As markets grow increasingly complex, having the proper research tools has never been more critical. Stock Rover is a popular option for serious investors seeking to enhance their analysis capabilities. With even a quick scan of Stock Rover reviews, you’ll find devotees praising its extensive feature set.

But is it the best stock research platform for you?

In this Stock Rover review, I’ll help you make that decision for yourself by walking you through everything it offers, from powerful screening capabilities to in-depth research reports. Plus, I’ll show you how it compares to competitors so you can choose the service best aligned with your style.

Let’s dive in and see if Stock Rover deserves a place in your investment toolkit.

Prefer stocks picked for you?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What Is Stock Rover?

Stock Rover is pretty neat.

It’s a web-based investment research and portfolio management platform designed for serious investors who want to make data-driven decisions.

Unlike basic tools provided by brokerages or free financial websites, Stock Rover delivers institutional-grade research capabilities in an accessible package.

The company was founded in 2008 by Howard Reisman and Andrew Martin, two engineers with a passion for investing. The platform officially launched in 2011 and has been expanding its capabilities ever since.

What makes Stock Rover different? Its laser focus on fundamental analysis and comprehensive data visualization. The platform excels at helping investors find, evaluate, and compare investment opportunities through powerful screening, in-depth research reports, and side-by-side comparisons.

Stock Rover targets self-directed investors who take a methodical, data-driven approach to investing. It’s ideal for fundamental and value investors who prioritize financial metrics and long-term performance over short-term price movements.

Key Features

Let’s take a dive into some of the features that come with a Stock Rover subscription.

