Not sure where to start on your investing journey? If you’re already a Chase banking customer, you might start by researching the Chase trading platform.

With no account minimums, minimal fees, a simple onboarding process and an intuitive mobile app, Chase might seem like great place to get started. But is it?

As you’ll learn in this Chase brokerage account review, more sophisticated investors or active traders may find the banking titan’s brokerage accounts to be lacking.

Want to see if Chase is right for you? Keep reading for a detailed Chase investing review that can help you decide your next steps:

Our TOP brokerage account…

Chase has plenty of banking benefits to offer, but when it comes to brokerage services, we think it falls flat. In my opinion, eToro is a superior alternative.

eToro is a unique online broker that offers social trading, which allows users to subscribe to popular traders and copy their trades automatically. eToro also offers access to thousands of stocks, ETFs, index funds, as well as over 50 cryptocurrencies.

With an intuitive, easy-to-use platform and the variety of assets available, eToro is a fantastic platform for both new and experienced investors. Get started on eToro today.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

J.P. Morgan Chase Investment Account Review in 2026

The Bottom Line: Commission-free trading, no account minimums, and a simple onboarding process make Chase investment accounts a solid choice for existing Chase clients and beginner traders alike.

However, a lack of advanced tools and limited tradable products can be a deal-breaker for advanced investors and active day traders.

Chase Brokerage Account Overview

Chase offers a few different types of brokerage accounts:

- General investment account

- Traditional IRA account

- Roth IRA account

With your chosen Chase brokerage account, you can invest in a variety of asset classes, including:

- Stocks

- ETFs

- Mutual funds

- Options

- Bonds

With the exception of options trades (which come with a small fee), the platform offers no-fee trading.

Plus, the easy-to-use platform can be integrated with your existing Chase accounts, so you can manage them all in a single app.

However, the platform doesn’t offer a lot of tools for active investors or day traders who use more sophisticated instruments such as options or futures contracts for their strategies.

For instance, you can’t trade futures, FX, or cryptocurrency with a Chase brokerage account, and options trading contract fees can add up if you’re a high-frequency trader.

As you’ll see in this Chase brokerage account review, the accounts are more suitable for passive or buy-and-hold investors. Let’s take a deeper look:

Pros of Chase Investment Accounts

Here’s a detailed breakdown of the benefits of Chase Investment accounts:

Low and No-Fee Trading

Low or no-fee trading is a big selling point of Chase accounts:

- No fees for trading stocks, mutual funds, and ETFs

- No inactivity fees

- No withdrawal fees

These days, no-fee online trading for U.S.-listed stocks and ETFs has become the industry standard. However, many Chase investment reviews praise the company for offering no-fee online mutual fund trading. That’s not necessarily the industry norm, and it can save you some hefty fees.

In contrast, brokerages like Interactive Brokers, Ally Invest, and Merrill Edge do charge to trade mutual funds — anywhere from $10 to $20 per trade.

Mutual Fund Fees (Comparison)

Chase | Interactive Brokers | Ally Invest | Merrill Edge |

No-fee | $15 | $10 | $20 |

Note: While Chase has $0 for mutual funds, it’s not for all mutual funds (only US-based). Similarly, the other platforms also have $0 trades for certain types of mutual funds.

Chase also encourages you to invest on your terms, since it charges no withdrawal or inactivity fees. With such a friendly fee structure, you can invest at your pace without pressure.

