Artificial intelligence has completely changed the game for investors and traders. And after testing dozens of AI trading platforms over the past few years, one system stands head and shoulders above the rest.

What’s the Best AI Trading System in 2026?

When it comes to a well-rounded approach that leverages AI but still considers traditional due diligence checks, Zen Ratings by WallStreetZen crushes the competition. This isn’t just marketing hype. We’re talking about a quant ratings system that utilizes a proprietary AI model paired with 114 additional reviews. On average, stocks rated “A” using this system have delivered +32.52% annual returns since 2003.

But Zen Ratings isn’t your only option. The AI trading world is packed with specialized tools, some excel at technical analysis, others focus on day trading signals, and a few are built for deep research.

I’ll show you why Zen Ratings leads the pack, then walk through other AI systems that might fit your investment style. Whether you’re hunting for growth stocks or playing it safe with dividends, there’s an AI tool designed for your approach.

Let’s jump in.

Prefer to follow real people?

If so, consider eToro’s CopyTrader.

It’s a system unlike any other that lets you follow the trades of top investors.

There’s good reason why it’s such a popular feature: many of the top traders on the platform have two-year returns of more than 50%. It’s one of the most dynamic ways to to watch and learn how to trade in real time.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

The 7 Best AI Trading Systems in 2026

Let’s get down to it. Here are the best AI trading systems in 2026

1. Zen Ratings – Best for AI Paired With Traditional Due Diligence

- Rating: 5/5

- Key Features: AI-powered stock analysis, 115 factors analyzed, 7 component grades, historical outperformance, comprehensive integration

- Price: $19.50/month (billed yearly) – Try it for $1

Zen Ratings doesn’t mess around with fancy marketing promises. This quant system reviews 115 separate factors across seven areas, such as Value, Growth, Momentum, Sentiment, Safety, Quality, and Financials — including a proprietary AI factor.

We’re not talking about basic screening here. The system spots patterns in market data that most human analysts miss completely.

The track record speaks volumes. Since 2003, ‘A’ rated stocks have returned 32.52% annually on average. It means $10,000 invested in ‘A’ rated stocks back in early 2003 would be worth over $6 million today.

Why Zen Ratings works so well:

- Deep Analysis: Processes 115 factors daily across 4,600+ stocks

- Component Breakdown: Seven detailed ratings let you match picks to your strategy

- Proven Results: Two decades of documented outperformance

- Seamless Integration: Works perfectly with Zen Investor for deeper research

The AI keeps learning and adapting, so the ratings stay relevant as markets shift. If you’re serious about AI-driven investing, this is where you start.

