There are 3 criteria that are crucial for the best options trading brokers:

- Low fees (and spreads!)

- Fast executions

- Ease-of-use

If you’re using a broker without these 3, you’re immediately placing yourself behind the 8 ball. And in one of the most (if not the most) competitive industries in the world, you can’t afford to put yourself at a disadvantage.

Based on the criteria above and several other factors, here is my list of the 6 best options trading platforms, brokers, and apps in 2026:

Our favorite options alert service…

A great alert system can help give you an all-important edge in the market.

Our favorite service? Stock Market Guides.

Stock Market Guides helps you identify opportunities that have a historical track record of profitability in backtests. For every trade setup, they show you that exact setup has performed historically. Does it work? Well, consider the service’s track record: As of January 2025, Stock Market Guides’ options alert service has delivered an average annualized return of 150.4%.

The Best Options Trading Platforms

- eToro – Where Social Meets Strategy

- moomoo – The Best Option Trading Platform for Tech-Savvy Traders

- TradeStation – The Best Options Trading Platform for Advanced Traders

- Interactive Brokers – The Best Broker for Pros and Global Traders

- Webull – The Best Mobile Experience for Options Trading

- Robinhood – The Best Options Trading Platform for Beginners

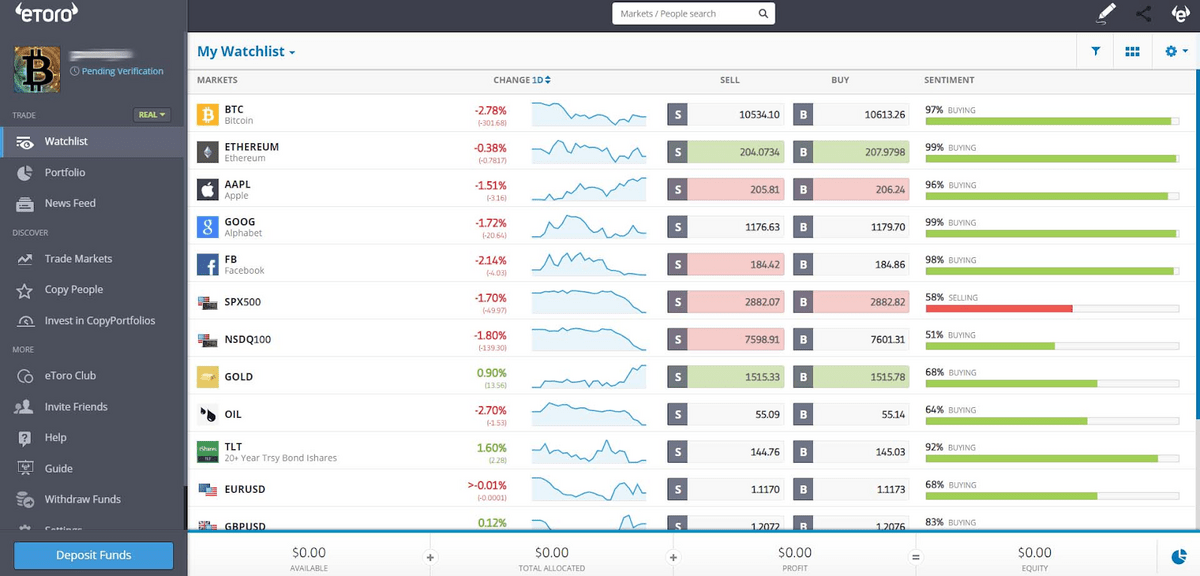

1. eToro – The Best Option Trading Platform for U.S. Investors

Overall rating: ⭐️⭐️⭐️⭐️⭐️

- Options commissions/fees: $0 per contract

- Account minimum: $100 for UK and US users

eToro offers thousands of stocks and ETFs for options trading, a user-friendly platform, and commission-free trading for stocks, ETFs, and options.

But the platform really differentiates itself from other brokerages with its social trading feature — CopyTrader. This allows users to follow and even manage their portfolios by copying the trades of more experienced traders.

These traders will have a profile with a rating, performance history, risk profile, and other statistics. Users can allocate a portion of their funds to mimic their trades, and these transactions automatically take place in their portfolio, proportional to the designated amount. In essence, it gives access and exposure to professional traders and allows users to benefit from their experience.

