Stock shares can be expensive.

For instance, Berkshire Hathaway’s stock (NYSE: BRK.A) currently trades at a staggering $679,000, meaning most investors would be unable to buy even a single share of stock — myself included!

While this is a huge outlier, even Autozone (NYSE: AZO) and several other big-name stocks trade above $3,000 per share.

How can you add higher-priced stocks to your portfolio without using all of your available funds?

Charles Schwab’s solution is Stock Slices — their version of fractional stock shares. But are they all they’re cracked up to be?

In this Schwab slices review, I’ll give you the answer by covering:

- What are Stock Slices?

- Can you make money on fractional shares?

- Does Charles Schwab have fractional shares?

- Are Schwab stock slices worth it?

And more. Let’s dig in:

Our favorite platform for fractional shares (and more)…

One potential drawback of Schwab Slices? You can only buy fractional shares of companies from the S&P 500 Index.

In contrast, eToro offers fractional shares of any of the stocks or ETFs on the platform. Plus, they offer stock and ETF trading with 0% commissions.

With a minimum investment of just $10 and plenty of other great features for traders and investors, it’s not hard to see why 30+ million users have signed up for eToro.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

What Are Fractional Shares?

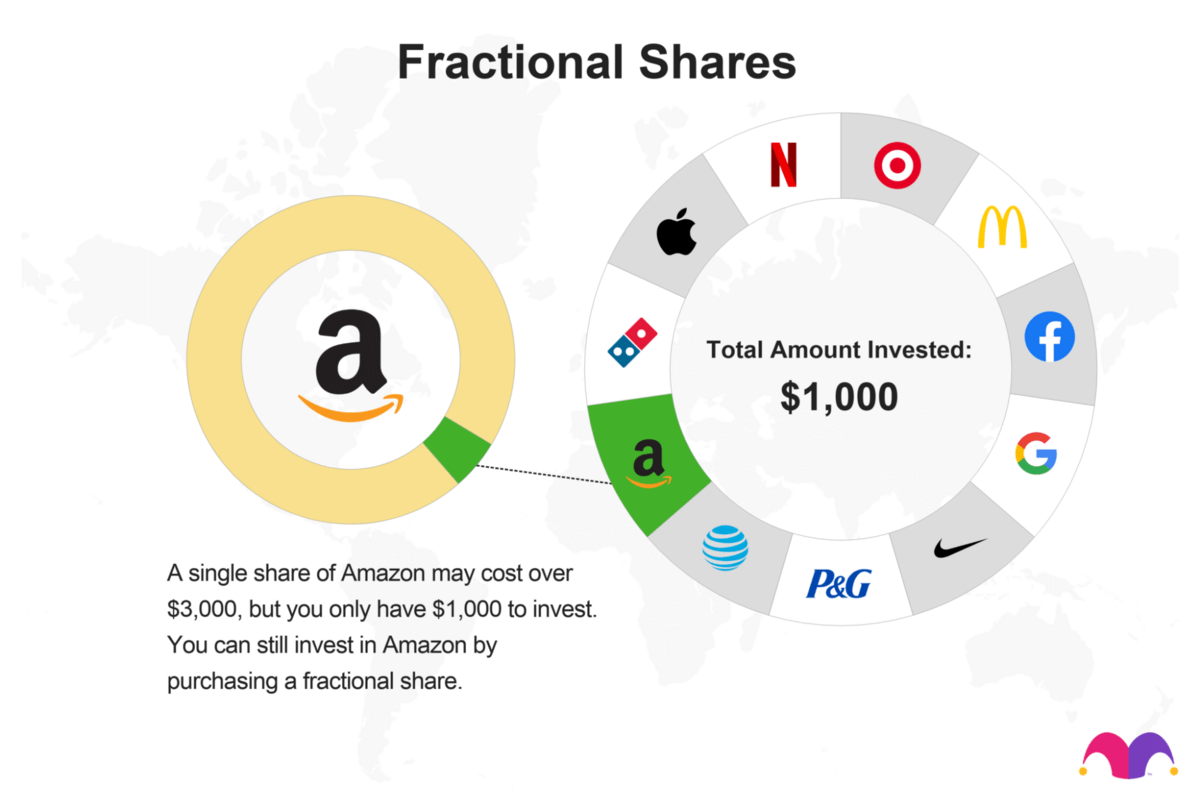

Fractional shares, as the name suggests, are small pieces of what would otherwise be a single share.