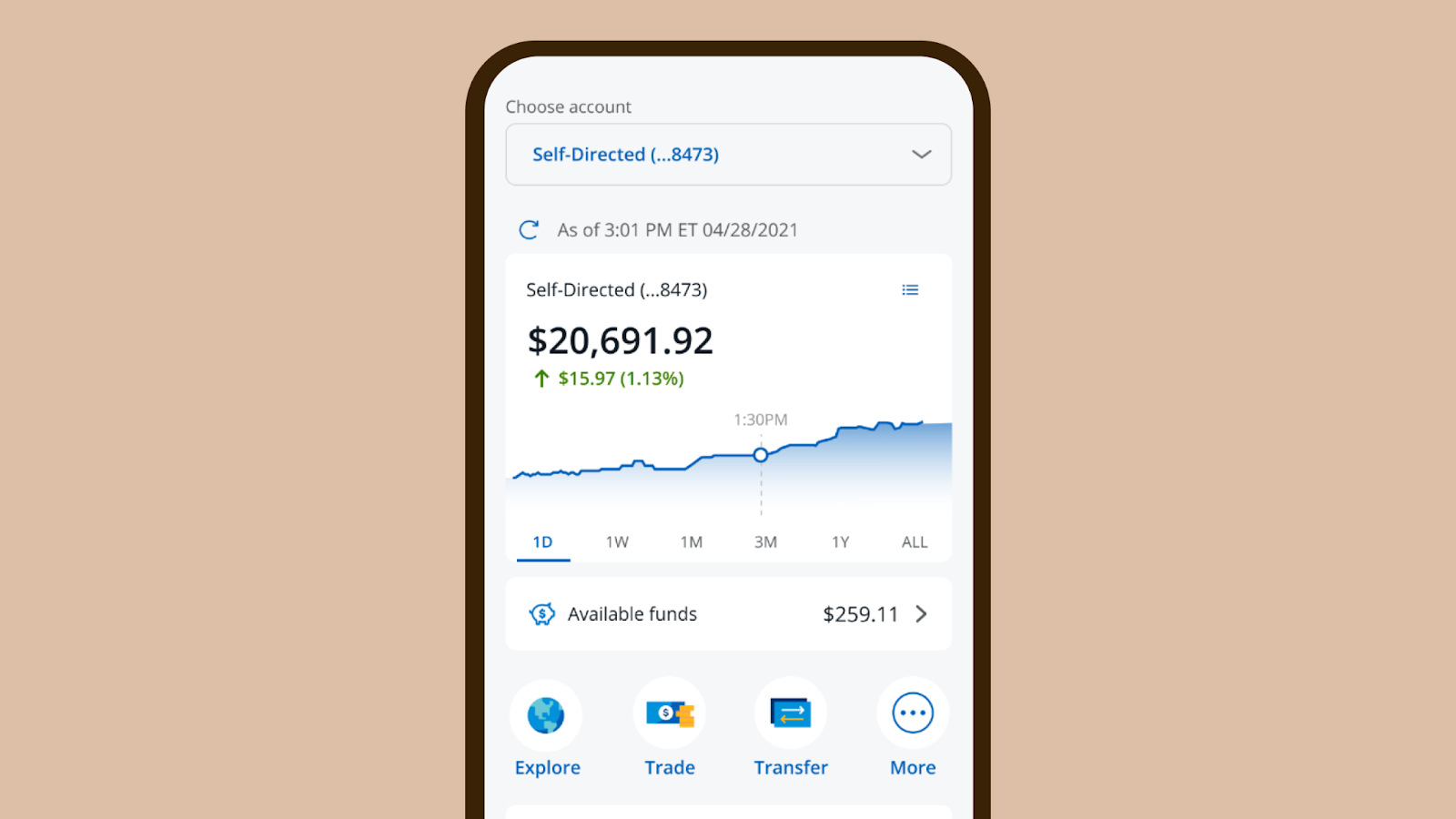

Simple Trading Platform

Chase has an extremely user-friendly platform for trading. The Chase mobile app is designed to enable effortless trading on the go, with an intuitive UI and simple workflow.

Self-Directed Investing Account

The Chase trading platform offers two account types: a Self-Directed Investing account and an Automated Investing account (for AI-driven investing).

If you want to open the former, you start by choosing an account type:

- General investment account

- Traditional IRA

- Roth IRA

Then you’ll be prompted for some personal details to open the account, and then you’ll be ready to invest on the easy-to-use platform.

If you need a little more help, Chase offers a Portfolio Builder feature.

This feature can help propose an asset allocation split between stocks, ETFs, fixed-income securities, and other investments. However, you must have at least $2,500 in your account to be eligible for this service.

If you’re interested in a service like this but don’t like the idea of having to maintain a $2500 minimum balance, consider Empower’s free dashboard, which is loaded with investing tools like a retirement planning calculator, “investment check up tool,” and more. Sign up for Empower’s FREE dashboard today.

Automated Investing account

Up until recently, Chase offered a robo-advisor service; however, it was discontinued in May of 2024. If you’re interested in kobo-advisor services, two platforms that might interest you are M1 Finance and Acorns.

If passive investing and squirreling away your small change sounds like your speed, Acorns might be the perfect fit. The platform allows you to round up everyday purchases to the next dollar and then deposit the change into your investment account, which automatically invests for you based on your profile, which is determined with a short quiz about your investment objectives and risk tolerance.