In addition to CopyTrader, eToro also has a user-friendly interface that simplifies options trading, making it accessible to less sophisticated investors. However, its offerings may be lacking for more experienced traders who are pursuing sophisticated strategies. One limitation is fewer types of available contracts and tools for analysis.

Overall, eToro is an excellent choice for beginner and intermediate options traders. However, it lacks advanced tools and an extensive selection of instruments and strategies that seasoned traders often demand. Its social trading features are a unique draw, but the higher fees and limited research resources may make it less appealing for active traders seeking a more comprehensive platform.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

2. moomoo – The Best Options Trading Platform for Growing Traders

Overall rating: ⭐️⭐️⭐️⭐️⭐️

- Options commissions/fees: $0 contract fees for stock and ETF options trading

- FREE real-time options data

- Account minimum: $0

Moomoo offers powerful tools and features for active and experienced traders in addition to competitive pricing and an intuitive design.

A favorite among users is its customizable options chain interface, allowing traders to easily navigate calls and puts, select expirations, and monitor key data like implied volatility and open interest.

Traders can personalize their workspace by adjusting layouts, customizing data columns, and filtering options based on chosen factors. This flexibility empowers both novice and experienced traders to tailor the platform to their specific needs and trading styles.

Moomoo’s pricing structure is also a significant draw for options traders. Commission-free equity options trades and a $0 per-contract fee significantly reduce trading costs, maximizing potential profits. Index options carry a $0.50 per-contract fee which is competitive within the industry.

This cost-effective approach, coupled with the platform’s features, makes Moomoo an attractive option for traders looking to minimize expenses and maximize returns.

Recognizing the varying levels of experience among traders, Moomoo offers valuable educational resources. A comprehensive “Learn” section provides articles and tutorials on various options strategies, empowering newcomers to gain knowledge and confidence.

The paper trading feature allows users to practice and refine their strategies without risking real capital, providing a safe and effective learning environment.

While the abundance of features is a strong selling point for advanced traders, it may be overwhelming to more inexperienced traders as noted in this moomoo review. Another drawback is that the platform currently only offers access to US, Hong Kong, and Chinese markets. It also lacks support for more complex, multi-layered strategies compared to other brokerages.

Additionally, while it’s not options-specific, it’s worth noting that moomoo has one of the most spectacular intro specials around:

