What’s the Best AI For Stock Market Research?

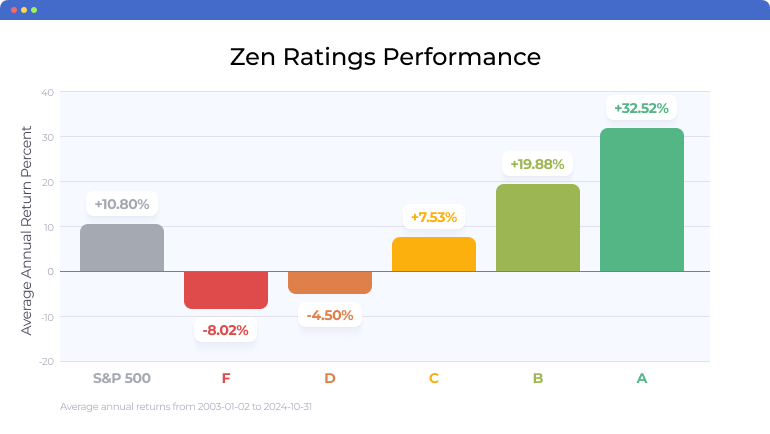

Zen Ratings is our top pick for AI stock research tools for its comprehensive 115-factor review of each stock, AI rating factor powered by machine learning and 20+ years of historical data, plus integrated expert analysis to arrive at a trustworthy stock rating number.

We’ll break down why we think Zen Ratings takes the cake in this comparison, but also compare six other worth AI-powered stock research platforms. We’ll break down what makes each of them unique, who each is best for, and the cost of each tool.

1. WallStreetZen – Zen Ratings

- Best for: AI stock analysis with expert insights

- Key Features: AI ratings model with backtested data, integrated expert analysis, watchlists, forecasts & recommendations

- Cost: Free plan available; for added features, try a Premium membership for $1 (renews at $234/year). See plans here

Zen Ratings is an AI-driven research platform that boasts a track record of average annual returns of 32.52% for A-rated stocks. Combining AI number crunching with machine learning and expert market analysis makes this a comprehensive (but easy to understand) research tool for smart investors.

Go ahead — enter any ticker here and check out its Zen Rating. I’ll wait.

As part of its 115-factor review of each stock, the overall Zen Rating includes a proprietary AI factor that leverages machine learning to locate stocks with market-beating potential.

The Zen Rating AI factor stands out among AI investing tools by merging key elements — earnings, cash flow, price movement, and industry trends — into a single, actionable insight.

This factor employs machine learning using a Neural Network trained on 20+ years of fundamental and technical data. It can detect patterns beyond human capability, offering a deeper view of not only past performance but potential for future price movements.

Plus, with advanced cross-validation, the artificial intelligence avoids overfitting. That’s a fancy way of saying it adapts to the market today and in the future, adjusting for things like market volatility rather than just past market trends.

Zen Ratings is free, but to unlock limited stock research, you’ll want to upgrade to a Premium membership.

What You Get With Premium Membership

- Access to the most up-to-date list of A-rated stocks

- Access to premium screeners like the popular Strong Buy Ratings From Wall Street’s Top Analysts screener

- AI-powered stock picking with Zen Ratings with an AI score for each stock

- Forecasts and recommendations from top-performing analysts

- One-sentence explanations of Why Price Moved

- Important email updates for your watchlist stocks

2. Seeking Alpha Premium

- Best for: Detailed stock analysis summaries

- Key features: AI-powered stock analysis, simple ratings system with multiple factors, access to Seeking Alpha’s industry-leading research platform

- Cost: Starts at $4.95 for 1 month (then renews at $299/year). See plans here

Seeking Alpha Premium offers access to AI-powered Virtual Analyst Reports to provide advanced market analysis and stock recommendations. Harnessing the power of AI and Seeking Alpha’s breadth of historical and current financial market data, Virtual Analyst Reports offers a digestible evaluation of thousands of stocks and ETFs.

The Virtual Analyst Reports use AI algorithms to analyze historical and current financial data, earnings reports, and analyst ratings, giving each stock a ranking to help you make better investment decisions.

These reports help you crunch the data to find ones that fit your investment goals, and use AI to help predict future price movements.

