Did you know that CNBC has a premium investment subscription? It’s called CNBC Pro. But at nearly $300 a year, is it worth it?

Personally, I think not. But the service is legit and does have value, so I want to help you make that decision for yourself.

In this article, I’ll break down what CNBC Pro offers, analyze its features, compare its pricing to competitors, and help you decide if it deserves a place in your investing toolkit.

Plus, you’ll discover some better alternatives that could save you money while delivering better investment insights.

Let’s dive in and find out if CNBC Pro deserves your subscription dollars in 2026.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What is CNBC Pro?

If you’ve ever turned on your TV to follow the markets, you’ve likely encountered CNBC. As one of the world’s leading financial news networks, CNBC has been delivering market updates, economic analysis, and business news to millions of viewers since 1989.

Their regular programming is already a staple for investors who want to stay informed about market movements and business developments.

But CNBC Pro takes things to an entirely different level. CNBC Pro is the network’s premium subscription service designed for serious investors who need more than just the headlines.

Think of it as the VIP section of the financial news world — where you get deeper insights, exclusive content, and ad-free access to everything CNBC offers.

Launched to cater to a more sophisticated audience, CNBC Pro targets active traders, institutional investors, and market-savvy retail investors who demand professional-grade information and analysis.

It’s positioned as a way to get “institutional-level insights” without actually working at a hedge fund or investment bank.

The service transforms CNBC from a general financial news provider into a comprehensive research and analysis platform. While regular CNBC viewers get the basic market coverage, CNBC Pro subscribers receive the extended cut with expert commentary, exclusive interviews, and in-depth analysis that don’t make it to the regular broadcast.

But here’s the million-dollar question (or in this case, the $299.99 question): Does the premium content provide enough value to justify the subscription cost? That’s what we’re here to figure out in this comprehensive CNBC Pro review.

CNBC Pro Review and Features Breakdown

Let’s get into the meat of what you’re paying for with a CNBC Pro subscription. After all, if you’re paying $300 a year on this service, you deserve to know what’s behind the paywall.

Exclusive Pro Articles

One of CNBC Pro’s main selling points is its library of exclusive articles that aren’t available to regular CNBC.com visitors.

These exclusive articles typically include:

- Deep-dive analysis of market trends that go beyond surface-level reporting

- Forward-looking forecasts from CNBC’s team of financial journalists

- Expert commentary from market veterans and industry insiders

- Detailed breakdowns of complex economic events and their potential impact on various sectors

The quality of these articles is generally high, with CNBC’s experienced financial journalists providing insights that you won’t find in their regular coverage.

Pro Stock Picks

For many subscribers, this is where the rubber meets the road. CNBC Pro offers stock recommendations backed by analysis from both CNBC’s internal team and external analysts they feature.

The stock picks section includes:

- “Top stocks to buy now” style recommendations

- Analyst-backed picks with detailed rationales

- Performance tracking of previous recommendations

- Sector-specific investment ideas

In my analysis, I found the quality of these picks to be mixed. While some recommendations come with thorough analysis and clear reasoning, others feel more like passing mentions without substantial backing.

Live CNBC TV (Ad-Free)

If you’re already a CNBC viewer, this feature might be worth considering. CNBC Pro provides streaming access to both CNBC and CNBC International programming, with no advertisements.

This includes:

- Live streaming of all CNBC channels

- Ad-free viewing experience

- Access on desktop and mobile devices

- Ability to watch international CNBC programming

For active traders who keep CNBC on throughout the day, the ad-free experience represents a significant improvement. It’s valuable during fast-moving market events when you don’t want to miss crucial information because of commercial breaks.

Pro Talks & Interviews

CNBC Pro subscribers get access to exclusive interviews that don’t make it to the regular broadcast. These often feature:

- Extended conversations with hedge fund managers

- In-depth discussions with top Wall Street analysts

- One-on-one interviews with economists and market strategists

- Q&A sessions with industry leaders

These interviews are more substantive than what you’d see on regular CNBC programming, with guests given more time to provide nuanced views. The exclusivity factor is real here — many of these conversations are only available to Pro subscribers.