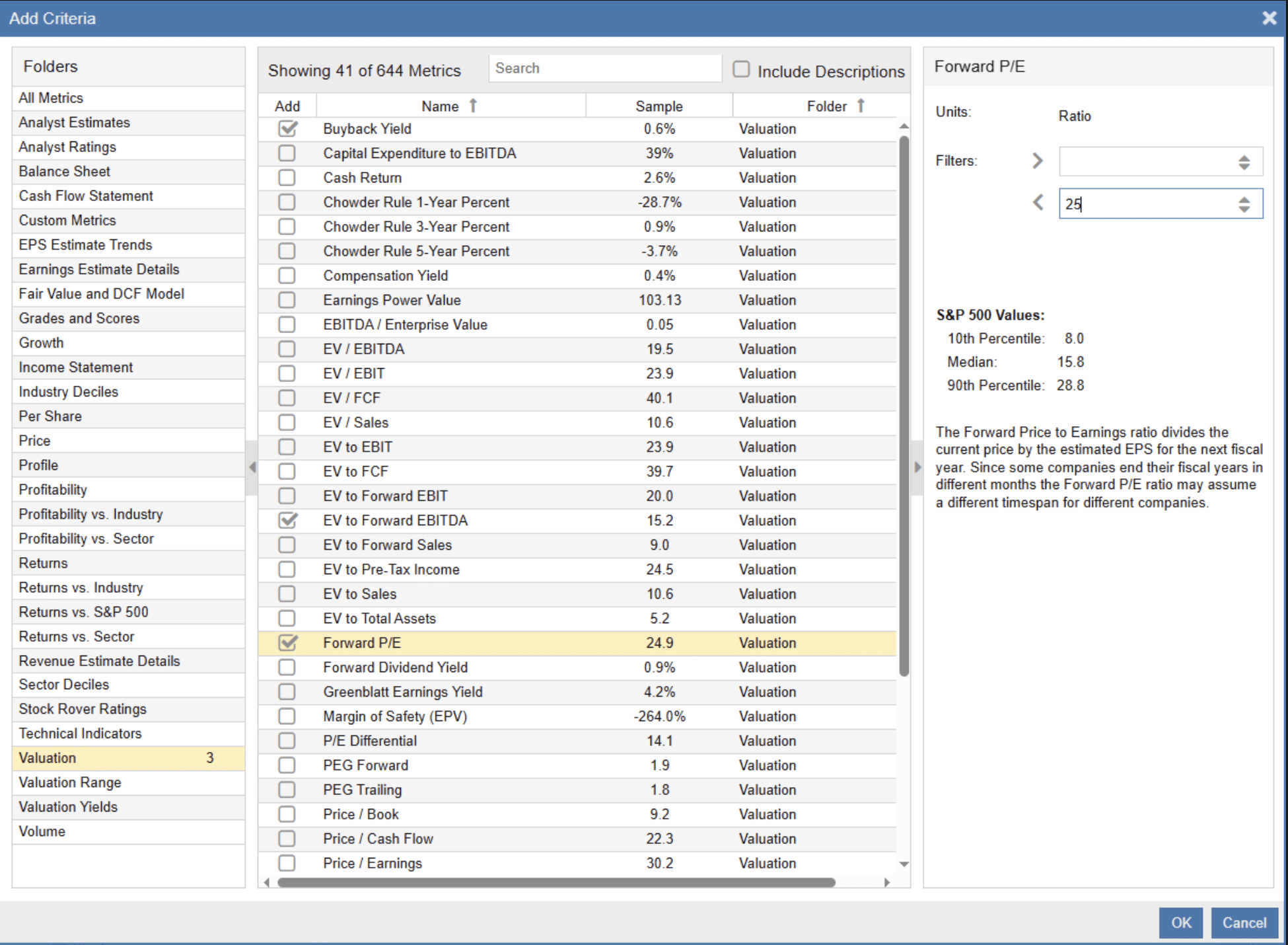

Stock Screener

Stock Rover’s screening capabilities are impressive and form the backbone of the platform. Depending on your subscription tier, you can filter stocks based on hundreds of metrics.

The screener allows you to create complex, multi-factor screens that can identify stocks matching specific investment strategies.

For example, you can easily set up a Warren Buffett-style value screen that looks for companies with substantial competitive advantages, consistent earnings growth, low debt, and reasonable valuations.

The platform has several pre-built screeners, but the real power comes when creating your own. The Premium Plus plan offers equation screening, allowing you to create custom formulas that combine multiple metrics in ways that aren’t possible with simple filters.