Ratings are given for each stock based on several factors, including:

- Valuation

- Growth

- Profitability

- Momentum

- Earnings Revisions

Related reading: Check out our Seeking Alpha review

What You Get With Membership

- Premium investing tools and analysis

- Unlimited investing expert content

- AI-powered Virtual Analyst Reports

- Stock ratings based on financial metrics

- Exclusive research reports

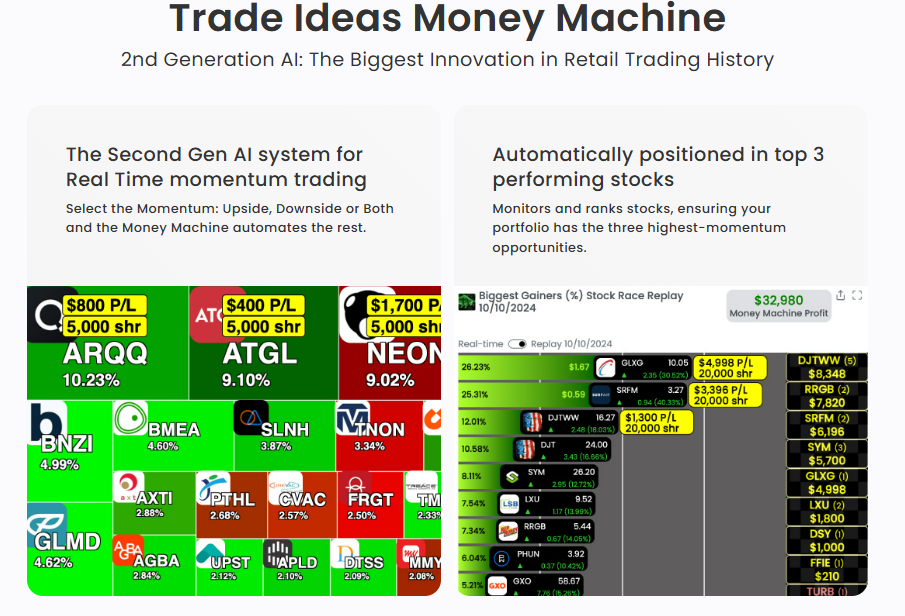

3. Trade Ideas

- Best for: Active traders and real-time data

- Key features: Nightly backtesting, trade setup ideas (including stop-loss and take-profit data), AI system “Holly” that continuously monitors market data in real-time

- Cost: Starts at $89/month. See plans here

Trade Ideas is an AI stock analysis platform that offers real-time research and uses machine learning to generate high-quality stock picks and trade signals.

Designed with active traders in mind, Trade Ideas offers 1-click trading directly from the chart by linking your brokerage, allowing you to quickly execute trades directly from the platform.

Trade Ideas is powered by an AI system named “Holly” that runs backtests for thousands of stocks on a nightly basis to help you find the best stocks for the next trading day. Holly continuously reviews market data to adapt its predictions in real-time, so your trades are always relevant to recent market movements.

Trade Ideas’ AI system is designed to help you find the best trade setups — and even suggests optimal stop-loss and take-profit levels for each trade. This makes Trade Ideas a powerful ally when you’re looking to profit on short-term trade setups.

Related reading: Check out our Trade Ideas review

What You Get With Membership

- Holly AI assistant

- Pre- and post-market scans to identify trades outside regular trading hours

- AI-powered stock scanning

- Real-time trade alerts

- Simulated trading to test your ideas first

- Customizable filters for focusing on specific metrics

- Market replay for backtesting strategies

- Proprietary AI trade signals with risk management (SmartStop)

