Hot or Not, Stock Market Edition: 03/18/2025

What’s up and what’s down? It’s hard to tell in the current market, but we’re doing our best to decipher it for you:

- HOT: Kingstone Companies (NASDAQ: KINS) pops after reporting record earnings; Semtech Corporation (NASDAQ: SMTC) is hot despite legal woes

- NOT: Xponential Fitness (NYSE: XPOF) takes an exponential loss after faulty reporting; Hasbro (NASDAQ: HAS) is having a tough go following earnings

P.S. For more stocks making moves, check out our new Zen Ratings Upgrades & Downgrades screener.

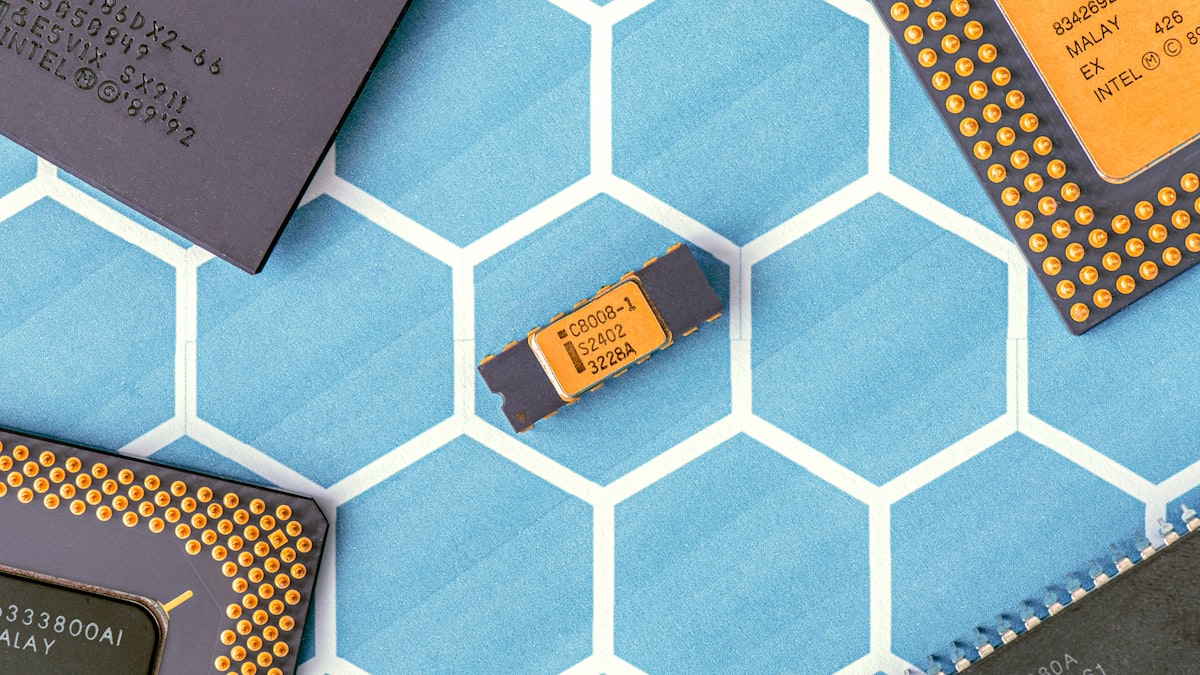

🔥 HOT: Semtech Corporation (NASDAQ: SMTC) is currently embroiled in a class action lawsuit over misrepresenting its CopperEdge products, but even that couldn’t stop the stock from gaining 21.1% after an outstanding earnings call. The company exceeded analysts’ expectations, earning $0.08 more per share than consensus estimates and issuing stronger-than-expected guidance for the first quarter of 2025. While the lawsuit is a concern, we see this as a buying opportunity for a promising young company on the forefront of the cutting edge analogy hybrid semiconductor field. We give the stock a B Zen Rating and a Buy rating, especially if you’re willing to take on some extra risk for the potential for some big gains in the mid to long-term.

🥶 NOT: Xponential Fitness (NYSE: XPOF) took it on the chin on Friday, losing 38.5% over an issue with its financial reporting back in 2023. The company’s loss-per-share was also significantly greater than expected. Experts anticipated earnings of $0.39 per share, but the company’s fourth-quarter report showed a loss of $0.19 instead. XPOF has been trending down since February 13th, earning it a C rating for Momentum. In fact, it also gets C ratings for Growth, Sentiment, Safety, and Financials. Its lone bright spot in our analysis is the B rating it gets for Value. Its current price could be a good entrypoint, but the latest uncertainty surrounding its 2023 accounting forces us to give it a C Zen Rating and a Hold recommendation.

🔥 HOT: Property insurer Kingstone Companies (NASDAQ: KINS) popped for a 22.0% gain on Friday after reporting record earnings late Thursday. The company earned more in premiums than it paid out in claims by around 22 percentage points, marking the fifth straight quarter it’s turned a profit. We give KINS a Strong Buy recommendation and an A Zen Rating due to solid B scores in Value, Momentum, and Financials and an outstanding A score in Growth.

🥶 NOT: Play-doh and Transformers action figure-maker Hasbro (NASDAQ: HAS) is up 5.4% on the year but has lost 13.4% since its post-earnings high on February 20th, making it a difficult stock to predict. The guidance it issued during its earnings call was based on a 10% tariff on China, but now President Trump is posturing for a 20% tariff, which could have a significant impact on Hasbro’s 2025 bottom line. HAS was relatively flat on Friday, gaining 0.9%. We give Hasbro a B rating for Financials, but all of its other component scores, including Momentum, Sentiment, and Growth get Cs. The uncertainty surrounding HAS and its current whipsaw action give it a C Zen Rating and a Hold recommendation.

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.