The Verdict: Is Danelfin Worth It in 2026?

After testing the platform extensively, I’d say Danelfin works best for tech-savvy swing traders who trust algorithms more than gut feelings. The interface is clean, updates occur daily, and the AI Score provides a quick snapshot of whether a stock might outperform.

Here’s what you need to know upfront: Danelfin won’t hold your hand. It’s pure AI with minimal human oversight. You get numbers, signals, and predictions, but no in-depth company analysis or expert analyst guidance.

Compare this to Zen Investor, a stock-picking newsletter that integrates AI screening with robust fundamental research. Zen Investor provides stock picks that consider analyst ratings, detailed financial data, and long-term value investing principles, all backed by human expertise.

Danelfin makes sense if you’re comfortable betting on algorithms and prefer medium-term trading strategies. However, serious investors who seek a thorough company analysis or more targeted guidance may find it lacking.

AI-fueled stock picks … With a human layer

If the idea of trusting your hard-earned cash with bots makes you uneasy, consider subscribing to Zen Investor — our stock-picking newsletter that leverages AI to choose stocks, but is also managed by a 40+ year market veteran.

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected using proprietary AI tools and traditional fundamental checks by Steve Reitmeister, former editor-in-chief of Zacks.com

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Why Consider Danelfin?

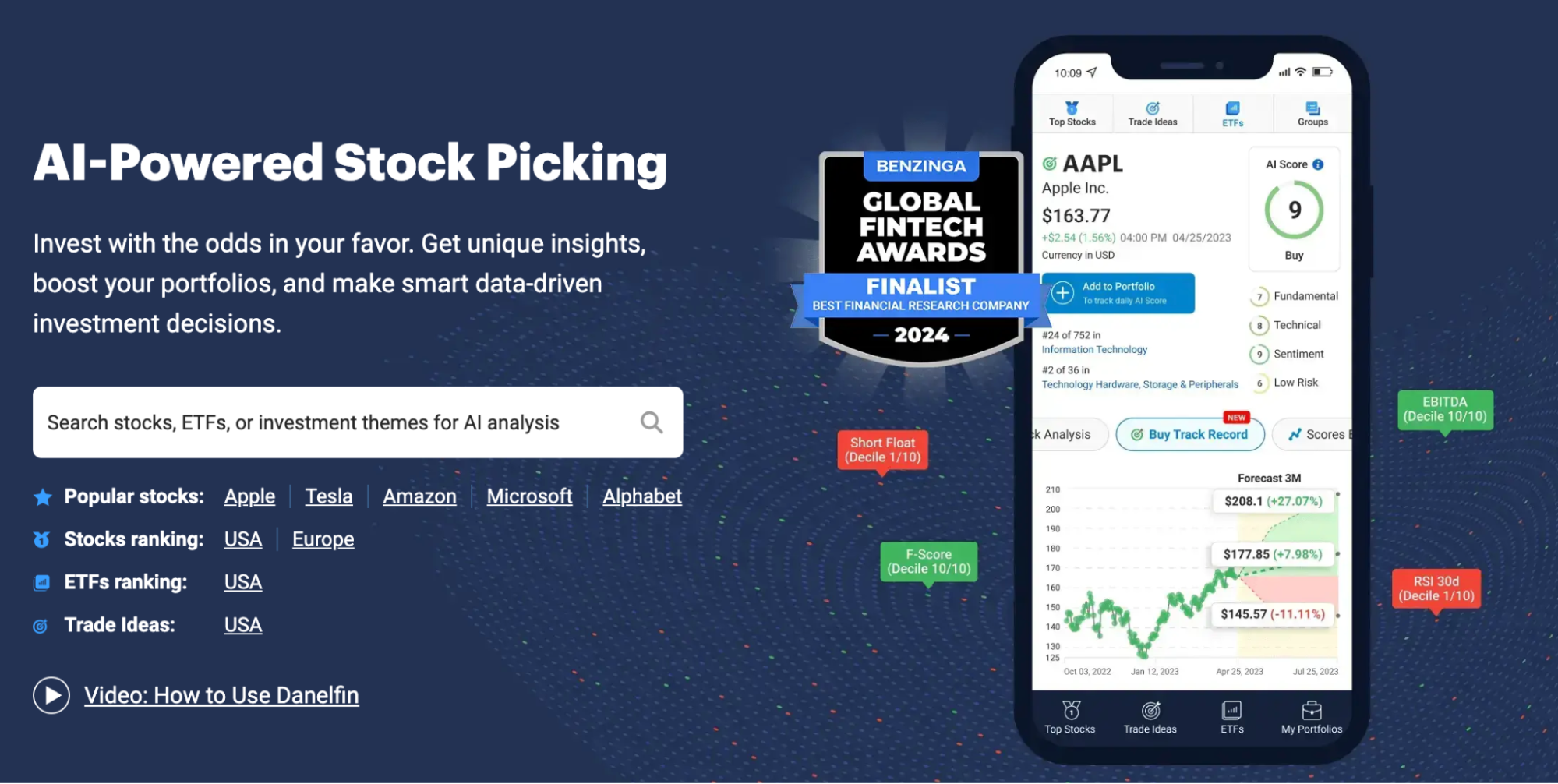

AI has completely changed how we pick stocks. What used to take hours of manual research now happens in seconds through sophisticated algorithms.