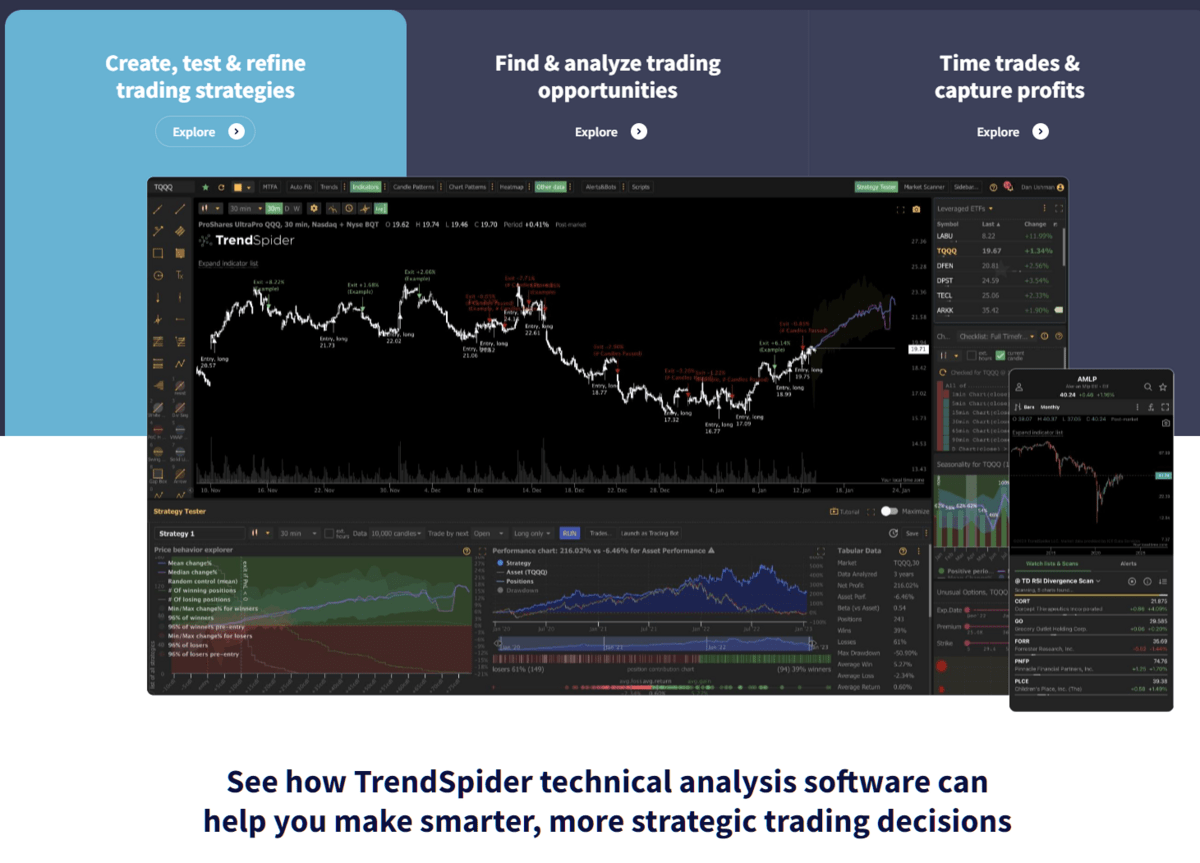

2. TrendSpider – Best for Charts and Technical Analysis

- Rating: 4.5/5

- Key Features: Automated trendlines, extensive charting, pattern recognition, strategy testing

- Pricing: $52.38/mo – $155/mo – See plans here

Regarding detecting trends and giving you options for charts, Trendspider is hard to beat, whatever asset class you analyze. If you are a professional, it will save you time on your technical analysis.

TrendSpider is designed to notice trendlines, Fibonacci patterns, and more. It will also point out the most prominent and likely trends for you.

What makes TrendSpider shine:

- Pattern Recognition: Identifies complex chart patterns instantly

- Strategy Tester: Test your trading ideas without writing code

- Multi-Timeframe Analysis: See trends across different time periods simultaneously

- Learning Resources: TrendSpider University gets new users up to speed

So why the 4.5/5 rating? One simple reason: There’s definitely a learning curve. But it’s worth it for select investors. If you’re into technical analysis, the time savings alone make it worthwhile.

