What is the Best Dividend Tracker in 2026?

Sharesight is the best overall platform with the widest range of features for serious dividend investors. (Plus, we worked with Sharesight to get our readers an excellent offer — get 4 months free with an annual plan purchase.)

If you’re looking for something free, Snowball Analytics’ free version and Empower both offer excellent portfolio dividend tracking tools.

Here’s how each app compares:

App | Best for | Free tier? | Premium tier cost |

|---|---|---|---|

Global investors | Yes (up to 10 holdings) | From $7/month | |

Snowball Analytics | Balanced dividend analysis | Yes (1 portfolio) | From $6.70/month |

Free portfolio tracking & wealth tools | Yes | N/A (Free) | |

Stock Events | Mobile-first tracking | Yes | $49.99/year |

Total beginners (auto-investing) | No | $3–12/month | |

All-in-one social investing | Yes | Tipping optional ($8/mo for advanced trading) | |

TrackYourDividends | Income-focused control | Yes (Unlimited manual portfolios) | $9.99/month |

Simply Safe Dividends | Dividend safety scoring & research | No | $468/year |

1. Sharesight – Best Overall for Global Investors

- Free features: Track up to 10 holdings, automatic dividend tracking, capital gains reports

- Premium subscription: From $19/month – unlocks unlimited holdings, DRIP support, advanced tax reports

- Supported platforms: Web

- Special offer: WSZ readers get 4 months free with the purchase of an annual plan — get the offer here

Sharesight is a powerful portfolio tracking app for investors with global portfolios. Sharesight tracks 60+ markets and connects with 200+ brokers worldwide.

For dividend tracking, Sharesight can track distributions from over 700,000 global stocks, ETFs and mutual funds going back up to 20 years.

There’s a free version available, which allows you to track up to 10 holdings. But if you’re a serious investor, you can get detailed dividend tracking, advanced tax reporting, and a host of other features with Sharesight Premium. Plus, dividends and portfolio income are automatically converted to the local currency you receive them in.

Sharesight Premium features:

- Full dividend tracking with Dividend Reinvestment Plan (DRIP) adjustments

- Income breakdowns (capital gains vs. dividends)

- Advanced tax-ready reports (e.g. taxable income, capital losses)

- Foreign exchange tracking for international dividends

- Integration with Xero and other accounting tools

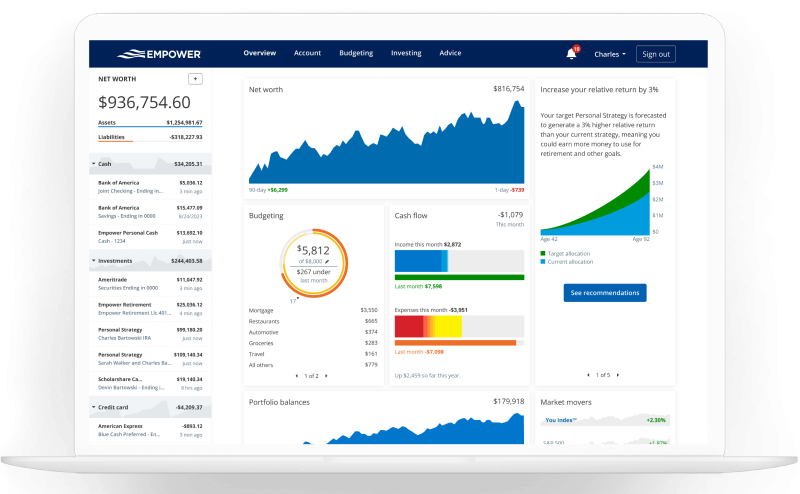

2. Empower – Best Free Dividend Tracker

- Free features: Full account aggregation, dividend tracking, net worth monitoring, retirement planning tools

- Premium subscription: None required

- Supported platforms: iOS, Android, Web

Empower Personal Dashboard is one of the best free personal finance apps available — with budgeting, investment tracking, fee analysis, and dividend tracking, all at no cost.

But more than just a dividend tracker, Empower gives you real analysis and insights into your full investment portfolio, including the fees you’re paying, how your performance compares to industry benchmarks (like the S&P 500), and even if you’re on track for retirement.