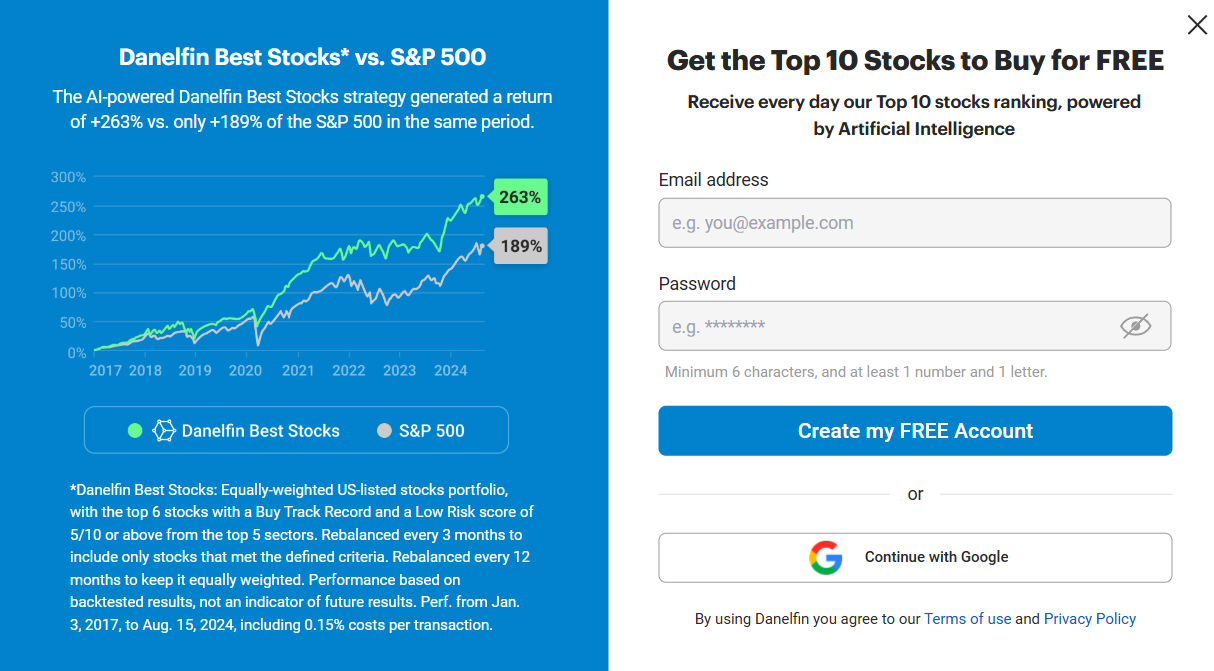

Danelfin sits right at the heart of this revolution, promising market-beating stock picks through its proprietary AI technology.

This platform analyzes thousands of stocks and ETFs daily, spitting out AI Scores and trade recommendations for US and European markets.

Danelfin’s algorithm sifts through over 10,000 data points, ranging from earnings reports to social media chatter, to predict which stocks are likely to outpace the market over the next three months.

But here’s the thing: Danelfin isn’t the only game in town. While it focuses purely on AI-driven signals, platforms like WallStreetZen take a different approach.

