Finding stocks is important. But once you find a great stock to buy, you face more decisions: How many shares should I buy? How many stocks should I own?

There’s no single right answer to these questions. Ultimately, it depends on your individual goals. However, there are strategies that can help you decide the right allocation for your portfolio — and that can help you avoid unnecessary risk.

In this article, I’ll break down some key components of portfolio construction to help you figure out how many stocks you should own along with how many shares you should buy in your chosen stocks.

Let’s talk shares.

If you want to buy shares of any stock, you need a broker. One of our top picks? eToro.

eToro is an extremely user-friendly platform that is accessible for beginners but loaded with enough sophisticated tools to make it appealing for veteran traders, including:

- A variety of commission-free assets including stocks, ETFs, and options.

- A CopyTrader tool that lets you follow the trades of top-rated professionals.

- Plus, tools like paper trading and stock screening.

See for yourself why more than 30 million people have signed up for eToro — click the button below to get started.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

How Many Shares Should I Buy?

The bottom line: The amount of shares you should buy depends on your personal situation. You need to consider things like:

- The level of risk you’re comfortable with

- Your investing time horizon

- How your purchase fits within your portfolio

If you don’t know how to figure these out, don’t worry! In this article, I’ll show you how to answer these questions and more.

How Many Shares Should You Buy of a Given Stock?

How many shares you should buy of any given stock shouldn’t just come down to the amount of capital you have to spare. You also need to ensure that the purchase fits within your current portfolio – a phenomenon known as position sizing.

Figuring out your ideal position sizing is an individual process based on your comfort with risk, investing timeline, and overall market outlook.

But the general guideline is that no single stock should be able to decimate your portfolio. That means you shouldn’t invest all your funds into a single stock – even an allocation of 20% is extremely aggressive.

So, how many shares should you buy of a given stock?

Simply figure out how much money you’re willing to invest, and then divide that by the price of the stock.

For example, if you want to invest $1,000 in Meta (NASDAQ: META), you have to divide that total by $294 (the current price of the stock), allowing you to buy 3 shares of the stock (3.4 if you have access to fractionalized shares).

What are fractional shares? A method of investing without buying complete shares — instead of a full-priced share of a high-priced stock, you can buy a fraction of a share. It gives you access to stocks you might not otherwise be able to buy, and it allows for easier diversification.

eToro offers access to fractional stock and ETF trading with 0% commissions. You can buy fractional shares of any of the stocks or ETFs on the platform.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Another thing to consider? The fees you pay on your stock purchases.

If the platform you use has a flat rate per transaction, you want to make sure that the fee isn’t a large percentage of your purchase.

If it is, you might want to postpone the purchase until you have enough funds to minimize the fee’s impact on your returns. (Another point for eToro: zero-commission trades on a variety of different assets.)

Now that we’ve answered “How many shares should I buy?”, the next step to optimize your portfolio is considering overall industry and sector risk.

How Much of Your Portfolio Should Be in One Stock?

Answering this question is all about figuring out your ideal portfolio diversification strategy.

Diversification

The more diversified you are, the less individual stock movements will affect your portfolio while a less diversified approach subjects your portfolio to more volatility – to both the upside and downside.

While I briefly touched on this topic above, most experts agree that you should invest between 2% to 10% of your portfolio to reduce unsystematic risk (risk from an individual company or industry).

However, you should also consider the makeup of your current portfolio.

