Everyone wants a hack to find the best stocks to buy right now.

Hate to burst your bubble, but there isn’t one. At the end of the day, you’re the one who has to live with your investment decisions — so it’s in your best interest to do your own due diligence.

That said, plenty of trusted pros do have opinions on the top stocks to buy now — and you can use that information to make more informed choices.

Here are some of the best stocks to buy now…

Want to know how we find stocks before they explode?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools including the proprietary Zen Ratings system

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

At-a-Glance: The Best Stocks to Buy Now *

- Freshworks (NASDAQ: FRSH)

- Meta Platforms (NASDAQ: META)

- APi Group (NYSE: APG)

- Yext (NYSE: YEXT)

- US Foods Holding (NYSE: USFD)

* Your investments are solely your responsibility. Your capital is at risk.

Top Stocks to Buy Now: Before You Trade

As I said earlier, there’s no shortcut to stock market success. You’re responsible for your own trades, so it’s worth taking the time to “build a case” for every trade.

As such, here are a few best practices that every investor should keep in mind before trading:

Consider the Market

When it comes to investing, market conditions matter. A lot. For instance, is the market in a sharp downtrend? It might not be the time to enter a new position. In general, the best time to invest is when the market is in a definite and confirmed uptrend.

Have a Plan in Place

Before you take a position in a stock, take a little pause and consider your objectives. First, why do you think it’s a good idea to take a position? Second, do you want to put a cap on potential losses — and if so, what’s your “sell” price?

Research the Stock

Never trade without doing a little research first. We’re talking a deep dive into the company’s fundamentals, a hard look at the stock chart, and more. Here are some of our favorite resources (which just so happen to be the same ones used to research this post):

WallStreetZen: I curated this list using two WallStreetZen tools:

Zen Ratings: This is our proprietary system of identifying potentially market-beating stocks, and it’s available on the page of each ticker on WallStreetZen. Zen Ratings is a little different from other metrics. It evaluates 115 factors that drive stock growth, and distills them into an easily digestible letter grade for each stock.

Not only can you see a stock’s overall grade, but you can see how it scores in a variety of different areas, such as value, financials, safety, and so on. Stocks with an A rating (Strong Buy) have produced an average annual return of +32.52% since 2003 — so it’s definitely something to check out before you buy a stock. Currently, all of the stocks on this list have an A or B rating.