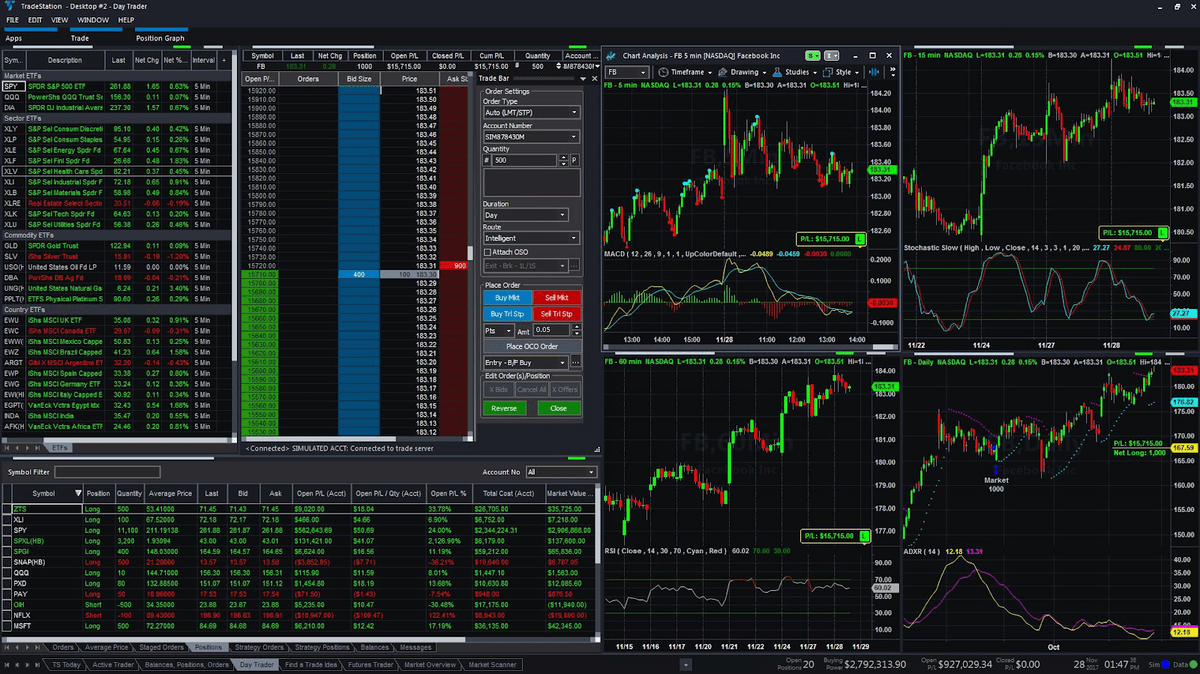

3. TradeStation – The Best Options Trading Platform for Advanced Traders

Overall rating: ⭐️⭐️⭐️⭐️⭐️

- Options commissions/fees: $0.60 per contract

- Account minimum: $0

TradeStation offers institutional-level tools tailored for active traders.

The company is known for its native scripting language, EasyLanguage, and the ability to automate complex strategies. The flagship desktop platform delivers unmatched customization, boasting over 180 technical and fundamental indicators for deep analysis.

OptionsStation Pro is quite powerful and appreciated by advanced traders. It enables traders to evaluate positions, visualize profit/loss scenarios, backtest trade concepts, and execute complex multi-leg options trades efficiently. Pricing is competitive, with $0 commissions on stock and ETF trades and a $0.60 per-contract fee for options, appealing to cost-conscious traders.

TradeStation’s educational resources and community further enhance its value. Comprehensive video tutorials, webinars, and options-focused masterclasses equip traders of all levels to sharpen their skills. Paired with robust analytical tools, these offerings empower users to build and refine strategies with confidence. The platform’s active trader community fosters collaboration, adding a layer of support. For those who thrive on technical precision and learning, TradeStation is a compelling choice.

That said, TradeStation has its drawbacks. The platform’s complexity can overwhelm less experienced traders due to a steeper learning curve. Compared to other platforms, there is also less access to fundamental research.

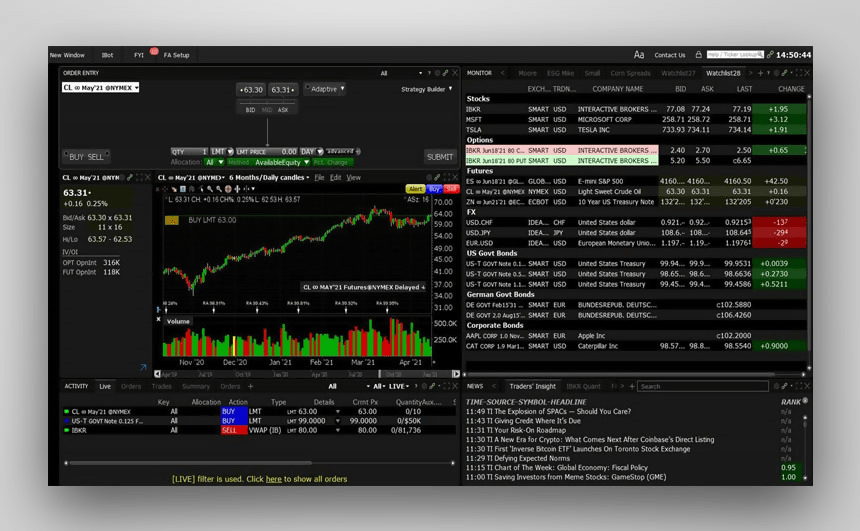

4. Interactive Brokers – The Best Broker for Advanced Options Traders

Overall rating: ⭐️⭐️⭐️⭐️⭐️

- Options commissions/fees: $0.25 – $0.65 per contract

- Account minimum: $0

Interactive Brokers provides a comprehensive set of tools and features for options trading. The platform is aimed at advanced traders who need depth and precision.

Fees are quite lean: $0 base, $0.65 per contract for stock/ETF options on IBKR Lite, dropping as low as $0.15 for high volume on IBKR Pro. Index options range from $0.25 to $0.85 based on scale. These lower fees can be particularly impactful for those trading with larger size or more frequently.