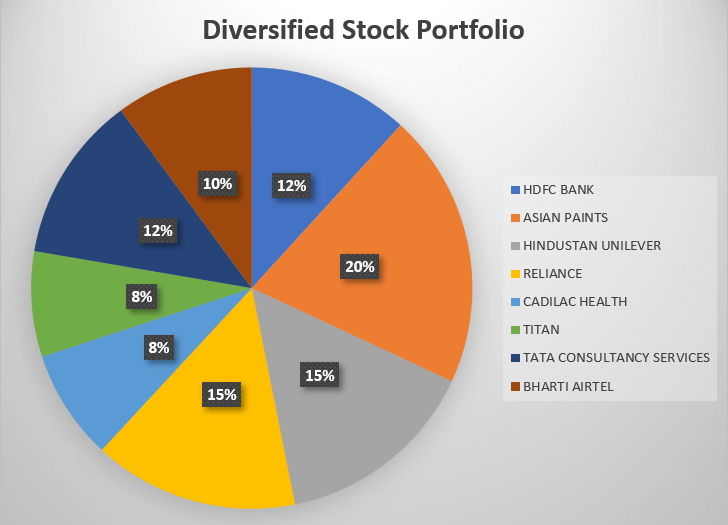

As you can see in the above image (source), a diversified portfolio includes a balance of different assets.

If you already have a few tech stocks in your portfolio with allocations of 5% each, it doesn’t make sense to add another because you’re reducing the benefit of diversification.

While these stocks will move differently, in times of stress you’ll find the sector moves together, which can result in significant drawdowns – something true diversification can reduce.

The specific percentages you choose are completely up to you and will be based on your confidence in the company and the overall stock market.

Naturally, portfolio allocations of 10% represent extremely confident investments where the stock passes your due diligence with flying colors. But if you’re investing this amount, you’ll likely only be able to hold a single stock from that sector.

On the other hand, allocations of 2% may be for risky small-cap stocks or may reflect defensive positioning in an uncertain market. Smaller allocations are also a great way to get exposure to multiple stocks within the same industry or sector without over-concentrating your portfolio.

Time Horizon

Another factor to consider is your investing time horizon.

The more time you have, the more room you can give your stock picks to reach their full potential. That means you can be more aggressive with your portfolio allocations without fear of significant downswings.

For example, if you have a 20-year investing horizon and absolutely believe tech stocks have tons of room to grow, you could break the 10% rule as long as you’re willing to sit through years of market volatility.

The importance of tracking…

Whatever your ideal percentages, it’s always a good idea to use a portfolio tracking tool that breaks down your current holdings by their total portfolio value.

That way, you’ll always know how much you’re able to invest whenever you’re buying new stocks.

If you don’t use one yet, Empower’s portfolio tracker may be a good fit. It’s part of Empower’s impressive FREE dashboard full of tools, which (in addition to the aforementioned portfolio tracker) include a retirement calculator, net worth calculator, and more.

How Many Individual Stocks Should I Own?

There’s no simple answer to “how many stocks should you own” – some experts suggest 30 as a minimum while others believe you need over 1,000 to achieve true global diversification!

At the end of the day, it’s up to you to decide based on your perceived benefits and drawbacks of diversification.

For example, the more concentrated your portfolio is (think 5 – 10 stocks) the more impact these stocks will have on your returns. If you choose right, you’ll enjoy greater returns over someone that owns 20 – 30 stocks. But if you choose wrong, chances are you’ll underperform a more diversified investor.

Simply put, the more stocks you own in different sectors and industries, the more your return will mirror the overall market. And the fewer, more concentrated bets you make, the more different your return profile from the market.

