What’s the Best Nancy Pelosi Stock Tracker in 2025?

CapitolTrades.com takes the crown for the best Nancy Pelosi stock tracker in 2026.

It’s completely free, requires no registration, and provides comprehensive trading data with clean visualizations. The platform has earned credibility through features in major media outlets and offers the most accessible entry point for tracking congressional trades.

Honorable Mention

If you’re looking for automated trading, Dub App offers the slickest mobile Nancy Pelosi stock tracker app experience, though it comes with notable limitations around data delays.

For serious data nerds who want every possible metric, Quiver Quantitative dominates the advanced analytics space with institutional-grade research tools.

Here’s my complete ranking of the six best platforms, each excelling in different areas.

Want Solid Stock Picks?

Good news: Following Nancy Pelosi isn’t the only option. Zen Investor saves you time by letting a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Each selection undergoes a careful review of 115 factors proven to drive growth in stocks, including proprietary AI algorithms, using our Zen Ratings system

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary

1. CapitolTrades.com – Best Free Nancy Pelosi Stock Tracker

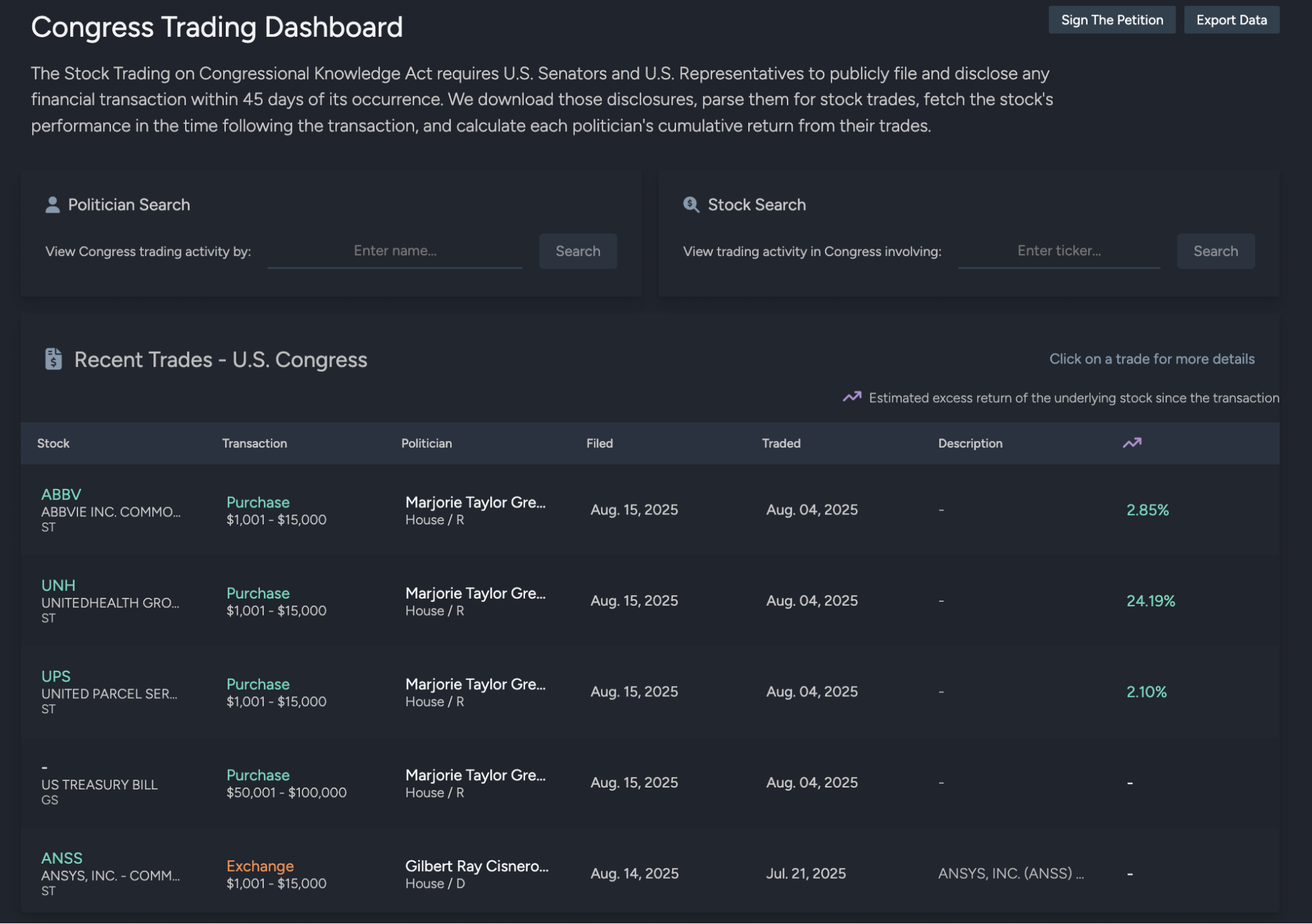

How it works: CapitolTrades.com pulls data straight from mandatory congressional disclosure filings and presents it in a clean, accessible format.

You get Nancy Pelosi’s complete trading history, performance charts comparing her returns to market indices, and detailed trade information without any barriers. The platform processes thousands of congressional trades and makes them searchable and sortable for easy analysis.

Performance: Nancy Pelosi’s profile shows 47 trades across 23 issuers with a total volume of $62.98 million. (At writing, her last recorded trade occurred on June 20, 2025.)

The platform reveals clear outperformance versus the S&P 500 across multiple periods, with detailed charts showing the magnitude of her market-beating returns. Filing delays typically range from 3-29 days after actual trade execution, giving you transparency into the reporting timeline.

Key features:

- Zero cost for comprehensive trade data

- Performance charts and sector breakdowns showing Information Technology as her dominant sector

- Filing delay tracking so you know how fresh the data is

- Mobile-responsive design that works perfectly on smartphones

- Weekly newsletter with exclusive insights and market analysis

- Search functionality to quickly find specific politicians or stocks

- Related news articles connected to major trades

Limitations: This Nancy Pelosi stock tracker free option lacks advanced analytics and copy trading features found in premium platforms. There’s no dedicated mobile app, though the website works well on mobile browsers.

You won’t get real-time alerts or notifications when new trades are filed. The data comes delayed by congressional filing requirements, and there are no automated portfolio management or backtesting capabilities.

Cost: Completely free with no registration required, no premium tiers, and no hidden fees. The platform generates revenue through its newsletter and partnerships, allowing it to provide core tracking features at no cost.

