial combines ChatGPT (or similar large language model tech) with its own AI systems. This mix helps the platform understand complex questions and provide nuanced, conversational responses while handling the computational side of investment analysis.

As a “copilot for self-directed investors,” Magnifi provides personalized investment advice and guides users through market events. Founder Vinay Nair sees it democratizing financial intelligence as Wall Street explores AI’s potential to enhance investment decision-making.

Is Magnifi Really Better Than DIY Investing?

Whether Magnifi beats traditional DIY investing depends on your style and how much you value your time.

Let’s break it down:

Pros: Why You Might Love Magnifi | Cons: Where It Falls Short |

It’s Fast: Magnifi analyzes mountains of data in seconds, spotting opportunities you’d miss when researching manually. What might take hours of manual research happens in minutes with Magnifi. | Algorithm Limitations: Magnifi can’t handle unprecedented market events as well as human judgment might. (A system like Zen Ratings can offer a more balanced picture.) |

No Emotional Trading: AI doesn’t panic sell or buy on hype. It sticks to data, helping you avoid emotional investing mistakes. | Less Control: Some investors feel uncomfortable letting AI influence their investment decisions. |

Beginner-Friendly: Complex investing concepts get translated into plain English, making investing more accessible. | Ongoing Cost: Unlike free DIY research, Magnifi requires a subscription fee. |

Big Picture View: Seeing all your accounts in one place gives you a complete picture that’s hard to achieve manually. | Not Fully Customizable: Sophisticated investors might find the recommendations too general for their specific strategies. |

Magnifi Pricing: Is It Worth It?

Magnifi offers straightforward pricing:

- Monthly: $14

- Annual: $132 ($11/month equivalent, saving 21%)

- Managed Portfolios: Additional 0.23% yearly fee on assets

All plans include a 7-day free trial.

The subscription might seem pricey for casual investors who only make a few monthly trades. But if Magnifi helps you find even one better investment per year or avoid one bad one, it could easily pay for itself.

Active investors who trade frequently will likely find more value, as the time-saving features and risk analysis tools deliver more benefits the more they are used.

When comparing costs, remember:

- Traditional financial advisors charge 1-2% of assets

- Competing platforms like Trade Ideas cost $84-$228 monthly

- Free DIY tools require a significant time investment

From this angle, Magnifi is a reasonable middle ground. It is pricier than basic tools but way cheaper than full-service advisors.

However, it’s not the only option out there. Here are some worthy alternatives to consider:

Magnifi vs. Other AI Investing Tools

The AI investing world is getting crowded. Here’s how Magnifi stacks up against competitors:

Zen Investor

Main Difference: Zen Investor pairs AI with human experts, while Magnifi relies primarily on AI alone.

Advantages Over Magnifi:

- Human validation of AI recommendations

- More comprehensive fundamental analysis

- Proven market-beating track record

Cost: $99/month ($79 for a limited time, using links in this post)

Best For: Investors who want AI efficiency with human expertise for stock selection.

Zen Investor offers a compelling compromise if you’re torn between pure AI and DIY. Unlike Magnifi’s primarily AI approach, Zen Investor combines AI analysis with human expert oversight.