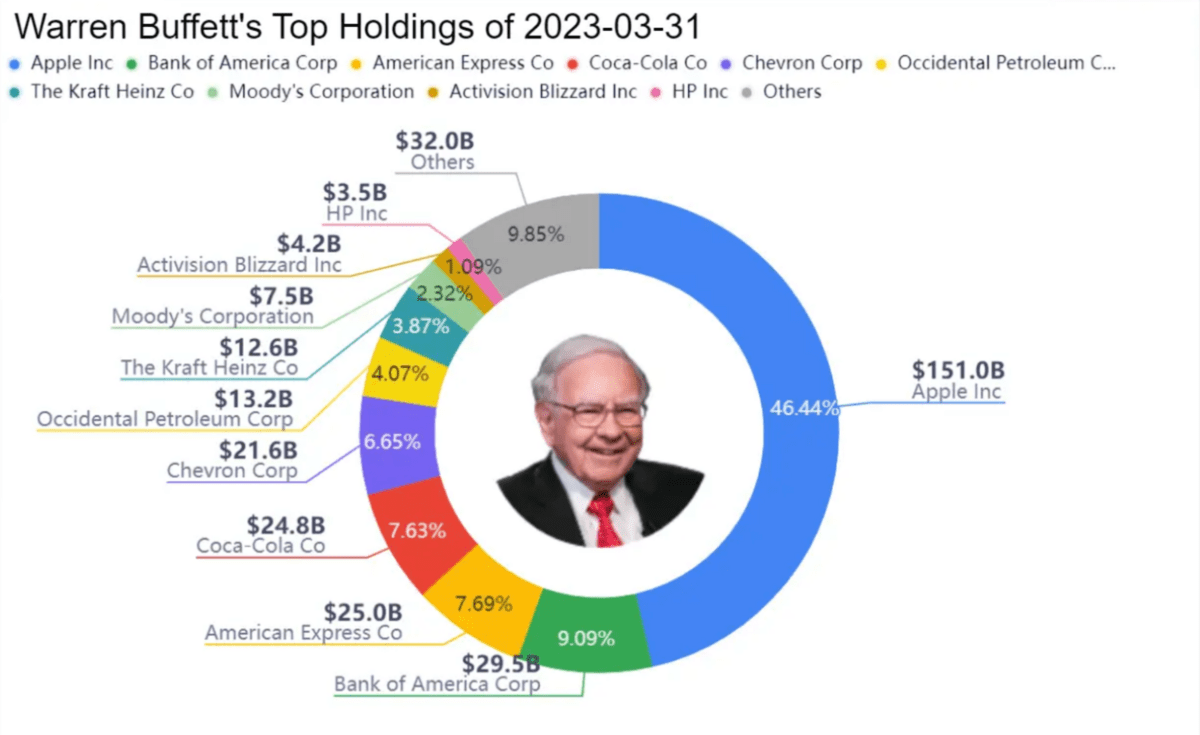

In the below chart (image source), you can take a look at Berkshire Hathaway’s current portfolio and see how many stocks one of the world’s greatest investors owns.

Besides stock holdings of over $300 billion, Berkshire also held $127 billion in cash and cash equivalents as well as owning other assets (inventory, property, equipment) worth roughly $545 billion.

So, even though the portfolio consists of 46% of Apple (NASDAQ: AAPL) stock, it actually works out to 15% of total assets which is much more reasonable.

Additionally, Berkshire holds a total of 48 stocks which sees them meet the typical diversification benchmark of 30 stocks.

But one thing to note is that Buffet isn’t concerned with maximizing his diversification because he believes in his stock picking skills – and that’s what’s helped him generate outsized returns versus the S&P 500.

Finding great stocks is the first step…

The topic of how many shares to buy only really matters after you find a stock to invest in. Need some ideas?

WallStreetZen is the first stock research platform that doesn’t just show you data — it helps you interpret it by distilling due diligence checks used by professional investors into simple one-line explanations so you can understand a stock’s fundamentals within minutes.

We’ve also developed WallStreetZen Daily, a newsletter that connects the dots between real-world events and the markets with data-driven updates and stock recommendations from top-rated analysts.

Check out WallStreetZen here, and click below to subscribe to our newsletter.

How Many Stocks is Too Many?

Again, answering “how many stocks is too many?” is a personal endeavor as your risk profile and goals will be different to most investors.

For example, if your goal is to outperform the market, you can’t expect to do it by buying 1,000 stocks as you’re pretty much buying the whole market!

However, if your goals are to simply keep pace with the market while minimizing your drawdowns you absolutely can do it by owning hundreds or even thousands of different stocks.

But the problem then is administration and trading costs.

Firstly, keeping track of even hundreds of stocks can be a headache – especially when it comes time to rebalance your portfolio. You’ll likely have to conduct hundreds of trades along with researching which stocks to add or remove from your portfolio.

And with purchases and sales comes trading fees and commissions which can put a significant dent in your returns.