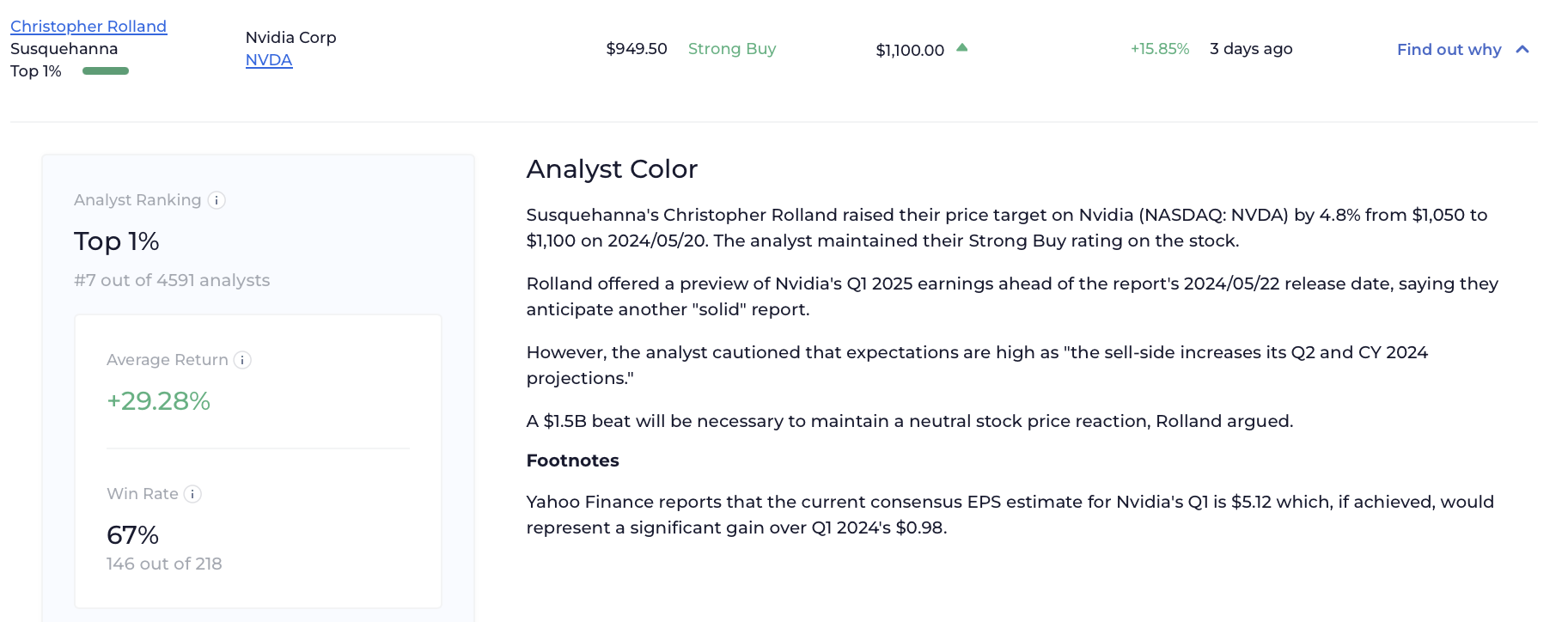

With WallStreetZen Premium, you gain access to top-rated analyst ratings. With WSZ’s Strong Buys from Top Analysts feature, you can zero in on ratings from ONLY top-rated analysts, and you have easy access to their track record and average win rate.

For instance, below you’ll see the Top Analyst entry for one of today’s picks: NVDA. You can easily see the analyst’s track record, plus the “why” behind their rating.

TradingView: This is our go-to program for charts (and the charts in this post are sourced from TradingView). Why? Its comprehensive feature set, speed, ease-of-use, coverage, reliability, and extreme affordability. As a result of these things, we firmly believe it’s the best solution for new and veteran traders alike.

FEATURED OFFER:

If you sign up to TradingView using any of the links in this article, you will receive a $15 credit which will be automatically applied to any plan you select.

Plus, test drive any plan risk-free with a free 30-day trial.

June 2025: Top Stocks to Buy Now (and Why)

There are too many stocks to keep track of on your own. You need a system, and you need recommendations. For the system, WallStreetZen has you covered. For the recommendations, why not start with these five?

They’re all recommended by top analysts and have compelling reasons to add them to your portfolio, as we’ll soon explore.

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations to buy or sell. Your investments are solely your decisions.