- Fully automated trading bot for hands-free investing

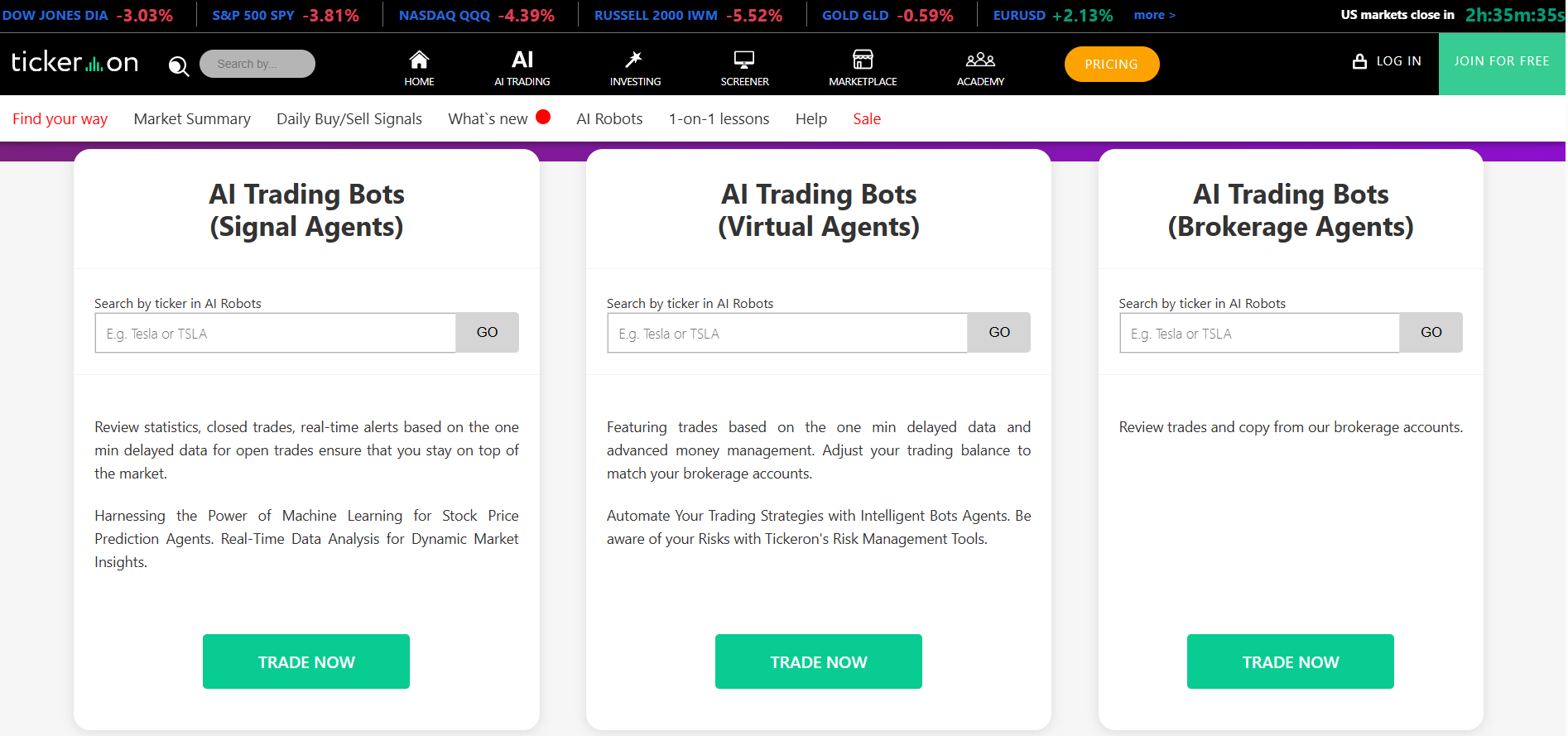

4. Tickeron

- Best for: AI trading bots

- Key features: AI-powered trading bots, technical analysis, pattern recognition, and buy/sell signals

- Cost: $60/year for daily buy/sell signals, trading bots start at $90/month. See plans here

Tickeron is a marketplace for AI bots and research tools that can help you find trade signals, trade setups, and even copy trades.

The basic membership gives daily buy/sell signals, and you can add on trading bots, AI search engines, AI patterns, an AI stock screener, and other real-time analysis tools for a hefty monthly fee.

Tickeron offers AI-powered technical analysis and pattern recognition tools, AI stock prediction, and an AI-powered stock screener with buy/sell signals for each stock. This combines the power of AI to quickly crunch an overwhelming amount of market data and analysis to give you signals and ratings for stocks and other investments.

Tickeron also specializes in trading bots, with the ability to create trade setups and even execute trades automatically within your connected brokerage account. These bots have specific trading strategies and can employ advanced trading strategies such as long and short positions, as well as stop-loss and take-profit orders.