Empower doesn’t have many of the dividend-tracking alerts and features of other apps on this list, but will track every dividend that gets paid out in your account.

Plus, the portfolio analysis alone is worth linking your accounts to see if your dividend strategy is keeping up with the markets. Empower if free forever, so no need to upgrade to get access to premium features.

What You Get With Empower:

- Full view of dividend income across accounts

- Historical income reports and investment performance

- Asset allocation and fee analysis tools

- Free retirement planner

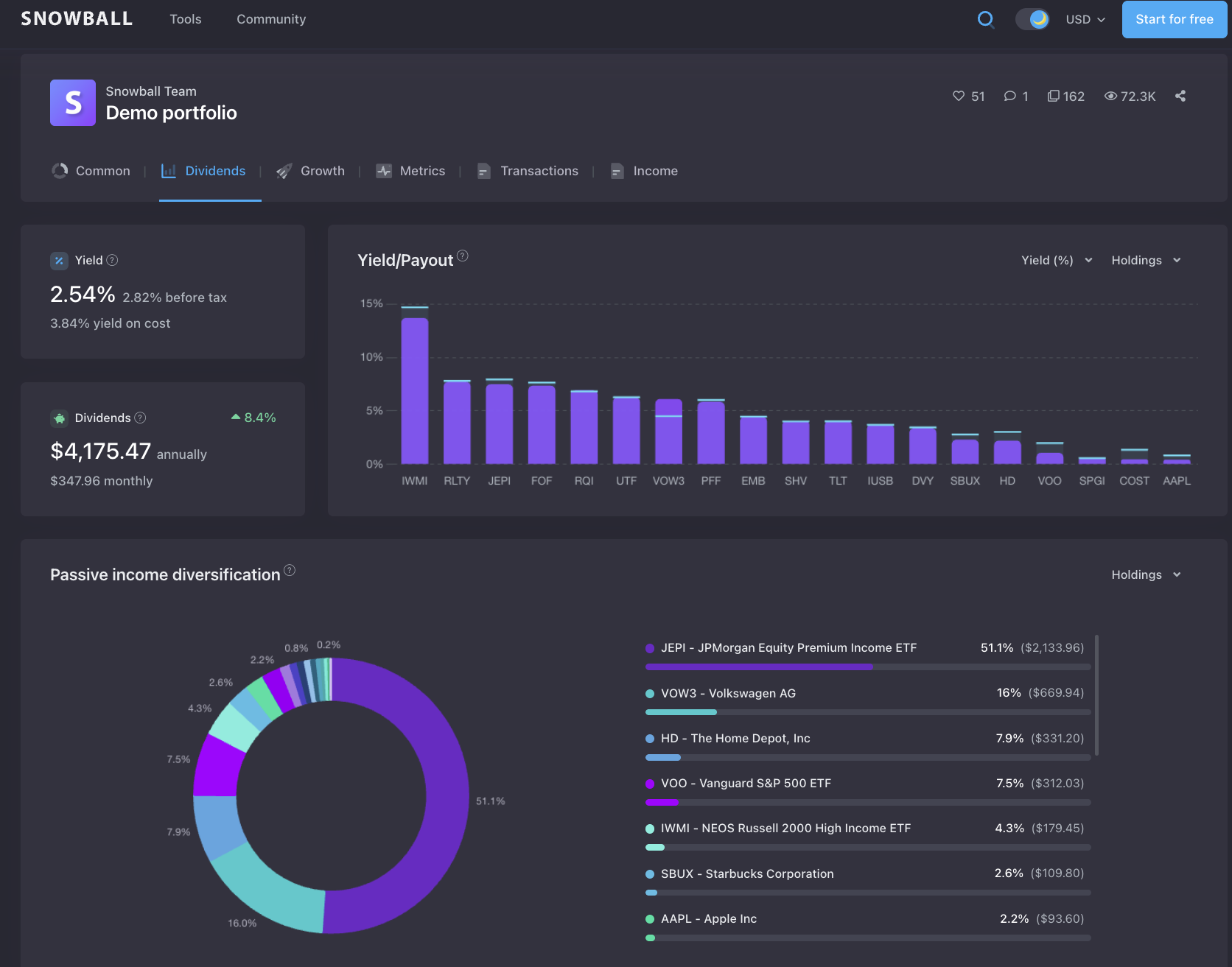

3. Snowball Analytics – A Solid All-Around Pick

- Free features: Unlimited manual portfolios, basic dividend tracking, dividend calendar