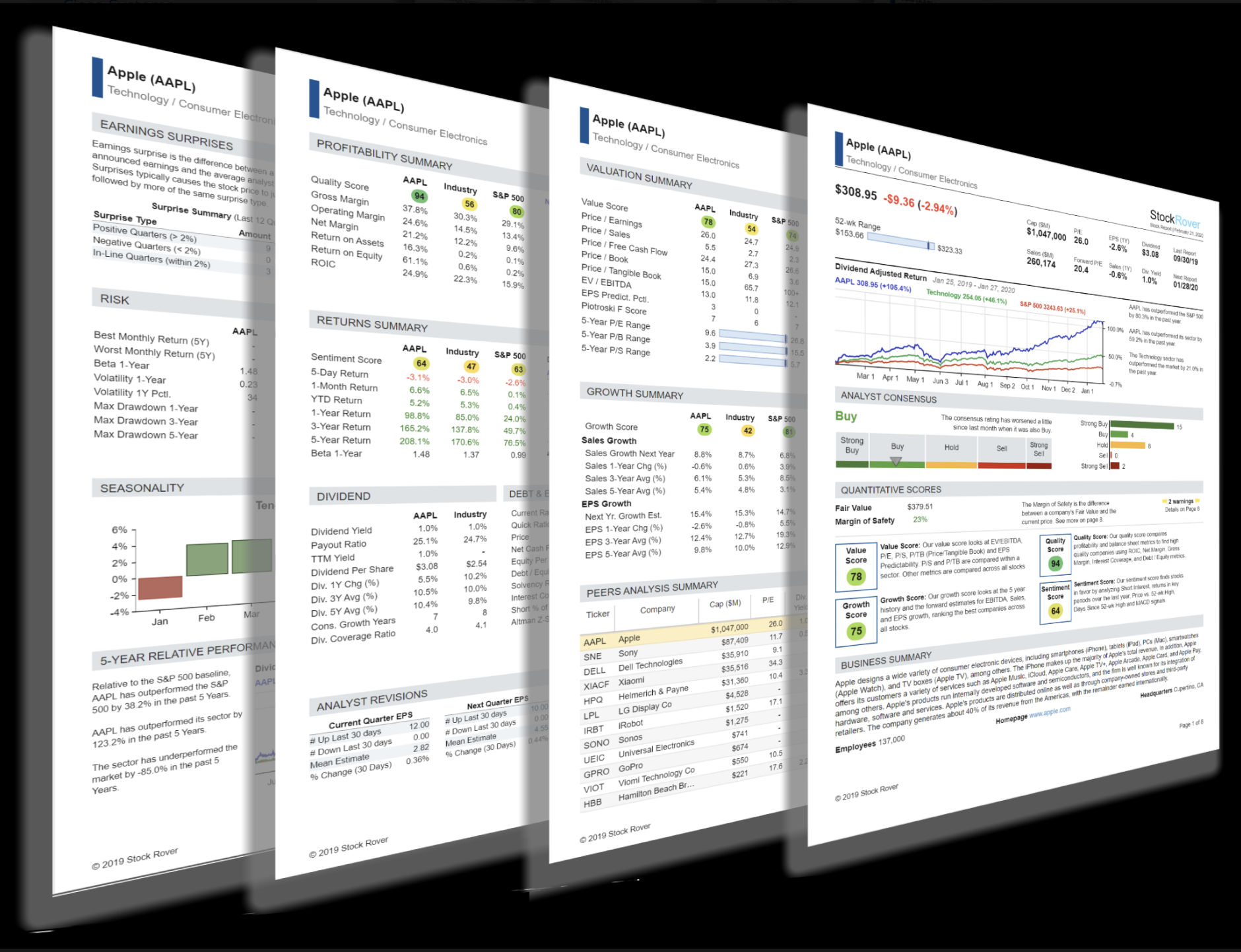

Research Reports

Stock Rover’s Research Reports compile essential information about a company into a well-structured, easy-to-digest format. Available as an add-on subscription, these reports include:

- Company Overview

- Valuation metrics with historical context

- Growth trends

- Profitability metrics

- Financial health indicators

- Dividend information

- Analyst ratings

- Peer comparisons

What sets these reports apart is the contextual presentation. Stock Rover doesn’t just show the current P/E ratio; it also shows how that P/E compares to the company’s historical average, its sector average, and the broader market.

The reports are thorough and well-designed, but they’re an additional cost to your subscription, which should be considered when evaluating the overall value of Stock Rover.