Real-Time Market Commentary

When major market events occur, CNBC Pro provides real-time commentary and analysis:

- Instant reactions to Federal Reserve decisions

- Quick analysis of significant earnings reports

- Commentary on unexpected market movements

- Expert perspectives on breaking economic news

The speed of this commentary is impressive, often appearing within minutes of major announcements. This can be valuable for active traders who need to make quick decisions based on breaking news.

Newsletters and Market Recaps

CNBC Pro subscribers receive curated email newsletters that summarize key market developments and highlight crucial Pro content:

- Daily market recaps with key takeaways

- Weekly summaries of the most important developments

- Alerts about new exclusive content

- Curated lists of the most significant Pro articles

These newsletters serve as a convenient way to stay up to date with CNBC Pro’s content, without having to check the website constantly. However, they sometimes rehash content you may have already seen, rather than providing new insights.

CNBC Pro Pricing

In 2026, CNBC Pro’s pricing structure is straightforward but not exactly budget-friendly:

- Annual subscription: $299.99 per year (approximately $25 per month)

- Monthly subscription: $34.99 per month (totaling $419.88 if kept for a full year)

- Free trial period: 7 days

At first glance, that annual price tag of nearly $300 might make you wince. It’s certainly not pocket change when you consider the growing number of subscriptions most of us are juggling these days.

The monthly option at $34.99 provides more flexibility but comes at a premium — you’ll end up paying about $120 more per year compared to the annual plan. This pricing strategy encourages you to make a yearly commitment, a standard practice in the subscription world that’s worth noting.

CNBC offers a 7-day free trial, which is enough time to get a taste of the service, but likely not long enough to evaluate whether it will improve your investment results over time. Consider setting a calendar reminder if you try it out, as they’ll automatically charge you once the trial period ends.

When we compare CNBC Pro’s pricing to other financial news subscriptions, it sits firmly in the premium tier:

- The Wall Street Journal: $38.99/month or $467.88/year

- Bloomberg: $34.99/month or $415/year

- Barron’s: $19.99/month or $239.88/year

So, while CNBC Pro isn’t the most expensive option, it’s certainly not a budget choice. The real question isn’t just whether you can afford it, but whether what you get is worth the price tag.

CNBC Pros and Cons

After spending considerable time with CNBC Pro, I’ve identified several clear strengths and weaknesses that you should consider before pulling out your credit card. Let’s break them down:

Pros | Cons |

|---|---|

High-quality, exclusive content | A high price point |

Ad-free live TV streaming | Limited portfolio management tools |

Expert analysis and stock picks | It may seem like information overload |

Real-time market commentary | Content is too general for seasoned investors |

CNBC Pro vs. Other Premium Services

To determine if CNBC Pro is worth your money, we need to compare it to some alternatives.

Let’s see how it stacks up against other premium financial services.

CNBC Pro Vs. WallStreetZen

Price:

- CNBC Pro: $299.99/year or $34.99 a month

- WallStreetZen Premium: $234/year

How they compare:

When comparing CNBC Pro to WallStreetZen, you’re looking at two fundamentally different approaches to investment research.

CNBC Pro is primarily a content and news service. You’re paying for expert commentary, interviews, and analysis from financial journalists. It’s excellent if you want to understand market narratives and get professional perspectives on market movements, but it doesn’t provide systematic stock analysis or concrete investment methodologies.