Tickeron is expensive, though, and adding on trading bots and AI tools can cost you over $100/month. But if you want AI-powered analysis that you can customize, Tickeron is worth considering.

What You Get With Membership

- AI-powered daily buy/sell signals

- Upgrade to get a trading bot of your choice

- Add-on AI pattern-recognition tools

- Add-on AI trend prediction analysis

- Add-on AI stock screener with buy/sell signals

- Add-on AI-based model portfolios for longer-term investors

- Add-on AI-based active portfolios for active traders

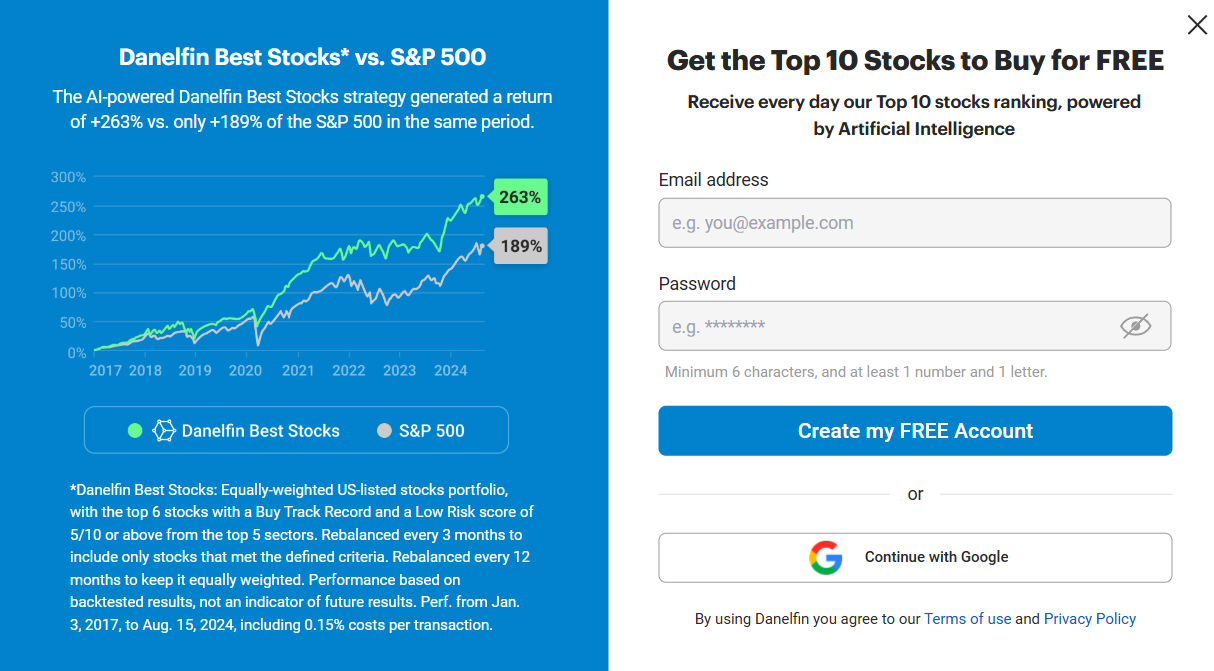

5. Danelfin

- Best for: Global investors

- Key features: AI-powered “best stocks” list, DanelFin ranking, AI Score for U.S. stocks & ETFs and European stocks

- Cost: $25/month up to $70/month. Free plan available.

DanelFin is an AI-powered stock research platform that offers a list of “Best Stocks” that update on a rolling 3-month period. These stocks have outperformed the S&P 500 since 2017, and come with a DanelFin 1-10 ranking. Rankings are included for both U.S. and European stocks.

There’s also an “AI Score” for all U.S. stocks, Europe 600 stocks, and U.S. ETFs. This score is based on the probability for a stock to beat the market over the next three months.

DanelFin also utilizes AI to create trade ideas for specific stocks, with multiple price targets and buy/sell signals. This allows you to create trade setups and strategies for winning short- and medium-term trades.

There’s a free version to get the list of top 10 stocks, but you can upgrade to a $25/month plan for trade ideas and access to all AI scores for all stocks and ETFs. The Pro plan allows you to download historical data back to 2017 for a deeper dive into AI scores for stocks and ETFs over time.

