Exclusive Discount: WallStreetZen readers can grab 50% off TipRanks Premium. This deal makes the value proposition much stronger. Get it here:

> Get 50% Off TipRanks Premium

This discount significantly improves the cost-benefit ratio, especially if you’re considering an upgrade.

Have you ever felt like you’re drowning in stock market opinions? I have. One day, you’ll read that Company X is a “Strong Buy,” only to find another analyst calling it a “Sell” the next day. It’s maddening.

That’s where TipRanks comes in.

TipRanks tracks Wall Street analysts, bloggers, corporate insiders, and hedge funds and grades them based on how their recommendations perform. It’s like getting a cheat sheet that tells you which experts are worth listening to and which ones consistently fall short.

But to unlock the best features, you’ll need a paid subscription. Is it worth it? Let me help you find out — I’ve spent weeks testing it to separate the hype from reality.

And if you decide you are interested? I’ve snagged a 50% discount for our readers — you can use any of the links in this post to get the offer.

Is TipRanks Premium Worth It?

My TipRanks Premium review findings: If you’re serious about using analyst insights and expert activity in your investment process, TipRanks Premium ($30/month) delivers real value. Seeing which analysts consistently perform well has helped me avoid several potential missteps. Plus, TipRanks is offering WallStreetZen readers a hefty discount (use any of the links in this post to get it!)

Most TipRanks reviews from active investors agree that the Premium tier provides essential functionality that justifies the cost, especially with a discount.

But I Just Want Stock Picks!

Are you less interested in fundamental research … And more interested in high-quality stock picks? With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What is TipRanks?

Founded in 2012, TipRanks brings something desperately needed to the financial world: accountability. Most investment platforms just tell you what analysts think. TipRanks tells you which analysts have been right.

The platform crawls through financial data from regulatory filings, news sites, and brokerage reports. It then rates financial experts based on how their recommendations have performed over time.

This approach means you’re not just getting opinions – you’re getting scored, ranked opinions with track records attached.

Side note: WallStreetZen offers a more selective approach here. Instead of tracking thousands of analysts, WSZ focuses exclusively on the top 1% of analysts with proven track records, which means less noise to filter through, and you’ll pay less for this more curated approach.

Is TipRanks worth it for investors like you? That depends. If you frequently use analyst ratings to guide your investment decisions but get frustrated trying to figure out which experts to trust, TipRanks solves a real problem. I’ve found it useful for retail investors who don’t have time to track every analyst’s hit rate manually.

Many institutional investors rely on TipRanks data, which speaks to its credibility. But it’s designed with the everyday investor in mind – someone who values expert opinions but wants proof to back them up.

Key Features of TipRanks

Let’s take a look at what’s under the hood at TipRanks.

Analyst Ratings & Ranking System

The platform doesn’t just collect analyst recommendations – it grades them. Each analyst gets ranked based on the following:

- Success rate – how often their picks make money

- Average return – how much their recommendations beat (or lag) the market

- Statistical significance – whether their results come from skill or luck

I love being able to filter for only 5-star analysts. Why listen to everyone when you can focus on the proven winners?

Focusing on top-ranked analysts’ consensus views in my testing has helped avoid several potential investment mistakes.

As a side note, WallStreetZen also allows you to focus solely on top-rated analysts with the Top Analysts feature.

Top Stocks Tool

Need investment ideas? This feature flags stocks that are currently catching the attention of top-rated experts. You’ll find:

- Top Analyst Stocks – companies with strong buy ratings from analysts with proven track records

- Top Smart Score Stocks – high-scoring stocks based on TipRanks’ proprietary rating system

- Insider Hot Stocks – companies where executives are putting their own money on the line

These lists serve as excellent starting points for further research, and they’re frequently mentioned in positive TipRanks reviews from other users.

Of course, I’d be remiss if I didn’t mention that WallStreetZen also offers stock picks — you can get them via the Strong Buy Stocks from Top Wall Street Analysts screener, or subscribe to our Zen Investor stock-picking newsletter for expert stock picks vetted by a 40+ year market veteran.