M1 Finance is a little more juiced-up, with a few more options for automated investing and other brokerage services. Check out our M1 Finance review to learn more.

However, if you’re less interested in automated investing and more interested in stock-picking, keep scrolling for our top brokerage picks.

Managing Multiple Chase Accounts With a Single App

If you’re an existing Chase customer, one of the big benefits of using Chase as a brokerage account is that you can manage all of your accounts on the same platform and mobile app. That includes easy transfers between accounts.

If you have multiple Chase accounts, you can access all of them with one username and password but you’ll need to link them via the “Manage linked accounts” option which you’ll find inside the “Profile & Settings” option in the app.

Do you have both personal and business accounts with Chase? You can easily switch between your personal and business accounts as they are labeled in the app as “Business” and “Personal”.

Cons of Chase Investment Accounts

While the Chase trading platform offers a lot of benefits, there are potential downsides.

Namely, the account types and tradable assets are limited. For many long-term investors, this won’t be a problem.

However, if you’re a more active or sophisticated investor, a few things could prove problematic, namely:

- Limited tradable assets

- No cryptocurrency trading

- No futures trading

- No foreign exchange trading

- No demo account

- Limited ability to trade fractional shares

Let me explain.

Limited Tradable Assets

Chase offers trading for these assets: stocks, ETFs, Options, Mutual funds, and bonds.

However, it does not offer many instruments used by active traders like Forex, futures, and crypto.

So if you’re interested in the aforementioned assets, or if you want a more diverse portfolio, Chase might not be the right fit.

No Crypto Trading

Chase doesn’t offer crypto trading.

So if you’re hoping to win big in volatile markets, or even just to diversify your portfolio beyond traditional assets like stocks and bonds, you’re out of luck. (If you’re interested in crypto trading, we recommend eToro — we’ll talk more about the platform below.)

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

No Demo Account

Demo accounts, or trading simulators, can be an invaluable tool for investing newbies who want to get familiar with how trading works without putting real money on the line. They can also help experienced investors test new strategies.

While Chase doesn’t offer a demo account, it does offer other educational resources, including:

- Educational articles

- Educational videos and tutorials

- Research reports

- Market news

While you’ll certainly benefit from these topics, you won’t have the opportunity to learn by doing that comes with a demo account.

Our TOP demo trading platform…

Hands-down, eToro is our favorite trading simulator. It’s easy to sign up and get started with a demo account where you can practice investing with $100,000 in virtual funds. Check out the demo account on eToro today.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Limited Fractional Shares

Fractional shares, or portions of stock shares, make it easier for you to buy expensive stocks that otherwise may be inaccessible.

Fractional shares let you build a more diverse portfolio and get ROI from top-tier companies’ stocks for affordable initial investment.

Unfortunately, Chase only offers fractional share trading on S&P 500 and NASDAQ 100 stocks, as well as ETFs.

Who is Chase Brokerage Account Best For?

Chase brokerage account is best for:

- New investors

- Casual investors

- Existing Chase clients

Here’s why…

New investors will love the easy-to-use and beginner-friendly trading platform. Plus, no account minimum makes it easy to get started fast.

Plus, existing Chase clients will benefit from the platform’s integration of all their Chase accounts in one app so you can check all your balances in one place.

Why Public and eToro Are Better Than Chase Investment

While Chase has a lot to offer for new investors, advanced traders may opt for a platform like Public or eToro, since they provide more tradable assets, educational resources, and trading tools.

eToro vs Chase

Here’s what eToro has to offer:

- No-fee Crypto, Forex, CFDs trading: Unlike Chase, eToro offers no-fee crypto trading, Forex and CFDs. The wider variety of tradable assets makes it more appealing for active traders.

- Beginner-friendly trading features: The eToro trading platform comes with a unique CopyTrader feature that lets you see and follow the trades of successful pro traders on the platform. This gives you the chance to learn from experienced traders and potentially improve your trading performance.

- No-fee options trading: Both Chase and eToro offer options trading, but Chase charges you $0.65 per trade, while eToro offers fee-free options trades.

Public vs Chase

Here’s what Public has to offer that Chase doesn’t:

- Social investing features: Public.com allows you to join a robust online community of investors and see their trades. This is great support for beginner investors as the online community can give you access to new investment ideas.

