3 New Strong Buy Ratings from Top-Rated Analysts: 11/28/2025

Here’s something better than Black Friday crowds: The latest picks from our Strong Buy Stocks from Top Wall Street Analysts screener:

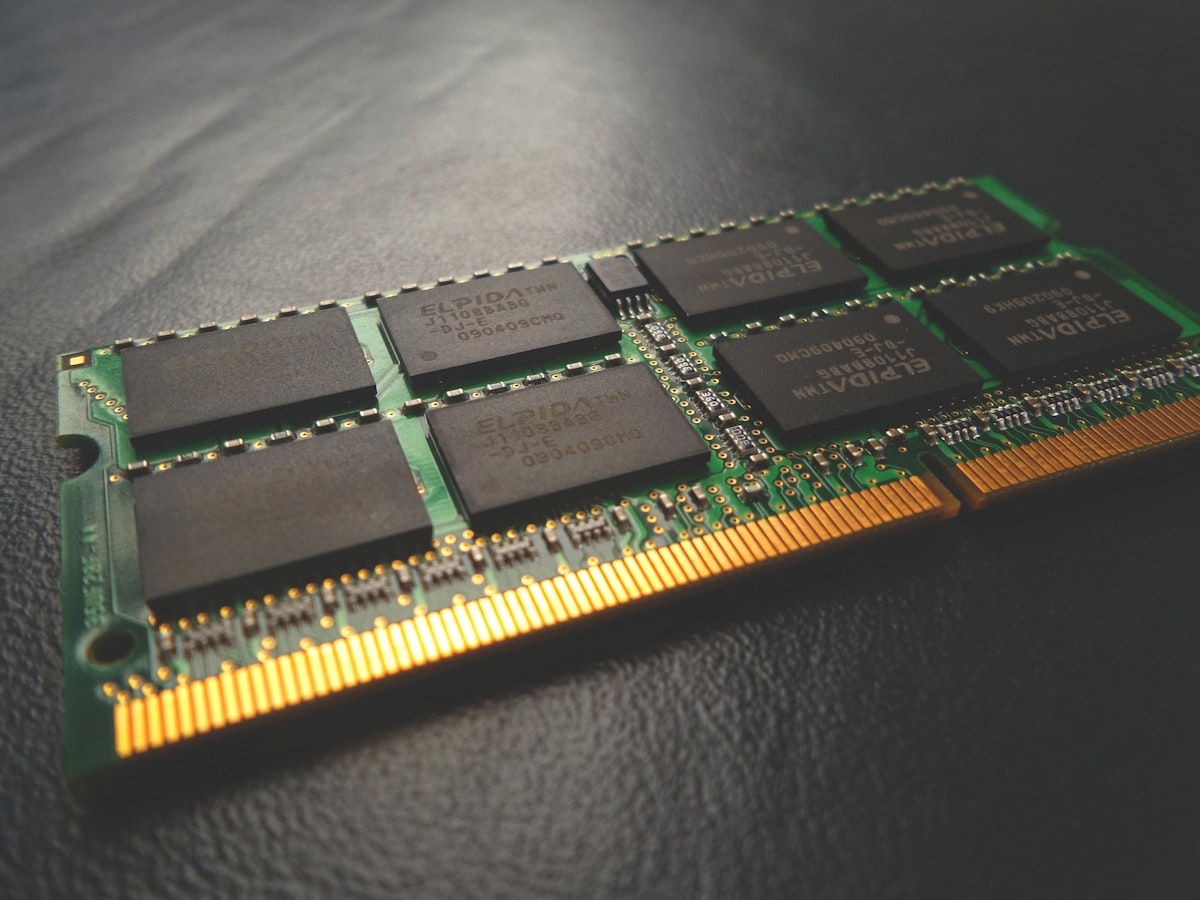

- Micron Technology (MU) is surging on the AI boom

- Daktronics (DAKT) is our latest Stock of the Week

- Information Services Group (III) gains traction in a hot industry

P.S. Get more alerts like this daily … Try WallStreetZen Premium.

A note from our sponsors...

Buffett's $114 Secret In 1943, a teenage Warren Buffett put $114 into a special type of account called "The 29% Account." Today, that single, $114 investment would be worth over $15 million. Your bank never told you about this. Click Here to See How It Works1. Micron Technology (NASDAQ: MU)

Micron is riding the AI boom hard, powering everything from data centers to next-gen compute with its cutting-edge memory and storage tech. With explosive growth forecasts, massive analyst backing, and the #1 spot in the Semiconductor industry, this is one ticker investors are racing to research right now.

Zen Rating: Strong Buy (A) — see full analysis

Recent Price: $219.48 — get current quote

Max 1-year forecast: $338.00

Why we're watching:

- Analyst support: MU commands exceptional Wall Street coverage with 15 Strong Buy and 8 Buy ratings out of 25 total analysts we track, achieving a Strong Buy consensus. See the ratings

- Morgan Stanley's Joseph Moore (a top 1% rated analyst) recently maintained his Strong Buy rating with the Street-high price target of $338.00, representing 50.94% upside potential from current levels.

