Wouldn’t it be great to earn crypto as cash back for everyday purchases? Yes, it would — and you can make it happen by signing up for a crypto rewards credit card.

I want to teach you how.

In this article, I explore the best crypto credit cards. I’ll discuss features, bonuses, fees, and more so you’ll have all the information you need to decide whether or not any of these options are right for you.

Keep your crypto safe…

With online crypto hacks happening on the regular, many investors prefer to keep their crypto safe and sound in a hardware wallet.

SecuX is a leader in crypto storage. The company is known for its security measures — notably, the Flash CC EAL5+ Secure Element chip that comes with most wallets in their lineup, a feature that helps protect your private key from potential threats. They also created the first NFT hardware wallet in the world!

What is a Crypto Credit Card?

A crypto credit card offers rewards for purchases made with the card in cryptocurrency instead of in cash (that’s fiat to you hardcore crypto enthusiasts).

Different cards handle distributing crypto rewards in different ways; some reward you with crypto directly, while others allow you to convert your traditional cash rewards to crypto after you’ve already earned them.

I know that many crypto enthusiasts are wary of traditional finance and embrace crypto’s decentralization, but crypto credit cards are a great way to accumulate crypto through making ordinary purchases.

Even though some of these credit cards are managed by traditional banks and backed by big companies like Visa and Venmo, some are handled by trusted crypto exchanges like Gemini.

Where to invest in crypto…

Not all exchanges are created equal. Our favorite crypto platform? eToro.

It’s a straightforward platform with top-notch security features, as well as excellent trading resources like its CopyTrader feature, which lets you follow top traders at work.

In terms of crypto, the platform offers 80+ coins, including Bitcoin, Ethereum, XRP + more — in addition to competitive rates and secure storage.

These features can give you a lot of peace of mind and save you headaches — making it our top suggestion for crypto as well as stocks and ETFs.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

5 Best Cryptocurrency Credit Card Options in October 2025

Let’s take a look at the five best cryptocurrency credit cards available today.

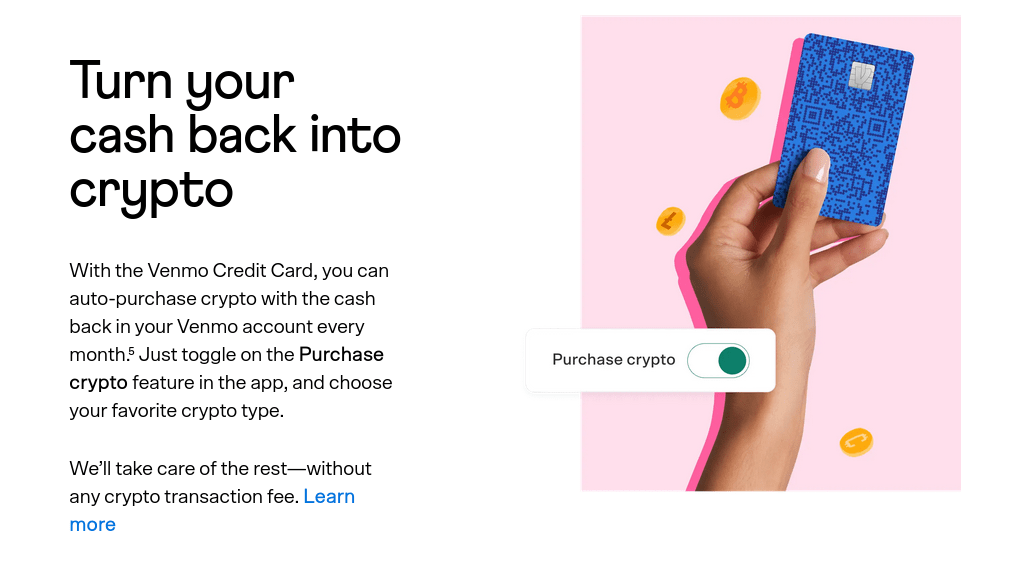

1. Venmo Credit Card – Best Crypto Credit Card For Most People

- Overall rating: 4.9 out of 5.0

- Rewards: 3% back in your top spending category, 2% in your second choice category, 1% on all other purchases

- Sign-up bonus: None

- Annual fee: $0

How to get crypto with the card:

You earn cash back on all purchases you make with the Venmo Credit card in the form of Bitcoin, Ethereum, Litecoin, or Bitcoin Cash. You can choose one spending category each month to receive 3% back and another separate category to receive 2% cashback. All other purchases in the remaining spending categories receive 1% cash back.