Smart Score

The Smart Score is TipRanks’ proprietary rating system that scores stocks from 1 to 10. It combines eight factors:

- Analyst ratings

- Blogger opinions

- Crowd wisdom

- Hedge fund activity

- Insider transactions

- News sentiment

- Technical indicators

- Fundamentals

According to TipRanks’ backtesting, stocks scoring 8+ have historically outperformed. This is useful as a quick sanity check before making investment decisions. It’s like getting a second opinion that incorporates multiple perspectives.

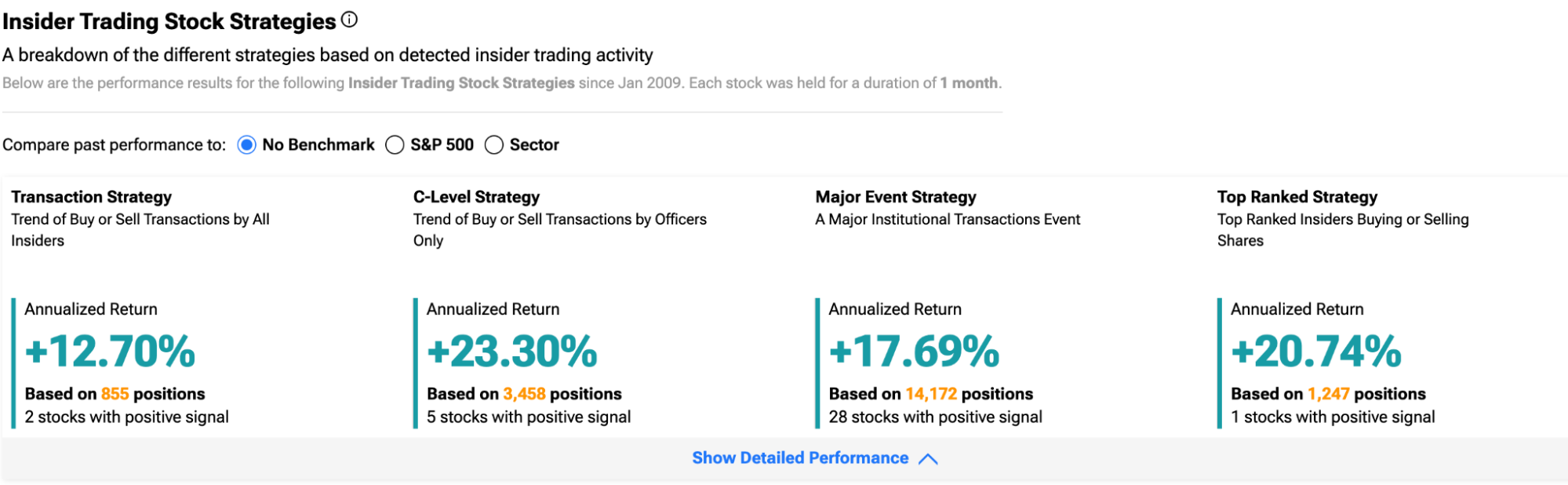

Insider Transactions

Want to know if company executives are buying or selling their own stock? This feature makes it easy to spot significant insider activity. You can quickly identify:

- Who’s buying (executives, board members, major shareholders)

- How much they’re buying

- Whether this represents a significant portion of their holdings

When combined with other positive indicators, insider buying is often a strong confirmation signal. Many TipRanks reviews highlight this as one of the platform’s most valuable features.