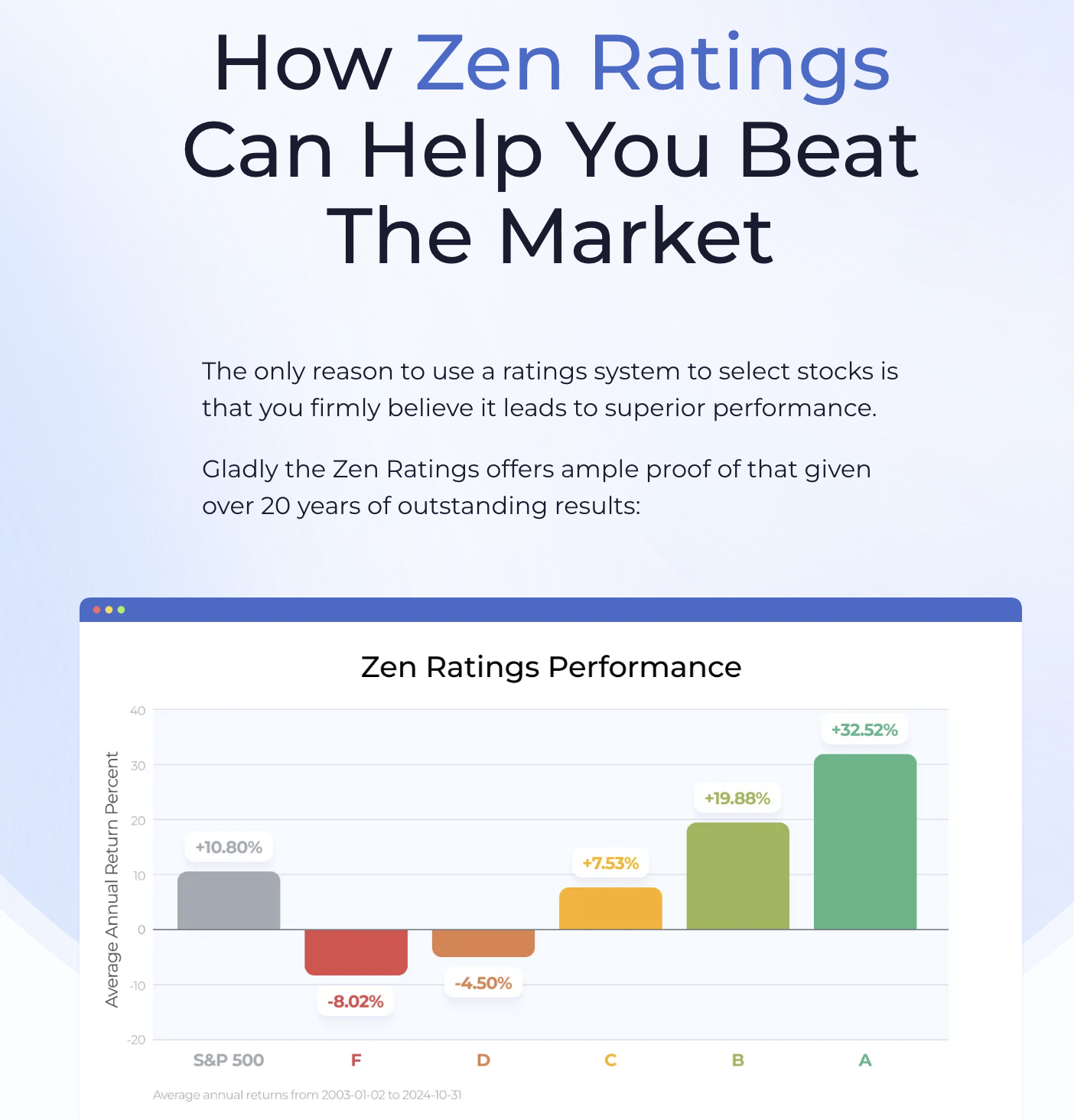

The quant ratings system, Zen Ratings, combines AI screening with in-depth fundamental analysis, providing you with both algorithmic insights and the wisdom that comes from experienced analysts who have navigated multiple market cycles.

But I digress. If you’re searching for comprehensive Danelfin reviews, you’ve come to the right place. Let’s explore what this AI investing platform offers and whether it’s worth your hard-earned money.

How Danelfin Works

Danelfin operates on a simple premise: feed massive amounts of data into AI models and let them spot patterns humans miss. The platform targets U.S. and European stocks and ETFs, processing information across three main buckets.

First, fundamental data such as company financials, valuations, and growth metrics. Second, technical indicators like price trends and trading volume. Third, sentiment analysis from news articles and social media buzz.

The AI crunches over 10,000 features and 900 indicators daily for each stock. That’s a lot of number-crunching, but the goal is straightforward: to identify which stocks are likely to beat market benchmarks over the coming months.

You don’t need a PhD in data science to use it. Danelfin distills all this complexity into simple scores and trade ideas that regular investors can understand and act on.

Platform Features

AI Analytics for Stocks and ETFs

Danelfin covers thousands of stocks and ETFs across US and European exchanges. The AI engine operates continuously, updating scores and analysis based on fresh market data, company reports, and news feeds.