5 Stocks to Watch: Week of 6/16/2025

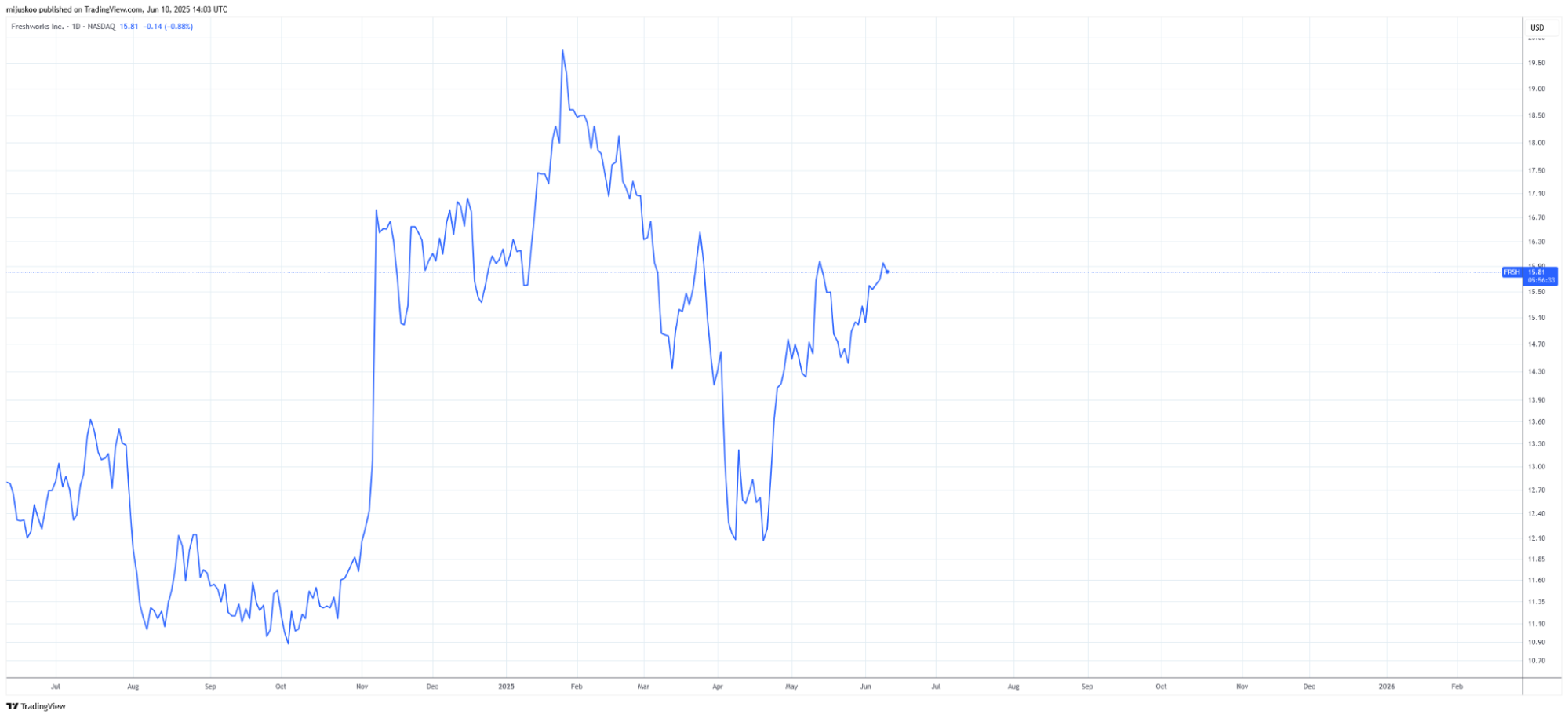

1. Freshworks (NASDAQ: FRSH)

Freshworks is a SaaS business that provides a wide variety of products — from customer support, sales, and IT management to marketing tools. The company has managed to notch 13 consecutive quarters of earnings beats, and equity researchers from top Wall Street firms still see plenty of upside to come.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $15.11 — get current quote >

Max 1-year forecast: $27.00

Why we’re watching:

- At present, 13 Wall Street researchers track and issue ratings for FRSH. The stock has 5 Strong Buy ratings, 3 Buy ratings, and 4 Hold ratings, with no Sell or Strong Sell ratings. See the ratings

- The average 12-month price forecast for Freshworks, pegged at $21.83, implies a 36.89% upside.

- Piper Sandler researcher Brent A. Bracelin (a top 1% rated analyst) recently reiterated a Strong Buy rating, and upped his price target on the stock from $20 to $22.

- FRSH is the 11th highest rated stock in the App industry, which has an Industry Rating of A.

- FRSH ranks in the 96th percentile of stocks based on a holistic analysis of 115 proprietary factors that correlate with outsized returns, giving it a Zen Rating of A.

- In terms of Sentiment, Freshworks ranks in the 95th percentile of the stocks covered by our rating system.

- However, Growth is the star of the show — when it comes to this Component Grade rating, FRSH ranks in the top 2% of the more than 4,600 equities that we keep track of. (See all 7 Zen Component Grades here >)