- Premium subscription: From $6.70/month – unlocks brokerage sync, DRIP simulator, forward income forecasts

- Supported platforms: Web

Snowball Analytics is a portfolio tracking app that offers robust dividend tracking — even on their free plan.

The user interface is extremely well designed, making it easy for investors to quickly see payouts (per stock), total dividends accumulated, and the average yield across your entire portfolio.

In the free version, you can add your holdings manually and track dividends (and upcoming dividends) with the dividend calendar.

For just $6.70 per month (paid annually), you gain access to brokerage syncing for automatic tracking, a dividend reinvestment simulator (DROP), and unlimited holdings in a single portfolio.

Snowball Analytics also gives each stock you hold a dividend rating, with lower-rated stocks at risk of dropping or cutting their dividend.

Snowball Premium features:

- DRIP simulator to test reinvestment growth

- Future income forecasting

- Yield-on-cost, diversification, sector breakdown

- Portfolio syncing with brokers

- Clean UI and exportable reports

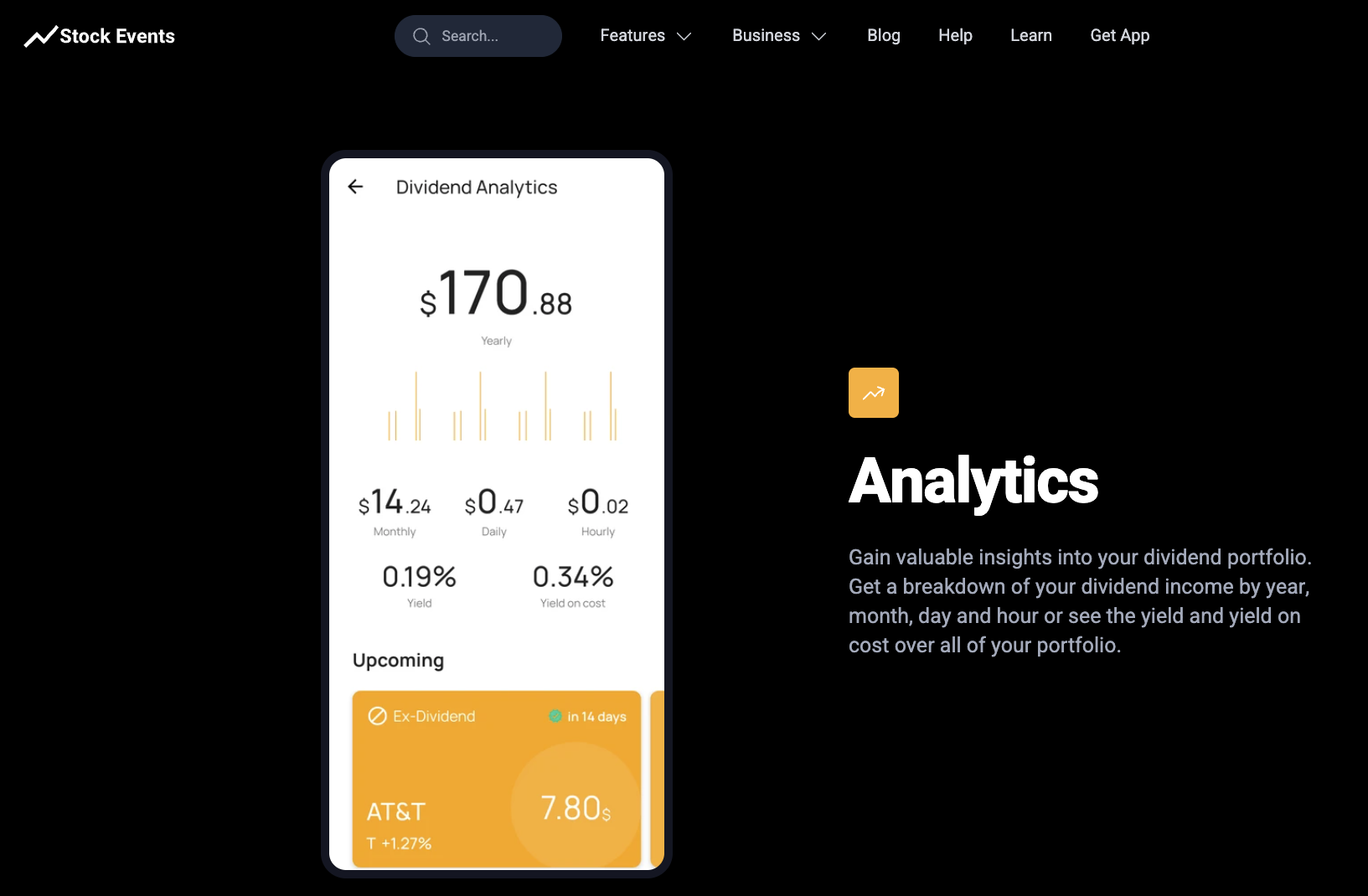

4. Stock Events – Best Mobile Dividend Tracker

- Free features: Real-time market tracking, dividend calendar, ex-date alerts, basic portfolio tracking

- Premium subscription: $49.99/year – unlocks advanced analytics, custom alerts, and full device sync

- Supported platforms: iOS, Android, Web

Stock Events is a sleek, mobile-friendly tracker with excellent visual tools. You can break down dividend income by day, month, or even hour. The premium version unlocks a complete analytics dashboard with customizable dividend views and notifications.

Stock events is only available in iOS and Android devices, so it’s truly designed for mobile users only. While the free version allows you to track dividend on a portfolio of up to 15 stocks, upgrading to PRO gives you unlimited tracking, watchlists, multiple portfolios, and a host of useful features for tracking your dividend portfolio.

What You Get With Stock Events PRO:

- Push alerts for dividend dates and payouts

- Stock dividend calendar connection

- Performance breakdowns by country, sector, and asset type