One of the best parts about getting crypto rewards from the Venmo Credit Card is that you can store the crypto you get in the Venmo app. This makes it easy to build up your holdings and sell at the most opportune time.

2. Upgrade Bitcoin Rewards Visa Credit Card – Best Bitcoin Credit Card

- Overall rating: 4.7 out of 5.0

- Rewards: 1.5% back in Bitcoin on all purchases

- Sign-up bonus: None

- Annual fee: $0

How to get crypto with the card:

Earning bitcoin with the Upgrade Bitcoin Rewards Visa Credit Card is extremely easy. You receive 1.5% back in Bitcoin for every purchase you make with the card. That’s it.

When you make purchases with your card, bitcoin is purchased and stored in an NYDIG wallet until you pay off your balance.

There is one catch, though…

You can only cash your Bitcoin rewards in for a statement credit. This means you can’t sell your Bitcoin and deposit the cash into your bank account. This is a severe limitation in my opinion and makes the Upgrade Bitcoin Rewards card less attractive than it would be if you could use the bitcoin rewards however you wanted to.

Want to improve your crypto prowess? Consider taking one of these top-rated courses:

3. Gemini – Best Crypto Rewards Credit Card

- Overall rating: 4.7 out of 5.0

- Rewards: 3% back on dining, 2% back on groceries, 1% back on all other purchases

- Sign-up bonus: None

- Annual fee: $0

How to get crypto with the card:

The Gemini Credit Card gets you 3% back on dining, 2% back on groceries, and 1% back on everything else.

The only catch is that the dining cashback is limited to $6,000 per year before it switches to 1% cash back, so you won’t be able to stack up tons of satoshis by eating at five-star restaurants every week.

The best thing about the Gemini Credit Card is that you can receive your rewards in more than 40 different cryptocurrencies.

You can go for tried-and-true options like Bitcoin and Ethereum, or try to hit the next big swing by getting your rewards in up-and-coming coins like Solana and Polkadot. And if you change your mind, you can choose a different crypto as your reward at any time.

I think the Gemini Credit Card is the best crypto credit card, but I didn’t make it my top pick because it’s not for everyone.

Using Gemini might not seem like a big deal to a seasoned crypto vet, but the barrier to entry is a bit higher for the average person. Still, if you’re willing to be a little adventurous, the freedom you get with the Gemini Credit Card makes it the best crypto rewards card for my money.

4. Brex Card – Best for Businesses

- Overall rating: 4.0 out of 5.0

- Rewards: 1 point per $1 spent

- Sign-up bonus: 10,000 points when you spend $3,000 within three months of signing up

- Annual fee: $0

How to get crypto with the card:

Brex’s corporate card earns you one point for every dollar you spend, which you can redeem for Bitcoin or Ethereum. You must have a minimum of 1,000 points before you can redeem them for crypto.

When you choose to take your rewards as crypto, the transaction happens through TravelBank. On its side, TravelBank uses Coinbase to purchase crypto before transferring the tokens to your wallet address. That means that to redeem your crypto rewards you need to have a wallet. If you’re comfortable with crypto wallets this isn’t a big deal, but it’s definitely not as easy as keeping your crypto in an app like Venmo.

Brex offers the only cryptocurrency credit card for businesses that I know of, which makes it a unique alternative to the other cards on this list. Another thing I really like about the Brex card is that it’s the only crypto rewards credit card that offers a signup bonus of 10,000 points when you spend at least $3,000 within three months of signing up.

5. Nexo – Best for Hardcore Crypto Fans

How to get crypto with the card:

The Nexo card works just like the other cards I’ve covered so far, with one important difference.

Earning crypto rewards in Bitcoin gets you a modest 0.5% on all purchases, but choosing to redeem in NEXO — the company’s own token — boosts your rewards to 2.0%.

Now, anyone who’s been around crypto long enough knows that Bitcoin is the most dependable, least risky crypto to invest in. That’s not to say it’s not volatile and risky, because it is, but it’s less volatile and risky than lesser-known coins. However, NEXO has shown it has staying power, and it has been around and thriving since before the last bull run.

Whether or not earning in Nexo fits within your risk appetite is up to you, but it’s an interesting option if you’re ok with taking some extra risk. Think of it like this: since the crypto you’re earning is already a bonus, the extra risk won’t cause you to lose money; it’ll only affect you as an opportunity cost.