They’re made possible through a process called share splitting, meaning brokerage firms and investment platforms break down whole shares into smaller, more accessible portions

This enables you to buy and own fractional shares of popular companies, even if you don’t have the necessary capital to purchase full shares.

For example, you can own a fraction of a BRK.A share that corresponds to the amount you invest. So instead of having to own say, one share, you could own 0.0001 shares in the company. This frees up your capital for other investment opportunities and allows for easier diversification.

Be sure to check out our article on the best brokerage for fractional shares.

Schwab Slices Review

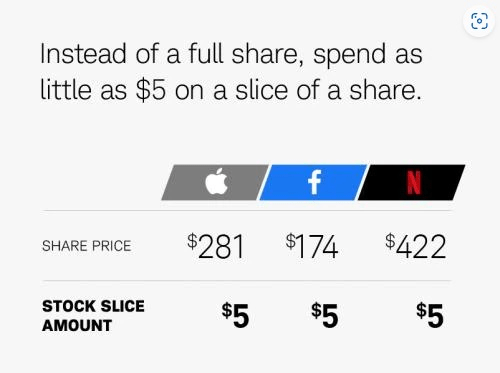

While Schwab’s Stock Slices may sound like a new way to invest in stocks, they’re just fractional shares with a fresh name.

Investing through stock slices allows you to invest in any company listed in the S&P 500 Index — the top 500 publicly traded US-based companies.

You can buy anywhere between one to 30 stock slices in any transaction with a minimum dollar value of $5 up to a maximum of $50,000.

However, there’s a limit to how many stock slices you can buy and sell in a single week before you’re considered a Pattern Day Trader by FINRA regulations. In this case, the Schwab day trade limit is three complete trades in five business days.

Additionally, Schwab doesn’t charge commissions when you invest in their Slices.

Looking for more ways to invest in fractional shares? eToro offers zero-commission fractional share investing.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Can You Make Money on Fractional Shares?

Yes, it’s definitely possible to make money on fractional shares as they’re just another way to invest in the stock market. But instead of having to buy a whole share, you can capitalize on the performance of a company’s stock with an amount that suits you.

For that reason, many investors prefer fractional shares for dollar-cost averaging into their investments. By investing a fixed amount of money regularly, regardless of the share price, you can accumulate more fractional shares when prices are low and fewer shares when prices are high.

While this can also work with standard shares, there are limitations depending on your capital and the stocks you want to buy.

Like buying standard shares, there are two ways in which you can make money with fractional shares:

- Capital Appreciation: If the price of the stock rises over time, the fractional share’s value will increase, meaning you can sell your fractional shares at a higher price than your initial investment.

- Dividend Payments: Many companies pay dividends to their shareholders as a distribution of profits. As a fractional shareholder, you’re still entitled to receive dividends in proportion to your ownership.

Schwab Slices aren’t the only option for fractional share dividends. eToro* also offers fractional share dividends.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Is Schwab the Best Place to Invest in Fractional Shares?

While you can still successfully invest in fractional shares with Schwab, we prefer three alternatives — eToro, M1 Finance, and Public.

Simply put, their simple user interfaces make it easy to navigate their platforms, making them more user-friendly. At the same time, they offer more varied and powerful investing features that you can use to increase your investing profits.

eToro

eToro is one of our favorite brokers, period. So it should come as no surprise that they’re also a top pick for fractional share investing.

On eToro, you can invest in fractional shares of any of the stocks or ETFs offered on the platform. The minimum investment is just $10, and fractional dividends are available.