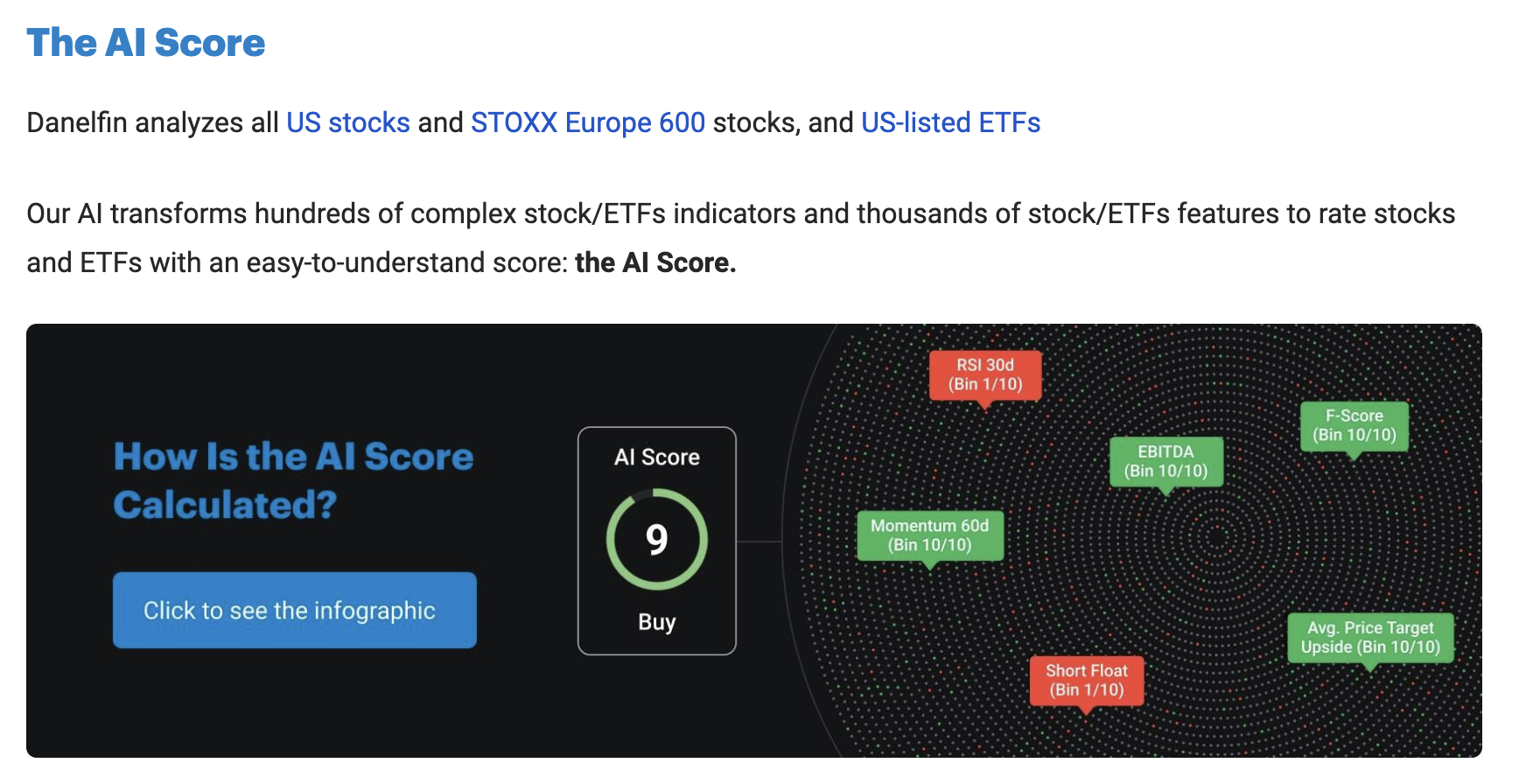

AI Score

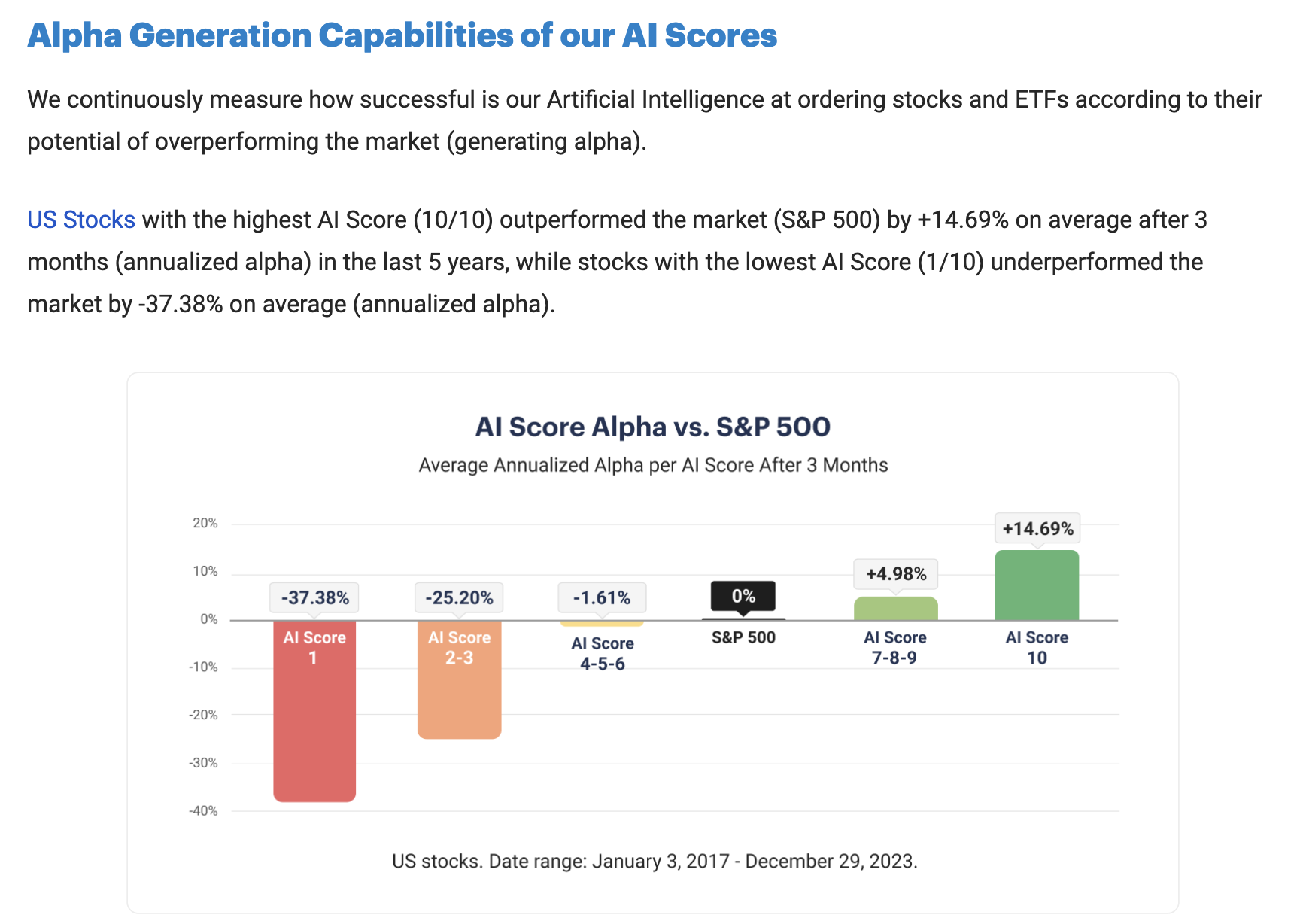

This is Danelfin’s bread and butter. Every stock gets a score from 1 to 10, with 10 being the most bullish. Think of it as the AI’s confidence level that a stock will outperform the market over a three-month period.

The score combines multiple factors: fundamental strength (is the company financially healthy?), technical momentum (is the stock trending up?), sentiment trends (what’s the buzz saying?), and risk assessment (how volatile might this get?).

It’s more sophisticated than single-metric systems that only look at price action or earnings growth. You get a holistic view wrapped in a straightforward number.

