3 New Strong Buy Ratings from Top-Rated Analysts: 11/27/2025

What’s better than pumpkin pie? A peek at the latest picks from our Strong Buy Stocks from Top Wall Street Analysts screener:

- Semtech (SMTC) is a Strong Buy despite recently announcing lower-than-expected sales results

- Alkermes (ALKS) turns heads with a high-stakes bid

- Te Connectivity (TEL) enjoys bullish industry outlook

P.S. Get more alerts like this daily … Try WallStreetZen Premium.

A note from our sponsors...

Buffett's $114 Secret In 1943, a teenage Warren Buffett put $114 into a special type of account called "The 29% Account." Today, that single, $114 investment would be worth over $15 million. Your bank never told you about this. Click Here to See How It Works1. Semtech (NASDAQ: SMTC)

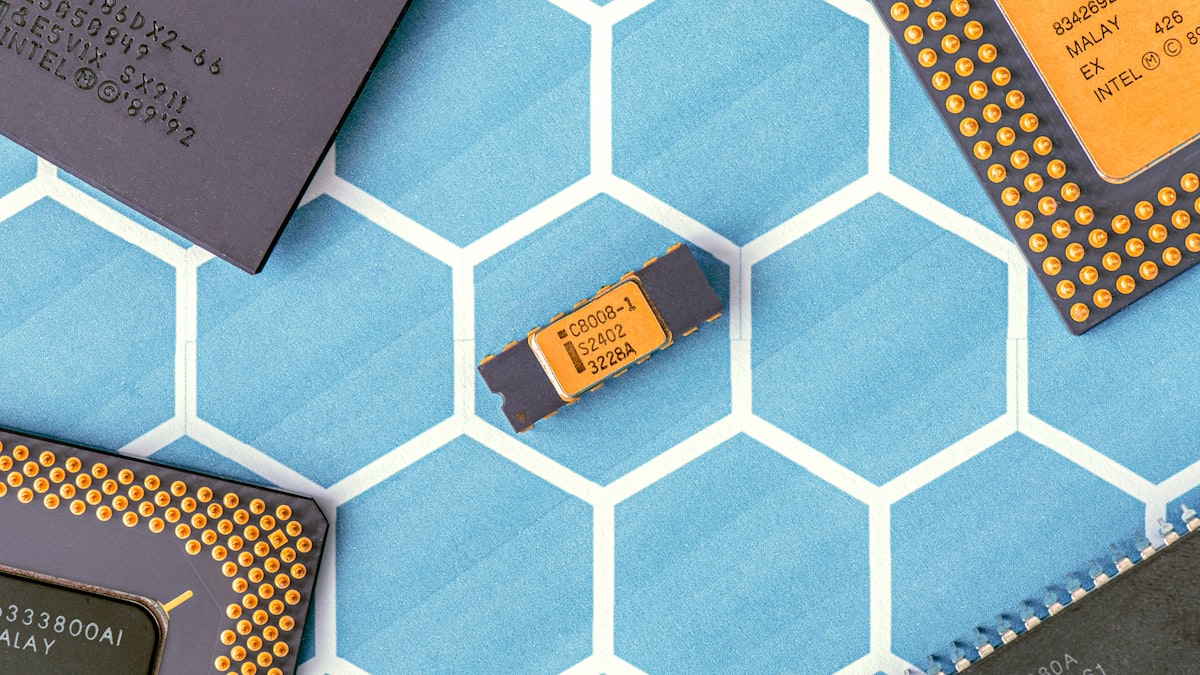

Semtech is a fast-rising semiconductor player powering next-gen data centers, IoT, and high-speed connectivity. With strong margins and a top-tier Zen Rating in its industry, it’s earning real hype as infrastructure and AI-driven demand surges.

Zen Rating: B (Buy) — see full analysis

Recent Price: $64.10 — get current quote

Max 1-year forecast: $85.00

Why we're watching:

- Analyst support: SMTC enjoys strong coverage with 6 Strong Buy, 4 Buy, and 1 Hold rating from 11 analysts we track. See the ratings

- Susquehanna researcher Christopher Rolland (a top 1% rated analyst) recently maintained his Strong Buy rating with an $80 price target (+25.29% upside) ahead of the company’s earnings call.