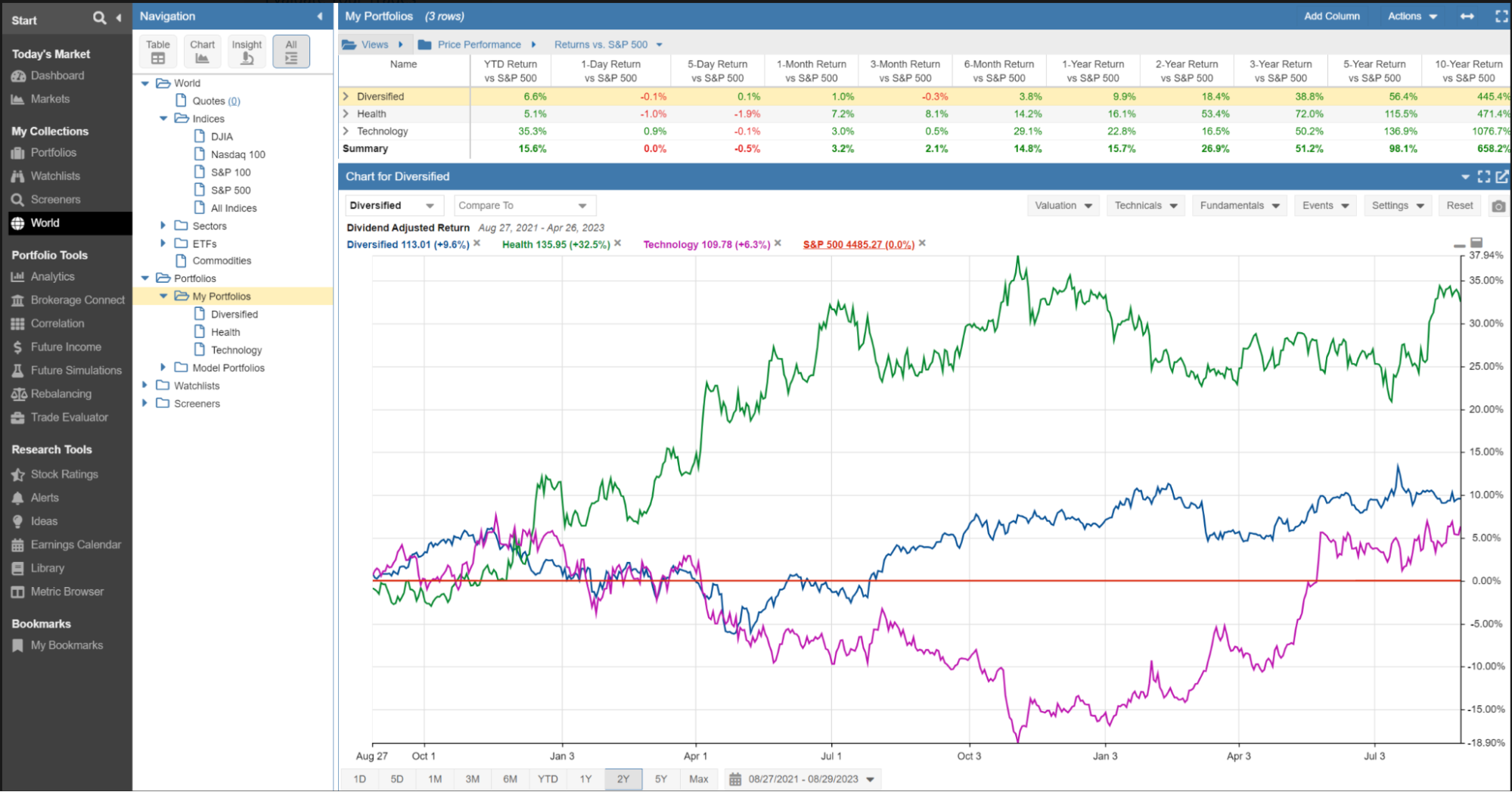

Portfolio Management & Tracking

Stock Rover excels at helping you monitor and analyze your investment portfolios. You can import your holdings directly from your brokerage through their integration system or manually create portfolios within the platform.

Once your portfolio is set up, Stock Rover provides detailed performance metrics that update in near real-time. You can track your returns against any benchmark, not just the S&P 500.

The allocation analysis tools help you understand exposure across various dimensions, including asset classes, sectors, geographic regions, market capitalization, and investment styles. The rebalancing tools are invaluable for those with multiple accounts or complex portfolios.

I found the portfolio correlation analysis particularly useful. It helps identify redundancies and concentration risks that might not be obvious when looking at sector allocations alone.

Financial Data & Ratios

The depth of financial data available in Stock Rover is impressive, especially in the higher-tier plans. The Premium Plus subscription gives you access to 10 years of detailed financial history across hundreds of metrics.

This data is valuable as you can easily compare companies side by side. Want to see how Apple’s gross margins stack up against Microsoft’s over the last decade? You’ll have that information in a clean, comparable format with just a few clicks,

The platform includes specialized metrics that are not commonly available on retail platforms, such as the Piotroski F-Score, Altman Z-Score, and custom fair value and margin of safety calculations.

Charting and Visualization Tools

Stock Rover’s charting capabilities go beyond simple price charts. You can chart virtually any financial metric over time, allowing you to visualize trends in earnings, margins, debt levels, or any other fundamental factor.

Comparative charting is where Stock Rover shines. You can chart multiple stocks on the same graph, normalized to show percentage changes from a starting point. Beyond that, you can chart fundamental metrics across companies—for example, comparing revenue growth rates between competitors.

While these visualization tools are powerful, I found them less intuitive than those offered by platforms that specialize in charting. The learning curve is steeper than I expected, and creating custom charts takes more clicks than it should.