When you consider all of eToro’s other offerings along with fractional share investing — its CopyTrader feature, demo account for testing out strategies, easy-to-use interface, and low fees, it’s well worth your time.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

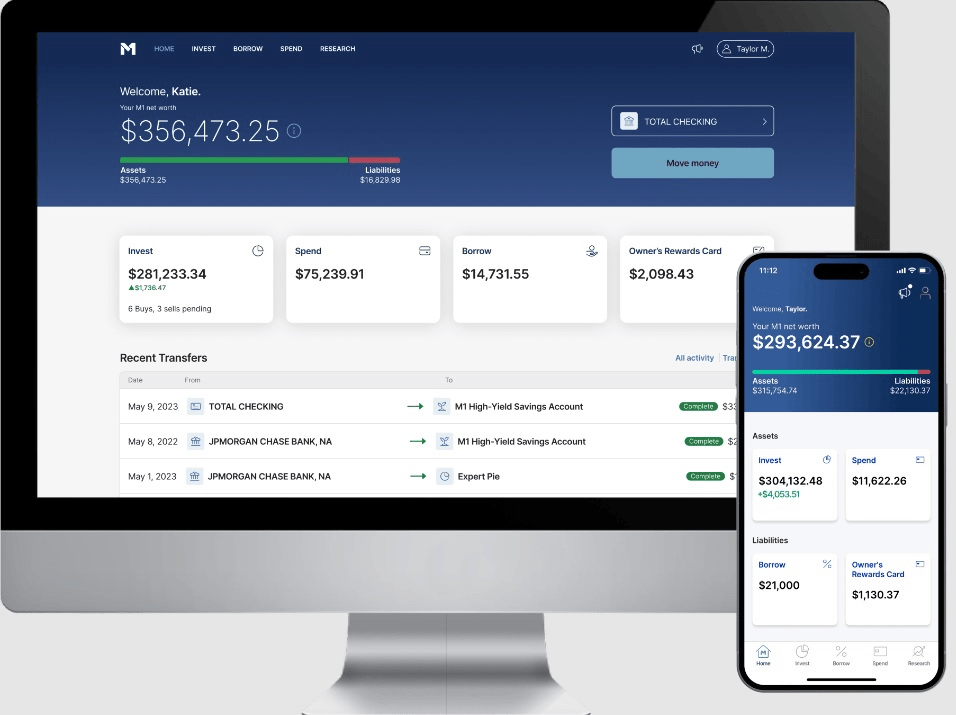

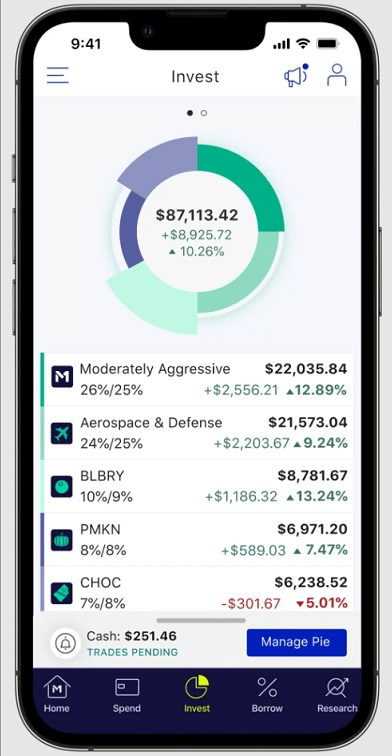

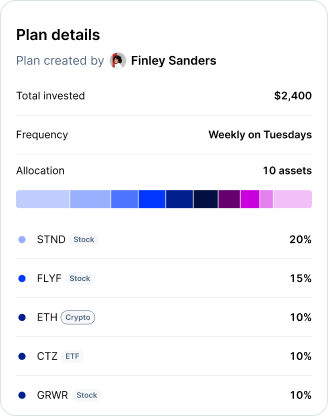

M1 Finance

M1 Finance is an online brokerage and investment platform that allows you to invest in stocks, exchange-traded funds (ETFs), and other securities.