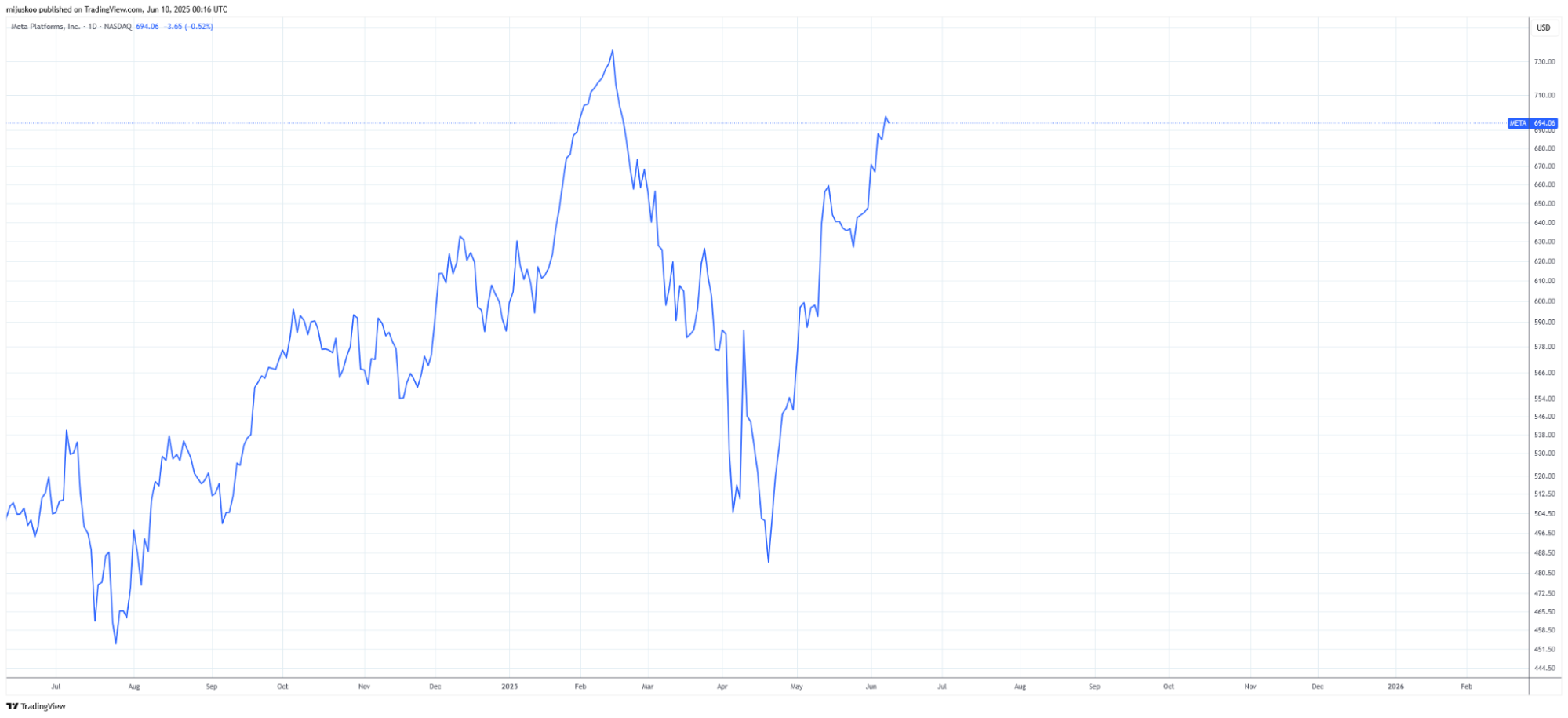

2. Meta Platforms (NASDAQ: META)

Meta Platforms is more than just Facebook — it’s also the parent company of Instagram, and WhatsApp, plus an AI and VR innovator. Bottom line? Meta keeps redefining the digital landscape, and with strong ad revenue and bold bets on the future, it’s well worth watching.

Zen Rating: B (Buy) — see full analysis >

Recent Price: $690.80 — get current quote >

Max 1-year forecast: $935.00

Why we’re watching:

- Unsurprisingly, the tech titan attracts a lot of analyst attention. A whopping 39 equity researchers issue ratings for META stock, which currently has 26 Strong Buy ratings, 11 Buy ratings, and 2 Hold ratings. See the ratings

- JP Morgan’s Doug Anmuth (a top 1% rated analyst) recently doubled down on a Strong Buy rating, and increased his price target from $675 to $735.

- In an Internet sector overview note, Anmuth said that JP Morgan cut estimates and multiples “for the vast majority of names in the group after President Trump’s ‘Liberation Day,’ but has now reversed some of those moves on better-than-expected Q1 earnings and guides.

- The analyst detailed that their firm revised multiples higher for select names to reflect lower recession risk, which is no longer the firm’s base case, company-specific outperformance, and China tariff relief for companies with direct exposure.

- Meta Platforms shares rank in the top 12% of equities, giving them a Zen Rating of B.

- Our quant rating system has identified two areas where Meta excels — Sentiment, in which it ranks in the top 5% of stocks, and Financials, where it ranks in the top 2%. (See all 7 Zen Component Grades here >)