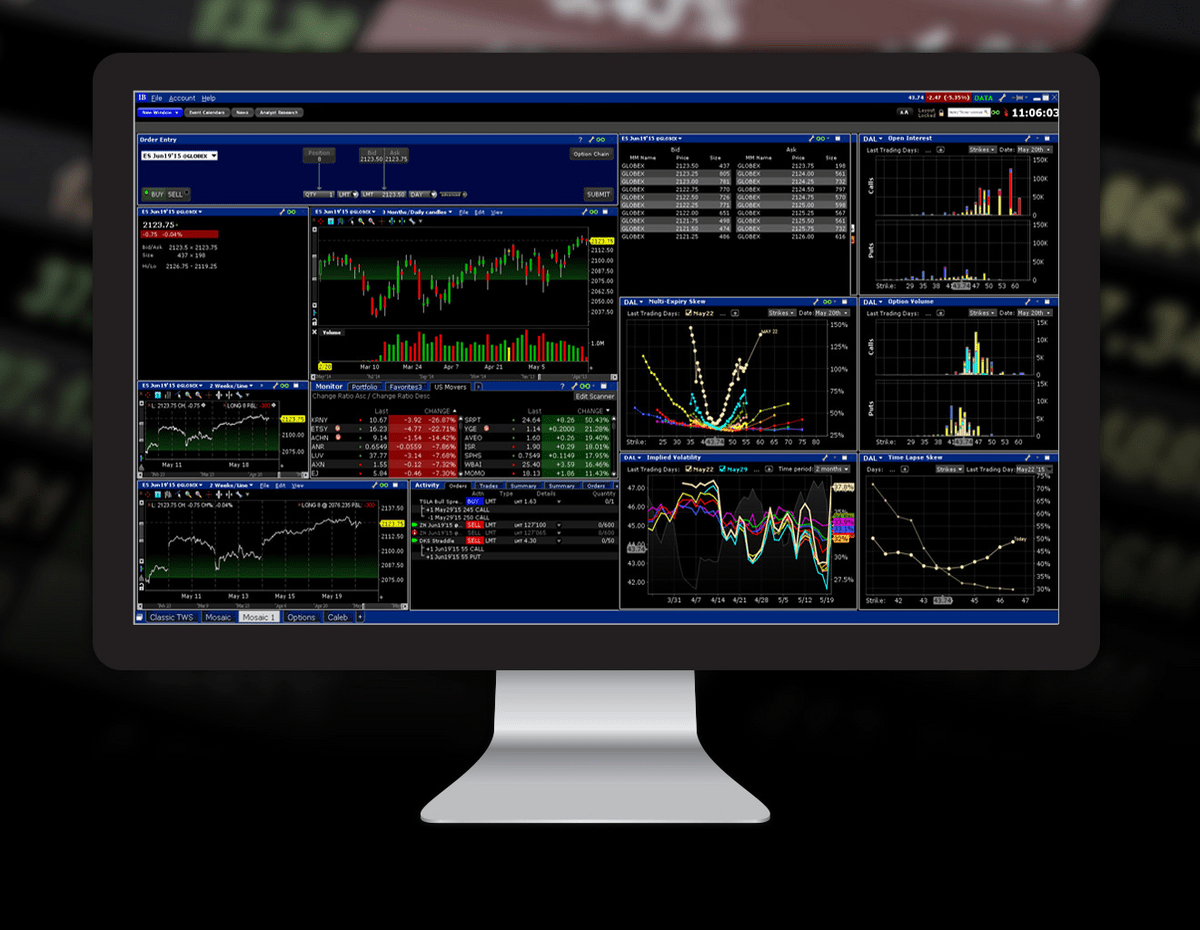

3. Trade Ideas – Best Automated Features

- Rating: 5/5

- Key Features: Holly AI signals, advanced backtesting, real-time scanning, broker integration

- Pricing: $89/mo The Birdie Bundle; $178/mo The Eagle Elite – See plans here

Trade Ideas built something special with Holly AI. This isn’t just another stock screener, but a robust platform that watches the markets 24/7.

Holly scans after-hours data, runs backtests, and serves up trade ideas based on current market conditions. The platform throws tons of information at you, but somehow keeps everything organized and actionable.

What sets Trade Ideas apart:

- Holly AI: Provides entry/exit signals from comprehensive market analysis

- Real-Time Scanning: Catches opportunities as they develop

- Broker Integration: Connects with E-Trade, Interactive Brokers, and others

- Extensive Backtesting: Test strategies against years of historical data

One catch: Trade Ideas focuses mainly on the US and Canadian markets. If you trade internationally, you’ll need to look elsewhere.

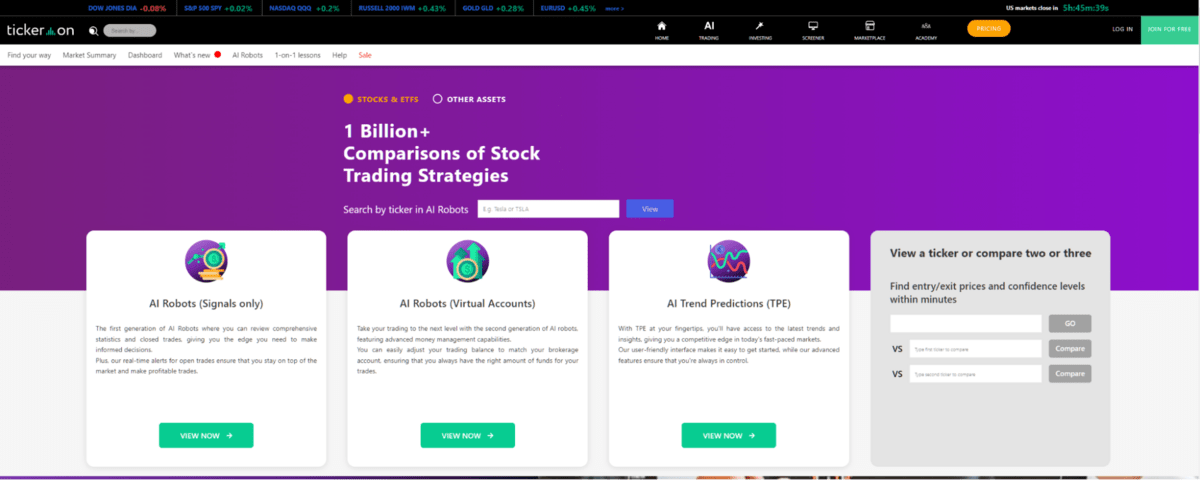

4. Tickeron – Best for Live Data Analysis

- Rating: 3.5/5

- Key Features: Prediction accuracy tracking, neural networks, automated trading rooms, live data analysis

- Pricing: $600-$3,000/year – See plans here

Tickeron offers more than just AI trading software; it’s a comprehensive platform filled with information on potential trades, expert advice, and more. The goal is to provide investors with actionable insights.