2. Dub App – Best Nancy Pelosi Stock Tracker App

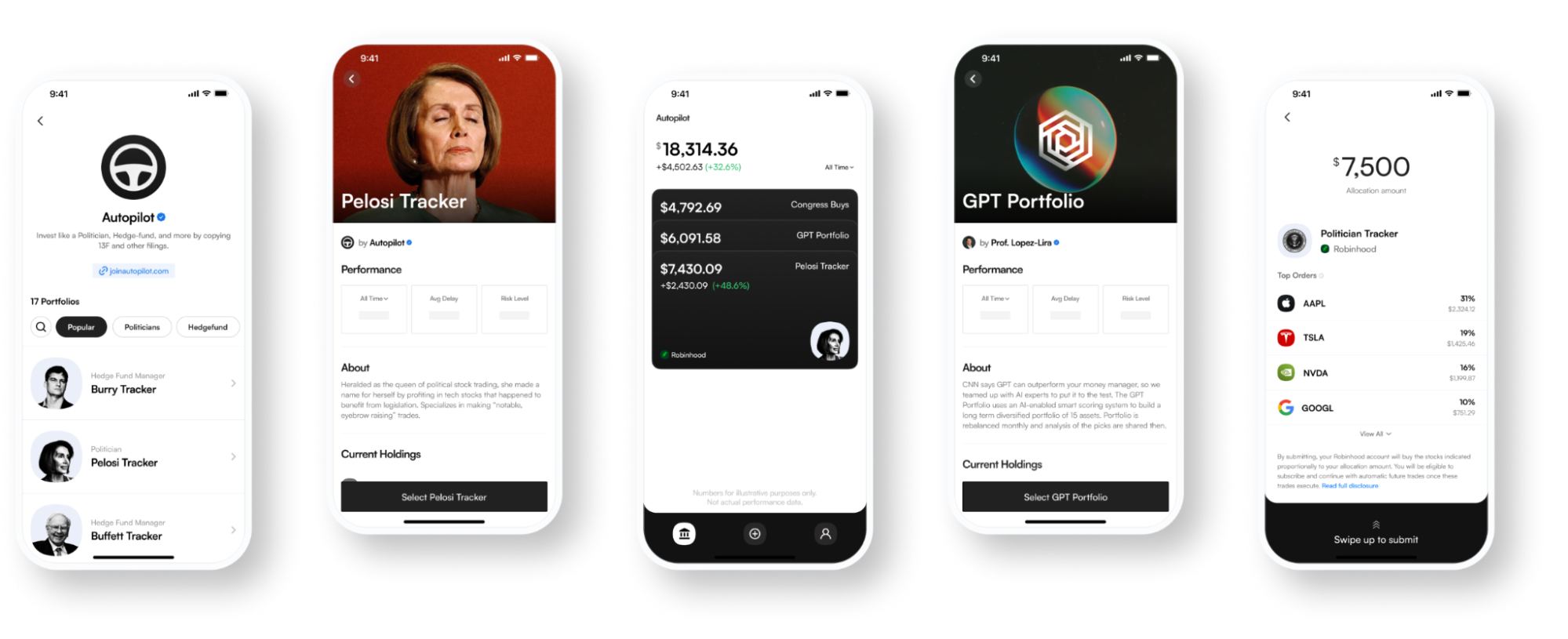

How it works: Dub App calls itself “Instagram for investing,” and that comparison hits the mark. Instead of following celebrities, you follow successful investors and automatically copy their trades.

Related Reading: Dub App Review: Is the “Instagram For Investing” App Legit?

The platform monitors Nancy Pelosi’s moves through public disclosures and copies them instantly into your account using fractional shares to mirror percentage-based investments. The app’s clean interface makes it easy to browse different investors and see their recent activity.

Performance: Dub App has processed over $2 billion in trades for more than 100,000 investors since launching in 2023. The platform has facilitated substantial trading volume, though there’s a significant caveat.

It relies on 13F filings and congressional disclosures that can be up to three months old. This means you might copy trades long after the smart money has moved on, potentially impacting your returns compared to the original timing.

Key features:

- Real-time copy trading of politicians, hedge funds, and top traders

- Clean, mobile-first interface designed for smartphone use

- Fractional shares support so you can mirror percentage allocations

- SIPC insurance up to $500,000, providing regulatory protection

- Social features where investors share commentary explaining their moves

- Integration with DASTA Financial (registered broker-dealer) and DASTA Investments (SEC-registered investment advisor)

- Zero trading commissions on stock and ETF purchases

Limitations: The biggest problem is delayed data from congressional filings, which can be up to three months old for some trades. You’re limited to U.S. stocks and ETFs only, which means there is no exposure to options, crypto, international stocks, or bonds. So you can’t copy truly diversified portfolios.

The $100 minimum deposit requirement, combined with annual subscription fees, can eat into returns for smaller accounts. The platform also lacks the analytical depth found in more specialized congressional tracking tools.

Cost: $89.99 per year or $9.99 per month, with a $100 minimum deposit and zero trading commissions. While there are no hidden fees, the subscription cost can be significant if you don’t have substantial funds invested.

The trouble with DubApp? You need serious money to make it work.

With an annual fee of $89.99 plus a $100 minimum deposit, smaller investors are squeezed. If you’ve got $2,000 in your account, that fee eats nearly 5% of your potential returns before you even start.

That’s why eToro beats Dub for most people. Its CopyTrader feature is Dub’s closest competitor, and there’s no additional fee to use it.

CopyTrader doesn’t focus on Nancy Pelosi, but it does focus on mirroring the trades of experienced investors. Thanks to a longer track record in copy trading and a relatively simple entry to the platform, it’s an excellent alternative.

3. Quiver Quantitative – Best for Advanced Analytics

How it works: Quiver Quantitative serves as the data nerd’s dream platform. Instead of just showing you what Nancy Pelosi bought, it provides deep analytics on timing, performance attribution, and market context.