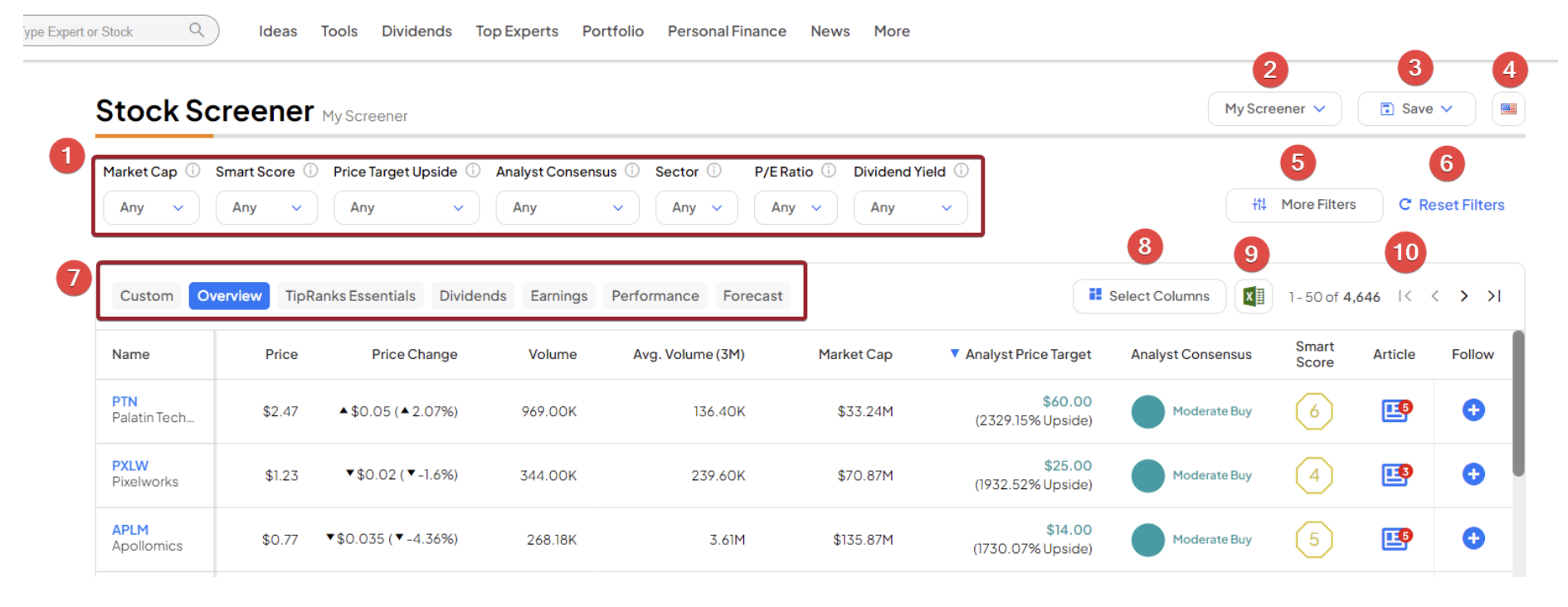

Stock Screener

TipRanks’ stock screener lets you filter the market based on dozens of criteria. Beyond the usual fundamental and technical filters, you can screen for:

- Analyst consensus ratings

- Smart Score ranges

- Insider activity signals

- Recent analyst revisions

- News sentiment

This tool has saved me countless hours of research time, which I would’ve spent manually finding stocks that match specific criteria.