Tickeron tracks how accurate its past predictions were, while most platforms conveniently forget to mention their misses.

The platform runs multiple neural networks that power different automated trading rooms. It’s appealing if you want a more hands-off approach to trading.

The AI bot scans stocks based on user-defined filters, and Tickeron also offers bots that operate automated trading rooms powered by multiple neural networks.

Once you move past the flashbang of information and potential services, you’ll find their bots are some of the best for day trading and making quick trading decisions.

One thing that stood out to me is that it will not only make predictions about financial markets and provide information to users on how those predictions got made, but it will also analyze and report how accurate its past predictions on a potential investment were.

(Interested in learning more? Check out our Tickeron review.)

What makes Tickeron unique:

- Prediction Tracking: See historical accuracy of recommendations

- Multiple Neural Networks: Different AI models for different strategies

- Live Data Focus: Real-time market analysis and alerts

- Educational Component: Learn why certain predictions were made

The price point is higher than alternatives, but the prediction accuracy tracking gives valuable insight into the AI’s reliability.

5. Kavout – Best for Learning and Pattern-Finding

- Rating: 3.5/5

- Key Features: K Score rating system, paper trading, Kai machine learning, educational focus

- Pricing: $20-$49/month – See plans here

Kavout takes an educational approach. Instead of just telling you what to buy, it explains why certain stocks score highly on its K Score system (1-9 scale based on over 200 factors).

It relies upon its Kai machine learning program, which it claims can outperform the index with lower risk in simulations. The software analyzes data through hundreds of metrics using millions of data points, ranking stocks and other assets for easier personal scanning and decision-making.

Their software will analyze data via hundreds of metrics, using millions of data points. This can sound like a lot, but it will rank the stocks and other assets for easier personal scanning and decision-making.

Learning advantages:

- K Score System: Clear 1-9 ranking for stock potential

- Paper Trading: Test strategies without risking real money

- Educational Focus: Understand the reasoning behind recommendations

- Risk Analysis: Lower-risk approach to AI-driven investing

This platform works best if you want to improve your own analysis skills rather than blindly follow AI recommendations.

Worth noting: Kavout only works with US stock market data and may not analyze as many different points as other AI trading systems.

6 Danelfin – Best for U.S. and European Markets

Danelfin does something most AI platforms don’t. It covers European markets just as thoroughly as US stocks. That’s huge if you want international exposure.

The “Explainable AI” feature really impressed me. Instead of just spitting out a score, Danelfin shows you exactly which factors influenced each rating. No black box mystery here.

Why Danelfin stands out:

- Dual Market Coverage: Both US and European stocks and ETFs

- Transparent Analysis: See the reasoning behind every rating

- Free Tier Available: Test drive before you commit

- Daily Updates: Fresh analysis every trading day

The free plan gives you enough features to see if Danelfin fits your needs. Smart way to try before you buy. (For more info, check out our Danelfin review.)

7. Fiscal.ai – Best For Conversational AI

- Rating: 4/5

- Key Features: Conversational AI, institutional-grade data, 10+ years of financials, data visualization

- Price: Free plan; Plus: $29/month; Pro: $79/month

Fiscal.AI changed how I do investment research. The Copilot feature works like having a financial analyst on speed dial. You can ask complex questions about companies or industries in plain English and get insightful responses.

The platform packs over 10 years of company financials and 12+ years of KPI data. But here’s the kicker: you don’t need to dig through spreadsheets. Just ask questions like “How has Apple’s gross margin trended over the past 5 years?” and get instant, visual answers.

(You can also check out my Fiscal.ai review.)

Research advantages:

- Conversational Interface: Ask questions in natural language

- Comprehensive Data: Institutional-quality financial information

- Visual Analytics: Turns complex data into clear charts

- Content Summarization: Quickly digest earnings calls and reports

This platform excels at fundamental analysis. Perfect for long-term investors who want to really understand their holdings.

Alternative to AI Trading – eToro’s CopyTrader

You might not think that AI trading is there yet or trust it enough to place fiscal faith in it, and that’s entirely understandable.

Still, there’s something to be said for taking advice and data from the top traders in the world and using that information for yourself to make informed trading decisions. Automation can save you time and potentially make you better returns since automation doesn’t hesitate.

For that reason, you might want to check out eToro’s CopyTrader, which will automatically copy the trades of top investors to the best of its ability.