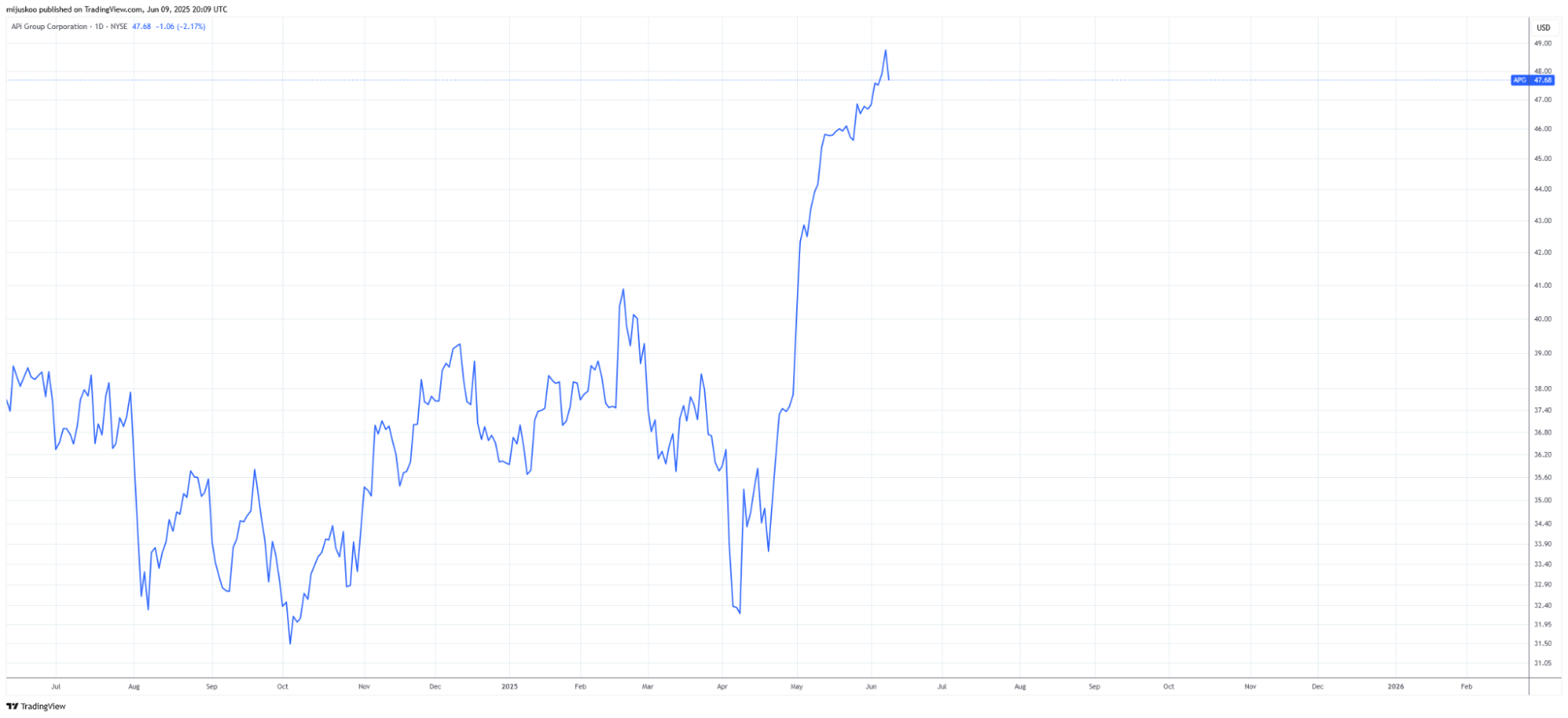

3. APi Group (NYSE: APG)

APi Group is on a tear. The company has provided 16 consecutive quarters of earnings beats — so it’s little wonder that this specialty contractor’s stock has seen a steady increase in price. The company also operates in a relatively recession-proof area — installing fire safety and HVAC systems in government, industrial, and commercial buildings.

Zen Rating: B (Buy) — see full analysis >

Recent Price: $47.65 — get current quote >

Max 1-year forecast: $55.00

Why we’re watching:

- APG is a consensus Strong Buy according to Wall Street researchers. The stock has 4 Strong Buy ratings, 2 Buy ratings, and 1 Hold rating — with 0 Sell or Strong Sell ratings. See the ratings

- Barclays researcher Julian Mitchell (a top 1% rated analyst) recently doubled down on a Strong Buy rating and hiked his price target on the stock from $48 to a Street-high $55.

- Mitchell reported that a deep dive into their Industrial Goods portfolio catalyzed their price target hike on API Group.

- The analyst predicted that estimate revision momentum and valuation multiples will become more concentrated among names in the Multi-Industry sector as end-market growth dispersion narrows.

- APi Group is currently the 11th highest rated stock in the Engineering & Construction industry, which has an industry rating of A

- APG has been selected as a likely outperformer by our quant rating system, which ranks the stock in the top 11% of equities, giving it a Zen Rating of B.