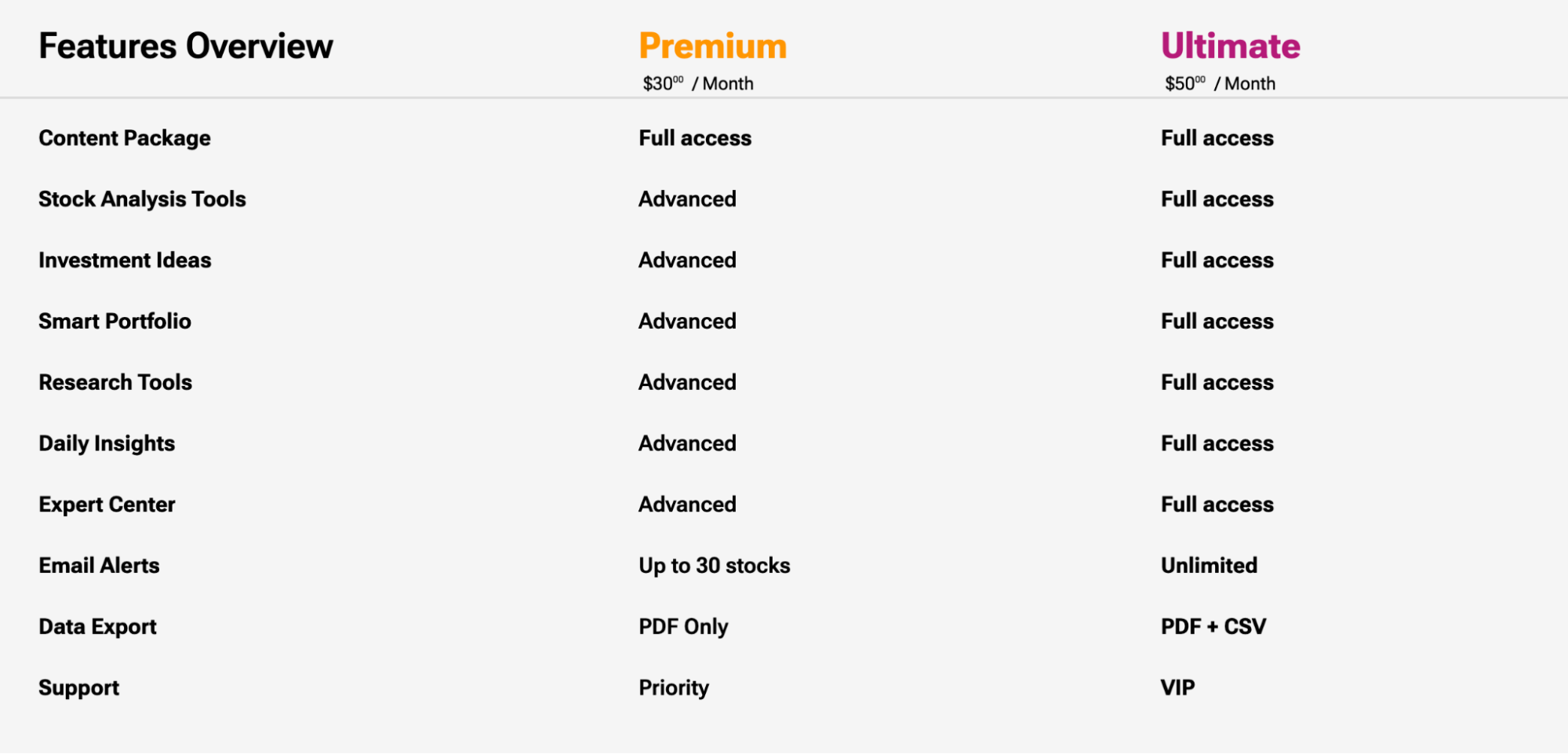

TipRanks Premium: What Do You Get?

The free version of TipRanks barely scratches the surface. It’s more of a teaser than a useful tool. My TipRanks Premium review revealed that upgrading unlocks the platform’s real power.

TipRanks offers two paid tiers:

TipRanks Premium ($30/month, often discounted annually)

This popular option includes:

- Access to all analyst ratings, including 5-star experts

- Complete Top Stocks lists

- Full Smart Score details for every stock

- Advanced screening capabilities

- Email alerts for up to 30 stocks

- Enhanced portfolio analysis

- PDF exports

- Better customer support

Most TipRanks Premium reviews suggest this tier offers the best balance of features and cost for serious individual investors.

TipRanks Ultimate ($50/month, often discounted annually)

For power users, Ultimate adds:

- Unlimited email alerts

- VIP support

- Additional data sets like risk factor analysis

- Enhanced export options

Is TipRanks Accurate and Legit?

Any thorough TipRanks review needs to address accuracy. Can you actually trust the data?

Based on my testing, TipRanks’ methodology for tracking expert performance is solid. The company:

- Collects recommendations and price targets from public sources

- Measures return against market benchmarks

- Accounts for statistical significance to filter out lucky guesses

The company has been in existence since 2012, and major brokerages like TD Ameritrade integrate their data, which is a decisive vote of confidence.

That said, is TipRanks worth it for predicting future performance? That’s trickier. TipRanks measures past performance, and markets are notoriously unpredictable. Even 5-star analysts sometimes miss it.

TipRanks is most valuable when used as part of a broader research process. The data is accurate for its measures (historical performance), but no system can perfectly predict future results.