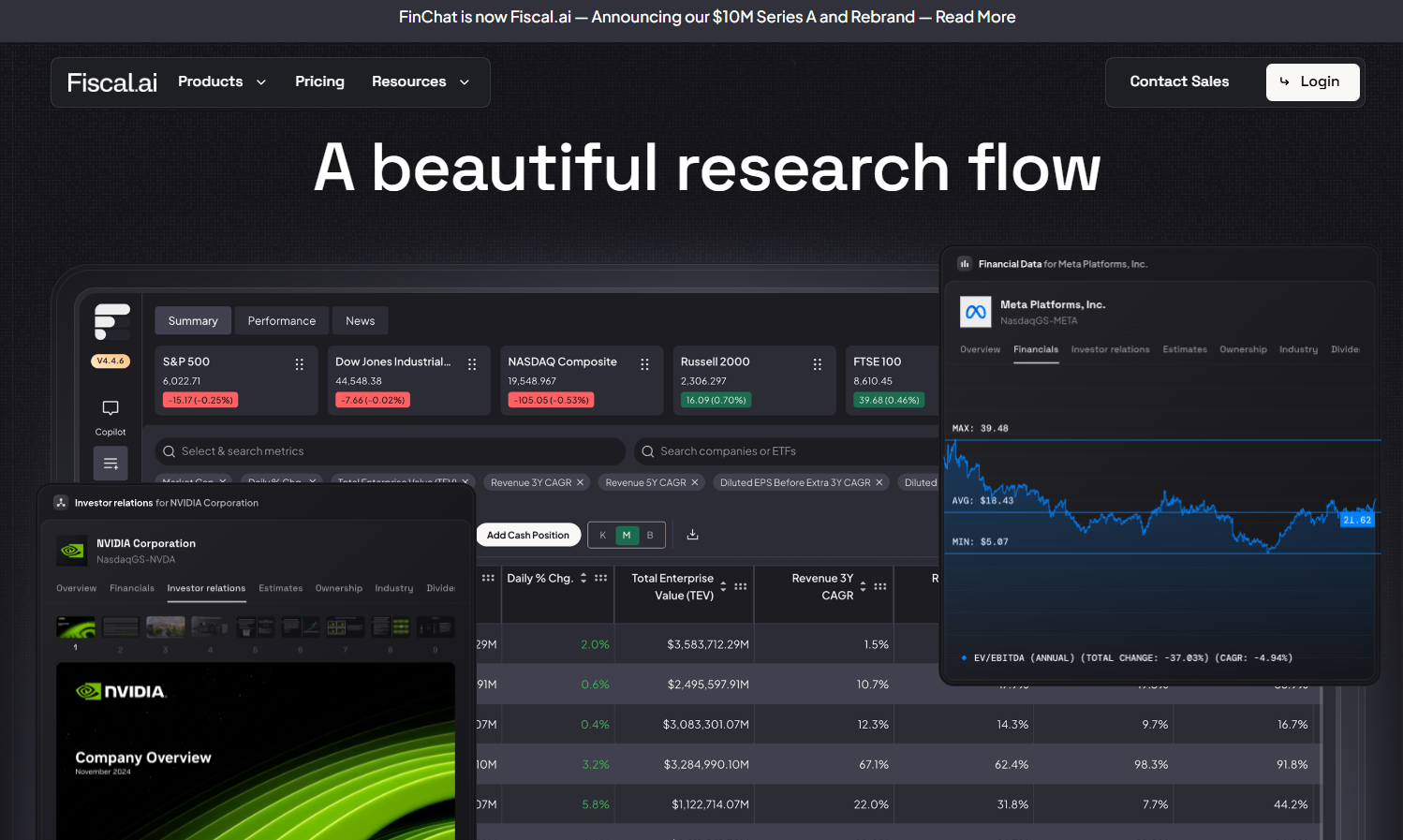

6. Fiscal.ai (Formerly FinChat.io)

- Best for: Deep AI research with a “chat” interface

- Key features: Live chat AI stock research, access to data from 100,000+ investments globally, AI summaries, 20+ years of data

- Cost: $24/month up to $199/month. 2-week free trial available. See plans here

Fiscal.ai is a fundamental research terminal for investors that is powered by AI. If you want deep, accurate data analysis in an easy-to-read dashboard, Fiscal.ai is a great solution.