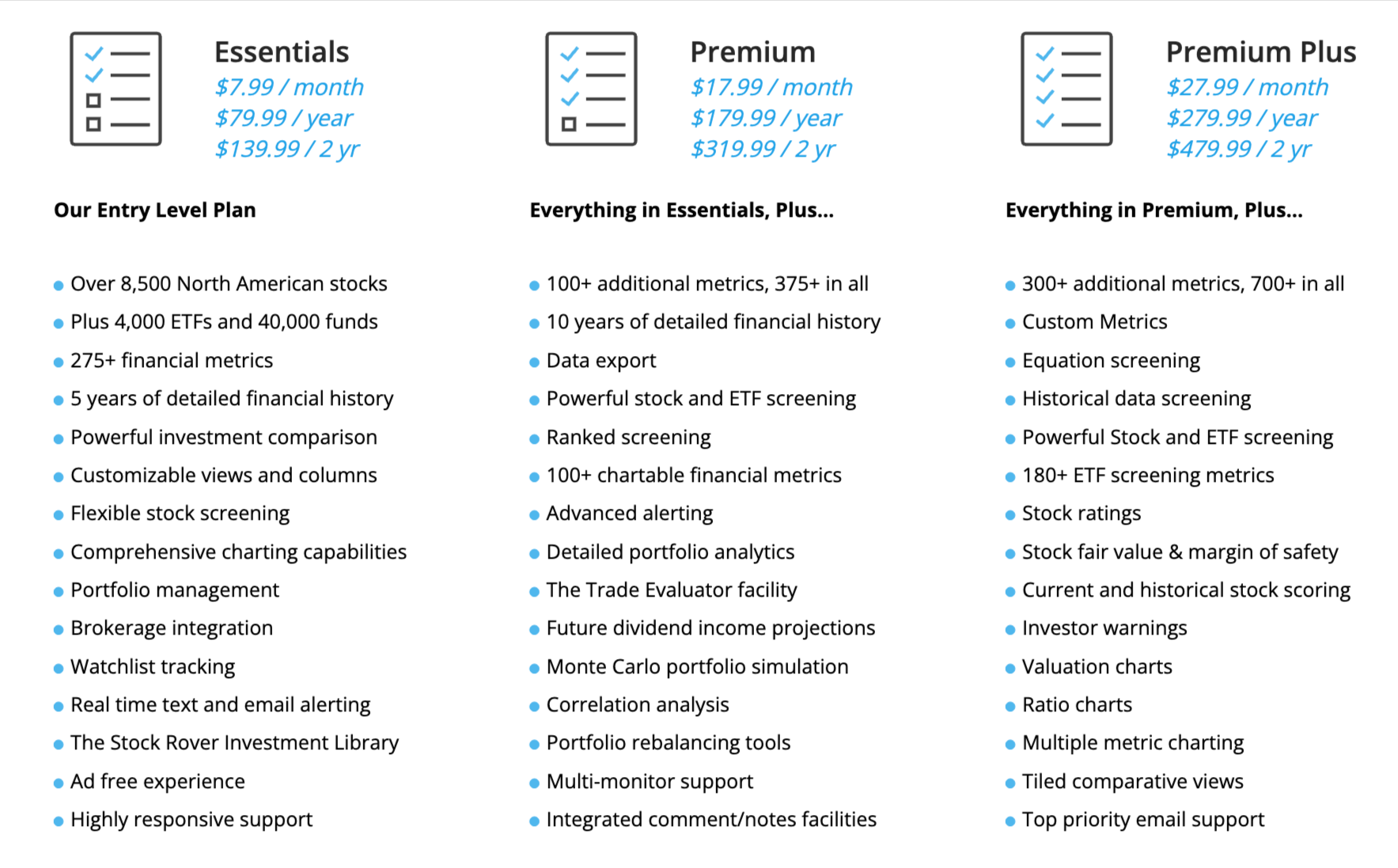

Plans and Pricing

Stock Rover offers a tiered pricing structure with three main subscription levels plus an optional Research Reports add-on.

Free Plan

Yes, Stock Rover offers a free version, but it’s not as good as the paid plans. The free version just gives you access to basic screening capabilities and a taste of what the platform has to offer.

Essentials Plan

The Essentials plan is Stock Rover’s entry-level paid option, priced at:

- $7.99 per month

- $79.99 per year (saving about 17%)

- $139.99 for two years (saving about 27%)

This plan includes data on over 8,500 North American stocks, 4,000 ETFs, 40,000 funds, 275+ financial metrics, 5 years of financial history, basic screening capabilities, portfolio management, and real-time alerts.

Premium Plan

The Premium plan represents a significant step up in capabilities, priced at:

- $17.99 per month

- $179.99 per year (saving about 17%)

- $319.99 for two years (saving about 26%)

This plan includes everything in Essentials, plus over 100 additional metrics (375 total), 10 years of financial history, data export capabilities, advanced screening with ranking, more than 100 chartable financial metrics, detailed portfolio analytics, and portfolio rebalancing tools.

Premium Plus Plan

The Premium Plus plan is Stock Rover’s most comprehensive offering, priced at:

- $27.99 per month

- $279.99 per year (saving about 17%)

- $479.99 for two years (saving about 29%)

This plan includes everything in Premium, plus over 300 additional metrics (for a total of 700+), custom metric creation, equation screening, historical data screening, stock ratings and scoring, fair value calculations, and top-priority support.

Based on my experience with the platform, the free version of Stock Rover is too limited for anyone serious about investment research.

The Essentials plan offers good value for casual investors, but most users drawn to Stock Rover’s capabilities will find the Premium plan to be the best balance of features and cost.