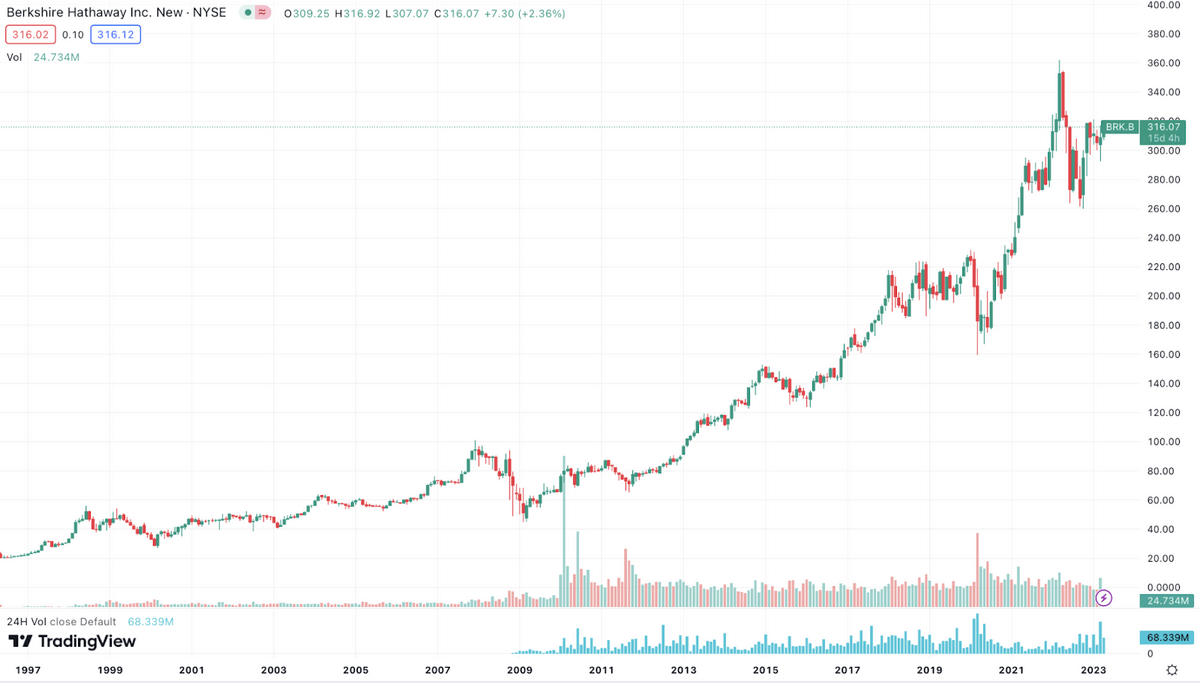

- Fractional shares: Unlike Chase, Public.com offers fractional shares, so you can buy a portion of a stock share or ETF. This is useful if you have a small account but want to diversify your portfolio with shares of companies like Tesla (NASDAQ: TSLA) Apple (NASDAQ: AAPL), and Berkshire & Hathaway (NYSE: BRK.B — chart below), which may be too expensive otherwise.

Final Word: Chase Investment Account Review

If you’re an existing Chase customer, a beginner investor, or you just like stress-free casual trading, then a Chase investment account could be a great fit.

In this Chase investing review, you’ve learned the platform’s benefits, including low fees, easy integration with other Chase accounts, automated tools, and an easy-to-use app.

But while these features might be great for casual investors, they might not be as appealing for serious investors, speculators, or traders.

Forex, futures, and crypto are not available, and the platform isn’t optimized for day traders. So if you’re interested in these features, you should seek an account elsewhere.

FAQs:

Is Chase Investment Account Free?

There’s no account minimum for Chase brokerage accounts. You can trade stocks, mutual funds, ETFs, and more either fee-free or for low fees.

How Much Money Do You Need to Invest With Chase?

Chase requires no account minimum for trading and the brokerage also doesn’t charge you for trading stocks, ETFs, and mutual funds. However, If you want to trade options with Chase, the brokerage charges $0.65 per contract.

Is JPMorgan a Good Investment Company?

J.P. Morgan and Chase investment reviews can be mixed. The company has been in operation for over 200 years, it is FDIC-insured, and has an overall reputation as a well-respected financial institution. However, J.P Morgan Chase has been involved in several regulatory incidents, including the “London Whale” scandal of 2012.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.