I’d be remiss if I didn’t mention WallStreetZen’s proprietary AI algorithm at this point. As part of the Zen Ratings system, there’s an AI Component, which employs machine learning using a Neural Network trained on 20+ years of fundamental and technical data.

What can it do? In essence, it detects patterns beyond human capability — giving you a deeper view of not only past performance, but future potential. Read more about the AI Component here.

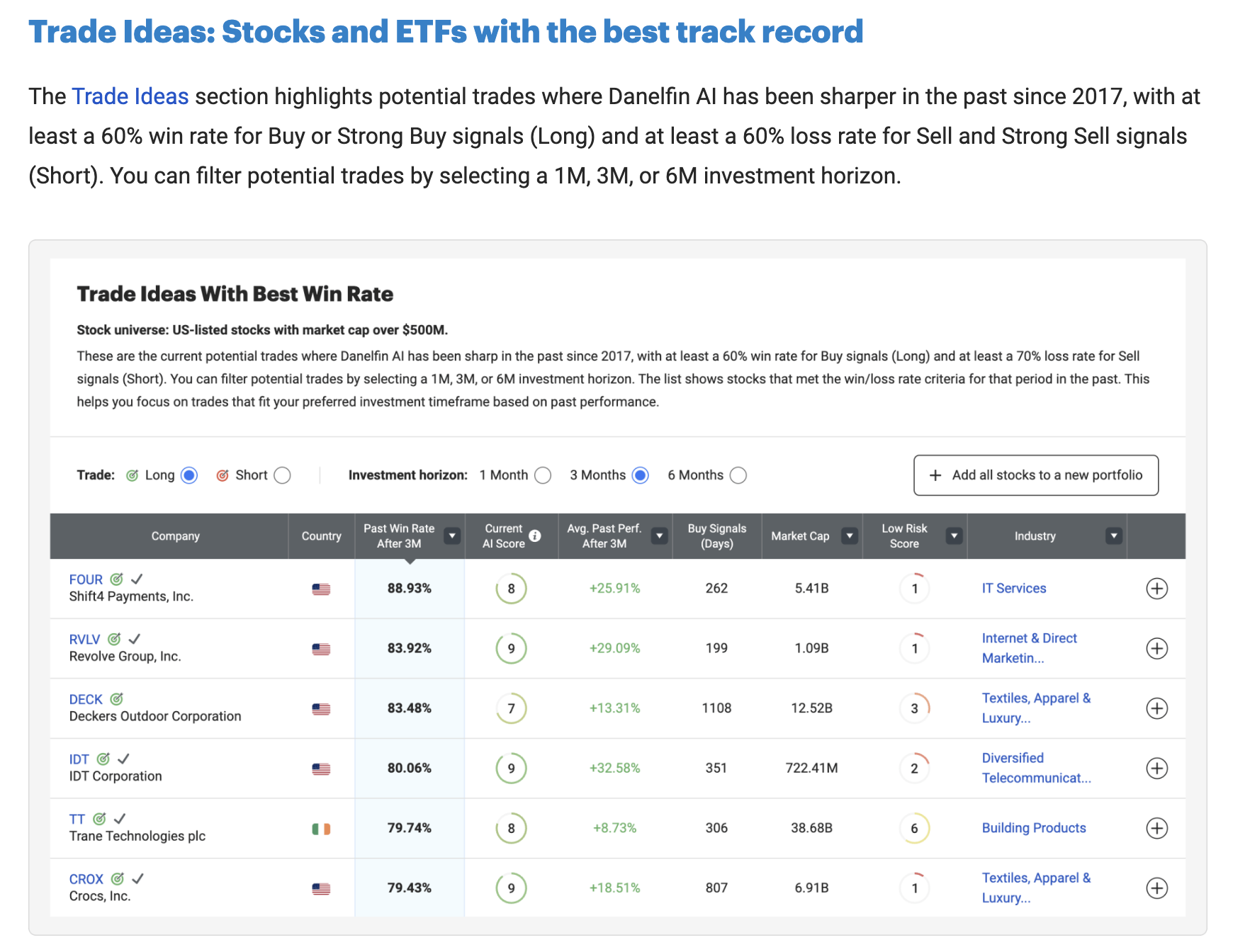

Trade Ideas

Beyond scores, Danelfin serves up specific buy and sell signals. These aren’t just random suggestions but based on historical patterns and the AI’s predictions for different timeframes.