Related Reading: Quiver Quantitative Review: Is It Worth It For Retail Investors?

The platform aggregates alternative data from congressional filings, social media sentiment, insider trading, and government contracts to paint a complete picture of what drives political trading decisions. Recent updates include improved visualization tools and enhanced backtesting features.

Performance: At writing, the Nancy Pelosi strategy shows a remarkable +744.79% return since May 16, 2014, compared to the market index (SPY) return of +242.16% over the same period.

This performance data gets updated regularly and includes detailed breakdowns of wins, losses, and timing analysis that help you understand not just what she bought, but when and why those trades worked.

The platform’s “Congressional Alpha” metric quantifies exactly how well following specific politicians’ trades would have performed.

Key features:

- Unparalleled depth in congressional trading data with transaction-level details

- “Congressional Alpha” metric showing politician performance against benchmarks

- AI-powered insights through their Smart Score feature

- Comprehensive backtesting capabilities to test historical strategies

- Copy trading functionality added in 2025 updates

- WallStreetBets sentiment tracking and insider activity monitoring

- Government contract data integration for additional context

- Advanced visualization tools and custom dashboard creation

Limitations: The platform’s biggest strength is also its weakness, as there’s almost too much data for casual investors. The interface requires a learning curve to navigate effectively, and it’s designed for active traders who can handle complex analytics.

Beginners might feel overwhelmed by the sheer volume of information and analytical tools available. The platform caters more to quantitative traders than passive investors seeking simple portfolio tracking.

Cost: Free tier with basic access to some datasets. Premium tier costs $30 per month or $300 annually (with a 20% discount for yearly subscriptions). Premium unlocks complete access to all datasets, full features, and advanced analytics. New accounts get a 7-day free trial (30-day trial for yearly plans).

4. Autopilot – Best Nancy Pelosi Husband Stock Tracker

How it works: Autopilot takes a different approach than simple copy trading. Instead of just mirroring Nancy Pelosi’s exact positions, it creates diversified portfolios based on congressional trading patterns.

Related Reading: Autopilot Investment App: Is It Worth It For Automated Investing?

The platform analyzes trades from multiple politicians and builds balanced portfolios that capture the collective wisdom of political insiders while reducing single-stock risk. This approach reduces volatility while maintaining upside potential.

Performance: Autopilot’s Nancy Pelosi-inspired portfolio has delivered solid returns, though the platform doesn’t publish specific performance numbers publicly.

The key advantage lies in diversification. Rather than betting everything on her latest Broadcom purchase, you get exposure to her top picks alongside other high-performing congressional traders. The automated rebalancing helps maintain target allocations as market conditions change.

Key features:

- Automated rebalancing to maintain target portfolio allocations

- Tax-loss harvesting to optimize after-tax returns

- Fractional shares support for precise position sizing

- Custom allocation options to adjust risk levels

- Integration with major brokers, so you don’t need to transfer accounts

- Detailed analytics explaining why each stock was selected

- Portfolio optimization based on modern portfolio theory principles

- Professional-grade risk management tools

Limitations: The diversified approach means you won’t capture the full upside of Nancy Pelosi’s biggest winners. If she hits a home run with a single stock, your returns get diluted across the broader portfolio.

The platform requires a $500 minimum investment, which is higher than some competitors. Automated rebalancing can trigger taxable events in non-retirement accounts, potentially creating unwanted tax consequences for some investors.

Why I call this the best Nancy Pelosi husband stock tracker: A spokesperson for Nancy Pelosi has reiterated that the congresswoman doesn’t own stocks herself. Instead, her husband, Paul Pelosi, conducts all the trades, and she reports them through legally required Periodic Transaction Reports.

Autopilot’s approach mirrors this reality by focusing on the actual trading patterns and portfolio construction rather than individual stock picks.

Cost: Paid Version: $29 quarterly or $100 annually per portfolio.

The Gotcha: Each portfolio requires separate fees. Want Pelosi Tracker plus GPT Portfolio? That’s $200 per year.

5. Unusual Whales – Best Nancy Pelosi Stock Portfolio Tracker + ETF

How it works: Unusual Whales offers the unique combination of individual portfolio tracking and an actual Nancy Pelosi stock tracker ETF (NANC) that you can buy to invest alongside Democratic Congress members automatically.