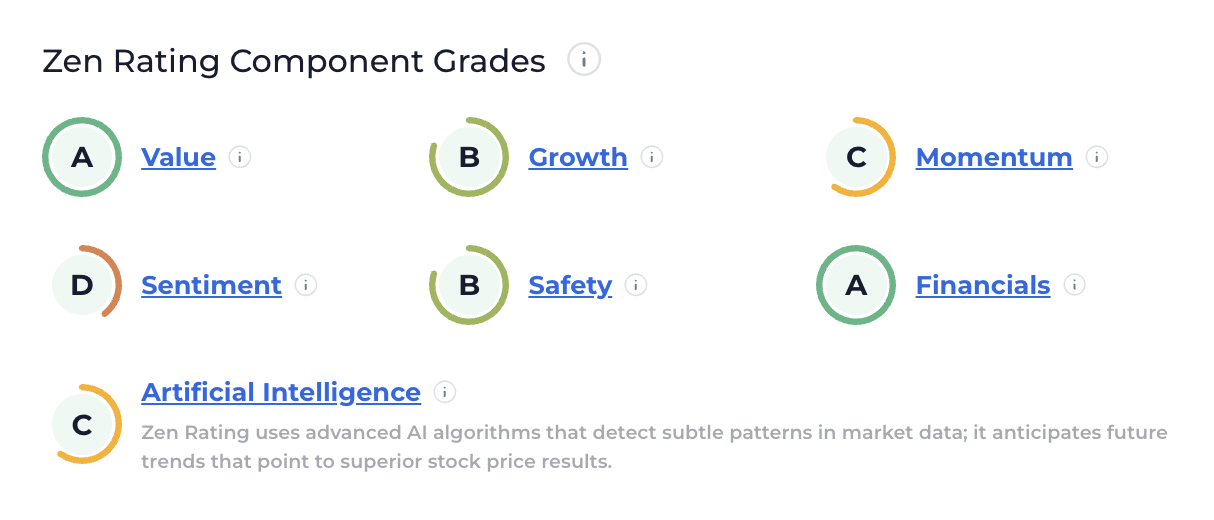

WallStreetZen offers something completely different. The Zen Ratings quant model analyzes 115 factors to identify stocks with upside potential. It’s a systematic, data-driven approach to finding investment opportunities.

The results speak for themselves: WallStreetZen’s “A” rated stocks using this system have averaged an impressive +32.52% annual return since 2003. That’s not just beating the market; it’s crushing it.

What I appreciate about WallStreetZen is the transparency. They show you exactly how their ratings are calculated across seven component grades, including value, growth, profitability, and more. This gives you a comprehensive view of why a stock receives its rating, rather than just telling you to buy or sell.

Additionally, WallStreetZen’s Top Analysts Database tracks the performance of over 4,000 Wall Street analysts, allowing you to follow recommendations from analysts with proven track records.

This feature alone provides tremendous value that CNBC Pro simply doesn’t offer.

Additionally, WallStreetZen offers a stock-picking newsletter: Zen Investor. This portfolio, curated by 40+ year investing veteran (and former Editor in Chief of Zacks.com) Steve Reitmeister, includes stocks like Kinross Gold (NYSE: KGC), which is up over 50% since it was added to the portfolio.

For investors who want actionable insights rather than just market commentary, WallStreetZen delivers significantly more value at a lower price point.