- Industry ranking context: SMTC is currently the 3rd highest-rated stock in the Semiconductor industry, which has an Industry Rating of B, positioning it well among semiconductor peers.

- Zen Rating highlights: Buy (B) stocks average +19.88%/yr, and Semtech's 78.52% earnings growth significantly exceeds both the industry average of 51.88% and the market average of 42.92%.

- Component Grades: The company earns strong marks with B grades in Growth, Financials, and AI, supported by return on equity of 44.45% and forecasted EPS growth of +245.69% year-over-year. (See all 7 Zen Component Grades here)

2. Alkermes (NASDAQ: ALKS)

Alkermes is turning heads right now with a high-stakes $2.37B bid for Avadel and fresh Vibrance-2 trial results that just de-risked one of its most promising programs. With strong analyst momentum behind it, this is one biotech investors are scrambling to dig into.

Zen Rating: B (Buy) — see full analysis

Recent Price: $28.61 — get current quote

Max 1-year forecast: $55.00

Why we're watching:

- Analyst support: ALKS currently has 6 Strong Buy, 3 Buy, and 2 Hold ratings from the analysts we track. See the ratings

- Truist Securities researcher Joon Lee (a top 2% rated analyst) recently maintained Strong Buy with a $55 price target (+92.24% upside) following positive Vibrance-2 results, noting that cross-trial comparisons show alixorexton outperforming competitive narcolepsy treatments.

- Lee noted that Takeda management views the alixorexton program as representing "credible competitive pressure," with the added split-dosing regimen in Phase 3 potentially enhancing efficacy further.

- Industry ranking context: ALKS is currently the 15th highest-rated stock in the Pharmaceutical industry, which has an Industry Rating of A, placing it solidly in the top tier of pharma companies.

- Zen Rating highlights: Buy (B) stocks average +19.88%/yr, and with analyst targets suggesting 50%+ upside, Alkermes offers exceptional risk-reward at current levels.

- Component Grades: The company demonstrates outstanding fundamentals with A grades in both Value and Financials, supported by 20.21% return on equity and 15.04% return on assets. (See all 7 Zen Component Grades here)

3. Te Connectivity (NYSE: TEL)

TE Connectivity is gaining serious buzz after a strong Analyst/Investor Day and a bullish industry outlook, with Goldman Sachs boosting U.S. auto delivery forecasts. Ranked #5 in Electronic Components and backed by top-tier analyst support, TEL is quickly becoming a must-watch name in the industrial tech space.

Zen Rating: A (Strong Buy) — see full analysis

Recent Price: $220.94 — get current quote

Max 1-year forecast: $297.00

Why we're watching:

- Analyst support: Strong institutional backing with 6 Strong Buy ratings, 2 Buy ratings, and 3 Hold ratings from 11 analysts, reflecting confidence in the automotive recovery cycle. See the ratings

- Goldman Sachs analyst Mark Delaney (a top 2% rated analyst) maintains Strong Buy at $263, noting that Goldman raised its FY 2025 U.S. auto forecast from 15.75M to 16.2M vehicles and FY 2026 from 15.5M to 16M based on solid year-to-date sales.

- Delaney explained that Goldman's leading indicators analysis implies stronger vehicle demand and "relatively benign" pricing actions from the automotive industry in response to potential tariffs, supporting TEL's growth outlook.

- Industry ranking context: TEL is currently the 5th highest-rated stock in the Electronic Component industry, which has an Industry Rating of A.

- Zen Rating highlights: Strong Buy (A) stocks average +32.52%/yr, and TEL's exceptional A grades in Momentum and Safety combined with forecasted EPS growth of +70.52% position it for strong performance.

- Component Grades: The company demonstrates elite quality with an A grade in both Momentum and Safety, plus B grades in Sentiment and Financials, supported by return on equity of 31.44% and revenue growth of 8.5%. (See all 7 Zen Component Grades here)

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.