TipRanks Pros + Cons

Analyst Accountability: Finally, someone’s keeping score! You can see which experts consistently get it right. | Limited Free Version: The basic tier is essentially a demo – you’ll hit paywalls quickly. |

Data Consolidation: Saves tons of time by pulling together analyst ratings, insider activity, and sentiment in one place. | Subscription Cost: At full price, it’s a significant investment for casual investors. |

Idea Generation: The Top Stocks tools quickly surface investment candidates worthy of deeper research. | Backward-Looking Data: All the analysis is based on historical performance, with the usual caveats about the future. |

User Experience: Clean interface that doesn’t require a finance degree. | Black Box Elements: The Smart Score’s exact formula isn’t fully disclosed. |

Customizable Alerts: Premium users receive notifications when important changes occur with their watched stocks. | Information Overload: Beginners might find all the data points overwhelming without guidance. |

Comprehensive Coverage: Tracks analysts, bloggers, insiders, and hedge funds for a well-rounded view. | Short-term focus: The emphasis on analyst price targets may skew toward shorter investment horizons. |

TipRanks Alternatives: How Does It Compare?

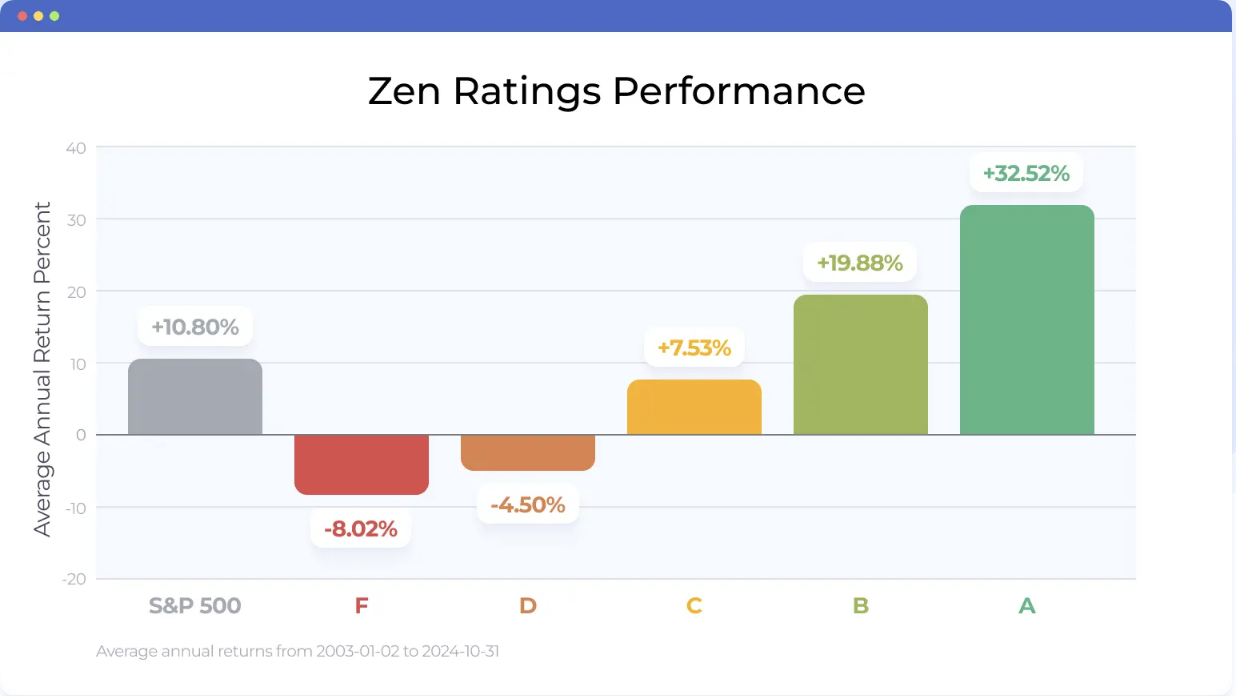

A Cheaper Alternative…

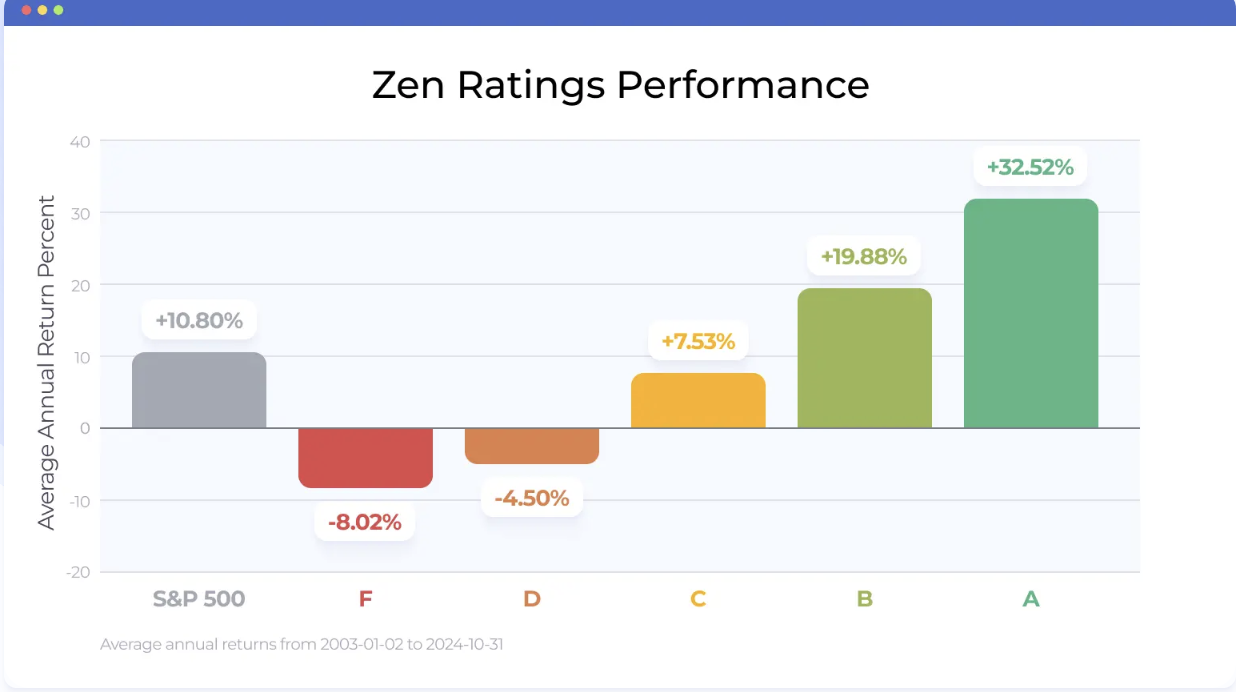