But to help you level up your investing, the platform combines the features of a traditional brokerage account with automated portfolio management through a robo-advisor.

M1 Finance also offers a unique investing approach called “pie investing.”

Pie investing allows you to create a personalized investment portfolio by selecting various slices of the pie (aka different stocks, ETFs, or other investments). M1 offers over 60 of these pre-set pies, but you’re able to customize your own pie as you see fit.

Alongside M1s pie investing, a key feature is its dynamic rebalancing which automatically rebalances your portfolio by buying and selling securities to maintain your pie slice ratios. This ensures that your portfolio doesn’t become heavily skewed in one direction.

Additionally, investing on M1 is commission-free. However, the minimum account balance is $100 for standard accounts and $500 for retirement accounts.

And like Schwab, M1 also offers fractional share investing as well as a range of other tools and services, including:

- Tax-efficient investing.

- Retirement accounts (such as IRAs).

- High-yield checking and savings accounts.

- A free robo advisor.

- Lending services.

They also don’t participate in payment for order flow, ensuring you get the best prices on your investments.

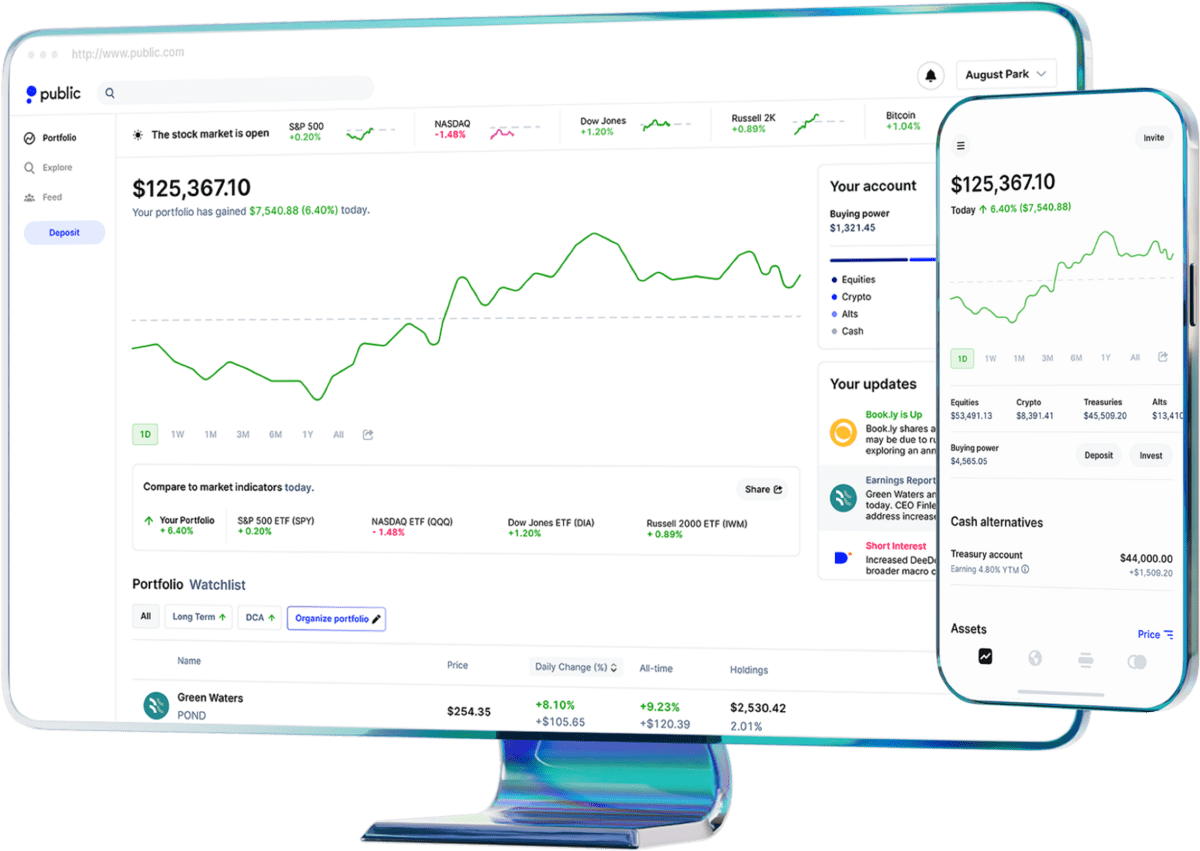

Public

Public also stands out for its comprehensive features and user-friendly experience.

The platform offers SIPC and FDIC insurance for securities and cash held on the platform, ensuring the safety of your assets. The platform also uses bank-grade encryption to safeguard your personal information.

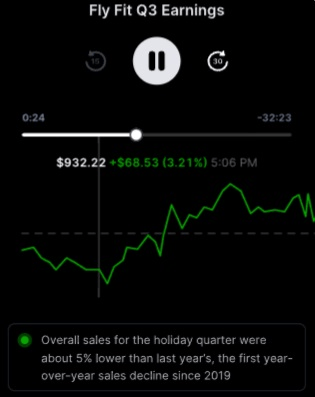

Public embraces social investing elements, enabling you to use insights from millions of investors and analysts. Through the platform, you can listen to experts, analysts, and journalists discussing the day’s biggest market headlines, allowing you to tap into the “wisdom of the crowds”.

Like M1, Public doesn’t participate in payment for order flow nor do they charge account maintenance or inactivity fees for accounts with more than $20 deposited.

When it comes to investing, Public offers a powerful suite of investing tools including:

- Personalized automatic reinvestments.

- Built-in price alerts.

- Extended-hours trading.

Additionally, the platform delivers advanced data and company-specific analysis which you can use to deepen your understanding of market trends.