- Advanced dividend charts and yield-on-cost insights

5. Acorns – Best For Total Beginners

- Free features: None – all investing plans require a monthly fee

- Premium subscription: $3/month (Investing), $12/month (Investing + Premium tools)

- Supported platforms: iOS, Android, Web

Acorns is a robo-advisor platform that is known for rounding up your spare change and investing it in a diversified portfolio automatically. But you can also choose to create a custom portfolio of dividend stocks that offer high yields with no trading fees.

Acorns gives you alerts whenever dividend payments hit your account. And while there is no free tier, eventually your portfolio of dividend stocks could easily pay for the $3 monthly fee (and then some). The best part of Acorns? You just have to deposit money (or round up your purchases), and it will automatically

What You Get With Acorns:

- Hands-off dividend investing via ETFs

- Automatic reinvestment of dividends

- Basic dividend income view

- Educational content on dividends and compound growth

6. Public – Best All-in-One Solution

- Free features: Full investing platform, dividend history, DRIP support, community feed

- Premium subscription: None required; tipping optional for creators; $8/mo for advanced trading features

- Supported platforms: iOS, Android, Web

Public is an all-in-one investing app that gives you access to a wide range of investments, including thousands of dividend stocks and ETFs.

Once you invest in dividend-paying stocks or ETFs, you’ll find a dedicated “Dividends” section showing your payout history, estimated income, and details about upcoming distributions. You can even enable dividend reinvestment (DRIP), which lets your dividends automatically purchase more shares, helping your portfolio grow faster over time

Public issues alerts when you receive a dividend on stocks and ETFs that you hold, making it easy to see and track. But Public also offers access to more than just stocks, with the ability to invest in U.S. Treasuries, bonds, options trading, and even crypto (through partner Bakkt).

If you want a complete investing app to track dividends and a wider portfolio of investments, Public is a great option.

