Hot or Not, Stock Market Edition: 09/25/2025

Happy Thursday. Here’s what’s hot and what’s not in the market today:

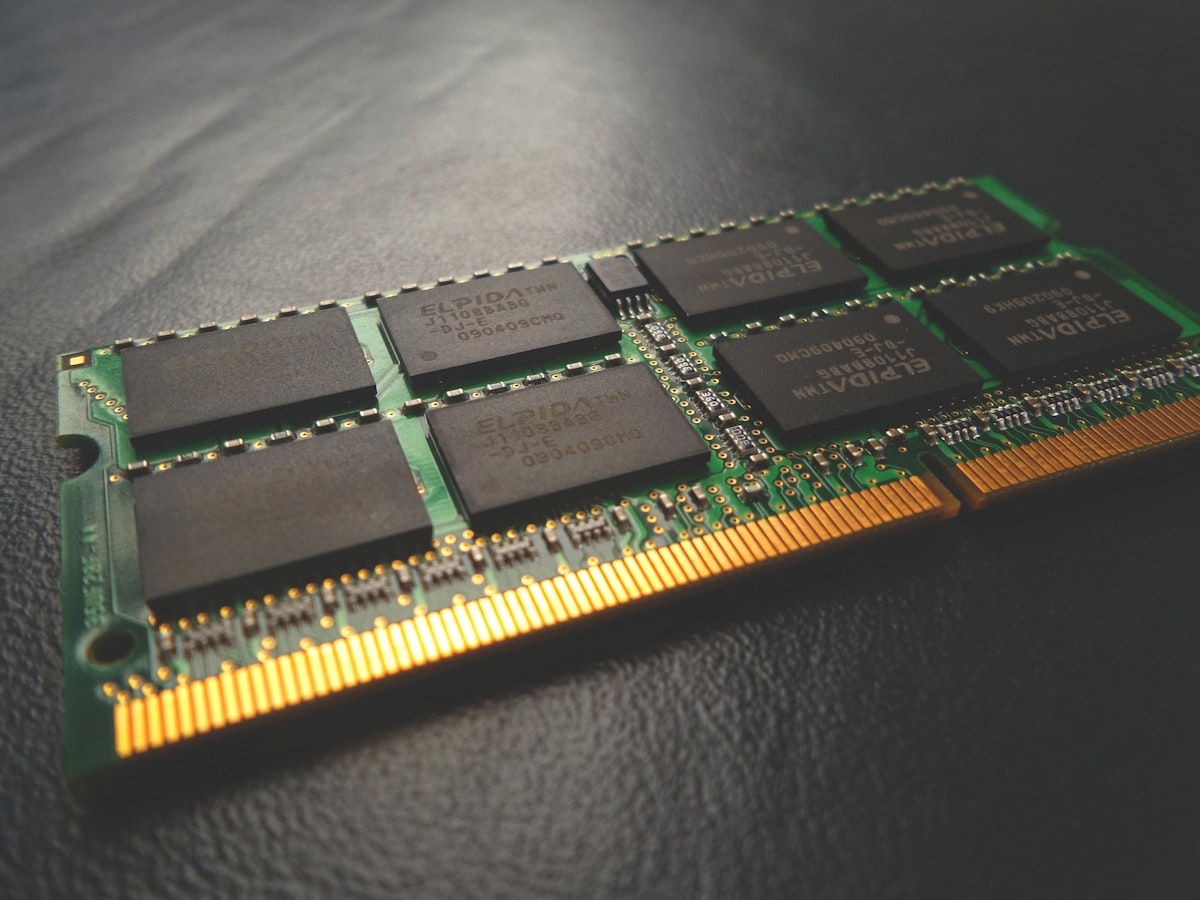

- HOT: Micron (MU) and Amphenol (APH) are powering AI’s backbone — memory chips and electronic components.