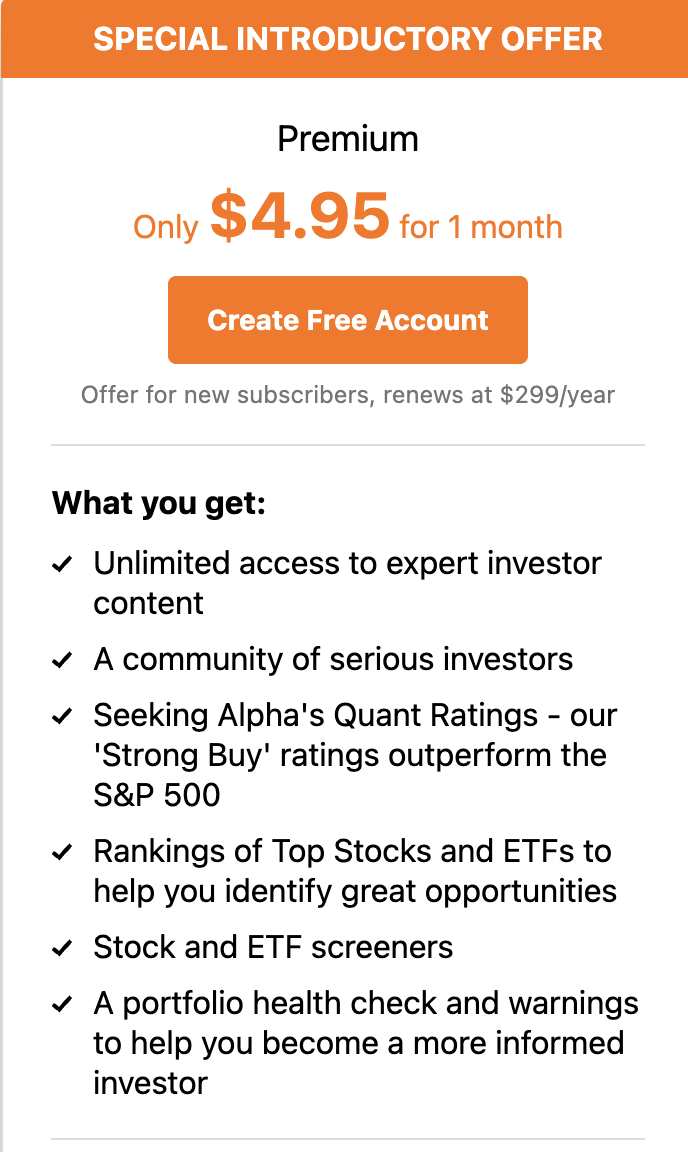

CNBC PRO Vs. Seeking Alpha Premium

Price:

- CNBC Pro: $299.99/year or $34.99/month

- Seeking Alpha Premium: $299/year or $29.99/month

How they compare:

Seeking Alpha Premium focuses on crowd-sourced investment research from a diverse community of contributors rather than professional journalists.

Seeking Alpha’s strength lies in its broad coverage and diverse opinions. You’ll find detailed analysis on virtually any publicly traded company, including small caps that might not get coverage on CNBC.

The platform also offers concrete tools, such as portfolio tracking, stock screening, and quantitative ratings, that CNBC Pro lacks.

Where CNBC Pro excels is in its professional production quality and access to high-profile market participants. You won’t get interviews with leading hedge fund managers or Fed officials on Seeking Alpha. Still, you will get more granular, company-specific analysis from investors who often have specialized industry knowledge.

For investors who prefer reading detailed investment theses over watching market commentary, Seeking Alpha Premium offers better value at a lower price point.