The platform tracks Nancy Pelosi’s portfolio with weekly updates. It provides both direct tracking tools and the option to invest in their Subversive Unusual Whales Democratic Trading ETF, which is named after Nancy Pelosi.

Performance: Nancy Pelosi’s portfolio on Unusual Whales shows a +28.10% return with detailed performance tracking available to premium members.

According to platform data, the Pelosi portfolio returned an impressive 65% in 2023, substantially outperforming the S&P 500 during the same period. The NANC ETF, which tracks Democratic Congress trades more broadly, has also shown strong performance since its 2023 launch, though it carries higher fees than broad market ETFs.

Key features:

- Comprehensive individual politician portfolio tracking with weekly updates

- NANC ETF option for automated investing in Democratic congressional trades

- Custom alerts and notifications for new trade filings

- Access to special portfolios like Inverse Jim Cramer, Pro Congress, and Short Congress

- Congressional reports with detailed analysis of trading patterns

- API access for developers and institutional users

- Community features for discussing trades and strategies

- Mobile alerts via email and push notifications

Limitations: The platform requires a premium subscription for full access to return data and detailed analytics. The interface can be complex with many features that might overwhelm casual users seeking simple tracking.

The NANC ETF carries a relatively high expense ratio compared to broad market ETFs. The platform’s focus on “unusual” market activity means it caters more to active traders than passive investors.

Cost: The NANC ETF carries a 0.75% annual expense ratio, which is higher than typical index funds but reasonable for a specialized strategy ETF. Premium membership is required for full access to performance data and advanced features.

6. CongressTrading.com – Best Database + Forum

How it works: CongressTrading.com combines comprehensive congressional trading data with an active community forum where investors discuss strategies, share insights, and analyze political trading patterns.

The platform positions itself as a way to “capitalize on Congress’ access to insider information” through both historical data analysis and real-time community discussions about emerging trends and opportunities.

Performance: The platform emphasizes that “Congress outperforms the market” and provides historical tracking of congressional trades to support this claim.

While specific performance metrics for Nancy Pelosi aren’t prominently displayed on the main site, the community forum includes detailed discussions about her recent trades and their outcomes, with members sharing analysis of her timing and stock selection strategies.

Key features:

- Comprehensive database of congressional trades with search functionality

- Active forum community for strategy discussions and trade analysis

- Media credibility through features in major outlets, including CNBC, Wall Street Journal, New York Times, FOX, and CNN

- Email support available for technical questions and platform assistance

- Affordable subscription pricing compared to more advanced platforms

- Historical data going back multiple years for trend analysis

- Regular updates on new congressional trade filings

Limitations: The platform requires a paid subscription for full access, limiting free users to basic information. The community forum, while valuable for insights, can be overwhelming for beginners who just want straightforward tracking.

CongressTrading.com is a smaller platform compared to major competitors, which means fewer resources for advanced features like sophisticated mobile apps or complex analytical tools. The 7-day free trial is also shorter than some alternatives.

Cost: $8.99 per month with a 7-day free trial and the ability to cancel anytime. This makes it one of the more affordable paid options, though still more expensive than completely free alternatives like CapitolTrades.com.

Nancy Pelosi Stock Tracker Comparison Table

Platform | Best For | Cost | Key Features | Limitations |

|---|---|---|---|---|

Automated Copy Trading | $89.99/year or $9.99/month | Real-time copy trading, mobile-first, SIPC insured | 3-month data delay, US stocks only | |

Portfolio Management | $100 per portfolio per year | Diversified portfolios, auto-rebalancing, tax optimization | $500 minimum, diluted returns | |

Advanced Analytics | $25/month or $250/year | Deep analytics, Congressional Alpha, AI insights | Complex interface, learning curve | |

CapitolTrades.com | Free Tracking | Free | No registration, comprehensive data, media trusted | Basic features only, no alerts |

CongressTrading.com | Database + Forum | $8.99/month | Community forum, media credibility, and affordable | Smaller platform, limited features |

Unusual Whales | Portfolio + ETF | $10/month + 0.75% ETF fee | NANC ETF option, weekly updates, comprehensive tracking | Premium required, complex interface |

Why Track Nancy Pelosi’s Trades?