What You Get With Public:

- View and manage dividend payments

- DRIP reinvestment for fractional shares

- Payout notifications and income summary

- Themed lists of dividend stocks for exploration

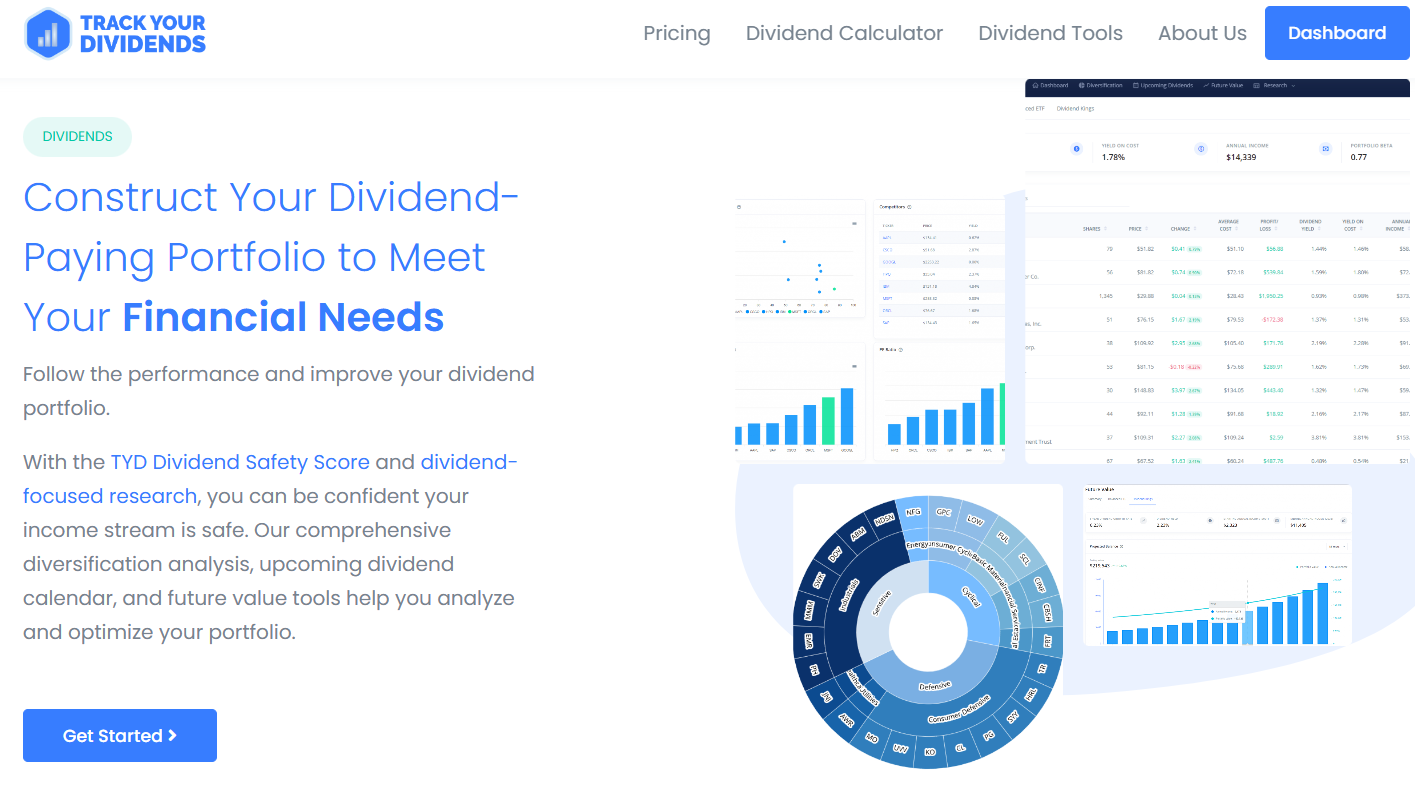

7. TrackYourDividends – Best Income-Focused Control

- Free features: One brokerage sync via Plaid, unlimited manual portfolios, dividend calendar

- Premium subscription: $9.99/month or $99.99/year – unlocks dividend safety scores, income projections, and portfolio analytics

- Supported platforms: Web

TrackYourDividends is a clean and simple dividend portfolio tracker with access to a dividend calendar, yield tracking, and income breakdowns — even on the free plan.