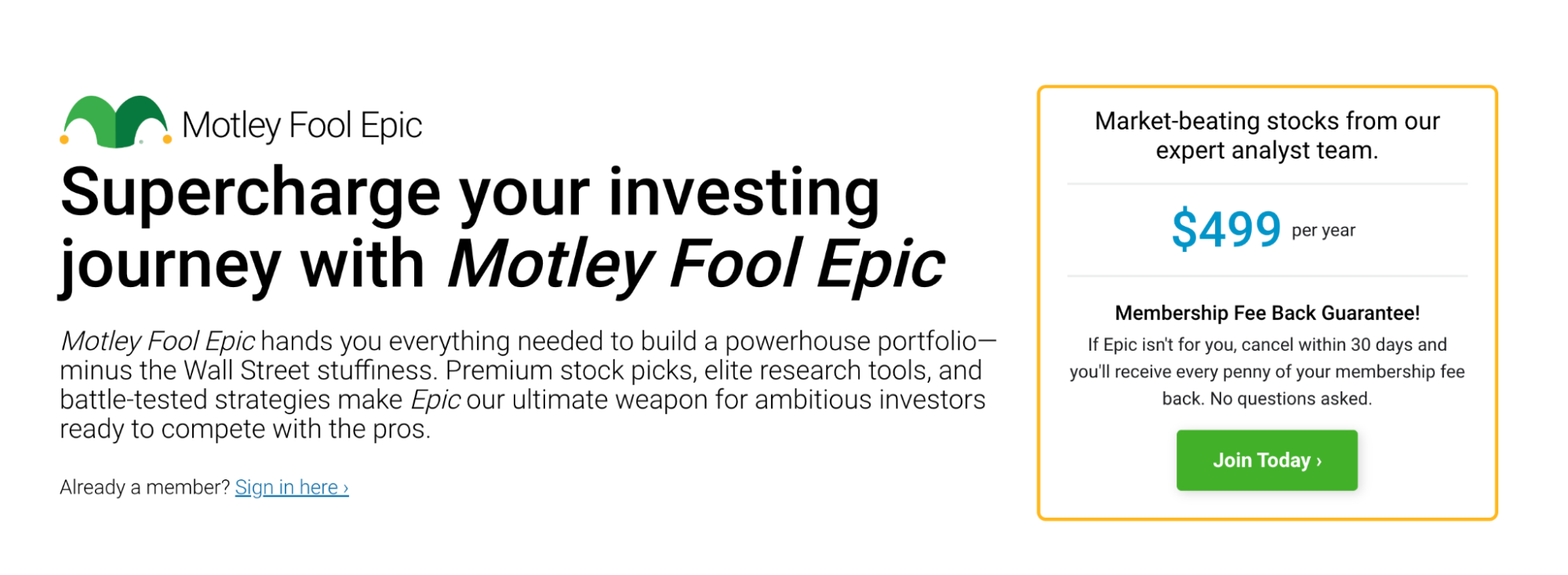

CNBC Pro Vs. Motley Fool Epic

Price:

- CNBC Pro: $299.99/year or $34.99/month

- Motley Fool Epic: $499/year (for a limited time, just $299/year using the links in this post!)

Motley Fool Epic represents yet another approach to investment research, focusing on stock recommendations with long-term holding periods rather than daily market commentary.

The Motley Fool’s flagship services have impressive long-term track records, and their Epic bundle gives you access to multiple recommendation services.

Unlike CNBC Pro, which may mention dozens of stocks in a given week without clear buy or sell guidance, The Motley Fool provides specific recommendations with clear entry points and holding timeframes.

Related reading: Check out our Motley Fool Epic review

CNBC Pro offers timely market news and broader coverage of economic trends, which some investors might find valuable for context. However, for investors seeking clear, actionable stock recommendations with proven long-term performance, Motley Fool’s services provide concrete value.

The higher price point of Motley Fool Epic reflects its more comprehensive suite of recommendation services. Still, for investors who want to buy specific stocks rather than receive general market commentary, it may represent better value despite the higher cost.

Who Is CNBC Pro Best For?

Not every financial service is right for every investor. Based on my extensive analysis, here’s who would benefit most from a CNBC Pro subscription — and who should probably look elsewhere.

CNBC Pro is Ideal for:

Investors Who Already Watch CNBC Regularly

If you’re already a dedicated CNBC viewer who values their coverage and perspectives, upgrading to Pro is a natural extension. The ad-free experience alone might justify the cost if you watch several hours of CNBC daily, and the additional exclusive content will enhance your existing consumption habits.

Traders Who Need Real-time, Curated News Without the Clutter

Active traders who make decisions based on breaking news and market movements will appreciate CNBC Pro’s real-time commentary and analysis.

The curated nature of the content means you’re getting insights from experienced financial journalists rather than the unfiltered firehose of information you might find on Twitter or Reddit.

Financial Professionals Who Need to Stay Informed About Market Narratives

If your job requires you to understand how the market interprets economic events and what narratives drive investor behavior, CNBC Pro provides valuable context.

The extended interviews and exclusive articles often reveal the thinking of influential market participants, which can help you understand market psychology.

CNBC Pro is NOT Ideal for:

Hands-on Portfolio Builders or DIY Quants

If you prefer to build your portfolio based on quantitative factors, financial metrics, or systematic approaches, CNBC Pro doesn’t provide the tools or data you need. You’d be better served by platforms that offer stock screening, factor analysis, or quantitative ratings like WallStreetZen’s Zen Ratings.

Beginning Investors With Limited Capital

At nearly $300 a year, CNBC Pro represents a significant expense for investors just starting out. That money might be better invested directly or spent on educational resources that provide foundational knowledge rather than day-to-day market commentary.

Investors Seeking Specific Stock Recommendations With Clear Entry and Exit Points

While CNBC Pro does feature stock picks, they’re often mentioned in passing without systematic follow-up or clear guidance on position sizing, entry points, or exit strategies. If you want concrete recommendations, WallStreetZen’s analyst picks provide more actionable advice. To get a FREE preview of the latest Strong Buy recommendations we’re following, subscribe to WallStreetZen’s FREE newsletter — we share 3 Strong Buy picks in each issue.

