Investors are bombarded with stock recommendations from stock analysts and other so-called experts.

But who are these analysts and how do you know who you should listen to?

Do they have a proven track record – or are they just making a prediction, then loudly reminding you when they were right, and just quietly ignoring the times they were wrong?

Introducing WallStreetzen’s Analyst Performance Database

WallStreetZen helps investors filter out the noise by analyzing public stock recommendations made by Wall Street analysts.

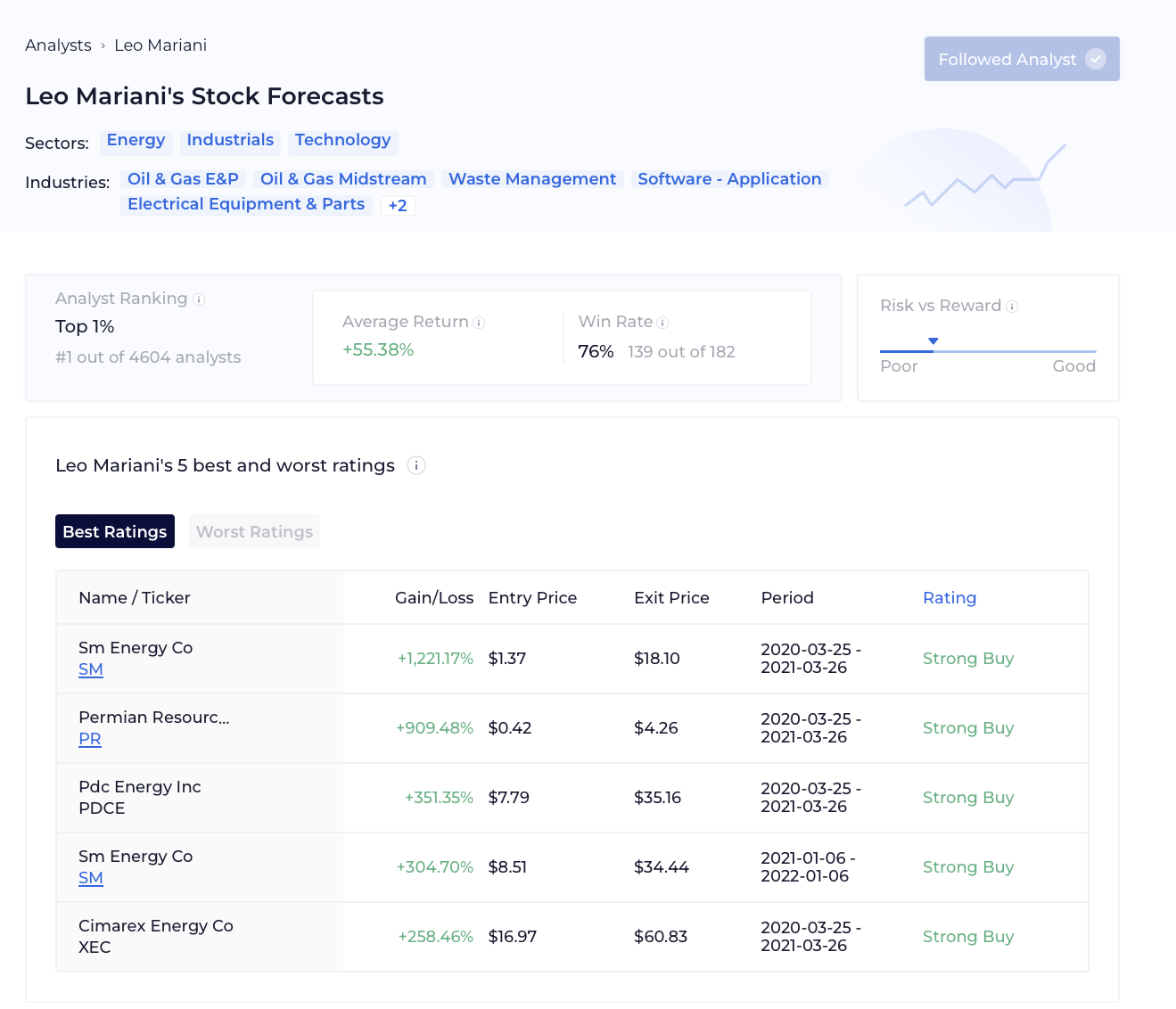

Our proprietary algorithm analyzes each analyst’s recommendations for quality based on average returns, win-rate, and consistency, and ranks each analyst accordingly.

We make it easy for you to identify the analysts who have been right for years, so you can follow them with confidence, while ignoring analysts who consistently make losing recommendations.

Methodology

We take each analyst’s buy/hold/sell recommendations and turn them into entry/exit signals.

Buy and sell recommendations open a trade (sells are treated a short trade). A hold or opposing recommendation (e.g., sell recommendation after a buy recommendation) closes the trade.

If no such recommendations are found within 1 year from trade opening, the trade is automatically closed.

We then apply our proprietary algorithm to these trades to measure each analyst’s performance, and rank them.

The 3 factors that the algorithm takes into account are average return, win-rate, and consistency.

Average Return

We hold each analyst accountable for their recommendations. By tracking each analyst’s recommendations over multiple years and measuring their return, you can get a picture of an analyst’s historical track record before you take their forecasts seriously.

Win Rate

To ensure that analyst’s are not disproportionately rewarded for a single lucky prediction, our algorithm also factors in the analyst’s win rate.

Win rate measures the percentage of the analyst’s recommendations that generate a positive return over their total number of recommendations.

Consistency

The algorithm gives more weight to analysts who consistently make recommendations that generate a high return and maintain a high win rate over multiple recommendations.

Analysts with a high return and/or high win rate over a handful of a recommendations will be ranked lower than their more prolific peers.

You can sign up here (it’s free to start) and use WallStreetZen’s Analyst Performance database to uncover winning stock ideas and make more confident buy / sell decisions.

Read more: Head to this article to learn how to use stock analyst ratings.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.