The Premium Plus plan delivers exceptional value for professional investors, investment clubs, or very active individual investors who will fully utilize its advanced capabilities. However, the complexity and cost may be overkill for most individual investors.

Personally, I find WallStreetZen’s Premium subscription to be a better-priced alternative for the majority of investors. (More comparisons below.)

User Experience & Ease of Use

Stock Rover’s interface is designed more like a desktop application than a typical website. It uses a multi-panel approach that allows you to view different types of information simultaneously.

I appreciate the ability to customize this interface to match your workflow. To create your ideal layout, you can resize, detach, or collapse panels. If you’re working with multiple monitors, Stock Rover’s Premium and Premium Plus plans support multi-monitor setups.

I won’t sugarcoat it – Stock Rover has a steep learning curve. This isn’t because the interface is poorly designed, but because the platform offers so many capabilities and customization options that can overwhelm new users.

To be frank — there are a lot more tools than most part-time investors — even serious ones — might need.

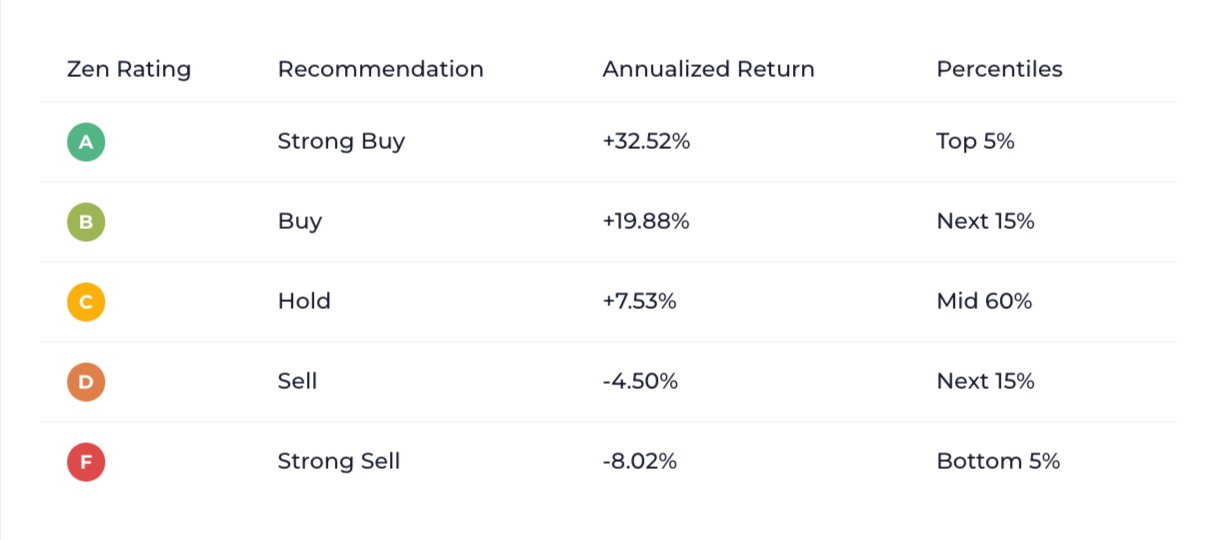

As a point of comparison, WallStreetZen may not have the same level of detail, but the data on the platform is well curated and easy to understand. For instance, the Zen Ratings system gives each stock a simple, easy-to-read letter grade with seven Component Grades in specific areas of interest to investors, like Value, Sentiment, and Momentum — which makes it easy to branch off and do more research or to dismiss a stock that lacks the key attributes you’re looking for.

The platform is primarily designed for desktop use, which makes sense given the data-intensive nature of investment research. While it is technically mobile-responsive, the smartphone experience is suboptimal due to the density of information and controls.

However, there is help to be had. Based on user testimonials and my own experience, Stock Rover’s customer support is exceptional. They offer email support to all subscribers, with Premium Plus members receiving priority responses.

Who Should Use Stock Rover?

Stock Rover is ideal for:

Long-term, Buy-and-hold Investors

Stock Rover’s emphasis on historical data, valuation metrics, and long-term trends aligns perfectly with those who make decisions based on fundamental analysis.

Value Investors

You’ll appreciate Stock Rover’s comprehensive valuation metrics and the ability to compare current valuations against historical averages. The platform easily identifies potentially undervalued companies and assesses their financial strength.