Beyond Bitcoin Credit Card: Long-Term Crypto Investing Solutions

Rewards credit cards aren’t the only way to gain exposure to cryptocurrencies. Check out these two crypto IRA options for using crypto to save for retirement.

Alto Crypto IRA

- Overall rating: 4.7 out of 5.0

- What it is: Alto Crypto IRA is an individual retirement account that allows US citizens to hold cryptocurrencies.

Alto’s Crypto IRA works by integrating with Coinbase, which means Alto customers can access more than 200 cryptocurrencies in an Alto Crypto IRA. Want to know more? Check out our complete Alto Crypto IRA review.

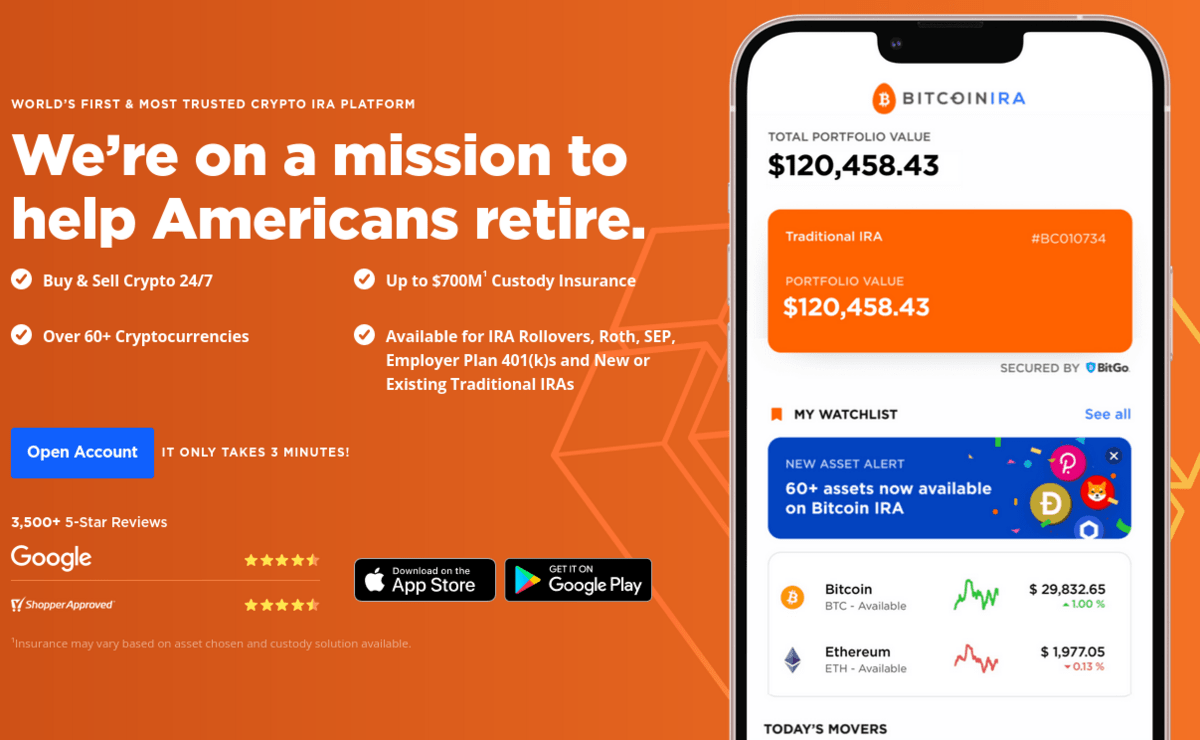

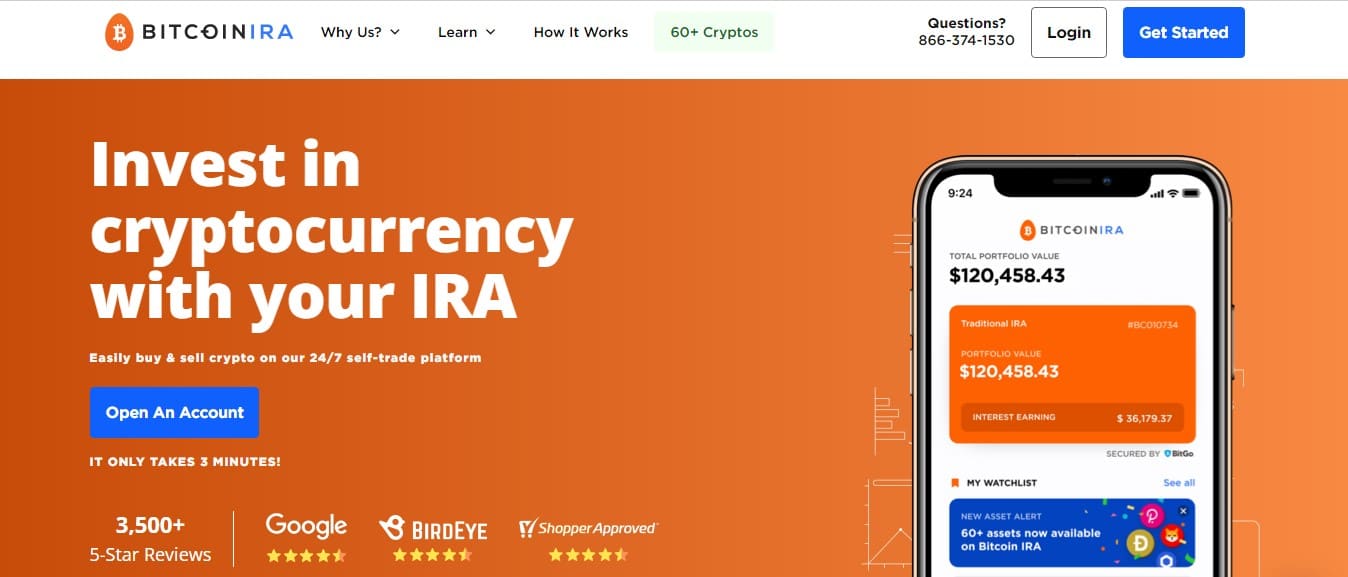

Bitcoin IRA

- Overall rating: 4.7 out of 5.0

- What it is: A company that makes it easy to purchase cryptocurrencies in an IRA.

Bitcoin IRA lets you combine the explosive growth of cryptocurrency with the tax advantages of an IRA. It’s possible to get exposure to crypto indirectly in standard retirement accounts through Bitcoin ETFs and crypto-adjacent companies, but Bitcoin IRA is the easiest way to directly buy crypto in a retirement account. Learn more in our Bitcoin IRA review.

Final Word: Best Crypto Credit Card in 10 2025

In my opinion, the best crypto credit card right now is the Gemini Credit Card. If you’re not comfortable using a card from a crypto exchange like Gemini, Venmo offers a more mainstream crypto rewards credit card through its Venmo Credit Card.

For business owners and startups, there’s the Brex card, which lets you redeem points for crypto and has a bunch of nice features aimed at corporate customers.

But overall, every one of these cards has its benefits. There’s no “wrong” choice — it’s all about taking the time to read the fine print before you sign up to ensure you’re choosing the right card to suit your needs.

