Hot or Not, Stock Market Edition: 12/02/2025

Happy December! Here’s what’s hot and what’s not in the market today:

- HOT: Huntington Ingalls Industries (HII) is up 58% in the past year (and the move might not be over); Semtech (SMTC) is riding the semiconductor heat wave

- NOT: An ugly outlook for Cousins Properties (CUZ); Chinese EV maker Li Auto (LI) appears to be in freefall

P.S. For more stocks making moves, check out our Zen Ratings Upgrades & Downgrades screener.

A note from our sponsors...

Buffett's $114 Secret In 1943, a teenage Warren Buffett put $114 into a special type of account called "The 29% Account." Today, that single, $114 investment would be worth over $15 million. Your bank never told you about this. Click Here to See How It Works🔥 HOT: Defense contractor Huntington Ingalls Industries (HII) is up 58% in the past year. What’s driving the momentum? In short, the company is delivering on its promises. It recently supplied a Virginia-class submarine to the U.S. Navy and hit major delivery milestones on Navy ship contracts, demonstrating strong execution on high-value defense programs. These aren't just headline wins—they're proof points that HII can execute on complex, long-cycle contracts.

But that’s not the only good news — the stock also just earned an upgrade to Strong Buy in our Zen Ratings system. It currently ranks in the 96th percentile of stocks we track. Right now, the stock's valuation looks reasonable given the growth trajectory, and with a B grade for Safety, there appears to be downside protection. The defense industry itself ranks 5th out of 71 sectors we track, suggesting tailwinds from geopolitical dynamics and defense spending. The bottom line? HII looks like a solid stock for investors seeking exposure to defense spending.

🥶 NOT: Hey CUZ … Things aren’t looking so hot for Cousins Properties (CUZ) right now. The office REIT is stuck in the structural headwinds plaguing commercial real estate, and the market is pricing in continued pain. On top of that, CUZ was just downgraded to a Strong Sell with an F rating (5th percentile of stocks we track). The office REIT sector itself ranks 16th out of 18 REITs we track. Digging into the Component Grades, its Financials, Growth, and Momentum ratings are all Ds — a trifecta of weakness (see more signs a stock is ready to sell here). Sentiment is also in the basement at an F. While the company does have a B for Safety, that's cold comfort when the business model itself is under pressure. When you factor in recent analyst commentary highlights softening revenue growth expectations and lowered price targets, there are plenty of reasons to steer clear of this ticker.

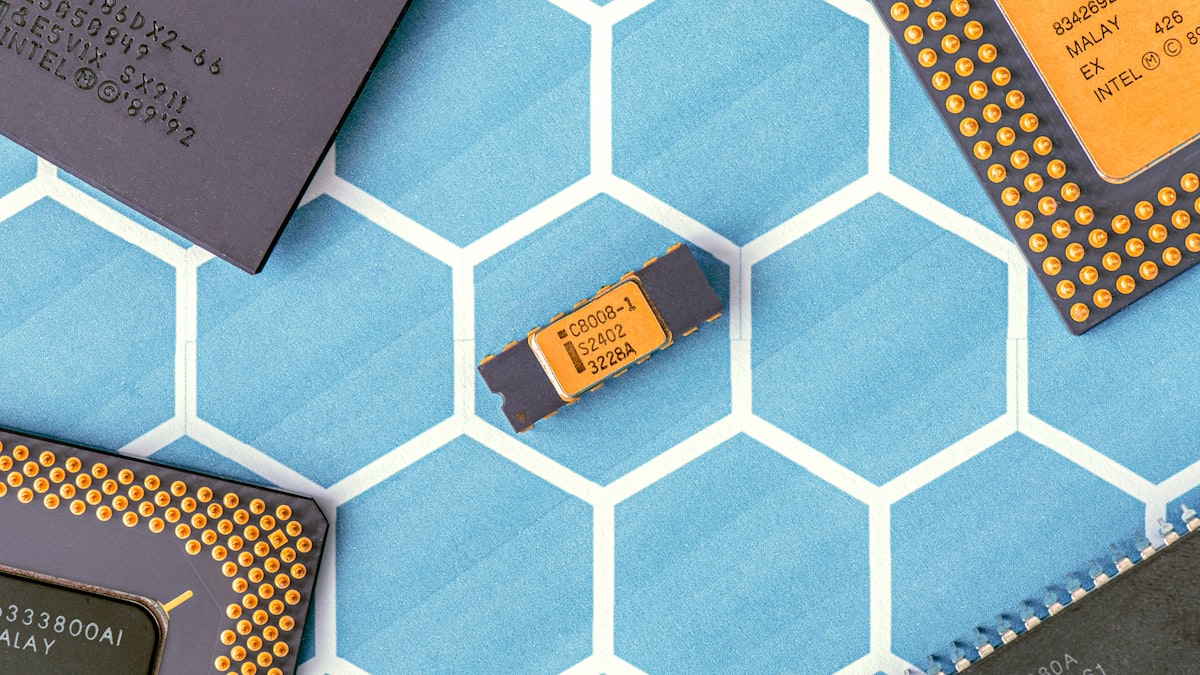

🔥 HOT: Semiconductors are megahot right now, and Semtech (SMTC) is one of the current leaders of the pack, thanks to recently crushing Q3 earnings and revenue estimates. The semiconductor specialist just got upgraded from Buy to Strong Buy, and the market is taking notice. The stock earns an A Zen Rating, ranking in the 95th percentile of stocks we track, with exceptional strength across multiple dimensions — particularly an A for our proprietary AI factor (here’s how it works!) and B grades for both Safety and Financials. The combination of earnings beats, analyst upgrades, and a strong balance sheet makes SMTC an appealing pick in a sector that's firing on all cylinders.

🥶 NOT: Chinese EV maker Li Auto (LI) is in freefall, and the numbers tell the story. The stock is down 13% in the past month, and LI just got downgraded to Strong Sell with a Zen Rating of F (3rd percentile of stocks we track). This isn't a stock in trouble — it’s in crisis. The problem? Growth has evaporated. LI's Growth rating is an F, and Sentiment is also an F, reflecting investor skepticism about the company's path forward. Following the company’s Q3 earnings, the market's reaction has been decidedly negative, with analyst sentiment collapsing. In a hyper-competitive EV market where Tesla and Chinese competitors are battling for share, LI's premium positioning isn't translating into financial outperformance. (Here’s more about when to sell a stock.)

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.