Many traders choose Interactive Brokers because of its global reach and powerful platform. Users can trade options in more than 30 global markets, spanning North America, Europe, and Asia.

For more advanced traders, IBKR offers Trader Workstation, unlocking 100+ order types, real-time Greeks, and single-screen chain management. The platform’s API and EasyLanguage-like coding can be used to automate complex strategies such as multi-leg spreads triggered by volatility spikes. Many professional, independent traders also choose IBKR due to advanced features such as the Probability and Volatility Lab.

Some of Interactive Brokers’ drawbacks are limited access to fundamental research and an intimidating user experience for newer traders.

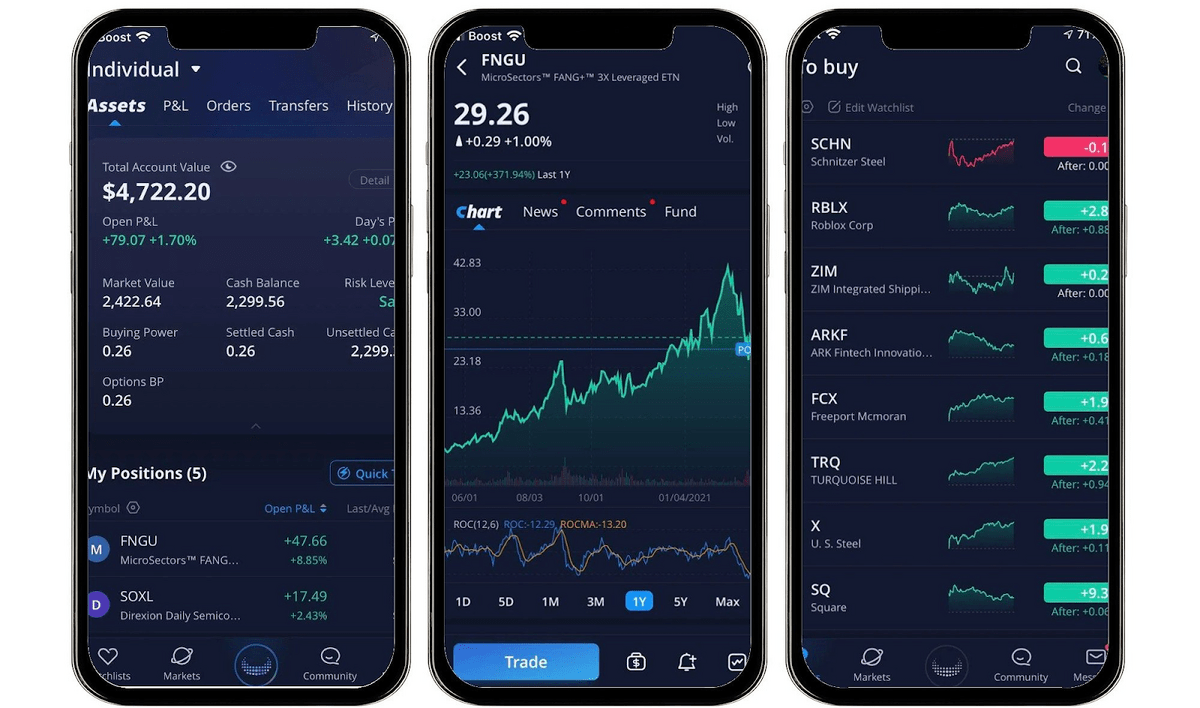

5. Webull – The Best App for Options Trading

Overall rating: ⭐️⭐️⭐️⭐️

- Options commissions/fees: $0 per contract

- Account minimum: $0

Webull, launched in 2017, has quickly established itself as a competitive player in options trading. Its appeal lies in its combination of low costs and robust tools, without unnecessary frills. The platform offers zero commissions and no per-contract fees on stock and ETF options, making it a cost-effective choice for traders.

However, index options carry a $0.55 fee per contract, and orders over 500 contracts incur an additional $0.10 fee. Webull’s advanced charting capabilities include over 50 technical indicators and support for multi-leg strategies like iron condors and straddles, making it suitable for both novice and experienced traders.

Webull’s mobile app is particularly strong, providing a comprehensive trading experience on-the-go. It features voice command trading, robust charting with 63 on-chart signals and 50+ indicators, and a price ladder for direct order placement from the order book. The app also syncs watchlists across devices and offers Level 1 and Level 2 market data with a subscription.