FAQs:

What is the best card to use for crypto?

In my opinion, Gemini’s crypto rewards credit card is the best overall card to use for crypto. It gives you all the flexibility of the Gemini exchange and makes earning crypto from everyday purchases a breeze. For something more mainstream, I recommend Upgrade Bitcoin Rewards Visa Credit Card or the Venmo Credit Card.

What credit card can I use for crypto?

Among the credit cards you can use for crypto, the best cryptocurrency credit card options today are the Venmo Credit Card, Gemini Credit Card, Upgrade Bitcoin Rewards Visa Credit Card, and the Brex card.

Is it risky to buy crypto with a credit card?

Buying crypto with a credit card isn’t any riskier than buying it through an exchange like Coinbase or Gemini. However, there are two types of risk to think about when you buy crypto with a credit card.

The first is the risk of charging more than you can pay off, which is unrelated to crypto and has to do with maintaining good credit practices. The second is the risk associated with crypto’s inherently volatile and swingy nature. Any money you spend on crypto — whether you buy it with a credit card or not — should be money you’re ok with losing.

Can you have a crypto credit card?

Crypto credit cards provide crypto rewards, but there aren’t any credit cards that let you pay off your balance in crypto. Your best bet would be to use a regular credit card, sell your crypto for cash, and transfer it to your bank to pay your balance. However, there are crypto credit cards that let you earn cash back, for example, in the form of cryptocurrency.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our October report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.