Fiscal.ai uses AI to help summarize important company information quickly, with a built-in “Chat” feature to get real-time insights from AI. Fiscal.ai overlays Microsoft’s Copilot AI chat tool on its deep datasets — allowing you to ask for quick summaries of over 100,000+ investments globally.

Fiscal.ai recently upgraded their platform to offer even more deep dive research, and an Enterprise offer for unlimited prompts and team support. And the platform supports over 100,000 global investments.

While Fiscal.ai is aimed at long-term investors that want to review company fundamentals — you can use the AI chat feature, stock screener, analyst ratings, and other datasets to form a trading thesis. This can help you pick stocks that are moving in the right direction — ideal for swing or momentum traders.

What You Get With Membership

- 10 – 500 Monthly Copilot AI prompts (Free to Pro plan, Unlimited for Enterprise)

- Access to data from over 100,000 stocks, funds, and ETFs

- Notifications (on Plus, Pro, and Enterprise plans)

- Access to company filings, investor relations data, earnings calendar, and more

- API access to your own analysis tool integration

7. TrendSpider

- Best for: Swing traders

- Key features: AI-powered technical analysis, automated charting tools, heat maps & pattern recognition, trading bots

- Cost: Starts at $99.51/month. See plans here

TrendSpider is an AI stock analysis software and trading bot that leverages technical analysis and AI to help create and execute trading ideas. It simplifies the process of technical analysis through automated charting and helps identify trends to help you pick stocks.

There are built-in backtesting tools for further review and analysis, and even a built-in trading bot to execute trades automatically.

TrendSpider’s AI algorithms will actively scan stocks and even draw trend lines with support/resistance zones on your chart for you. There are additional AI-driven insights via heat maps and pattern recognition tools enhance market predictions.

And the AI tools are customizable — allowing you to train the AI to find additional trends and market insights for your trading style.

TrendSpider has a unique approach for swing traders as well with built-in multi-timeframe analysis. You can use AI to detect trends across different time periods simultaneously. This gives you additional insights for smarter trade setups using short- and long-term time frames to trade stocks.

What You Get With Membership

- AI tools including an Assistant to get instant feedback on trading ideas

- Custom alerts based on price action

- Backtesting tools for technical strategies

- Heat maps and smart trend detection

- Custom AI model training based on your prompts

- Multi-timeframe analysis for your stock picks

- AI-powered trading bot for automatic trade execution

Final Word:

Harnessing the power of AI to quickly sift through mountains of market data and find stocks or ETFs that are undervalued is no big deal for each of these AI research tools. But the best ones are more intuitive, offering simple stock scores and rankings, summarized insights that a 5th grader could understand, and a blending of AI and expert analysis to find the best investments available.

While Zen Ratings is the most comprehensive and “real” of these AI powered research tools, all of these options offer something unique for different types of investors.

FAQs:

Is OpenAI’s deep research feature good for ai stock research?

While OpenAI’s deep research feature as part of Chat GPT Plus can help you synthesize large amounts of data and summarize deep research into a company’s stock movement, financials, earnings, popularity, and other data — it has limited reach. Custom-built tools like Zen Ratings or Seeking Alpha’s Cirutal Analyst Reports are far more comprehensive (and easier to understand) when researching stocks.

What’s the best ai stock research tool?

Zen Ratings offers the simplest breakdown of any research tool, with AI-powered ratings and actual human review to rank thousands of stocks. Seeking Alpha’s Virtual Analyst Reports offers comprehensive analysis in an easy-to-understand format, quickly allowing you to see only the important information about a specific investment.

What’s the best way to use AI for stock research?

Using an AI stock research tool that’s programmed to give you the data you need to invest is the best approach. Don’t just ask Google or Chat GPT what to invest in. You need to use an AI-powered analysis tool (like Zen Ratings) to analyze thousands of investment options and give you ratings and investment research accurately.

What is AI stock research?

AI stock research is the process of leveraging AI tools to review and analyze market and financial data from publicly-traded companies. This includes fundamental and technical analysis, as well as reviewing market sentiment and other factors to find investments worthy of investing in.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our February report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.