Want to create a DIY dividend tracker spreadsheet?

TrackYourDividends has a bunch of great templates — get them here.

You can sync one brokerage account via Plaid, and it will pull in your holdings to calculate estimated dividends, upcoming payments, and historical income. You can also manually enter unlimited holdings across multiple portfolios, or upgrade to Premium for unlimited portfolios and automated tracking.

TrackYourDividends offers a “TYD Safety Score” which helps identify risky stocks likely to cut dividends. And you can see future income projections for individual stocks and ETFS that let you forecast what your monthly or annual dividend income could look like as your portfolio grows.

Combined with a dividend stock screen to find your next favorite dividend stock, and TrackYourDividends is one of the better options available for dividend-focused investors.

What You Get With Premium:

- Unlimited portfolio syncing

- Projected income charts and growth modeling

- Custom dividend alerts and portfolio insights

- Dividend safety scoring

- Diversification by sector, stock, and income concentration

- Dividend screener with filters

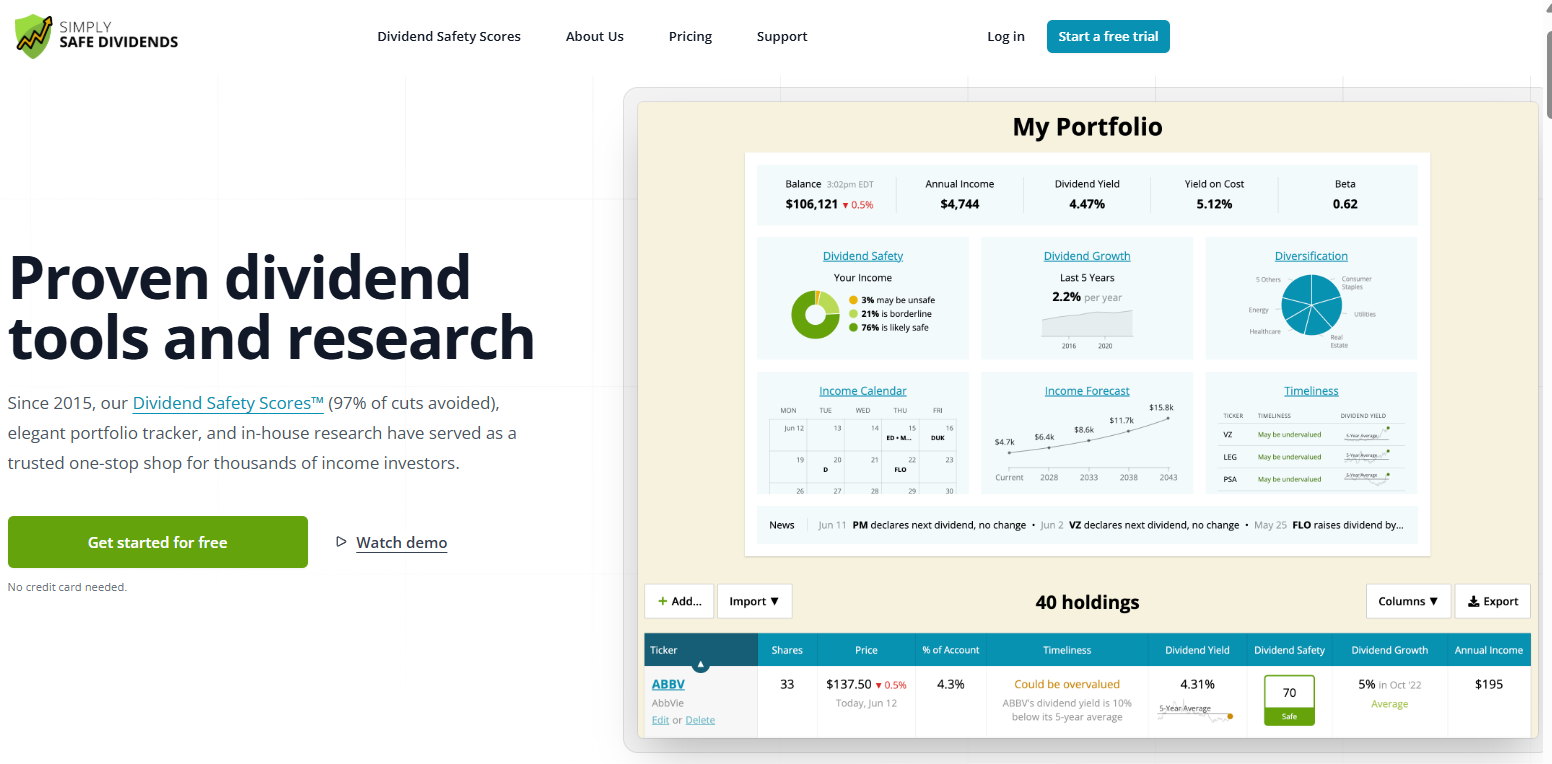

BONUS: Simply Safe Dividends – Best for Dividend Safety Scores

- Free features: None

- Premium subscription: $399/year

- Supported platforms: Web

Simply Safe Dividends is a premium research tool built for income-focused investors. It connects to your brokerage to track all dividends, or you can manually build portfolios to get dividend safety ratings, forward income forecasts, and alerts about payout changes.

The power of Simply Safe Dividends comes in its clean user interface, dividend calendar view, and the safety alerts to catch up to 97% of dividend cuts before they happen.

There is no free version, and membership costs $399/year. If you’re a serious dividend investor that wants to retire on dividend income alone, Simply Safe Dividends is worth a look.

What You Get With Membership:

- Dividend Safety Score for 1,000+ stocks and ETFs

- Income calendar and diversification breakdown

- Alerts for dividend cuts, suspensions, or raises

- 10-year dividend history, payout ratio, and yield stats

- Custom portfolio tools for planning and optimization

What is a Dividend Tracker?

A dividend tracker is an app that connects with your investment portfolio and finds all dividend payment activity in your account. The best dividend trackers will analyze your investments, show the upcoming dividend payment schedule for each of your stocks and ETFs, and help project your potential dividend income.

