Itron (ITRI): Buy THIS Dip!

Itron (ITRI) is riding one of the best growth cycles in the country. That being the long term trend to upgrade the nations power infrastructure.

This is not just about meeting higher and higher energy demand in the future…this is a matter of national defense to prevent power outages from any future cyberattack.

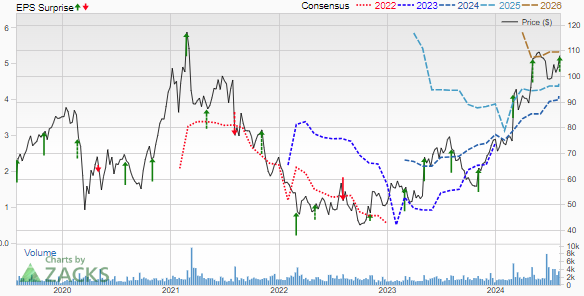

This is a layer of growth for ITRI and its peers on top of the stable business of monitoring energy usage (aka meters). The best way to show you that is to focus on the 2nd half of the chart below as business took off post Covid:

What this chart tells you is that there is tremendous earnings momentum at play. Not only is year over year growth on the rise (dashed colored lines), but they are riding a series of 8 monster earnings beats that greatly exceeded expectations…pushing future earnings projections higher and yes, ample share price gains to boot.

The most recent beat was served up on 7/31 where they hit the trifecta.

- 26% earnings beat

- Topped revenue expectations

- Raised guidance for the future

This was a big part of the +4.4% gain the day following the report. And this was followed by a wave of Wall Street analyst love letters with earnings outlook and fair value targets raised across the board.

Not just any analysts…but some of the industry’s top performing analysts are behind ITRI. This includes Noah Kay of Oppenheimer (Top 14%) and Joseph Osha ofGuggenheim (Top 4%) pounding the table on shares.

I just want to be clear. This is not a boring utility play as it may sound like on the surface. This is riding a long term growth trend that is FAR exceeding expectations and is likely to continue on that path providing attractive gains for investors.

Clearly this passes the test with Earnings Estimate Revisions. And it passes the test with the POWR Ratings with particular strength in operational metrics (aka Quality) as well as consistency of growth.

The recent pullback for the overall market gives us a great opportunity to buy an attractive dip on ITRI shares. If their earnings momentum continues with more beat and raise quarters, then its not hard seeing 50 to 100% upside in shares by the end of 2025.

Time to power up with ITRI shares!

What To Do Next?

Itron (ITRI) is just one of the 9 stellar stocks found in my Zen Investor portfolio.

To learn more about my exclusive 4 step process to find more 100%+ stock winners…and to get your hands on the current top 9 recommendations…then all you need to do is click the link below.

Discover the Zen Investor portfolio >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

Editor of the Zen Investor

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.