WallStreetZen’s Zen Ratings system combines fundamental data into a single, easy-to-understand score — helping you invest with confidence, not guesswork. It’s free to get started, and you can unlock unlimited features with WallStreetZen Premium for just $19.50/month — significantly cheaper than TipRanks’ $30/month price tag.

Why use Zen Ratings?

✅ Instantly see how strong a stock is — no spreadsheets required

📊 Combines analyst ratings, fundamentals, and valuation into one score

🧠 Backed by data, not hype — perfect for long-term investors

🔍 Quickly filter out weak stocks and focus on high-quality opportunities

💡 Used by thousands of retail investors to spot winning stocks faster

👉 Start using Zen Ratings now — it’s free!

TipRanks vs WallStreetZen

Cost:

- TipRanks: Free Basic; Premium ($30/mo); Ultimate ($50/mo). Remember our 50% off deal.

- WallStreetZen: Free Basic; Premium ($19.50/mo annually or $59/mo monthly). Check the latest WSZ pricing.

How it compares:

TipRanks casts a wide net, tracking thousands of experts and their performance. WallStreetZen takes a more focused approach, highlighting only the top 1% of analysts and emphasizing automated fundamental analysis through its Zen Ratings system.

I find TipRanks better for monitoring broad market sentiment and expert consensus, while WallStreetZen excels at streamlining fundamental due diligence and focusing only on elite analysts. WallStreetZen also typically costs less annually for comparable features.