- Exceptional growth trajectory: Micron is forecasting dramatic earnings growth with EPS expected to surge 123.5% to $17.10 in one year and 149.97% to $19.12 in two years, while revenue is projected to increase 48.91% to $55.7B, driven by strong demand for AI and data center memory solutions.

- Industry ranking context: MU is currently the 1st highest-rated stock in the Semiconductor industry, which has an Industry Rating of B.

- Zen Rating highlights: Strong Buy (A) stocks average +32.52%/yr — with particular strength in Momentum (A), supported by solid B grades in Value, Sentiment, and Financials.

- Component Grades: The company excels in Momentum (A) reflecting its strong price performance, with Value (B), Sentiment (B), and Financials (B) grades demonstrating balanced strength across fundamentals, while maintaining a return on equity of 37.97% that significantly outpaces many competitors. See all 7 Zen Component Grades here

_________________________________

⚡ Seeking Alpha's Black Friday Flash Sale: Save Up To 28% through December 9th

✓ Seeking Alpha Premium — $299 $239/year (save $60) + 7-day free trial for new users

✓ Alpha Picks — $499 $399/year (save $100) | Portfolio up +244% since 2022

✓ Bundle — $798 $574/year (save $224) | Best Value

Rare discounts — won’t see pricing this low again until 2026.

_________________________________

2. Daktronics (NASDAQ: DAKT)

Daktronics is lighting up investor radars with its arena-class LED displays and a jaw-dropping 126% earnings growth rate. As the #2 stock in an A-rated Electronic Component industry, this quiet powerhouse is suddenly looking like one of the most electrifying tech stories of the moment.

Zen Rating: Strong Buy (A) — see full analysis

Recent Price: $18.39 — get current quote

Why we're watching:

- It’s our Stock of the Week: Read more here about why Zen Investor Editor in Chief Steve Reitmeister believes that “opportunity is knocking to buy one of the most impressive stocks at a truly attractive entry price.”

- Financial momentum: Daktronics has delivered exceptional earnings growth of 126.3%, significantly outpacing both the Electronic Component industry average of 26.3% and the broader market's 104.63% growth rate.

- Revenue acceleration: The company is forecasting revenue growth of 14.01% to reach $854.4M in the next year, with two-year projections showing 22.17% growth to $915.5M, demonstrating sustained business momentum.

- Industry ranking context: DAKT is currently the 2nd highest-rated stock in the Electronic Component industry, which has an Industry Rating of A.

- Zen Rating highlights: Strong Buy (A) stocks average +32.52%/yr — reflecting the company's robust financial position with an A grade in Financials and solid B grades in Growth and Sentiment.

- Component Grades: The company earned its highest marks in Financials (A), supported by strong return on equity of 21.32% and return on assets of 10.93%, with additional strength in Growth (B) and Sentiment (B) reflecting market confidence in the company's trajectory. See all 7 Zen Component Grades here

3. Information Services Group (NASDAQ: III)

Information Services Group is gaining serious traction as a top-tier tech advisory firm, riding demand for AI-driven workforce and compensation solutions. Ranked #2 in the Information Technology Service industry, it’s quickly becoming a standout name in the digital transformation boom.

Zen Rating: Strong Buy (A) — see full analysis

Recent Price: $5.24 — get current quote

Max 1-year forecast: $7.00

Why we're watching:

- Analyst support: ISG only has 1 rating among the analysts we track, but it’s a Buy rating with a price target of $7.00, representing 33.59% upside potential from current levels. See the ratings

- That rating is from Barrington Research analyst Vincent Colicchio recently maintained his Buy rating with a $7.00 price target, recognizing the company's strategic positioning in the growing AI and digital transformation consulting markets.

- AI transformation catalyst: The company is actively expanding its research into AI-driven solutions, recently announcing studies of compensation management software evolution and the Salesforce ecosystem, positioning itself at the forefront of enterprise AI adoption trends.

- Strong earnings momentum: ISG is forecasting impressive EPS growth of 53.5% to $0.31 in one year and 78.75% to $0.36 in two years, with earnings growth of 33.41% outpacing the Information Technology Service industry average of 31.82%.

- Industry ranking context: III is currently the 2nd highest-rated stock in the Information Technology Service industry, which has an Industry Rating of C.

- Zen Rating highlights: With its A (Strong Buy) Zen Rating, III is in a class of stocks that have historically averaged +32.52%/yr.

- Component Grades: The company excels with top-tier grades in both Sentiment (A) and Financials (A), demonstrating robust analyst confidence and strong financial health, complemented by solid Momentum (B) and balanced C grades across Value, Growth, Safety, and AI categories. See all 7 Zen Component Grades here

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.