So, if you want to outperform the S&P 500, take a leaf out of Warren Buffett’s book and stick to roughly 50 stocks.

But if you’re happy to earn a steady return that mimics the overall market, ETFs and index funds might be just what you need to reduce the headaches of a significantly diversified portfolio.

Diversification with ETFs

To achieve true diversification, you have to think about more than just the number of stocks in your portfolio.

You need to invest across different types of stocks such as large-cap, small-cap, growth, and income stocks. It’s also important to spread your portfolio across different sectors, industries, and even countries.

But to truly bulletproof your portfolio and smooth your returns, you should also consider different asset classes like bonds and commodities.

Now, doing all this research and managing your portfolio at this level is extremely time-consuming – and that’s why there are exchange-traded funds (ETFs).

ETFs, index, and mutual funds enable you to easily diversify your portfolio across hundreds of stocks and other assets with a few simple clicks.

So, instead of attempting to figure out which stocks in the S&P 500 will outperform, you can simply buy Vanguard’s $VOO which would give you exposure to all 500 companies.

Besides that, ETF investing is the most cost-efficient way to diversify your portfolio since you’re completing fewer transactions – just imagine the fees you’d pay if you purchased every single S&P 500 stock separately!

If you’re new to ETFs, check out eToro. It offers a range of ETFs across different industries, asset classes, and stock types.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Diversify beyond stocks and ETFs…

To further diversify your portfolio, consider investing in assets that are not strongly correlated to the stock market.

There are plenty of alternative assets out there, from real estate to fine art and beyond. Want to learn more? Check out our article on the best alternative investments.

Always Keep an Emergency Fund

While investing in stocks is a key part of growing your wealth, it’s vital that you have an emergency fund so that you don’t have to dip into your portfolio.

As a general rule, you should have enough cash to cover at least six months of your living costs, ie. rent, food, utilities, etc. So, if for some reason you were laid off, you still have plenty of runway to figure out your next steps.

Besides that, most investors keep at least part of their portfolio in cash (anywhere from 20% to 30%) to take advantage of good buying opportunities, such as recessions.

The good news is that you don’t need to keep these funds completely sidelined.

There are various savings accounts that pay higher interest rates than banks while still giving you access to your funds at all times!

One example is M1 Finance, which provides one of the highest APYs around for their high-yield cash account — 4.25%, but using this link you can get a boost of 0.50% for a limited time, bringing you up to 4.75%. This makes it an excellent choice for both your emergency fund and the cash portion of your portfolio.

Final Word:

Ultimately, the number of shares you should buy and own for your portfolio depends on highly individual factors like your account size, investing objectives, risk tolerance, and time horizon.

In this article, I’ve introduced you to some best practices for investment diversification. Armed with this information, you’ve got what you need to proceed in your investment career with a balanced and diversified portfolio.

FAQs:

What is a good number of shares to buy?

The number of shares you should buy depends on the price of the stock and how much money you are willing to invest.

For example, if a stock is worth $10 and you have a $10,000 portfolio, a good number of shares would be between 20 to 100 depending on your risk tolerance. If you were to go below this number, the stock likely won’t increase your returns while buying more than 100 shares may subject your portfolio to too much unsystematic risk.

What is a decent number of shares?

For some investors, a few hundred shares of a lower-priced stock may be considered decent. But for others, a few shares of a higher-priced stock might be sufficient.

Instead, you should focus on the total amount of money you are willing to risk and divide that by the price of the stock which will give you the ideal number of shares.

Is buying 1 share of Amazon worth it?

Yes, buying 1 share of Amazon could be worthwhile. Consider this: the IPO price in 1997 was $18 per share. Today, the stock trades in the $130 range.

While past performance doesn’t guarantee future returns, this illustrates that a single-share purchase of Amazon does have the potential to appreciate in value.

How many shares do I need to buy to average down?

The number of shares you need to buy to average down depends on your initial investment, the current share price, and how much you want to reduce the average cost.

To average down, you would buy additional shares at the lower price, and the more shares you buy, the more you’ll reduce your average cost per share.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.