You select a popular investor to copy (some of which have two-year returns of more than 50% — though past performance is not an indication of future results, and the system does the rest of the work for you.

You can learn more about the process in our eToro CopyTrader review.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

What is an Artificial Intelligence Trading System?

An AI trading system is a sophisticated program or automated trading platform that leverages machine learning, artificial intelligence, and advanced computer algorithms to recommend or execute trades on behalf of investors.

What’s the Difference Between AI Trading Systems and Algorithmic Trading?

Many will use these two terms and ideas interchangeably, often incorrectly.

Algorithmic trading systems will work via a series of rules and commands. If/then rules are common and control the full process. It’s helpful, but it doesn’t learn. A human must adjust the rules if there is an error.

AI trading systems are supposed to learn and adapt. In an ideal scenario, an AI trading system will not make the same mistake twice. It adjusts and changes its own algorithms automatically according to its programming. Essentially, it’s on a higher level of automation.

Which one is better? It depends. Algorithmic trading has more human input, with its pros and cons. AI trading systems can learn more independently, but the goals best be well defined.

Benefits of AI Trading Software

- Analysis: An AI stock trading bot can review and analyze massive amounts of data quickly and make it more accessible for humans, pointing out what’s important to consider in the best cases. It might detect what humans cannot.

- Automated Trading: Some AI trading software can make deals or trades for you based on rules you set for them. It can feel risky but save you a lot of time and stress.

- Affordability: AI trading software is far more affordable than a traditional financial advisor or investment manager. It’ll either cost less per month or take less of a cut. An AI doesn’t need to pay rent or feed itself (yet).

- Impartiality: AI trading software doesn’t care, and that is best when making mathematical and data-based decisions. AI, to my confident knowledge, doesn’t experience adrenaline rushes when faced with new data. It simply analyses and provides results.

- Speed: While human traders may offer creativity and intuitive thinking, AI systems excel at information processing speed. They can analyze data and execute trades before human traders can fully process the same information.

- Self-Improvement and Learning: The most advanced AI trading platforms continuously update and improve their performance by learning from market trends and trading outcomes. This reduces the likelihood of repeating costly mistakes.

What Features Should I Look for in AI Trading Software?

- Past Results: While past returns cannot predict future returns, it’s hard to bet on something that has never performed well.

- Ease-of-Use: If you’re disincentivized from using software because it’s unnecessarily complicated, that’s a problem.

- Transparency: I don’t expect trade secrets, but I want to know about the basic principles behind AI and how it operates. The only good decision is an educated decision.

- Cost: Don’t just pick the cheapest one; understand the cost of using a certain product.

- Customer Support: Access to human customer service remains important when technical issues arise or when clarification is needed on platform features.

- Adaptability: The AI system should demonstrate the ability to learn quickly from changing market conditions while accommodating individual investment goals and risk tolerance.

- Available Data: The trading software should make its information and real-time data available to you.

Final Word: AI Trading Software

AI trading platforms and artificial intelligence represent rapidly evolving technologies in the financial sector. These systems can potentially deliver strong returns, though some programs may have steep learning curves for new users.

However, while AI can provide valuable assistance, it’s important to remember that these systems aren’t perfect. They can analyze CEO performance metrics, but they may not adequately assess factors like leadership’s ability to retain top talent or navigate complex corporate challenges.

Consider using AI trading platforms if they align with your investment strategy, but exercise caution. Supplement AI recommendations with additional research and critical thinking when making investment decisions.

The greatest chance of investment success comes from utilizing multiple tools, trading strategies, and resources in a comprehensive approach.

FAQs:

What is an AI trading system?

An AI trading system automatically uses artificial intelligence and analytics to buy and sell stocks, build portfolios, and manage investments. It employs machine learning, historical data analysis, algorithms, and trend recognition to make or recommend trades at optimal prices and timing.

Can I use AI for trading?

Yes. Nothing stops you, and AI can provide some excellent ideas and models for investing.

However, you should be cautious about relying completely on AI. If AI always provided the best returns, we would have completely abandoned normal investment and risk management practices by now. AI is still developing and it can make mistakes.

Are AI trading bots legal?

Yes, AI trading bots operate legally within current regulatory frameworks. While some individuals and organizations raise ethical concerns about AI trading tools and their market impact, this could influence future regulations.

Remember that AI trading bots and users of their recommendations must still comply with all relevant market rules, laws, and regulatory requirements.

What is the best AI trading bot?

After testing of dozens of platforms, we find that Tickeron is the best AI trading bot due to a strong track record of historical accuracy of recommendations and its use of multiple AI models.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.