- NOT: RTX Corporation (RTX) and AppLovin (APP) look uninspiring, with recent downgrades in our Zen Ratings system

P.S. For more stocks making moves, check out our Zen Ratings Upgrades & Downgrades screener.

A note from our sponsors...

The 10 Best AI Stocks to Own NOW-Yours FREE If you've been following the AI revolution, there's a chance you can guess who's #1 on my brand new list of the best AI stocks to own (if you are lucky, you may even own some shares of this powerhouse already). But I doubt you can guess who's #3 on the list. (HINT: It delivers a technology that's critical to the AI revolution and will soon be embedded in countless consumer products.) Learn the names of all 10 stocks here. FREE.🔥 HOT: Micron (MU) is making memory chips cool again — and profitable, too. The stock’s up 42% in the past month, but signs point to continued gains. What’s driving the sizzle? A red-hot semiconductor space, ultra-strong demand for AI memory, spurring a slew of fresh Strong Buy ratings ahead of the company’s next earnings report. Under the hood, Micron ranks in the top 6% of stocks we track in the Zen Ratings system, buoyed by a B in Value and Momentum and a rock-solid B in Sentiment. Sure, Safety and Growth grades are only C, but the critical factor is relentless margin expansion as memory prices spike. The bullish setup and market momentum place Micron in the pole position for further gains.

🥶 NOT: RTX Corporation (RTX), better known as Raytheon, may be a household name in defense, but lately, it’s sputtering on the runway. Despite a recent $271 million deal for TOW missiles, there’s not enough going on right now to stoke serious investor excitement — a fact clearly reflected in the stock’s recent downshift to C (Hold) from the Zen Ratings system. Most Component Grades hover in mediocre C territory, with slightly better readings for Safety and Momentum. Yet, nothing shines bright enough to cut through the noise. The problem? RTX is steady and reliable, but not exactly inspiring. Even with features like a new, pumped-up radar and NATO contracts, the company’s business remains a slow burner. With the stock already reflecting much of the industry’s recent contract wins, there’s not much to catapult shares much higher near term.

🔥 HOT: Amphenol (APH) is smack in the center of the electronic component revolution, supplying the connectors and sensors that keep cloud servers, data centers, and new AI gear running at warp speed. The stock has been riding a strong rally; it’s currently trading in the $125 range, well above its 200-day moving average of $84.48. Why is APH so hot? Because as AI spending accelerates, so does the need for data centers — and with each shiny server rack goes a handful of Amphenol parts. With a Zen Rating of B, APH currently ranks in the 93rd percentile of stocks we track, with strong Component Grades of A in both Momentum and Sentiment. While Value and Safety only come in at C, the overall momentum, AI excitement, and Industry Rank of A indicate the current surge has fundamental legs.

A note from our sponsors...

The 10 Best AI Stocks to Own NOW-Yours FREE If you've been following the AI revolution, there's a chance you can guess who's #1 on my brand new list of the best AI stocks to own (if you are lucky, you may even own some shares of this powerhouse already). But I doubt you can guess who's #3 on the list. (HINT: It delivers a technology that's critical to the AI revolution and will soon be embedded in countless consumer products.) Learn the names of all 10 stocks here. FREE.🥶 NOT: AppLovin (APP) is up over 400% in the past year — but it looks like the euphoria is ready for a timeout. Following a flurry of bullish speculation and analyst upgrades following its recent S&P inclusion, the company was recently downgraded to a C (Hold) by the Zen Ratings system. We can find some clues as to why from the Component Grades — notably, APP only earns Cs in several key areas, including Value, Growth, Sentiment, Safety, and from our proprietary AI algorithm, which has the ability to sniff out subtle trends that may not be evident to the human eye. An A rating for Financials and a B rating for Momentum offer some bright spots, but they may not be enough to continue stoking the fire on this stock’s long and impressive run. Barring new catalysts, we’re content leaving APP on the sidelines for now.

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.