- There’s a lot to like here, as APi Group scores highly in multiple categories. The stock ranks in the top 19% in terms of Financials and Momentum, as well as the 91st percentile when it comes to Growth. However, Safety is its strongest Component Grade rating — as it ranks in the top 1% of the equities we track in this regard. (See all 7 Zen Component Grades here >)

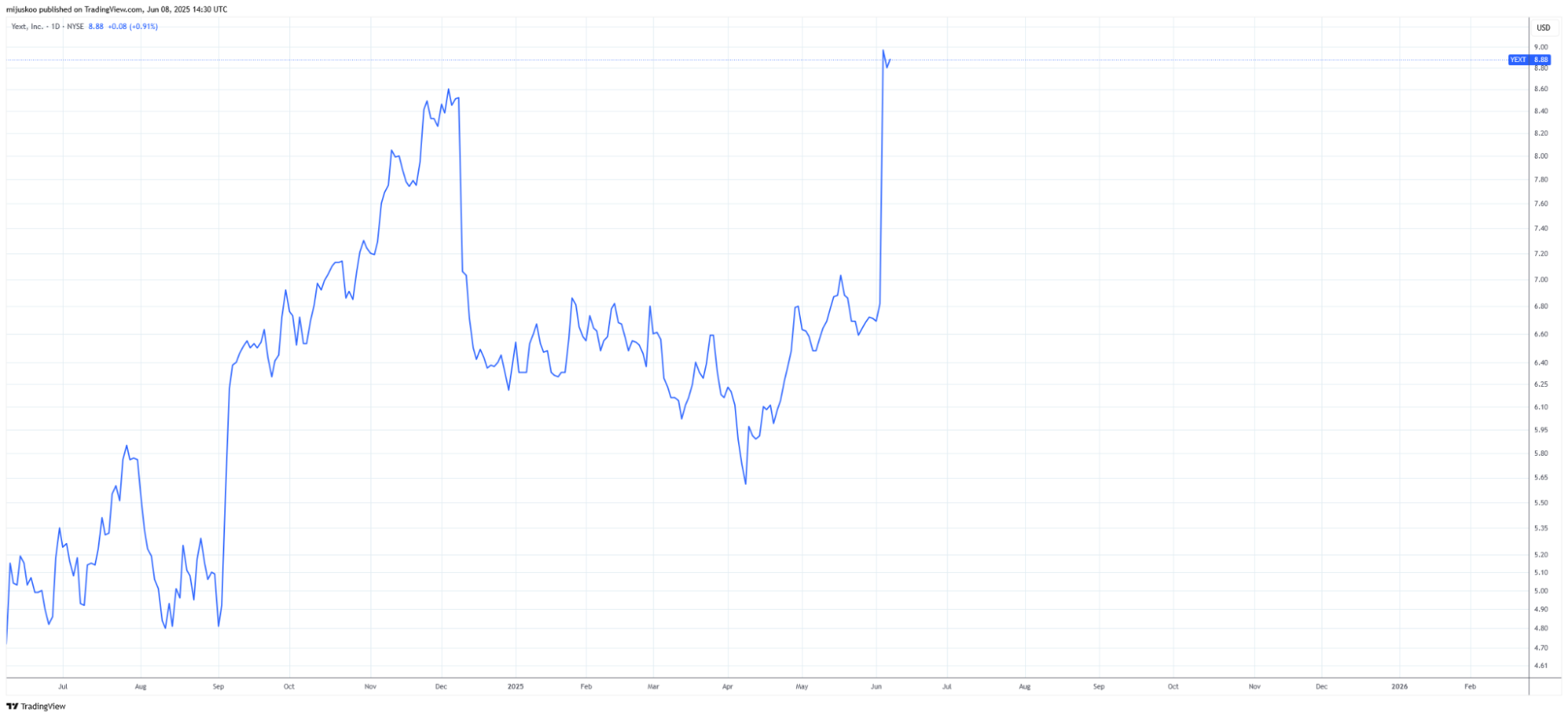

4. Yext (NYSE: YEXT)

Yext is in the business of brand management — more accurately, the company helps other businesses ensure that their public-facing information is consistent and accurate across a variety of channels such as search engines, voice assistants, and apps. Yext’s AI platform has allowed it to position itself as a key infrastructure player in the space — and Wall Street is confident that the company will leverage its substantial war-chest efficiently going forward.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $8.22 — get current quote >

Max 1-year forecast: $10.00

Why we’re watching:

- At present, YEXT has 4 analyst ratings — 2 Strong Buys, 1 Buy, and 1 Hold. See the ratings

- On June 4, after the company’s Q1 2026 earnings report, B. Riley Securities researcher Naved Khan (a top 8% rated analyst) upgraded the stock to a Strong Buy rating, and hiked his price target from $7 to a Street-high $10.