You’ll see recommendations for 1-month, 3-month, and 6-month horizons, allowing you to match the signals to your trading style.

Portfolio Tracking

You can build and monitor portfolios within the platform. Danelfin tracks your holdings’ AI Scores and sends alerts when something significant changes which means you dont have to login daily to check if your stocks are still AI-approved.

User Experience

Most Danelfin reviews praise the platform’s clean design. The interface doesn’t overwhelm you with charts and data, as everything flows logically from stock search to AI Score to trade ideas.

Daily updates keep the information fresh. You can set up alerts for your portfolio, and you’ll know immediately when the AI changes its mind about your holdings.

However, there is one major limitation: Danelfin only works through web browser as there is no mobile app. If you’re used to managing investments on your phone, this might frustrate you.

The web platform works fine on mobile browsers, but it’s not the same as a dedicated app optimized for smaller screens.

How Danelfin Uses AI

Unlike platforms that focus solely on technical charts or financial ratios, Danelfin’s AI examines everything simultaneously. This creates a more complete picture than traditional analysis methods.

The system processes over 10,000 features daily for each stock. That includes obvious factors, such as earnings growth and price momentum, as well as subtle signals, like changes in analyst sentiment or social media chatter volume.

This comprehensive approach enables the AI to identify correlations that human analysts might overlook. A specific combination of technical indicators and shifts in sentiment consistently precedes significant market moves. The AI learns these patterns and applies them to current market conditions.

The goal isn’t just historical analysis, it’s predicting what happens next. Specifically, which stocks will outperform over the next three months?

AI Score Mechanics

Here’s how Danelfin builds its AI Score:

Fundamental Analysis:

Traditional metrics like P/E ratios, profit margins, revenue growth, and balance sheet strength. The AI determines whether a company is financially stable or teetering on the edge.

Technical Indicators:

Price trends, momentum oscillators, volume patterns, and support/resistance levels. This captures whether the stock is in an uptrend, a downtrend, or going sideways.

Sentiment Analysis:

News headline analysis, social media buzz, and changes in analyst ratings. Sometimes the story matters as much as the numbers.

Risk Assessment:

Volatility measures and other factors that make a stock too risky despite good fundamentals or technicals.

The AI weighs these factors using proprietary formulas to create subscores, then combines them into the final 1-10 rating.

Many Danelfin AI reviews highlight the platform’s “explainable AI” feature, which enables users to see which factors most influenced a particular score, rather than receiving a black-box prediction.

Danelfin’s Trade Ideas

Danelfin doesn’t just provide you with scores; it also suggests specific trades. These buy and sell signals are derived from the AI’s analysis, as well as historical performance patterns.

The platform claims impressive win rates of 60%+ for its signals, although you should approach these numbers with caution. Backtested results don’t always translate to real-world performance due to trading costs, slippage, and changing market conditions.

Still, the concept makes sense. If the AI consistently identifies patterns that lead to outperformance, those patterns should continue to work (until they no longer do, which is always a risk with any trading strategy).

Proprietary AI Technology

Danelfin builds its own AI models instead of using off-the-shelf solutions like ChatGPT. This matters because financial markets have unique characteristics that generic AI might miss.

Custom models can incorporate market-specific knowledge, like how earnings announcements typically affect stock prices or how sentiment shifts during market volatility. Generic AI lacks this specialized training.

Of course, we can’t peek under the hood to verify exactly how sophisticated these models are. But the fact that Danelfin invests in proprietary technology suggests they’re serious about creating a genuine competitive advantage.

Danelfin Pricing: Is It Worth It?