Dividend Investors

Stock Rover offers specialized tools for dividend analysis. The dividend income projections help you visualize your future income stream, while the dividend safety metrics help you assess the sustainability of current dividend payments.

Portfolio Managers

Stock Rover’s portfolio management capabilities are exceptional if you manage multiple portfolios or take a holistic approach to your investments. In fact, we name Stock Rover one of the top stock portfolio tracking apps.

The correlation analysis, rebalancing tools, and performance attribution features help you understand what’s happening with individual holdings and how your entire portfolio is performing.

Stock Rover is NOT ideal for:

Day Traders and Short-term Traders

The platform’s focus on fundamental analysis and historical data makes it less suited for traders who make decisions based on intraday price movements or technical patterns. If you’re a day trader, you may want to check out this post detailing the best day trading setup.

Options Traders

Stock Rover provides limited options data and no specialized options analysis tools. If you’re interested in options trading, I highly recommend checking out Stock Market Guides, which offers some of the best options trading alerts out there. You can also check out our best apps for options trading post.

Complete Beginners

The learning curve and data density make Stock Rover potentially overwhelming for investors just starting out.

Mobile-first Investors

If you primarily research and manage investments on your smartphone, Stock Rover’s desktop-oriented interface may be frustrating.

What Real Users Are Saying

In my research for this Stock Rover review, I found consistently positive feedback across multiple Stock Rover reviews and user forums:

Strengths Commonly Mentioned:

- Depth of data: Many users highlight the comprehensive nature of Stock Rover’s financial data as its standout feature.

- Screening capabilities: The powerful screening tools are frequently mentioned by experienced investors.

- Customer support: The quality of Stock Rover’s customer service is mentioned in numerous reviews. Users appreciate the knowledgeable responses and quick turnaround times.

- Value for money: Although it’s not the cheapest option available, many users feel that Stock Rover provides excellent value for its capabilities.

Common Criticisms Include:

- Learning curve: Many users take weeks to feel comfortable with Stock Rover’s features.

- Mobile limitations: A frequent complaint is the lack of a dedicated mobile app.

- Interface density: Some users find the amount of information displayed simultaneously to be overwhelming.

- Price for casual investors: Several reviews mention that the cost is difficult to justify for those with smaller portfolios.

The overall sentiment among Stock Rover users is overwhelmingly positive among those who have used the platform long enough to overcome the initial learning curve. Many describe it as an essential part of their investment process.

Pros + Cons

Pros | Cons |

|---|---|

Comprehensive data access with up to 700+ metrics in the Premium Plus plan | A steep learning curve for new users |

Powerful screening capabilities with ranking and equation screening | Limited mobile experience with no dedicated app |

Excellent portfolio analysis with correlation analysis and rebalancing suggestions | No direct trading integration |

Research Reports that save hours of manual research time | No options or cryptocurrency coverage |

Fair value calculations for value investors | Higher price point than many competing platforms |

Outstanding customer support | Dense interface that can be visually overwhelming |

Customizable interface that adapts to your workflow | Limited technical analysis compared to dedicated platforms |

Stock Rover vs Competitors

Stock Rover vs WallStreetZen

Cost:

- Stock Rover: Essentials ($7.99/month), Premium ($17.99/month), Premium Plus ($27.99/month)

- WallStreetZen: Free plan with basic features, Premium ($59/month or $234/year)

How They Compare:

Both Stock Rover and WallStreetZen target fundamental investors but take different approaches. Stock Rover offers more comprehensive data and customization options, while WallStreetZen focuses on simplifying complex financial information with multifacted analysis that includes traditional fundamental checks as well as the awesome power of artificial intelligence analysis.

The standout feature of WallStreetZen is the Zen Ratings tool, which analyzes stocks across 115 proven factors to generate easy-to-understand Buy, Hold, or Sell ratings.

This proprietary rating system distills complex financial data into actionable insights, making it valuable for investors who want clear guidance without having to dive into the raw numbers themselves.

Stock Rover excels in its depth of data and customization. With up to 700+ metrics in its Premium Plus plan, it provides significantly more data points than WallStreetZen and offers more powerful screening capabilities.

But let’s be honest — more data points can be kind of confusing. If you’re looking for solid investments, a review of 115 factors proven to drive stock growth is likely sufficient.

Additionally, WallStreetZen’s interface is more streamlined and user-friendly, with a gentler learning curve than Stock Rover. If you want a simplified analysis and clear buy or sell recommendations, WallStreetZen’s Zen Ratings provide an elegant solution.