- Upgrading the stock and hiking their price target significantly in response, Khan pointed to the scale of sequential improvement in the company’s key performance indicators as well as to the quarter’s “modestly better-than-expected results and guidance.

- The analyst backgrounded that Yext has a track record of strong execution, reflected in meaningful EBITDA margin expansion over the past two years and accretive acquisitions.

- Looking ahead, Khan told readers that B. Riley Securities “also sees signs of early positive traction for Scout in its closed beta, which should bode well for retention and ARR growth once rolled out.”

- YEXT is currently the 4th highest-rated stock in the Software Infrastructure industry, which has an Industry Rating of A.

- Stocks with a Zen Rating of A, like YEXT, have provided an average annual return of 32.52% in the last 22 years. A Zen Rating of A is given to stocks that our system ranks in the top 5% based on an analysis of 115 proprietary factors divided into 7 Component Grade categories.

- As if that wasn’t enough, YEXT actually ranks in the top 99% of stocks on the whole — it is currently the 43rd highest-rated equity out of the more than 4,600 that we keep track of.

- So, why has our quant rating system singled out Yext? It ranks in the top 4% in terms of Growth, as well as the top 10% when it comes to Financials.

- Last but not least, the stock ranks in the 89th percentile according to its Artificial Intelligence Component Grade rating. In simple terms, a neural network trained on more than two decades of fundamental and technical data has picked up on subtle signs that hint at outperformance to come. (See all 7 Zen Component Grades here >)