TipRanks vs Seeking Alpha

Cost:

- TipRanks: Free Basic; Premium ($30/mo); Ultimate ($50/mo).

- Seeking Alpha: Basic (Free with limitations); Premium ($299/year, but you can get $30 off using the links in this post). Check current SA pricing.

How it compares:

These platforms couldn’t be more different. TipRanks quantifies expert performance data. Seeking Alpha offers a vast library of articles from investors and analysts with its quant rating system.

If you prefer diverse written opinions and investment theses, Seeking Alpha wins. If you want objective performance tracking of professional analysts without wading through articles, TipRanks is your better bet.

TipRanks vs Morningstar

Cost:

- TipRanks: Free Basic; Premium ($30/mo); Ultimate ($50/mo).

- Morningstar: Basic (Free with limitations); Investor ($249/year — use links in this post to get $50 off your first year). Check Morningstar offers.

How it compares:

Morningstar built its reputation on fund research and fundamental analysis. Its stock coverage emphasizes long-term valuation models and economic moat assessments.

TipRanks focuses more on what experts are saying now and how reliable they have been historically. It’s more about capturing market sentiment and expert activity than deep fundamental analysis.

Choose Morningstar if you’re a long-term, fundamental value investor. Pick TipRanks if tracking analyst sentiment and insider activity plays a significant role in your strategy.

The Bottom Line: Is TipRanks Worth It?

After extensively testing the platform for this TipRanks review, here’s my verdict on whether TipRanks is worth it in 2025:

It’s worth it if:

- You regularly use analyst recommendations but want to filter out the noise

- You value seeing what top-performing experts think about stocks you’re researching

- Insider transactions and hedge fund movements factor into your strategy

- Do you prefer having diverse data points consolidated into simple scores

- You’re an active trader or investor who’ll use these tools frequently

It’s probably not worth it if:

- You’re strictly a buy-and-hold fundamental investor (look at WallStreetZen or Morningstar instead)

- You prefer reading detailed investment theses (Seeking Alpha would be better)

- You only check your stocks occasionally

- You’re on a tight budget and can’t justify the subscription cost

TipRanks brings much-needed accountability to financial advice. It won’t predict the future with certainty – no tool can – but it highlights which experts have delivered results.

Most TipRanks reviews agree that the platform fills an essential gap in the investment research landscape. And with our 50% discount (available here), you can access the platform at a lower price.

TipRanks Premium offers solid value for investors who want to know which voices in the market are worth listening to.

So, is TipRanks worth it? Yes. However, some investors may find that WallStreetZen’s lower price tag for comparable features make it a more appealing pick.

FAQs:

How much does TipRanks cost?

TipRanks offers a free Basic plan with limited features, a Premium plan at $30/month (cheaper with annual billing), and an Ultimate plan at $50/month.

Is TipRanks worth the money?

Based on my TipRanks review, it's worth it for investors who regularly use analyst ratings and want to know which experts have proven track records.

Which is better: Seeking Alpha or TipRanks?

Choose TipRanks for expert accountability and Seeking Alpha for diverse investment theses and ideas.

Is TipRanks a credible source?

Yes. TipRanks transparently tracks expert recommendations using public data, and major brokerages integrate their services.

How to get TipRanks for free?

You can use TipRanks' Basic plan for free, but it's severely limited. You'll only see basic analyst ratings, restricted stock research, and minimal portfolio tools – essentially a demo version of the platform.

What’s included in TipRanks Premium?

TipRanks Premium includes access to all analyst ratings (including top performers), complete Top Stocks lists, enhanced Smart Score details, advanced stock screening, email alerts for up to 30 stocks, portfolio analysis tools, and PDF exports.

Can beginners use TipRanks?

Yes, though there's a learning curve. The interface is intuitive, but beginners might feel overwhelmed by all the data points.

What are the best TipRanks alternatives?

The best alternatives depend on your needs: WallStreetZen for fundamental analysis automation and elite analyst tracking, Seeking Alpha for investment articles, and Morningstar for long-term fundamental analysis and fund research.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.