Despite its strengths, Webull has some limitations. It uses payment for order flow, which may slightly impact execution prices. Additionally, the platform lacks extensive educational resources for options beginners and does not offer mutual funds or forex trading, potentially limiting portfolio diversification options.

Webull’s focus on providing a streamlined, tech-driven experience for self-directed traders makes it a compelling choice for those who prioritize efficiency and mobile functionality. Its no-frills, cost-effective approach, combined with powerful mobile capabilities, positions it as a strong contender in the options trading space.

Plus, you can get free shares for signing up with any of our links.

6. Robinhood – The Best Options Trading Platform for Beginners

Overall rating: ⭐️⭐️⭐️⭐️

- Options commissions/fees: $0 per contract

- Account minimum: $0

Robinhood is one of the simplest ways to trade stocks, ETFs, crypto, and/or options in 2026.

Robinhood, launched in 2013, is the original fintech originator in introducing an engaging and user-friendly options trading experience on mobile devices. However, the company is now looking to expand by appealing to more sophisticated traders with the launch of Robinhood Legend, a desktop trading platform which addresses many limitations for its mobile app and includes more advanced charting capabilities.

Robinhood’s options trading interface is noted for its simplicity and user-friendly design, especially on mobile. It offers a streamlined process for placing options trades, with easy-to-navigate expiration dates and strike prices. However, this simplicity can be a double-edged sword; while it makes options trading more accessible to beginners, it may obscure some of the complexities and risks inherent in options strategies.

The platform supports basic options strategies like calls and puts, as well as more advanced multi-leg strategies such as iron condors and straddles. Robinhood’s commission-free model extends to options trading, with no per-contract fees on stock and ETF options, making it an attractive choice for cost-conscious traders. However, index options do carry a $0.50 per contract fee for non-Gold members ($0.35 for Gold), which is still competitive in the industry.

One drawback, relative to other platforms, is the lack of a paper trading feature, which is particularly valuable for options traders looking to practice strategies without risking real capital. Additionally, while Robinhood has improved its educational resources, they still lag behind some competitors in depth and breadth, potentially leaving newer traders at a disadvantage.

Robinhood’s options platform shines in its mobile execution, real-time data, and cost structure. However, it may not satisfy the needs of highly advanced traders who require more complex analysis tools or extensive research capabilities. For the average retail investor or those new to options trading, Robinhood offers a compelling, low-cost entry point into the world of options, backed by an increasingly robust set of tools.

Plus, get a free share when signing up with any of the links in our article.

Final Word: The Best Options Trading Platform

All of the aforementioned brokerages are top-class, but some are more oriented toward beginners, like Robinhood and Webull. If you’re looking for commission free option trading, these 2 are your best bet.

Intermediate traders may prefer a platform like moomoo which also offers commission-free trading along with access to some global markets and more sophisticated tools.

More established in your options trading career? A platform like TradeStation may be more appropriate for active options traders to execute options trades.

FAQs:

Which platform is best for options trading?

While the landscape of options trading platforms is ever-evolving, each platform offers a unique blend of power and finesse, much like a warrior choosing their weapons for battle.

For example, Thinkorswim, with its rich tapestry of analytical tools and research capabilities, empowers traders to see the market through multiple lenses. TradeStation, akin to a finely-tuned instrument, provides a robust and feature-rich environment for those who demand precision in their craft. Interactive Brokers, meanwhile, opens doors to global markets with the efficiency of a seasoned diplomat, all while keeping costs remarkably low.

Therefore, it’s best for traders to compare offerings and check out various platforms to determine the best fit. The choice between them often comes down to the trader's personal style and goals.

Can you get rich from options trading?

Even the most optimistic studies say that about 30% of options traders generally make a profit, while 70% either break even or lose. As such, making immense returns is possible, but traders should be mindful of the risk they are taking on.

Which option trading is best for beginners?

The covered call is a strategy often recommended to beginners because it balances risk and reward. With limited loss and the potential for modest gains, new traders don’t stand to lose much even if their bet fails.

What is the most profitable options trade?

Some of the most statistically probable trading strategies include using covered calls and implementing protective puts. These strategies can help traders take advantage of volatility and manage risk within their portfolios.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.