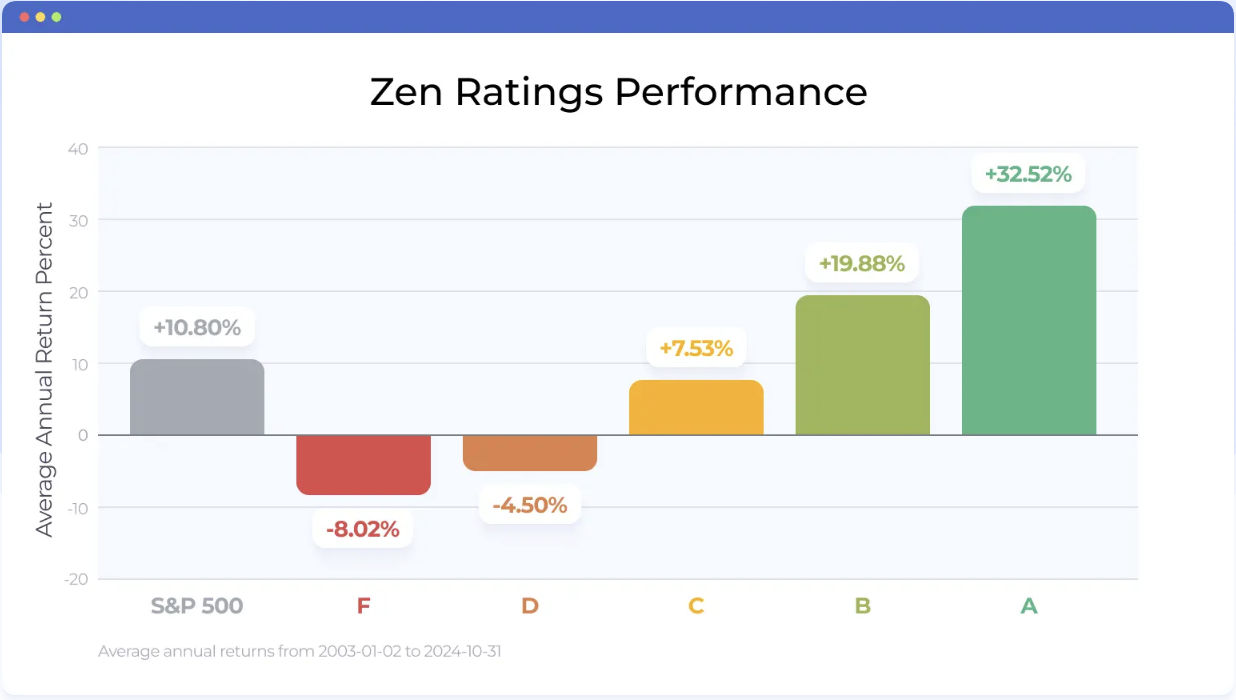

Zen Investor employs the Zen Ratings system, a 115-factor model alongside experienced investment professionals who review the AI’s picks. This adds a critical layer of judgment that pure AI systems lack, which is invaluable during unusual market conditions when historical data might not apply.

The human-in-the-loop approach helps avoid the “black box” problem, where you don’t understand why the AI made specific recommendations. This hybrid model makes a lot of sense for anyone skeptical about fully automated investment advice.

Trade Ideas

Main Difference: Trade Ideas focuses on active trading and technical analysis versus Magnifi’s longer-term investing approach.

Advantages Over Magnifi:

- More sophisticated technical analysis tools

- “Holly” AI is explicitly designed for day trading

- Better automated trading integration

Cost: $127-$254/month or $1,068-$2,136 annually

Best For: Active day traders wanting AI-powered trade signals.

TrendSpider

Main Difference: TrendSpider specializes in technical analysis and pattern recognition, while Magnifi offers a broader but less specialized approach.

Advantages Over Magnifi:

- Superior charting capabilities

- Better pattern recognition

- Strategy backtesting and automation

Cost: $54-$199/month

Best For: Technical traders wanting AI help identifying chart patterns.

Seeking Alpha Virtual Analyst

Main Difference: Seeking Alpha’s Virtual Analyst creates comprehensive research reports while Magnifi provides interactive, conversation-based analysis.

Advantages Over Magnifi:

- Detailed analysis reports

- Ties into Seeking Alpha’s vast content library

- Strong fundamental analysis focus

Cost: Included with Seeking Alpha Premium ($299 annually — get $30 off using this link)

Best For: Fundamental investors who value detailed research reports.

Tickeron

Main Difference: Tickeron specializes in AI trading bots while Magnifi offers a more accessible conversational approach.

Advantages Over Magnifi:

- Specialized AI trading bots marketplace

- Advanced pattern recognition

- Automated trading options

Cost: Various tiers, premium features over $100/month

Best For: Algorithmic trading enthusiasts.

Is Magnifi Safe To Use?

Magnifi works best for:

- Tech-comfortable investors who like conversation-based interfaces

- People researching investments based on themes or goals

- Anyone wanting an all-in-one research, portfolio management, and trading platform

- Investors juggling holdings across multiple accounts

When it comes to financial platforms, security matters.

Here’s Magnifi’s safety profile:

Magnifi Financial operates under SEC and FINRA oversight, using Apex Clearing Corporation as its custodian. Through Apex, your accounts get SIPC insurance up to $500,000 (including $250,000 for cash).

The platform uses standard encryption and security protocols, partnering with Plaid and Okta for secure account connections. User reviews show mixed experiences. Some praise the intuitive interface, while others mention technical hiccups. However, there aren’t widespread security complaints.

Like all AI platforms, Magnifi collects data to train and improve its system. Review their privacy policy to understand how they use your information. And always use strong passwords and two-factor authentication when available.

Final Word:

This Magnifi review shows how AI is changing investing, making research faster and portfolios easier to manage. The platform strikes a good balance between simplicity and valuable features, helping both new and experienced investors.

Magnifi’s biggest strengths are its conversational interface, which eliminates investing jargon, and its portfolio analysis, which spots risks you might miss. For many investors, the subscription cost makes sense when considering the time saved and potential for better investment decisions.

That said, it’s not perfect. Technical traders might prefer TrendSpider, while those skeptical of pure AI recommendations might prefer Zen Investor’s human-AI hybrid approach.

The bottom line: Your investment style and comfort with technology will determine if Magnifi is worth it. Their 7-day free trial makes it easy to test drive before committing.

As AI keeps evolving, platforms like Magnifi will only get smarter, making now a good time to see if AI-assisted investing fits your approach.

FAQs:

Does Magnifi pick stocks for you?

Magnifi suggests investments based on your queries and goals, but you make the final buying decisions.

Their managed portfolios offer more automation, but even then, you choose which portfolios to invest in.

Can I link my brokerage account to Magnifi?

Yes, you can connect external brokerage accounts for analysis. This lets Magnifi spot risks across your entire investment landscape, even with accounts at different providers.

How much does Magnifi cost per month?

Magnifi costs $14 monthly or $132 annually ($11/month equivalent). Managed portfolios cost an additional 0.23% of assets annually.

Does AI investing work?

AI investing excels at data analysis, pattern recognition, and reducing emotional bias, but results depend on the quality of algorithms and market conditions.

It works best when combined with human judgment and clear financial goals.

No AI can predict market crashes or unprecedented events with certainty.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.