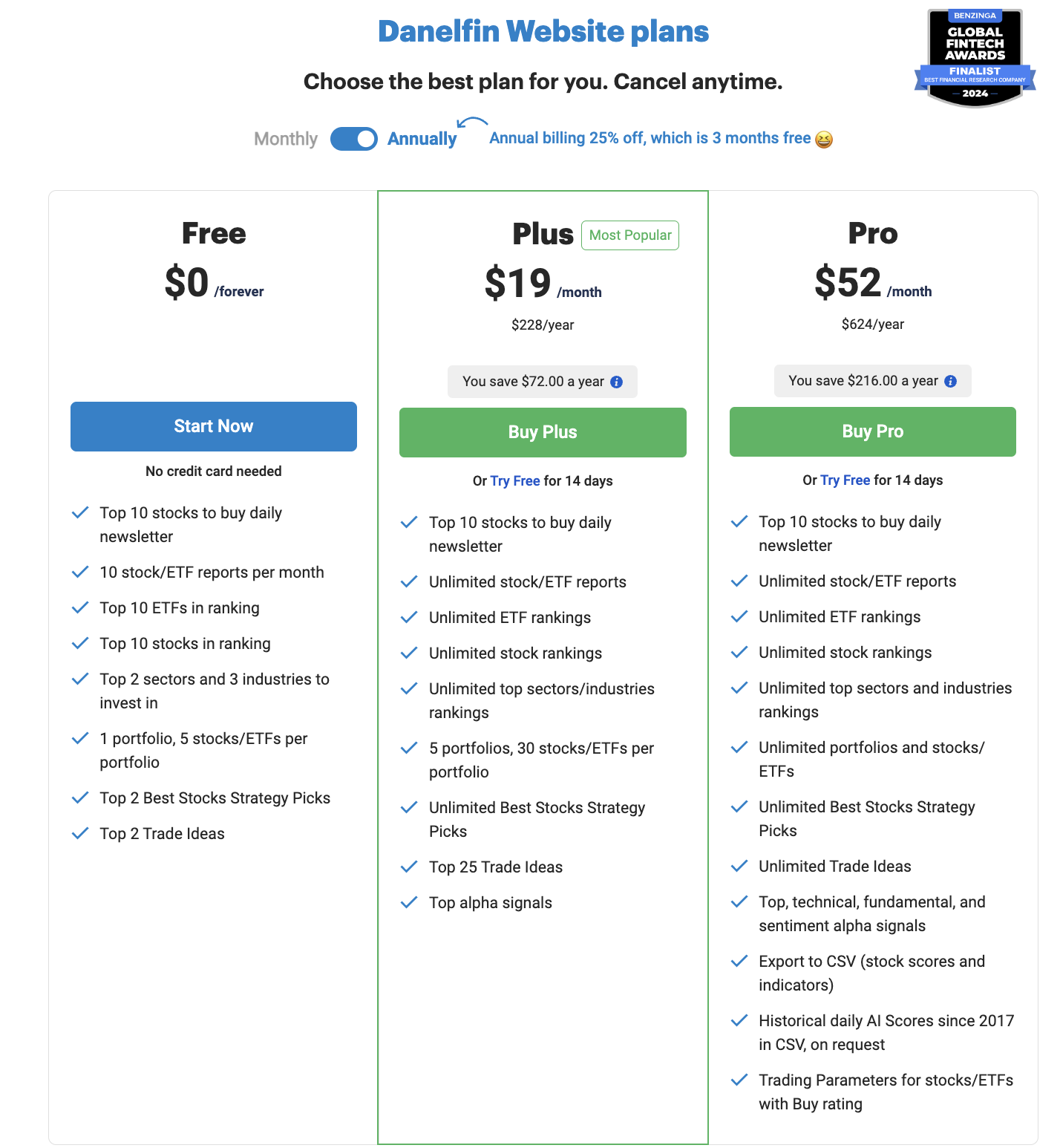

Danelfin uses a three-tier pricing structure:

Pricing Breakdown

Free Plan: Basic access to newsletters and sample reports. Suitable for testing the waters without commitment.

Plus Plan: $19 monthly (billed annually) unlocks full AI Scores for one region, trade ideas, and portfolio tracking. Includes 14-day free trial.

Pro Plan: $52 monthly (annually) provides access to both US and European markets, along with advanced features. Also includes a 14-day free trial.

Cost vs. Value

For active swing traders, $19-52 monthly isn’t unreasonable if the signals improve your returns. The key word is “if,” as you need to track whether Danelfin’s recommendations generate a profit after accounting for trading costs.

Casual investors might find the free plan sufficient for occasional research. However, serious users will require a paid subscription to access the complete feature set.

Compare this to institutional-grade platforms that cost thousands monthly, and Danelfin’s pricing looks quite reasonable for individual investors.

Who Should Use Danelfin?

Danelfin isn’t right for everyone. Understanding whether you fit the target profile saves time and money.

Ideal Investor Profiles

- Swing Traders: If you hold positions for days to months, Danelfin’s 3-month predictions align perfectly with your timeframe.

- Algorithm Believers: You trust data over gut feelings and don’t mind making decisions based on AI recommendations.

- US/European Focus: Danelfin’s coverage matches your investment universe.

- Tech-Comfortable Investors: You’re comfortable with web-based platforms and don’t need human hand-holding.

Non-Ideal Investor Profiles

- Buy-and-Hold Investors: If you’re buying index funds for retirement, short-term AI signals won’t help much.

- Fundamental Purists: Investors who want deep financial analysis and detailed company research will find Danelfin too superficial.

- Human Guidance Seekers: The platform doesn’t offer personal advice or portfolio management services.

- Day Traders: The daily update cycle doesn’t match the speed needed for intraday trading.

Investment Style | Good Fit? | Why? |

Swing Trading | ✓ | Perfect time frame match |

Day Trading | ❌ | Too slow for intraday moves |

Buy and Hold | ❌ | Short-term signals are irrelevant |

Fundamental Analysis | ❌ | Lacks research depth |

Danelfin vs. Other AI Investing Tools

Zen Investor

If you want stock picks that utilize AI as part of the selection process, consider Zen Investor.

This stock-picking newsletter combines AI screening with comprehensive fundamental analysis and top analyst insights. You get algorithmic efficiency plus human expertise and detailed financial research.

While Danelfin focuses purely on AI predictions, Zen Investor grounds its recommendations in solid value investing principles. Think of it as AI with adult supervision — you get the speed of algorithms plus the wisdom of experienced analysts.