Most quality dividend trackers have a premium version that will cost money, but if you’re focused on building an income-producing portfolio of dividend stocks without getting burned by bad companies, it’s usually worth the upgrade. And the best apps even offer tax forms, in-depth portfolio analysis, and even alerts for when you receive payments.

Final Word:

There are many dividend trackers to choose from, but the one that works best for you depends on your investing goals. Some trackers offer everything (Snowball Analytics, Sharesight) while others offer simple tracking to help you keep an eye on your dividend income (Stock Events, TrackYourDividends).

It’s best to pick a tracker that offers a simple user interface, a built-in dividend calendar (so you know when you’re getting paid), and some type of safety score to help you avoid stocks that are likely to cut their dividend payments.

With a good dividend tracker, you and build a solid income portfolio of quality stocks that can pay you for years to come.

FAQs:

What is the best dividend tracker app?

Sharesight is the most comprehensive dividend tracker app for global investors with large dividend portfolios. It offers tracking for over 700,000 stocks and ETFs globally, have advanced tax reporting, and gives detailed insights into your dividend income, payout schedule, and analysis of stocks and ETFs you hold.

How to make $1,000 a month in dividends?

It all depends on what you invest in. If you own dividend stocks with a yield of 4% annually, you need to earn $12,000 per year. This means you’d need to hold around $300,000 of dividend stocks paying that 4% yield to earn $1,000 per month.

What is the 25 rule for dividends?

According to Investor.gov, the 25% rule for dividends is when a stock’s dividend is 25% or more of the stock value, special rules apply to the determination of the ex-dividend date.

With a 25% or larger dividend, the ex-dividend date is deferred until one business day after the dividend is paid. This means if the dividend is paid on July 25, 2025, the ex-dividend date would be July 26, 2025.

How do I track all dividends?

To track all of the dividends paid in your portfolio, you’ll need a dividend tracker app that can parse the payment information and showcase your income in an easy-to-understand way.

The best apps will show you your total income (per month, per year), your upcoming dividend schedule, and the quality of the stocks and ETFs you hold in your portfolio.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.