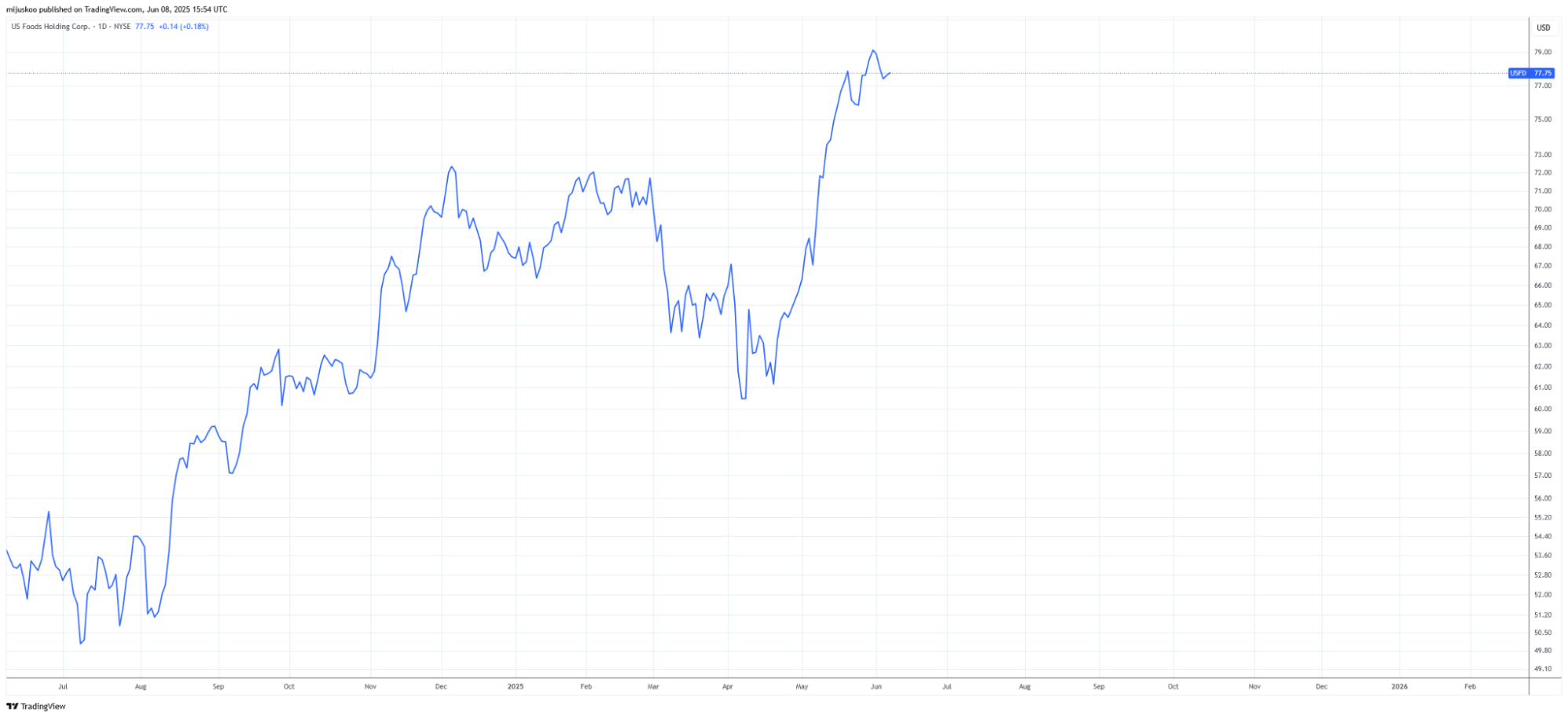

5. US Foods Holding (NYSE: USFD)

This past Stock of the Week pick is back on the list, with a fresh new Strong Buy rating. To refresh you on the company, US Foods Holding distributes food — whether fresh, frozen, or dry, to food service companies all across the United States. While it is faced with a tough macro environment, it stands out as quite a safe pick in a tumultuous market.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $75.70 — get current quote >

Max 1-year forecast: $95.00

Why we’re watching:

- USFD enjoys extensive and almost unanimously bullish coverage from equity analysts. At present, the stock has 8 Strong Buy ratings, 1 Hold rating, and 0 Sell or Strong Sell ratings. See the ratings

- Barclays researcher Jeffrey A. Bernstein (a top 12% rated analyst) recently doubled down on a Strong Buy rating, and increased his 12-month price forecast for US Foods Holding from $85 to a Street-high $95.

- Bernstein reported that they attended a meeting with U.S. Foods Holding’s management, and that their takeaways catalyzed their price target hike.

- In spite of the latest consumer-led sales challenges, management’s overall tone was one of continued confidence that it would achieve its 2025 to 2027 adjusted EBITDA and earnings goals, the analyst told investors.

- USFD is the top rated stock in the Food Distribution industry, which has an Industry Rating of A.

- The stock ranks in the top 4% of the equities we track, giving it an overall Zen Rating of A. Let’s dig deeper into the Component Grades that shape that grade.

- On account of a stable, mature business model, and relatively predictable earnings, USFD ranks highly in terms of Safety — in the top 3%, to be exact.

- US Foods Holding also ranks in the top 14% in terms of Artificial Intelligence, and the top 18% in terms of Financials.

- While a Value Component Grade rating in the top 29% seems relatively uninspiring, readers should note that the stock is trading at a price-to-earnings growth (PEG) ratio of 1. (See all 7 Zen Component Grades here >)

Gain access to dozens of alerts like this per week — Click the button below.

👉👉 Try WallStreetZen Premium for just $1

Best Stocks to Buy Now: The Final Word

There are literally thousands of stocks out there. What are the best stocks to buy now?

The truth is that there are no guarantees in the stock market. The market is constantly changing, as are the factors that play into stock prices.

That said, this list includes a ton of great watches we discovered on WallStreetZenPremium. Each of these picks has something (or several things) going for them in the near to long-term, so consider keeping them on watch.

But remember — you alone are responsible for your investment decisions. So be sure to do your own research before you buy any stock.

FAQs:

What are good stocks to invest in right now?

According to analyst ratings, good stocks to invest in right now include:

1. Freshworks (NASDAQ: FRSH)

2. Meta Platforms (NASDAQ: META)

3. APi Group (NYSE: APG)

4. Yext (NYSE: YEXT)

5. US Foods Holding (NYSE: USFD)

What stock will grow the most in 2025?

It’s impossible to say for sure what stock will grow the most in 2025. However, top-rated analysts are currently bullish on stocks like:

1. Ceragon Networks (NASDAQ: CRNT)

2. Ibex Ltd. (NASDAQ: IBEX)

3. Pilgrims Pride Corp. (NASDAQ: PPC)

4. Precision Drilling Corp. (NYSE: PDS)

5. Ranger Energy Services (NYSE: RNGR)

What stocks to buy today for beginners?

The best stocks to buy for beginners depend on your goals and objectives. While even beginners should do their own research, established companies like Walmart and Microsoft may be worth researching.

Which share is best to buy today under $100?

The best stock shares under $100 will depend on your goals and objectives as an investor, and your investment decisions are solely your own.

However, it’s worth noting that the ability to invest in fractional shares of stocks means that you can access even higher-priced stocks like Amazon (NASDAQ: AMZN) or Google (NASDAQ: GOOGL).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.