Long-term, Buy-and-hold Investors

If your investment strategy involves buying quality companies and holding them for years, the daily market noise that CNBC Pro excels at covering may be more distracting than helpful.

Your subscription dollars might be better spent on services focused on fundamental business analysis rather than market movements.

Final Word: Is CNBC Pro Worth It?

After thoroughly examining CNBC Pro’s features, pricing, and how it compares to alternatives, it’s time to answer the big question: Is CNBC Pro worth it in 2025?

The answer, like most things in investing, depends on your specific needs and circumstances.If you’re an active trader who already watches CNBC regularly, the ad-free experience combined with real-time market commentary and exclusive interviews could enhance your trading process.

The $299.99 annual fee breaks down to about $25 per month, which is reasonable if you’re using the service daily and it helps inform your investment decisions.

Financial professionals who need to stay on top of market narratives and understand how influential participants are thinking about economic events will also find value in CNBC Pro’s exclusive content. The extended interviews and in-depth analysis provide valuable context for client conversations or market positioning.

However, for the majority of individual investors focused on building long-term wealth, there are more effective ways to spend your subscription dollars. Here’s why:

- CNBC Pro excels at delivering market commentary and expert opinions, but opinions aren’t the same as strategies. The service lacks the systematic approach and concrete tools that many investors need to make consistent investment decisions.

- The price point is significant when compared to alternatives that provide more actionable insights. For a lower cost, you could access services like WallStreetZen that offer quantitative ratings with proven track records of market-beating returns.

- The daily market noise that CNBC Pro amplifies can lead to overtrading and poor decision-making for many investors. Research consistently shows that most investors who trade frequently based on news underperform the market over time.

A More Effective Alternative for Most Investors

If you’re looking for a service that helps you identify high-potential stocks based on proven factors rather than opinions, WallStreetZen offers a compelling alternative.

The Zen Ratings system analyzes 115 factors to identify stocks with exceptional upside potential. “A” rated stocks have averaged an impressive 32.52% annual return since 2003.

Unlike CNBC Pro’s opinion-based approach, WallStreetZen provides a systematic methodology for finding investment opportunities, complete with transparent ratings across multiple factors.

This gives you a clearer picture of why a stock might be worth considering, rather than just telling you what some expert thinks.

The platform’s Top Analysts Database is another standout, tracking the performance of over 4,000 Wall Street analysts to help you identify which professionals have track records worth following.

This data-driven approach to analyst recommendations is far more valuable than the occasional stock mention you might get on CNBC Pro.

My recommendation? If CNBC Pro seems compelling, try the 7-day free trial to see if it fits your investing style. But also explore alternatives like WallStreetZen that offer more systematic approaches to finding investment opportunities. Your portfolio might thank you for it.

FAQs:

Can I watch CNBC live with CNBC Pro?

Yes, CNBC Pro offers full live streaming access to CNBC's television programming, ad-free.

Does CNBC Pro provide real stock recommendations?

CNBC Pro features stock picks and recommendations from both its internal team and external analysts it interviews. However, these recommendations often lack the systematic approach and follow-up that dedicated stock recommendation services provide.

Can I cancel CNBC Pro easily?

Yes, CNBC Pro can be canceled at any time through your account settings on their website.

Are there discounts or student rates for CNBC Pro?

CNBC occasionally offers promotional discounts for CNBC Pro, particularly around major shopping events like Black Friday or at the beginning of the year.

Is a CNBC Pro subscription worth it?

Based on numerous CNBC Pro reviews and my own testing, for specific types of investors — particularly active traders who already watch CNBC regularly and financial professionals who need to stay informed about market narratives — CNBC Pro can be worth the subscription cost.

What is the difference between CNBC Pro and CNBC Club?

CNBC Pro and CNBC Investing Club are two distinct subscription services offered by CNBC. CNBC Pro provides premium content access, including exclusive articles, ad-free live TV, and extended interviews.

The CNBC Investing Club, led by Jim Cramer, focuses specifically on portfolio management and stock recommendations, providing subscribers with Cramer's personal investment insights, real-time trade alerts, and access to his charitable trust portfolio.

Does CNBC Pro have a free trial?

Yes, CNBC Pro offers a 7-day free trial for new subscribers.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.