Nancy Pelosi’s trading success isn’t just political theater. Instead, it represents one of the most consistent market-beating strategies available to retail investors.

Her portfolio delivers returns that would make professional hedge fund managers jealous, with gains far exceeding what anyone could accumulate through her $174,000 congressional salary alone.

The trading is reportedly conducted by her husband, Paul Pelosi, a successful businessman with decades of experience in real estate and financial markets.

A Bit More About Paul Pelosi’s Investing

Sorry y’all — ChatGPT wouldn’t help me make a funny image to insert here…

But I digress.

Paul has built a substantial business empire, including real estate investments and consulting work, giving him financial expertise beyond his wife’s political position. However, congressional disclosure rules require Nancy to report all of Paul’s trades, which is why they appear under her name in public filings.

Recent performance has been nothing short of spectacular.

Nancy Pelosi’s 2024 portfolio generated a 54% return, beating nearly every hedge fund and crushing the S&P 500’s 25% gain. This performance included several high-profile trades that generated millions in profits, including strategic positions in NVIDIA, Apple, Microsoft, and emerging companies like Tempus AI.

Recent Paul Pelosi Trades

In early 2025, Paul Pelosi executed $38 million worth of trades around the presidential inauguration, demonstrating continued active management of their substantial portfolio. These trades included strategic positions in technology companies and emerging sectors that have continued to generate sizable returns.

The Nancy Pelosi stock trades tracker data reveals consistent outperformance across market cycles, bull markets, bear markets, and periods of high volatility. Whether it’s superior fundamental analysis, fortunate timing, access to regulatory information, or simply exceptional investment acumen, the results speak for themselves.

What makes this particularly compelling for retail investors is the transparency. Unlike hedge funds that can hide their positions for months, congressional disclosure requirements mean you can see exactly what trades are being made, when they’re executed, and how they perform over time.

This level of visibility into a consistently successful investment strategy is unprecedented in financial markets.