Stock Rover vs Finviz

Cost:

- Stock Rover: Essentials ($7.99/month), Premium ($17.99/month), Premium Plus ($27.99/month)

- Finviz: Free plan with basic features, Finviz Elite ($24.96/month or $299.50/year)

How They Compare:

Finviz (Financial Visualizations) is known for its stock screener and visualization tools, particularly its heat maps that show market movements at a glance.

Finviz’s strength lies in its technical analysis tools and visualizations. Its heat maps provide an intuitive way to see sector performance, and its technical charts include more indicators and drawing tools than Stock Rover offers. Finviz Elite also provides real-time data, which Stock Rover doesn’t offer at any tier.

Stock Rover pulls ahead in fundamental analysis and portfolio management. It provides more comprehensive fundamental data and offers much more robust portfolio analysis tools.

Stock Rover vs Seeking Alpha

Cost:

- Stock Rover: Essentials ($7.99/month), Premium ($17.99/month), Premium Plus ($27.99/month)

- Seeking Alpha: Basic (Free with limited access), Premium ($29.99/month or $299/year), Pro ($2400/year)

How They Compare:

Seeking Alpha and Stock Rover serve different primary purposes. Seeking Alpha focuses on investment research articles and community insights, while Stock Rover emphasizes data analysis and portfolio management.

Seeking Alpha’s main strength is its vast library of articles written by a community of contributors, offering diverse perspectives on stocks and market trends. Its Quant Ratings system provides algorithmic stock ratings similar to WallStreetZen’s Zen Ratings.

Stock Rover provides more comprehensive tools for data analysis and portfolio management. Its screening capabilities are more powerful than Seeking Alpha’s, and its portfolio analysis tools are more robust.

Final Verdict: Is Stock Rover Worth It?

Stock Rover stands out as an exceptional research platform for serious fundamental investors. If you’re a long-term, value-oriented investor who makes decisions based on comprehensive analysis, Stock Rover offers capabilities that few other retail-accessible platforms can match.

Is it worth the price? That depends on your investing style and portfolio size. For active investors managing substantial portfolios, even the Premium Plus plan can easily pay for itself if it helps you make better investment decisions or saves you significant research time.

The Essentials plan provides a good balance of capabilities and costs for more casual investors or those with smaller portfolios. The free plan, while available, is too limited to be truly useful for serious research.

Compared to alternatives like WallStreetZen, Finviz, and Seeking Alpha, Stock Rover offers the most comprehensive toolset for data-driven fundamental analysis.

However, it might be more than you need.

WallStreetZen’s Zen Ratings system offers a more streamlined experience, making it a better choice if you prefer simplified analysis and clear buy or sell recommendations.

FAQs:

Is Stock Rover free?

Stock Rover does offer a free version, but it is pretty limited compared to the paid plans. For meaningful research capabilities, consider one of the paid plans: Essentials ($7.99 per month), Premium ($17.99 per month), or Premium Plus ($27.99 per month).

Is Stock Rover reliable?

Yes, Stock Rover is a highly reliable platform. User reviews consistently praise the reliability of both the platform itself and the data it provides.

Does Stock Rover offer real-time data?

Stock Rover does not offer real-time data. The data is delayed by approximately 15-20 minutes, which is standard for most retail investment research platforms.

Can you trade directly through Stock Rover?

Stock Rover is purely a research and analysis platform; it does not offer direct trading capabilities. You'll need to execute trades through your brokerage account. However, Stock Rover does integrate with many popular brokerages for portfolio tracking purposes.

How much does Stock Rover cost?

Stock Rover offers three paid subscription tiers:

-Essentials: $7.99/month, $79.99/year, or $139.99/2 years

-Premium: $17.99/month, $179.99/year, or $319.99/2 years

-Premium Plus: $27.99/month, $279.99/year, or $479.99/2 years

The Research Reports add-on costs $49.99/year when bundled with any yearly or two-year plan or $99.99/year as a standalone subscription.

What is better than Stock Rover?

Few platforms match Stock Rover's capabilities for fundamental analysis and comprehensive data at its price point. However, WallStreetZen offers a more streamlined experience with its Zen Ratings system, making it easier to identify investment opportunities without quickly getting lost in data overload.

For investors who value simplicity and actionable insights over comprehensive customization, WallStreetZen may be the better choice.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.