If you prefer a DIY approach, you can also opt to use the same tools that Zen Investor’s Editor-in-Chief, Steve Reitmeister, uses. Namely the Zen Ratings system, which combines 115 factors proven to drive stock growth into a single, easy-to-understand letter grade.

Within that letter grade, you can also dig deeper into “Component” scores for some of the most important clusters of reviews: Financials, Value, Growth, etc.

There’s even a proprietary AI factor that uses an advanced algorithm to sniff out potential in stocks that, when combined with the traditional checks, can give you a more well-rounded look at a stock’s near and long-term prospects. (You can read more about the AI component here — it’s pretty cool.)

Want AI screening backed by deep fundamental analysis? Check out Zen Investor

Tickeron

Tickeron offers a range of AI tools, including pattern recognition across stocks, cryptocurrencies, and forex, as well as automated trading features.

Where Danelfin focuses on its AI Score for stocks and ETFs, Tickeron expands its offerings to include more asset classes and automation options. It’s more complex but offers greater flexibility for active traders.

Need AI pattern recognition across multiple asset classes? Check out Tickeron

TrendSpider

TrendSpider specializes in automated technical analysis — AI-powered trendlines, chart patterns, and support/resistance detection.

This platform caters to technical traders who seek to automate their charting analysis. Danelfin includes technical factors in its AI Score but doesn’t offer TrendSpider’s depth of automated charting tools.

Want advanced automated charting and technical analysis? Check out TrendSpider

Trade Ideas

Trade Ideas targets day traders with real-time market scanning and AI-driven trade suggestions for short-term opportunities.

Trade Ideas operates at high speed for intraday moves, while Danelfin focuses on medium-term predictions (3 months).

Looking for real-time AI scanning for day trading? Check out Trade Ideas

Danelfin’s Unique Features

Several features distinguish Danelfin from competitors:

- Multi-factor AI Score: Combines fundamental, technical, and sentiment data in one metric

- 3-Month Focus: Specifically calibrated for swing trading timeframes

- Transparent AI: Shows you why stocks received particular scores

- Daily Refresh: Updates all scores and analysis every day

Is Danelfin Safe To Use?

Customer Reviews

Looking at Danelfin reviews on Trustpilot, the feedback is generally favorable.

Users appreciate the clean interface, helpful AI Score concept, and responsive customer support.

Like any service, you’ll find occasional complaints about subscription management or specific trade outcomes.

But the overall sentiment leans favorable in most user Danelfin reviews.

Security Features

The platform utilizes standard security measures, including HTTPS encryption and established payment processors such as Stripe. No major security breaches or privacy scandals have surfaced.

Danelfin doesn’t require brokerage account access, as you’re only viewing research and not executing trades through the platform. This limits potential security exposure.

Platform Reliability

Founded in 2018, Danelfin has operated for several years without significant disruptions. The platform consistently delivers daily updates, suggesting stable backend systems.

While the AI’s prediction accuracy will fluctuate with market conditions, the platform itself appears reliable from an operational standpoint.

Final Word

Danelfin delivers precisely what it promises: AI-driven stock analysis wrapped in a clean, user-friendly package. The AI Score provides you with quick insight into a stock’s potential, daily updates keep information fresh, and the explainable AI helps you understand the reasoning behind the recommendations.

But it’s not a complete investment solution. The platform’s strength — pure AI analysis — is also its weakness. You won’t find the deep fundamental research, analyst insights, or human expertise that serious investors often need.

This is where platforms like WallStreetZen’s Zen Investor shine — combining AI efficiency with comprehensive fundamental analysis, top analyst ratings, and proven value investing principles.

This Danelfin review shows the platform works well if you’re comfortable with algorithm-driven decisions and focus on medium-term trading. The 14-day free trial lets you test the waters without risk.

However, if you require thorough investment research supported by both AI and human expertise, Zen Investor provides a more comprehensive toolkit.

The choice depends on your investment style and how much human insight you want to incorporate with your AI signals.

We hope these Danelfin reviews and insights help you make informed decisions for your portfolio.

FAQs:

How Reliable Is Danelfin’s AI?

Danelfin's AI processes over 10,000 daily features across fundamental, technical, and sentiment data. The platform shares backtested performance data; however, please note that past results don't guarantee future success.

Does Danelfin Automatically Pick Stocks?

No. Danelfin provides AI Scores (1-10 ratings) and Trade Ideas (buy/sell signals), but you make all final decisions. Think of it as a research tool that flags opportunities, but you still need to execute actual trades.

Is Danelfin Suitable for Day Trading?

Not really. Danelfin updates daily and focuses on 3-month predictions, which suits swing trading better than day trading.

What Are Danelfin’s Subscription Costs?

Three tiers are available: Free (basic features), Plus ($19/month annually), and Pro ($52/month annually). Both paid plans include 14-day free trials. Costs can be justified for active traders who use the signals effectively.

Is Danelfin worth it?

Danelfin is worth it for tech-savvy swing traders who trust algorithms more than gut feelings. The interface is clean, updates occur daily, and the AI Score provides a quick snapshot of whether a stock might outperform.

However, Danelfin won't hold your hand. It's pure AI with minimal human oversight. For a little bit of both, consider a service like Zen Investor.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.