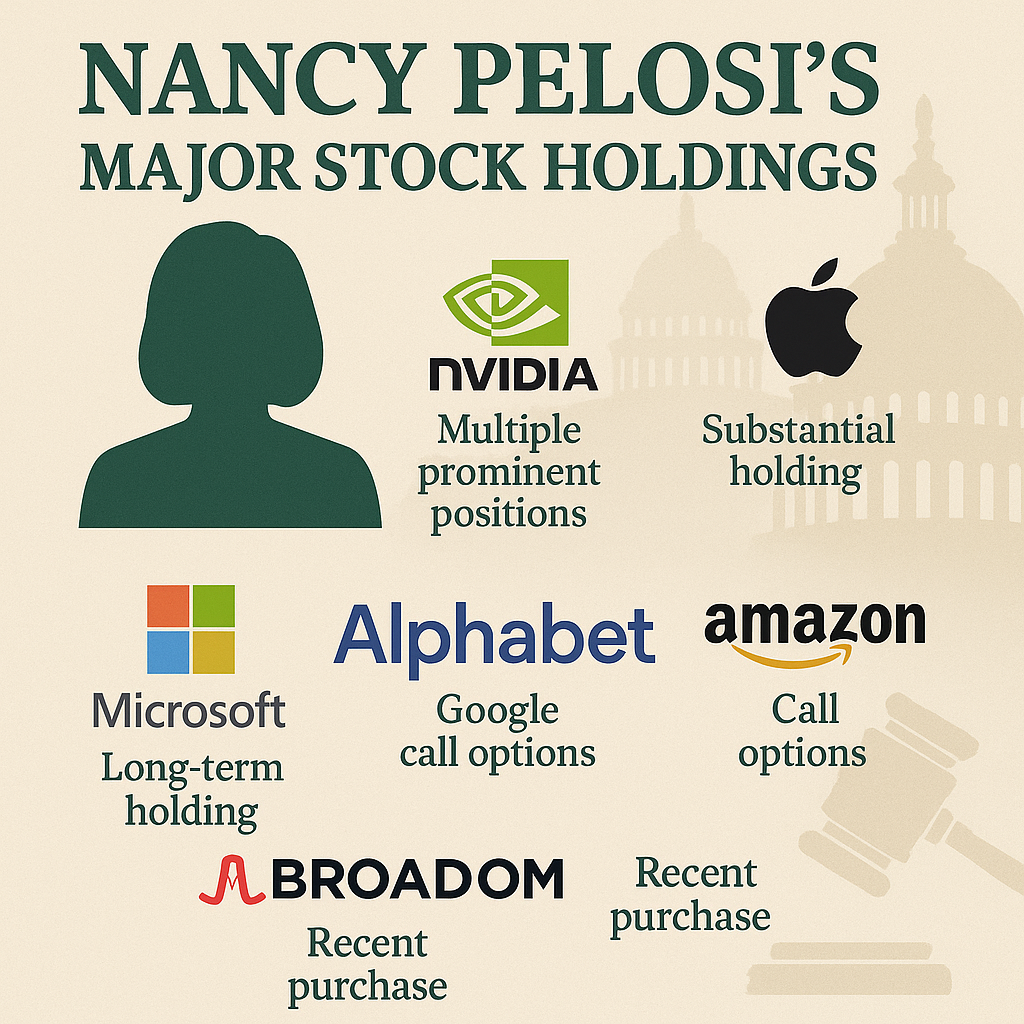

What Stocks Does Nancy Pelosi Own?

Nancy Pelosi’s current portfolio includes positions in some of the world’s largest and most successful companies, with a clear emphasis on technology stocks that have driven much of the market’s recent gains. Her holdings reflect both growth-oriented investments and established blue-chip companies.

Major Holdings:

- NVIDIA Corporation (NASDAQ: NVDA) – Multiple prominent positions totaling millions in value

- Apple Inc. (NASDAQ: AAPL) – Recently reduced position but still substantial holding

- Microsoft Corp (NASDAQ: MSFT) – Long-term holding maintained across multiple years

- Alphabet Inc. (NASDAQ: GOOGL) – Google call options providing leveraged exposure

- Amazon.com (NASDAQ: AMZN) – Call options for upside participation

- Broadcom Inc (NASDAQ: AVGO) – Recent $1 million to $5 million purchase in semiconductor space)

Recent Additions:

- Tempus AI (NASDAQ: TEM) – High-performing biotech position that has generated substantial gains

- Vistra Corp (NYSE: VST) – Energy sector play during the renewable energy transition

- Palo Alto Networks (NASDAQ: PANW) – Cybersecurity investment as digital threats increase

Research any of Nancy Pelosi’s holdings + see how they stack up on 115 fundamental checks — enter any ticker on WallStreetZen

The portfolio demonstrates strategic diversification beyond technology stocks, though tech remains the dominant sector, reflecting broader market trends and potentially advantageous timing on regulatory developments. Her real estate investments through various LLCs provide additional diversification and hedge against market volatility.

Recent trading activity shows continued focus on artificial intelligence and semiconductor companies, sectors that have seen tremendous growth and regulatory attention.

The timing of these investments, often ahead of major regulatory announcements or market developments, has contributed significantly to the portfolio’s outperformance.

Want to buy shares of the same stocks Nancy Pelosi owns? You need a broker. Don’t have one? We recommend eToro.

It’s one of the world’s most popular investing platforms, with over 28.5 million users.

Plus, eToro is currently offering a $10 bonus* for U.S. residents.

$10 bonus for a deposit of $100 or more. Only available to U.S. residents. New accounts only. Additional terms and conditions apply.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

What is Nancy Pelosi’s Net Worth?

Nancy Pelosi’s estimated net worth is about $264 million, according to Quiver Quantitative. However, different organizations use varying approaches to estimate congressional wealth, with some focusing on disclosed assets while others attempt to include estimated values of real estate and business interests.

This wealth accumulation stands out given Nancy Pelosi’s congressional salary of $174,000 per year, highlighting how investment returns and business ventures have played the primary role in building her family’s fortune.

The wealth growth has accelerated over the past decade, coinciding with her husband’s active trading strategy.

Her trading strategy has consistently outperformed major indices over more than a decade, with the Nancy Pelosi stock portfolio tracker data showing this isn’t just market beta, it’s alpha generation that would be impressive even for professional fund managers. (Just saying — stocks rated “A” in our Zen Ratings system have also crushed major indices — learn more here.)