Public also taps into the power of AI with its investing co-pilot called Alpha.

You can ask Alpha different questions to help you screen the markets for the day’s biggest movers, gainers, losers, and more.

It can also provide you with a wealth of information, including:

- Quote data.

- Company financials.

- Fundamental analysis.

- Analyst recommendations and outlooks.

- News and commentary.

You can also find comprehensive stock pages on Public which house helpful information about each company’s performance. These pages include key metrics, news, and recent activity from other investors, cutting down the time you need to spend on research and idea generation.

Finally, the platform offers automated investing, allowing you to preset your investment mix, frequency, and amount — similar to M1’s pies.

Are Stock Slices Worth It?

In my opinion stock slices aren’t worth it as they’re just fractional shares that Schwab has rebranded to make them more attractive to investors.

So if you want to invest in fractional shares, I’d recommend choosing one of the platforms I covered above — eToro, M1 Finance, or Public.

Why?

They offer a wider range of investable assets (particularly Public), innovative investment technology, deeper insights, and more user-friendly platforms.

Final Word: Schwab Slices Review

While there’s nothing particularly bad about Schwab Slices, they’re nothing new to the investment world.

For that reason, it’s better to choose a platform that offers fractional investing and better features like the ones above.

That said, if you’re already established on Schwab and are interested in diversifying your portfolio, Schwab Slices may be worth your while.

FAQs:

Are stock slices worth it?

Investing in stock slices can be worth it if you’re looking for a simple way to invest in a diversified portfolio of stocks. However, it's important to consider your investment goals, risk tolerance, and other fractional investing brokers before choosing Schwab.

Does Schwab charge for stock slices?

No, Schwab doesn’t charge commissions when you purchase stock slices.

How does Schwab slices work?

Schwab Slices allow you to purchase fractional shares of top US companies, improving access to expensive stocks and making it easier to diversify your portfolio.

Can I sell Schwab stock slices?

Yes, you can sell Schwab stock slices at any time just like you would with a traditional stock.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.