The Pelosi family’s wealth also includes substantial real estate holdings in San Francisco and other high-value markets, business investments, and various financial instruments beyond publicly traded stocks. This diversification has helped protect and grow wealth across different economic cycles and market conditions.

Final Word:

Nancy Pelosi’s stock trading track record represents one of the most compelling investment stories in modern politics. With returns exceeding 744% since 2014 and consistent market outperformance across multiple economic cycles, her strategy has captured the attention of millions of investors seeking an edge in increasingly competitive markets.

The key lies in choosing the right platform for your specific needs and understanding the inherent limitations of following congressional trades. CapitolTrades.com provides the best free tracking experience with comprehensive data and clean visualizations.

Dub App offers seamless automated copy trading despite significant data delays that can impact timing. For serious analysis and institutional-grade research, Quiver Quantitative delivers unmatched analytical depth.

By using the right Nancy Pelosi Stock tracker platform, you can benefit from one of the most successful investment approaches in modern political history. With free options available, there’s no reason not to start tracking and see if Nancy Pelosi’s market magic can work for your portfolio, too.

FAQs:

Is there an app to track congressional stock trades?

Yes, several dedicated apps track congressional stock trades effectively. Dub App offers the best mobile-first automated copy trading experience, allowing you to automatically mirror Nancy Pelosi's trades through a clean smartphone interface.

Unusual Whales and Quiver Quantitative provide mobile-responsive web platforms with comprehensive tracking features. CapitolTrades.com works excellently on mobile browsers despite not having a dedicated app.

Each platform offers different strengths depending on whether you want simple tracking or advanced analytics.

How long do politicians have to disclose stock trades?

Politicians must disclose stock trades within 45 days under the STOCK Act of 2012, but violations are surprisingly common with minimal consequences.

During the 117th Congress, 78 members violated disclosure rules by filing late or not at all, sometimes extending delays well beyond the 45-day requirement.

This means the already significant delay can stretch much longer, reducing the value of the information for investors trying to follow congressional trades in real-time.

What’s the best way to track Nancy Pelosi’s husband’s trades?

Since Paul Pelosi conducts the actual trading while Nancy reports it through congressional disclosure requirements, any Nancy Pelosi tracker effectively tracks Paul's trades.

CapitolTrades.com offers the best free tracking with comprehensive historical data and performance analysis.

Autopilot provides sophisticated portfolio management based on their combined trading patterns, while Quiver Quantitative delivers the most profound analytical insights into timing and performance attribution for their trading strategy.

Is Nancy Pelosi guilty of insider trading?

Nancy Pelosi's trades are legal under current U.S. law, and no definitive evidence has emerged showing violations of insider trading statutes.

While President Trump and other critics have made accusations, the timing and success of trades, though controversial, don't constitute legal violations.

The STOCK Act of 2012 requires disclosure but doesn't prohibit congressional trading altogether.

The controversy has fueled ongoing debates about congressional trading reform, with some proposing complete bans on congressional stock trading.

Is Nancy Pelosi rich from stocks?

Yes, Nancy Pelosi's wealth has been built primarily through exceptionally successful stock investments that far exceed what could be accumulated through her $174,000 congressional salary alone.

Her portfolio's 744% return since 2014 demonstrates how trading has played the dominant role in wealth accumulation.

The family also has substantial real estate holdings and business investments, but the stock market returns have been the primary driver of their dramatic wealth growth over the past decade.

Does Nancy Pelosi beat the market?

Here's what the data shows clearly: Nancy Pelosi's trading strategy has consistently beaten the market for over a decade through multiple presidential administrations, economic cycles, and market conditions.

Whether that performance stems from superior fundamental analysis, exceptional timing, access to regulatory information, or simply remarkable investment skill, the results are undeniable.

Can you get rich following Nancy Pelosi trades?

Copying congressional trades isn't a guaranteed path to riches, and several factors can impact your results. The 45-day disclosure delay means you're often buying weeks or months after the original purchase, potentially missing the initial price movements that drive much of the returns.

Market conditions change rapidly, regulatory environments shift, and past performance never guarantees future results.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.